USDJPY

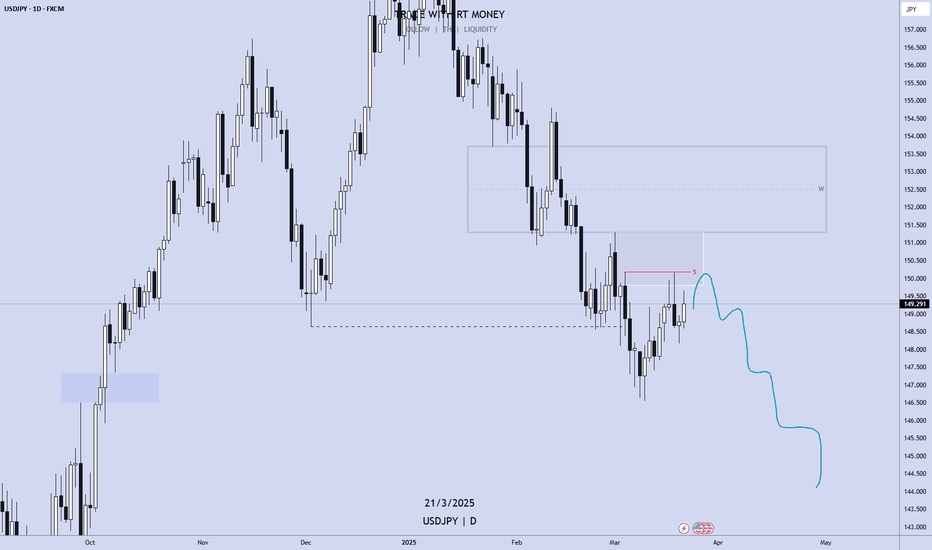

Weekly FOREX Forecast Mar 24-28: Buy CAD, CHF, JPY vs USD!This is an outlook for the week of March 24 - 28th.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

The USD Index is entering a Daily +FVG, which is nested in a Weekly +FVG. This is a bearish indication for the USD, which is a potential bullish situation for EURUSD, GBPUSD, AUDUSD and NZDUSD. This will be potentially bearish for the USDCAD, USDCHF, and USDJPY. Wait for the market structure shift going in the direction of your TP, and enter on the pullback.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

USD-JPY Move Down Ahead! Sell!

Hello,Traders!

USD-JPY is trading in a

Downtrend below the falling

Resistance line and the pair

Will soon hit the resistance

From where we will be

Expecting a further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD Sell Position 24-28 March 2025Hello everyone, dzhvush here!

I am looking for selling position on GBPUSD chart. All week I am going to look to opportunities for selling. We have news also. Be careful, pay attention and trade.

If you agree with me, drop a comment !

