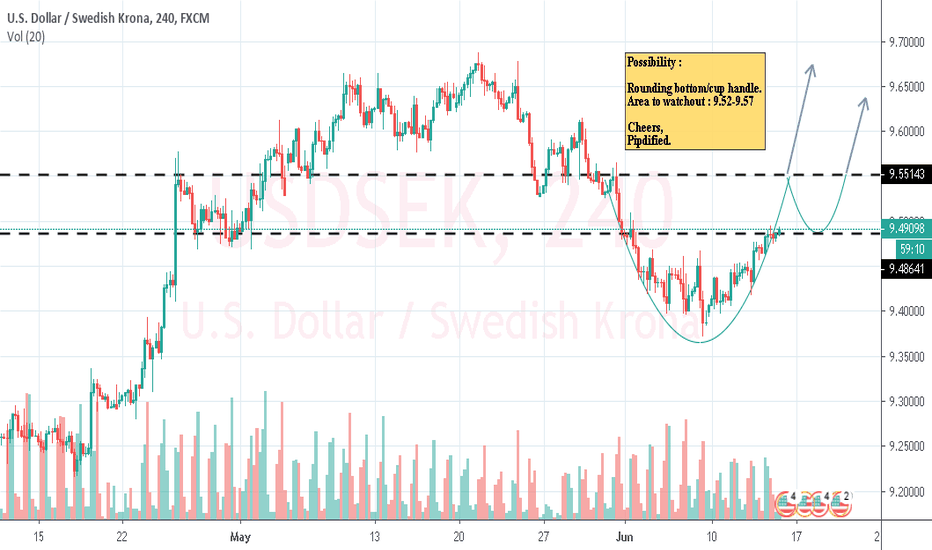

Usdsekshort

USDSEK SWING TRADE SELL IDEAThis is an idea and not a signal to sell. It is for educational and demonstration purposes only. If you enter, you trade at your own risk. Always do your own analysis to confirm you agree with any idea before trading.

With that being said,

Price reached top of ascending channel and had bearish momentum. Looking for a pullback to the trendline and continuation of sell to a key zone in the market, which is the 50% or 61.8% fib level from swing low to swing high. The trade from the pullback to the trendline is a possible 575 pips after pullback.

Trade at your own risk.

USD/SEK 5th wave bullish in the short-term,sentiment swifts 20201. 10 flat rate might be psychological resistance

2. 2 Possible bullish targets at the 1.272 and 1.62 * Wave 1.

2. Things are heating up in the States, we will see how long it will last.

3. Global growth rate slowdown (particularly the EU(Italy, Spain, France) Turkey, China, Canada, Australia) will catch up onto the States in the near term. There's a good chance that the new tariffs will stay in place.

=>2007-09 Pattern should reoccur, as USD usually corrects very hard during recessions, as Swedish GDP is quite stable, ironically because of the good safety net and unemployment spending. The US can't even borrow soo much money anymore and the deficit is rising.

Historical resistance! We hope rebound!FX:USDSEK

En el último año es la tercera vez que toca esta zona de precio, en las dos veces anteriores este nivel fue rechazado y el precio bajó, la resistencia fue fuerte. Esperamos que ocurra lo mismo.

El precio está en los niveles máximos históricos, en pocas ocasiones llegó a este nivel y siempre rebotó en la resistencia.

Agosto 2018: el precio rebotó en la resistencia.

Noviembre 2018: el precio rebotó en la resistencia.

Estaríamos en condiciones de vender en este momento.

In the last year it is the third time that this price zone touches, in the two previous times this level was rejected and the price fell, the resistance was strong. We hope that the same thing happens.

The price is at historic maximum levels, rarely reached this level and always bounced on the resistance.

August 2018: the price bounced on the resistance.

November 2018: the price bounced on the resistance.

We would be able to sell at this time.

Potential short reversal setting up for the Swedish KronaOn the 4H charts, the USDSEK is at an interesting point. We can see that for the most of April, the pair has been in a clean and long uptrend and is now in oversold territory (the Fibonacci extension indicates a move well over 200%). Additionally, the pair has reached a previous swing high. This clearly acts as a resistance level, which the price hasn't been able to break.

Instead, a double top was created, followed by a strong move lower. For the first time in a long time, our moving average has been broken. This has all the signs of a reversal in the making.

An aggressive trader might already be tempted to enter here, but I reckon that the pair will make a retracement to the 9.06000 area first as a way for the sellers to catch their breath. If we see strong selling momentum afterwards, I will be looking for a short entry. Of course, price might move lower straight away too.

I've laid out some of the levels (in light blue) where I can see the price hold up a bit or even change direction. However, if the trending markets of the previous months are any indication, we might see a nice move down.

Find more analysis on smartforexlearning.com and give us a follow:

- on Twitter: twitter.com

- on Facebook: www.facebook.com

- on Google+: plus.google.com

Reversal ongoing!USDSEK did climb for a while now and getting closer to the highs of 2009. It couldn't make a higher high and did just broke and close below the TL. i'll be waiting for a flag or retest of the TL. IF price fail to make a higher high THEN i'll be looking for entry reason for short.

Like if you agree, follow and support please!