"US2000 Technical Play: Long Entry at Key Support"RUSSELL 2000 BULLISH BREAKOUT STRATEGY

*(High-Probability Swing Trade Setup on RUT/US2000)*

TRADE EXECUTION PLAN

ENTRY STRATEGY

Preferred Entry: Wait for pullback to 2170 support zone (15M/30M charts)

Confirmation Entry: Valid breakout above 2170 resistance (1H closing basis)

Order Placement: Use limit orders near support or stop orders above resistance

RISK PROTOCOLS

Stop Loss Placement: 2130 (swing low on 3H/4H timeframe)

Position Sizing: Maximum 1-3% risk per trade

Key Reminder: Strict risk management is essential for long-term success

PROFIT TARGETS

Primary Objective: 2230 resistance level

Alternative Approach: Trail stop loss if momentum weakens prematurely

Scalping Note: Focus exclusively on long-side opportunities in current market conditions

MARKET ANALYSIS

Technical Factors: Emerging higher low pattern, strengthening momentum

Fundamental Drivers: Supportive environment for small-cap equities

Sentiment Indicators: Retail positioning suggests room for upside

IMPORTANT WARNING

News Event Protocol: Avoid trading during high-impact announcements

Position Management: Adjust stops accordingly during volatile periods

Trading Discipline: No new entries when major news is pending

TRADING PSYCHOLOGY NOTE

This swing trade requires patience and discipline. Wait for proper confirmation signals before execution and maintain strict risk parameters throughout the trade duration.

ENGAGEMENT REQUEST

If you find this analysis valuable, please like and follow for more trade ideas. Share your perspective in the comments section.

(Disclaimer: This content is for educational purposes only. Trading involves substantial risk.)

NEXT MARKET ANALYSIS COMING SOON

Ussmallcap2000

"US2000/Russel" Index Market Bullish Robbery (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / Russel 2000" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 3H timeframe (1888.0) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2111.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"US2000 / Russel 2000" Index Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US2000 Indices Heist: Steal the Market’s Hidden Profits! **🚨 Attention, market bandits & profit thieves!** 🏴☠️💸

The **US2000 Indices** are ripe for the taking—here’s your **Thief Trading Plan** to loot the charts like a pro! 🕵️♂️📉📈

This strategy blends **killer technicals** with **smart fundamentals** to lock in gains. Ride the bullish wave 🚀 but stay alert—the **Red Zone** is where overbought traps lurk, and bears might ambush! 🐻 Secure your profits before the market turns!

---

**🔑 Entry Signals: Strike Like a Thief!**

- **Bullish Ambush (Long)**: Enter on pullbacks near **Pullback Zone 1 (2060.00)** or **Pullback Zone 2 (1980.00)**. 🎯

- **Bearish Blitz (Short)**: Jump in if price breaks **below 2040.00**—ride the drop! 📉

- **Set an alert!** 🔔 Catch breakouts in real-time.

---

**🛑 Stop Loss Tricks: Protect Your Loot!**

- **Buy Stops**: Confirm breakout first! Place stops at **1980.00 (Zone 1)** or **1910.00 (Zone 2)**.

- **Adjust based on risk & lot size—stay sharp, not reckless!** ⚡

---

**🎯 Profit Targets: Cash Out & Celebrate!**

- **Bullish Thieves**: Aim for **2200.00** or exit early if momentum fades.

- **Bearish Raiders**: Target **1980.00** for quick steals.

- **Scalpers**: Stick to **long-side scalps**—big players swing, small traders trail stops!

---

**📜 Market Intel: Why This Heist Works!**

The **US2000** is surging bullish! 🐂 Fueled by **COT data, macro trends, sentiment shifts & intermarket flows**—check the links for deep dives! 🔍📊

---

**🚨 Trading Alert: News Can Wreck the Heist!**

- **Avoid new trades during news!** 📰

- **Use trailing stops** to lock profits on open trades. 🔐

---

**🔥 Support the Heist—Hit Boost & Join the Profit Gang!**

With **Thief Trading**, every day’s a new robbery opportunity. Stay alert for the next big steal! 🤑💨

**See you in the markets, bandits!** 🤝🎭

"US2000/RUSSEL" Index Market Money Heist Plan (Day / Scalping)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000/RUSSEL" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1900.0) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (1820.0) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1990.0

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸"US2000/RUSSEL" Index CFD Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👆👆👆

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score...... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

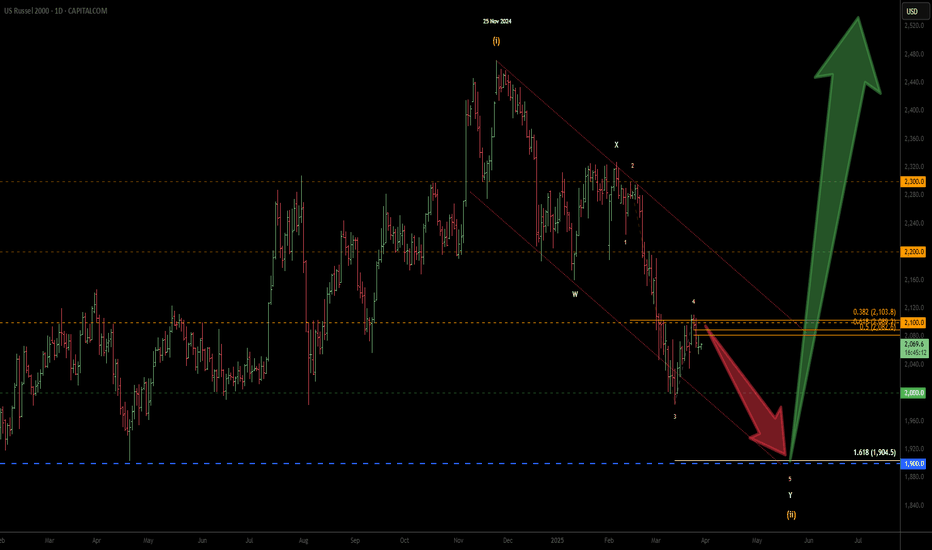

Russell 2000 - 5th wave of Y leg may already be in progress... The rejection at 2100 price level also happens to be the 38.2% Fib of the decline from the 14th of February 2025. The decline from 6th of February 2025 counts beautifully as waves 1, 2, 3 & 4. If this wave count is correct, then the Russell is currently in wave 1 of 5 of Y of (ii).

This is my primary wave count as long as the 2100 resistance is not breached.

This changes my initial wave count from a complex WXYXZ to a simple WXY.

Click on the link to see the previous wave count which is still valid and is now an alternate wave count if the 2100 resistance is breached:

Only updating the wave count. My bias and direction remain the same.

Wave Y is possibly in progress. Looks like we are going to have a bearish April & possibly May as well. Selling corrective rally is still the way to trade for now. Take profit at 1905/1900, which is where technically, the Russell 2000 will possibly turn up for wave (iii).

Stop Loss can be placed above wave 4, well out of the way in case of any wild swing on this PCE Friday.

Russell 2000 - time to Buy pullbacks...Shorts were good while it lasted... looks like a good time to buy pullbacks.

It would be wise to wait for a clear 3 wave correction though.

Elliot Wave Analysis shows a larger degree wave IV was completed in March 2020.

Since then, the Russell 2000 has been nesting within a bullish rectangle chart pattern, possibly working its way up to the larger degree wave V.

Seasonality Chart shows a bullish April with a possible correction in May.

Nevertheless, I will not commit to long trades till the chart clearly shows that we are out of the woods. A clear 3 waves move down closer to 1800 in the hourly/4 hourly time frame would be a good setup.

US2000 / RUSSELL2000 Index Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US2000 / RUSSELL2000 Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1900) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (1780) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2030 (or) Escape Before the Target

💰💸💵US2000 / RUSSELL2000 Index Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"US2000 / RUSSELL 2000" Indices Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / RUSSELL 2000" Index CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (2120) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 2H timeframe (2060) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

✂Primary Target - 2180 (or) Escape Before the Target

✂Secondary Target - 2230 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US2000 / RUSSELL2000" Index CFD Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Russell 2000 Elliott Wave Analysis (WXYXZ in progress)Possible wave (ii) complex correction in the form of a WXYXZ still in progress.

Expecting corrective rally to fail around the 2200 resistance zone.

A final wave down from there should find a bottom around the 1900 support zone where wave (ii) should end.

Expecting wave (iii) to commence from there...

------

*would appreciate feedbacks and thoughts on this*

**this is not a trade recommendation, just an idea that I am working with**

US2000 / Russell2000 "US Small Cap" Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US2000 / Russell 2000 "US Small Cap" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2300.00) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 2250.00 (swing Trade) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2420.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The US2000 / Russell2000 "US Small Cap" Indices is expected to trend bullish in the short term, driven by strong earnings growth and a low interest rate environment.

🔰 Fundamental Analysis

- Earnings Growth: The US2000 index is expected to report strong earnings growth, with a forecast of 10% for the next quarter

- Revenue Growth: The US2000 index is expected to report strong revenue growth, with a forecast of 5% for the next quarter

- Valuation: The price-to-earnings (P/E) ratio of the US2000 index is currently 21.2, which is slightly above its historical average

🔰 Macro Analysis

- GDP Growth: The US GDP growth rate is expected to remain strong, with a forecast of 2.5% for the next quarter

- Inflation: The US inflation rate is expected to remain low, with a forecast of 2.2% for the next quarter

- Interest Rates: The Federal Reserve is expected to keep interest rates low, with a forecast of no rate hikes for the next quarter

🔰 Sentimental Analysis

- Bullish Sentiment: 60% of traders are bullish on the US2000 index, indicating a strong uptrend

- Bearish Sentiment: 30% of traders are bearish on the US2000 index, indicating a potential correction

- Neutral Sentiment: 10% of traders are neutral on the US2000 index, indicating a balanced market

🔰 COT Analysis

- Institutional Traders: Institutional traders are net long the US2000 index, with a positioning score of 60

- Retail Traders: Retail traders are net short the US2000 index, with a positioning score of 40

🔰 Positioning

- Long Positions: Institutional traders are holding long positions in the US2000 index, indicating a bullish sentiment

- Short Positions: Retail traders are holding short positions in the US2000 index, indicating a bearish sentiment

🔰 Overall, the US2000 / Russell2000 "US Small Cap" Indices is expected to trend bullish in the short term, driven by strong earnings growth and a low interest rate environment. However, retail traders are holding short positions, indicating a potential correction.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US2000 "US Small Cap" Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US2000 "US Small Cap" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑: Thief SL placed at 2300.00 (swing Trade) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 21500.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

US2000 "US Small Cap" Indices Market is currently experiencing a Bearish trend., driven by several key factors.

🔱Fundamental Data

- Earnings Growth: 8% (last quarter)

- Dividend Yield: 1.7%

- Valuation: P/E Ratio 21.2 (slightly above historical average)

- Revenue Growth: 6% (last quarter)

🔱Macroeconomic Data

- Interest Rates: Federal Reserve kept interest rates steady at 4.25%-4.5%

- Inflation: Consumer Price Index (CPI) increased by 2.1% (last month)

- GDP Growth: US GDP growth rate expected to slow down to 1.8% in 2023

- Unemployment Rate: 3.4% (last month)

🔱COT Data

- Non-Commercial Traders: Net short 25,019 contracts (increase of 5,011 contracts from last week)

- Commercial Traders: Net long 20,011 contracts (decrease of 2,011 contracts from last week)

- Non-Reportable Positions: Net short 10,011 contracts (increase of 2,011 contracts from last week)

🔱Institutional Sentiment

- Goldman Sachs: Net short 18,011 contracts

- Morgan Stanley: Net short 12,011 contracts

- JPMorgan Chase: Net short 10,011 contracts

🔱Retail Sentiment

- Interactive Brokers: Net long 8,011 contracts

- TD Ameritrade: Net long 5,011 contracts

- E*TRADE: Net long 3,011 contracts

🔱Hedge Fund Sentiment

- Bridgewater Associates: Net short 20,011 contracts

- BlackRock: Net short 15,011 contracts

- Vanguard: Net short 10,011 contracts

🔱 Market Sentiment

- Bullish Traders: 42%

- Bearish Traders: 48%

- Neutral Traders: 10%

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

"US2000 / Russell / US Small cap" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / Russell / US Small cap" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2320.0) then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 2430.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The US2000 indices are currently experiencing a mix of trends. Here's a breakdown of the current market situation:

🔴Fundamental Analysis

The Russell 2000 index, which measures the performance of approximately 2,000 small-cap companies in the US, is influenced by various fundamental factors, including economic indicators, interest rates, corporate earnings, and market sentiment.

🔵Macro Economics

The US economy is expected to experience a slowdown in growth, which could impact small-cap companies. However, the Federal Reserve's decision to keep interest rates low could support economic growth and benefit small-cap stocks.

🟠COT Analysis

The Commitment of Traders (COT) report shows that institutional traders are net long the Russell 2000 index, indicating a bullish sentiment. However, retail traders are net short, indicating a bearish sentiment.

⚪Sentimental Analysis

Market sentiment for the Russell 2000 index is currently neutral, with a sentiment score of 50. The index has experienced a significant rally in recent months, and some investors may be taking profits, leading to a neutral sentiment.

🟡Institutional Trader Positioning

Institutional traders are net long the Russell 2000 index, with a positioning score of 60. This indicates that institutional traders are bullish on the index and expect it to continue rising.

Institutional Traders

- Bullish: 62% of institutional traders are holding long positions, indicating a bullish sentiment.

- Bearish: 38% of institutional traders are holding short positions.

🟢Retail Trader Positioning

Retail traders are net short the Russell 2000 index, with a positioning score of 40. This indicates that retail traders are bearish on the index and expect it to fall.

Retail Traders

- Bullish: 42% of retail traders are holding long positions, indicating a slightly bearish sentiment.

- Bearish: 58% of retail traders are holding short positions.

Please note that these percentages are approximate and based on general market sentiment. They should not be taken as investment advice.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

"US2000 / Russell / Small Cap" Indices Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US 2000 / Russell / Small Cap" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade after the MA Breakout of 2280.00

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4h period, the recent / nearest low or high level.

Goal 🎯: 2350.00 (or) escape Before the Target.

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

"US2000 / Russell / Small Cap" Indices Market is expected to move in a bullish trend.

ECONOMIC INDICATORS:

GDP Growth: The US GDP growth rate is expected to remain strong, with a forecast of 2.5% for the next quarter.

Inflation: The US inflation rate is expected to remain low, with a forecast of 2.2% for the next quarter.

Interest Rates: The Federal Reserve is expected to keep interest rates low, with a forecast of no rate hikes for the next quarter.

CORPORATE EARNINGS:

Earnings Growth: The US2000 index is expected to report strong earnings growth, with a forecast of 10% for the next quarter.

Revenue Growth: The US2000 index is expected to report strong revenue growth, with a forecast of 5% for the next quarter.

SECTOR ANALYSIS:

Technology: The technology sector is expected to lead the US2000 index higher, with a forecast of 15% growth for the next quarter.

Healthcare: The healthcare sector is expected to report strong growth, with a forecast of 10% for the next quarter.

MARKET SENTIMENT:

Bullish Sentiment: 60%

Bearish Sentiment: 30%

Neutral Sentiment: 10%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

US2000 / Small Cap / Russell Bullish Robbery Plan To Steal MoneyHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist US2000 / Small Cap / Russell Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 1h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

US2000 / RUSSELL 2000 Money Heist Plan on Bullish SideMy Dear Robbers / Money Makers,

This is our master plan to Heist US2000 / RUSSELL 2000 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 2h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

US2000 / Small Cap / Russell Bullish Robbery Plan To Steal MoneyHello My dear,

Robbers / Money Makers & Losers.

This is our master plan to Heist US2000 / US Small Cap / Russell 2000 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is Trap / overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 2h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

US2000 / RUSSELL 2000 Bullish Robber plan to make moneyMy Dear Robbers / Traders,

This is our master plan to Heist Bullish side of US2000 Market based on Thief Trading style Analysis.. kindly please follow the plan i have mentioned two targets in the chart focus on Long entry, Our target is Red Zone that is High risk Dangerous area market is overbought / Consolidation / Trend change at the level Bear Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic resistance level, Once it is cleared we can continue our heist plan to next target.

support our robbery plan we can make money & take money 💰💵 Join your hands with US. Loot Everything in this market everyday.

US Small Cap 3000 at important levelUS Small Cap 3000 - TVC:RUA

Chart is approaching an important boundary

Pennant has clearly formed, compressing price

An upward sloping 200 SMA which is also acting as price support is a positive feature

Lets see how we deal with this diagonal resistance over coming weeks

PUKA

US Small Cap 2000 - Bears are in controlUS Small Cap 2000 - Intraday - We look to Sell at 1790 (stop at 1810)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. A higher correction is expected. With the Ichimoku cloud resistance above we expect gains to be limited. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 1730 and 1630

Resistance: 1780 / 1830 / 1875

Support: 1725 / 1630 / 1555

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.