USDJPY BEARISH SETUP ONFIRMED.?USD/JPY Bearish Scenario Analysis

Trend: Downtrend (bearish bias confirmed by lower highs and lower lows on the daily timeframe)

Current Price Action: After a failed attempt to sustain above the 148.200 resistance level, USD/JPY has shown rejection patterns such as bearish engulfing candles and increasing selling volume. Price is now breaking below key moving averages (e.g., 50 and 100 EMA), confirming momentum shift to the downside

Key Technical Levels

Resistance: 148.200 – Strong supply zone, multiple rejections seen here.

1st Bearish Target: 143.900 – Recent swing low and minor support zone; break below confirms bearish continuation.

2nd Bearish Target: 141.600 – Major horizontal support from previous consolidation area.

Support: 140.100 – Long-term support level; likely to attract strong buying interest or signal a trend exhaustion.

Bearish Scenario Setup

1. Entry Zone: Between 147.500 - 147.800 (pullback/retest of broken structure)

2. Stop Loss: Above 148.500 (just beyond the resistance zone to avoid false breakouts)

3. Take Profit Targets:

TP1: 143.900

TP2: 141.600

4. Bonus Target (extended move): 140.100 – if selling momentum continues and macro conditions favor JPY strength.

Usdjpysell

USDJPY Retest of Supply Zone Before Bearish ContinuationUSDJPY pair is reacting to key supply around 143.70–144.00 but shows signs of weakness after failing to hold above this level. With renewed risk-off sentiment and escalating global trade tensions—especially involving Japan and the U.S.—this pair may be setting up for a bearish continuation. Here's what both the chart and macro backdrop suggest.

📊 Technical Breakdown (4H Chart)

Key Supply Zone Retested:

The pair retraced into a previously broken structure zone (blue box), rejecting the 143.70–144.00 area multiple times.

Price is now forming lower highs, indicating bearish pressure building beneath resistance.

Bearish Continuation Pattern:

Price action resembles a bear flag, with a minor pullback likely before continuation lower.

A retest of 143.00–143.50 could serve as an ideal sell zone.

Major Support Levels:

142.04–142.02: Immediate support, already tested.

140.16: Key structure low from late April.

138.04: Final measured move target based on Fibonacci extension and prior demand zone.

Bearish Trade Setup:

Entry Zone: 143.00–143.50

Stop: Above 145.35

TP1: 142.00

TP2: 140.15

TP3: 138.00

🌐 Macro Fundamentals

Trump Tariffs Stir Instability:

President Trump is pressing Japan in trade talks with threats of new tariffs, already impacting investor confidence

A 25% tariff on Japanese auto exports has gone into effect, disrupting trade negotiations.

Urgency for a Deal, But No Progress Yet:

Trump says multiple deals are “coming,” but little substance has emerged. Analysts fear economic fallout and potential global recession if tensions continue

JPY Strengthening on Safe-Haven Flows:

With U.S. economic indicators weakening and global uncertainty rising, the yen may benefit from risk aversion.

✅ Summary

USDJPY remains vulnerable to downside continuation from the 143–144 resistance zone. If price breaks below 142.00 again with conviction, expect momentum to build toward 140.15 and potentially 138.00.

USD/JPY "The Gopher" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1D timeframe (148.800) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 140.000 (or) Escape Before the Target

💰💵💸USD/JPY "The Gopher" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Explanation Recap ✨

Fundamentals: Policy divergence + trade risks ⚖️ favor JPY 💪.

Macro: US slowdown 📉 + Japan resilience 🌱 lift JPY.

Global Markets: Risk-off flows 🛡️ + yield dynamics 📜 boost JPY.

COT: Speculative unwinding 📉 aligns with bearish pressure.

Seasonality: Mild JPY edge in April 🌸.

Intermarket: USD weakness 💸 across assets aids JPY.

Quantitative: Technicals confirm bearish 📉.

Sentiment: Broad bearish tilt 😟, retail as contrarian 🚨.

Trend Prediction: Downward bias 📉 across timeframes.

Outlook: Strong bearish case 🐻 with clear targets.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/JPY) bullish trend analysis Read The ChaptianSMC Trading point update

Technical analysis of USD/JPY chart shows a bullish reversal setup. Here’s a breakdown behind the analysis:

1. Downtrend & Channel Breakout:

Price was trending downward within a descending channel (marked “channel trend”).

Recently, the price broke out of the channel, signaling a potential trend reversal.

2. Demand Zone (Diamond Zone):

The yellow box labeled “Diamond Zone” represents a demand/support zone where price previously found buyers.

