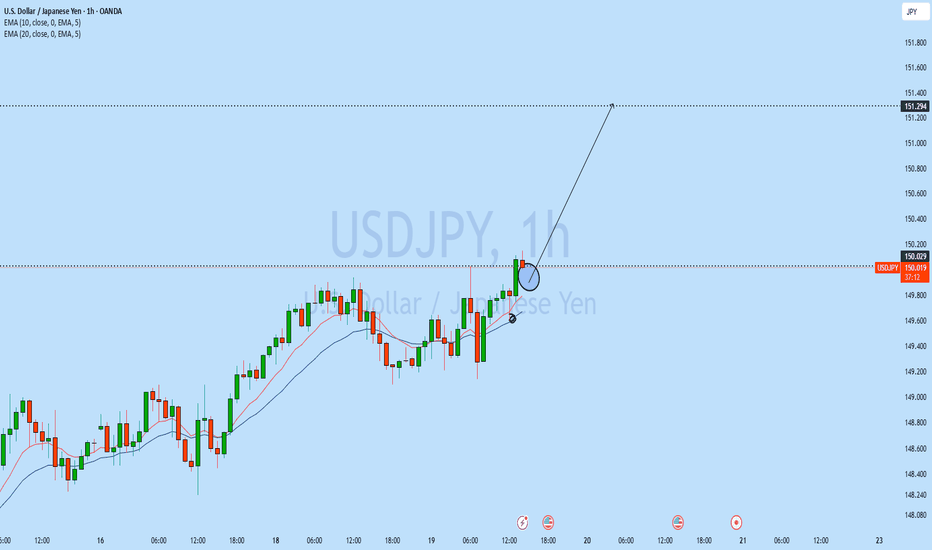

USDJPY: Volatility and Key LevelsThe recent trend of the USD/JPY has been highly volatile. On the economic data front, the rise in Japan's unemployment rate and the decline in corporate capital expenditure have triggered selling pressure on the Japanese yen. However, factors such as corporate wage growth provide grounds for the Bank of Japan to consider raising interest rates.

From a technical perspective, key support levels are situated around 147.7 and 146.5, whilst the resistance levels are now between 150 and 151. Amid the ongoing battle between bulls and bears, the pair is likely to continue trading within the range of 147.00-149.00. That said, given the current upward momentum, a technical pullback followed by further gains in the short term cannot be ruled out.

USDJPY

buy@148.000-149.000

tp:150.000-151.000

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Usdjpyidea

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY and AUDUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/JPY "The Gopher" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

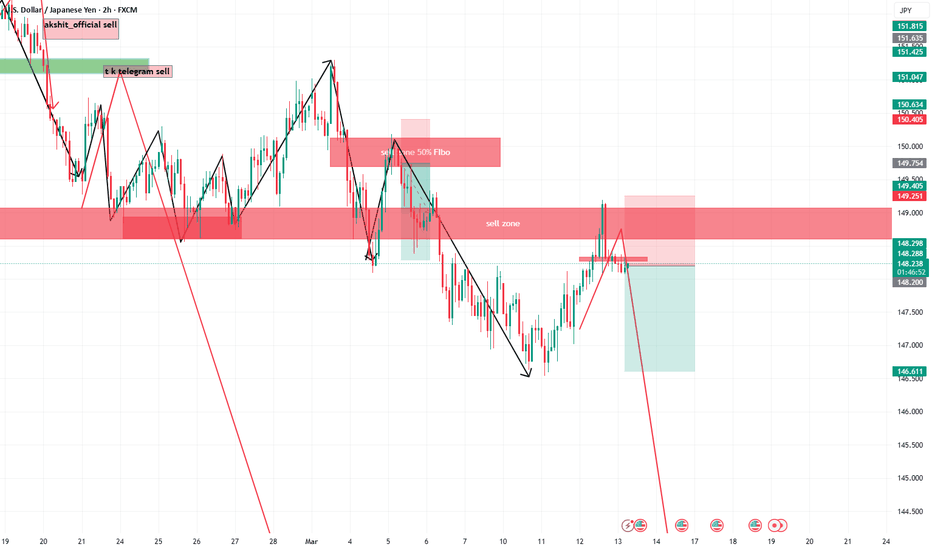

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗USD/JPY "The Gopher"˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (148.000) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

📌I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at (150.000) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 145.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

USD/JPY "The Gopher" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.

