USDCHF LongHi guys,

Hope everyone is still enjoying the lovely big profits we earned on gold, BTC, and EURUSD. We are yet to hit a stop loss this year, which is good.

Anyway, here is our long signal for EUR USD. Wait for the 5 minute candle to close above, and respect the entry.

USD CHF Buy 🦇

📊Entry: 0.81733

⚠️Sl: 0.81531

✔️TP1: 0.81938

✔️TP2: 0.82199

✔️TP3: 0.82530

✔️TP4: 0.82868

Hope you earn lots of profit. Please drop me a comment if you follow the signal

Best wishes

Sarah ETAforex

DJ FXCM Index

gold on bullish reversal#XAUUSD trying to form new pattern on bearish, but price needs to fall below 3210 before the sell is possible.

The H1 candle shows a reversal on buy but firstly price needs to retrace and close above 3229 on H4 before buying, target 3252, stop loss 3215.

Below 3210 holds sell, Target 3196-3177.

Trade Analysis for Week 16 (14Apr25 onwards)Hello fellow traders , my regular and new friends!

Over here I will be sharing my analysis for this week.

Mainly On:

EURUSD

EURAUD

EURNZD

BTC

USDSGD

Moving forward I will separate both the Trade review and Coming week trade analysis for easy viewing!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

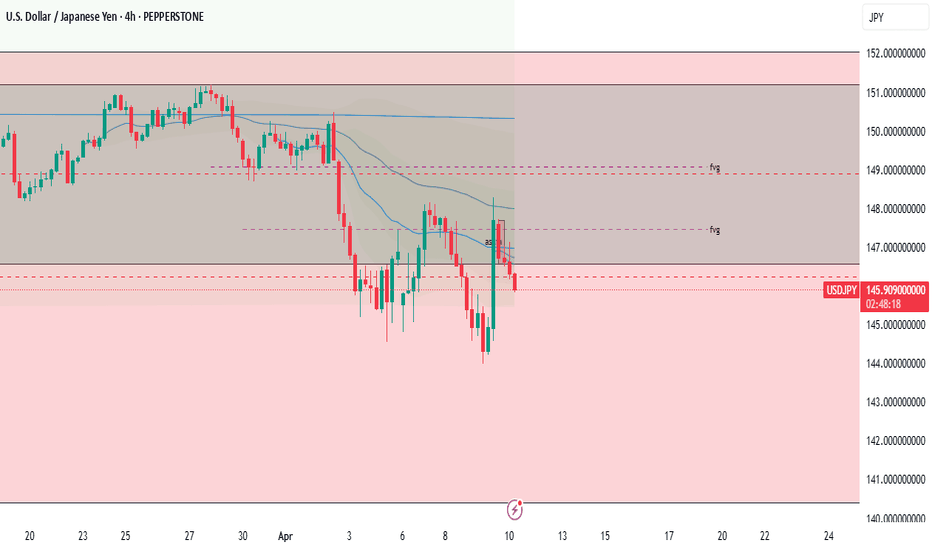

USDJPY LONG FORECAST Q2 W16 D14 Y25USDJPY LONG FORECAST Q2 W16 D14 Y25

We caught a the long play for a similar setup. We need more this time around.

Why? To be sure of the weekly order block rejection. Compared to EURUSD and EURGBP for example... That is the type of weekly order block rejection we prefer. With that said we will not give up on USDJPY. We simply must await more levels of confluences.

15' break of structure, Order block creation as a result of the BOS. Pull back into area, lower time frame break of structure.

Let's see what USDJPY provides us with.

FRGNT X

EURUSD SHORT FORECAST Q2 W16 D14 Y25EURUSD SHORT FORECAST Q2 W16 D14 Y25

- Weekly Order Block rejection

Setup 1

-15' break of structure

- Tokyo low range remains

- Pull back into 15' order block

- Lower time frame shift in price action from bullish to bearish

Setup 2

- Lower time frame break of structure

- Lower time frame bearish candle formation

Let's see how EURUSD short set up plays.

Certainly short potential but as always. We await price action to present itself to us.

It is far too easy to find a position once we have noticed potential. Sit back and await the play!

EURUSD SHORT FORECAST Q2 W16 D14 Y25

FRGNT X

Weekly FOREX Forecast: Wait for Buys vs USD!This is the FOREX outlook for the week of April 14-18th.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

The USD is still overall bearish... but is due for a correction. Short term bullishness in the USD is what I am monitoring this week, then aa resumption of it's bearish trend. This will provide

buying opportunities in xxxUSD pairs, and selling opportunities in USDxxx pairs.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly Market Forecast: Stocks Markets Could Push Higher!In this video, we will analyze the S&P 500, NASDAQ, and DOW JONES futures for the week of April 14-18th.

The Stock Market Indices ended a turbulent week on a bullish note, and next week could see some continuation. The markets have peeked above the consolidation, and could be on the way to resume the overall bullish trend.

Wait for confirmations of the trend before jumping in! One bad report of tariffs or geo-political news can turn the markets down at any time.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

gold (update)Hello friends

Due to the price growth, we have given you the analysis that the price will fall and the same thing happened. Now, due to the sharp decline, the price has entered the channel and the 3 specified areas are important support areas for us, where we can buy with risk and capital management and move towards the specified goals.

*Trade safely with us*

Trading Week 15 Review 2025Hello fellow traders , my regular and new friends!

How was your trading this week?

Did you get a killing on the SNP, EURUSD etc?

This part will be on the review for this week.

Moving forward I will separate both the Trade review and Coming week trade analysis for easy viewing!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

EURUSD: Detailed Support & Resistance Analysis 🇪🇺🇺🇸

Here is my latest support and resistance analysis for

EURUSD for the week ahead.

Resistance 1: 1.1456 - 1.1552 area

Resistance 2: 1.1640 - 1.1700 area

Resistance 3: 1.1860 - 1.1915 area

Support 1: 1.1150 - 1.1280 area

Support 2: 1.0730 - 1.0900 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin is not going back to 100k anytime soon!!Good day traders, back against it with this bitcoin idea I’m currently on back on what price has shown us in recent weeks.

1W- Here price is still very much bearish as we can see that the market is in an expansion meaning any idea of price moving higher is what we all wish for but price does not care so overall here we bearish and need to be ready alert to price always wanting to move higher by taking recent highs.

4H- Now here we can see price shot higher for the liquidity that was resting above the recent broken highs, keeping in mind that our weekly bias is still bearish we than wanna see a shift in structure on the 1 hour TF to give us our first confirmation of many confirmations we use to come at a decision. After price respects our idea than we wanna see price go take the equal lows(Sellside liquidity) below.

Now I wanna make this bold prediction, and it’s my opinion by the way it’s not a fact or anything like that right. In my opinion I don’t think bitcoin will see 100k for the rest of 2025. And my prediction is based on my analysis only!!

$DXY suffers worst day since Nov 10, 2022 – What does it mean?💵 The US Dollar Index just posted its biggest daily drop in nearly 2.5 years, crashing through the 100 level with strong volume. This breakdown signals weakness in the dollar that could have massive implications across all asset classes:

📉 Why it matters:

A weak dollar makes US exports more competitive globally, but also reflects investor fear or policy shifts.

Commodities like gold, oil, and crypto tend to rally when the dollar drops.

Could indicate a pivot in monetary policy, potential rate cuts, or macroeconomic concerns.

🧠 From a technical standpoint, this break of support could trigger further downside. The last time this happened, we saw a significant shift in risk appetite.

📊 What to watch:

Upcoming Fed statements

Inflation & jobs data

Reaction in equities and crypto

👇 Is this the start of a larger trend, or just an overreaction?

Let’s discuss!

#DXY #USD #DollarIndex #Forex #Macro #MarketUpdate #Commodities #Gold #Crypto #TradingView

USDJPY LONG FORECAST Q2 W15 D11 Y25

USDJPY LONG FORECAST Q2 W15 D11 Y25

Happy Friday Traders, It has been a week of sitting on capital. Being cautious, awaiting for breaks of structures at key areas and not not getting dragged into trades that do not fully present themselves. The clues have been there. The carrot has been continually dangled however as risk managers... You know how the saying goes.

We stay true to our trading plan.

We hold firm with what we know works.

We are aware of our market edge.

We know our "perfect" set up does present itself.

with that said, we are dynamic! We do of course entertain the "Imperfect" setup. We simply approach with caution.

A slightly different take. Can we snap the lows of Tokyo in the London session. Tap into the 4 hour order block, push bullish to break Lower time frame structure?

