XRP/USDT -H1 - Triangle Breakout (07.08.2025)The XRP/USDT Pair on the H1 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming Days.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.7054

2nd Support – 2.5468

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

USDT-D

Will Neymar Break Out the Price Action of Santos To the moon.

Neymar did return to Santos, the energy around the club has exploded.

He has: 📸 Instagram: approximately 231.4 million followers

🐦 Twitter (X): approximately 64 million followers

🔥 Fan engagement is surging: Social media growth, merchandise sales, and matchday hype have all increased.

⚽️ On-field performance is matching the hype:

In their last match, Santos won 3–1, with Neymar scoring 2 goals, reminding fans of his legendary form.

📅 Next match this Sunday could further drive visibility and excitement — both for fans and investors.

💰 What’s Driving the Coin's Value?

The Santos fan token isn’t just hype — it has real utility:

🎟️ Buy match tickets using the token.

🛍️ Purchase merchandise directly from the official club store.

🗳️ Participate in fan votes and club decisions.

📈 Outlook: Can We Hit $4.60?

With Neymar back, the spotlight is back on Santos. As attention increases:

⚡️ Demand for the token may spike.

💎 Whales and fans alike are accumulating.

📊 The chart shows strong potential for a break, and $4.60 could be the next big target if momentum holds.

👉 Stay tuned. Santos might just be going to the moon, and next break can be $4.60

Next match is Sunday with Neymar.

USDT Dominance – Diagonal Ending? | Wave F in Progress🔸 Market Structure:

Tether dominance is currently unfolding in a contracting diagonal (Diametric) formation, and we are now in wave F of the structure. Diagonals typically alternate in direction and converge toward a terminal point.

⸻

🔸 Key Observations:

• Price has rejected from the top of wave E

• Wave F is now unfolding as a corrective move down

• Two potential targets are identified for wave F completion

⸻

🔹 Scenario 1 (Sc1): 4.40%

• Short-term ascending trendline support

• Possibility of a shallow correction before another bounce

• Less ideal in terms of geometric balance of the diametric

🔹 Scenario 2 (Sc2): 4.28%

• Aligns with the lower boundary of the diametric pattern

• Converges near previous demand/resistance flip zone

• Better symmetry and structure for a completed wave F

• This scenario is currently more probable

⸻

🎯 Expected Path:

Wave F likely targets 4.28% before any significant bounce, aligning with a complete structure.

⸻

📌 Summary:

USDT dominance is likely in the final stages of a Diametric pattern. We’re watching for signs of completion around 4.28%, which aligns better structurally. A bounce from 4.40% is possible, but less favored unless strong bullish evidence appears.

#DOGE/USDT | Eyes Bounce from Key Support !#DOGE

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 0.1930.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.1895, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2060.

First target: 0.2111.

Second target: 0.2183.

Third target: 0.2264.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

PENDLE Breakout Watch – Red Resistance Being Tested! 🚨 CRYPTOCAP:PENDLE Breakout Watch – Red Resistance Being Tested! 🔴⏳

CRYPTOCAP:PENDLE is testing the red resistance zone.

📊 If breakout confirms, next move could target:

🎯 First Target → Green line levels

A breakout here could trigger buyer momentum and push price toward the next key resistance.

Will a Drop Below 4.12 Push BTC to New Highs ?👋 Hello, and welcome to Satoshi Frame .

📊 USDT Dominance , after a sharp move toward 6% , got rejected strongly from that level with a powerful candle .

🔻 Following that , it lost its key support and entered a deep corrective phase .

🚀 During this period, Bitcoin and altcoins experienced a strong upward trend , and 🟠 Bitcoin even recorded a new all-time high .

📉 The key support level for USDT Dominance is at 4.12% .

⚠️ If this level is broken, Bitcoin could potentially reach a new all-time high again .

📐 I’ve drawn my Fibonacci from the point where the support was lost , the structure broke , and the previous uptrend turned into a corrective or bearish trend .

🔽 The breakdown of that key support pushed USDT Dominance down to 4.12% , where we saw strong buying pressure in Bitcoin and altcoins, leading to a sharp upward movement.

🔄 Price then retraced to the 0.382 Fibonacci level (4.61%) , acting as a corrective pullback within the ongoing downtrend.

❌ However , this area triggered a rejection , and now we are witnessing another decline in USDT Dominance.

