USDINR Stuck in a Triangle. Trade the break-out.The USDINR pair is trading inside a 1.5 month Triangle (blue), following the upward break-out of the 1 year Ascending Triangle. The 1D MA50 (blue trend-line) has been supporting for 2 months and as long as it holds, buy when the price breaks above Resistance 1 (83.4200). The target can be 84.500, representing a +2.13% leg extension on a potential emerging Channel Up. If the 1D MA50 breaks, we will sell instead and target the 1D MA200 (orange trend-line) at 82.4500, which is marginally above Support 2.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR

NIFTY:- Pundits or Punters!Extreme fear, Futures hopes, future should look like future ("Elan Musk"). FED officials' comments cuts both ways, starts with hawkish to very hawkish tone. Ranging from need more than one hike, soft landing possible, rates will stay till 2024 then not sure if the next meeting holds any hike. Crude gallops near 95, blame the inventory deficits. USD continues to rocket; safe heaven Gold goes south.

There are no safe heavens right now other than dollar, and that is reflected even in Rupee (despite the regulatory interventions, no one knows when it is over!). Crypto continues its riddle, most memory have been erased of this space. Data front Final GDP, PPI, Michigan Inflation expectations, some inflation from Europe, Powell speech is the one's to look for. Half year ending, flows to drive the markets.

Fear Index is at its lowest, SPOOS held the support on close basis, despite much deeper low. 4240-4340 dictates here.

Markets behaved more or less to our expectations, those who feared the fall, would have seen an opportunity to buy around 19570 area for move towards our top of the range 19730. Held by the trend line, the PIP graphs show the hammer pattern, assuming that remains the support, one can expect max moves to 19880 (not today's call and not 100% probable moves). While a close above 19880 is needed for the bulls to re-assert, bears need 19580 close to trigger more fears. Holiday shift does not do any great things, FII and DII volumes are dried up. For the day 19650-19780 should work.

NSE recommendation to SEBI for longer hours, not sure why that is needed when GIFTNIFTY is available, are we moving towards ODTE tribe here too. Then Why do you need Gaming apps?

NIFTYBANK:- The 60/40 approach!60/40 is the popular investment strategy that has gone terribly wrong to the international investors. If any it might turn out to be the third year in row. While the liquidity is pouring in the bonds (safety?), the bets for yields fall is coming down. The recent up-move of USD is anything but a factor of another 25 basis point move higher in terms of cost. Not referring directly to us, but in general. FED's Kashkari comments that there is 40% chance rates to go higher pushes the hawkish tone further. He is voting member. His comments about economy hitting soft landing with 60% chances echos mixed voices. (read our last week comments on economy in the substack). With Crude at elevated levels, next week our MPC, higher US dollar, post the Bond Inclusion, it is interesting to take a look at our own bond yields. The graph PIP shows the price action is held the long supply line, now in the shape of bull flag. So, the corrections to continue but the yields appear based. Note the shape of the correction and continuation needs to be read in different ways based on different asset classes, there are no one fit all scales. What is interesting to note with the recent up and down moves, on a three month scale this index is down 120 points. That is, we are where we were three months back. Completely dominated by the PSU pack. On the Index this is not the story, in otherwards, this looks much more beaten than the main index. 44400-44900 are the range to watch and hold before next meaningful move. The banking stocks elsewhere are not in favourable places, partly due to the market-to-market losses, squeeze in NIMS and the broader economic outlook or is there a credit event in the waiting. Citi Share price down near 50% from 80 to 40, mathematically it needs 100% move to reach where it was. Thankfully we are not in that pack. For the day continue grudging moves down first flat next kind of a day one can expect.

