USOIL Trading Strategy: Secrets to Consistent ProfitsThe situation in the crude oil market has been complex recently.

On the supply side, it is affected by the uncertainty of the OPEC+ production increase plan, the recovery of U.S. shale oil production, and the potential supply risks in Iran.

On the demand side, due to the weak momentum of global economic recovery and trade disputes, demand has been suppressed. However, the rising market expectations of the Federal Reserve's interest rate cut may boost crude oil demand if the loose monetary policy is implemented.

In terms of inventory, although U.S. crude oil inventories have decreased slightly recently, there is still pressure for inventory accumulation, and the decline in the geopolitical risk premium has weakened the support for oil prices.

In the short - term, the crude oil price was blocked and retraced at the upper edge of the trading range. Eventually, it rebounded and recovered, yet failed to break through to a new high. The bullish and bearish forces are locked in a stalemate. Objectively, the short - term trend direction remains unclear, while subjectively, it is biased upward. It is expected that crude oil will break through the resistance at the upper edge of the range and continue to rise today, though with limited upside potential.

USOIL Trading Strategy

sell@68.5-69

tp:67-66.5

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Crude Oil WTI

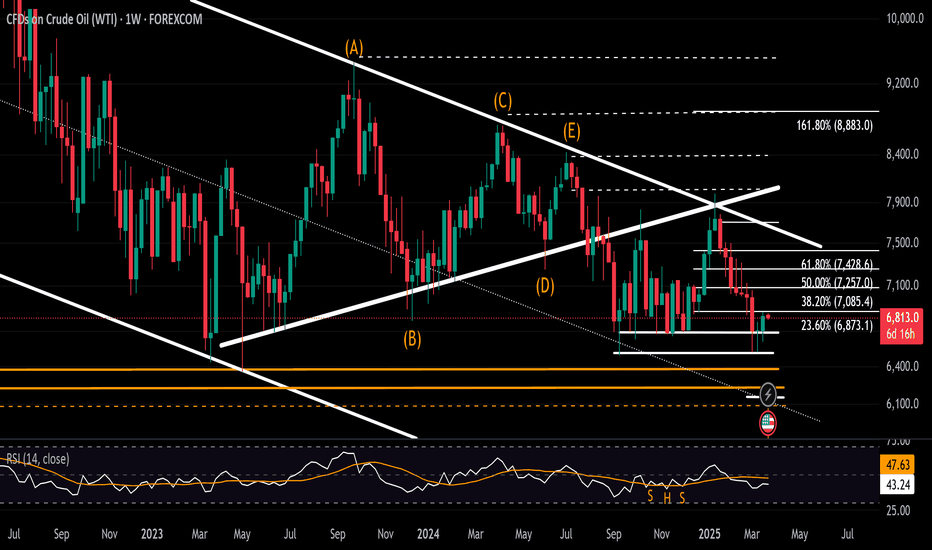

Crude Oil Week AheadFrom a weekly time frame perspective, oil prices have continued to respect the boundaries of a declining channel since the 2022 highs, reaching three-year lows in 2025, in alignment with the long-standing support zone between $64 and $66 that has held since 2021.

After recently rebounding from the $65 level, a decisive close below $63.80 would confirm further downside potential, opening the way toward key support levels at $60, $55, and, in more extreme scenarios, $49.

If the support zone holds, resistance levels within the declining channel may come into play at $70.80, $72.60, $74.30, and $76. A breakout above the channel’s upper boundary and a sustained hold above $78 could shift the outlook to bullish, with potential resistance at $80, $84, $89, and the $93–$95 range.

Despite a complex mix of OPEC quotas, U.S. policy shifts, Chinese economic dynamics, global growth uncertainty, renewable energy demand, and escalating geopolitical tensions, oil remains bearish and range-bound—awaiting a decisive breakout.

Written by Razan Hilal, CMT

USOIL Today's analysisUSOIL is at 68.335. Technically, I'm bearish short - term.

The strong resistance at 69.000 has repeatedly blocked upward moves. Heavy selling occurs near this level, making it a firm price cap.

There are two key supports. 67.000 has halted drops before. If breached, 66.30, a crucial level from past down - trends, comes into play.

