USDJPY: Long Signal with Entry/SL/TP

USDJPY

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USDJPY

Entry Level - 145.33

Sl - 144.41

Tp - 147.41

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDJPY

USDJPY Moment of truth for the long-term bullish trend.The USDJPY pair has been trading within a Channel Up since the October 17 2022 High and right now the current 1W candle is very close to its bottom (Higher Lows trend-line). This offers a low risk trading set-up.

Confirmed buy will be if the price breaks and closes a 1W candle above the 1W MA50 (blue trend-line), in which case our Target will be July's Resistance at 161.500 (similar to the 2023 Bullish Leg).

If on the other hand it breaks and closes a 1W candle below the Channel Up, turn short and target the 1W MA200 (orange trend-line) at 139.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Fundamental Market Analysis for April 10, 2025 USDJPYThe Japanese yen (JPY) showed strength during the Asian trading session on Thursday, reacting to the release of producer price index (PPI) data that exceeded market expectations. This macroeconomic signal reinforced speculation about possible further monetary policy tightening by the Bank of Japan (BoJ), keeping the probability of an interest rate hike in the future. Additional support for the yen was provided by positive expectations of a potential trade agreement between Japan and the United States.

Amid the weakening of the US dollar (USD), the USD/JPY pair showed a pullback and fell below the psychologically important level of 147.000, which was also supported by a limited correction of the US currency amid a general recovery in market confidence.

The divergence in monetary expectations between the Bank of Japan and the Federal Reserve remains significant. While Japan is increasingly likely to tighten monetary policy, markets in the US are pricing in a scenario of multiple cuts in the Fed's key interest rate in 2025. This discrepancy has prevented the US dollar from maintaining momentum after an overnight recovery from a weekly low, prompting a reallocation of capital in favor of the more stable yen despite its status as a low-yielding currency.

Improved global risk sentiment, driven by US President Donald Trump's announcement of a temporary suspension of retaliatory tariffs against key trading partners, may also help strengthen the yen as a safe haven asset, especially amid continued uncertainty in international markets.

Trade recommendation: SELL 146.800, SL 147.400, TP 145.400

Yen Climbs as Trump Softens Stance on Japan TariffsThe Japanese yen strengthened past 147 per dollar on Thursday, moving in a volatile range as trade tensions persisted. Markets reacted to President Trump’s 90-day pause on tariffs for non-retaliating countries, offering Japan some relief with a reduced 10% baseline tariff. However, tensions remained elevated as Trump raised tariffs on Chinese imports to 125% in response to Beijing’s retaliation. The EU may be excluded from the pause due to its own countermeasures. Meanwhile, the U.S. confirmed plans to begin trade talks with Japan after Trump’s call with Prime Minister Shigeru Ishiba.

Key resistance is at 148.70, with further levels at 152.70 and 157.70. Support stands at 145.60, followed by 143.00 and 141.80.

USDJPY H1 I Bullish Bounce Off Based on the H1 chart, the price is falling toward our buy entry level at 145.09, a pullback support that aligns with the 78.6% Fibo retracement.

Our take profit is set at 148.83, a pullback resistance.

The stop loss is set at 143.98, a swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

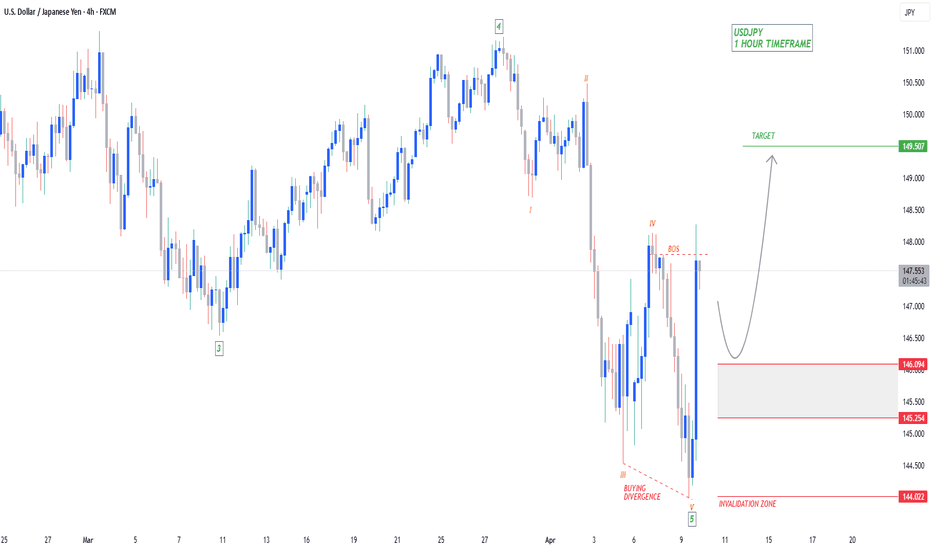

USDJPY Bullish to $149.500Rather than buying at the top of the ‘Impulse Wave’, wait for a ‘Wave 2’ or ‘Wave B’ correction towards the support zone, so you can buy back at a cheaper price.