NIFTYBANK - "Bonds-Bears-Bats"Two pictures, the big one is intra-day and the PIP is Weekly. Intra-day is picture showing the bearish bat pattern, which moved to its logical down path. Triggered on break of the 0.886 number break. This morning BOJ leaves rates unchanged, no trouble in moving any of the financial markets. The bank that has not rocked any boat. SNB leaves, BOE pauses despite expectation of hike. Markets punish. The much-awaited news of Bond Inclusion is liquidity additive, not sure if they are in short term equity additive. On the aggregate, it should add to the underlying investment pool when the global interest rate differences skew to us. At present with USD Rates of Closer to 6% and our Yields minus the Currency Depreciation, will be the considerations to keep in mind. Timing is important, for today, they are mere headlines, market may treat them at a later date. One dead cat bounce? The big trouble to the Index unfolds 43800-44200 range and base if they are taken out. The large Caps stocks have given away their advantage, while the small caps are prone to profit taking. The Second half of 2023 will go to the nimble and humble traders. Move over Exuberance, Return to Sanity (worth reading the speech form RBI). For the day 44400-44900 would fancy a range. Week-end fear or hopes will drive the last one hour. Dont be influenced by overseas cues for a change.

Swing trade during the FOMC meetingThe swing in 4H time frame is still in the impulse wave of the daily swing.

The impulse of the 4H time frame swing has started(DB neckline breakout level 83.2500)

Caution :: FOMC meeting on 20 Sep'23 11:30PM IST and the current market price is at the weekly resistance of the ascending triangle pattern.

NIFTY BANK:- Soft Sourroundings Soft landing of the economy is the word that is catching cold. All hard landings in the first-place look like soft landing until it is over. Inflation is re-defined, calls for higher base from 2% is catching up. World is facing the debt scare with 337% of world GDP. Reports from RBI suggests our savings too are fast depleting. Further drill down of the numbers may reveal the cause and effect of these numbers. Equity is the new saving; Equity is the new debt remains the one of the takings. While the local currency pushes past 83.00 it is not going to draw any ire other than headlines, as it is commensurate with annual depreciation that we have witnessed if any it is at the lower end. One can aim a slow move towards 85.00. Diplomatic tussle with Canada is not a market mover yet and hence the space of PSU banks remains to be invested. Larger banks are mixed to the likes of HDFC, ICICI, AXIS and SBI the laggard remains the HDFC. Relative to the NIFTY, this index to get supported around the 45800 area, waiting to hit the ATH. Ahead of FOMC there will be reluctance to move either way and hence the range is preferred. Soft Sourroundings it the internal Women's clothing brand that filed for Chapter 11. US building permits are higher, but housing starts fall below the expectations. Yellen comments that inflation is starting to decent, (Michigan 5 Y inflation expectations moved to 2.7, an indicator that FED Watches). FED would pause today, to take stock of the aggregate of the rate hikes so far to gauge the final impact. At no point they would sound a rate cut. 45750-46250 range to work for the day. Attached graph stronger trendline, Ichimoku supports suggest to play from longs than otherwise.

NIFTYBANK: Musch desired "IRR'A-tionalIn recent times trades faced glitches on execution, many incurred heavy losses. the new platform by the regulators, Investor Risk Reduction Access (IRRA) platform to address technical glitches and outages is a welcome move. However, this is not available to the ALGO traders. This clearly helps the novice traders as well as classical traders, to reduce this risk. It is always the case of new risks emerging and there is no reason why there will no zero risk at any point of time. While we talk on IRR, the irrationality of the markets remains. Nifty bank is in its path to ATH. The only hurdle is tomorrow being the holiday. Will that stop the bulls from piercing to the ATH. The PSU back reverts to the bullish view all over, still does not appear to be a crowded space yet. It is more like, I missed it this space. Incoming FED meet, elevated Crude prices, and rising US Yields as well as the US Dollar are some of the concerns, but they are collectively not a consideration to change the trend. The question is will it be a vertical move up for ATH or will there be a correction before the climb. This space is known for the U turns at crucial areas, despite the underlying trend being continuation. This can potentially be true this time also. However, that is an opportunity to get the bags of bulls. 45800-46500 is the new range, out of the old range just two months back. Bias to the upside, basing around 46080-45880.