With the price below 69.000, facing downward pressure and bearish sentiment, USOIL may decline soon. There's no strong bullish factor to push it higher. The downward - sloping momentum and proximity to supports suggest a downward path. Traders should be cautious and might consider short - term short positions, with risk control, as the price may test 67.000 first, then 66.300 if the bearish trend persists.

💎💎💎 USOIL 💎💎💎

🎁 Sell@68.500 - 69.000

🎁 TP 67.000 - 66.300

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

WTI Oil H4 | Rising into 50% Fibonacci retracementWTI oil (USOIL) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 69.23 which is a pullback resistance that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 70.70 which is a level that sits above the 61.8% Fibonacci retracement and a multi-swing-high resistance.

Take profit is at 66.44 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Market Analysis: WTI Crude Oil Face HurdlesMarket Analysis: WTI Crude Oil Face Hurdles

Crude oil is attempting a recovery wave but upsides could be limited.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil prices started a recovery wave from the $66.00 support zone.

- There is a key bullish trend line forming with support at $67.50 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price remained in a bearish zone below the $70.00 level against the US Dollar. The price started a fresh decline below the $68.00 support.

The price even dipped below the $67.50 level and the 50-hour simple moving average. Finally, the bulls appeared near $66.00 and the price started a recovery wave. The price recovered above $67.50 and tested the $68.50 zone.

The price is now consolidating gains below the 23.6% Fib retracement level of the upward move from the $66.54 swing low to the $68.48 high. There is also a key bullish trend line forming with support at $67.50.

If there is a fresh increase, it could face resistance near the $68.30 level. The first major resistance is near the $68.50 level. Any more gains might send the price toward the $69.20 level.

The main resistance could be near the $70.00 level. Conversely, the price might continue to move down and revisit the $67.50 support and the 50% Fib retracement level of the upward move from the $66.54 swing low to the $68.48 high. The next major support on the WTI crude oil chart is $67.00.

If there is a downside break, the price might decline toward $66.55. Any more losses may perhaps open the doors for a move toward the $66.10 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

WTI Price Analysis: Key Insights for Next Week Trading DecisionOil prices are showing signs of recovery after a strong bearish move, with $68.00 as a key level that will play a significant role in guiding our trading decisions for the new week.

📌 Key Technical Outlook:

🔹 Oil is currently trading within an ascending channel on the 4H timeframe.

🔹 I’ll be watching for a breakout/retest of the channel resistance and $68.50 for buying opportunities.

🔹 If selling pressure remains below the resistance line of the channel and the $68.00 key level, I will be considering selling opportunities.

📌 Major Market Drivers:

🔹 US Sanctions on Iran: The US Treasury imposed new sanctions targeting entities involved in supplying Iranian crude oil to China. Analysts expect a 1 million bpd drop in Iranian exports, which could support prices.

🔹 OPEC+ Production Cuts: A new plan will see seven member nations cut production by 189,000–435,000 bpd per month until June 2026.

🔹 Geopolitical Risks: Ongoing tensions in the Middle East & the Russia-Ukraine war continue to add a risk premium to oil prices.

📅 Key Economic Events on Our Radar Next Week:

🛢 Tuesday: API Crude Oil Stock Report – Offers insight into US oil inventory levels.

🛢 Wednesday: EIA Crude Oil Inventories Report – A key supply indicator affecting price movements.

🗓 Tuesday: US S&P Global PMI – Important for economic sentiment and demand expectations.

🗓 Thursday: US GDP (Q4 Final) – Provides clues on economic growth and potential impact on oil demand.

🗓 Friday: US Core PCE Index – The Fed’s preferred inflation measure, critical for policy direction.

Oil remains bullish in the short term, but I’ll be monitoring price action closely at $68.00 and $68.50 for trade setups. We’ll break it all down in Forex Morning Mastery tomorrow—stay tuned! 🔥📈

Light Crudeoil Futures hourly trend forecast for March 24, 2025According to my analysis, this commodity is at its strong resistance at 68.46 and the likely support levels are at 67.56 and 66.83.

According to my "Advanced Market Timing" indicator, Light Crudeoil Futures is likely to see a bearish trend and then bounce back.

Those who trade are suggested to use your own technical studies for entries, stops and exits.

WTI - Positioning for Upside After Anticipated CorrectionThe US Light Crude 4-hour chart shows price action currently oscillating near the $68,60 level after recovering from early March lows. The recent price structure suggests we may see a short-term pullback before a stronger upward move develops. The chart indicates a potential bullish scenario with price expected to eventually rally toward the blue reaction zone (around $69,00-$69,50) after a possible retracement. This anticipated upside move is supported by the higher lows forming since mid-March and the overall recovery pattern from the $65,67 support level (marked by the red line). A prudent approach would be monitoring for reversal signs at lower levels before positioning for the higher probability move toward the blue reaction zone, with the orange resistance at $70,77 serving as the ultimate target if bullish momentum accelerates.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL Technical Analysis! SELL!

My dear friends,

My technical analysis for USOIL is below:

The market is trading on 68.25 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish Bearish continuation.

Target - 67.21

Recommended Stop Loss - 68.91

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

USOIL in Limbo: Will 66 Holdor70 Break? Next week, the trend of USOIL still remains highly uncertain. Technically, the current price is continuously fluctuating within a range. Around $70 serves as a strong resistance level, while $66.05 is a key support level.

Fundamentally, the tense geopolitical situation and the supply decisions of OPEC+ provide some support for oil prices. However, the slowdown in global economic growth, coupled with the increase in US crude oil production, exerts downward pressure on oil prices.

Barring unforeseen events, USOIL is likely to trade in the range of $66 - $70. Once the key levels are broken through, the direction of the trend will become clear. In terms of trading operations, it is recommended to adopt a "buy low and sell high" strategy within the range of $67.5 - $69.5.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL SHORT FROM RESISTANCE

USOIL SIGNAL

Trade Direction: short

Entry Level: 68.25

Target Level: 65.67

Stop Loss: 69.99

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

WATCH OUT FOR OIL'S DESCENDING TRIANGLE...A potential close above 70 will signal the likelihood of oil price to test trendline is sloping downward or the bearish order candle.

N.B!

- USOIL price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#usoil

#wti

#ukoil

WTI Crude Oil The Week Ahead 24th March '25WTI Crude Oil bearish & oversold, the key trading level is at 69.50

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

BRIEFING Week #12 : Alt-Season might be coming soonHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

USOIL: Short Trade with Entry/SL/TP

USOIL

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short USOIL

Entry - 68.25

Sl - 68.94

Tp - 67.09

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

WTI CRUDE OIL: Hard rebound on 1.5 year support targeting $72.WTI Crude Oil is neutral on its 1D technical outlook (RSI = 48.748, MACD = -1.080, ADX = 23.603), which indicates the slow transition from a bearish trend to bullish. This started when the price hit the S1 level, a 1.5 year Support, and bottomed. The slow rebound that we're having since formed a Channel Up on a bullish 1D RSI, much like the one in September 2024, which eventually peaked after a +10.70% price increase. A similar rebound is expected to test the 1D MA200. The trade is long, TP = 72.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USOil The Final dealBased on current market conditions, we predict an upward movement for USOil.

The first resistance level is set at 69.000. This level has proven to be a significant hurdle in previous price actions, with selling pressure often emerging as the price approaches it.

However, given the current positive momentum, there's a strong likelihood of breaking through this resistance.

On the downside, the primary support level stands at 67.000. This level has been tested multiple times and has held firm, acting as a floor for the price.

Below this, we have a second support at 66.500. This secondary support is crucial as it provides an additional buffer against significant price drops. If the price manages to stay above the 67.000 support, the upward trend is likely to continue towards the 69.000 resistance and potentially beyond.

💎💎💎USOil 💎💎💎

🎁 Buy@67.500 - 67.700

🎁 TP 68.800 - 69.000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

OIL Today's strategyCurrently, crude oil prices are fluctuating near the resistance level. Recently, the increase in US crude oil inventories has affected the supply dynamics and exerted certain pressure on oil prices. However, overall, the geopolitical tensions and supply risks have a relatively significant supporting effect on oil prices at present.

OIL Today's strategy

sell@68.5-68.8

buy:67.2-67.6

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses

CRUDE OIL Free Signal! Sell!

Hello,Traders!

CRUDE OIL made a sharp

And sudden move up

And it seems that it will

Soon hit a horizontal

Resistance level of 68.80$

From where we can go short

On Oil with the TP of 67.67$

And the SL of 68.87$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.