USOil:Profit realized by shorting on reboundsOn Thursday, crude oil dipped and then rallied towards the end of the trading session, reaching a low of around 69.1. Today, it rebounded to around 69.8 and then started to decline. The short-selling strategy implemented in the morning resulted in a profit.

Next, attention should be paid to whether the upper resistance level of 70 can be broken through. If it cannot be broken through in a short period of time, consider shorting again during the subsequent rebound.

USOIL Trading Strategy:

Sell@69.7-70

TP:68.5-68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Usoilshort

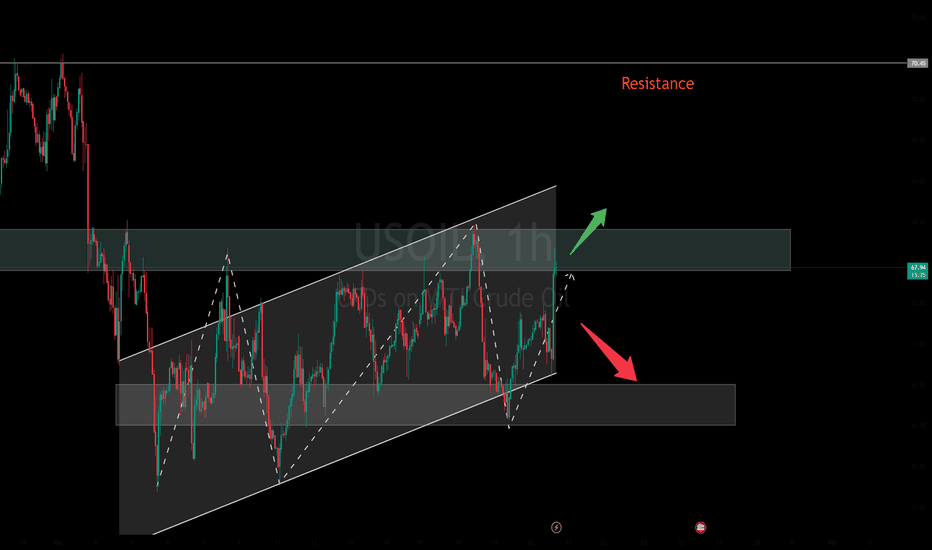

USOil:When it rebounds to the resistance, continue go shortIn terms of crude oil, in the short term, with the decline in US crude oil inventories, the escalation of US sanctions against Iran and Venezuela, and the resumption of hostilities between Russia and Ukraine, efforts at reconciliation have been ineffective. Therefore, the short-term market has hyped up the reduction in crude oil supply, causing crude oil to fluctuate repeatedly at high levels without being able to decline. However, as tariffs are upgraded and concerns about the global economic downturn intensify, the demand for crude oil has further decreased. At the same time, in order to control inflation, the control of crude oil prices remains a top priority.

Therefore, the medium- to long-term downward trend remains unchanged. Currently, from a technical perspective, when crude oil rebounds to the resistance level, it is advisable to continue taking short positions as before.

USOIL Trading Strategy:

Sell@69.7-70

TP:68.5-68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Continue to be bearish.Supply : The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the second time in May. The 30-day ceasefire agreement between Russia and Ukraine has not been effectively implemented in substance. However, recently, the United States, Russia, and Ukraine have reached some consensus on Black Sea navigation and the protection of energy facilities.

From a technical perspective, when the price repeatedly encounters resistance below an important resistance level and fails to achieve an effective breakthrough, it is often a bearish signal. This implies that the selling force in the market is dominant. Once the price starts to retrace due to its inability to break through the resistance, it may initiate a downward trend. Therefore, based on the strong resistance level at 70.000, there is a certain basis in technical analysis for a bearish outlook.

💎💎💎 USOIL 💎💎💎

🎁 Sell@70.000 - 70.200

🎁 TP 68.5 68.0 67.5

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

USOIL:Pay attention to the short-term adjustmentCurrently, in the 4-hour time frame, the crude oil price is temporarily maintaining a high-level oscillatory consolidation. However, after consecutive periods of oscillation, there are signs that the technical pattern is gradually weakening. The short-term moving averages are beginning to gradually turn downward and diverge, and the K-line is starting to be under pressure from the short-term moving averages, maintaining a slightly weaker operating trend. It is believed that there may still be a certain room for adjustment in the short-term trend. In terms of trading operations, consider the short position opportunity around 69.7-70.

USOIL Trading Strategy:

Sell@69.7-70

TP:68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL Strategy DiscussionThis week, we've analyzed the reasons behind the short - term strong performance of crude oil. We specifically remind you to pay attention to the price movements within the range of $68.5 - $69.5.