A retest of this zone is expected before the bullish move.

3. EMA (200):

The EMA (200) is currently above the price but close. A break above this level (142.522) could add to bullish momentum.

4. RSI Indicator:

RSI is showing a bounce off a mid-level (~50), suggesting bullish momentum is gaining.

5. Target Level:

The analysis targets 147.838, which aligns with a prior resistance zone.

The move projects a 5.19% gain (~778.5 pips) from the current setup.

Trading Idea Summary:

Entry: Around the “Diamond Zone” after a successful retest.

Confirmation: Watch for bullish candlestick patterns or a break above EMA 200.

Target: 147.838

Stop Loss (implied): Below the Diamond Zone (~140.000)

Pales support boost 🚀 analysis follow)

USD/JPYThe Japanese Yen (JPY) oscillates in a narrow trading band at the start of a new week and remains close to a two-week trough touched against its American counterpart on Friday. Mixed signals from the US and China temper hopes for a quick resolution of the trade conflict between the world's two largest economies, which, in turn, offers support to the safe-haven JPY. Moreover, expectations that Japan will strike a trade deal with the US turn out to be another factor underpinning the JPY.

Meanwhile, investors have been scaling back their bets for an immediate interest rate hike by the Bank of Japan (BoJ) as rising economic risks from US tariffs overshadow signs of broadening inflation in Japan. This holds back the JPY bulls from placing aggressive bets, which, along with a modest US Dollar (USD) uptick, acts as a tailwind for the USD/JPY pair. However, the divergent BoJ-Federal Reserve (Fed) policy expectations should cap the USD and benefit the lower-yielding JPY.

USDJPY (1h) sell updateEarlier this week we had this USDJPY sell setup where price perfectly pulled back into our entry price and even though it's been ranging the trade is now running in profit so if you did take this trade move the stop-loss to break-even (to the entry level) & watch it play out till it hits take profit or you can manually close the trade in profit.

USD/JPY) demand and supply analysis ); Read The ChaptianSMC Trading point update

shows a bearish setup for USD/JPY on the 1-hour timeframe. Here’s a breakdown

---

1. Trend Context:

Downtrend: The pair is clearly in a bearish channel, forming lower highs and lower lows.

200 EMA (~146.297) is above price and sloping down — confirms bearish bias.

---

2. Key Zones Identified:

Supply Zone (~144.800–145.200): A strong area of resistance where sellers may re-enter. If price returns here, it’s a potential short setup.

Demand Zone (~142.800–143.100): A possible reaction point where short-term buyers may provide a bounce.

Target Point (~141.168): A projected target if the downtrend continues and demand zone fails.

---

3. Expected Scenarios:

Primary Bearish Move:

Price may react from current levels or from the demand zone.

A pullback to the supply zone is expected before continuation downward.

Then, sell-off toward the target zone around 141.168.

Alternate Play:

Price could bounce between the demand and supply zones a bit more before breaking down.

---

4. Indicators:

RSI (~46.37): Shows room to the downside before oversold, aligning with bearish momentum.

Mild bullish divergence in RSI recently, suggesting potential for a small pullback or bounce.

Mr SMC Trading point

---

Summary of Idea:

This is a sell setup:

Sell entries: Ideal around the supply zone (144.8–145.2).

First target: Demand zone (~143.0)

Final target: 141.168

Invalidation: Break above 146.30 (200 EMA and channel resistance).

pales support boost 🚀 analysis follow,)

USDJPY (1h) Potential SellAll major time frames indicate this pair will keep going down.

3 point confluences:

1. Created lower highs in both long term & short term tend failing to break the trendlines

2. We've just got a CHoCH (change in character)

3. Sell order block has formed after going sideways for a couple of days which means price is most likely to revisit it before exploding down.

Entry strategy:

Wait for a pullback into the recent sell order block then enter when the stochastics indicator is overbought to help give us a tighter stop-loss.

Alternatively you can set a sell-limit order on the entry price (green line)

Note: price could keep travelling down without doing a pullback

GoodLuck!

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/JPY Bearish Trade Setup – SBR + DBD Zone Rejection📉 Trend Analysis:

🔴 Downtrend confirmed by lower highs and lower lows.

📉 Descending trendline indicates continuous bearish pressure.