💡Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the United States and Japan, which directly influence the USD/JPY pair.

💡United States Economic Indicators:

GDP growth is forecasted at around 2.0% to 2.5% for 2025, reflecting steady expansion Economic Forecast for the US Economy.

Inflation rate is expected to be around 2.5% to 3.0%, with recent data showing stability United States Inflation Rate.

Interest rates are at 4.50%, with expectations of cuts to around 4.0% to 4.25% by the end of 2025, reflecting a dovish shift United States Fed Funds Interest Rate.

Trade balance shows a deficit of $50 billion in January 2025, a persistent challenge but manageable with strong growth United States Balance of Trade.

💡Japan Economic Indicators:

GDP growth is projected at 1.1% for 2025, with recent Q4 2024 data showing 2.8% annualised growth, indicating recovery Japan's GDP beats forecasts.

Inflation is expected at around 2%, with core inflation robust, driven by wage gains Japan Economic Outlook.

Interest rates are at 0.5%, with expectations to reach 1.0% by the end of 2025, reflecting policy normalization Japan Outlook.

Trade balance shows a deficit, with recent figures at -2759 JPY Billion in January 2025, impacted by import costs Japan Balance of Trade.

The narrowing interest rate differential, with US rates expected to cut and Japan's rates rising, could support JPY strength, though US economic resilience remains a counterforce.

💡Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

Global GDP growth is projected at 3.0% to 3.3% for 2025, according to recent forecasts, with mixed regional performances World Economic Outlook Update.

Commodity prices are expected to decline by 5% in 2025, with energy prices leading the drop, impacting JPY due to Japan's import reliance Commodity Markets Outlook.

Stock markets show mixed performance, with US indices up 5% YTD and Japanese indices showing recovery, supporting risk-sensitive currencies Global Stock Market Performance.

Bond yields are expected to be range-bound, with the US 10-year Treasury yield possibly around 3.5% to 4.5%, suggesting lower USD appeal 2025 Bond Market Outlook.

💡Global Market Analysis

Global economic conditions play a significant role in currency movements:

Geopolitical events, such as potential tensions, could boost JPY as a safe-haven currency, though no major events are currently noted.

Central bank policies are diverging, with the Fed expected to cut rates and the Bank of Japan (BoJ) raising rates, narrowing the interest rate differential Central Bank Policies.

Commodity trends, with declining prices, have a muted direct impact, though energy costs affect Japan's inflation.

Stock market performance, with global indices up, suggests risk-on sentiment, potentially supporting USD over JPY Market Performance Analysis.

💡COT Data and Positioning

COT data provides insights into large trader positions, with recent reports showing:

For USD/JPY futures, large speculators are likely net long, driven by the interest rate differential and stronger US economic outlook JPY Commitments of Traders.

Positioning shows that institutional traders are cautiously optimistic, with some covering shorts as the price approaches support levels.

Key Insight: Long positions in USD/JPY align with economic fundamentals, suggesting bullish sentiment among speculators.

💡Intermarket Analysis

Intermarket relationships influence currency valuation:

USD/JPY is positively correlated with US stock markets; with strong US indices, the USD could benefit from risk-on sentiment Intermarket Analysis.

Gold, trading at $1900 per ounce, slightly up, suggests a weaker USD, supporting JPY strength as a safe-haven Gold Price Trends.

Bond yields, with declining US yields, indicate lower USD appeal, potentially boosting JPY/USD Bond Market Insights.

Key Insight: Positive correlations with US stocks suggest USD strength, while gold and bond yields support JPY, creating a mixed dynamic.