Once again, we advise you to observe more and trade less.

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income,You can follow the link below this article

USOIL:It's time to go shortRecently, the WTI crude oil has been on a continuous upward trend with fluctuations. The current intraday price has reached a three - week high. At present, the long - position sentiment in the market is greatly influenced by the fundamental news, mainly due to the intensified U.S. sanctions on Iranian energy and the ineffective implementation of the 30 - day cease - fire agreement between Russia and Ukraine.

Today's trading strategy: Focus on shorting at high levels. Currently, the price has a firm support at $69. Observe whether it can reach the resistance range of $69.5 again. If it breaks through the upper level, look at the important psychological resistance level of $70. Select to short again within the range.

USOIL Trading Strategy:

Sell@69.5-70

TP:68-67

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOil:When to short at high levels?During the evening session yesterday, the price of crude oil surged again, reaching the resistance level of 69.5 per barrel in the session. However, after encountering resistance, part of the bullish momentum took profits and fled the market, causing the price to decline slightly to the support level of 69 per barrel without further drops.

After today's opening, the bullish momentum is obviously insufficient, and the price has not risen further, showing a downward extension trend.

Today's trading strategy: Focus on taking short positions at relatively high levels. Currently, the support at 69 per barrel is relatively solid. Observe whether the price can reach the resistance range of 69.5 per barrel again. If it breaks through upwards, look at the important psychological resistance level of 70 per barrel. Choose to take short positions again within the range of 69.5 - 70 per barrel, with the target price at $68 per barrel. Participate with a small position.

USOIL Trading Strategy:

Sell@68.5-69

TP:68-67

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL:Bide one's timeThis week, we've analyzed the reasons behind the short - term strong performance of crude oil. We specifically remind you to pay attention to the price movements within the range of $68.5 - $69.5.

Once again, we advise you to observe more and trade less.

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income,You can follow the link below this article

USOIL: Rally, Resistance, and Technical ReversalThe recent trend of USOIL has been continuously rising in a volatile manner, and the current intraday price has reached a three - week high.

Currently, the bullish sentiment in the market is greatly influenced by fundamental news, mainly due to the combined effects of the United States increasing sanctions on Iran's energy and the ineffective and substantive implementation of the 30 - day cease - fire agreement between Russia and Ukraine.

Analyzing the short - term trend from the one - hour chart of USOIL, during the US trading session last night, the crude oil price surged again, hitting the resistance of $69.5 in the market. However, after encountering resistance, part of the bullish momentum took profits and fled, and the price slightly retreated to the support of $69 without further decline.

After today's opening, the bullish momentum was obviously insufficient, and the price did not rise further. The upper track of the Bollinger Bands extended downward, exerting pressure. The moving average of the Macd indicator formed a cross at a high level and has a downward extension trend, and the momentum column began to release downward.

USOIL Trading strategy

Sell@69.5-69

tp:68-67.5

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

OIL Today's strategyYesterday, prices were affected by tightening expectations on the supply side, geopolitics and other factors, and the trend was strong, breaking through $69.

Today, it is fluctuating above $69, and another wave of gains is expected. At the same time, we need to pay close attention to the situation in the $68.5-69.5 area and adjust it at any time

usoil buy@68.3-68.7

tp:69.5-70

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income, you can contact me

USOil:Wait for rebound to shortThe market movement on Friday was not significant. The intraday high was reached at the opening in the morning, hitting a peak of $68.65, while the low was at $67.65. The maximum intraday fluctuation was just $1, and the price trend showed a shallow V - shape. Considering that Trump is bound to end the Russia - Ukraine conflict over the weekend, crude oil will likely remain bearish in the short term. Therefore, today's market is generally expected to rise first and then decline under pressure again.

USOIL Trading Strategy:

Sell@68.5-69

TP:67-66

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL Trading Strategy: Secrets to Consistent ProfitsThe situation in the crude oil market has been complex recently.

On the supply side, it is affected by the uncertainty of the OPEC+ production increase plan, the recovery of U.S. shale oil production, and the potential supply risks in Iran.

On the demand side, due to the weak momentum of global economic recovery and trade disputes, demand has been suppressed. However, the rising market expectations of the Federal Reserve's interest rate cut may boost crude oil demand if the loose monetary policy is implemented.

In terms of inventory, although U.S. crude oil inventories have decreased slightly recently, there is still pressure for inventory accumulation, and the decline in the geopolitical risk premium has weakened the support for oil prices.

In the short - term, the crude oil price was blocked and retraced at the upper edge of the trading range. Eventually, it rebounded and recovered, yet failed to break through to a new high. The bullish and bearish forces are locked in a stalemate. Objectively, the short - term trend direction remains unclear, while subjectively, it is biased upward. It is expected that crude oil will break through the resistance at the upper edge of the range and continue to rise today, though with limited upside potential.