💡 Disclaimer : This analysis is for educational purposes only and should not be considered financial advice . Always do your own research and manage your risk before making any trading decisions .

$BTC New Cycle: It’s Hard Not to Notice the ShiftSince December 2024, CRYPTOCAP:BTC has been closely following the SPX500, forming three similar cycles—each decreasing in intensity and shorter in duration.

The similarities are striking, especially when analyzing the MACD and RSI.

Each cycle ends with a bearish divergence.

Each cycle sees a rebound or bottom during consolidation, often touching the top of the previous cycle.

Most importantly, the cycles are accelerating.

However, it’s difficult to draw a definitive conclusion. These patterns are new in Bitcoin’s history, and there's no past reference for such institutional-driven behavior.

I believe the entry of institutions is reshaping Bitcoin’s rhythm. Their strategy is accumulation, not speculation, which brings more stability but also alters traditional crypto cycles.

What do you think will be the consequences of this shift?

Drop your thoughts in the comments👇

Don’t Panic — It’s Just a Healthy Crypto Correction!While the crypto market has seen some red this week, the bigger picture remains intact. Let’s zoom out and make sense of the current correction.

🔸 TOTAL Market Cap (left chart)

The structure remains overall bullish, trading inside the red rising channel.

After a solid rally, the market is currently pulling back toward a strong demand zone – perfectly aligned with the lower trendline. This area is likely to act as a major support, from which the next bullish impulse could kick off.

🔸 USDT Dominance (right chart)

USDT.D remains overall bearish, trading inside the red falling channel.

It’s currently pushing higher toward a well-defined supply zone, which also intersects with the upper red trendline. As long as this area holds, we expect sellers to take over again — giving altcoins the space they need to bounce back.

📌 In simple terms:

The market is in a healthy correction. Don’t let short-term dips shake your long-term view. The trend is still your friend.

➡️ As always, speak with your financial advisor and do your own research before making any investment decisions.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

Tether Rakes in $4.9B Q2 Profit, Cementing Its Reign as Crypto’sTether Q2 Net Profit Hits $4.9 Billion, Pushing Total Earnings to $5.7 Billion: What It Means for the Crypto Industry

Tether Holdings Ltd., the issuer of the world’s largest stablecoin USDT, has once again made headlines with its Q2 2025 earnings report, revealing a staggering net profit of $4.96 billion. This brings the company’s total profits for the first half of the year to $5.7 billion—a record-breaking milestone for both the company and the broader stablecoin ecosystem.

This article explores the implications of Tether’s Q2 performance, the sources of its revenue, its impact on the crypto markets, and the growing significance of stablecoins in the evolving financial landscape.

________________________________________

A Record-Setting Quarter for Tether

Tether’s Q2 2025 results have astonished even seasoned analysts. The company’s reported $4.96 billion in net profit in a single quarter represents one of the most profitable periods in the history of any fintech or crypto-native company. What’s even more remarkable is that this profit was not driven by speculative trading or token sales, but by conservative, yield-generating strategies rooted in traditional finance.

The company’s Q1 earnings were already impressive at $0.76 billion, but Q2’s results eclipse those numbers entirely. Tether’s cumulative profit year-to-date now stands at $5.72 billion, putting it on track to potentially exceed $10 billion in earnings for the full year if current trends continue.

________________________________________

What’s Driving Tether’s Massive Profit?

Tether’s incredible profitability is primarily fueled by one key factor: the interest earned on its reserves. As the issuer of USDT, Tether is responsible for maintaining a 1:1 backing of every token in circulation. These reserves are primarily held in short-term U.S. Treasury Bills (T-Bills), reverse repos, and cash equivalents.

Here’s a breakdown of the main profit drivers:

1. High Interest Rates on U.S. Treasuries

With the U.S. Federal Reserve maintaining elevated interest rates to combat inflation, short-term T-Bills have become highly lucrative. Tether holds tens of billions of dollars in these instruments, generating billions in annual interest income.

For example, the yield on a 3-month Treasury bill in Q2 2025 averaged around 5.2%, and Tether’s reserve base has hovered near $90 billion to $100 billion. Even a conservative allocation can earn several billion dollars in annual yield.

2. Reverse Repurchase Agreements (Reverse Repos)

Tether has also expanded its use of reverse repos, which allow it to lend cash to counterparties in exchange for securities, earning a premium on the transaction. This has contributed significantly to its earnings, especially in a high-yield environment.

