USOIL Bulls Seize a New OpportunityThe EIA crude oil inventory data is scheduled for release today and is expected to have a significant impact on USOIL prices. Based on the previously released API report, there’s a high probability that the EIA data will also be bullish.

From a technical perspective, USOIL is currently showing signs of a potential rebound. Therefore, for traders participating in USOIL today, it may be more favorable to adopt a bullish bias. If managed well around key support levels and timing, the setup could offer attractive profit opportunities.

Usoilbuy

USOIL:Narrow trading strategy

USOIL: There is no update in the past two days, because the oil price still continues to fluctuate in a narrow range, and the space for volatility is gradually reduced, which is not very different from our overall trading idea. The original long target of 65.9-66.4 can be adjusted to 65.8-66.2 with the reduction of the space for volatility. It is expected that the trend will come out this week, and we will adjust our thinking then.

Friends who do not trade at present can refer to the interval trading strategy within a day:

BUY@64.7-65

TP: 65.8 to 66.2

SELL@65.8-66.2

TP: 64.7-65

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

USOIL:Today's trading strategy

Oil prices have been sideways for the fourth trading day, volatility began to narrow, the market is brewing a new round of trend, short-term range 64-66.4. Today you can sell high and buy low around a narrow range.

Trading Strategy:

BUY@64.7-65.1

TP: 65.9-66.4

SELL: 66-66.4

TP: 65.1-64.5

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

USOIL Expected to Rebound to the 68–70 ZoneUSOIL has shown signs of short-term overselling, and a technical rebound is likely during today’s session. Traders participating in crude oil can consider buying on dips, focusing on short-term opportunities with proper position management. Quick entries and exits are recommended.

USOIL:Go short before you go long

The idea of crude oil is still to go long. Today, the more appropriate entry point is 72-72.3, there is still a little space at present, if you consider selling short first, then the more appropriate short point is 73-73.3 range. Give to the point to do, to wait to do more.

Trading Strategy:

SELL@73-73.3

TP: 72-72.3

BUY@72-72.3

TP: 73.7-74

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL 1 - Hour Chart AnalysisUSOIL 1 - Hour Chart Analysis

Key Levels

Support: ~69.50 (short - term), 67.70 (critical backup).

Resistance: 73.50 (major hurdle, tested before).

Trend, Pattern & Middle East Conflict

Price oscillates between support/resistance, with a potential “V - shaped reversal”. Middle East conflicts add high uncertainty:

Escalation: Fears of supply cuts could push price above 73.50 rapidly.

De - escalation: May pressure price down, but 67.70/69.50 still get support from lingering supply - risk worries.

Trading Strategies

Bullish: If 69.50 holds (e.g., long lower shadows/bullish candles), small - size long. Target 73.50; stop - loss ~69.20. Watch for sudden conflict news.

Bearish: If 69.50 breaks (consecutive closes below), short. Target 67.70; stop - loss ~69.80. Stay alert to conflict updates.

Note: Oil prices hinge on supply - demand, Middle East tensions, and the USD. Combine tech/fundamental analysis; manage risk strictly.

⚡️⚡️⚡️ USOil ⚡️⚡️⚡️

🚀 Buy@ 70.50 - 71.00

🚀 TP 73.00 - 74.00

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Today's Crude Oil Trend Analysis and Trading RecommendationsFrom a daily chart perspective, the violent rally in USOIL driven by external factors has completely disrupted prior technical expectations. The sharp surge has also significantly exhausted future upside potential, explaining today's gap-up and subsequent decline. With minimal likelihood of near-term de-escalation in the Iran situation, USOIL is likely to remain bullish. However, severe overbought conditions on technical charts have disrupted structural expectations, necessitating a price correction.

Technically, the $70-$75 range serves as a reasonable short-term consolidation zone, contingent on no severe escalation in Iran tensions. Given the high probability of worsening tensions, USOIL may retest $75 and even challenge $80 driven by geopolitical developments.

Thus, while the market remains focused on Iran-related risks, the short-term bias remains bullish. Avoid chasing the rally recklessly. Focus on the $70.5-$71.5 pullback zone early in the week—consider long entries only after price consolidation in this area.

USOIL

buy@70.50-71.50

tp:74-76-78

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

Next Week's Crude Oil Trend Analysis and Trading RecommendationsThe continued escalation of geopolitical tensions in the Middle East remains the core driver propelling oil prices higher. With U.S.-Iran relations at a critical juncture and the Ukrainian attack on the Crimean Bridge exacerbating the Russia-Ukraine conflict, markets are increasingly concerned about potential disruptions to Black Sea crude exports. As a key channel for 2% of global crude oil supplies, risks to Black Sea exports directly threaten supply chain security, triggering a surge in short-term market risk aversion and driving oil prices sustainably higher.

Since crude oil broke through the $64.8 resistance level with a solid candlestick last week, we have maintained a consistent bullish stance. After two weeks of consolidative oscillations, prices finally broke free from the trading range, fully demonstrating the dominance of bullish momentum. When oil prices pulled back to the $71.5–$72.0 range last Friday, we once again emphasized the short-term long strategy, which was subsequently followed by a sharp rally catalyzed by news developments. With the current trend clearly defined, we advise trading in line with the momentum: short-term long positions can be initiated above $71.0 at the start of the week.

USOIL

buy@71-72

tp:75-78

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

In - depth: USOIL 1 - hr Chart - Significance of 60.00 Support In the USOIL 1 - hour chart, 60.00 acts as a strong support 💪.

Support Validation

The price twice failed to break 60.00 and rebounded 📈. Psychologically, investors see 60.00 as a key level 🔑. Approaching it, buy orders pour in as they think crude oil is undervalued 📉. Technically, it's on a support line from prior lows, and repeated tests have fortified its support 🛡️.

⚡️⚡️⚡️ USOil ⚡️⚡️⚡️

🚀 Buy@ 60.00 - 60.60

🚀 TP 62.50 - 62.80

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

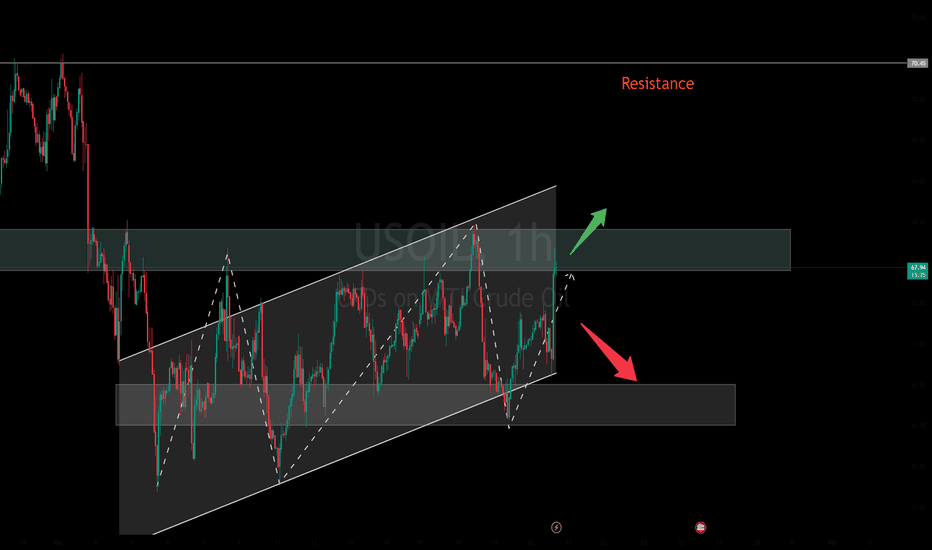

USOIL Opening Trends and Trading Strategies Next WeekTrend Analysis

As shown in the chart, in the 1 - hour time frame, USOIL is moving within an upward - trending channel 📈. This channel is defined by two trendlines, and the price is fluctuating upwards within it. Although there have been pullback trends during this period, the overall trend remains upward. This indicates that in the short term, the bullish forces are relatively dominant, driving the price to gradually climb 📈. However, the frequent price fluctuations also reflect a certain degree of game - playing between the bulls and bears in the market 🤺.

⚡⚡⚡ USOIL ⚡⚡⚡

🚀 Buy@61.5 - 62.0

🚀 TP 63.5 - 65.0

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟

USOIL: Next Week's Blueprint for Profit Amid VolatilityDuring the US trading session on Friday, March 28th, international oil prices fluctuated slightly and declined. However, both Brent crude oil and WTI crude oil remained firmly near their one - month highs and were projected to register "three consecutive weekly gains" on the weekly chart. The ongoing tug - of - war between the supply tightness instigated by geopolitical unrest and the latent concerns regarding an economic downturn has placed oil prices in a volatile state of being "caught between a rock and a hard place".

From the perspective of the USOIL daily chart, following the medium - term trend's breach of the lower edge of the range, it has predominantly fluctuated around lower levels. The oil price has experienced consecutive short - term increases, breaking through the suppression of the moving average system, and the medium - term objective trend has entered a transition phase. Nevertheless, in terms of kinetic energy, neither the bulls nor the bears have demonstrated a clear - cut inclination to overpower the other. It is anticipated that the medium - term trend will persist in its volatile rhythm for a while, awaiting the establishment of a distinct trend direction.

The short - term (1H) trend of USOIL has not continuously set new highs and has exhibited a pattern of high - level consolidation. The short - term objective trend remains upward. In the early trading session, the oil price underwent a narrow adjustment at a high level, presenting an overall secondary rhythm with a sound internal rhythm. The fundamental objective trend during the week has been upward in sync, and it is highly likely that the short - term trend of USOIL will continue its upward trajectory next week.

USOIL

buy@68-68.5

tp:69.5-70

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL: Rally, Resistance, and Technical ReversalThe recent trend of USOIL has been continuously rising in a volatile manner, and the current intraday price has reached a three - week high.

Currently, the bullish sentiment in the market is greatly influenced by fundamental news, mainly due to the combined effects of the United States increasing sanctions on Iran's energy and the ineffective and substantive implementation of the 30 - day cease - fire agreement between Russia and Ukraine.

Analyzing the short - term trend from the one - hour chart of USOIL, during the US trading session last night, the crude oil price surged again, hitting the resistance of $69.5 in the market. However, after encountering resistance, part of the bullish momentum took profits and fled, and the price slightly retreated to the support of $69 without further decline.

After today's opening, the bullish momentum was obviously insufficient, and the price did not rise further. The upper track of the Bollinger Bands extended downward, exerting pressure. The moving average of the Macd indicator formed a cross at a high level and has a downward extension trend, and the momentum column began to release downward.

USOIL Trading strategy

Sell@69.5-69

tp:68-67.5

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL Trading Strategy: Secrets to Consistent ProfitsThe situation in the crude oil market has been complex recently.

On the supply side, it is affected by the uncertainty of the OPEC+ production increase plan, the recovery of U.S. shale oil production, and the potential supply risks in Iran.

On the demand side, due to the weak momentum of global economic recovery and trade disputes, demand has been suppressed. However, the rising market expectations of the Federal Reserve's interest rate cut may boost crude oil demand if the loose monetary policy is implemented.

In terms of inventory, although U.S. crude oil inventories have decreased slightly recently, there is still pressure for inventory accumulation, and the decline in the geopolitical risk premium has weakened the support for oil prices.

In the short - term, the crude oil price was blocked and retraced at the upper edge of the trading range. Eventually, it rebounded and recovered, yet failed to break through to a new high. The bullish and bearish forces are locked in a stalemate. Objectively, the short - term trend direction remains unclear, while subjectively, it is biased upward. It is expected that crude oil will break through the resistance at the upper edge of the range and continue to rise today, though with limited upside potential.

USOIL Trading Strategy

sell@68.5-69

tp:67-66.5

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL in Limbo: Will 66 Holdor70 Break? Next week, the trend of USOIL still remains highly uncertain. Technically, the current price is continuously fluctuating within a range. Around $70 serves as a strong resistance level, while $66.05 is a key support level.

Fundamentally, the tense geopolitical situation and the supply decisions of OPEC+ provide some support for oil prices. However, the slowdown in global economic growth, coupled with the increase in US crude oil production, exerts downward pressure on oil prices.

Barring unforeseen events, USOIL is likely to trade in the range of $66 - $70. Once the key levels are broken through, the direction of the trend will become clear. In terms of trading operations, it is recommended to adopt a "buy low and sell high" strategy within the range of $67.5 - $69.5.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL Market Analysis and Tactical InsightsCurrently, USOIL is trading around $67 per barrel.

On the supply side, while OPEC+ plans to increase production, ongoing geopolitical tensions in the Middle East are adding supply uncertainties.

On the demand side, U.S. fuel demand remains resilient, but the subdued global economic outlook may limit crude oil demand growth.

Technically, the daily chart shows moving averages in a bearish alignment, though the short - term RSI suggests relative market strength.

If the price rebounds and faces resistance near $67.9, consider a light short with a target of $66.

If the price stabilizes around $66, a long could be considered, with a target of $67.

USOIL Trading Strategy

sell@67.5-68

tp:66

buy@66

tp:67

I will share trading signals daily. All signals have been consistently accurate for an entire month. If you need them, you can check my profile for more information.

Next Week's Trading Blueprint for USOILThis week, U.S. crude oil closed at $67.18, with a weekly increase of 0.2%. Next week, there is sufficient upward momentum. The United States has tightened sanctions on Iran, and there is a risk of supply contraction. Moreover, the decline in U.S. gasoline inventories far exceeds expectations, indicating strong demand. Technically, if the key resistance level of $69.00 is breached, an upward space will be opened, and the bullish forces are expected to push up the price of U.S. crude oil.

USOIL Trading Strategy for Next Week:

buy@ 65-66.5

tp:69-70

I firmly believe realized profit and a high win - rate are the best measures of trading skill. Daily, I share highly precise trading signals. These include clear entry points, stop - loss levels for risk control, and profit - taking targets from in - depth analysis. Follow me for big financial market returns. Click my profile for a trading guide on trends, strategies, and risk management.

LONG ON USOILOil is currently rising from a major demand zone.

It has broken out of a nice double/triple bottom and a downtrend line.

I expect price to tap into the demand zone as a pullback from its recent break of a high and then continue to rise.

I am buying oil and expecting it to rise to the next supply level for just about 200 pips or a $2 move on.

Oil Prices in Stagnation: A Moment to Await the ReboundSince the recent sharp decline, the movement of oil prices has been notably flat compared to gold, leaving many of us feeling quite exasperated. Is it really true that oil prices won’t rebound after such a drop? Are you, like me, growing increasingly impatient?

I believe we should exercise a bit more patience; today, oil prices should be able to rise above $72. I always remember the saying: “The longer the sideways movement, the greater the potential up or down movement.”

This means that the duration of a sideways consolidation will determine the magnitude of the subsequent rise or fall.

Let’s continue to be patient and anticipate the moment of oil price rebound.

USOIL: BUY

Oil prices have experienced a significant decline due to recent news, with the market oscillating within established support zones. Today's API data is bullish; however, it has not resulted in a notable price increase, nor has it breached the support levels.

As the EIA data release approaches, the likelihood of a positive impact remains high, suggesting a potential for a substantial upward movement. Our trading outlook leans towards buying, positioning for an anticipated rally in oil prices

W-Formation in USOIL Signals a Strong Bullish Opportunity

USOIL has formed a classic W-bottom pattern, with the only remaining resistance around the MA30. There is a high probability of a breakout, making this an ideal time to go long.

If you have been holding a long position and were concerned about it, congratulations—you're likely to see a favorable outcome soon. Moreover, if your available capital allows, this is a strong opportunity to add to your position and maximize potential gains.

Why Accumulation Signals a Bullish Future for USOILH ello,

Per the green dotted lines, large players seem to accumulate USOIL. The rising volume data on the bottom chart backs this claim.

The price action resolves within a falling channel. This kind of channel usually breaks upwards. The combination of the bullish channel and the accumulative sentiment signals a bullish future for USOIL.

The same approach was profitable in 2022 and formed a successful trade until July 2022. Unless USOIL breaks the green support zone downward, I expect a bullish outcome in the upcoming long position.

Regards,

Ely