A quick setup with a take profit area where FRGNT anticipates a potential turn around in price short.

Lets see how it plays !

Trade well.

FRGNT X

$S&P500 macro analysis , market approaching correction °•° $SPXHi 👋🏻 check out my previous analysis ⏰ on SP:SPX macro bullish analysis ⏰

As provided it went up up 🚀 completed my target's 🎯 💯💪🏻 ✅ ✔️

Click on it 👆🏻 just check out each and every time updates ☝🏻 ☺️

•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

NOW I was completely 🐻 BEARISH on the market with in upcoming months SP:SPX

📌 Expecting liquidation pump $6500 - $6700

Invalid 🛑 when complete month close above $6700

¹support - $5500 ( 🎯 ¹ )

²support - $5130 ( 🎯 ² )

🎯 3 ... Will be updated based on market conditions by that time ☺️

📍 A wise 🦉 man said - always having patience " is " always gaining only /-

NASDAQ:TSLA ( i accumulate slowly until it cross above $400 )

rest of stocks i will follow index ☝🏻 i will invest based on market conditions ..... ✔️

USDJPY LONG FORECAST Q2 W15 D11 Y25USDJPY LONG FORECAST Q2 W15 D11 Y25

Happy Friday Traders, It has been a week of sitting on capital. Being cautious, awaiting for breaks of structures at key areas and not not getting dragged into trades that do not fully present themselves. The clues have been there. The carrot has been continually dangled however as risk managers... You know how the saying goes.

We stay true to our trading plan.

We hold firm with what we know works.

We are aware of our market edge.

We know our "perfect" set up does present itself.

with that said, we are dynamic! We do of course entertain the "Imperfect" setup. We simply approach with caution.

USDJPY LONG FORECAST Q2 W15 D11 Y25

15' of course, bearish start to the Friday. Perhaps we are asking a lot from UJ today but let's see if we can break 15' structure before taking a deeper look.

Bigger picture, We are in a weekly order block in the long direction so all shorts are OFF until further notice.

Best of Luck Traders.

Continue to manager your capital.

FRGNT X

BTC SPX Ratio At Its LimitsAs BTC has matured, it has revealed its limits relative to SPX. Any time the price rises above 15, a correction follows.

While it has not yet cracked I find myself violating my own rules again and compelled to share this chart with you BEFORE the crack.

Markets are volatile and I am simply trying to keep people from getting hurt. Do not make the mistake of thinking BTC is a safe asset.

Bulls best to take profits.

Click boost, follow, subscribe, and let me help you navigate these crazy markets.

USDJPY Moment of truth for the long-term bullish trend.The USDJPY pair has been trading within a Channel Up since the October 17 2022 High and right now the current 1W candle is very close to its bottom (Higher Lows trend-line). This offers a low risk trading set-up.

Confirmed buy will be if the price breaks and closes a 1W candle above the 1W MA50 (blue trend-line), in which case our Target will be July's Resistance at 161.500 (similar to the 2023 Bullish Leg).

If on the other hand it breaks and closes a 1W candle below the Channel Up, turn short and target the 1W MA200 (orange trend-line) at 139.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY SHORT LIVE TRADE AND EDUCATIONAL BREAKDOWNUSD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

gold on buy till 3137#XAUUSD price have breakout 3100 once more now its will reach the ATH which will decline again on sell.

Firstly we buy at the rectangle 3100-3102 on multiple breakout first, target 3137 TP, SL 3085.

Above 3137 have bearish decline which will drop the price back but multiple breakout above 3137 will reach the ATH.

EURUSD TO BUY (Wednesday-FOMC Meeting Minutes and Thursday-CPI)As EURUSD as been dropping the past couple of days, it has been on the support levels of 1.0900 lately. On Wednesday and Thursday, there are news about FOMC Meeting Minutes and CPI of the US Dollar. Therefore, we could possibly see price of the EURUSD going up based on news, support pattern of the triangle.

TP: 1.1050-1.110

NZDUSD: Support & Resistance Analysis and Key Levels 🇳🇿🇺🇸

Here is my latest structure analysis and

important supports & resistances on NZDUSD.

Support 1: 0.5506 - 0.5538 area

Support 2: 0.5470 - 0.5479 area

Resistance 1: 0.5644 - 0.5683 area

Resistance 2: 0.5796 - 0.5854 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.