USDINR- Broke the resistance zoneUSDINR has broken the falling trendline and also broke past an important horizontal resistance region of 78.15 - 78.20. This was broken with a huge candle.

With this move, it has not only broken the horizontal and trendline supports, but also the tend of LL-LH. This is a clear bullish signal. However, we can't go away with the fact that the central bank may step in to control these levels.

Let's see how the follow-through candles develop today and tomorrow on Daily timeframe. It shall retain the 78.15 - 78.20 region for further up-move.

USDINR

USDINR - Short-term trend looks downUSDINR is forming lower-lows and lower-highs. Same is the case with RSI.

I see the upward side strong resistance zone remains between 78.05 - 78.10. Till the time 78.10 is not broken on the upside, I see we may see some bearish to sideways trend in USDINR during next few days.

USDINR Current TrendUSDINR is following a upward channel, visible in daily chart and in consolidation phase from last almost one month. Similarly, a visible downward channel is also visible in four-hour time frame which is continuing for last fifteen days. Breakout from the consolidation phase in any direction may give this instrument a massive movement.

#usdinr

USD/INR Bullish /Uptrend As we see in the graph that double correction has completed and now the journey towards the upside is started in the form of C leg .....

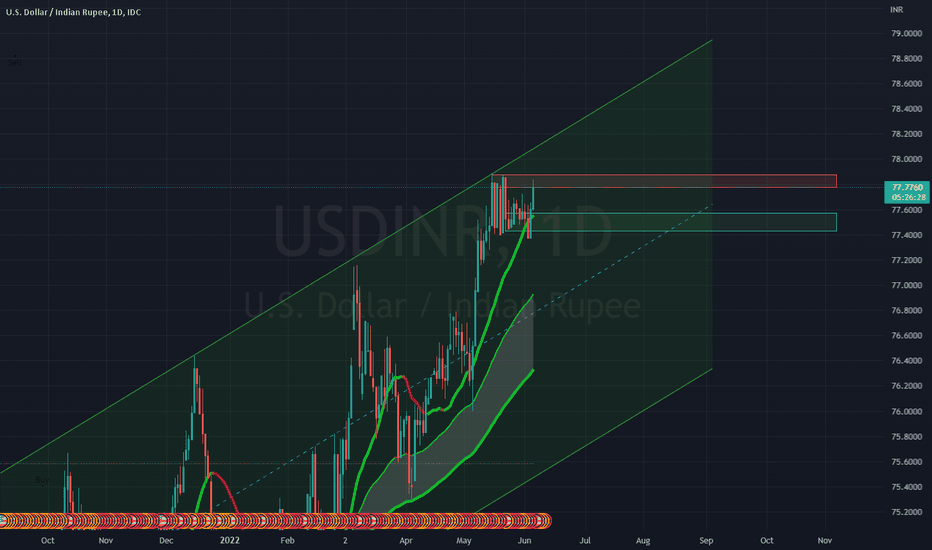

USDINR looks strong on Daily & Weekly timeframe, heading to 77.8USDINR is rising on rising sharply due rising crude oil prices this week, as European nations has said No to Russian Oil.

USDINR is looking strong and can head to levels of 77.8 where it can face huge resistance.

If USDINR manages to trade above 77.8 levels on daily and weekly timeframes, then it is heading towards 78.5 levels.

If BEARS managed to hold USDINR further upward movement or if RBI intervenes, then it can fall back to retest 77.4 levels.

P.S. Most of this movement in USDINR this week would be dependent on how CRUDE OIL performs in global markets.

USDINR looks to be good short, heading down to 77.2 levelsUSDINR has been trading in an Upward Parallel Channel, since last year end till now. Recently it has hit the upper top of the channel at 77.88 levels.

Its a SELL till 77.4 and if it breaks 77.4 level with good volume, it can further drift down to 77.17 levels.

76.94 to 77.1 7 is a Buy Zone, where can be a bounce back but till that time, its a Short.

USDINR AnalysisDollar is near all time high against INR, and is following an uptrend channel from last six months. At this point 77.580 and 77.707 levels will act as crucial resistance. If it crosses 77.707 level then we may see new highs. But any negative price action below 77.580 level we may expect some downward move. In that case 77.350 will act as major support followed by trend lines at daily chart. In daily Time frame RSI was showing some weakness but at current scenario it may take support at 60 level from where we may also see a bounce back. A possible uptrend line is also present which is visible at 1 hour time frame

USDINR : Breakout or Breakdown USDINR is at crucial levels, if it breaches on upside it would mean more pain in Indian share market

but if it breaks down from these levels which has a very high probability then look for recovery in Nifty & BN from here on.

USDINR - 26Apr2022USDINR - 26Apr2022

On the daily, USDINR tested the 78.6% Fib retracement at around 76.758 yesterday.

On the H4, price have pull back from the 1st Resistance after Stochastic has pulled back from Stochastic. If price can closes above this level, we could expect it to retest previous highs at 77.055.

Disclaimer: This is for personal work record purposes only, not financial advise or solicitation of trade.

USDINR - 19Apr2022USDINR - 19Apr2022

On the daily, price is bouncing higher after a triangle breakout with upside target to around 78.200, Before that could take place it has to close above 78.6% Fib retracement at around 76.758.

On the H4, price faced bearish pressure from the 1st Resistance at 76.4250 yesterday. H4 is still playing out its previous h&s pattern. If price actions close above right shoulder highs at around 76.60, we can invalidate the H4 h&s and expect upside to the daily triangle target.

Disclaimer: This is for personal work record purposes only, not financial advise or solicitation of trade.

GBPUSD- 14Apr2022GBPUSD- 14Apr2022

On the daily, GBPUSD is trying to bounce above the 20EMA

On the H4, GBPUSD bounced higher on the back of DXY pulling back. Price has also bounced and confirmed above 20EMA and 50MA. With H4 Stochastic at resistance, we could expect price to face bearish pressure from the 200MA + 1st Resistance at around 1.31570.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDINR - 07Apr2022USDINR - 07Apr2022

On the H4, USDINR bounced back strongly to the descending trendline + Fib resistance. With RSI also coming into resistance, we could expect USDINR to have a pullback to at least 1st Support at 75.6500.

This is for personal work record purposes only, not financial advise or solicitation of trade.

USDINR - 06Apr2022USDINR - 06Apr2022

On the weekly, USDINR dropped back to 20EMA support. On the daily, price is also at Fib confluence support with a doji candle closed yesterday. We could expect a short-term bounce today.

On the H4, USDINR continued its h&s downside target to 74.35. However, price is currently at daily and Fib confluence support. It could have a short-term bounce first before going lower.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDINR - 31Mar2022USDINR - 31Mar2022

On the H4, there could potentially be a h&s in play with downside target of 74.35. If the price were to bounce back to 1st Resistance at 76.19, it could potentially face bearish pressure to push the price down to 74.35.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDINR - 23Mar2022USDINR - 23Mar2022

On the H4, market structure for recent price action have changed to lower highs and lower lows. Price faced rejection yesterday at the 50% Fib resistance at 76.45. As long as price action is kept below 76.70, we could expect USDINR to drop lower to 200MA at around 75.60.

This is for personal record purposes only, not financial advise or solicitation of trade.

USD/INR longDespite srabotnanny SL in the last idea, I consider that height of vapors of USD/INR will proceed. Now the price reached the trend line on the week chart from which the price many times made a start. I set as the purpose on this idea a price maximum.

TP = 76.97

Information provided is only educational and should not be used to take action in the market.

USDINR - 14Mar2022USDINR - 14Mar2022

On the weekly, price close as a spinning top candle last week above the minor bullish channel. On the larger timeframe, USDINR has room for further upside.

On the H4, price is bouncing back to retest previous highs at 77.16 after a strong bounce back last Friday.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDINR - 11Mar2022USDINR - 11Mar2022

On the daily, the price gapped lower and bounced yesterday. But the price is still close lower than the previous day's candle.

On the H4, price bounced from 50MA support at 76.08. As price closed lower on the daily, we could expect USDINR to pullback further to daily / H4 Support at 75.75

This is for personal record purposes only, not financial advise or solicitation of trade.