Market Mood Sours as Inflation Surprises AgainU.S. stock markets were under pressure on Tuesday after new inflation data came in higher than expected. This has made investors rethink how soon the Federal Reserve might cut interest rates.

What Happened?

● The Consumer Price Index (CPI) recorded its biggest monthly rise in 5 months.

● Core inflation (which excludes food and energy) jumped by 2.9% compared to last year — more than the Fed's 2% target.

What It Means

● Investors had expected the Fed to cut interest rates multiple times in 2025.

● After the inflation report, they now think the Fed will cut less than expected.

● The chances of a rate cut in September also dropped sharply.

Market Impact

● Bond yields went up — the 10-year U.S. government bond yield rose to 4.49%, making borrowing more expensive.

● Stock futures fell (Dow, S&P 500, Nasdaq), as higher yields tend to hurt company profits and stock prices.

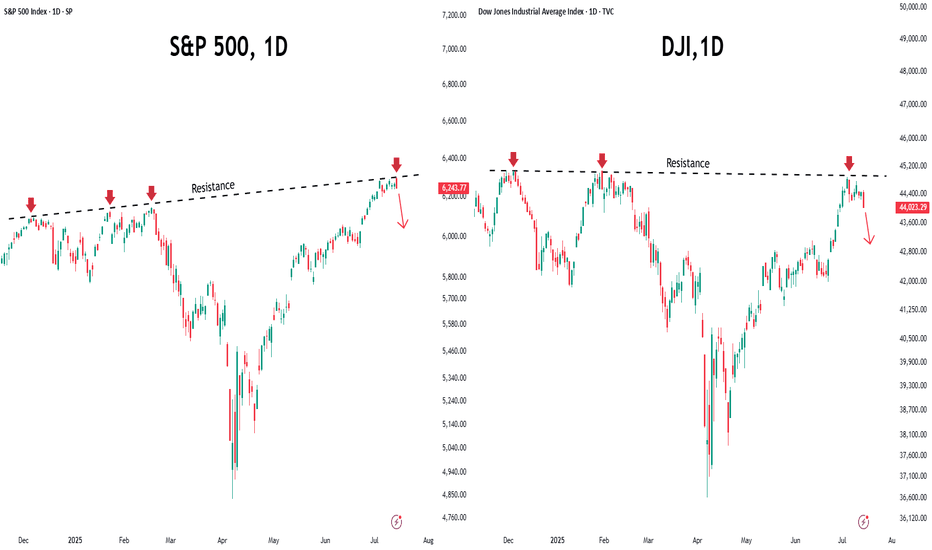

S&P 500 and Dow Struggle at Resistance

● Both the S&P 500 and Dow Jones faced resistance near all-time highs.

● This rejection suggests potential for further short-term pullback, especially if macro pressures like inflation and rate uncertainty persist.

Near-Term Outlook

With inflation running hotter than expected, hopes for early Fed rate cuts have cooled. Traders and investors should remain cautious, manage risk actively, and prepare for continued volatility in the coming weeks.

Usstockmarket

SPX 500 to 17,000 in 7 years.This chart represents the S&P 500, showcasing its performance over time, including quarterly data.

It captures everything.

Every recession.

Every war.

Every president.

Every variation of the monetary base as superpowers rise and fall.

Whenever I hear a bear in the stock market declare that THE TOP has been reached, and we are about to CRASH -50% to -90%

I find myself drawn to these comprehensive long term charts.

If the bulls are genuinely in control and we have merely undergone an intermediate-term correction, then the long-term bull market that commenced at the 2009 low remains robust, with many more years ahead.

The chart also illustrates that the three significant bull market phases typically last around 18-20 years following a major breakout.

And they yield a comparable number of X's.

It's all quite fascinating, if you ask me.

See you in the future!

US2000 Indices Heist: Steal the Market’s Hidden Profits! **🚨 Attention, market bandits & profit thieves!** 🏴☠️💸

The **US2000 Indices** are ripe for the taking—here’s your **Thief Trading Plan** to loot the charts like a pro! 🕵️♂️📉📈

This strategy blends **killer technicals** with **smart fundamentals** to lock in gains. Ride the bullish wave 🚀 but stay alert—the **Red Zone** is where overbought traps lurk, and bears might ambush! 🐻 Secure your profits before the market turns!

---

**🔑 Entry Signals: Strike Like a Thief!**

- **Bullish Ambush (Long)**: Enter on pullbacks near **Pullback Zone 1 (2060.00)** or **Pullback Zone 2 (1980.00)**. 🎯

- **Bearish Blitz (Short)**: Jump in if price breaks **below 2040.00**—ride the drop! 📉

- **Set an alert!** 🔔 Catch breakouts in real-time.