💡Quantitative Analysis

Technical analysis provides insights into price trends:

At 149.000, USD/JPY is near key support at 148.43 (Classic S3), with resistance at 149.02 (Classic R2), based on recent charts USD/JPY Technical Analysis.

Moving averages show a mixed picture, with shorter-term (MA5, MA10) suggesting buy and longer-term (MA50, MA100, MA200) suggesting sell TradingView Analysis.

RSI (Relative Strength Index) is at 45.418, neutral, suggesting potential for a bounce if support holds Technical Indicators Guide.

Key Insight: Technicals suggest a possible downward trend, with sell signals dominating, though support levels could trigger a reversal.

💡Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows 62% of forex traders long on USD/JPY, with an average price of 154.6568, contrasting with a downward price movement, creating a bearish indicator Forex Sentiment USDJPY.

Bank forecasts predict USD/JPY dropping to 145.00 by year-end, citing Japan's recovery and expected Fed rate cuts Currency Forecasts.

Key Insight: Mixed sentiment, with retail traders long but institutional forecasts bearish, supporting a downward outlook.

💡Next Trend Move

Combining all factors, the next trend move for USD/JPY is likely downward:

The pair is at a key support level (148.43), and if it breaks, could drop to test lower levels around 145.00.

Potential catalysts include Fed rate cuts and BoJ rate hikes, narrowing the interest rate differential, supporting JPY strength.

Key Insight: The next move favors a downward continuation, with risks of an upward bounce if support holds.

💡Overall Summary Outlook

The USD/JPY pair, at 149.000 on March 4, 2025, exhibits a bearish outlook. Key drivers include the narrowing US-Japan interest rate differential, with US rates expected to cut to 4.0%-4.25% and Japan's rates rising to 1.0% by year-end, alongside Japan's economic recovery (1.1% GDP growth in 2025). Technical indicators suggest sell signals, supported by mixed market sentiment and declining commodity prices. Risks include strong US economic data maintaining USD dominance or global risk-off sentiment boosting USD. However, the prevailing trend points to potential JPY appreciation in the near term.

💡Future Prediction

Trend: Bearish

Details: The pair is likely to see a downward move, testing support at 148.43 and potentially dropping to 145.00 in the next few months, driven by narrowing interest rate differentials and technical sell signals. Risks include stronger-than-expected US data maintaining USD strength, but current indicators suggest a reversal is imminent.

💡Summary of Key Economic Indicators

Indicator United States (2025 Forecast) Japan (2025 Forecast)

GDP Growth 2.0%-2.5% 1.1%

Inflation Rate 2.5%-3.0% ~2%

Interest Rate 4.0%-4.25% (end of year) 1.0% (end of year)

Trade Balance Deficit ($50 billion, Jan 2025) Deficit (-2759 JPY Billion, Jan 2025)

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

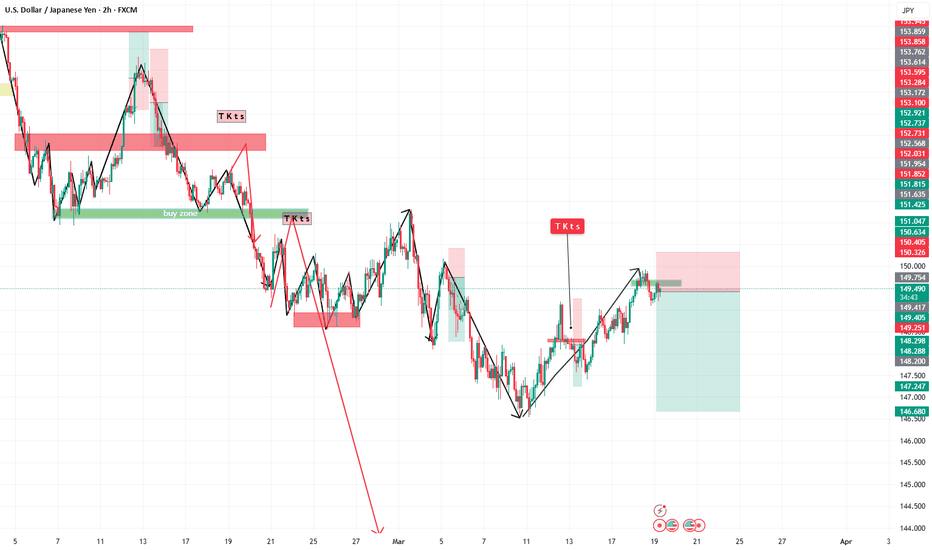

USDJPY Counter Trend Opportunities - Fxdollars - {11/03/2025}Educational Analysis says USDJPY may give countertrend opportunities from this range, according to my technical.

Broker - FXCM

So my analysis is based on a top-down approach from weekly to trend range to internal trend range.

The weekly trend range is long up to 170.000

Trading Range Approach is a long counter trend opportunity or pushback up to 155.000

The internal Trend Range Approach is a Long counter trend opportunity or pushback up to 150.000

or continue going down with an internal trading range or trading range up to 135.000

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars .

USD/JPY "The Gopher" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 1H timeframe (148.600) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 152.300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

USD/JPY "The Gopher" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🔰 Fundamental Analysis

- The Bank of Japan's (BOJ) monetary policy decisions significantly impact the yen's value. The BOJ's negative interest rate policy and quantitative easing program have contributed to the yen's depreciation.

- The US Federal Reserve's interest rate decisions also influence the USD/JPY exchange rate. Higher interest rates in the US can attract investors, causing the dollar to appreciate.

- Japan's trade balance and current account deficit can impact the yen's value. A large trade deficit can lead to a depreciation of the yen.

🔰 Macroeconomic Factors

- Inflation: Japan's inflation rate has been relatively low, which can impact the BOJ's monetary policy decisions.

- GDP Growth: Japan's GDP growth rate has been slow, which can impact the yen's value.

- Unemployment Rate: Japan's unemployment rate has been relatively low, which can impact the labor market and inflation.

🔰 COT Data

- Non-Commercial Traders: These traders, including hedge funds and individual investors, hold a significant portion of the USD/JPY futures market.

- Commercial Traders: These traders, including banks and other financial institutions, hold a smaller portion of the USD/JPY futures market.

🔰 Market Sentiment Analysis

- Bullish Sentiment: Some investors are bullish on the USD/JPY due to the interest rate differential between the US and Japan.

- Bearish Sentiment: Others are bearish due to concerns about Japan's economy and the potential for the BOJ to intervene in the currency market.

🔰 Positioning

- Long Positions: Some investors have taken long positions in the USD/JPY, betting on a continuation of the uptrend.

- Short Positions: Others have taken short positions, betting on a reversal of the uptrend.

🔰 Next Trend Move

- The USD/JPY may continue its uptrend if the interest rate differential between the US and Japan remains significant.

- However, if the BOJ intervenes in the currency market or if Japan's economy shows signs of improvement, the uptrend may reverse.

🔰 Overall Summary Outlook

The USD/JPY currency pair is influenced by a combination of fundamental, macroeconomic, and market sentiment factors. While some investors are bullish on the pair due to the interest rate differential, others are bearish due to concerns about Japan's economy. The next trend move will depend on various factors, including the BOJ's monetary policy decisions and Japan's economic performance.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDJPY and GBPJPY AnalysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY BuyUSDJPY Trade Signal

📉 Pullback & Potential Reversal

Price Level: 150.41

Support Zone: 148.37 - 149.98

Resistance Targets: 152.06 / 154.00

📌 Trade Plan:

Wait for a pullback confirmation before entering long.

Stop Loss: Below 148.37

Targets: 152.06 → 154.00

⚠️ Risk Management: Control risk and wait for a clear breakout.

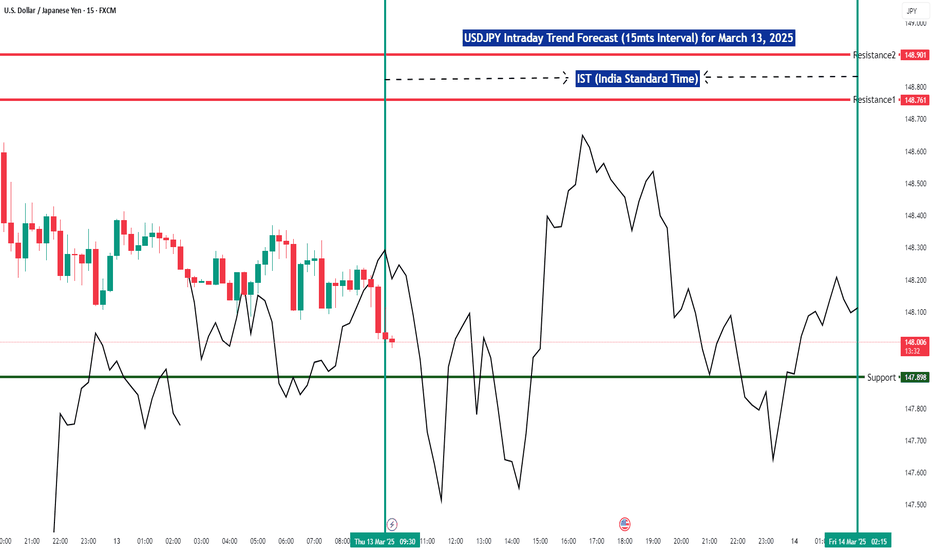

USDJPY Weekly SetupFor the past few weeks, this pair has been on a bearish trajectory, and I do anticipate that the momentum will continue.

The targets are;

1. 150.93 ~ This is the lows of the past 2 previous weeks.

2. 149.6 ~ This is the Weekly Bullish Order Block

3. 148.7 ~ Another sellside liquidity formed in December.

The daily and 15 minute timeframe will give us the best entry and stop loss for this pair.

#USDJPY 4HUSDJPY (4H Timeframe) Analysis

Market Structure:

The price is currently respecting a trendline support, indicating that buyers are maintaining control. Additionally, the presence of a buy engulfing area suggests strong bullish momentum, signaling a potential continuation of the uptrend.

Forecast:

A buy opportunity may arise if the price continues to hold above the trendline support, confirming bullish pressure.

Key Levels to Watch:

- Entry Zone: A buy position can be considered near the trendline support after confirmation of bullish price action.

- Risk Management:

- Stop Loss: Placed below the trendline support to manage risk.

- Take Profit: Target key resistance levels based on previous price action.

Market Sentiment:

The combination of trendline support and a buy engulfing area indicates strong buying interest. A confirmed bullish move from this level can provide better validation for a buy setup.

IS USDJPY HAVE BUY SIDE LEQUIDITY?USDJPY is Sweep Buy Side Lequidity now sell side Lequidity Rest In Upside Market Will Go And Hunt These Lequidities That I Mentioned In Chart Be Patience Be Discipline With Your Strategies Without Knowing Market Behaviors Not Put Your Harder Money.

This Is Analysis Not A Financial Advice DYOR.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Signal - 5 months support test 24.2.25148.60 to 152.70 range

Currently trading at 149.70

Support of 148.60-149.80 range is holding strong for the past 5 months.

Standard correction 300 pips up towards 152.70 makes sense following the expanding wedge pattern highlighted on the chart.

100 pip downside compared to 300 pip upside swing trade.

Make logical, timed, calculated action sticking to a plan and managing risk as top priorities.

GOOD LUCK!

USDJPY: remains below 150.00Furthermore, any significant retracement could find immediate support near the 149.50 level, which is followed closely by the 149.00 round number. A break below the latter might expose the USD/JPY pair to a retest of the 148.50 region, a level seen as the next strong support. Sustained weakness below this area could pave the way for a deeper corrective decline, with the next target around the 148.00 level. Traders will likely keep a close eye on these levels, as they could provide fresh directional impetus for the pair.