NIFTY: "My time, My Rules"Rules are blurred, game changes. Credit goes to the "Ground" reality. Four wickets in one over, no hattrick, but history is made. 50 looks like double century. Stunning Performance of a century by Siraj, a loss to both who spared time to watch, and those who failed to watch. Clearly, Siraj said "My time and My rules". Japan's increasing worries of Chinese aggression. North Korea cosy with Russia, just a week after China Visit to Russia are some uneasy moves. China says, not to use nuclear weapons is an outdated promise. Bulls here say, "My time and My rules". Clearly many important messages, but no peace for bears. Cues are negative, who cares them though. Crude is 90 plus, 10 Y yields cross new high. Data from US Michigan 5 Year expectation softens, but this inflation will remain higher for longer. Europe crude crosses 100 mark. Dollar remains elevated to the discomfort of the bulls. Our own trade deficit widens, one eye on the rupee is once again needed. Looks the resolve is to hold the range, as the last State Elections are around. Controversy surrounded about the economic data, whether it is based on income or expenditure, MOF gives clarifications. It's difficult to gauge the mood, as the Retail continues to buoy the economy though concerns remain on the path ahead. With tomorrow being holiday, today close is vital as that would confirm the robustness of the move ahead. It is one thing the Index moving up, it is altogether different if the mid and small caps give back or climb up further. Clearly the Index stocks are relatively positive than the NIFTY500 basket. Not suggesting a softer tone, but profit taking would remain the mantra. With the third week posting strong gains, it is important to look at the shape, size and space. Shape is strong, with relatively small upper and lower wicks, Size is large, Space is new High. The PIP graph shows the last half hour profit taking, the open cues can bring some more, but ideally should be bought. 20060 is the new base while this holds back to 20280-330 is the expectation. Tread cautiously, nothing to jump and pump. Broad range for the day remains 20080-20280

What to expect in FOMC meeting on 19/20 Sep'23The market looks bullish in daily time frame.

The FOMC meeting on 19/20 Sep'23 is expected the pause the interest rate at 5.50%, which keeps the USDINR less volatile. If the interest rate is increased USDINR will be bullish.

There is 3 more trading sessions to decide the direction.

www.federalreserve.gov

www.forexfactory.com

www.nseindia.com

Macro Economics- BRICS Oil Nations, GDPHi Traders, Investors and Speculators of Charts 📈💰

The 15th BRICS summit was held in South Africa from August 22-24, 2023. There have been some important updates that concluded from this summit and if you're an active trader / speculator in the Forex, stocks or commodities market, you NEED to know about this.

The BRICS countries (Brazil, Russia, India, China, and South Africa) now control 30% of the entire global economy. This is up from 17% in 2000 and 23% in 2010 . The BRICS countries are also home to 42% of the world's population.

Incase you missed the previous article, find it here:

BRICS Total GDP With New Members:

B razil: $2.08 trillion

R ussia: $2.06 trillion

I ndia: $3.74 trillion

C hina: $19.37 trillion

S outh Africa: $399 billion

Saudi Arabia: $1.06 trillion

Argentina: $641 billion

UAE: $499 billion

Egypt: $387 billion

Iran: $367 billion

Ethiopia: $156 billion

BRICS will now control 30% of the global economy.

If you're invested in any BRICS related stocks or Forex markets, this concerns you!

The summit outcomes are expected to lead to a weaker US dollar in the near term. This means that currencies against the dollar will strengthen. This is because the BRICS countries are collectively a major source of demand for commodities, such as oil and gold.

The outcomes of this summit lead to proposed increased investment in the BRICS economies. This could lead to higher demand for commodities, which would put upward pressure on commodity prices and the value of currencies of commodity-exporting countries, such as the Brazilian real and the Russian ruble. This would make the US dollar less attractive to investors, which could lead to a weaker dollar.

_______________________

📢 Show us some LOVE 🧡 Follow for daily updates and trade ideas on Crypto , Stocks , Forex and Commodities 💎

We thank you for your support !