USOIL Trading Strategy

sell@68.5-69

tp:67-66.5

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL Today's analysisUSOIL is at 68.335. Technically, I'm bearish short - term.

The strong resistance at 69.000 has repeatedly blocked upward moves. Heavy selling occurs near this level, making it a firm price cap.

There are two key supports. 67.000 has halted drops before. If breached, 66.30, a crucial level from past down - trends, comes into play.

With the price below 69.000, facing downward pressure and bearish sentiment, USOIL may decline soon. There's no strong bullish factor to push it higher. The downward - sloping momentum and proximity to supports suggest a downward path. Traders should be cautious and might consider short - term short positions, with risk control, as the price may test 67.000 first, then 66.300 if the bearish trend persists.

💎💎💎 USOIL 💎💎💎

🎁 Sell@68.500 - 69.000

🎁 TP 67.000 - 66.300

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

WTI Price Analysis: Key Insights for Next Week Trading DecisionOil prices are showing signs of recovery after a strong bearish move, with $68.00 as a key level that will play a significant role in guiding our trading decisions for the new week.

📌 Key Technical Outlook:

🔹 Oil is currently trading within an ascending channel on the 4H timeframe.

🔹 I’ll be watching for a breakout/retest of the channel resistance and $68.50 for buying opportunities.

🔹 If selling pressure remains below the resistance line of the channel and the $68.00 key level, I will be considering selling opportunities.

📌 Major Market Drivers:

🔹 US Sanctions on Iran: The US Treasury imposed new sanctions targeting entities involved in supplying Iranian crude oil to China. Analysts expect a 1 million bpd drop in Iranian exports, which could support prices.

🔹 OPEC+ Production Cuts: A new plan will see seven member nations cut production by 189,000–435,000 bpd per month until June 2026.

🔹 Geopolitical Risks: Ongoing tensions in the Middle East & the Russia-Ukraine war continue to add a risk premium to oil prices.

📅 Key Economic Events on Our Radar Next Week:

🛢 Tuesday: API Crude Oil Stock Report – Offers insight into US oil inventory levels.

🛢 Wednesday: EIA Crude Oil Inventories Report – A key supply indicator affecting price movements.

🗓 Tuesday: US S&P Global PMI – Important for economic sentiment and demand expectations.

🗓 Thursday: US GDP (Q4 Final) – Provides clues on economic growth and potential impact on oil demand.

🗓 Friday: US Core PCE Index – The Fed’s preferred inflation measure, critical for policy direction.

Oil remains bullish in the short term, but I’ll be monitoring price action closely at $68.00 and $68.50 for trade setups. We’ll break it all down in Forex Morning Mastery tomorrow—stay tuned! 🔥📈

USOIL in Limbo: Will 66 Holdor70 Break? Next week, the trend of USOIL still remains highly uncertain. Technically, the current price is continuously fluctuating within a range. Around $70 serves as a strong resistance level, while $66.05 is a key support level.

Fundamentally, the tense geopolitical situation and the supply decisions of OPEC+ provide some support for oil prices. However, the slowdown in global economic growth, coupled with the increase in US crude oil production, exerts downward pressure on oil prices.

Barring unforeseen events, USOIL is likely to trade in the range of $66 - $70. Once the key levels are broken through, the direction of the trend will become clear. In terms of trading operations, it is recommended to adopt a "buy low and sell high" strategy within the range of $67.5 - $69.5.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOil The Final dealBased on current market conditions, we predict an upward movement for USOil.

The first resistance level is set at 69.000. This level has proven to be a significant hurdle in previous price actions, with selling pressure often emerging as the price approaches it.

However, given the current positive momentum, there's a strong likelihood of breaking through this resistance.

On the downside, the primary support level stands at 67.000. This level has been tested multiple times and has held firm, acting as a floor for the price.

Below this, we have a second support at 66.500. This secondary support is crucial as it provides an additional buffer against significant price drops. If the price manages to stay above the 67.000 support, the upward trend is likely to continue towards the 69.000 resistance and potentially beyond.

💎💎💎USOil 💎💎💎

🎁 Buy@67.500 - 67.700

🎁 TP 68.800 - 69.000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

USOIL Market Analysis and Tactical InsightsCurrently, USOIL is trading around $67 per barrel.

On the supply side, while OPEC+ plans to increase production, ongoing geopolitical tensions in the Middle East are adding supply uncertainties.

On the demand side, U.S. fuel demand remains resilient, but the subdued global economic outlook may limit crude oil demand growth.

Technically, the daily chart shows moving averages in a bearish alignment, though the short - term RSI suggests relative market strength.

If the price rebounds and faces resistance near $67.9, consider a light short with a target of $66.

If the price stabilizes around $66, a long could be considered, with a target of $67.

USOIL Trading Strategy

sell@67.5-68

tp:66

buy@66

tp:67

I will share trading signals daily. All signals have been consistently accurate for an entire month. If you need them, you can check my profile for more information.

OIL Today's strategyCurrently, crude oil prices are fluctuating near the resistance level. Recently, the increase in US crude oil inventories has affected the supply dynamics and exerted certain pressure on oil prices. However, overall, the geopolitical tensions and supply risks have a relatively significant supporting effect on oil prices at present.

OIL Today's strategy

sell@68.5-68.8

buy:67.2-67.6

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses

USOIL Strategy AnalysisInternational crude oil prices have been trending sideways-to-downward recently. As of March 19, WTI crude oil was priced at $66.58/barrel, marking a cumulative decline of over 7% since the beginning of the year. The current core market contradiction focuses on the dual pressures of loose supply expectations and divergent demand prospects.

Oil trading strategy:

sell @ 68.2

buy @ 66

If you are currently unsatisfied with your crude oil trading performance and need daily accurate trading signals, you can visit my profile for free strategy updates every day.

USOil: The trading strategy is to continue shortingYesterday, crude oil prices peaked and then witnessed a sharp decline, directly plunging through the upward gap that opened at the beginning of the week.

The current market situation is at the initial stage of a downtrend. It is projected that after rebounding to the range of 67.00 - 67.80, the downward movement will resume. Moreover, the strength of today's rebound indicates relatively feeble upward momentum, and market sentiment leans towards caution.

Consequently, today's trading strategy will mainly focus on shorting on rebounds. Traders should wait for the market to rebound to key resistance levels before entering the market.

USOIL Trading Strategy:

Sell@67.7-68.3

TP:66-65

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.

Buy directlySupply and Demand Aspect

Supply: In 2025, the expected increment in global crude oil supply has been generally lowered. The production increase in non-OPEC+ countries is limited, and the actual effect of OPEC+'s gradual lifting of production cuts is lower than expected. However, the US shale oil production is on a strong upward trend. The EIA predicts that the total US crude oil production in 2025 will reach 13.61 million barrels per day, making it the largest source of supply growth in the world. If OPEC+ continues to increase production, the IEA predicts that the global crude oil supply surplus in 2025 may expand to 1 million barrels per day. At the same time, the uncertainties in the US sanctions policies against oil-producing countries such as Iran and Venezuela, and the fact that Russia's crude oil exports have climbed to a yearly high of 5.7 million barrels per day further increase the pressure on the supply side.

Demand: The demand side shows a differentiated trend. In March, the IEA lowered the global crude oil demand growth rate in 2025 by 70,000 barrels per day to 1.03 million barrels per day, mainly reflecting the impact of the escalation of trade frictions on the macro economy. On the other hand, OPEC maintains an optimistic forecast of 1.45 million barrels per day, emphasizing the resilience of air travel and consumption in emerging economies. The EIA has raised the demand growth rate to 1.37 million barrels per day and expects the growth rate to further rise to 1.61 million barrels per day in 2026.

USOil

🎁 Buy@66.80 - 66.90

🎁 SL 66.50

🎁 TP 68.80 - 69.00

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

USOILHello friends

Due to the price falling in the identified support area, buyers were able to support the price, but given the weakness of the trend we are witnessing, it seems that sellers have more power...

Now, for the price to rise, the identified resistance must be broken, and for the price to fall, if the support is broken, the price will continue to fall.

*Trade safely with us*

USOIL Analysis of TodayThe global economic situation has a significant impact on the demand for crude oil.

During periods of economic prosperity, industrial production and transportation activities are frequent, leading to an increase in the demand for crude oil, which in turn drives up the price of USOIL.

For example, during the period of rapid development of emerging economies, the demand for energy was robust. When there is an economic recession, the demand decreases, and the price may drop. Just like after the global financial crisis in 2008, the demand for crude oil plummeted sharply, and the price also crashed accordingly. In terms of supply, the changes in production output of major oil-producing countries are of vital importance.

The adjustment of production capacity and production disruptions in major oil-producing countries such as the United States, Saudi Arabia, and Russia will all affect the global crude oil supply. For instance, the development of the shale oil industry in the United States has significantly increased the country's crude oil production, having a major impact on the global crude oil market supply pattern.

🎁 Buy@66.90 - 67.00

🎁 SL 66.80

🎁 TP 67.15 - 67.20

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates