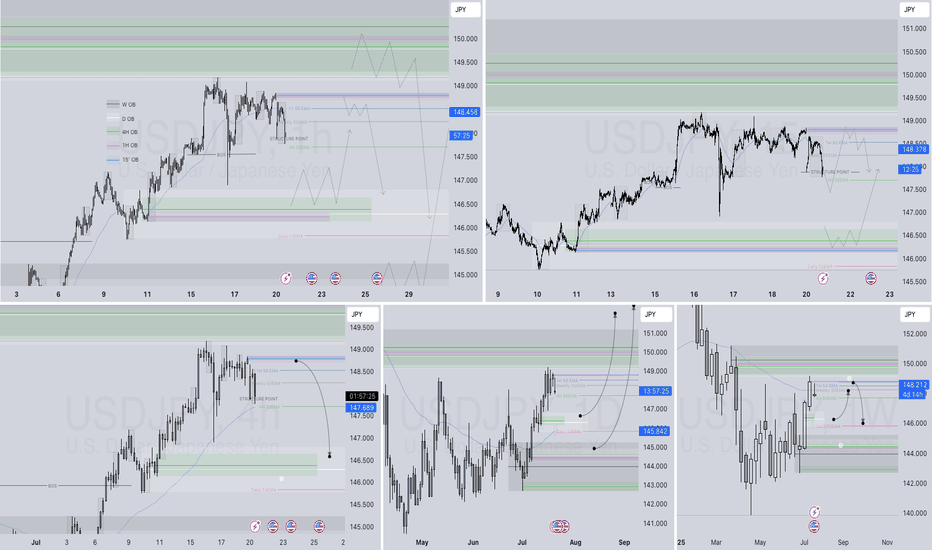

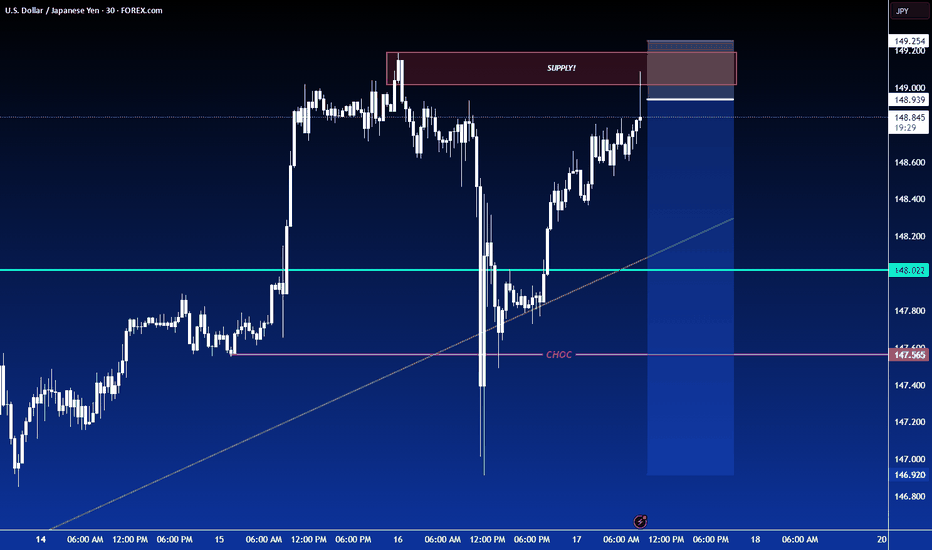

USDJPY Q3 | D21 | W30 | Y25 15' OB UPDATE 📊USDJPY Q3 | D21 | W30 | Y25 15' OB UPDATE

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

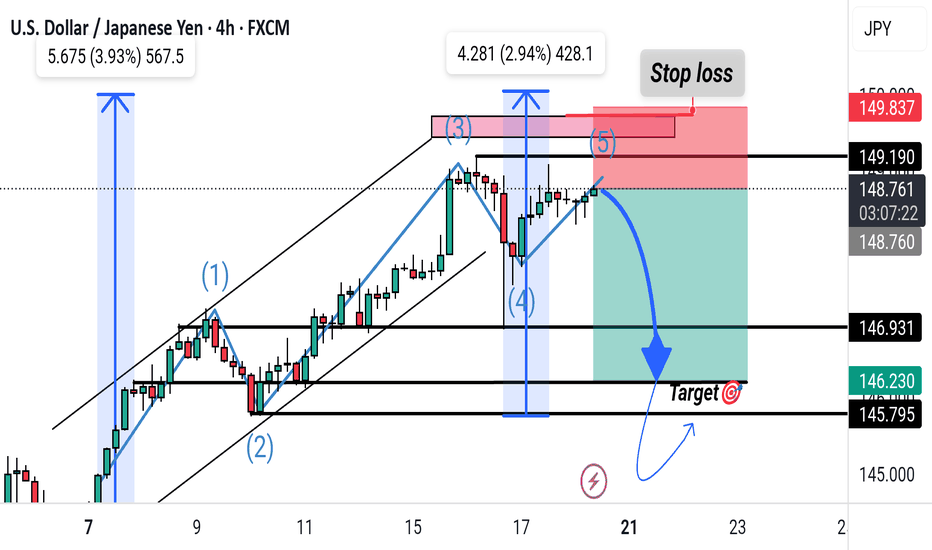

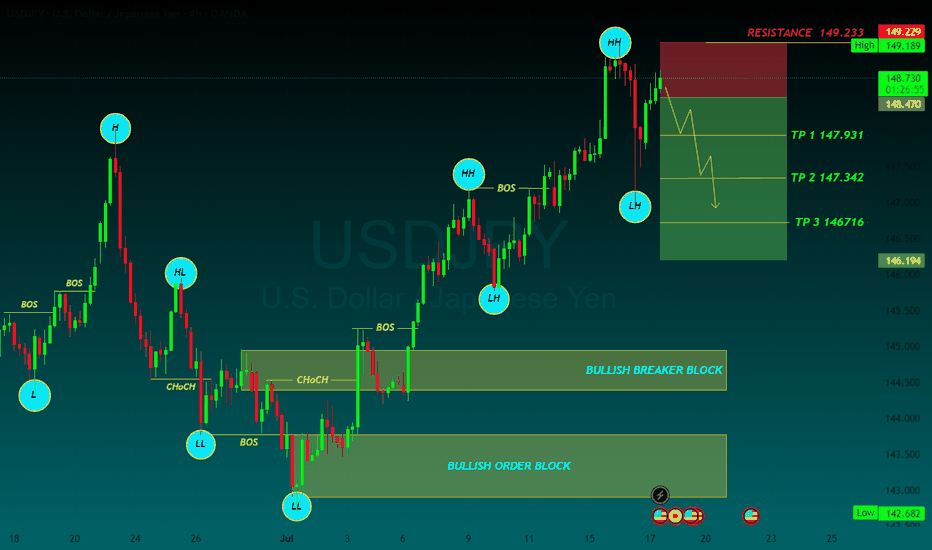

Usdjpyshort

"USD/JPY Elliott Wave Short Setup – Targeting Key Support Zone"This chart shows a potential USD/JPY short trade setup based on Elliott Wave analysis. The price appears to have completed a 5-wave upward structure, reaching resistance near 148.75–149.19. A short position is suggested with:

Entry: Around 148.75

Stop Loss: Above 149.19

Target: 146.23–145.80 support zone

The trade aims to capture a corrective move following wave (5).

