USDJPY Will Explode! BUY!

My dear subscribers,

This is my opinion on the USDJPY next move:

The instrument tests an important psychological level 147.65

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 148.86

My Stop Loss - 147.06

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

———————————

WISH YOU ALL LUCK

USDJPY

USD/JPY Finding Support at Key Fibonacci Level - Will it Hold?USD/JPY pair has been trending lower in a well-defined descending channel, respecting its upper and lower boundaries. Price action recently tested the 61.8% Fibonacci retracement level (146.95), where a mild rebound is now taking shape.

Despite this, the 50-day SMA (152.84) and 200-day SMA (152.01) remain above price, acting as resistance levels should a reversal attempt materialize. The MACD remains in negative territory, confirming bearish momentum, while the RSI at 39.79 suggests the pair is approaching oversold conditions but hasn't confirmed a bullish shift yet.

Key Levels to Watch:

📉 Support: 146.95 (Fib 61.8%), 143.71 (Fib 78.6%)

📈 Resistance: 152.00 (200-day SMA), 152.84 (50-day SMA)

A break above the descending channel could suggest a reversal attempt, while continued rejection at the upper trendline favors further downside.

-MW

USDJPY Under Pressure! SELL!

My dear friends,

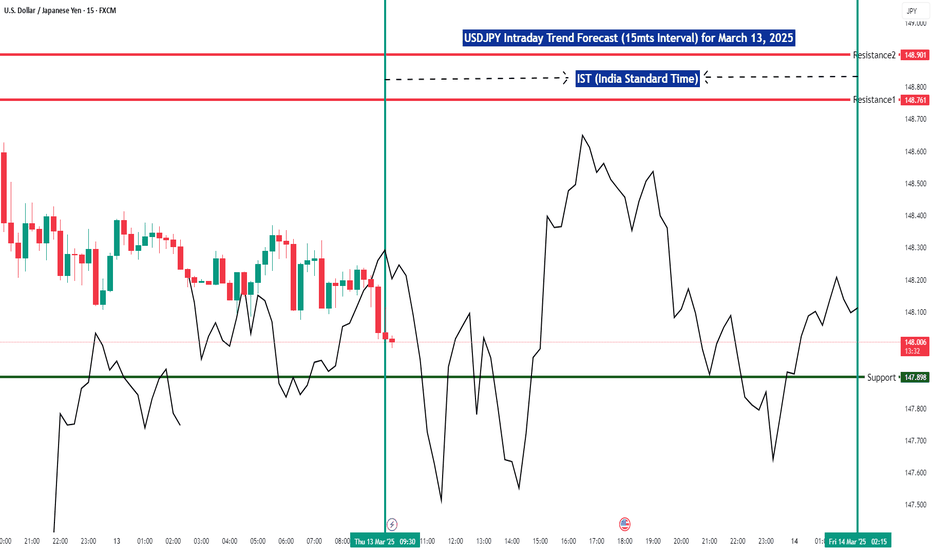

Please, find my technical outlook for USDJPY below:

The instrument tests an important psychological level 148.76

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 147.83

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

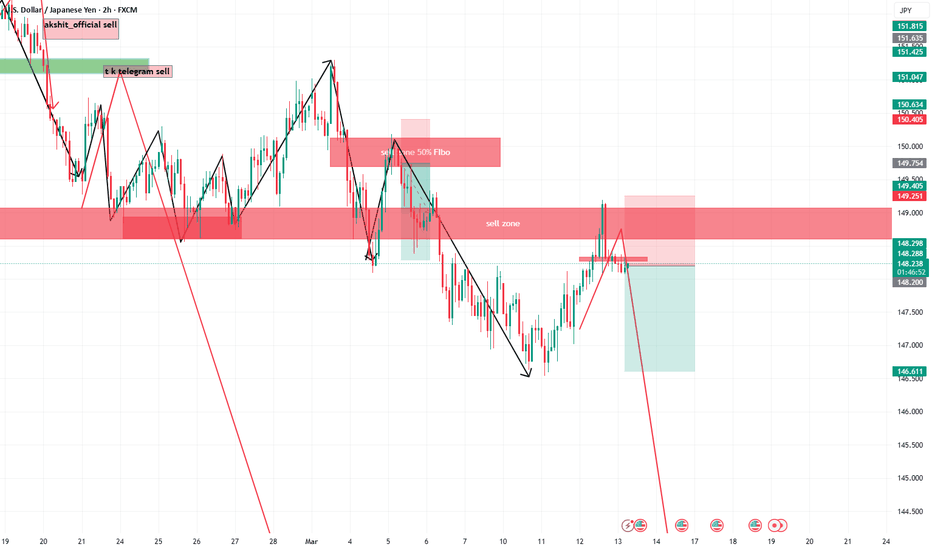

USDJPY Channel Down to make an important decision.The USDJPY pair has been trading within a Channel Down pattern since the January 10 High. During that time it technically got rejection upon every 4H MA100 (green trend-line) contact or close contact into a new Bearish Leg.