⭕️5 Major Wave Bearish Move Complete.

⭕️5 Minor Waves Complete in Wave 5.

⭕️BOS Confirming Bullish Structure Now Valid.

Another tariff u-turn: Oil overbought on news? President Trump announced a 90-day pause on reciprocal tariffs for countries that have not retaliated, sparking a sharp rally in U.S. markets. The Nasdaq 100 led gains with a 12.2% surge. The U.S. dollar also strengthened against safe-haven currencies such as the Japanese yen and Swiss franc.

Crude oil prices rebounded alongside equities, with oil futures rising more than 4% to trade above $62 per barrel.

However, the strength of the oil rally may be overstated. China, one of the world’s largest oil consumers, was among the first to retaliate against U.S. tariffs. Tensions between Washington and Beijing have worsened, prompting the U.S. to raise tariffs on Chinese goods to 125%.

Adding to the caution, analysts at Goldman Sachs revised down their 2026 average price forecasts for Brent and WTI, citing rising recession risks. The bank now expects Brent to average $58 per barrel and WTI to average $55.

USDJPY Bearish Flag Breakdown – Eyes on 140.11 Support ZoneUSDJPY is showing signs of a bearish continuation, following a breakdown from a rising wedge pattern. The recent strong drop confirms a shift in momentum from bullish to bearish, with price now forming a bear flag just below a key structure.

Key Technical Zones:

Current Price: 147.78

Resistance Area (Invalidation Zone): 148.11 – 151.44

Support Targets:

TP1: 142.87

TP2: 140.11

Technical Confluence & Patterns:

✅ Series of Rising Wedges followed by sharp breakdowns

✅ Bear Flag Pattern forming after recent drop

✅ Lower highs & lower lows confirming downtrend

✅ Volume spike during breakdown, low volume on pullback

Trade Outlook:

📉 Bias: Bearish below 148.11

📌 Entry Zone: On confirmation of flag breakdown

🎯 Target 1: 142.87 – Previous horizontal support

🎯 Target 2: 140.11 – Major swing support / demand zone

🛑 Invalidation: Break above 151.44 (major resistance zone)

Conclusion:

USDJPY is set up for a potential bearish continuation as it respects a textbook flag breakdown setup. A close below 147.50 would reinforce bearish pressure with further downside toward 142.87 and 140.11. Traders should monitor momentum and structure confirmation before entering positions.

Let me know if you want a short caption or video script version! 📉

Yen surges to six-month high, BoJ cautiousThe Japanese yen continues to make inroads against the US dollar. In the North American session, USD/JPY is up 1.1% on Wednesday, trading at 144.60. Earlier, the yen strengthened to 143.98, its strongest level since Sept. 2024.

Bank of Japan Governor Kazuo Ueda said on Wednesday that the central bank will have to determine the impact of US trade policy on growth and inflation in Japan. Ueda said that US tariffs had created new uncertainty and signaled that the BoJ might hold off on further interest rates until the situation became more clear.

Ueda repeated that the BoJ would raise rates if the economy continued to improve, and currently, underlying inflation was rising and moving closer to 2% target. The uptake is that the BoJ is being very cautious with all the turmoil in the markets and is dampening expectations of a rate hike at the May 1 meeting.

FOMC minutes - still relevant?

The Federal Reserve will post its minutes of the March rate meeting. Investors scrutinize the minutes for policy clarity but global economic developments are unfolding so quickly that it's questionable if the minutes will be relevant with the massive market sell-off and the trade war between the US and China.

Earlier today, the US lifted tariffs on China to an astounding 104% and China has retaliated with an 84% counter-tariff. The turmoil in the financial markets has nervous investors looking for safer shores, and are parking their funds in safe-haven assets like the Japanese yen and the Swiss franc. In April, the yen has jumped 3.3% against the US dollar, while the Swiss franc has soared 5% against the greenback.

USD/JPY has pushed below support at 145.46 and is putting pressure on support at 144.64

There is resistance at 146.79 and 147.61

#USDJPY:1351+ Bullish Move One Not To Miss| Three TPs| JPY has been bullish since the dollar strengthened, potentially leading to a trade war that would make the Japanese yen more valuable to global investors. However, we may see a strong correction on all XXXJPY pairs, potentially returning stronger with a major bullish correction. We’re not sure if the price will hit all three take profit zones, but we’re interested in how far it goes.

Use accurate risk management. This analysis is purely for educational purposes only. Use your own knowledge and analysis before taking any entries.

Team Setupsfx_

USDJPY Bearish continuation below 148.10The USDJPY currency pair remains in a bearish trend, with the recent price action showing signs of an oversold bounce. While a temporary rebound is in play, the broader sentiment remains weak unless a decisive breakout occurs.

Key Levels to Watch:

Resistance Levels: 148.10 (critical level), 150.10, 150.90

Support Levels: 144.20, 143.00, 141.40

Bearish Scenario:

A rejection from the 148.10 resistance level could reaffirm the downside bias, leading to a continuation of the bearish move toward 142.20, with extended declines targeting 143.00 and 141.40 over the longer timeframe.

Bullish Scenario:

A breakout above 148.10 with a daily close above this level would challenge the bearish sentiment, opening the door for further gains toward 150.10, followed by 150.90.

Conclusion:

The market sentiment remains bearish, with 148.10 acting as a critical resistance zone. A rejection from this level could reinforce the downtrend, while a confirmed breakout would shift the outlook to bullish, favouring further upside. Traders should closely monitor price action at this key level for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USD/JPY(20250409)Today's AnalysisMarket news:

The U.S. Customs and Border Protection Agency reiterated that the specific tax rates for each country will be announced at 12:01 a.m. on April 9.

Technical analysis:

Today's buying and selling boundaries:

146.77

Support and resistance levels

148.90

148.10

147.59

145.95

145.43

144.63

Trading strategy:

If the price breaks through 145.95, consider buying, the first target price is 146.77

If the price breaks through 145.43, consider selling, the first target price is 144.63

Yen Appreciates with Trade TurmoilThe Japanese yen rose above 146 per dollar on Wednesday, extending gains as Trump's looming tariffs drove safe-haven flows. The dollar weakened on recession fears tied to escalating trade tensions and potential Fed rate cuts. New U.S. tariffs include a 24% duty on Japanese goods and a 25% car import levy. Trump confirmed that Japan will send a delegation to renegotiate terms, while PM Ishiba urged a policy rethink. Domestically, Japan's current account surplus hit a record in February, supported by strong exports and reduced imports, boosting the yen further.

Key resistance is at 148.70, with further levels at 152.70 and 157.70. Support stands at 145.60, followed by 143.00 and 141.80.

Possible Battle Between USDJPY Bulls and Bears at TrendlineUSDJPY is currently testing its weekly trendline, but recent data from Japan may challenge the possibility of a downward break.

Market turmoil has increased demand for long-term U.S. bonds, and the resulting drop in the TVC:US10Y has kept the TVC:DXY under pressure, conditions that have supported Yen bulls. However, the latest wage data out of Japan may shift the short-term outlook just as the trendline is being tested.

Base full-time wage growth dropped to 1.9% year-over-year, down from 3%. This slowdown may give the Bank of Japan more justification to hold rates steady at its next meeting. If tariff-related panic subsides with any calming news from the White House, USDJPY could see renewed upside potential.

In the short term, two resistance levels are crucial: 146.50 and 147.50. The battle between bulls and bears is likely to play out between these resistance levels and the weekly trendline near 145.

USDJPY Double Bottom PatternFenzoFx—USDJPY formed a double bottom pattern, which is a bullish signal. The immediate support is at 144.56. If this level holds, the currency pair could rise toward 148.2. Traders should monitor this level for bearish signals.

Please note that the bullish outlook should be invalidated if USD/JPY dips below the immediate support.

USD/JPY H1 | Pullback resistance at 38.2% Fibonacci retracementUSD/JPY is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 146.018 which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 146.98 which is a level that sits above the 61.8% Fibonacci retracement and an overlap resistance.

Take profit is at 144.54 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDCAD IS DRROPPING. DETAILED TECHNICAL AND FUNDAMENTALSUSDCAD is currently trading around 1.4200 after a clean retest of a previously broken support zone, which has now turned into a strong resistance level. Price action is confirming the bearish structure as we see a gradual yet consistent drop from the highs of 1.4540. With the rejection seen from the supply zone and recent lower high formation, momentum is shifting further in favor of the sellers. I am now targeting 1.3800 for the next key level, aligning with both technical confluence and fundamental sentiment.

