USDJPY EA MAN UPDATE > READ THE CHAPTIAN Key Observations:

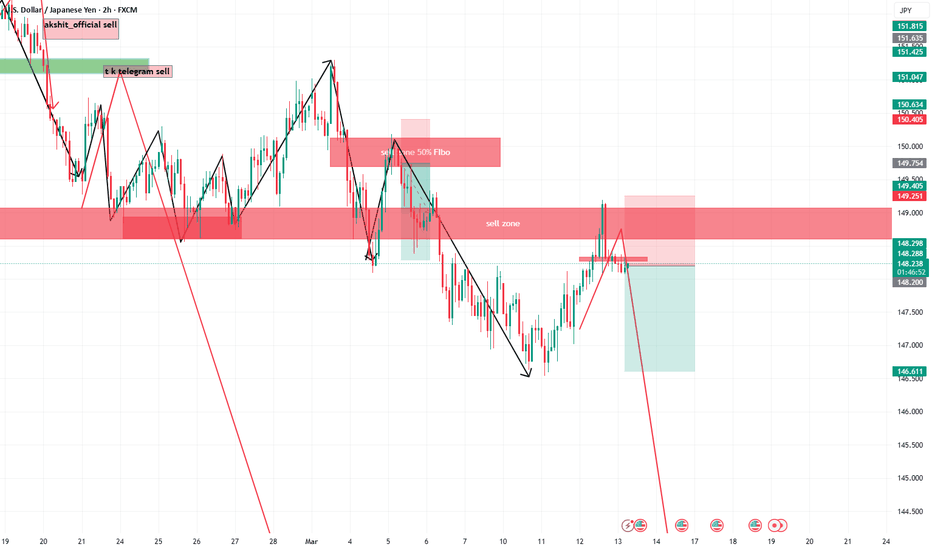

Resistance Level: The price is testing a key resistance zone around 150.026, where selling pressure could emerge.

EMA Confluence: The price is currently above both the 30 EMA (149.639, red) and 200 EMA (149.339, blue), indicating an overall bullish trend.

Projected Bearish Move: A rejection from the resistance zone could lead to a pullback towards the 149.117 support level, aligning with the potential short-term bearish scenario.

If price fails to break above the resistance and starts forming lower highs, a move towards the target point at 149.117 could unfold.

Usdjpysell

USD/JPY "The Gopher" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗USD/JPY "The Gopher"˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (148.000) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

📌I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at (150.000) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 145.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

USD/JPY "The Gopher" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.

💡Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the United States and Japan, which directly influence the USD/JPY pair.

💡United States Economic Indicators:

GDP growth is forecasted at around 2.0% to 2.5% for 2025, reflecting steady expansion Economic Forecast for the US Economy.

Inflation rate is expected to be around 2.5% to 3.0%, with recent data showing stability United States Inflation Rate.

Interest rates are at 4.50%, with expectations of cuts to around 4.0% to 4.25% by the end of 2025, reflecting a dovish shift United States Fed Funds Interest Rate.

Trade balance shows a deficit of $50 billion in January 2025, a persistent challenge but manageable with strong growth United States Balance of Trade.

💡Japan Economic Indicators:

GDP growth is projected at 1.1% for 2025, with recent Q4 2024 data showing 2.8% annualised growth, indicating recovery Japan's GDP beats forecasts.

Inflation is expected at around 2%, with core inflation robust, driven by wage gains Japan Economic Outlook.

Interest rates are at 0.5%, with expectations to reach 1.0% by the end of 2025, reflecting policy normalization Japan Outlook.

Trade balance shows a deficit, with recent figures at -2759 JPY Billion in January 2025, impacted by import costs Japan Balance of Trade.

The narrowing interest rate differential, with US rates expected to cut and Japan's rates rising, could support JPY strength, though US economic resilience remains a counterforce.

💡Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

Global GDP growth is projected at 3.0% to 3.3% for 2025, according to recent forecasts, with mixed regional performances World Economic Outlook Update.

