NETFLIX INC - Hello Friends ! Please support us with like and comment if you have any opinion

the netflix stock market is pushing upwards by constituting an uptrend , so you can enter the market as a buyer and take your profit at the first red candle that follows this trend and exit with a very good trade

Thank you .

Usmarket

SPY fork pattern analysisI published another fork pattern idea earlier today (see related idea) on the daily chart pointing out how the fork patterns predicted the lasts 2 major market falls and the starting of the recovery after the previous fall and likely the point where recovery starts for the current fall (which was yesterday). I went to 1H chart to get a feel for where the market is going. You can see (for the 1st fork on th chart) the market fell when it reached the top fork line and that yesterday SPY went below the bottom fork line (for the second fork). The 3rd fork, meant to predict the market direction, is a bit premature: it's only based on 2 days of price action and it's rather narrow. Price action over the next days will likely go beyond the fork and will expand it. However, the fork may still give a valuable idea about the upcoming trend. Thus I predict that the SPY will reach the last red circle on the graph (when the last fork will reach the top line of the 2nd fork). That is around 342-343 on Oct. 13. As I said, this is preliminary, as the price action over the next days will likely expand the fork and thus, that point of intersection may come sooner. Whenever it comes, I find it rather likely that SPY will have a little, temporary fall at that point. That may happen instead when the last fork reaches the green line of the 2nd fork (where the 1st red circle is, around 339 price level on Oct. 7) but I find that less likely.

Conclusion: go long.

"Like it" if you like it! Add your comments, questions or concerns if you have any.

DISCLAIMER: Security trading involves substantial risk of loss. My analysis is not trading advice. Do your own research first and/or consult a financial advisor. I'm not responsible for any losses you may incur following my analysis.

SPY fork pattern indicating the fall ended and recovery startedIf you draw the highest resistance trend line since the recovery started (the blue line in the graph) and from the high before the last one (where the red line starts, on April 29) draw a fork to the last high on that resistance trend line (on June 28) and to the latest low after that high (on the green line, on June 29) this fork clearly shows that SPY fell right after it opened and went over the the upper fork line (on 9/2) and, if the pattern holds, yesterday when it went below the upper line of the fork will be the point where recovery starts and the market will go up.

Conclusion: go long.

"Like it" if you like it! Add your comments, questions or concerns if you have any.

DISCLAIMER: Security trading involves substantial risk of loss. My analysis is not trading advice. Do your own research first and/or consult a financial advisor. I'm not responsible for any losses you may incur following my analysis.

S&P-500 - time to be cautious, not excitedWith new ATH in TVC:SPX and AMEX:SPY , it is worth to remember that since 2018 such highs are later followed by new lows inside the broadening pattern.

In fact, with current state of macro and fundamentals, new lows (price going ~40% lower!!!) would not be so surprising, and if history is a guide it can happen fast as well. Therefore, buyer beware!

S&P500 SITUATION UPDATE| 8 DOLLARS TILL ALL TIME HIGH ON SPY|

Me and the boys are mesmerized by this unstoppable "Ride of the Valkyries" against all the laws of physics, economics and common sense, which is in limited supply in the contrast to its name these days. Never before the common phrase "the rich get richer as the poor keep getting poorer" been visualized so brutally, namely: SPY is 8 dollars away from reaching new all time high, coupled with the news of 30% downturn in the GDP.

Anyhow, thats what the promise of the unlimited liquidity from the FED means on practice. However, the question is: after the new all time high, whats next?

When the market reaches the previous high, which might be somehow justified by front-running the recovery, I fail to come up with any reason to justify the market getting higher than this mark. The economy will recover no sooner than 2021 by the most optimistic predictions. And I am in the camp of those who are convinced that we are to see a massive recession ahead of us.

However, I will reiterate my point, which I expressed here before: shorting SPY before a clear bearish signal is outright insane.

I hope you all got enough popcorn as this show seems to have no end in sight, completely embracing the Maos formula: the worse the better.

The turning point it seems will be the end of the presidential elections, which, no matter the result will give the market some clarity as to the further direction of the US and the World. +It seems like the vaccine will be available by that time too. 4 more months to go till November.

Lets see how it goes!

Thank you for reading, like and subscribe>> I'll keep you updated!

SPX - Rejected off 3200 resistance againSPX500USD for the second time was rejected off 3200 resistance, but not as violent as a first time.

First good support is around 3130, ultimate support is 3000, but I doubt it will get this low this time.

Cautiously slightly more bearish here 'coz still under resistance. But not rush into positions here.

Hit the "LIKE" button and follow to support, thank you.

Information is just for educational purposes, never financial advice. Always do your own research.

NASDAQ Doesn't Make Any Sense Anymore! But let's earn some moneyWe know it's wrong. We know it's unsustainable. There's a Corona Crisis. There's unsustainable growth. There are huge unemployement issues. Crazy deathrates.

Stockmarkets are surging.

No, it doesn't make any sense. But to make a decision on this trade when the price hit this support zone so beautifully we have to look at the data. Purely based on technical analysis I expect the price to break out.

Okay, we could look at fundamental information like how the technology sector might not be negatively impacted by corona as much as the other sectors. Not just because their products are all online, and people have to arrange their whole life online right now. Also because the people who work for those companies are much more comfortable and capable working from home.

But hey, look at other markets that are not technology based. All green. All going up. This doesn't make any sense to me. Let's earn some money.

It already tried this level one time before, and only bounced back a little bit. With this second attempt on the resistance the bulls will be stronger and have left many bears behind them.

Follow me for consistent high quality updates, with clear explanations and charts.

Please like this post to support me.

- Trading Guru

--------------------------------------------------------------

Disclaimer!

This post does not provide financial advice. It is for educational purposes only!

SPY and S&P-500 - time for speculative short?TVC:SPX and AMEX:SPY are still forming triangle, and when it breaks we can expect that move in the direction of the breakout would be rather strong.

Nevertheless, for low risk entry (though also with much more uncertainty), trade may be attempted right now with stop just above previous high @294 and target as far ~275 area.

Again with such tight stop the failure rate is likely to be high, but potential reward is rather huge if succesful

Waiting for the market to catch up with reality..Nice running flat formation here. The .786 doesn't seem to be holding so the best target is the 1:1 (which is typically a standard target).

Could happen tomorrow or Wednesday, when the fed's July meeting minutes are reported. I'd recommend getting into position by tomorrow though because we could have a big jump in the opening price on Wednesday.

Target = $15.25

Big drop incoming. Wave 4 correctionAs you can see, I don't think the world is ending as many have said, although we are about to see the large drop in the market continue into 2020 and possibly for the next year or so.

I recommend using the VIX to make some money as that has been working for me because you can profit off of people's overreactions.

I have my retirement plans completely in cash until this shakes out and suggest all do the same. If I could put it in gold and silver I would.

We will break up to all time highs again most likely, but I don't see any reason to risk it and stay in the market right now.

The real crisis will come once we reach wave 5 at the top. That could be a dollar crisis or war of some kind that will bring the market back to fair value like in 99' or 08'.

Overall view of NAS100 or US markets - Update of June 24thAfter a retest of the resistance zone that carries the high of the year and the all-times high as well, US markets are subjected to selling pressure. Volatility is to be expected at the end of the week with US major news like the initial jobless claim, the GDP annualized or the G20 meeting. NAS100 and its correlated pairs are likely to move to the support zone unless they are brought to @7720.0.

Possible targets: @7500.0 (+1200pips or 120.0 per unit)

Advice: Stay bearish and sell at any high points while we don't break up the @7720.0 level.

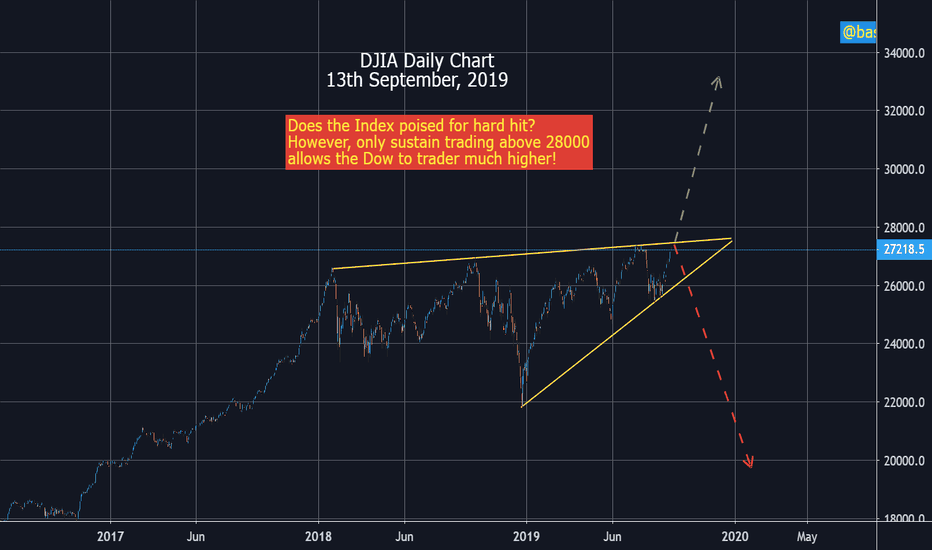

DOW JONES INDUSTRIAL AVERAGE DAILY CHARTDOW JONES INDUSTRIAL AVERAGE DAILY CHART

10th October, 2018

Back in July 26th we expected the recent sharp

drop. As showing in the chart this could be or even

get better level to buy for eventual all time high target

around 28000 area during the forthcoming weeks.