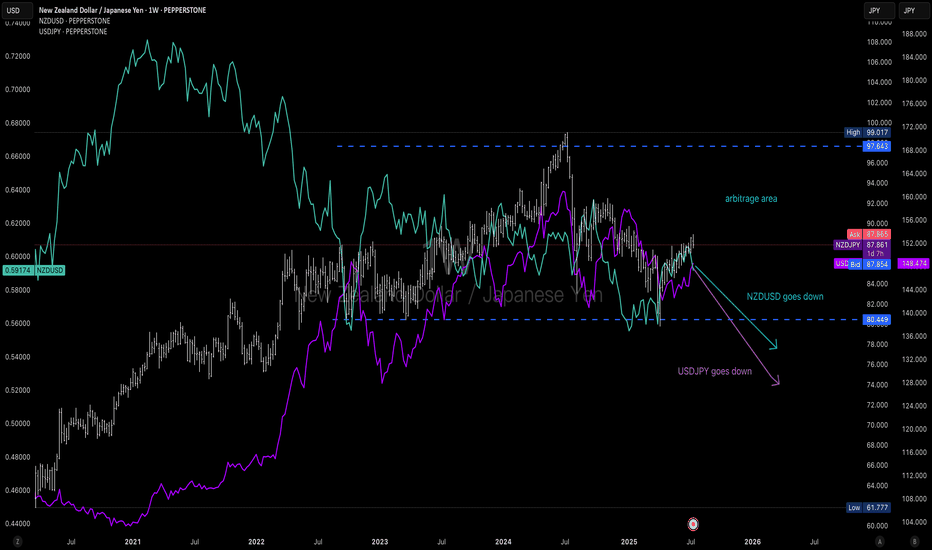

An arbitrage chance: NZ Dollar goes down & JP Yen goes upDue to economies trends and currency policies, USDJPY is going down in a long term (3 to 5 years) and NZDUSD is also going down in the next 3 years

Except for trend following trade for these 2 pairs, you can also set buy limit at the bottom of a value box for NZDJPY and sell limit at the top boarder of this box. Will take good P/L and good win rate positions for this crosspairs

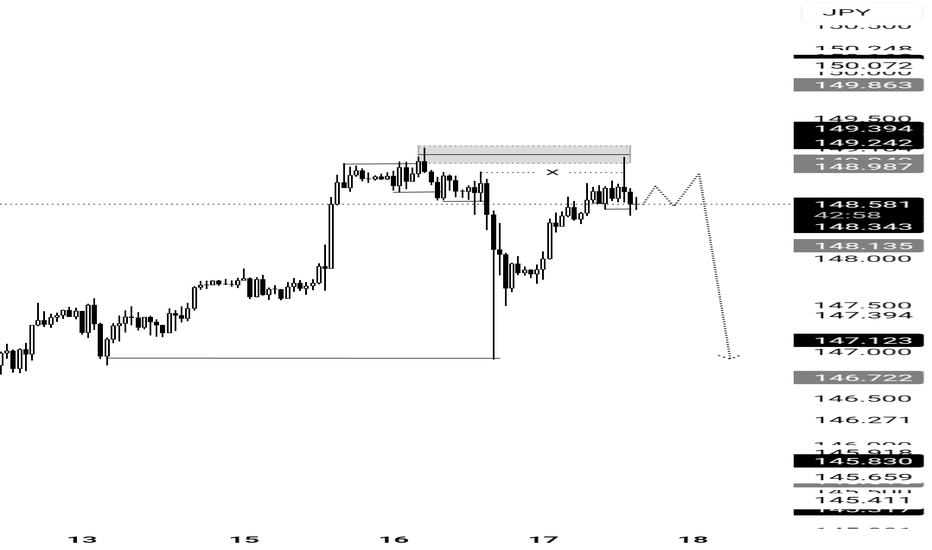

USDJPY SELLJapanese Yen adds to intraday losses; USD/JPY climbs to 148.80 amid broad-based USD strength

The Japanese Yen selling remains unabated through the early European session on Thursday, which along with a goodish pickup in the US Dollar demand, lifts the USD/JPY pair to the 148.80 region in the last hour. Data released earlier today showed that Japan clocked a smaller-than-expected trade surplus in June.