Three out of those four Bearish Legs have been -3.16% so even if a rejection does happen at the top (Lower Highs trend-line) of the Channel Down, you can still be expecting 145.350 as a Target.

If however the 4H RSI Bullish Divergence on Higher Lows prevails and causes the price to break above the Channel Down, we will accept the small loss on the short and go long instead, targeting the 2.0 Fibonacci extension at 156.000. A lower Target in that scenario can also be Resistance 2 (154.800).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Yen Slips Against USD as Tariff Concerns Increase the DollarThe yen fell below 148 per dollar on Friday, reversing gains as trade tensions increased the dollar. Trump reaffirmed plans for reciprocal tariffs starting April 2. Despite this drop, the yen remains near a five-month high, backed by expectations of BOJ rate hikes. Japanese firms agreed to wage increases for a third year, aiming to offset inflation and labor shortages. Higher wages may spur spending and inflation, giving the BOJ room for future hikes. While rates are expected to remain unchanged next week, policymakers may pursue hikes later this year.

Key resistance is at 149.20, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Potential bullish rise?USD/JPY has bounced off the pivot which has been identified as an overlap support and could rise to the 1st resistance.

Pivot: 148.14

1st Support: 147.58

1st Resistance: 149.25

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD/JPY Bearish Outlook: Key Support Levels to WatchUSD/JPY 4-hour chart is showing a clear downtrend, with price forming lower highs and lower lows. A recent retracement has tested a previous support-turned-resistance zone (148.240 - 148.262), and rejection from this level indicates the potential for further downside movement.

Bearish Confirmation & Entry:

The price is currently testing the 148.240 - 148.262 resistance zone.

A strong rejection from this level would confirm a sell setup.

The trade setup suggests a move towards the next key support zones if momentum continues downward.

Target Levels:

First Take Profit (TP1): 146.543 (Recent low & strong support level)

Second Take Profit (TP2): 145.807 (Key demand zone)

Final Take Profit (TP3): 142.960 (Major psychological support)

Risk Management:

Stop-loss placement: Above the 148.262 resistance zone, ensuring protection against unexpected bullish reversals.

The risk-to-reward ratio is favorable, with a structured trade setup providing a high-probability short opportunity.

USD/JPY at a Key Level: Is a New Trend Emerging?USD/JPY is currently in the D1 discount zone and approaching a D1 FVG, where a potential reaction may occur. The price is moving within a downtrend channel for now.

If a reaction happens at this level, we should wait for a channel breakout. A trade opportunity arises either on the breakout retest or immediately after the breakout, confirming bullish momentum and increasing the probability of an upward move.

Risk Management Strategy:

To secure profits and manage risk effectively, consider scaling out at key levels:

• Target 1: Close 25% of the position to secure initial profits.

• Target 2: Close 50% of the position to lock in more gains.

• Target 3: Close 100% of the remaining position for full take profit.

Risk Reward 1.3

Monitoring price action closely at this level is crucial.

Bullish bounce?USD/JPY is falling towards the support level which is an overlap support that aligns with the 127.2% Fibonacci extension and the 71% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 147.31

Why we like it:

There is an overlap support level that aligns with the 127.2% Fibonacci extension and the 71% Fibonacci retracement.

Stop loss: 146.54

Why we like it:

There is a pullback support level.

Take profit: 148.14

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Is Going Down! Short!

Please, check our technical outlook for USDJPY.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 147.816.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 146.645 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Usdjpy analysis This chart represents a technical analysis of USD/JPY on the 1-hour timeframe from TradingView, outlining potential price movements based on key support and resistance levels.

Support Level: Marked around 147.175, this level is expected to act as a strong demand zone where buyers might step in if the price retraces.

Current Price: USD/JPY is trading around 148.262, showing signs of bullish momentum.

Potential Price Movement: The chart suggests a possible pullback toward the support level before resuming an uptrend.

First Target: Positioned at approximately 149.678, this is the next key resistance level where price action might encounter selling pressure.

Second Target: Identified near 151.002, indicating further bullish continuation if the first target is broken.

Outlook:

The analysis suggests a bullish bias, but a retracement to support may occur before a potential breakout. Traders may look for confirmation signals before entering positions. The volume profile on the right shows strong activity around these levels, reinforcing the importance of these key zones.

USDJPY H4 I Bullish Bounce OffBased on the H4 chart analysis, we can see that the price is approaching our buy entry at 148.01, which is a pullback support that aligns close to the 50% Fibo retracement.

Our take profit will be at 148.94, which is a pullback resistance

The stop loss will be placed at 147.13, an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (fxcm.com/uk):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stratos Global LLC (fxcm.com/markets):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Falling towards 50% Fibonacci support?USD/JPY is falling towards the support level which is a pullback support that aligns with the 50% Fibonacci retracement and could bunce from this level to our take profit.

Entry: 148.03

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Stop loss: 149.23

Why we like it:

There is a pullback support level that lines up with he 78.6% Fibonacci retracement.

Take profit: 149.23

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.