Technically, the structure is clear: we had a failed breakout above 1.4450, followed by a decisive bearish engulfing move. The market then completed a textbook retest at the 1.4340–1.4450 supply zone before resuming the downside move. The current formation on the 12H chart shows a lower low and lower high sequence intact, signaling a trend continuation to the downside. The highlighted zones also provide ideal reward-to-risk setups for continuation traders.

From a fundamental perspective, the Canadian dollar is gaining strength due to rising oil prices, with WTI crude now climbing back above the $85 mark. This directly supports the loonie given Canada’s oil-export-driven economy. Meanwhile, US economic uncertainty around upcoming CPI data and shifting Fed rate cut expectations continue to weigh on the dollar’s upside momentum. Additionally, recent risk-on sentiment in global markets is pushing flows into commodity-linked currencies like CAD.

With technicals and fundamentals aligning, I remain firmly bearish on USDCAD. As long as price remains below the 1.4340 resistance, I’m looking for continuation toward the major demand zone near 1.3830–1.3800. This setup offers a clean 1:3+ risk-to-reward profile, and I will be scaling in further on bearish confirmations as the market progresses.

USDJPY Analysis: Reversal Estimations Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels. The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Double Bottom/Top

Engulfing Bullish /Bearish

Hanging Man

Hammer/Inverted Hammer

Morning Star

Shooting Star

Triple Top/Bottom

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Price levels

Price DH Price DL

144.52194 144.63007

144.48096 144.67107

144.38595 144.76618

144.19602 144.95648

144.00622 145.14691

143.81654 145.33746

143.62698 145.52814

143.43756 145.71894

143.24825 145.90987

143.05907 146.10093

142.30361 146.86639

141.55015 147.63385

140.79868 148.40332

140.04922 149.17478

139.30176 149.94824

138.55630 150.72370

137.81283 151.50117

137.07137 152.28063

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

Eur/Usd sell setup update!!Good day traders, we back again we another beauty of a setup well Atleast I like to believe that😂.

Eur/Usd a set was posted here by me on TradingView before market opened on Monday and if you go look at that set up today’s move was seen before hand and now that price went higher, we can now expect to see price move lower for the rest of the week to our liquidity resting below(equal lows). On the 4 hour price just broke structure higher solidifying a low that we want to see get broken during today trading day.

As soon as price breaks structure lower on the LTF’s than we have a alert to enter our shorts, good luck and have a wonderful day✌️

My name is Teboho Matla but you don’t know me yet…

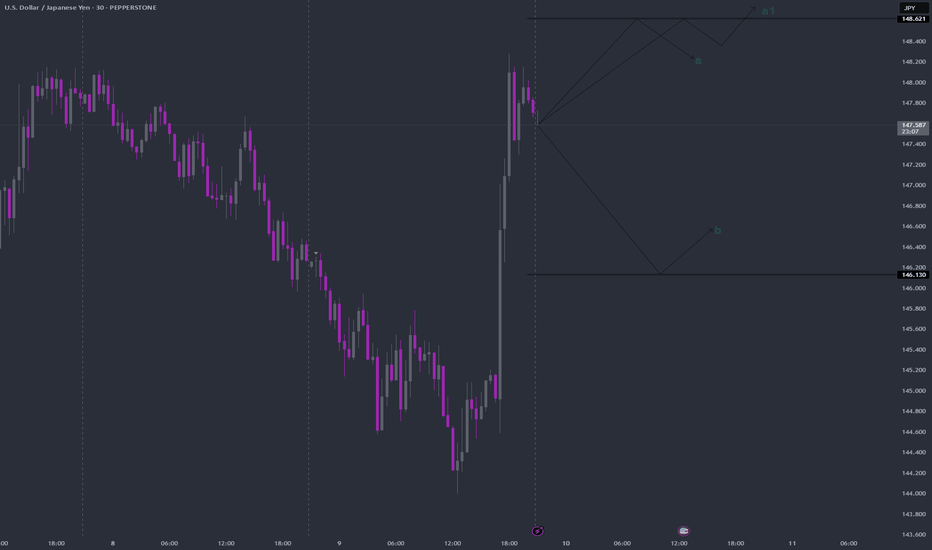

Usdjpy 8 Apr updateAs per last usdjpy post, price formed 5 waves down which signal end of a phase.

Price indeed move up and now formed a more bullish outlook.

Maybe mr market is trapping all those bears and going to hunt their stops, as traders thought shorting usdjpy is easy money for risk aversion(Tariffs war).

Anyway, the move up had given a few hundred pips of profit, closed most and running the rest up, "if it works...lol"