From a technical perspective, the USD/JPY pair showed some resilience below the 100-hour Simple Moving Average (SMA) on Wednesday, and the subsequent move up favors bullish traders. Moreover, oscillators are holding comfortably in positive territory and are still away from being in the overbought zone, suggesting that the path of least resistance for spot prices is to the upside. Hence, some follow-through strength back towards the 149.00 mark, en route to the overnight swing high near the 149.15-149.20 region, looks like a distinct possibility. The upward trajectory could extend further towards reclaiming the 150.00 psychological mark for the first time since late March.

On the flip side, the 148.00 round figure now seems to protect the immediate downside ahead of the Asian session low, around the 147.70 region. The latter nears the 100-hour SMA, below which the USD/JPY pair could retest sub-147.00 levels. Some follow-through selling might shift the bias in favor of bearish trades and drag spot prices to the 146.60 intermediate support en route to the 146.20 area, the 146.00 mark, and the 100-day SMA support, currently pegged near the 145.80 region\

TP 1 147.931

TP 2 147.342

TP 3 146716

RESISTANCE 149.233

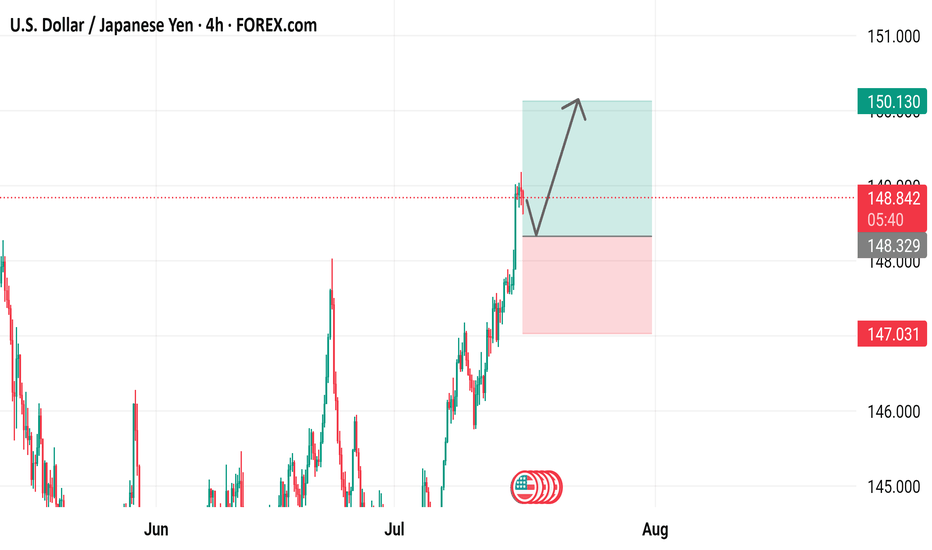

USD/JPY 4-Hour Chart Analysis4-hour chart displays the price movement of the U.S. Dollar against the Japanese Yen (USD/JPY) from June to August 2025. The chart shows a significant upward trend in July, followed by a correction. Key levels are highlighted, including support at 147.031 and resistance at 150.130, with the current price at 148.809. The chart suggests a potential bullish continuation, as indicated by the upward arrow and green box, targeting higher levels above 150.000.

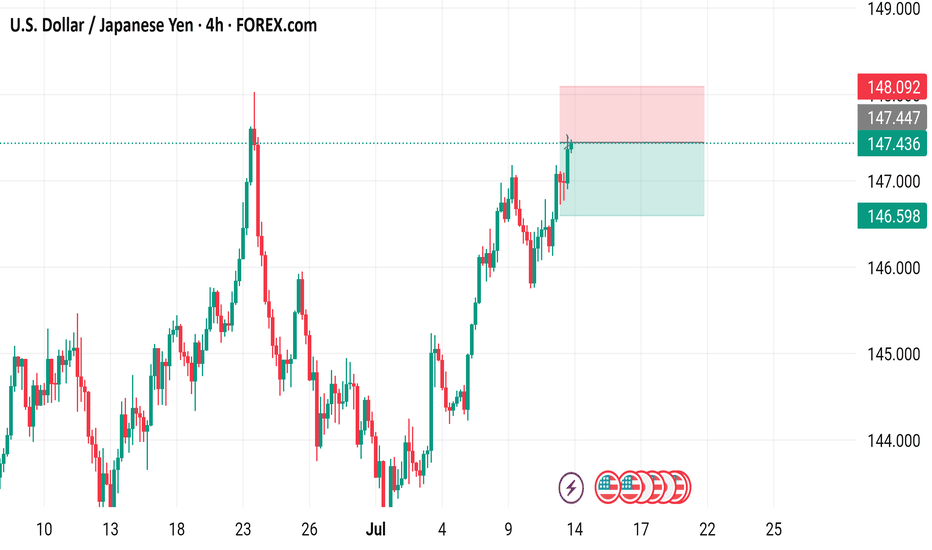

USD/JPY 4-Hour Forex Chart4-hour performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) from late June to mid-July 2025, sourced from FOREX.com. The current exchange rate is 147.436, with a 1.178 (+0.81%) increase. Key levels include a sell price of 147.393 and a buy price of 147.479. The chart shows a recent upward trend with a resistance zone highlighted between 147.436 and 148.092, and support around 146.598. Candlestick patterns indicate volatility, with notable price movements around early July.

USDJPY LONG & SHORT – DAILY FORECAST Q3 | D15 | W29 | Y25💼 USDJPY LONG & SHORT – DAILY FORECAST

Q3 | D15 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

USDJPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

USDJPY: Bearish Divergence – Eyeing Shorts to 143 CAPITALCOM:USDJPY

We’re seeing strong bearish divergence in USDJPY near the 148 resistance zone, shifting our focus to short opportunities with a medium-term target at 142.

📈 Trading Plan:

🔻 SELL Stop: 147.040

❌ Stop Loss: 149.220

✅ Take Profit: 143.000

(Click 👉 Trade Now 👈 on your mobile to copy SL & TP easily)

🔍 Why am I short here?

✅ Technical: Clear bearish divergence on the H4 (RSI & MACD), indicating potential reversal signals.

✅ Resistance Zone: Price is testing the key 148 resistance, providing an ideal risk-reward location for shorts.

✅ Macro Event: Ahead of tomorrow’s US CPI release, a conservative trade structure is maintained to manage volatility risks.

📰 Fundamental Snapshot:

Japan’s economy shows signs of stabilization:

Core machinery orders fell only 0.6% MoM in May to ¥913.5B, much better than April’s -9.1% and forecasts of -1.5%.

Despite the headline decline, it indicates resilience in Japan’s capital spending, supporting the JPY’s medium-term outlook amid global trade and growth risks.

Trade cautiously!

