USDINR testing 3 month long supportHi trading view members.

Thanks for interactions on my last post.

USDINR is testing 3 month long support. Looking at elections and political situation, I predict that #USDINR will oscillate in the 69 to 69.6 range.

Rebound trend expected around early End march to April.

USDINR

USD/INR: Buy & Sell Full Trade Setup !!BUY & SELL Above Given Chart or

You Can Also set Own Risk reward.

Let see what Will be Next Move.

Warning- I m Not a Financial Advisor this idea Only For Educational Purpose Only.

Thank You !!

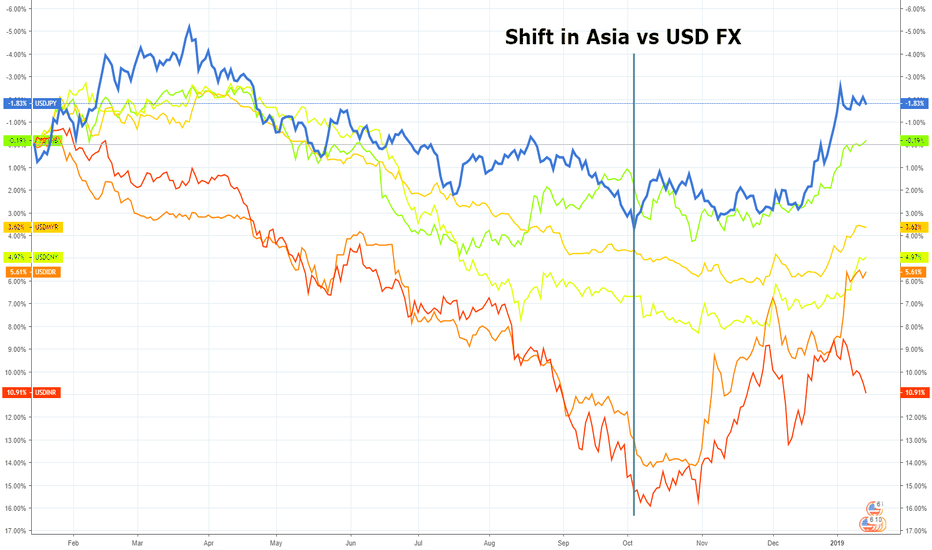

Asia Forex: Comparison chart vs USDFor the purposes of taking a broader view of movements in forex markets...

Chart: 1-year performance of JPY, THB, MYR, CNY, IDR, INR vs the USD (inverted)

Since October, there has been a marked improvement in the performance of Asian currencies. The change means Asian currencies have paired losses over the last 12 months, with the yen and Tai bot entering the black.

A relief rally or turning point for Asia FX?

The only level in play is 68.86=> After many requests from our followers in India we are posting an update to the USDINR map.

=> Here from a technical perspective we can see that there is a case to be made for the '5th wave' already being put in place... although we didn't quite reach the target for the minimum flow it came close enough.

=> This means the next big support level below is 68.86 which includes a confluence of major highs in 2013 and 2018. This is the 50% retrace of the final advance wave.

=> Rationally, the fact this level was so important on the way up and took many times to crack ...we know it will be equally important on the way down. A break below will increase confidence that a major top has been put in placed and afterwards there is very little in the ladder till 66.15.

=> Here actively looking to build positions to the downside and tracking 68.86 very closely.

=> Good luck to all those trading this one in live or looking to build positions ... or simply watching from the sideline

USD/INR ViewUSD/INR is now bearish, Support Zone is at 71.65_71.45

Selling Candidate on the Resistance to reach support 71.65_71.45

Further EM pressure and INR will capitulate=> With oil creeping higher again we are maintaining a bearish view on India

=> There is no reason for INR to no longer remain offered as US yields push higher and attract foreign capital and global uncertainties rise.

=> The Indian government deficit has rising for half a year now and we are seeing a widening of corporate spreads with equities selling off.

=> This will be a very interesting one to track as we may see capitulation in other EM markets.

=> GL all

USD/INR making Double TopIn Recent times we have seen Rupee making fresh lows against dollar which resulted in forming double top pattern.

CMP is 71.73

NECKLINE is 71.45

If Neckline gets broken I am expecting 69.95

IF this Happens Expect Nifty Touching 11700 again

Key reversal for USDINR in play here=> Studies are starting to show we are extremely overbought here in USDINR and a mean reversion play looks imminent...

=> The daily close below 71.38 will confirm this and unlock both the 70.395 and 69.530 before there is anything else to the buy side.

=> Similarly to the USD/RUB and USD/TRY we are starting to see temporary short-term highs across most of the EM spectrum.

=> Good luck

USDINR Possible ABCD patternUSDINR Possible ABCD pattern

Looks to be following an ABCD Formation

Love to hear your ideas?

Always Trade SAFE!!!

USD/INR - Charts show a scary picture going forwardUSD/INR

Monthly Chart

CMP 70.32

A nice VCP pattern breakout observed.

Previous VCP pattern breakout propelled USD by 40%;

If history repeats, USD/INR likely to touch levels close to 98-100 in a similar time frame (around 2 years).

THIS IS NOT A TRADING CALL AS POSITIONS CANNOT BE TAKEN FOR SUCH A LONG PERIOD OF TIME.

VIEW NEGATED AT 60.

USDINR LONG and SHORT STRATEGYWhite dotted lines represent short term support and resistance levels based on the tightening equilibrium pennant pattern. Note the bullish divergence on rsi. green arrow = long / red arrow = short. Green and red shaded area = sell zone via dca based on fib retracement 1.618 (of course ema may act as support so sell if you see strong support on ema if shorting)

WEEKLY ELLIOTT WAVE OF US DOLLAR INDIAN RUPEELong term elliott wave perspective

do not count much on this

if i am right , i am lucky ,

if not , i am just another elliott wave practitioner