Commodity prices are expected to decline by 5% in 2025, with energy prices leading the drop, impacting JPY due to Japan's import reliance Commodity Markets Outlook.

Stock markets show mixed performance, with US indices up 5% YTD and Japanese indices showing recovery, supporting risk-sensitive currencies Global Stock Market Performance.

Bond yields are expected to be range-bound, with the US 10-year Treasury yield possibly around 3.5% to 4.5%, suggesting lower USD appeal 2025 Bond Market Outlook.

💡Global Market Analysis

Global economic conditions play a significant role in currency movements:

Geopolitical events, such as potential tensions, could boost JPY as a safe-haven currency, though no major events are currently noted.

Central bank policies are diverging, with the Fed expected to cut rates and the Bank of Japan (BoJ) raising rates, narrowing the interest rate differential Central Bank Policies.

Commodity trends, with declining prices, have a muted direct impact, though energy costs affect Japan's inflation.

Stock market performance, with global indices up, suggests risk-on sentiment, potentially supporting USD over JPY Market Performance Analysis.

💡COT Data and Positioning

COT data provides insights into large trader positions, with recent reports showing:

For USD/JPY futures, large speculators are likely net long, driven by the interest rate differential and stronger US economic outlook JPY Commitments of Traders.

Positioning shows that institutional traders are cautiously optimistic, with some covering shorts as the price approaches support levels.

Key Insight: Long positions in USD/JPY align with economic fundamentals, suggesting bullish sentiment among speculators.

💡Intermarket Analysis

Intermarket relationships influence currency valuation:

USD/JPY is positively correlated with US stock markets; with strong US indices, the USD could benefit from risk-on sentiment Intermarket Analysis.

Gold, trading at $1900 per ounce, slightly up, suggests a weaker USD, supporting JPY strength as a safe-haven Gold Price Trends.

Bond yields, with declining US yields, indicate lower USD appeal, potentially boosting JPY/USD Bond Market Insights.

Key Insight: Positive correlations with US stocks suggest USD strength, while gold and bond yields support JPY, creating a mixed dynamic.

💡Quantitative Analysis

Technical analysis provides insights into price trends:

At 149.000, USD/JPY is near key support at 148.43 (Classic S3), with resistance at 149.02 (Classic R2), based on recent charts USD/JPY Technical Analysis.

Moving averages show a mixed picture, with shorter-term (MA5, MA10) suggesting buy and longer-term (MA50, MA100, MA200) suggesting sell TradingView Analysis.

RSI (Relative Strength Index) is at 45.418, neutral, suggesting potential for a bounce if support holds Technical Indicators Guide.

Key Insight: Technicals suggest a possible downward trend, with sell signals dominating, though support levels could trigger a reversal.

💡Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows 62% of forex traders long on USD/JPY, with an average price of 154.6568, contrasting with a downward price movement, creating a bearish indicator Forex Sentiment USDJPY.

Bank forecasts predict USD/JPY dropping to 145.00 by year-end, citing Japan's recovery and expected Fed rate cuts Currency Forecasts.

Key Insight: Mixed sentiment, with retail traders long but institutional forecasts bearish, supporting a downward outlook.

💡Next Trend Move

Combining all factors, the next trend move for USD/JPY is likely downward:

The pair is at a key support level (148.43), and if it breaks, could drop to test lower levels around 145.00.

Potential catalysts include Fed rate cuts and BoJ rate hikes, narrowing the interest rate differential, supporting JPY strength.

Key Insight: The next move favors a downward continuation, with risks of an upward bounce if support holds.

💡Overall Summary Outlook

The USD/JPY pair, at 149.000 on March 4, 2025, exhibits a bearish outlook. Key drivers include the narrowing US-Japan interest rate differential, with US rates expected to cut to 4.0%-4.25% and Japan's rates rising to 1.0% by year-end, alongside Japan's economic recovery (1.1% GDP growth in 2025). Technical indicators suggest sell signals, supported by mixed market sentiment and declining commodity prices. Risks include strong US economic data maintaining USD dominance or global risk-off sentiment boosting USD. However, the prevailing trend points to potential JPY appreciation in the near term.