🔹 Key Levels & Zones:

🔵 Resistance Zone (SBR + DBD) – 144.123 📍 (Sell Entry Point)

🟠 Stop Loss – 145.209 🚫 (Above resistance to avoid fake breakouts)

🟢 Target Point – 139.694 🎯 (Strong support area)

🏹 Expected Price Action:

🔸 Scenario:

🔺 Price moves up toward the resistance zone (🔵 SBR + DBD Zone)

🔻 Bears take control (Rejection expected)

⚡ Drop towards target at 139.694

📊 Trade Plan:

✅ Entry – Wait for rejection at 144.123 (🔵)

✅ Stop Loss – Keep at 145.209 (🛑🔺)

✅ Take Profit – Aim for 139.694 (✅🎯)

💡 Risk-Reward Ratio: Good (More reward than risk)

USD/JPY Bearish Reversal Setup – Short from Resistance ZoneCurrent Price: ~146.252

EMA 30 (Red): ~146.573

EMA 200 (Blue): ~146.662

The price is below both EMAs, suggesting short-term bearish momentum.

📉 Trade Setup:

Entry Point: 146.551 (marked on the chart)

Stop Loss (SL): 148.514 (above resistance zone)

Take Profit (TP): 142.374 (marked as “EA TARGET POINT”)

Risk/Reward Ratio (RR): Approx. 1:2.5+

📌 Zone Analysis:

Resistance Zone: 147.6 – 148.5 (highlighted in purple)

Previous highs rejected from this level multiple times.

Sellers appear to be defending this zone strongly.

Support Zone: 142.3 – 143.0

Previous accumulation zone marked for the TP.

🧠 Bias & Interpretation:

Bearish Bias: Confirmed by:

Price rejection from resistance.

Below both EMA 30 & EMA 200.

Bearish engulfing patterns near the resistance zone.

Potential Strategy: Short from 146.551 targeting 142.374 with tight SL at 148.514.

⚠️ Watch for:

Any bullish crossover between EMA 30 and EMA 200 could shift momentum.

False breakouts above the resistance zone before actual reversal.

Key U.S. or Japan news that may cause volatility.

USDJPY Bearish Flag Breakdown – Eyes on 140.11 Support ZoneUSDJPY is showing signs of a bearish continuation, following a breakdown from a rising wedge pattern. The recent strong drop confirms a shift in momentum from bullish to bearish, with price now forming a bear flag just below a key structure.

Key Technical Zones:

Current Price: 147.78

Resistance Area (Invalidation Zone): 148.11 – 151.44

Support Targets:

TP1: 142.87

TP2: 140.11

Technical Confluence & Patterns:

✅ Series of Rising Wedges followed by sharp breakdowns

✅ Bear Flag Pattern forming after recent drop

✅ Lower highs & lower lows confirming downtrend

✅ Volume spike during breakdown, low volume on pullback

Trade Outlook:

📉 Bias: Bearish below 148.11

📌 Entry Zone: On confirmation of flag breakdown

🎯 Target 1: 142.87 – Previous horizontal support

🎯 Target 2: 140.11 – Major swing support / demand zone

🛑 Invalidation: Break above 151.44 (major resistance zone)

Conclusion:

USDJPY is set up for a potential bearish continuation as it respects a textbook flag breakdown setup. A close below 147.50 would reinforce bearish pressure with further downside toward 142.87 and 140.11. Traders should monitor momentum and structure confirmation before entering positions.

Let me know if you want a short caption or video script version! 📉

USDJPY Breakdown?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Reversal: Bearish Momentum Builds Below Key ResistanceUSDJPY pair is showing signs of a bearish reversal after rejecting a key resistance zone near 151.241. The price has failed to sustain bullish momentum and has formed a potential double-top/wedge structure, indicating a shift in trend.

Key Resistance: 151.241 - 152.097 (Strong supply zone)

Bearish Confirmation: Break below 149.592 confirms downside continuation.

Key Downside Targets: 148.195, 146.990, and 145.855 as major support zones.

If sellers maintain pressure, a deeper pullback toward the 145.855 - 145.824 region could be expected. However, a break above 152.097 would invalidate the bearish setup and could push the price toward 154.090.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

151.00 Cracks: Is USD/JPY’s Rally Over? Key Levels AheadFrom a fundamental perspective, the USD/JPY exchange rate retreated from around the 151.00 level. Despite the poor Japanese PMI data on Monday, investors bought the Japanese yen influenced by the hawkish outlook of the Bank of Japan (BoJ). The minutes of the January meeting showed that policymakers tend to tighten policies when appropriate. The BoJ governor also stated that the degree of monetary easing will be adjusted once the 2% inflation target is achieved.

Technically, the overnight breakout above the 150.00 psychological mark and the 200 - period Simple Moving Average (SMA) on the 4 - hour chart is a bullish signal. Indicators on the daily chart also support appreciation, and pullbacks may present buying opportunities. If the rate breaks below 150.00, it may accelerate its decline to support levels such as 149.30 - 149.25. Failure to hold these levels indicates that the rebound momentum has been exhausted and the trend may turn bearish. Conversely, if it stabilizes above 151.00, the upward resistance levels are successively 151.30, 151.75 (the 200 - day SMA), and it may even rise to 153.00.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USD/JPY 4H Analysis – Potential Bearish RetestThe USD/JPY pair has been in a clear downtrend, trading within a descending channel for an extended period. Recently, price action has broken above the channel, but it is now facing resistance around the 150.35 level.

Retest Zone: The pair is currently retesting the broken trendline, and if it fails to sustain above this level, a rejection could lead to further downside.

Bearish Expectation: If the price fails to reclaim 150.35, a move towards the 147.00 support zone is likely.

Confirmation: A strong bearish candle from this level could indicate a reversal, confirming the downward move.

Traders should watch for price action signals at the retest level before making decisions.

USDJPY 1.2850 Long in Profit: Next Week's Take - Profit GuideThis week, the long position signal on USDJPY at the 1.28500 level has already started yielding profits. As we look ahead to next week, it is advisable to commence position closing once the price reaches the pre - determined target levels. Rest assured, I will persist in furnishing precise trading signals.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USDJPY: Volatility and Key LevelsThe recent trend of the USD/JPY has been highly volatile. On the economic data front, the rise in Japan's unemployment rate and the decline in corporate capital expenditure have triggered selling pressure on the Japanese yen. However, factors such as corporate wage growth provide grounds for the Bank of Japan to consider raising interest rates.

From a technical perspective, key support levels are situated around 147.7 and 146.5, whilst the resistance levels are now between 150 and 151. Amid the ongoing battle between bulls and bears, the pair is likely to continue trading within the range of 147.00-149.00. That said, given the current upward momentum, a technical pullback followed by further gains in the short term cannot be ruled out.

USDJPY

buy@148.000-149.000

tp:150.000-151.000

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

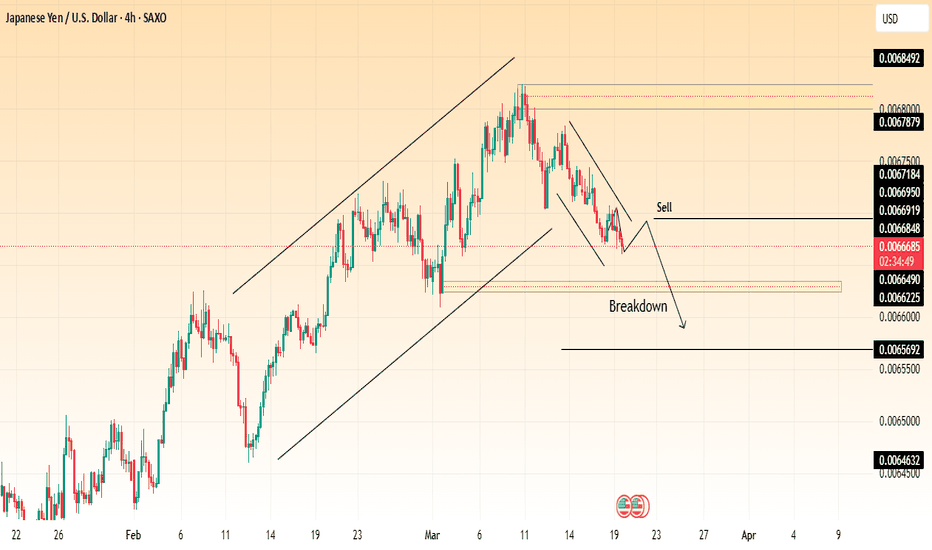

USD/JPY Bearish Continuation📉 Trend Analysis:

The chart shows a breakdown from an ascending channel, indicating a potential bearish reversal after an extended uptrend.

Price has formed a descending channel, reinforcing the short-term bearish structure.

🔍 Key Levels:

Sell Zone: Around 0.0066848 - 0.0066919, acting as resistance.

First Target: Around 0.006490, a strong support area.

Second Target: Around 0.0065692, marking a deeper level of bearish continuation.

Final Target: Around 0.0064632, a critical demand zone.

📌 Trade Plan:

Look for sell entries on a possible pullback to the resistance zone.

Confirmation through rejection candles or continuation patterns could strengthen the bearish case.

⚠ Risk Management:

Stop loss above the previous resistance around 0.0067184.

Take profits gradually at key support zones.