CryptoCheck

Forex & Stocks: Capitalize on BRICS2023Hi Traders, Investors and Speculators of Charts 📈💰

The 15th BRICS summit is being held in South Africa from August 22-24, 2023 and will undoubtedly affect the Forex market. The main reason for this, is the commonly know agenda of BRICS to implement a new reserve currency instead of the USD. More details on that topic here:

The 5 Forex markets we'll consider are: FX_IDC:USDINR FX:USDCNH FX_IDC:USDRUB FX_IDC:USDBRL FX:USDZAR

As we can clearly see from the charts, from a Cycle / Phase analysis, it is dire time for the USD to correct as we see top outs in basically all of the charts Don't be surprised if it goes UP first, then down (sell the news but in reverse for the BRICS currencies).

The summit is being hosted by South Africa, which is the current chair of BRICS. The other members of BRICS are Brazil, Russia, India, and China.

The summit is expected to focus on the war in Ukraine, the global economy, and the expansion of BRICS. The theme of the summit is "BRICS and Africa: Intra-BRICS cooperation for sustainable development in Africa".

Russia's President Vladimir Putin is not attending the summit in person due to the international arrest warrant issued against him for alleged war crimes in Ukraine. He is being represented by Foreign Minister Sergei Lavrov.

The summit is expected to boost investor confidence in the BRICS economies. This is because the summit will provide an opportunity for the BRICS leaders to discuss ways to strengthen their economic cooperation and coordination. This could lead to increased investment in the BRICS economies, which would boost their growth prospects.

Top Stocks to consider are:

1. Petrobras (PBR) is the largest oil and gas company in Brazil. NYSE:PBR

2. Sberbank (SBER) is the largest bank in Russia. MOEX:SBER

3. State Bank of India (SBI) is the largest bank in India. BSE:SBIN

4. China Mobile (CHL) is the largest mobile phone company in China. MIL:CHL

5. Tencent (TCEHY) is a Chinese multinational technology conglomerate. OTC:TCEHY

6. Alibaba (BABA) is a Chinese multinational technology conglomerate. NYSE:BABA

7. Vale (VALE) is a Brazilian multinational mining company. NYSE:VALE

8. PetroChina (PTR) is the largest oil and gas company in China. SSE:601857

9. ONGC (ONGC) is the largest oil and gas company in India. NSE:ONGC

10. Infosys (INFY) is an Indian multinational information technology company. NSE:INFY

The summit is also expected to lead to a weaker US dollar. This means that the other currencies against the dollar as listed on the 4 charts will strengthen. This is because the BRICS countries are collectively a major source of demand for commodities, such as oil and gold. If the summit leads to increased investment in the BRICS economies, it could lead to higher demand for commodities, which would put upward pressure on commodity prices and the value of currencies of commodity-exporting countries, such as the Brazilian real and the Russian ruble. This would make the US dollar less attractive to investors, which could lead to a weaker dollar.

A great way to capitalize on the outcome of BRCIS 2023, is to anticipate and keep an eye out on markets that will potentially be positively affected by this summit.

_______________________

📢 Show us some LOVE 🧡 Follow for daily updates and trade ideas on Crypto , Stocks , Forex and Commodities 💎

We thank you for your support !

CryptoCheck

What's the next move ?The CMP(current market price) is at weekly resistance zone.

Below scenarios can happen:

1. Bear :: If a daily candle closes below 82.5920, advisable not to enter the market as the triangle is about to converge leading to triangle breakout & also the Risk: Reward ratio would be small.

2. Bull :: If a weekly closes above 83.2850, this is a ascending triangle breakout. The target for the weekly breakout will be 86.7317. This target will take time to reach.

Best advisable to add 1 or 2 lots in far out of the expiry(like 3 or 6 months far expiry after the breakout)

USDINR Indian Rupee Long TradeSome traders will buy straight up the pullback

back into the demand/support/break-out retest

area while others will wait for a potential Stop hunt

liquidity search of those traders and buy after that

happens. I always like the idea of waiting for confirmation

on smaller timeframes (1hr/4hr)....

