Usdt

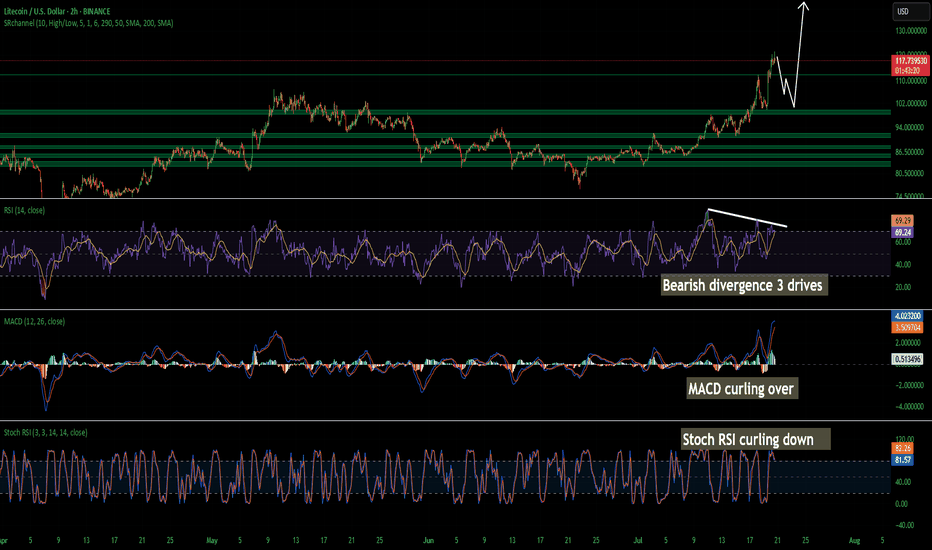

LTC Litecoin Short Term Pull Back Quick and SharpI believe Litecoin Is topping out on the 2 hour. Looks like we may come back down and tap support at around 104 but I wouldn't be surprised a wick hits 100. I have buy orders around 103-106. I am not super confident on a deeper pullback so thats why my buys are there is so i don't miss the dip. Id rather make a little less money than miss a buy in trying to nail the bottom. Litecoin is starting its breakout from a 7 year consolidation and accumulation phase. This should be pretty massive. Litecoin is going to benefit considerably from these new bills that are being signed and many of the favorites in the top 100 will soon disappear!

The time for Litecoin to shine as I have been talking about for years is now. I am almost certain that this is that time. My predictions all still hold if you would like to go read them. I was just off on timing. Timing is the hardest thing to predict especially with how wild this planet has been lately. None of this is financial advice its just my opinion.

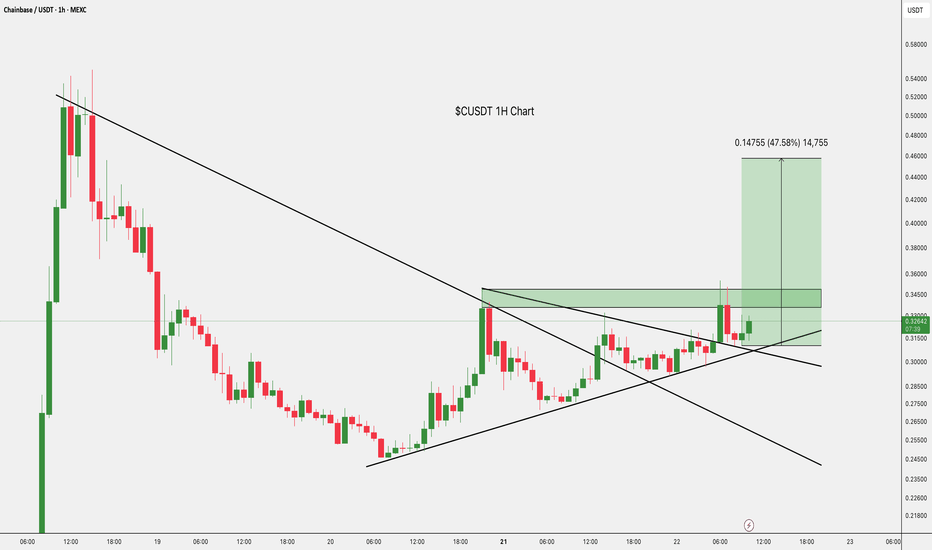

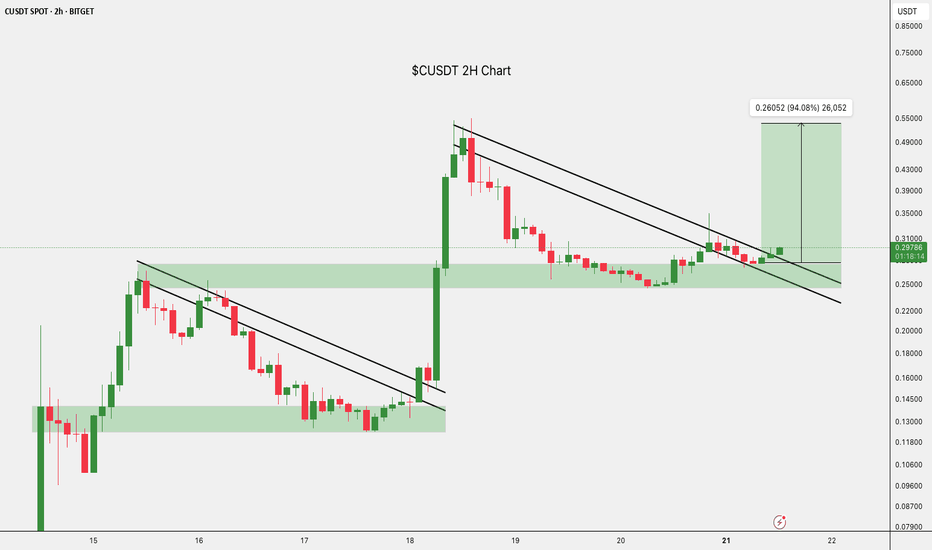

$CUSDT Breakout: Eyes on 94% Upside.BITGET:CUSDT is showing signs of strength again.

After a healthy pullback, it held support and broke out of the falling wedge.

This move could kickstart the next leg up, with a potential target near $0.53882, almost 94% from here.

Keep it on your radar if momentum picks up.

DYOR, NFA

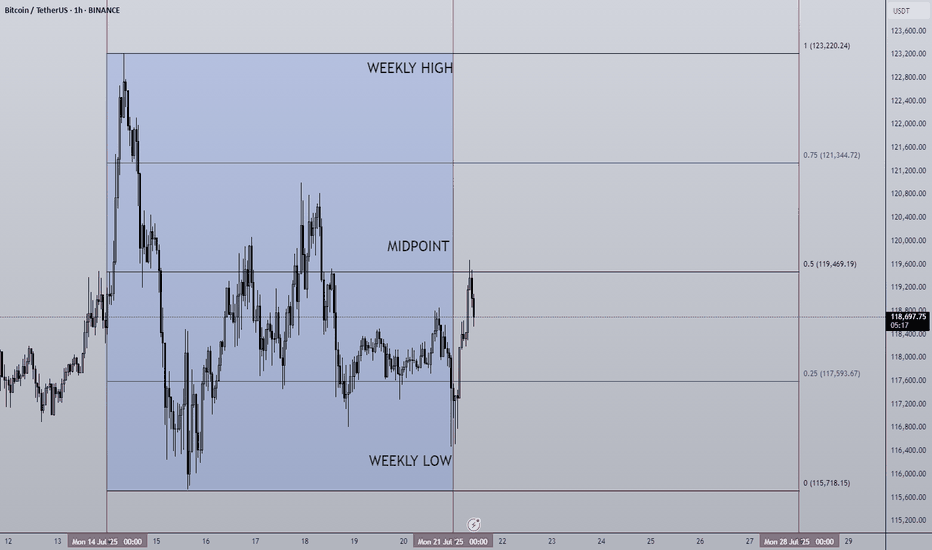

21/07/25 Weekly OutlookLast weeks high: $123,220.24

Last weeks low: $115,718.15

Midpoint: $119,469.19

New BTC ($123,220) & SPX ($6,315) ATH last week! We're really seeing progress being made on all fronts now, bitcoin saw its sixth week of net inflows into BTC ETFs ($2.39B).

The week began strong hitting the new ATH very early and then settled into a tight range to cool off. Altcoins however surged in relation to BTC to break out of HTF downtrends and begin to make up lost ground. One of the beneficiary's of this price movement has been ETH, breaking out from a multi year downtrend against BTC and hitting $3,800 in its USD pair.

For this week I do expect much of the same for BTC as momentum is with altcoins for now. However, as those altcoins reach HTF resistance levels it becomes very important for Bitcoins chop to be accumulation for the next leg up and not distribution for the way down. With so few pullbacks the threat of a sudden correction is present but the probability drops should BTC look to press higher with strong demand.

The ECB Interest rate decision takes place on Thursday but no changes to the 2.15% rate is forecast. In terms of news there are no planned upsets that I can see.

Good luck this week everybody!

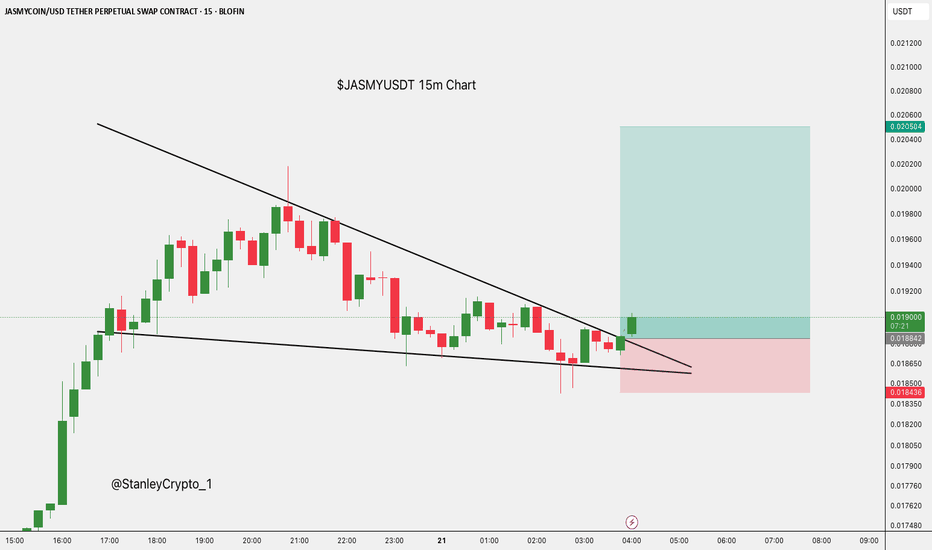

#BTC.D Just Hit the DAILY SUPPORT, WILL THERE BE A PULLBACK?CRYPTOCAP:USDT is breaking out on LTF while BTC.D just hit support that looks ready to break down.

Not a short call, but if you've been trading well, this is when you reduce margin and cut leverage.

Although I could be wrong about USDT here but profit-taking matters.

We will probably get a pullback this week to enter again.

It's better to watch coins rise a few more waves without you than to give it all back in a few reckless trades.

Spot bags? HODL and DCA.

Futures? Trade cautiously.

DYOR. NFA.

Do show your support with your likes if this post adds any value, and hit the like button.

Thank You

#PEACE

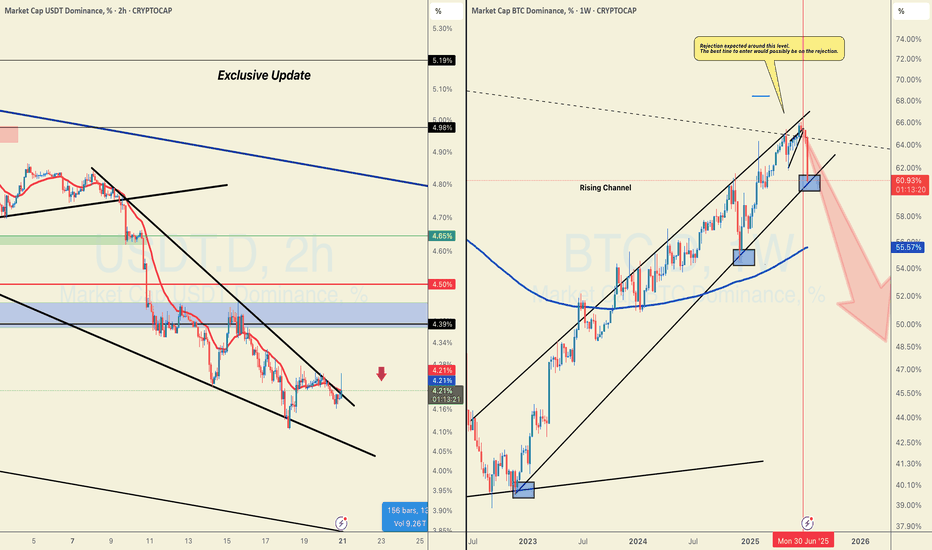

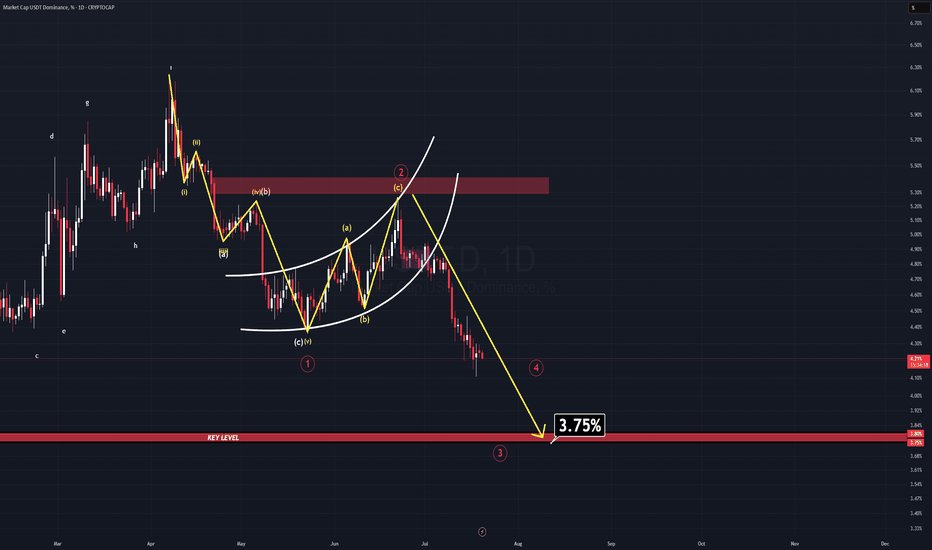

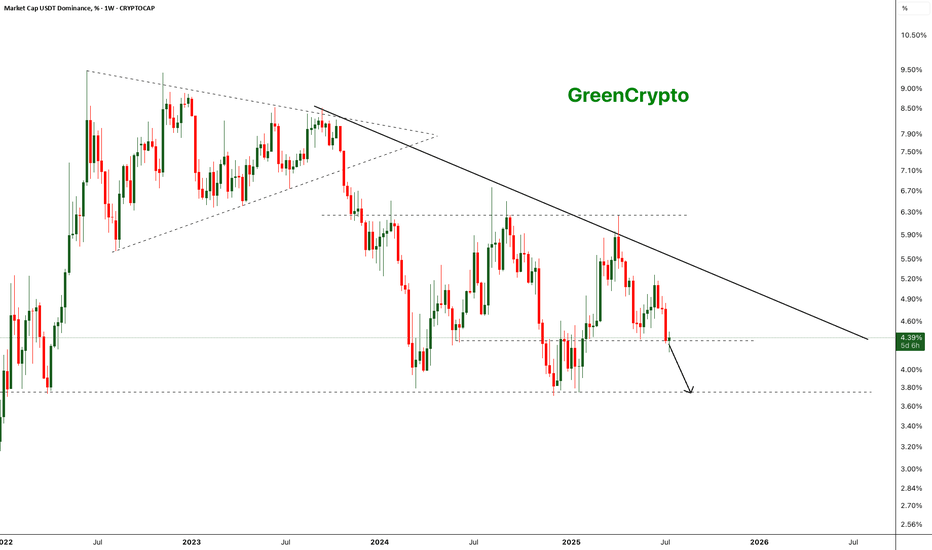

USDT DOMINANCE NEW UPDATE (1D)In a previous analysis, I mentioned that the long-term outlook for this parameter (USDT.D) remains extremely bearish. At the time, a bear flag was clearly visible—but it hadn’t been broken yet.

Well, now it has.

The breakdown confirms the bearish continuation, and there’s still more room to fall. As USDT.D continues to descend towards the projected target for Wave 3, we are likely to see a new All-Time High in Bitcoin, accompanied by a strong rally in many altcoins.

The main target for Wave 3 sits at 3.75%—a historically critical level. For years, USDT.D has never fallen below this zone, making it an extremely strong support area.

⚠️ Reminder: Consider taking profits when USDT.D approaches the 3.80–3.75% region. A reversal or temporary bounce is highly likely there.

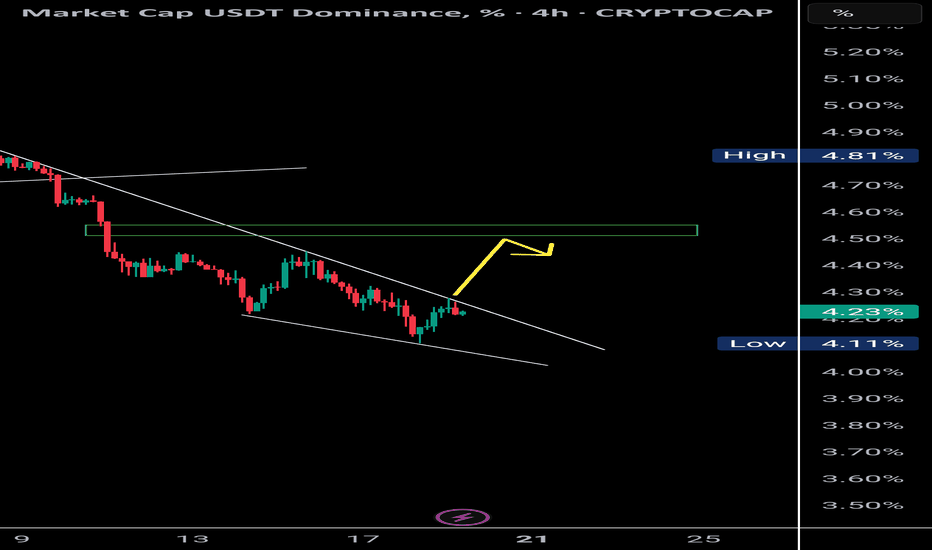

USDT Dominance Forming Bullish Divergence | Altcoins May Retest 📉 USDT Dominance (4H):

Currently forming a bullish divergence with RSI, supported by a falling wedge structure. Price is respecting a clear supply OB (resistance zone) and might retest the 4.55% level.

🔁 Historically, a rise in USDT.D signals short-term corrections in BTC and altcoins, creating opportunities for OB/supply fills and long setups.

📊 This could be the retest phase for major crypto assets before resuming upward momentum.

🧠 Use this phase wisely — it’s where strong setups begin to form.

$SUSDT (or S , ex FANTOM): good entry for a long setupCrypto Market Outlook

The overall crypto market is in a clear uptrend.

The money printer is running, and USD dominance is dropping — all signs pointing to a potential continuation of the rally in the coming months.

Unless a black swan event hits, it's not too late to position yourself if you’re still on the sidelines.

⚠️ Always manage your risk with a proper stop loss — altcoins move fast and can reverse just as quickly.

One interesting setup: $S

✅ Relatively new

✅ Didn’t pump too hard

✅ Broke out of its downtrend

✅ Found solid support

The Fib levels offer good targets for take profit zones.

🔍 Ideal entry: within the green box or lower.

Let the pump cool off — it could offer a perfect entry opportunity. Be patient and wait for a good position.

If $S pumps from here without retrace:

→ Jump in with a tight stop loss

→ Or look elsewhere for a better risk/reward setup.

DYOR.

#Crypto #Altcoins #Bitcoin #ETH #Trading #CryptoMarket #TechnicalAnalysis #RiskManagement #DYOR

Bearish Breakdown in USDT Dominance - Altseason Loading?The chart shows a clear long-term descending trendline acting as resistance since mid-2023. After multiple failed attempts to break this trendline, USDT dominance has broken below a key horizontal support around ~4.35% on strong bearish momentum.

- Weekly close below the ~4.35% horizontal support.

Next key support zone: ~3.65–3.70% (marked by previous 2023 lows).

- Strong bearish engulfing candle confirming breakdown.

- Bearish continuation expected if dominance remains below 4.35%.

Further drop of the usdt dominance will start the altseason

Cheers

GreenCrypto

BTC & USDT.D => Bullish Correction Incoming?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Both BTC and USDT.D are sitting around key rejection zones.

💰 BTC is hovering near the $100,000 level — a major previous low and a psychological round number.

📊 Meanwhile, USDT.D is testing the 5% resistance — a supply zone and another critical round number.

As long as $100,000 holds as support on BTC and 5.1% holds as resistance on USDT.D, we could expect a bullish correction across the crypto market.

What do you think? Will these levels hold or break? 🤔

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

100% Win Rate on BTC & Alts! Where’s the Next Breakout?USDT Dominance Update:

While the herd chases the latest hype, we called this before it even unfolded. BTC’s recent surge was lightning-fast.

These were the trades shared in the last 30 days. I'm just saying we could've had more wins!

Our setups didn’t just hit targets…

They exploded through them 🚀

These are spot gains, imagine trading wth leverage with these.

There's more to come in the next week.

✅ MIL:ENA +53%

✅ HOSE:VIC +50%

✅ $CHILLGUY +40%

✅ NASDAQ:HUMA +35%

✅ CRYPTOCAP:XRP +34%

✅ $VOXEL +32%

✅ OMXTSE:MAGIC +30%

✅ CRYPTOCAP:RENDER +25%

✅ CRYPTOCAP:AVAX +24%

✅ SEED_DONKEYDAN_MARKET_CAP:FLOKI +25%

✅ CRYPTOCAP:LINK +17.65%

✅ CRYPTOCAP:SUSHI +17.3%

✅ AMEX:MBOX +15%

✅ $MAVIA +14.7%

✅ TVC:MOVE +11.66%

✅ $EPT +11%

✅ BME:ETC +10.3%

✅ PSX:POL +20%

✅ CRYPTOCAP:SUI +20%

✅ LSE:ONDO +7.5%

✅ SET:PORT +6.17%

✅ CRYPTOCAP:TON +3%

📈 These aren’t just simple trades; they’re alpha-backed calls.

If you’re still watching from the sidelines…

You’re watching others print.

Be patient and precise with your entries and exits. Never FOMO.

The market will bait you into bad timing if you let it.

A 4.4% drop in USDT dominance marks the start of a new altcoin season, but remember, BTC will steer this cycle.

More setups on the way.

Stay tuned.

Do hit the like button and share your views in the comments.

Thank you

#PEACE

$USDT Dominance CRYPTOCAP:USDT dominance just broke down from a key pattern, and that’s a big signal.

It means people are likely moving money out of stablecoins and back into altcoins and Bitcoin.

If this drop continues, we could see a strong altcoin rally soon.

Keep an eye on it, altseason might be around the corner.

DYOR. NFA

MIGGLES/USDT THE BREAK RETURN TO THE MOONMIGGLES/USDT THE BREAK RETURN TO THE MOON

We are following with live data on this coin for the next volume trend, which can have a break in the coming time.

At this moment, this coin is showing signs of an increase. When it gets confirmed, we will follow it with live updates.

MArket scan shows PRIME CAN RETURN BACKMarket scan shows PRIME CAN RETURN to higher levels.

soon, more data on this update

The first smart money whales have taken the step.. lets see what can happen next with new updates below.

We can't see the future what can happen, but we can follow the data.

as long there is more whales entering this coin, we can expect an interesting return.