💡Future Prediction

Trend: Bearish

Details: The pair is likely to see a downward move, testing support at 148.43 and potentially dropping to 145.00 in the next few months, driven by narrowing interest rate differentials and technical sell signals. Risks include stronger-than-expected US data maintaining USD strength, but current indicators suggest a reversal is imminent.

💡Summary of Key Economic Indicators

Indicator United States (2025 Forecast) Japan (2025 Forecast)

GDP Growth 2.0%-2.5% 1.1%

Inflation Rate 2.5%-3.0% ~2%

Interest Rate 4.0%-4.25% (end of year) 1.0% (end of year)

Trade Balance Deficit ($50 billion, Jan 2025) Deficit (-2759 JPY Billion, Jan 2025)

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Counter Trend Opportunities - Fxdollars - {11/03/2025}Educational Analysis says USDJPY may give countertrend opportunities from this range, according to my technical.

Broker - FXCM

So my analysis is based on a top-down approach from weekly to trend range to internal trend range.

The weekly trend range is long up to 170.000

Trading Range Approach is a long counter trend opportunity or pushback up to 155.000

The internal Trend Range Approach is a Long counter trend opportunity or pushback up to 150.000

or continue going down with an internal trading range or trading range up to 135.000

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars .

USDJPY and GBPJPY AnalysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY BuyUSDJPY Trade Signal

📉 Pullback & Potential Reversal

Price Level: 150.41

Support Zone: 148.37 - 149.98

Resistance Targets: 152.06 / 154.00

📌 Trade Plan:

Wait for a pullback confirmation before entering long.

Stop Loss: Below 148.37

Targets: 152.06 → 154.00

⚠️ Risk Management: Control risk and wait for a clear breakout.

USDJPY Weekly SetupFor the past few weeks, this pair has been on a bearish trajectory, and I do anticipate that the momentum will continue.

The targets are;

1. 150.93 ~ This is the lows of the past 2 previous weeks.

2. 149.6 ~ This is the Weekly Bullish Order Block

3. 148.7 ~ Another sellside liquidity formed in December.

The daily and 15 minute timeframe will give us the best entry and stop loss for this pair.

USDJPY: remains below 150.00Furthermore, any significant retracement could find immediate support near the 149.50 level, which is followed closely by the 149.00 round number. A break below the latter might expose the USD/JPY pair to a retest of the 148.50 region, a level seen as the next strong support. Sustained weakness below this area could pave the way for a deeper corrective decline, with the next target around the 148.00 level. Traders will likely keep a close eye on these levels, as they could provide fresh directional impetus for the pair.

USDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Daily BiasThe price has been on a bearish momentum for the past few days and I do anticipate that the momentum will continue.

The price had retracted towards the Volume Based Inefficiency formed around 152.2 and my sell entry position will be determined in a smaller TF (15 Minutes) in a follow up analysis on the same.

USDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/JPY Ready For Sell To Give Us 250 Pips In The Next Days !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

SELL USDJPY H4 | FOREX BEEHey Traders,

This USD/JPY H4 chart appears to show a descending triangle formation, typically signaling a bearish continuation pattern. The key levels and considerations are:

1. Trend Analysis:

- The market seems to have broken the ascending trendline (blue) decisively, suggesting strong bearish momentum.

- The price is currently trading below key resistance zones (highlighted in red).

2. Fibonacci Level:

- The 0.618 Fibonacci retracement (155.01) was tested but failed to hold, further indicating bearish strength.

3. Target Zones:

- A bearish move toward the next demand zone near the 0.236 Fibonacci level (~151.18) appears likely, as marked on the chart.

4. Retest and Continuation:

- The blue arrow suggests a possible retest of the broken support-turned-resistance zone before continuing downward.

### My Thoughts:

The chart indicates bearish bias, with the next likely target near 151.18. However, monitoring the retest area closely for rejection signals to confirm the continuation is essential. Fundamental factors like USD or JPY economic data can further drive this movement.