GBPUSD - Opportunities for Selling

USDJPY - Buying opportunities can be sought

Best Regards

dzhvush

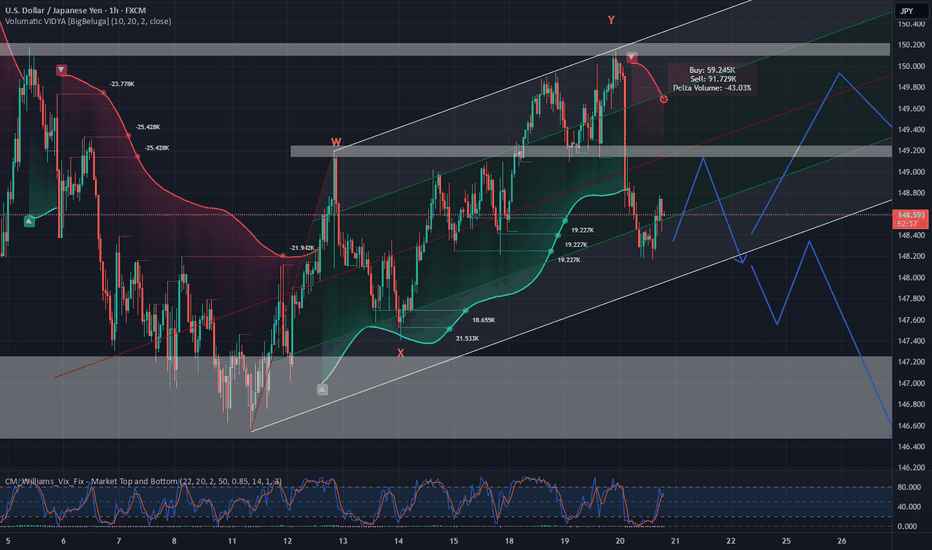

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 149.500 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 149.500 support and resistance area.

Trade safe, Joe.

USD/JPY Analysis: Dollar Weakens After Fed DecisionUSD/JPY Analysis: Dollar Weakens After Fed Decision

Yesterday, the Federal Reserve announced its interest rate decision, which, as expected, remained unchanged. Fed Chair Jerome Powell emphasised that there is no rush to cut rates amid uncertainty surrounding US inflation and the tariff policies implemented by the Trump administration.

This key announcement triggered volatility in financial markets, notably:

→ US stock indices rose;

→ the US dollar weakened, which was evident in currency (and cryptocurrency) charts involving USD pairs.

The most significant movement occurred in the USD/JPY chart, as the Bank of Japan was also active yesterday. While it also left interest rates unchanged, it acknowledged growing uncertainty around Japan’s economy and added a new reference to the "changing trade environment."

Technical Analysis of USD/JPY

As we noted on 21 February when analysing the Japanese yen’s exchange rate against the US dollar:

→ Price fluctuations are forming a downward channel (marked in red).

→ The former support at the lower boundary of the blue channel may now act as resistance.

Since then, the price has:

→ Tested the breakout level (indicated by an arrow) before continuing to decline within the channel, confirming its relevance.

→ Reached the lower boundary of the channel and rebounded upwards from the 147 yen per dollar level.

Given that the price is closely interacting with the channel lines and is currently around its median, it suggests that supply and demand are relatively balanced under these conditions. This is further supported by the fact that neither the Fed nor the Bank of Japan introduced surprises, leaving interest rates unchanged.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDJPY: Critical moment for the 2 month Channel Down.USDJPY is neutral on its 1D technical outlook (RSI = 46.506, MACD = -0.960, ADX = 25.882) as it is on the tightest range possible between the 4H MA50 and 4H MA200. This consolidation is taking place at the top of the 2 month Channel Down. As long as it holds, the trade is short, aiming for a -3.20% bearish wave (TP = 145.500). If the price crosses above the 4H MA200 though, go long, aiming for the R1 level (TP = 154.835).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Yen Slips to 149 as Inflation EasesThe yen fell to around 149 per dollar on Friday, ending a two-day rally, after Japan’s core inflation eased to 3% in February from 3.2% in January, still above expectations of 2.9%. This marked the second month of stronger inflation, reinforcing the case for future rate hikes.

Earlier, the BoJ held rates at 0.5% and maintained a cautious stance, citing global uncertainties, particularly rising U.S. tariffs. The bank also reiterated its focus on monitoring currency moves. A stronger U.S. dollar further pressured the yen amid global growth and trade concerns.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

USDJPY Will Go Lower! Short!

Please, check our technical outlook for USDJPY.

Time Frame: 8h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 149.408.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 147.585 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY: Volatility and Key LevelsThe recent trend of the USD/JPY has been highly volatile. On the economic data front, the rise in Japan's unemployment rate and the decline in corporate capital expenditure have triggered selling pressure on the Japanese yen. However, factors such as corporate wage growth provide grounds for the Bank of Japan to consider raising interest rates.

From a technical perspective, key support levels are situated around 147.7 and 146.5, whilst the resistance levels are now between 150 and 151. Amid the ongoing battle between bulls and bears, the pair is likely to continue trading within the range of 147.00-149.00. That said, given the current upward momentum, a technical pullback followed by further gains in the short term cannot be ruled out.

USDJPY

buy@148.000-149.000

tp:150.000-151.000

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USDJPY SELL SETUP!!From a technical perspective, examining the USD/JPY chart, we might notice that prices are forming a lower high, which often indicates a potential downtrend. The price respecting Fibonacci retracement levels can also suggest that the market is reacting to key support and resistance levels. When traders see the price approaching these levels and behaving predictably, it can bolster their confidence in the direction of their trades.

Overall, the expectation is for a continuing strength in the yen, especially if the market sentiment remains focused on potential rate hikes from the Fed. This scenario might lead to more bearish moves for the USD/JPY pair, making it important to watch for any significant economic data releases or comments from central bank officials that could signal changes in monetary policy.

Bullish rise?USD/JPY has reacted off the pivot and could rise to the 1st resistance.

Pivot: 148.96

1st Support: 148.34

1st Resistance: 149.97

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Short Opened 4 short positions (1 trading side divided into 4 small sizes):

148.622 has been the major support area USDJPY was struggling to break below since last December, however, it finally broke and closed below that level on March 4th 25 (red vertical line in 4H chart).

Since then, USDJPY has been oscillating between 150.24 and 146.55, but this morning it decisively broke and closed below the key level.

Price is below EMA 200 in Daily and 4H.

Daily MACD is in bear territory and Daily stochastic has reached over bought territory and starting to come down.

All momentum indicators in 4H are forming negative divergence.

Entry price - 148.556

S/L - 149.39 (just above the previous week high)

Target 1: 147.30 (previous low in 4H)

Target 2: 146.55 (previous low in 4H)

Target 3- 145

Target 4: 142.26 (Fib 1.618 in Daily)

If Target 1 and 2 are hit successfully, I will adjust SL I will update the progress.

USD_JPY WILL KEEP FALLING|SHORT|

✅USD_JPY is trading along the falling resistance

And as the pair will hit it soon

I am expecting the price to go down

To retest the demand levels below at 147.500

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY DAILY ANALYSISHello traders here is my setup for USDJPY for the week as you can see the price has been on a down trend, and now you can see that the price have done a retracement and it is now on the level of structure that was recently broken and it is likely to act as resistance now I have to wait for confirmations like bearish engulfment then I would look to short the USDJPY.

NP: This is not a financial advice its just my prediction, what do you think?

Heading into overlap resistance?USD/JPY is rising towards the resistance level which is an overlap resistance that lines up with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 149.13

Why we like it:

There is an overlap resistance level that line sup with the 50% Fibonacci retracement.

Stop loss: 149.83

Why we like it:

There is a pullback resistance level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 148.19

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD/JPY - Breakdown Confirmation & Potential DeclineUSD/JPY - Breakdown Confirmation & Potential Decline

Chart Overview:

The USD/JPY price action has broken down from a previously established ascending channel.

A lower high formation suggests weakening bullish momentum, indicating a potential continuation of the downtrend.

The key support zones are marked below, with the price likely to move towards these levels if bearish momentum persists.

Technical Analysis:

Breakdown Zone: The price has breached the lower trendline of the ascending channel, confirming a bearish breakdown.

Resistance Levels: The price faces resistance around 0.0067786 - 0.0068488.

Support Targets: Possible downside targets at 0.0066848, 0.0066012, and 0.0065720.

Bearish Confirmation: A retest of the breakdown level followed by rejection strengthens the bearish outlook.

Trade Consideration:

Bearish Bias: A short position could be considered if the price fails to reclaim the broken trendline.

Stop Loss: Above the breakdown zone to avoid potential fakeouts.

Target Levels: Lower support zones for potential take-profit areas.

Conclusion:

The breakdown from the rising channel suggests a shift in market sentiment, with a bearish move likely. Traders should monitor price action for further confirmations.

USDJPY My Opinion! SELL!

My dear friends,

My technical analysis for USDJPY is below:

The market is trading on 149.96 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 148.72

Recommended Stop Loss - 150.69

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK