Bearish reversal?US Dollar Index (DXY) is rising towards the pivot and could reverse to the 1st support.

Pivot: 100.51

1st Support: 97.85

1st Resistance: 101.83

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Usdjpylongsetup

USD/JPY) bullish trend analysis Read The ChaptianSMC Trading point update

Technical analysis of USD/JPY chart shows a bullish reversal setup. Here’s a breakdown behind the analysis:

1. Downtrend & Channel Breakout:

Price was trending downward within a descending channel (marked “channel trend”).

Recently, the price broke out of the channel, signaling a potential trend reversal.

2. Demand Zone (Diamond Zone):

The yellow box labeled “Diamond Zone” represents a demand/support zone where price previously found buyers.

A retest of this zone is expected before the bullish move.

3. EMA (200):

The EMA (200) is currently above the price but close. A break above this level (142.522) could add to bullish momentum.

4. RSI Indicator:

RSI is showing a bounce off a mid-level (~50), suggesting bullish momentum is gaining.

5. Target Level:

The analysis targets 147.838, which aligns with a prior resistance zone.

The move projects a 5.19% gain (~778.5 pips) from the current setup.

Trading Idea Summary:

Entry: Around the “Diamond Zone” after a successful retest.

Confirmation: Watch for bullish candlestick patterns or a break above EMA 200.

Target: 147.838

Stop Loss (implied): Below the Diamond Zone (~140.000)

Pales support boost 🚀 analysis follow)

USD/JPYThe Japanese Yen (JPY) oscillates in a narrow trading band at the start of a new week and remains close to a two-week trough touched against its American counterpart on Friday. Mixed signals from the US and China temper hopes for a quick resolution of the trade conflict between the world's two largest economies, which, in turn, offers support to the safe-haven JPY. Moreover, expectations that Japan will strike a trade deal with the US turn out to be another factor underpinning the JPY.

Meanwhile, investors have been scaling back their bets for an immediate interest rate hike by the Bank of Japan (BoJ) as rising economic risks from US tariffs overshadow signs of broadening inflation in Japan. This holds back the JPY bulls from placing aggressive bets, which, along with a modest US Dollar (USD) uptick, acts as a tailwind for the USD/JPY pair. However, the divergent BoJ-Federal Reserve (Fed) policy expectations should cap the USD and benefit the lower-yielding JPY.

#USDJPY: 2050+ Pips Swing Buy| Trend Confirmed| Comment Views? **FX:USDJPY** A significant market movement has confirmed, indicating the potential for a substantial bullish swing that could reach approximately 2050 pips. Three targets have been identified, allowing you to select the one that aligns best with your analysis. The primary catalyst for this move is the reversal of the Japanese Yen (JPY) to a bearish trend. It is crucial to employ precise risk management techniques and exercise caution during this period.

Good luck and trade safely.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

Japanese Yen seems poised to appreciate further against weaker UFrom a technical perspective, the daily Relative Strength Index (RSI) is already flashing slightly oversold conditions and warrants some caution for bearish traders. Hence, it will be prudent to wait for some near-term consolidation or a modest bounce before positioning for an extension of the USD/JPY pair's well-established downtrend witnessed over the past three months or so.

In the meantime, attempted recovery might now confront some resistance near the 141.60-141.65 region. This is followed by the 142.00 round figure and the 142.40-142.45 hurdle, above which a fresh bout of a short-covering move could lift the USD/JPY pair to the 143.00 mark en route to the 143.25-143.30 zone. Any further move up, however, might still be seen as a selling opportunity.

On the flip side, a sustained break and acceptance below the 141.00 mark could be seen as a fresh trigger for bearish traders and makes the USD/JPY pair vulnerable. The subsequent downfall below the 140.45-140.40 intermediate support might expose the 140.00 psychological mark. The downward trajectory could extend to the 2024 yearly swing low, around the 139.60-139.55 region.

USDJPY SHORT FORECAST Q2 W16 D17 Y25USDJPY SHORT FORECAST Q2 W16 D17 Y25

GM GM

SUMMARY

- Weekly low long setup

- Weekly order block Long set up

- 15' break of structure is required

- Lower time frame break of structure required

- Price action turn around in bullish direction required. Higher time frame closure. 1H minimum required.

Trade Well.

