Trade, Fed, and Policy Developments Impacting NASDAQ 100Tariff Expansion Threat:

Donald Trump signaled upcoming tariffs on pharmaceuticals and semiconductors, two sectors heavily represented in the NASDAQ 100. These measures could:

Raise consumer costs.

Disrupt tech and healthcare supply chains.

Add margin pressure on multinational firms.

Corporate Impact:

Rio Tinto revealed $300M in losses from US aluminum tariffs on Canadian output.

Canada-US trade talks will intensify, but tariffs appear likely to remain, adding to cost overhang for manufacturers and downstream users.

Fed Leadership Uncertainty:

Kevin Hassett is emerging as the frontrunner to replace Fed Chair Jerome Powell in 2026.

Trump is critical of Powell, even citing Fed building renovation costs as a potential fireable offense.

This adds uncertainty to monetary policy continuity, especially as inflation rises and rate path expectations diverge.

401(k) and Private Equity Access:

The administration is finalizing an executive order allowing 401(k) plans to invest in private equity, a move that could:

Increase alternative asset exposure.

Boost private market valuations.

Signal a policy tilt toward financial market liberalization, which may help sustain risk sentiment in the medium term.

Conclusion for NASDAQ 100 (NSDQ100) Trading

The near-term risk for NASDAQ 100 is tilted negative due to the tariff threats on semiconductors and pharma, both major index components.

Fed leadership uncertainty could inject volatility into rate expectations, pressuring tech valuations sensitive to discount rate changes.

However, the longer-term policy shift toward broader 401(k) access to private markets could support overall market sentiment and capital flows.

Bias: Cautiously Bearish in the short term due to trade and Fed risks; neutral to slightly bullish medium term if private capital access reforms proceed and trade escalation is contained.

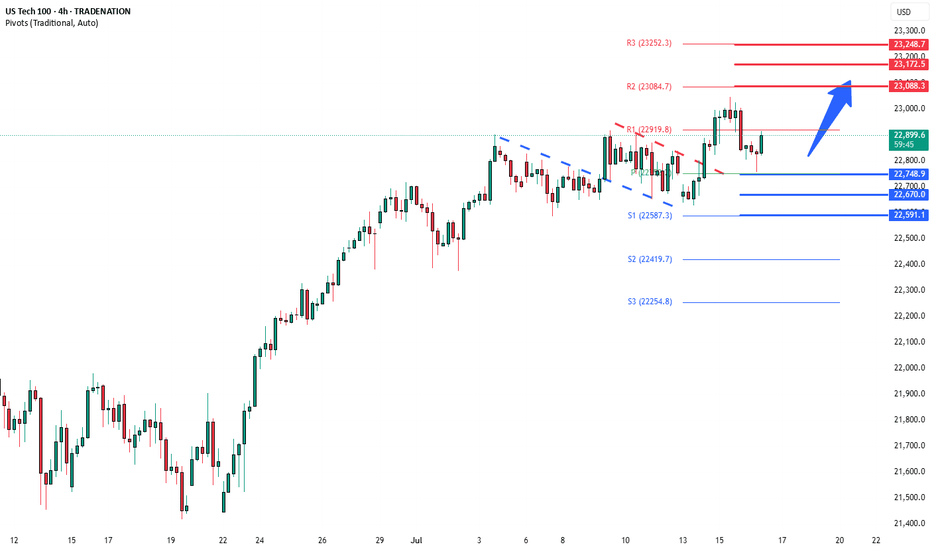

Key Support and Resistance Levels

Resistance Level 1: 23080

Resistance Level 2: 23170

Resistance Level 3: 23250

Support Level 1: 22750

Support Level 2: 22670

Support Level 3: 22590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Ustec100

USTEC100 Chart 4H, Trends To Watch for Short The provided USTEC 100 (US Tech 100) 4-hour chart highlights a strategic short (sell) trade setup based on technical price action and defined risk levels. The analysis suggests a bearish market bias, provided that specific price conditions are met and maintained. Let's explore the details and rationale behind this trade idea to understand how traders might approach this setup with calculated entries, targets, and stops.

As per the current market data presented, USTEC 100 is trading around 21,115.00 on Monday, 19 May 2025. The chart emphasizes a critical resistance zone highlighted in red, located at approximately 21,445.10. This level acts as a potential invalidation point for the short trade. If the price crosses above this red zone and a full candle closes above it, the entire bearish setup becomes invalid. This is a key condition – any move above this threshold signifies a shift in market sentiment and cancels the downward outlook.

NSDQ100 INTRADAY uptrend continuationTrade Tensions – Trump’s Tariff Plans

Donald Trump said he will set new tariff rates on trading partners within the next 2–3 weeks. China tariffs may remain at 30% through late 2025, according to a Bloomberg survey.

Relevance:

Renewed tariff threats could pressure Nasdaq 100 names with global exposure, especially semiconductors and large-cap tech (e.g., Apple, Nvidia).

Heightened inflation and supply chain risks may weigh on broader risk sentiment.

Geopolitical Risks – Russia, Middle East

Trump is open to meeting Vladimir Putin, though peace talks in Istanbul remain unproductive. Meanwhile, he returns from the Middle East with $200 billion in UAE investment deals.

Relevance:

Limited direct impact on Nasdaq 100, but reinforces broader geopolitical uncertainty, which may influence market volatility and global risk appetite.

Meta Under Pressure – Competition and Regulation

ByteDance, owner of TikTok, is reportedly on track to match Meta’s revenue this year. Meta shares fell on reports of delayed AI development and increasing EU regulatory pressure around user age restrictions.

Relevance:

Meta (META) faces increasing headwinds from both competition and regulation.

Sentiment could spill into other ad-driven or AI-exposed Nasdaq 100 names.

xAI Controversy – Grok AI Glitch

Elon Musk’s xAI chatbot Grok posted controversial content due to unauthorized system tampering. The company has since corrected the issue.

Relevance:

Raises concerns about oversight and content control in the AI space.

May indirectly affect sentiment around AI-related names in the Nasdaq 100, including Tesla and other emerging AI platforms.

Conclusion – Nasdaq 100 Implications

Caution warranted around large-cap tech, especially Meta and AI-focused companies.

Trade war rhetoric and geopolitical risk could add volatility to the broader index.

Watch for market reactions to tariff announcements, regulatory headlines, and key AI developments.

Key Support and Resistance Levels

Resistance Level 1: 21540

Resistance Level 2: 21710

Resistance Level 3: 21900

Support Level 1: 20890

Support Level 2: 20730

Support Level 3: 20600

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Nasdaq100/Us100 Possible Explosive Up Move About To Happen

Hello everyone! In this idea I have posted a picture of my current setup. I have taken a long positions once the 1 hour candles broke out of and closed beyond this range (Box) My SL is just the other side of this box and I am targeting the ATH on this position.

If another 1 hour box starts to form higher up I will simple add another position and move Stop losses accordingly.

although we have moved back within the range, the buy pressure is squeezing the candles to the top side of this range. This is why I am execting an explosive move. Once sellers are exhuasted it will propell itself to the next key level.

Let me know what you think.

I am not a financial adviser. Trade at your own risk.

NAS100/USTEC - 4hr| Descending TriangleSimple Trading: Descending Triangle

Nas100 has been trailing down for the past week. if the price breaks below 20,700, then the bullish momentum may be loss. Expect Nas100 to continue to bounce from one end of the triangle to the other end. Once the Triangle is broken, we can reveal the exact target area. Keep in mind that the last 4hr candle has closed below the previous candle low. Price could be preparing for a pullback before continuing to make a lower low. This will either be a break and retest with continued bearish pressure or a complete fakeout.

Bullish bounce?USTEC is falling towards the pivot which is an overlap support and could bounce to the 1st resistance which has been identified as an overlap resistance.

Pivot: 20,768.07

1st Support: 20,451.36

1st Resistance: 21,249.53

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Nas100 - End of August Update Hello Traders 🌍

So far so good, as mentioned yesterday. We making lower moves, ultimately i would like to see price move to 19,120 by the end of this week.

Notes

- Price left Friday's high + PWH intact

- Created bearish displacement during NY am session

- Total move plus 250 ticks from London

- 4hr Gap zone showing good price reaction

- Possible US tech selloff

today i am anticipating a move lower, however will sit on my hands until we between 19,630 and 19,666 for OTE, if all works out well.

Remember this is subjective price will tell us around 2:45am to 05:00am where it might want to go.

Trade safe 👌

Nasdaq reversed to bearish, looking short tradeHello traders 👋

According to 1 day chart, Nasdaq index is ready to do it's last downward movement. Hence I've prepared my analysis on how to trade in the bearish market. Many said rise from the previous low point; 11050 indicated beginning of bullish market. On the other hand, I think it is the 4th wave correction. Therefore I will continue to do short for the long term.

Buying NASDAQ at previous swing highs.NASDAQ - Intraday - We look to Buy at 11601 (stop at 11449)

There is no clear indication that the upward move is coming to an end.

The 261.8% Fibonacci extension is located at 12160 from 10592 to 11191.

Risk/Reward would be poor to call a buy from current levels.

We look to set longs at our bespoke indicator levels (11600).

Our profit targets will be 11991 and 12091.

Resistance: 11933 / 12160 / 12466

Support: 11600 / 11360 / 10667

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

US100 - DAILYDaily: Price is at its supply zone region. crossing up will take it to 12000ish region, and then trend-line, afterwards .618 fib level of previous LH to LL. A falling small trend line may also act as resistance.

There is a pattern here on Daily Time Frame: after completing and achieving its leg target (purple lines), price retraces a bit around 12% (marked in green circle), and then falls approx. 14% down (marked in yellow circle). it happened twice. Now, price did retraced 12% recently. But will it go back down 14%? we will have to wait and see

USTECH 100/NASDQ | Perspective for the week | Follow-up detailFollowing the strong sell that characterised this market in the last two weeks where we were able to scoop about 1,400 pips since my last publication on the index (see link below for reference purposes); we are currently at a critical point at around the $12,000 zone going into the new week. Are we going to be seeing buying potential during the coming week or a breakdown of the $12K zone will incite a plunge in the price of the index?

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

NAS100US NASDAQ next few weeks Trading IdeaHi All,

I'm looking for a short term Long to resistance at $12870

I think we will get a bit of sideways action on Monday as Liquidity

enters the market and most likely by Tuesday morning Japan Open 10am AEST

we should have an indication of market direction.

Over the coming months I think we will see price returning to the $11000 region.

I'll keep this Idea updated below as the week unfolds.

Short term momentum is bearish on US Nas 100NAS100USD/b] - Intraday - We look to Sell at 13124 (stop at 13319)

Short term momentum is bearish. There is scope for mild buying at the open but gains should be limited. Horizontal resistance is seen at 13150. Resistance could prove difficult to breakdown. We look to sell rallies.

Our profit targets will be 12705 and 12600

Resistance: 13150 / 13600 / 15200

Support: 12700 / 12000 / 11200

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

NAS100 [US100] Daily Outlook | 13-JuneWhat a move today!

Hi,

Looking at the volume and pips released by MAS100 asset today, am thinking these moves. Lets see how thing plays out. Am mostly waiting to see a retest before jumping right in, so please be cautious and risk less!

I will update later on.

Please like, follow me and share with your friends.

Live /Trading/Streaming at 8:45AM EST (Mon-Fri).

Kings.