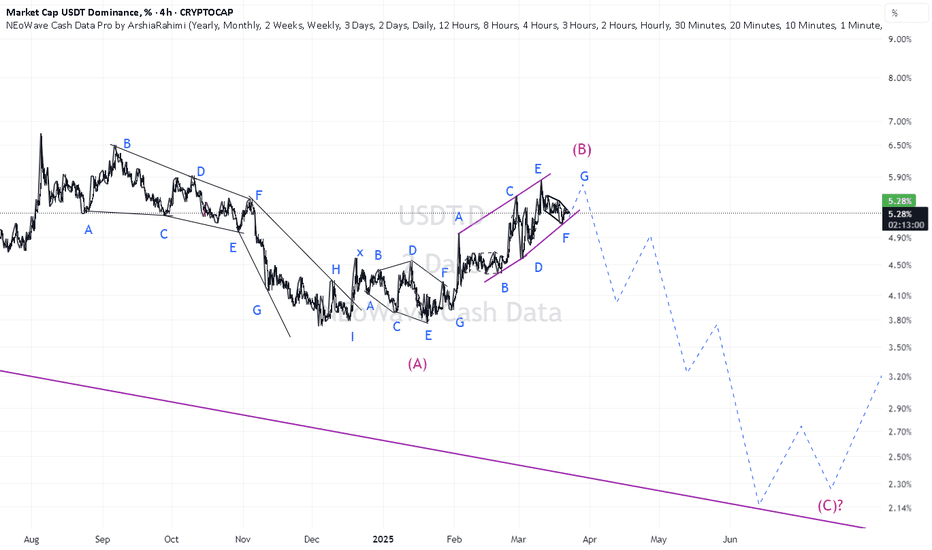

USDT.D - The dominance of real moneyThe dominance of the dollar over cryptocurrencies is a real indicator of the growth status of ETH!

The last wave of correction and decline is happening now! Pay attention to the accumulation zone before the Bitcoin price drops/inflates.

Money is being transferred to BTC=>ETH=>ALT=>USDT=>BTC and so on in a circle, during the active participation phase of DOU, money is being transferred to ETH and beyond, so be vigilant

In addition, I would like to draw your attention to the BTC.D indicator.

Usdt

EOSUSDT Breakout with Strong Volume: Bullish Momentum BuildingEOSUSDT has recently completed a breakout, demonstrating strong bullish momentum with significant volume backing the move. The breakout from the previous resistance level indicates a potential trend reversal, and with the volume surge, it confirms that investors are actively participating in this rally. Market sentiment appears positive, and the pair is well-positioned to capitalize on this momentum.

With the current bullish outlook, EOSUSDT shows promising potential for gains ranging from 90% to 100% or more. The increasing interest from investors further supports the likelihood of continued upward movement. If the buying pressure sustains, we may witness a robust rally that could attract more attention from the trading community.

Technical analysis highlights that the successful breakout combined with consistent volume influx may serve as a solid foundation for future growth. Traders should keep an eye on key support and resistance levels to make the most of potential price surges. As the momentum builds, managing risk effectively and staying updated with market conditions will be crucial.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Update about my previous warning about a crash of the SPX500📉 SPX500 Major Correction: Scenario 1 or 2?

In my previous analysis, I explained a scenario that could mimic the 2022 crash (Scenario 1):

🔗

However, the price action dropped much faster than in 2022, accelerating the correction.

Now, on the daily timeframe, we already have a bullish MACD crossover, signaling a potential bullish trend for several days:

🔗

Could This Invalidate the Bearish Trend?

✅ Yes, absolutely.

In June 2023 (Scenario 2), a similar situation occurred:

A bearish MACD reset was interrupted mid-course by a violent dump

This triggered a strong rebound, breaking through resistance levels

There are now strong signs that Scenario 2 might play out again.

What Does This Mean for Crypto & TradFi?

📈 If this bullish reversal holds, it could sync Crypto & TradFi, with both gaining bullish momentum on the weekly timeframe, peaking around May 2025.

Two Possible Outcomes:

1️⃣ Scenario 1 – The reversal collapses, and the correction continues 📉

2️⃣ Scenario 2 – The reversal holds, leading to a rally 📈

Let’s monitor this closely to see which scenario unfolds.

🔍 DYOR!

#SPX500 #StockMarket #Crypto #Trading #BullishReversal #BearishTrend #MACD #MarketAnalysis #Investing

LONG $900BMorning fellas,

I have been getting some spite, and about 75% of people who follow me stopped liking or commenting on my posts just because I've been sold since $100k and calling non-stop for this drop.

The drop came, and the moonfellas out there finally gave in.

Now it's time to look for longs and nothing better than a few select alt coins. I'm thinking $888B to $900B should hold and then we fly. Check trajectory line.

You people need to stop only posting that it's going up to the moon, and be realistic about things. Buy blood not green, buy LINK at $7 and not $25. Buy dot at $2 and not $15, and so on.

Trade thirsty, my friends.

BTC - What's next BTC Update – March 28, 2025

Quick update on where BTC is at and what I’m watching next.

We finally broke out of that daily downtrend — nice little shift in structure. Price is chilling around $85K right now, sitting just below that FWB:88K –$90K resistance, which is still a pretty strong zone to crack.

Key Levels I’m Watching:

🔴 Major Resistance:

FWB:88K –$90K – First big test. If bulls push through this, could get spicy.

$100K–$105K – Big macro level. Expect sellers to step in heavy here if we make it that far.

🟢 Major Support:

$75K–$78K – Solid higher timeframe support zone. Great bounce area if we dip.

$70K – 2021 ATH retest level. Would still be macro bullish unless that breaks.

🟡 Local Zones:

$84K – Acting as intraday support for now. Holding this could lead to a push higher.

GETTEX:82K – Another local support. If that breaks, next stop is probably mid/high 70s.

What I’m Thinking:

As long as we hold $84K, we’ve got a shot at pushing into FWB:88K –$90K again. Break that and it’s game on toward $100K+. But if we lose $84K and especially GETTEX:82K , I’m watching for a retest of the $75K–$78K zone. That’d still be a healthy pullback, nothing to panic about.

All in all... structure looks solid, levels are clear, let’s just stay patient and let price do its thing. I’ll keep you all posted if anything major changes 🔔

USDT.D update (1H)USDT.D has vioalated the previous analysis. It's breaking out the parallel channel which may engage a bullish flag pattern to activate.

As an extra, there will be PCE reports coming soon. If you see green candles on assest, don't dive in to long positions blindly.

Many of the parameters and signals are showing that prices about to go cheapher.

Market might be about getting close to another crash!

USDT.DOMINANCE 4HOUR CHART UPDATE !!A downward trend in USDT dominance typically signals growing confidence in riskier assets (such as Bitcoin and altcoins), as traders move funds out of stablecoins and into crypto investments.

Breakout Attempt

The latest price action shows a breakout from the descending channel.

This signals a potential reversal, during which traders may return funds to USDT due to market uncertainty or a correction in crypto prices.

The black line forecasts a strong upward move in USDT dominance.

If this happens, it could indicate that investors are selling crypto holdings and moving funds into stablecoins in anticipation of a market decline.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

DXY Monthly Analysis: Key Support Holding, Bullish Move Ahead?📊 DXY Monthly Chart Analysis (March 27, 2025)

Key Observations:

Current Price Action:

The U.S. Dollar Index (DXY) is trading near 104.267, with notable resistance ahead.

Price is consolidating within a key demand zone (~102.5–104) after rejecting higher levels.

Technical Levels:

Support Zone: 100.2–104 (Highlighted in purple)

Resistance Zone: 112.5–114.7 (Highlighted in purple)

Major Resistance: 114.77 (Previous high, acting as a supply zone)

200-MA Support: Located below current price, offering a long-term bullish confluence.

Market Structure:

Price remains in a higher time-frame bullish trend but is experiencing a correction.

The "BOSS" level (Break of Structure) suggests a prior bullish breakout.

If the demand zone holds, a bullish continuation towards 112.5–114.7 is possible.

Projected Move:

A bounce from 102–104 could trigger a rally toward the upper resistance zone (~112.5).

A break below 100.2 could indicate a shift in trend and further downside.

Conclusion:

DXY is at a critical decision point. Holding the current support zone (~102–104) could fuel a bullish continuation toward 112–114, while a breakdown below 100.2 would weaken bullish momentum.

2024-2026 Exploration of 5-100x Web3 cryptos and Stock Targe【Old article on 2024-3-5】-republish due to private indicators before

Time flies, nearly four years have passed since we wrote a similar article, and we feel quite satisfied as 95% of the predictions have been met. Except for Boeing, which surprisingly didn't take off, Bilibili ($19), BTC ($3800), Tiger $3, and PDD ($19) achieved the expected 5-10x growth within two years. The subsequent performances of ACH,UOS, NEAR, and ALGO

provided even greater surprises with 10-80x gains.

However, I continuously reflect and hope to improve my judgment since, compared to readers who directly read the articles, those of us immersed in the sea of information sometimes have our initial judgments clouded by various external factors.

We prefer to express our views at relatively low or high points in advance, allowing time to silently validate these opinions. Real-time perspectives are highly attractive but also constantly at risk, demanding much energy and health. Many have faced health warnings, and we hope everyone remains healthy and happy in 2024. I lean towards identifying the start and end points, then trusting the driver and natural progression for everything in between.

Returning to the topic, it has been over two and a half years since a similar article, and I will discuss a few targets and core catalysts I believe are underestimated:

1.Bitcoin (BTC) BINANCE:BTCUSD

Introduction: Born in January 2009 as a hedge against inflation after the 2008 financial crisis, BTC has experienced nearly 16 years. Its underlying logic and blockchain technology have birthed foundational blockchains like Ethereum, ADA, SOL, AVAX, CFX, and Algo. BTC's development attributes have expanded potential applications, such as Stacks and RGB protocols. My ultimate expectation for BTC is simple: it could be valued highly just as a new E-GOLD for decades to come. If its ecosystem applications further explode, it could become one of this century's leading assets.

Key Catalysts: The 2024 halving, reducing block rewards to 3.125 and resulting in a yearly inflation of about 0.782%, which is lower than the inflation rates of most developed countries. The next wave of funding entering the industry could be expedited by the SEC’s approval of ETFs, the alleviation of sell pressure from Grayscale's repositioning and MGOT, and traditional financial risks causing forced rescue actions by BTC-holding companies to pass.

● Expected Valuation: $200,000 MC: 4.2 trillion USD, marking the beginning of a new world, extensively unfolding application scenarios

Reminder: It's important to emphasize that long-term expected valuations do not imply a straight path upwards from current price points. There might be an average upward trend, but short-term intense volatility is possible. Always remember not to engage in long-term commitments with high leverage. This reminder is also placed here for additional caution.

2.Telegram Ime ( POLONIEX:LIMEUSDT Lime) & TON ( BINANCE:TONUSDT TON)

Introduction

Ime Messenger is a special version of Telegram, integrating functionalities such as a multi-chain wallet, enabling direct transfers of various blockchain assets like BTC, ETH, AVAX, BNB, Polygon, Mantle, AVAX, etc., among Telegram friends. It incorporates features like Binance Pay, direct Google Translate in Twitter and TG conversations, and optimizes Telegram's overall layout and usability.

Telegram accounts and chat histories, along with other crucial data, can be directly utilized in the Ime version of Telegram without the need for a new account. Similarly, chat histories in the IME version will automatically sync with the original Telegram version, facilitating easy switching. The Ime version essentially acts as an integrator, merging the Web3 world into the TG ecosystem, with TON leaning towards the chain ecosystem.

TON is a native public blockchain ecosystem developed on top of Telegram, serving as an inherited blockchain project from TG's original project team. It introduces more development possibilities and diversity to Telegram's native ecosystem growth.

● Core Logic:

Within three years, the user base of the Ime version increased from 2 million to 10 million users, a 500% increase. The friendly relationship with Telegram's founding team enables seamless connection to Telegram's 700 million users. The latest multi-chain Token group red packet function uses Lime as the Gas fee, which will greatly benefit the project's operation and promotion if more convenient modes are optimized in the future. Ime's multi-chain integration feature can help project parties integrate into the Telegram ecosystem faster. Currently, LIME's FDV fluctuates between $5M and $10M, far below the valuation of many primary market projects.

TON, as TG's native underlying public blockchain, ranks at the forefront in terms of operational level and market promotion. It can be directly used in the original version of TG, reducing the teaching cost. Although it doesn't support multi-chain, the wallet is a single-chain wallet in the form of a dialogue box. TON itself also has enough potential, and its FDV has surpassed $10 billion, indicating the market's expectations for Telegram.

● Keys to Launch:

Ime Lime:

Due to the presence of many hardcore tech personnel from Russia and Ukraine, the involvement of core operational PR is needed to enhance the project's self-marketing capability.

Further optimization of the TG group members' ability to freely use the red packet function to send various TOKENs as rewards to group members.

More optimization of TG functionalities to be utilized.

Further support and policies from Russia towards blockchain applications.

TON:

A more lenient regulatory stance from the SEC towards the official Telegram TON.

Collaboration and output of SocialFi Killer-level projects on the chain.

An increase in GameFi entering through TG as a portal.

● Expected Valuation:

Lime: Current MC FDV: $5.7M, Expected FDV: 3B-5B

TON: Current MC FDV: $MUN:10B, Expected FDV: $60B

3.Conflux (CFX)

BINANCE:CFXUSDT

● Basic Introduction:

Conflux is a Layer 1 public blockchain supported by a team that includes a Turing Award winner and technical advisors from Tsinghua University's Yao Class, aimed at long-term development platforms for dApps, e-commerce, Web 3, and metaverse infrastructures. Its Tree-Graph consensus mechanism, which combines Proof of Work (PoW) and Proof of Stake (PoS) algorithms, is considered one of the most prominent purely domestic projects in my opinion.

● Core Logic:

Conflux's unique Tree-Graph consensus algorithm achieves high scalability and low latency, driven by a technology-focused team, ensuring smoothness and convenience comparable to high-valuation blockchain projects like SOL and ETH. It aligns quickly with the mainstream development pace of Web3, waiting only for further opening and an increase in active users to unlock significant potential. Trendy applications are gradually making their way onto CFX.

● Keys to Launch:

Further support and liberalization for blockchain public chain applications and the metaverse by mainland China.Further popularization of the public chain as a pilot test in China's Hong Kong, Macao, and Taiwan regions.

More official cooperation and implementation with institutions like CITIC, Xiaohongshu, leading to the complete disappearance of traditional capital suppression.

Gradual maturity of Conflux's own development and formal, successful support for BTC L2.

● Expected Valuation:

Current MC FDV of CFX: Fluctuating around $0.9B, Expected FDV: $36B-$80B

4.Opulous (OPUL)

KUCOIN:OPULUSDT

● Basic Introduction:

A music RWA+DeFi project, where RWA has already achieved application cooperation with singers. Investors can participate in purchasing a portion of album rights with OPUL to earn subsequent album revenue shares from the artist. The new feature, Opulous OLOAN, creates a unique bridge between RWA and the music industry. By staking USDC in the pool, it provides funding for musicians and earns extra income on the staked USDC.

OVAULT is a unique staking pool on the Opulous platform that allows you to stake USDC to access a diverse music library. This library, curated by Opulous music experts, features popular and high-performing songs. Participating in OVAULT not only grants access to this music library but also rewards, offering a way to engage with the music industry and profit from staking.

● Core Logic:

The company has a rich network of core music resources, with dittos being a music collaboration company of ED Sheeran, Overall, Opulous maintains a relatively leading position in market rhythm control, ranking as one of the more playful project parties on the Algorand and Arb chains. The pressure from private placements has been fully released.

● Key to Launch:

The further popularization of music applications, as well as the actual revenue generated by high-profit artists.

● Expected Valuation:

OPUL current MC FDV fluctuates around $50M-100M, with an expected FDV of $MUN:10B-$30B

5.Bilibili (BILI)

NASDAQ:BILI

● Basic Introduction:

A video creation and live streaming platform, a haven for secondary elements, and a platform concentrated with young purchasing power, which has invested in a bunch of enterprises leading to poor financial reports in recent years. Thus, the stock price has plummeted from its peak, so let's just drink to that.

● Core Logic:

Currently, the only platform in China that seems capable of competing with YouTube.

Gaming may catch up to the era of Web3 entry points.

High user stickiness, but consumer rights are currently somewhat limited to anime series.

● Key to Launch:

Encourage more original creative educational videos, as most Chinese videos now are summary-based, and original content is much less compared to YouTube. Activating this "wasteland" could be a significant source of revenue for Bili, as many are willing to pay for quality knowledge, but management needs to be stricter to prevent bad money from driving out good.

Investments from the past two years are beginning to generate exit profits.

Revise the business distribution; the current mix of live streaming and gaming services with the website is a bit odd.

● Expected Valuation:

Bili's current valuation: $3.8B MC FDV, with an expected valuation in 5 years of $50-100B.

6.Avalanche / Polygon / Near / Algorand/ Solana

CRYPTOCAP:AVAX BINANCE:NEARUSDT COINBASE:MATICUSD BINANCE:ALGOUSDT BINANCE:SOLUSDT

● Basic Introduction:

Alt-L1 is a core foundational public blockchain infrastructure. AVAX and Polygon are more akin to Ethereum's sidechains, while Sol / Near / Algo have their own underlying architectures + EVM+BTC virtual machine compatibility or stand-alone projects to enhance compatibility with Ethereum. Each public blockchain has its own unique ecosystem. In 2024, it's more suitable for each chain to be discussed separately in a comprehensive series due to their foundational architectures, which cannot be fully covered here without extending into tens of thousands of words.

● Core Logic:

The security of L1's underlying architecture has become increasingly refined. Although there have been debates regarding Sol's foundational security, it's undeniable that Solana has become the largest ecosystem outside of Ethereum, even leading in popularity at times. However, with the initiation of Ethereum's layering series, Ethereum's ecosystem could potentially introduce more gameplay. AVAX, SOL, and Matic are perfect examples of market rhythm mastery, with Near being average in convenience, and Algo being the least market-savvy but having the highest prestige in terms of technical strength and collaborations.

The other L1s are advancing similarly, now engaging in mutual competition. After an uninteresting two years, the public chain ecosystem is finally starting to show some vitality again.

● Key to Launch:

After global macroeconomic black swan events are thoroughly cleared, the new era's focus will shift further towards AI, blockchain, and informational fields, increasing the exploration desire for reservoirs and funds. LSD, Restaking, Rollup, and various new DeFi gameplay will further penetrate major ecosystems, sparking new value bubbles.

● Expected Valuation:

Future MC FDV:

AVAX: 150B

SOL: 300B

ALGO: 60B-150B (300B--- if the team optimizes and gets designated by US policies)

NEAR: 50B-100B

MATIC: 80B-100B (250B--- if designated by Indian policies)

7.Tiger Brokers (Tiger) NASDAQ:TIGR

● Basic Introduction:

A youthful brokerage with excellent trading experience, superb data provision, and UI design, providing ample information on financial reports and data.

● Core Logic:

Undervalued, with virtual licenses approved. The support for compliant tokens like USDC for deposit could significantly increase trading volume and financial income.

● Key to Launch:

Further relaxation and support for compliant KYC by domestic policies.

Overall recovery and accumulation in the financial markets.

● Expected Valuation:

Current FDV: 0.58B, Expected FDV: 10-20 B

8.Planetswatch (Planets)

● Basic Introduction:

An eco-friendly project monitoring air quality through air sensors, allowing for real-time air quality data transmission via different sensor nodes in exchange for token rewards.

● Core Logic:

High early valuation and low circulation rate, with prices significantly dropping due to the bear market and inflation impacts, a common issue for early-stage projects with low circulation rates.

● Key to Launch:

Further global emphasis on environmental infrastructure, with Eco projects becoming a focal point in blockchain discussions.

● Expected Valuation:

Current MC FDV: 2M, Expected FDV: 20M-200M

9.ContextLogic (Wish) $NASDAQ:WISH NASDAQ:LOGC

● Basic Introduction:

Wish is a U.S.-based e-commerce platform founded in 2010 by former Google employee Piotr Szulczewski and former Yahoo employee Danny Zhang. Its parent company, ContextLogic Inc., is headquartered in San Francisco, USA, primarily selling inexpensive household items, clothing, jewelry, electronics, toys, etc.

● Core Logic:

Overhyped by consortia like Goldman Sachs in 2020, leading to a steady fall to the verge of delisting. Prices are near low, with recent market actions and promotions starting to revive.

● Key to Launch:

Further reliance on group buying, especially the expectation of cheap group purchases by the consumption downgrade population.

Entry of new major institutions into the acquisition process.

Revival in financial reports and business.

● Expected Valuation:

Current MC FDV: 0.1B, Expected MC FDV: 2B-10B

10.Waves Enterprises (West) $KUCOIN:WESTUSDT GATEIO:WESTUSDT

● Basic Introduction:

Waves Enterprise is an enterprise-grade blockchain platform for building fault-tolerant digital infrastructures. As a hybrid solution, it combines enterprises, service providers, and decentralized applications in a trustless environment, leveraging the advantages of public permissioned blockchain across a wide range of business use cases.

Sidechains are used for building private or hybrid infrastructures, storing metadata on the mainnet. The platform is powered by Waves Enterprise System Token (

WEST

), the native utility token for all network operations.

● Core Logic:

Enterprise-grade public and private hybrid blockchain protocols may be more easily accepted by traditional enterprises.

● Key to Launch:

Further support for blockchain technology from Russia, with traditional oligarchs and consortiums responding to related policies.

Further popularization

Expected Valuation:

Current MC FDV: 2-5M fluctuation, Expected MC FDV: 2B-5B (20-50B--- if designated by Russia)

Summary:

This article analyzes the long-term potential value of several projects. Some have survived through significant trials and tribulations, and others possess superior fundamentals and philosophies but lack market operation capabilities and are in need of a discerning eye. Therefore, while they have potential, it does not guarantee they will meet expectations, and they may also suffer unexpected setbacks.

The global economy has not yet emerged from the mire; in fact, it can be likened to treading on thin ice where the superficial prosperity cannot mask the unresolved core flaws. Certain festering issues and malignancies have yet to be addressed, so even as the future for AI and blockchain seems bright, it's prudent for individuals and institutions to adhere to a set of personal principles.

For emerging public chains like SEI, TIA, and Layer 2 solutions, as well as diverse projects like Altlayer, Manta, Dymension, Edenlayer, Zeta involving Restaking, LSD, and other novel mechanisms, the extended lock-up periods of this investment round make early valuations even more challenging to gauge. This tests the responsibility and habits of the project teams since the majority of tokens are still in their hands. If the foundation dumps early, new projects could experience significant setbacks. However, there's also the possibility of projects like TIA achieving "vintage" valuations, though such outcomes are difficult to predict swiftly.

The development of the blockchain industry is expected to be relatively bright in the coming years. However, it's important to reiterate the caution stated at the beginning of this article: long-term valuations do not mean a continuous upward trend from current price points. The market could experience intense volatility, similar to a scenario where BTC suddenly drops to

1K

and then rebounds to $40k, although such an event is highly unlikely. If one can maintain a healthy position in such scenarios, there should be no cause for concern.

Remember not to engage in long-term commitments with high leverage. Try to avoid or minimize engagement with contracts unless for entertainment and if you possess sufficient self-discipline. Do Your Own Research (DYOR) remains the primary way to maintain a healthy investment strategy.

Disclaimer: This article is not intended as investment or financial advice but merely reflects the author's opinions and insights, hoping for mutual learning and progress.

Stablecoin liquidity = Bitcoin bullish thesis --> $109k?Can BTC soon climb to the $109,000 level thanks to stablecoin liquidity? Maybe yes!

An increase in stablecoin market cap often signals more money entering the crypto space, indicating bullish sentiment as investors prepare to deploy capital. This increased liquidity can lead to smoother trading and attract more participants, potentially driving up Bitcoin's price.

The chart clearly illustrates this relationship:

Purple line ( CRYPTOCAP:USDT + CRYPTOCAP:USDC + CRYPTOCAP:DAI + CRYPTOCAP:USDEE market cap) shows steady growth

Bitcoin candle chart ( COINBASE:BTCUSD price) follows with more volatile increases

Blue line at the bottom: BTC and stablecoin correlation coefficient of 0.9 😊

This correlation can serve as a leading indicator for Bitcoin price movements. During downturns, investors might sell Bitcoin for stablecoins, but as sentiment shifts, this "dry powder" can quickly flow back, driving Bitcoin's price up.

Adding to that, the long-term correlation coefficient between stablecoin liquidity market cap (USDT+USDC+DAI+USDE) and Bitcoin is 90%. So, yes, there's a strong long term correlation and usually BTC and stablecoin liquidity converge.

According to my views on the stablecoin liquidity, the Bitcoin price should target the $109k level.

Last time I made this analysis, Bitcoin jumped from $58k to my price target of FWB:73K in the span of 2 months.

Let me know your thoughts.

Bitcoin may rebound up from pennant to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, BTC was trading inside a wide range, where the price moved sideways and eventually touched the resistance line, from which it turned around and began to fall. After the decline, BTC exited the range, breaking through the lower boundary and sharply dropping to the support level, which aligned with the buyer zone. From there, we saw a quick impulse up, but this movement faced strong resistance inside the seller zone, where a fake breakout occurred — price briefly moved above but then sharply reversed and began another decline. As BTC continued to decline, it formed a downward pennant pattern. Within this structure, we can clearly see how the price respected both the resistance line and the support line of the pennant, bouncing up from the lower boundary several times. The most recent bounce came again from the buyer zone, indicating that bulls are still defending this area. At the moment, BTC is consolidating near the tip of the pennant, and I believe there’s a high probability of an upcoming breakout. My base scenario assumes that we could see one more minor pullback toward the support line, followed by an upward breakout from the pennant. If that happens, the price may reach the 90000 points, which I consider as TP1. Please share this idea with your friends and click Boost 🚀

ALGO / USDT - Big Move AheadEvening fellas,

I got an order ready near the gap I believe its at $0.1844, it would require coming back down to the purple between both trendiness, one placed at the wick low, and the other at the body.

Maybe it moves up to resistance once again before a final shakeout.

It'll be a nice long.

Trade thirsty.

Bitcoin can exit from triangle and rise to resistance levelHello traders, I want share with you my opinion about Bitcoin. On the chart, we can see that the price entered a downward triangle, where it rebounded from the resistance line and dropped to the resistance level. After that, BTC bounced from the 86500 level, climbed back to the resistance line of the triangle, and then started to decline. Soon, it broke through 86,500 and reached the support level, which coincided with the buyer zone. BTC then broke this support and dropped further to the support line of the triangle before reversing and beginning to rise. In a short time, the price reached 81100, broke through it, and made a retest before continuing its upward movement. However, it later corrected back to the buyer zone, then climbed to 85000, and started declining again. Shortly after, the price dropped to the support level and then rebounded to the resistance line of the triangle. Given this price action, I expect BTC to correct toward the support line of the triangle before bouncing back up and breaking out of the pattern. From there, I anticipate further growth toward the 86500 resistance level, which is why I have set my TP at this level. Please share this idea with your friends and click Boost 🚀

bear market confirmationIf the chart will consolidates above 5.81%, i.e. above the sloping downtrend line, this would be an early indicator of the start of a bear market, because this line is global for the current bull market.

The second confirmation will be if dominance will bumped at 3.94 - 4.30% range as wave B and will update the end of wave A.

USDT.DOMINANCE WEEKLY CHART UPDATE. Current Market Structure:

Breakout Confirmation: USDT Dominance has broken out of its descending trendline and is now in a retest phase.

50MA as Support: The 50-week moving average now acts as dynamic support, reinforcing the bullish outlook.

Rejection or Breakout? The price is currently testing resistance. If it gets rejected, a temporary pullback is likely before further gains.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Bitcoin can rebound from triangle pattern to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, the price was trading within a range, where it quickly entered the seller zone and remained near this area for quite some time. BTC attempted to rise but failed, and after nearly reaching the upper boundary of the range, it dropped sharply. The price broke through the 94000 level, exiting the range as well, and then fell to the support level, which aligned with the buyer zone. Shortly after, the price made a strong upward impulse toward the resistance level before starting a decline within a downward triangle. Inside this pattern, BTC initially made a correction, climbed back to the resistance line of the triangle, and then resumed its decline. Eventually, the price dropped to the 78900 support level, where it touched the triangle’s support line and then began to rise. At the moment, BTC continues to climb near this level, and I expect it to rebound from the support line of the triangle and break above the resistance, signaling an exit from the pattern. If this happens, I anticipate further growth, so my target is set at 90000 points. Please share this idea with your friends and click Boost 🚀