What are you looking for?

BANKNIFTY - Bets, Cuts and threats. Starts with cuts, China cuts the Reverse Repo Rate, News of Michael Burry shorts surface and talk of the town here also. To his credit he predicted 2008 crash and a movie also made. His recent warnings include the warnings in 2021 which have not materialised. Till a week ago, bears are dead story remained. Correction and crash are completely different aspects. Also, his positions are in Options which is completely different than lethal naked shorts. While contextually it is a news worth adding to the existing trend, but that is more applicable to overseas than to our markets save little, short-term correlation. Fitch warns of downgrades coming more and that include names like JP Chase, that sent the market to shiver and cover. What is to be watched for us. 1 The recent manufacturing and Industrial production data was week. 2. ICRR impact is liquidity negative 3. Inflation number 7.45% is steepest and its impact on bond yields to be watched which looks toward 7.35% last but not the least 4. USDINR moves as most of the EM and CNY on the fall. While these bags full of negatives remain to the bears, the bulls will be watching how strong 43300-500 will be protected. Looks we are one more step-down range of 43300-44300. Shorts below 44300, any existing longs to unwind. With Index also showing signs of corrective move down, caution is better word. Hedge appropriately remains the choice.

NIFTY - Mov(i)e "83"83 is the popular movie on the famous victory of Indian Cricket. Another 50 days to go for the One Day World Cup. The left lower portion PIP graph is of USDINR. 83 has been the force kept pushing the dollar bull futile exercise, while narrative rupee bulls with chest thumping hops of deep down to the 80, drawing comfort of DXY failures (has not gone anywhere and in fact showing strong up trend against EM). The global cues are negative, Fitch warns of further down grade that include the big names also. China cuts the repo, confirms the deep-down issues, waives stamp duty on the real estate, episodes of Evergrande, and country garden continue to depress. Housing data today morning is sharply lower than the June numbers. Russia, rushes to hike the rate as rubble wobble. Turkey gets the rating upgrade is the lone positive but who cares. Not enough, Argentina dollarisation story makes rounds, as it has large CNY reserves. CNY tanks and near 7.30. In offshore market yesterday memes fly on rupee attaining independence at 83.47. What one needs to understand is rupee annualised depreciation of 2% is quite normal relative to 4-5%. For the USD denominated FII till yesterday the returns are flat for the last two years (based on INDEX), that can turn negative. FII numbers in the last couple of days are negative and looks that would continue be the case. July large SIP inflows are the buffer points to take away. The top left hand side PIP is the line graph showing HnS pattern, this calls for move towards 19060 or 18800-19000 range. The bottom Right hand side PIP shows evening star and potential 38.2% of retracement which also takes towards similar objective. The only question is will this be sharp move down or a measured one to expect. Both are on the cards. US Markets broken the strong supports while Europe indexes were the first to give away. Today Asia is red, Giftynifty down 80 points, one can expect 1% cuts to go. On the daily which is the main frame, trend line broken, the Monday candle is for sure not a hammer but bearish doji, decisive break today below 19380 confirms move towards low 19000. Shorts can continue and fresh shorts stops 19450.

USD breaks out against the Indian RupeeTypically the upside breakout of an ascending triangle will travel 1X to 2X in distance equal to the height of the triangle at its widest point. This would imply an advance toward 86 and possibly toward 88. $USD/INR. The best way to play this is with Singapore futures IMO

