USDTWD

Trade Like A Sniper - Episode 47 - USDTWD - (18th June 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing USDTWD, starting from the 4-Month chart.

If you want to learn more, check out my profile.

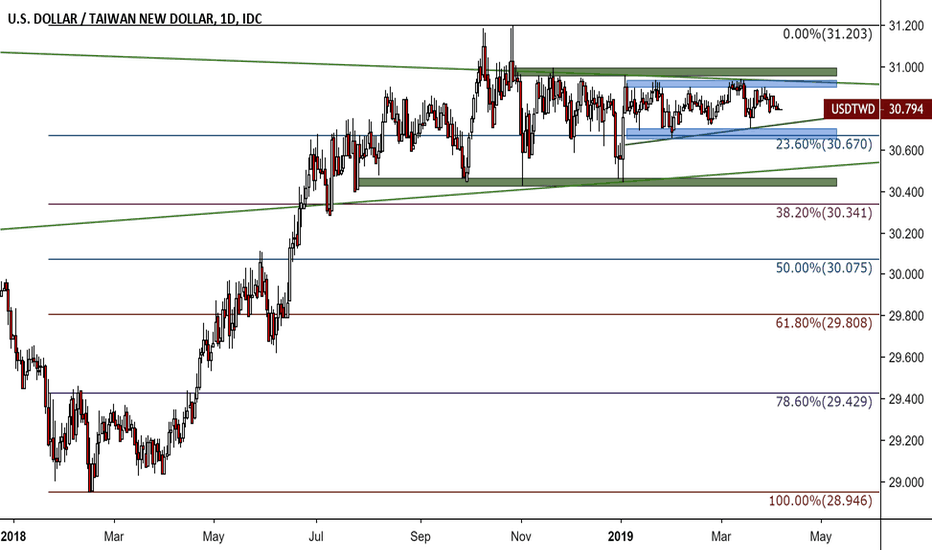

The Low Volatility Taiwan Dollar Is Now Less VolatileThe already incredible low volatility of the US dollar to the Taiwan dollar somehow over the past few weeks managed to drop volatility even lower than before. The range trading has tightened further from 30.42 to 31 by a tighter range of 30.65 to 30.94. This is truly incredible, even for the foreign exchange market which has suffered (or enjoyed given your financial position) from extremely low volatility compared to other asset classes such as commodities or equities. The question remains if this volatility can be sustained and if so for how long. Clearly, this pair suffers from low liquidity which can be seen by long tails of the candlesticks indicating short-term volatility. Less clear is the fact that this pair is still manipulated by the central bank. Either way, USDTWD is a fairly stable pair to invest in with foreign exchange risk extremely low, at least for now.

TWSE Off From Technical Overbought HighsWhile RSI and Bull/Bear sentiment have edged away from clear overbought signals, we are continuing to see exponential moving averages assert their authority in suggesting the uptrend will continue. This is the case for the 'ribbon' of EMAs excluding the five day EMA which price action has dropped below. In the short-term I am a bit bullish on Taiwanese equities especially since they tend to outperform other Asian equities when the majority of Asian stocks are in deep red territory. Moreover, Taiwanese equities outperform their Asian peers in differing times of entry point since the 2008 Financial Crisis. However, entry point is extremely important for this and perhaps for a buy and hold strategy prices are a bit too expensive for those types of investors.

USDTWD Continues Sideways, will do so for the immediate futureThis forex pair suffers from a number of problems including manipulation, low volume, lack of interest, etc. The technicals are not on the side of those expecting divergence from these trends. Overall, expect a continuation of this sideways move.

INTERMARKET | USDCNH vs USDTWD DeviationWhat is a meaningful relationship between the currencies of two very interlinked and substitute export-led economies appears to have broken down - at least directionally in this case.

I think they reconverge, so my bias here is long USDTWD... So now I shall look for an entry.