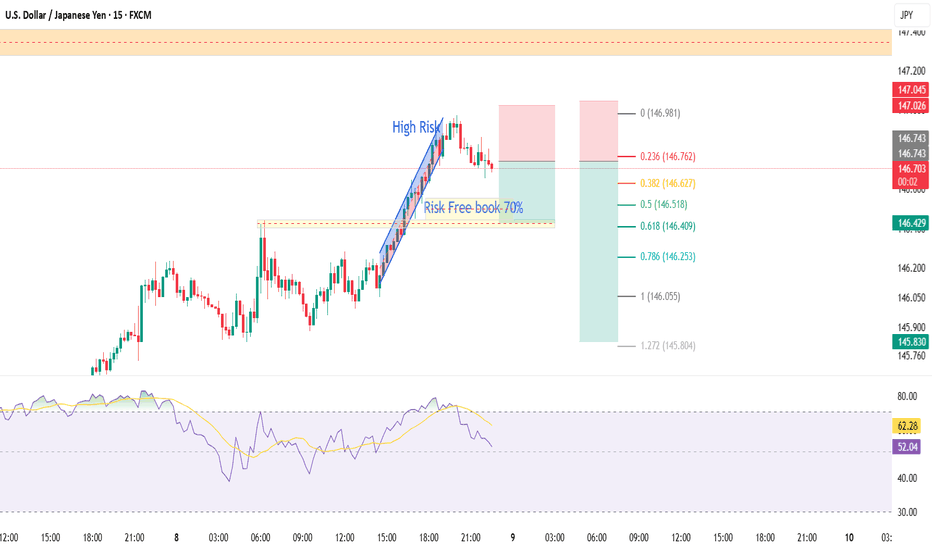

USD/JPY Made H&S Reversal Pattern , Short Setup Valid !Here is my 15 Mins Chart on USD/JPY , We have a very clear reversal pattern , head & shoulders pattern and we have a confirmation by closure below our neckline so we can enter direct now or waiting the price to go back and retest the neckline and this is my fav scenario .

USDJPY – Key Support Bounce with Macro TailwindsUSDJPY is bouncing off a key trendline and 61.8% Fib zone (143.25–143.60) with confluence across multiple JPY crosses (EURJPY, AUDJPY, CADJPY). This area has historically triggered strong upside momentum, and the current setup aligns with both technical structure and macro drivers.

📊 Fundamentals Supporting the Move:

✅ US Yields Stable: US10Y is holding above 4.20%, keeping USDJPY supported. If yields push back toward 4.30%, expect USDJPY to retest 145.30 and potentially 147.80.

✅ BoJ Dovish: Japan shows no shift in policy. Despite weak Tankan data, BoJ remains patient, and no meaningful rate hike or YCC change is expected soon.

✅ USD Macro Resilience: Core PCE held firm at 2.6%. Focus now shifts to ISM Services PMI (Wed) and NFP (Fri). Markets are still pricing a soft landing – supporting risk-on and a stronger USD.

✅ JPY as a Fading Safe Haven: Even with geopolitical headlines (Trump tariff tensions, Taiwan, Middle East), JPY demand remains weak. Traders are favoring USD and Gold over JPY as risk hedges.

⚠️ Risks to Watch:

Dovish US Data Surprise: Weak NFP or ISM could drag yields down and trigger USDJPY reversal.

Verbal or Actual BoJ Intervention: If we approach 148.50–150, Japan may step in again.

Geopolitical Escalation: Any sharp risk-off could trigger safe haven demand for JPY, though this has underperformed recently.

🔎 Correlation Dynamics:

📈 USDJPY is leading JPY crosses like EURJPY and AUDJPY. The recent bounce started simultaneously across the JPY complex, with USDJPY slightly ahead.

📉 If US yields drop or risk sentiment shifts, USDJPY may lag gold or bonds but eventually catch up.

🧠 Trading Plan:

📍 Entry Zone: 143.30–143.60 (trendline + Fib confluence)

🎯 Target 1: 145.30 (38.2% Fib)

🎯 Target 2: 147.80 (channel resistance)

🛑 Invalidation: Daily close below 141.50 with US yields breaking down

📅 Upcoming Events to Watch:

Wed July 3: ISM Services PMI (key for USD reaction)

Fri July 5: US Non-Farm Payrolls + Average Hourly Earnings

JPY Risk: Verbal intervention possible near 148+

🧭 Summary:

USDJPY is positioned for a bullish continuation, backed by:

Rising yields

Resilient US macro

Weak JPY fundamentals

Technical structure respecting trendline support

Short-term traders can target the 145–147.80 range ahead of NFP, with a tight eye on yield and risk sentiment.

📌 If this analysis helps, drop a like and follow for more real-time macro-technical breakdowns. Stay nimble ahead of NFP! 🧠📈

USD/JPY) back down Trend Read The captionSMC trading point update

Technical analysis of USD/JPY (U.S. Dollar / Japanese Yen) on the 3-hour timeframe, anticipating a rejection from a descending trendline resistance and a move down toward key support levels.

---

Analysis Overview:

Trend Bias: Bearish correction expected

Structure: Price is reacting at a descending trendline, which has held as resistance on multiple occasions.

Indicators:

EMA 200 (144.756): Price is currently above, but projected to break below it.

RSI (14): Overbought at ~74, signaling potential for a reversal.

---

Key Technical Components:

1. Descending Trendline Resistance:

Price is approaching/has touched a well-respected downtrend line, marked by three strong rejections (red arrows).

This trendline has consistently capped bullish moves, indicating strong seller interest.

2. Bearish Reversal Expectation:

The projected path suggests a potential fake breakout or double-top, followed by a steep decline.

A two-stage drop is anticipated, with price first targeting the EMA 200 zone, then extending lower.

3. Target Points:

First target: Around 145.244, near EMA 200.

Final target: 143.048, aligning with the key support zone (highlighted in yellow), where price previously bounced.

4. RSI (14):

Currently overbought (73.29), signaling a likely retracement.

Prior peaks at this level led to notable corrections.

---

Trade Setup Idea:

Parameter Level

Entry Near current price (~146.85) if bearish pattern confirms

Stop-Loss Above trendline (~147.30–147.50)

Target 1 145.24 (EMA 200 zone)

Target 2 143.05 (Support zone)

This setup offers a high-probability short opportunity if resistance holds.

---

Risk Factors:

Upcoming economic events could trigger volatility (news icon marked).

A clean breakout and close above the trendline (~147.50+) would invalidate this bearish thesis.

Mr SMC Trading point

---

Summary:

The analysis suggests a potential USD/JPY reversal from a descending trendline, supported by overbought RSI and prior rejections. The bearish projection targets a move toward 143.048, following a dip below the EMA 200 level at 145.244.

Please support boost 🚀 this analysis)

USDJPY h4 strongly downBearish Expectation Disruption / Bullish Counterpoint

Resistance (147.5) Rejection and drop Breakout and continuation toward 148.5+

Breakout FVG Fakeout and reversal True breakout — bullish trend continues

Bullish Zone (~144) Clean break below Accumulation zone, strong buying interest may emerge

Target (~143) Next leg down May not be reached if price stabilizes above 145

Support (~142.5) Final drop destination Could become irrelevant if trend flips decisively bullish Original Assumption: Market is behaving in isolation from fundamentals.

Disruption: If U.S. data (e.g., strong NFP, CPI, or Fed commentary) supports rate hikes, USD/JPY may remain bid and breakout to 148+ instead of reversing.

Watch For: Strong dollar narrative or dovish BOJ language.

USDJPY; Heikin Ashi Trade IdeaOANDA:USDJPY

In this video, I’ll be sharing my analysis of USDJPY, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

USD/JPY) Back support level Read The captionSMC trading point update

Technical analysis of USD/JPY pair using a combination of price action, resistance/support levels, and indicators. Here's a breakdown of the idea behind the analysis:

---

Chart Breakdown (2H - USD/JPY)

1. Key Zones:

Resistance Level (Yellow Box at Top):

Price has previously been rejected from this zone multiple times.

Recent bearish wicks and aggressive sell-offs are marked by red arrows—showing strong seller interest.

Support Level / Target Point (Bottom Yellow Box):

Price has found strong buying interest around 142.142.

This zone is the anticipated downside target if the bearish scenario plays out.

2. Bearish Bias Justification:

Liquidity Grab / Fakeout (labeled “fug”):

The price briefly broke above the smaller resistance block but quickly reversed.

This "fake breakout" often traps buyers, strengthening the bearish case.

EMA 200 (Blue Line):

Price is currently near or slightly under the 200 EMA (144.553), suggesting a potential rejection area aligning with resistance.

RSI Indicator:

RSI shows divergence and has not confirmed a bullish breakout.

The values (56.77 and 42.82) indicate loss of bullish momentum.

3. Projection (Black Lines):

The black zig-zag lines represent a forecasted drop to the support level.

Suggests a short setup near 144.50–145.00 with targets near 142.14.

Mr SMC Trading point

---

Summary:

Bias: Bearish

Entry Zone: Near resistance area (144.50–145.00)

Target: 142.142 (support zone)

Invalidation: Strong break above 145.00 and hold

Confirmation: Rejection from resistance with bearish candle pattern

---

Please support boost 🚀 this analysis)