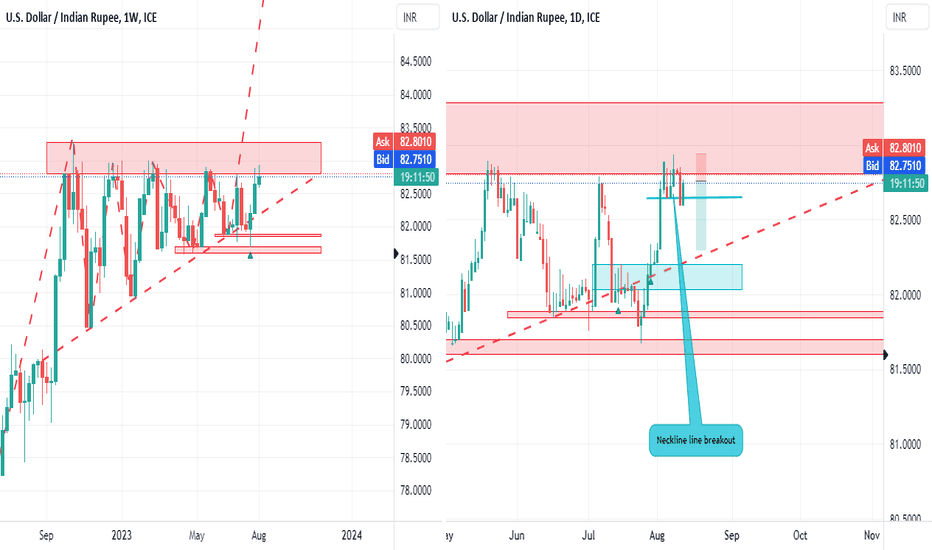

Double top neckline breakout In weekly the market is in Ascending triangle pattern. where the current market price is at weekly resistance.

In daily time frame there is change in trend(from bull to bear) formed by double top neckline breakout, so the market is expected to fall further till the weekly ascending trend line(support).

After the DT neckline breakout now the market is in retest, a good level to sell where minimum risk : reward ratio is 1:2.5

$USDINR Breakout Daily ChartFX_IDC:USDINR Breakout Daily Chart watch closely for a test of the horizontal line. The USD/INR exchange rate is important to the U.S. stock market because it affects the cost of investing in Indian stocks for U.S. investors. When the USD/INR exchange rate is high, it means that it costs more U.S. dollars to buy a given amount of Indian rupees. This makes Indian stocks more expensive for U.S. investors, which can lead to a decline in demand for these stocks. Conversely, when the USD/INR exchange rate is low, it means that it costs less U.S. dollars to buy a given amount of Indian rupees. This makes Indian stocks cheaper for U.S. investors, which can lead to an increase in demand for these stocks.

In addition to the cost of investing, the USD/INR exchange rate can also affect the profitability of U.S. companies that do business in India. When the USD/INR exchange rate is high, it means that U.S. companies that export goods and services to India earn more rupees per dollar. This can boost their profits. Conversely, when the USD/INR exchange rate is low, it means that U.S. companies that export goods and services to India earn fewer rupees per dollar. This can hurt their profits.

Overall, the USD/INR exchange rate is an important factor that can affect the U.S. stock market in a number of ways. It is important for U.S. investors to monitor this exchange rate and factor it into their investment decisions.

Here are some specific examples of how the USD/INR exchange rate can affect the U.S. stock market:

If the USD/INR exchange rate rises sharply, it could lead to a decline in demand for Indian stocks by U.S. investors. This could cause the prices of Indian stocks to fall.

If the USD/INR exchange rate falls sharply, it could lead to an increase in demand for Indian stocks by U.S. investors. This could cause the prices of Indian stocks to rise.

If the USD/INR exchange rate remains high for an extended period of time, it could hurt the profitability of U.S. companies that do business in India. This could lead to lower stock prices for these companies.

If the USD/INR exchange rate remains low for an extended period of time, it could boost the profitability of U.S. companies that do business in India. This could lead to higher stock prices for these companies.

USDINR is on verge of break out. USDINR has been trading in the 83-80 area since October 2022. The USDINR has been consolidating for nine months and is on the verge of breaking over the 83 barrier. If it breaks over 83 per USD, the pair might go to 86 within 6 months. When the rupee reaches 86 per USD, the Indian central bank may interfere. The ultimate target for Primary Degree Wave 3 may be 90 per USD in the next couple of years, as illustrated in the graph.