FRGNT X

USD/JPY Bullish Reversal Setup – Long Entry at 141.964 Targeting ahemdsaeed25: USD/JPY Long Setup – Eyeing 150.537 Target"

"Potential Bullish Reversal on USD/JPY"

"Swing Trade Alert: USD/JPY Long from 141.964"

"USD/JPY Breakout Play – Buy Zone Identified"

Let me know your tone preference (technical, casual, professional, etc.) and I can tailor the title further.

ahemdsaeed25: This chart is for the USD/JPY (U.S. Dollar / Japanese Yen) pair on the 1-hour timeframe, and it's displaying a bullish setup with a clear trade idea. Here's a breakdown of the analysis:

Key Components:

Current Price: Around 142.574.

Entry Point: 141.964

Stop Loss: 140.547

Take Profit / Target Point: 150.537

Reward-to-Risk Ratio: Favorable (approximately 5.94% upside, large potential move).

Indicators:

EMA 50 (Red Line): 142.798 — acting as near-term dynamic resistance.

EMA 200 (Blue Line): 144.699 — major resistance and a trend filter (downward trend visible).

Zone Analysis:

Support Zone (Purple Box near 141.964 - 140.547): This is the accumulation/buy zone.

#USDJPY: Huge Risk To Buy Read The Description

Trading JPY pairs is risky due to the market’s volatility.

USDJPY fell below our buying zone due to JPY’s bullishness and USD’s weakness. While USD has yet to recover, JPY is consolidating. The market is undecided, leading to unusual market movements. We have three targets in this chart analysis. Use it as an alternative bias and have your own analysis and trade management.

Thanks for your support. We expect it to increase, helping us post more analysis.

Much Love🧡

Team Setupsfx

USDJPY LONG FORECAST Q2 W16 D16 Y25USDJPY LONG FORECAST Q2 W16 D16 Y25

Good morning all.

It may look like we are holding onto a bias. I can understand why that assumption is created. However, a short position is invalid for FRGNT whilst in a higher time frame order block long.

As per, that does not mean LONG blindly.

Two set ups illustrated.

1) 15' Break of structure

2) Lower time frame Break of structure without 15' break.

Trading is risky.

Both positions of course come with a side dish of risk and reason to loose. The question is, would you like to see USDJPY explode long without you?

Lets see how price actions plays.

FRGNT X

USDJPY LONG FORECAST Q2 W16 D14 Y25USDJPY LONG FORECAST Q2 W16 D14 Y25

We caught a the long play for a similar setup. We need more this time around.

Why? To be sure of the weekly order block rejection. Compared to EURUSD and EURGBP for example... That is the type of weekly order block rejection we prefer. With that said we will not give up on USDJPY. We simply must await more levels of confluences.

15' break of structure, Order block creation as a result of the BOS. Pull back into area, lower time frame break of structure.

Let's see what USDJPY provides us with.

FRGNT X

USDJPY LONG FORECAST Q2 W15 D11 Y25

USDJPY LONG FORECAST Q2 W15 D11 Y25

Happy Friday Traders, It has been a week of sitting on capital. Being cautious, awaiting for breaks of structures at key areas and not not getting dragged into trades that do not fully present themselves. The clues have been there. The carrot has been continually dangled however as risk managers... You know how the saying goes.

We stay true to our trading plan.

We hold firm with what we know works.

We are aware of our market edge.

We know our "perfect" set up does present itself.

with that said, we are dynamic! We do of course entertain the "Imperfect" setup. We simply approach with caution.

A slightly different take. Can we snap the lows of Tokyo in the London session. Tap into the 4 hour order block, push bullish to break Lower time frame structure?

A quick setup with a take profit area where FRGNT anticipates a potential turn around in price short.

Lets see how it plays !

Trade well.

FRGNT X

USDJPY Bearish Flag Breakdown – Eyes on 140.11 Support ZoneUSDJPY is showing signs of a bearish continuation, following a breakdown from a rising wedge pattern. The recent strong drop confirms a shift in momentum from bullish to bearish, with price now forming a bear flag just below a key structure.

Key Technical Zones:

Current Price: 147.78

Resistance Area (Invalidation Zone): 148.11 – 151.44

Support Targets:

TP1: 142.87

TP2: 140.11

Technical Confluence & Patterns:

✅ Series of Rising Wedges followed by sharp breakdowns

✅ Bear Flag Pattern forming after recent drop

✅ Lower highs & lower lows confirming downtrend

✅ Volume spike during breakdown, low volume on pullback

Trade Outlook:

📉 Bias: Bearish below 148.11

📌 Entry Zone: On confirmation of flag breakdown

🎯 Target 1: 142.87 – Previous horizontal support

🎯 Target 2: 140.11 – Major swing support / demand zone

🛑 Invalidation: Break above 151.44 (major resistance zone)

Conclusion:

USDJPY is set up for a potential bearish continuation as it respects a textbook flag breakdown setup. A close below 147.50 would reinforce bearish pressure with further downside toward 142.87 and 140.11. Traders should monitor momentum and structure confirmation before entering positions.

Let me know if you want a short caption or video script version! 📉

#USDJPY:1351+ Bullish Move One Not To Miss| Three TPs| JPY has been bullish since the dollar strengthened, potentially leading to a trade war that would make the Japanese yen more valuable to global investors. However, we may see a strong correction on all XXXJPY pairs, potentially returning stronger with a major bullish correction. We’re not sure if the price will hit all three take profit zones, but we’re interested in how far it goes.

Use accurate risk management. This analysis is purely for educational purposes only. Use your own knowledge and analysis before taking any entries.

Team Setupsfx_

USD/JPY) Bullish reversal analysis Read The ChaptianSMC Trading point update

This chart is for USD/JPY on the 1-hour timeframe, and it presents a bullish trade setup. Let’s break down the idea

---

Key Observations:

1. Current Price:

USD/JPY is trading around 146.281.

2. Overall Bias:

Bullish setup expecting a bounce from demand into a higher target zone.

3. EMA 200:

Price is currently below the 200 EMA (147.942), which usually suggests a bearish trend — but this setup is aiming for a short-term bullish retracement.

4. Demand Zone (Buy Area):

Marked in yellow between 145.822 and slightly above.

Labeled as "FVG orders" (Fair Value Gap), suggesting institutional interest or imbalance fill.

5. Trendline Support:

The price is approaching a rising trendline, adding confluence for a potential bounce.

6. Expected Move:

Price is expected to bounce from the demand zone, form a higher low, and then move up toward the target zone at 148.221.

Two upside targets are drawn:

First Move: ~1.12% (30.6 pips)

Full Target: ~1.76% (256.1 pips)

Mr SMC Trading point

7. RSI (Relative Strength Index):

RSI is around 37.66, nearing oversold territory, supporting a bullish reversal idea.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Around 145.822 (fair value gap & trendline support)

Target Zone: 148.221

Stop Loss: Likely just below the demand zone or trendline

Confluence Factors:

Trendline support

RSI nearing oversold

Fair value gap zone

EMA 200 overhead (target acts as resistance)

---

Pelas support boost 🚀 analysis follow

USD/JPY) bullish trend analysis Read The ChaptianSMC Trading point update

This chart is an analysis of the USD/JPY currency pair on a 2-hour timeframe, and it presents a possible bullish scenario. Here’s a breakdown of the idea:

---

Key Points of the Analysis:

1. Support Level & Change of Character (ChoCH):

Price found strong support around 144.556.

A ChoCH (Change of Character) is noted, indicating a potential shift from a bearish to a bullish trend.

2. Bullish Reversal Setup:

The price is forming higher lows, suggesting the start of a "New Up Trend".

There's a clear zig-zag bullish projection, suggesting potential long opportunities.

3. Target Zones:

The first target point is in the range of 149.692 – 150.493.

This area is also marked with a resistance zone, making it a logical TP (Take Profit) level.

4. Risk/Reward Ratio:

The risk is around -3.75% (-564.8 pips), and the reward is around +3.94% (+569.2 pips), suggesting a 1:1.05 R/R ratio.

5. RSI Indicator (Below):

RSI is showing a bullish divergence (price made lower lows while RSI made higher lows).

This divergence supports the idea of a possible bullish reversal.

6. 200 EMA:

The 200 EMA is at 148.767, acting as a dynamic resistance. Price may react around that level before hitting the final target zone.

Mr SMC Trading point

---

Conclusion:

This analysis suggests a potential long trade setup on USD/JPY based on:

A support zone,

Bullish RSI divergence,

Market structure shift (ChoCH),

And projected movement toward 149.692–150.493.

Idea: Buy near the support zone (~144.556) and target the resistance zone (~150.493) while managing risk carefully.

---

Pales support boost 🚀 analysis follow)

USD/JPY Bullish Reversal: Order Block & EMA 200 TargetSMC Trading point update

This chart presents a technical analysis of USD/JPY on the 1-hour timeframe. The key insights from this analysis are:

1. Order Block & Potential Reversal

The price has dropped significantly and reached a highlighted order block zone (a key demand area).

A potential inverse head and shoulders pattern is forming, indicating a possible bullish reversal.

2. Expected Bullish Movement

The price is expected to bounce from the order block, creating a bullish structure.

The projected move suggests a retracement toward a resistance zone, which aligns with previous price action.

Mr SMC Trading point

3. Target Zone & EMA 200

The target zone is around 148.946 - 149.178, aligning with the 200 EMA, a significant resistance level.

4. RSI Indicator

The RSI is currently low (~38.93), indicating potential for a reversal as the market may be oversold.

Conclusion

The chart suggests a bullish retracement after the recent drop, targeting the resistance zone near the 200 EMA. However, confirmation is needed (e.g., bullish price action, volume increase) before taking a trade. Keep an eye on fundamental news that may impact USD/JPY volatility.

Pales support boost 🚀 analysis follow)

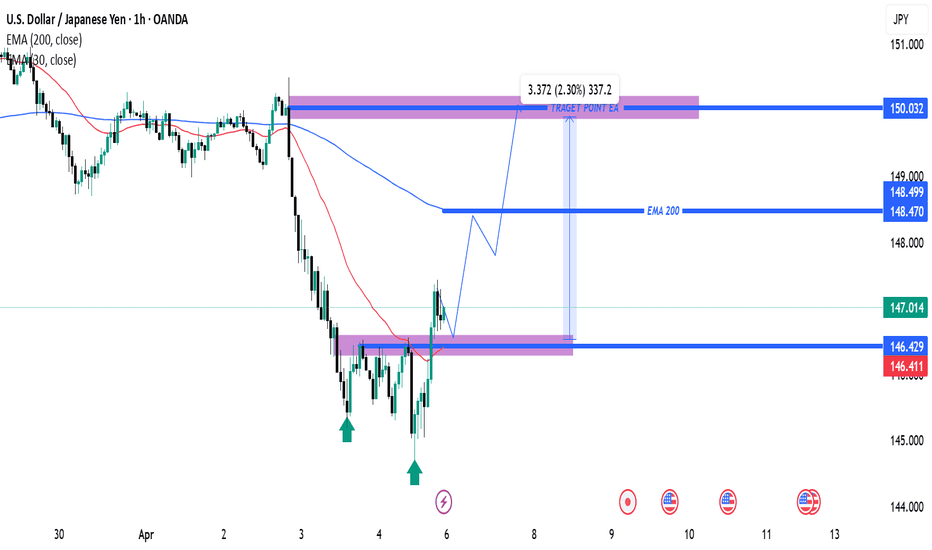

USD/JPY Bullish Reversal Setup with 2.30% Upside PotentialThis is a USD/JPY 1-hour chart analysis, and it looks like a bullish setup is being anticipated. Here's a breakdown:

Key Observations:

1. Support Zone (Purple Box - Around 146.411 - 146.429):

Multiple bullish rejections (green arrows) indicate a strong support level.

Price bounced off this support recently, forming a potential double bottom.

2. EMA Levels:

50 EMA (Red Line) is currently at 146.411.

200 EMA (Blue Line) is at 148.499, acting as dynamic resistance.

Price has crossed above the 50 EMA, a bullish sign, and might aim for the 200 EMA next.

3. Projected Bullish Path:

The path drawn suggests a pullback to the support zone around 146.429, followed by a bullish continuation.

Target zone is marked around 150.032, showing a projected gain of 2.30% (337.2 pips).

4. Resistance Levels:

Minor resistance at the 200 EMA (~148.5).

USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average 151.500 (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the nearest / swing low level Using the 5H timeframe (149.500) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 155.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

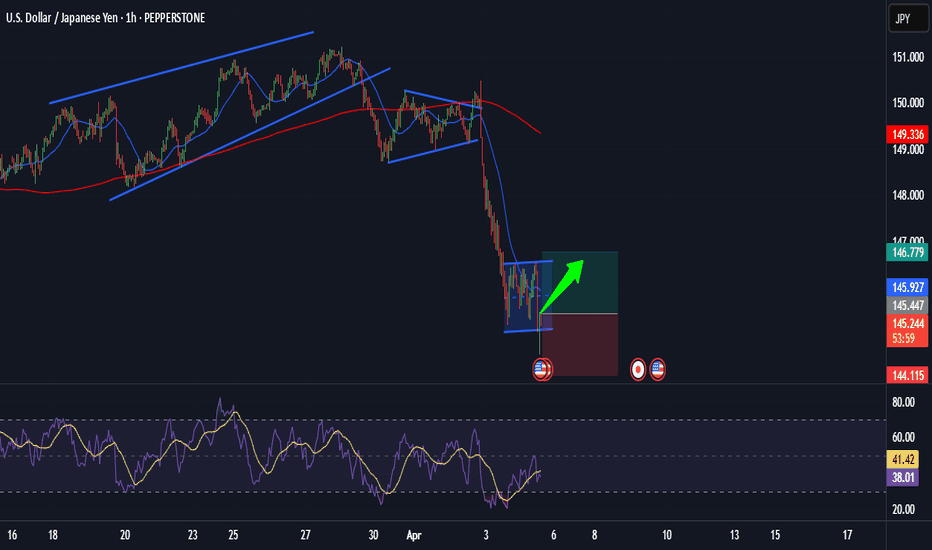

USD/JPY Ready for Liftoff? Catch This Potential Rebound! Hi traders! , Analyzing USD/JPY on the 1H timeframe, spotting a potential long entry:

🔹 Entry: 145.44

🔹 TP: 146.78

🔹 SL: 144.115

USD/JPY has formed a consolidation zone after a sharp downtrend, indicating a potential bullish reversal. If buyers step in, we could see a move towards 146.78. RSI is recovering from oversold levels, supporting the upside scenario.

⚠️ DISCLAIMER: This is not financial advice. Every trader makes their own decision.

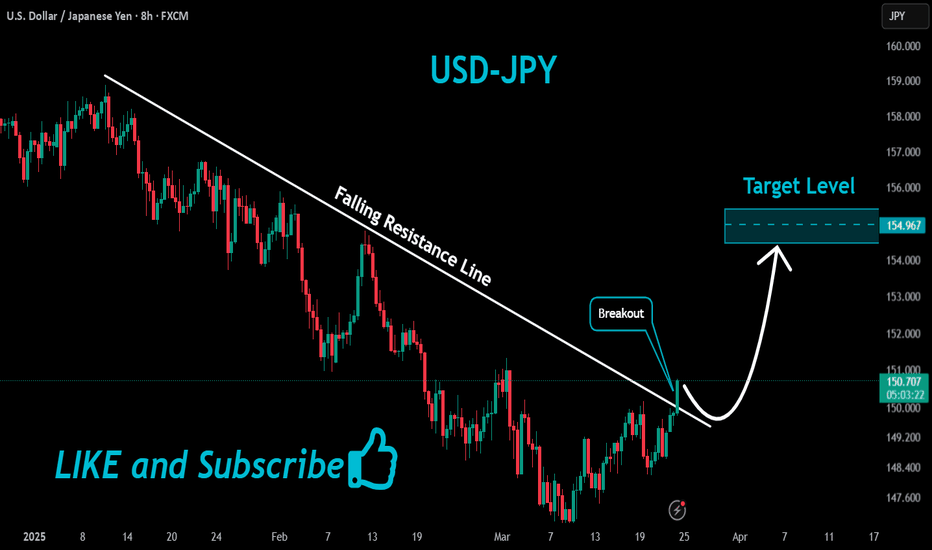

USDJPY Reversal: Bearish Momentum Builds Below Key ResistanceUSDJPY pair is showing signs of a bearish reversal after rejecting a key resistance zone near 151.241. The price has failed to sustain bullish momentum and has formed a potential double-top/wedge structure, indicating a shift in trend.

Key Resistance: 151.241 - 152.097 (Strong supply zone)

Bearish Confirmation: Break below 149.592 confirms downside continuation.

Key Downside Targets: 148.195, 146.990, and 145.855 as major support zones.

If sellers maintain pressure, a deeper pullback toward the 145.855 - 145.824 region could be expected. However, a break above 152.097 would invalidate the bearish setup and could push the price toward 154.090.

USD/JPY Trade Setup & Analysis – Bullish Reversal from 200 EMAThe 200 EMA (blue line) at 149.701 acts as a strong support level.

The 30 EMA (red line) at 150.458 represents a short-term trend guide.

Trade Setup:

Entry Point: Around 150.120 (near the 200 EMA).

Stop Loss: Below 149.496, protecting against downside risk.

Take Profit Levels:

TP1: 150.287

TP2: 150.533

TP3: 150.886

Final Target: 151.377

Strategy:

Buy Position: The expectation is for the price to bounce from the 200 EMA and move upwards toward the targets.

Risk-Reward: Favorable, as the trade has multiple profit-taking levels.