3. Gold Holdings and Bitcoin Exposure

Tether has acknowledged that a small portion of its reserves includes gold and Bitcoin holdings. These assets appreciated in Q2, contributing to the overall profit. While not the primary revenue source, their performance added notable value during the quarter.

4. Equity Investments

The company has begun investing in infrastructure and technology firms related to blockchain and AI. While these investments are not liquid, mark-to-market gains may have also contributed to the net profit figure.

________________________________________

A Closer Look at Tether’s Reserve Report

Tether’s Q2 attestation report, published alongside its earnings update, provides transparency into how its assets are allocated. Here are some highlights:

• Over 85% of reserves are held in U.S. Treasury instruments

• $5.4 billion in excess reserves—a buffer above the value of circulating USDT

• $3.3 billion in gold and Bitcoin holdings

• Minimal exposure to unsecured commercial paper or riskier debt instruments

Tether has continuously emphasized its commitment to transparency and risk management. Unlike in its early years, when it faced criticism over opaque reserve practices, the company now releases quarterly attestations audited by third-party firms such as BDO Italia.

________________________________________

USDT’s Growing Dominance

Tether’s profits are closely tied to the growth of its flagship product: USDT, the world’s largest stablecoin by market cap. As of August 2025, USDT has a circulating supply exceeding $110 billion, giving it a dominant share of the stablecoin market.

This growth can be attributed to several factors:

1. Increased Adoption in Emerging Markets

USDT is widely used in countries with unstable fiat currencies, such as Argentina, Nigeria, and Turkey. For many users, USDT represents a dollar-denominated safe haven in environments plagued by inflation and capital controls.

2. DeFi and Cross-border Payments

USDT continues to be a core asset in decentralized finance (DeFi) protocols, serving as a stable medium of exchange and collateral. It's also a preferred tool for cross-border remittances, given its speed and low transaction costs compared to traditional banking systems.

3. Institutional Integration

Major crypto exchanges, custodians, and payment processors have incorporated USDT into their platforms, driving further liquidity and utility. In many cases, USDT is preferred over fiat due to its 24/7 availability and blockchain-native nature.

________________________________________

What Does This Mean for the Crypto Industry?

Tether’s Q2 performance is more than just a corporate milestone—it’s a bellwether moment for the crypto industry. It signifies the maturation and institutionalization of digital assets and stablecoins. Here’s what it means for the broader ecosystem:

1. Stablecoins as Profitable Financial Products

Tether’s profitability proves that stablecoins are no longer just “crypto plumbing.” They are now financial products generating billions in yield, much like money market funds. This is reshaping how investors and regulators think about stablecoins—not as speculative tools, but as interest-bearing assets backed by real-world securities.

2. Regulatory Scrutiny Will Intensify

With Tether generating profits that rival traditional banks, expect regulators to increase oversight. Stablecoins have long been in the crosshairs of the U.S. Treasury, SEC, and global central banks, and Tether’s dominant market share will likely place it under further examination.

However, Tether’s transparency efforts, including quarterly attestations and reserve disclosures, may help it navigate these regulatory waters more effectively than in the past.

3. Competition Will Escalate

Tether’s extraordinary profits will likely attract new entrants and existing competitors to the stablecoin arena. Circle’s USDC, PayPal’s PYUSD, and even central bank digital currencies (CBDCs) are all vying for market share.

Tether’s early-mover advantage, global reach, and deep liquidity make it hard to displace, but increased competition could pressure margins in the long term.

4. Decentralized Alternatives Will Seek Market Share

Decentralized stablecoins like DAI, FRAX, and USDD aim to offer alternatives to centralized issuers like Tether. While they remain relatively small, the ethos of decentralization might gain appeal, especially in regulatory-heavy environments.

Still, decentralized stablecoins have struggled to maintain pegs during market stress, giving Tether an edge in terms of trust and resilience.

________________________________________

The Road Ahead for Tether

As Tether moves into the second half of 2025, several strategic themes will define its trajectory:

Continued Profitability

If interest rates remain elevated and USDT circulation continues to grow, Tether’s annual profit could reach or exceed $10 billion—putting it in league with the most profitable fintech firms globally. This surplus could be reinvested in:

• Infrastructure expansion

• Strategic acquisitions

• Reserve diversification

• R&D for stablecoin innovation

Expansion into Emerging Markets

Tether has hinted at expanding its presence in Latin America, Africa, and Southeast Asia, where demand for dollar-denominated assets is high and banking infrastructure is limited. Expect to see more localized partnerships and on-ramp/off-ramp solutions.