---

**🛑 Stop Loss Tricks: Protect Your Loot!**

- **Buy Stops**: Confirm breakout first! Place stops at **1980.00 (Zone 1)** or **1910.00 (Zone 2)**.

- **Adjust based on risk & lot size—stay sharp, not reckless!** ⚡

---

**🎯 Profit Targets: Cash Out & Celebrate!**

- **Bullish Thieves**: Aim for **2200.00** or exit early if momentum fades.

- **Bearish Raiders**: Target **1980.00** for quick steals.

- **Scalpers**: Stick to **long-side scalps**—big players swing, small traders trail stops!

---

**📜 Market Intel: Why This Heist Works!**

The **US2000** is surging bullish! 🐂 Fueled by **COT data, macro trends, sentiment shifts & intermarket flows**—check the links for deep dives! 🔍📊

---

**🚨 Trading Alert: News Can Wreck the Heist!**

- **Avoid new trades during news!** 📰

- **Use trailing stops** to lock profits on open trades. 🔐

---

**🔥 Support the Heist—Hit Boost & Join the Profit Gang!**

With **Thief Trading**, every day’s a new robbery opportunity. Stay alert for the next big steal! 🤑💨

**See you in the markets, bandits!** 🤝🎭

Breaking key resistance — could $BGM repeat $RGC’s 100x rally?Let me introduce a stock that has already generated a profit of nearly 40% and I have no intention of selling it yet. Because both the chart and fundamentals suggest the stock seems to be approaching the point of potential explosion, and it is even possible to increase several times.

This stock is NASDAQ:BGM , a traditional Chinese pharmaceutical chemical company but now it has transformed into an AI productivty platform. More on that later—let’s first take a look at the technicals, which I always pay close attention to.

Firstly,the uptrend remains intact.

Since last year’s stock split, the price has been climbing steadily within a clear uptrend. After breaking above $8.50, it has consistently held above that level for months, showing strong momentum. (I bought in when it dipped back to $8.50 earlier this year and have held since.)

In the recent days, the stock price has successfully broken through the upper limit of the consolidation range that has persisted for nearly 3 months, and has stabilized above $12.

This is a significant breakthrough, and it may indicate that the stock price could potentially start a significant upward rally at any time.

Secondly,the stock is almost fully controlled by the market maker.

There’s a saying in trading: “Volume precedes price.” Since December 2024, BGM’s trading volume has clearly increased, with each spike in volume followed by a small price uptick—money was buying.

Interestingly, each rise is followed by a pullback, but on much lower volume. This volume pattern—rising on gains and shrinking on pullbacks—suggests that the maket maker have accumulated most of the shares and now have strong control. The dips are likely just shakeouts to flush weak hands before a bigger breakout.

Thirdly, low short interest means minimal resistance to a price surge.

According to Nasdaq's data, BGM’s short position was 34,466 shares by 31th March, but dropping to 18,889 shares by April 30,the number of short positions has significantly decreased.

This was showing that as the stock price rose, short sellers mostly exited or turned bullish—clearing major obstacles for further gains.

Technically, everything is set—just waiting for the trigger. Pull the trigger could spark a massive rally, and that trigger may come anytime as the company nears to complete a key transformation.

Yes, the company is transforming from a traditional pharmaceutical firm into a leading AI tech ecosystem. Since last year, it has been actively acquiring companies to enter AI-driven healthcare, insurance, and wellness sectors, aiming to become an industry leader.

①In December 2024, BGM acquired RONS Tech and Xinbao Investment, integrating the AI insurance platform “Duxiaobao” (powered by Baidu’s NASDAQ:BIDU technology). Leveraging 704 million monthly active users, they aim to disrupt traditional insurance sales and drive exponential customer growth.

②In April 2025, BGM acquired YX Management to boost AI applications in insurance and transportation, accelerating the “pharma-insurance-health” ecosystem.

③In May 2025, BGM acquired HM Management and its two subsidiaries—SHUDA Technology and New Media Star—strengthening its algorithm optimization、data modeling and traffic-driven customer acquisition capabilities

After several acquisitions, the company has initially completed its transformation plan. So the "trigger" we are pursuing might emerge during the next major acquisition by the company to complete the final transformation.This is an important milestone. According to reliable sources, the company's next acquisition is likely to take place in the coming June. Let's wait and see.

Another "trigger" may be the company’s next earnings report, which will include the “Duxiaobao” AI insurance business for the first time, expected to add over $5 million in revenue, might to confirm the initial success of the company's transformation. And this is potentially spark a strong stock rally.

These two potential "triggers" are both approaching soon.

If all goes well, how far could this rally go? Let’s refer to the recent strong gains of Chinese stocks like $RGC.

Technically, RGC saw a clear volume increase and price rise around July-August 2024. Then it had a six-month shakeout with low volume pullback (similar to BGM’s current pattern). In March 2025, it launched a major rally, rising over tenfold.

In May, RGC surged again, supported by fundamental news: the company announced FDA approval for its new neurostimulation chip and a Parkinson’s study with Mayo Clinic. From the start to the peak, RGC gained over 100 times in a short period!

Looking at BGM again: after the breakout, the stock will likely first test resistance near $15, which may not be a big hurdle. The real test could be at $24—the pre-split high and the upper boundary of the current “megaphone” consolidation.

Even if the price only reaches around $24 , current investors could nearly double their money. After the company’s fundamental transformation, its revenue and profits potential could grow beyond RGC. So, how high can BGM’s stock go? Let’s wait and see.

Merck & Company Potential Post Tariff Resolution Bullish RallyWith potential developments towards the resolution of global tariffs and pharma being defensive in general, MRK price action seems to exhibit signs of a potential Bullish reversal breakout as the price action may form a prominent Higher High with multiple confluences through key Fibonacci and Support levels which presents us with a potential Non-Leverage hold opportunity.

Entry: (Buy 1 CMP 76.2 & Buy 2 87.6)

Stop Loss: 45 or 0 (depends on trading style as Non-Leverage Buy & Hold is recommended)

Potential Range for Targets: 130 - 170

GOLD Has Shown A Significant Bullish Move!!Gold Market Analysis

Over the past week, gold has shown a significant bullish move by touching its weekly bullish Fair Value Gap (FVG) and closing a candle above it. This price action serves as a strong indication that the market is currently exhibiting bullish momentum. However, it is important to note that the sustainability of this bullish trend will be confirmed only through future market developments and price behavior.

As of now, our analysis suggests that gold, after revisiting and respecting the weekly bullish FVG, is trending upward. Looking ahead, we anticipate a minor retracement in the short term. This pullback could provide a healthy opportunity for the market to gather momentum before making another move upward. Ideally, we expect the price to retrace slightly and re-enter the highlighted yellow zone. Within this zone, we will be watching for a Market Structure Shift (MSS), which would act as our confirmation signal to consider entering a long position.

Once confirmation is received through MSS or similar price action cues, our strategy would be to target the liquidity zones situated above the current price level. It is also worth mentioning that the market has already cleared liquidity on the sell-side, which further strengthens the bullish case. Based on current technical indications and liquidity structure, there is a high probability that gold could reach as high as $3,250 in the upcoming sessions.

That said, market conditions can evolve rapidly, and it is essential to monitor price action closely. Traders and investors are strongly advised to conduct their own research (DYOR) and await clear confirmations before making any trading decisions. Staying vigilant and informed will be key to capitalizing on potential bullish movements in the gold market.

Primoris Services: A Long-Term Pick in US Energy Infrastructure◉ Abstract

Our latest analysis focuses on the booming U.S. utility and energy sector, set to hit a massive $1.1 trillion! Learn about the key drivers fueling this growth, from our increasing electricity needs and the electric vehicle revolution to the exciting rise of clean energy.

We have also given a “Buy” rating on Primoris Services Corporation NYSE:PRIM , a major player in building this energy infrastructure. Our analysis reveals their strong financial performance, attractive valuation compared to its peers, and promising technical indicators. While acknowledging potential headwinds like regulatory shifts, we believe Primoris presents a compelling long-term investment opportunity with significant upside potential. Read detailed analysis here and invest smartly.

Read full analysis here...

◉ Introduction

Imagine the companies that bring electricity to your home, the gas for your stove, and are building the future of clean energy. That's the U.S. utility and energy sector! It's a massive part of the American economy, and it's getting even bigger. By 2025, experts predict it will be worth a whopping $1.1 trillion! This includes everything from generating electricity to delivering it through power lines and pipelines, as well as distributing natural gas across the country.

This sector has been steadily growing at about 2.7% each year between 2020 and 2025, and it looks like this growth is going to continue. This article will give you a snapshot of the major reasons behind this growth, top players in this sector, and investment opportunities.

◉ Major Factors Behind the Growth of US Energy Sector

1. Electricity Use is Climbing: Americans are using more power than ever. The EIA expects electricity consumption to hit 4,205 Billion kWh in 2025, up from 4,097 Billion kWh in 2024. This surge is fuelled by increased usage in residential, commercial, and industrial sectors.

2. Everything’s Going Electric: Think about electric cars, heat pumps that heat and cool homes, and even cleaner machines in factories. More and more things are switching to electricity, which means we need even more power! This big shift towards using electricity is called electrification, and it's a major driver for the energy sector.

3. Clean Energy on the Rise: Solar panels and wind turbines are becoming a bigger part of how we get our electricity. These renewable energy sources are growing fast. By 2026, it's expected that they will provide about 27% of all the electricity in the U.S., up from around 25% in 2024. This move towards cleaner energy is really important for the future.

4. Massive Investments Ahead: To keep up with this growing demand and the shift to new technologies, utility companies are investing a lot of money. They are upgrading power grids (the network of lines that deliver electricity), building charging stations for electric vehicles (EVs), and using smart technologies to manage energy better. Experts at S&P Global predict that total spending on these things could be over $790 Billion between 2025 and 2030!

◉ Big Players in Building the US Energy Infrastructure

1. Quanta Services, Inc. NYSE:PWR : A premier provider of specialized infrastructure solutions for the electric power and oil & gas sectors. They are also heavily involved in renewable energy projects like solar and wind farms. You can learn more about them on their official website .

2. Primoris Services Corporation NYSE:PRIM : They provide construction and engineering services for the energy, utility, and infrastructure markets. They are increasingly focusing on building projects related to renewable energy. You can explore their details on their official website .

3. MasTec, Inc. NYSE:MTZ : This is a top infrastructure company in North America, working on energy, utility, and communication projects. This includes building renewable energy facilities, telecom networks, and oil & gas pipelines. You can find more information on their official website .

This report offers an in-depth analysis of Primoris Services Corporation , a prominent player in the U.S. energy infrastructure space.

Our long term recommendation is backed by Primoris Services Corporation ’s technical analysis and fundamental performance.

◉ Investment Advice

💡 Buy Primoris Services Corporation NYSE:PRIM

● Buy Range - 67 - 68

● Sell Target - 88 - 90

● Potential Return - 30% - 45%

● Approx Holding Period - 12-14 months

◉ Revenue and Profit Analysis

● Year-on-Year

- In FY24, Primoris reported revenue of $6,367 Million, marking an 11% increase from $5,715 Million in FY23.

- EBITDA grew to $415 Million, up from $366 Million the previous year, with the EBITDA margin slightly improving to 6.5% from 6.4%.

● Quarter-on-Quarter

- Q4 FY24 revenue reached a record $1,741 Million, up from $1,649 Million in Q3 and 14.9% higher than $1,515 Million in Q4 FY23.

- Despite the revenue growth, Q4 EBITDA declined to $110.6 Million from $123 Million in Q3.

- Diluted EPS (LTM) rose to $3.30 in Q4, up from $3.00 in Q3 FY24, indicating solid earnings momentum.

◉ Valuation

1. P/E Ratio (Price-to-Earnings)

● Compared to Peers:

- PRIM’s P/E is 17.9x, much lower than the peer average of 32.7x. This means the stock is cheaper than most competitors based on earnings.

● Compared to Industry:

- With a P/E ratio of 17.9x, PRIM trades below the industry average of 26.4x, suggesting it offers strong value within the sector.

2. P/B Ratio (Price-to-Book)

● Compared to Peers:

- PRIM’s P/B is 2.6x, while peers average 4.5x—again showing the stock may be undervalued.

● Compared to Industry:

- Compared to the industry average of 4.4x, PRIM still appears to be a bargain.

3. PEG Ratio (Price/Earnings to Growth)

PRIM’s PEG ratio is 0.43, which suggests the stock is not only cheap but also expected to grow earnings strongly—an attractive combination for investors.

◉ Cash Flow Analysis

- Primoris saw a strong improvement in operating cash flow, which jumped to $508 Million in FY24 from $196.8 Million in FY23—a sign of better cash generation from its core business.

◉ Debt Analysis

- With a debt-to-equity ratio of 0.42, the company maintains a solid financial position, suggesting its debt levels are well under control and not overly risky.

◉ Top Shareholders

- The Vanguard Group holds a substantial 11.6% stake in Primoris, reflecting strong confidence in the company.

- BlackRock also increased its investment by 9.65% from Q3 FY24 and now owns approximately 11.3% of the company.

◉ Technical Aspects

- On the monthly chart, the price is in an overall uptrend and has bounced off the trendline support, indicating continued upward momentum.

- On the daily chart, the price has broken through a rounding bottom pattern and is holding above the breakout zone, suggesting a potential for further upside movement.

◉ Potential Risks & Challenges

1. Regulatory Uncertainty: Ongoing concerns about global trade policies, tariffs, and regulatory changes, especially in the solar and battery storage markets, could impact future project economics and timing.

2. SG&A Expenses: Increased by $10.9 Million year-over-year, driven by higher personnel costs and $3.2 Million in severance expenses.

3. Energy Segment Backlog: Experienced a decrease due to the timing of new solar awards, potentially affecting future revenue visibility.

◉ Conclusion

Primoris Services Corporation NYSE:PRIM stands out as a promising investment, backed by consistent growth, strong financials, and a strategic focus on renewable energy and infrastructure. Despite facing risks like regulatory changes and backlog fluctuations, its solid position in the U.S. energy sector—especially with increased demand for clean energy solutions—gives it a clear path forward. With a competitive valuation and support from major investors like Vanguard and BlackRock, Primoris is poised for sustainable growth, making it an attractive long-term opportunity for investors.

Invest in STRL: Ride the Coming US Digital Infrastructure Surge◉ Abstract

Sterling Infrastructure (NASDAQ: STRL) is a top pick to benefit from America's digital infrastructure boom, with the sector expected to grow 26% annually through 2034. The company specializes in data centers, 5G networks, and smart city projects, supported by a $1 billion backlog and improving profit margins. While risks like regional market shifts and housing demand exist, STRL's fundamentals are strong—revenue grew 7% in 2024, debt is manageable, and its P/E ratio (17.9x) looks cheap compared to peers (70.5x).

Technically, the stock shows bullish patterns after pulling back 35% from highs. With government infrastructure spending rising and strategic acquisitions likely, STRL could deliver 35-40% returns in the next 12-14 months. A good option for long term investing!

Read full analysis here...

◉ Introduction

The U.S. digital infrastructure market, valued at approximately USD 140 billion in 2024, is expanding rapidly, with a projected CAGR of 26.4% through 2034. This growth is driven by factors like the expansion of 5G networks, increased demand for data centers, rising cloud services adoption, AI automation, and investments in smart cities and edge computing. The 5G infrastructure segment alone is expected to grow at a CAGR of 20.2%, reaching USD 17.26 billion by 2030. North America holds a 42.8% share of the global market.

◉ Key Trends and Opportunities

1. Data Centers: Demand continues to rise, driven by cloud computing, AI, and data-intensive applications. Power availability and location are becoming critical, with providers moving to secondary markets to secure reliable energy sources.

2. Fiber Networks: Expansion is underway to support new data centers and remote connectivity needs. Middle-mile and long-haul fiber, as well as fiber-to-the-home (FTTH), are key areas of investment and consolidation.

3. 5G and Wireless: Ongoing rollout of 5G networks is fueling growth in hardware and network densification, with increased activity expected in wireless infrastructure and tower markets.

4. Edge Computing and Smart Cities: The proliferation of IoT devices and smart city initiatives is driving demand for edge data centers and low-latency networks.

5. Mergers and Acquisitions: The market is seeing consolidation, especially in fiber and data center segments, as major players acquire smaller firms to expand their footprint and capabilities.

Today, we’ll focus on Sterling Infrastructure (STRL), a key player navigating the U.S. infrastructure market.

This report provides a detailed look at STRL's technical and fundamental performance.

◉ Company Overview

Sterling Infrastructure Inc. NASDAQ:STRL is a U.S.-based company specializing in e-infrastructure, transportation, and building solutions. It operates through three key segments: E-Infrastructure Solutions, which focuses on site development for data centers, e-commerce warehouses, and industrial facilities; Transportation Solutions, handling infrastructure projects such as highways, bridges, airports, and rail systems for government agencies; and Building Solutions, providing concrete foundations and construction services for residential and commercial projects. Originally founded in 1955 as Sterling Construction Company, the firm rebranded to its current name in June 2022. Headquartered in The Woodlands, Texas, the company serves a wide range of sectors, including logistics, manufacturing, and public infrastructure.

◉ Investment Advice

💡 Buy Sterling Infrastructure NASDAQ:STRL

● Buy Range - 148 - 150

● Sell Target - 200 - 205

● Potential Return - 35% - 40%

● Approx Holding Period - 12-14 months

◉ SWOT Analysis

● Strengths

1. Strong E-Infrastructure Backlog – With over $1 billion in backlog, Sterling has a robust pipeline of future projects, ensuring sustained revenue growth.

2. Higher-Margin Services Shift – The company’s strategic focus on higher-margin work (21% gross profit margin in Q4) improves profitability without relying solely on volume.

3. E-Infrastructure Growth Potential – Expected 10%+ revenue growth and 25%+ operating profit growth in 2025 position Sterling for strong earnings expansion.

4. Strategic M&A Opportunities – Strong liquidity allows for accretive acquisitions, enhancing market share and service offerings.

5. Share Repurchase Program – Active buybacks reduce outstanding shares, potentially boosting EPS and shareholder value.

● Weaknesses

1. Texas Market Transition Risks – Moving away from low-bid work in Texas may slow revenue growth in the Transportation segment if not managed well.

2. Revenue Loss from RHB Deconsolidation – Excluding $236 million in RHB revenue could distort growth metrics and reduce reported earnings.

3. Residential Market Pressures – A 14% decline in residential slab revenue (due to DFW affordability issues) could persist if housing demand weakens further.

4. Geographic Expansion Challenges – High costs and logistical hurdles in expanding data center projects outside core regions may limit growth opportunities.

5. Competitive Bidding & Acquisition Risks – Difficulty in securing profitable acquisitions or winning competitive bids could hinder margin and revenue growth.

● Opportunities

1. Data Center & E-Commerce Boom – Rising demand for data centers and distribution facilities presents long-term growth potential for E-Infrastructure.

2. Government Infrastructure Spending – Federal and state investments in highways, bridges, and airports could boost Transportation Solutions revenue.

3. Strategic Acquisitions – Pursuing complementary M&A deals could expand capabilities and market reach.

4. Diversification into New Regions – Expanding into underserved markets could reduce dependency on Texas and mitigate regional risks.

5. Operational Efficiency Improvements – Further margin expansion through cost optimization and technology adoption.

● Threats

1. Economic Slowdown Impact – A recession could reduce demand for residential and commercial construction, affecting Building Solutions.

2. Rising Interest Rates – Higher borrowing costs may pressure profitability and delay large-scale projects.

3. Labor & Material Cost Inflation – Increasing wages and supply chain disruptions could squeeze margins.

4. Intense Competition – Rival firms competing for the same infrastructure projects may drive down pricing and profitability.

5. Regulatory & Permitting Delays – Government approvals and environmental regulations could slow project execution.

◉ Revenue & Profit Analysis

● Year-on-Year

➖ FY24 sales reached $2,116 million, reflecting a 7.28% increase compared to $1,972 million in FY23.

➖ EBITDA rose to $334 million, up from $264 million in FY23.

➖ EBITDA margin improved to 15.8%, up from 13.4% in the same period last year.

● Quarter-on-Quarter

➖ Q4 sales decreased to $499 million, down from $593 million in Q3, but showed a slight increase from $486 million in Q4 of the previous year.

➖ Q4 EBITDA was $80.3 million, down from $105 million in Q3.

➖ Q4 diluted EPS saw a notable rise, reaching $8.27 (LTM), up from $5.89 (LTM) in Q3 2024.

◉ Valuation

1. P/E Ratio (Price-to-Earnings)

● Current vs. Peer Average

➖ STRL’s P/E ratio is 17.9x, much lower than the peer average of 70.5x, suggesting the stock is undervalued compared to peers.

● Current vs. Industry Average

➖ Compared to the broader industry average of 22.9x, STRL again looks relatively inexpensive at 17.9x.

2. P/B Ratio (Price-to-Book)

● Current vs. Peer Average

➖ STRL’s P/B ratio stands at 5.7x, slightly higher than the peer average of 5x, indicating overvaluation.

● Current vs. Industry Average

➖ Against the industry average of 3.6x, STRL’s 5.7x P/B ratio suggests a noticeable overvaluation.

3. PEG Ratio (Price/Earnings to Growth)

➖ STRL’s PEG ratio is 0.21, which means the stock appears undervalued relative to its strong expected earnings growth.

◉ Cash Flow Analysis

➖ Sterling Infrastructure's operating cash flow grew to $497 million in FY24, up from $479 million in FY23, showing steady financial strength.

◉ Debt Analysis

➖ The company's debt-to-equity ratio is 0.38, indicating a healthy balance sheet with manageable debt levels.

◉ Top Shareholders

➖ The Vanguard Group has significantly increased its investment in this stock, now owning an impressive 8.3% stake, which marks a 30% rise since the end of the September quarter.

➖ Meanwhile, Blackrock holds a stake of around 8% in the company.

◉ Technical Aspects

➖ On the monthly chart, the stock remains in a strong uptrend.

➖ On the daily chart, an Inverted Head & Shoulders pattern has formed, signaling a potential breakout soon.

➖ The stock is currently trading at about 35% below its all-time high, making it an attractive investment opportunity.

◉ Conclusion

Sterling Infrastructure (STRL) stands out as a strong investment candidate, backed by solid financial performance, a growing E-Infrastructure backlog, and a strategic focus on higher-margin projects. Its attractive valuation, healthy cash flow, and low debt levels provide further confidence in its growth potential. While there are challenges—such as market competition, geographic expansion hurdles, and economic uncertainties—Sterling’s strengths, including a robust project pipeline, strategic acquisitions, and exposure to high-growth sectors like data centers and 5G infrastructure, offer a favorable risk-reward balance. Overall, Sterling is well-positioned to benefit from the ongoing U.S. e-infrastructure boom, making it an attractive long-term investment opportunity.

Long-Term Trend Still Intact for S&P 500The S&P 500 is falling, but despite the sharp negative moves in recent weeks, the longer-term trend remains positive.

The uptrend that began with the 2020 dip is still intact, and it appears the market has used this trend as an opportunity to buy the dips in the last two weeks.

If you zoom out from the current economic turmoil, the broader positive outlook for the U.S. market remains. U.S. stocks have become slightly more affordable following the recent selloff. If the U.S. manages to avoid a deep recession, this market pullback could create a huge opportunity for those who missed out on the 2023–2024 rally.

However, risks are notably higher now, especially with the introduction of new tariffs that are likely to weigh on growth.

As long as the long-term trend holds, downward moves into the 4600–4800 zone could offer compelling long-term buying opportunities.

U.S. Stock Swing TradeBRK.B

This stock remains one of the few in the U.S. market that continues to exhibit technical strength, maintaining a well-defined uptrend.

Current price action suggests a potential buy-on-dip opportunity near key support levels.

Entry Zone: 494 – 501

Take-Profit Target: 518 – 530

Stop Loss: 488

That said, it remains essential to closely monitor the S&P 500 index, along with prevailing macroeconomic developments, which continue to exert significant influence on market sentiment.

$S&P500 macro analysis , market approaching correction °•° $SPXHi 👋🏻 check out my previous analysis ⏰ on SP:SPX macro bullish analysis ⏰

As provided it went up up 🚀 completed my target's 🎯 💯💪🏻 ✅ ✔️

Click on it 👆🏻 just check out each and every time updates ☝🏻 ☺️

•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

NOW I was completely 🐻 BEARISH on the market with in upcoming months SP:SPX

📌 Expecting liquidation pump $6500 - $6700

Invalid 🛑 when complete month close above $6700

¹support - $5500 ( 🎯 ¹ )

²support - $5130 ( 🎯 ² )

🎯 3 ... Will be updated based on market conditions by that time ☺️

📍 A wise 🦉 man said - always having patience " is " always gaining only /-

NASDAQ:TSLA ( i accumulate slowly until it cross above $400 )

rest of stocks i will follow index ☝🏻 i will invest based on market conditions ..... ✔️

Head & Shoulder Breakdown: Will S&P 500 Drop Another 10%?● The S&P 500 has experienced significant volatility recently, mainly due to President Donald Trump's announcement of new tariffs.

● On April 3, 2025, the index saw a nearly 5% drop, its worst single-day loss in five years.

● The recent price action suggests that the index has broken below the neckline of the Head and Shoulder pattern, indicating a potential continuation of the downward trend.

◉ Key support levels to watch

● 1st Support - 5,200 - 5,250

● 2nd Support - 4,950 - 5,000

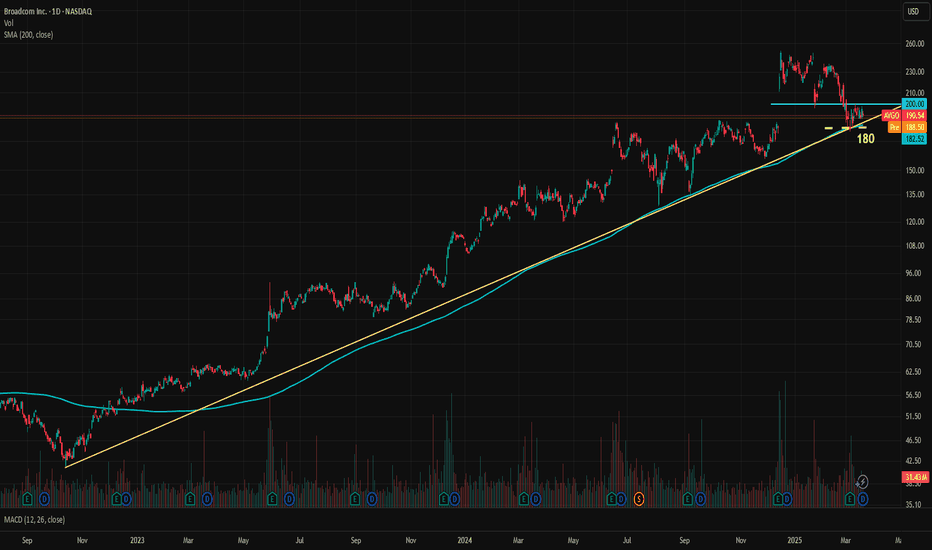

AVGO Stuck Between Key Levels, A Calm Before the Storm?Broadcom, one of the key favorites in the AI rally, is at a crossroads. AVGO has been in a steady logarithmic uptrend since October 2022, carrying the stock price from 41.51 to 251.88, marking an impressive 506% gain in about two and a half years. The company's EPS has been consistently increasing over the years and is expected to accelerate further this year. Although valuations are high, if Broadcom's performance in 2025 meets or exceeds expectations, the bullish case remains strong. The forward P/E for 2025 end is 28.7x.

Currently, the price is stuck between the trendline and the 200 resistance level. The uptrend is supported by the 200-day moving average. The trendline sits around 184, while the SMA is at 182.50. For a more cautious approach, 180 can be considered the key medium-term support level. If 180 holds and AVGO manages to break above the 200 resistance, there is significant upside potential for the bulls.

The current analyst consensus for the 12-month price target is 251, which also coincides with the stock's all-time high (ATH).

NAS100 Potential Intraday Shorts (Technical Analysis)Technical Outlook:

The price action since late February has been decisively bearish, characterized by a significant decline throughout March, indicating a clear mid-term distribution phase. We observed a recent rejection from a 4H and 1H supply zone (which fell within a pronounced drop-base-drop pattern). Notably, the most recent downward push failed to establish new lows. This follows a period of rapid decline with minimal bullish resistance. This suggests two possibilities:

Bulls are strategically allowing sellers to exhaust themselves before a potential countermove.

The prevailing bearish momentum is overpowering any attempts at bullish recovery.

Trading Considerations:

The daily candle has formed a bearish engulfing pattern, confirming strong selling pressure. My trading strategy involves waiting for a price retracement back into the identified supply zone. This pullback would serve to fill existing price imbalances and trigger resting orders above, providing an opportunity to enter short positions with improved risk-to-reward ratios on lower timeframes (LTFs). Currently, there are no indications of significant bullish manipulation. Therefore, I anticipate continued downward momentum this week. It's plausible that we might witness a final bearish surge coinciding with the FOMC announcement before a potential bullish reversal - a hypothetical scenario based on technical analysis.

Final Notes:

The previous instance of the price trading this far below the 200 EMA occurred in December 2022, marking the culmination of a year-long bearish trend. While we are currently only one month into this downward movement, it's crucial to remember that past performance is not indicative of future results. Although a bullish rally is possible, I will maintain a bearish bias and focus on short opportunities until a clear bullish reversal pattern emerges on the 4H and 1H timeframes. When such a reversal occurs, we will be ready to capitalize on the subsequent upward trend! ;)

Should wait for the Breakout..Bearish Divergence on Weekly & Monthly TF.

However, Hidden Bullish Divergence is appearing

on Weekly TF which is actually a Positive sign.

Immediate Support seems to be around 126 - 130.

But if 140 is Sustained on Weekly basis, we may witness

further Upside around 150ish.

Best Approach would be to wait for the Rectangular Channel

Breakout.

Nvidia’s Sell-Off Deepens: How to Capitalize on the Decline?📉 Nvidia’s Technical Breakdown:

● Nvidia’s stock has been caught in a storm of selling pressure over the past month.

● The recent breach of critical trendline support levels suggests the downward trend could gain momentum in the days ahead, opening the door for savvy traders to capitalize on the bearish momentum.

🔄 NVDS: The Perfect Inverse Play for Nvidia’s Slide

● For those looking to navigate this decline, an inverse ETF like NVDS NASDAQ:NVDS offers a compelling opportunity.

● Designed to move in the opposite direction of Nvidia’s stock, NVDS has shown a chart pattern that almost perfectly inverse Nvidia’s price action.

● This makes it a strategic tool to potentially profit from the stock’s anticipated slide.

Abbott and Amazon: Two Bright Spots in a Sea of Red◉ Abbott Laboratories NYSE:ABT

● The stock previously faced strong resistance near the $134 level, leading to an extended consolidation phase.

● During this period, a Rounding Bottom pattern emerged, signalling a potential continuation of the upward trend.

● Following a recent breakout, the stock has surged to its all-time high and is expected to maintain its upward momentum in the coming days.

◉ Amazon NASDAQ:AMZN

● Since August 2020, Amazon's stock has been consolidating, forming a clear Inverted Head & Shoulders pattern.

● After breaking above the neckline, the stock rallied sharply and reached an all-time high near $242.

● Following this, the price pulled back to retest the breakout level and with a successful retest, the stock is now well-positioned to resume its upward trend.

What’s Driving PLTR’s Recent Rally, and What’s Next?What’s Driving PLTR’s Recent Rally, and What’s Next?

Palantir Technologies (PLTR) has delivered a remarkable performance, surprising many investors and traders with its rapid ascent.

The stock surged from approximately $64 on December 20, 2024, to a peak of around $118 on February 11, 2025—an impressive 89% gain in less than two months.

This substantial rally raises an important question: Is PLTR at a critical turning point?

A key technical consideration is whether the stock will retrace to fill the $15 gap visible on the chart. Historically, gaps often get filled, but strong momentum can sometimes defy this pattern.

Traders and investors should closely monitor price action, volume trends, and any fundamental catalysts that could either sustain the uptrend or trigger a pullback.

As always, exercise caution and apply sound risk management strategies when trading.

📊 My chart analysis tells the story—trade wisely.