Embracing Blockchain Innovation

Tether is already deployed on multiple blockchains—Ethereum, Tron, Solana, and more. The company is likely to support new Layer 1s and Layer 2s to enhance speed, reduce costs, and maintain competitiveness in the DeFi space.

There are also rumors that Tether may be exploring tokenized asset offerings and programmable money features, allowing USDT to integrate more deeply with smart contracts and enterprise use cases.

________________________________________

Criticisms and Controversies: Still Lingering?

Despite its success, Tether continues to face criticism from parts of the crypto community and regulatory world. Concerns include:

• Lack of full audits (attestations are not the same as full financial audits)

• Opaque ownership structure

• Past legal issues, including settlements with the New York Attorney General and the U.S. CFTC

However, it’s worth noting that Tether has addressed many of these concerns over the past two years. Its transparency has improved, and its operations have become more conservative and professional.

Still, its scale and impact on the crypto market mean that any misstep could have systemic consequences. Investors and regulators alike will continue to scrutinize its activities.

________________________________________

Final Thoughts: Tether’s Moment of Ascendance

Tether’s Q2 2025 net profit of $4.96 billion doesn’t just reflect a successful quarter—it marks a paradigm shift in crypto finance. What began as a controversial stablecoin project has evolved into a global financial powerhouse, rivaling traditional banks and asset managers in profitability.

More than just a win for Tether, this moment signals the growing legitimacy of stablecoins in the global financial system. It shows that crypto-native firms can not only survive but thrive in traditional financial environments, leveraging yield, transparency, and blockchain infrastructure to create sustainable business models.

As the world watches, Tether’s next chapters will likely be shaped by innovation, regulation, and global expansion. But for now, with $5.7 billion in profits in just six months, one thing is clear:

Tether is no longer just a stablecoin issuer—it’s one of the most powerful financial entities

in the digital age.

________________________________________

Disclaimer: This article is for informational purposes only. It does not constitute financial advice. Always conduct your own research before making investment decisions.

$TOTAL at Key SupportThe crypto market cap has just bounced off a strong support zone around $3.67T, right where it aligns with the rising trendline.

This area has held firm before, and it's doing the same now.

If it continues to hold, we could see a nice recovery.

But if it breaks down, there’s a risk of more downside ahead.

HYPERUSDT Forming Bullish ContinuationHYPERUSDT is capturing significant attention as it emerges from a consolidation zone, signaling a potential bullish continuation. After a massive impulse move to the upside, the price found support at a critical zone, which has now flipped into a demand area. This area is acting as a strong base for buyers, with volume steadily increasing—a key indication of accumulation and renewed interest from market participants.

Currently, the price is forming a structure that reflects bullish momentum, supported by recent higher lows and increased wick rejections from below. This kind of setup often precedes a strong breakout, especially when reinforced by strong volume, as seen here. The chart suggests a potential upside move of over 130%, targeting previous liquidity zones and untouched resistance areas, as buyers step in aggressively.

HYPER is becoming a trending topic in the altcoin space, with investors closely watching its price action for signs of a full recovery. As trading sentiment shifts bullish and on-chain metrics support the narrative, HYPERUSDT stands out as one of the higher potential mid-cap coins. A breakout beyond recent highs could quickly accelerate gains, given the relatively thin resistance levels above.

This setup is ideal for breakout traders and swing positions, especially as the broader market regains confidence. Patience and technical confirmation will be key, but HYPERUSDT is positioning itself as a standout opportunity for the weeks ahead.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$USDT Dominance Breakdown Soon?Here’s a quick take on the CRYPTOCAP:USDT.D 1H chart: USDT dominance is bumping into a key trendline around 4.28%, right below strong resistance at 4.30%.

If it gets rejected here, we could see a drop toward 4.18%, which would be a healthy sign for altcoins.

But if dominance breaks above 4.30% with a strong candle close, that bearish setup gets invalidated.

Keep an eye on this zone, it’s a make-or-break moment.

DYOR, NFA

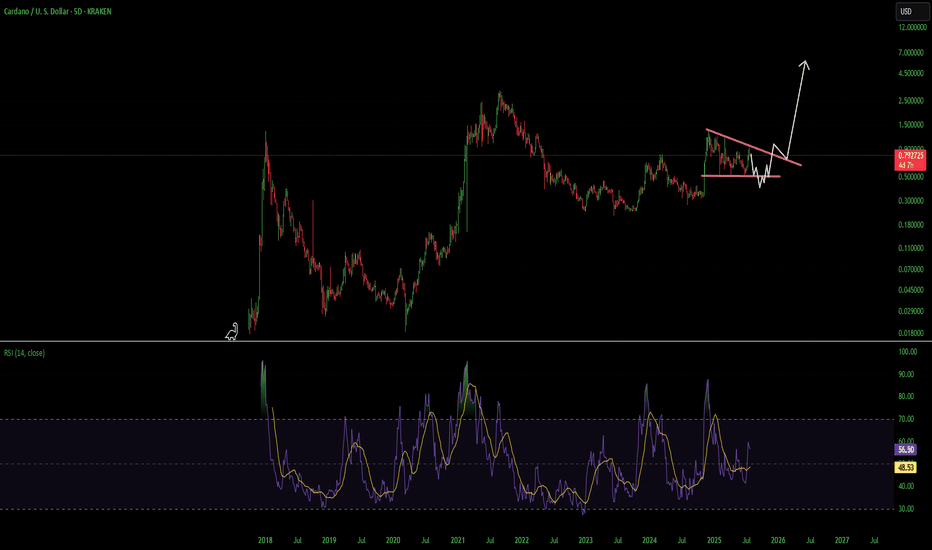

ADA Cardano Decsending Triangle Use Caution HereCardano had a heck of a move but i think its going to erase most if not all of it before it goes on its next leg up. A break over the overhead resistance line and finding support above would invalidate this. Not financial advice just my opinion. Thank you

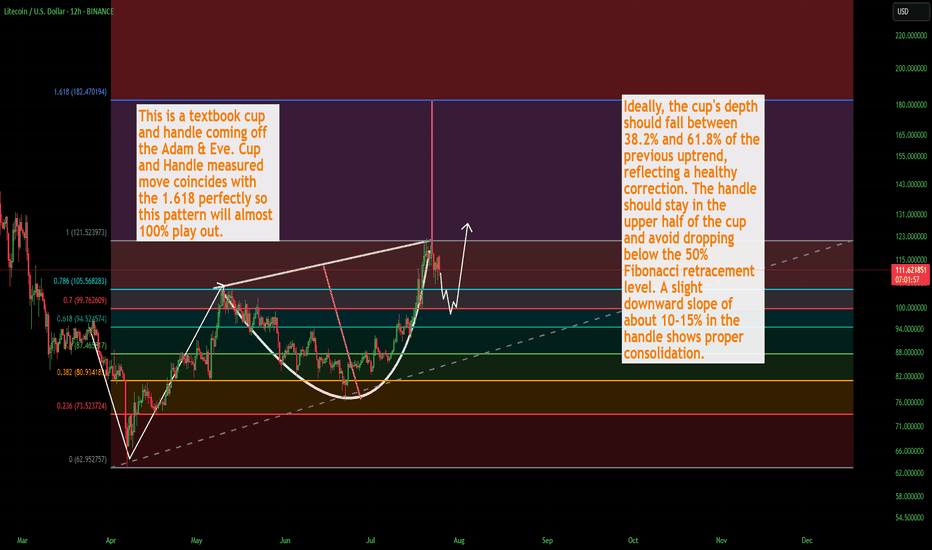

LTC Litecoin USD Textbook Cup & HandleLitecoin should finish its correction over the weekend and as we get into August the momentum will shift back to the upside. This is a washout of over-leveraged positionsbefore the next massive leg up. I still see a correction down to about 100 dollars. Could be a wick lower but not too confident. There is quite a bit of strength in Litecoin, and for good damn reason.

Not financial advice just my opinion. Thank you

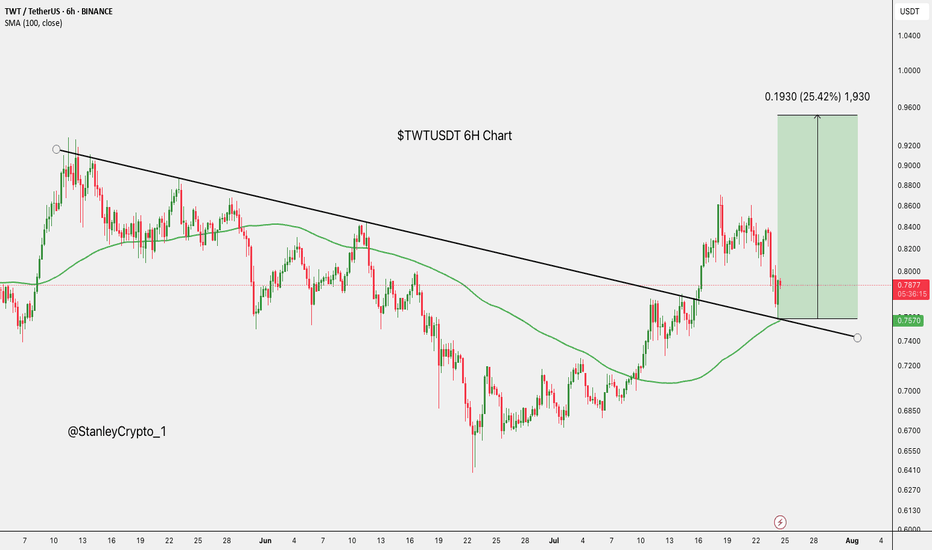

APT Forming Bearish Wedge Pattern – Watch the Support! APT Forming Bearish Wedge Pattern – Watch the Support! ⚠️📉

APT is forming a bearish wedge pattern and is now testing the blue support trendline.

🔻 If the support breaks, we could see a move down to the first green line level.

📊 Stay alert — this setup could trigger soon. Wait for confirmation before reacting.

Cup & Handle Formation 🚨 XETR:HOT Testing Red Resistance – Cup & Handle Formation 📈

XETR:HOT is currently testing the red resistance zone and has formed a bullish Cup & Handle pattern on the chart — a classic continuation setup.

If breakout is confirmed, potential upside:

✅ First Target: Green line level

✅ Second Target: Green line level

🕵️♂️ Wait for clear breakout confirmation before entering long.

This pattern often signals strong momentum if buyers step in.

Trade smart. Let’s monitor for the perfect entry! 💹💼

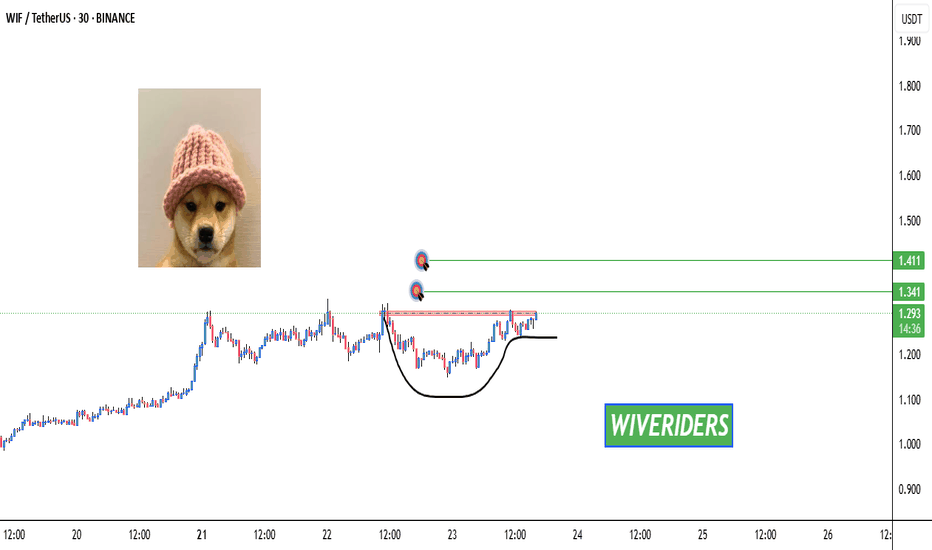

Bullish Cup & Handle Pattern Formed 🚨 SEED_WANDERIN_JIMZIP900:WIF Testing Red Resistance – Bullish Cup & Handle Pattern Formed 📈

SEED_WANDERIN_JIMZIP900:WIF is currently testing the red resistance zone and has formed a bullish cup and handle pattern on the chart.

If a breakout occurs, potential upside toward:

✅ First Target: Green line level

✅ Second Target: Green line level

Wait for breakout confirmation before entering long. 📊

Patience is key—watch this closely! 💼💸