USD/JPY rebounds, US GDP, Tokyo Core CPI nextThe Japanese yen has stemmed a 3-day slide, in which it declined around 1.5% against the US dollar. In the European session, USD/JPY is trading at 149.31, down 0.23%. In the US, third estimate GDP for the second quarter is expected to be revised lower to 2.1%.

Japan will release Tokyo Core CPI on Friday. The core rate, a key inflation gauge, is expected to ease to 2.6% y/y in August, down from 2.8% y/y in September. Core inflation has remained above the Bank of Japan's 2% inflation target for 15 consecutive months, which seems to indicate broad inflationary pressure. Still, Governor Ueda has said he will not phase out massive monetary stimulus, arguing that wages need to rise in order ensure that inflation remains sustainable around 2%. Japan's weak economy is making it easier for the BoJ to maintain its ultra-easy policy, and Friday's inflation release won't change the BoJ's stance.

The Japanese yen has paid the price for the BoJ's insistence on maintaining an ultra-loose policy and has had only one winning week against the dollar since July. The US/Japan rate differential continues to rise as Japanese yields stay put while US Treasury yields continue to move higher. USD/JPY is close to the 150 line and could breach it shortly. This will put pressure on Tokyo to intervene in the currency markets to prop up the ailing Japanese currency.

The US dollar is having an off day against the major currencies on Thursday, but the greenback has looked sharp against the majors lately. The markets are concerned that interest rates could remain higher for longer, as the US economy has been showing signs of resilience. Oil prices have hit $93 and are contributing to higher inflation - In August, US CPI rose from 3.3% to .3.7%. The futures markets have priced in a rate hike before the end of the year at 36.5%, which means the markets are uncertain if interest rates have peaked.

There is resistance at 149.19 and 149.93

USD/JPY tested support at 148.79 earlier. Below, there is support at 148.05

Usyields

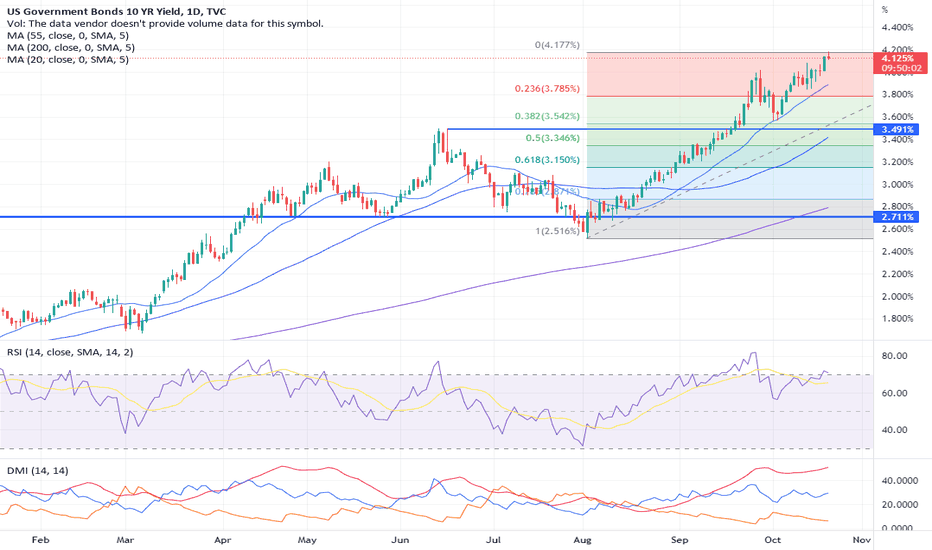

Stocks Are Turning Down After Three Wave Rally US yields are coming higher once again and looks like new high can show up soon, and this is something that is drving the USD higher. Even stocks are coming down this morning, cannot handle the USD strenght anymore so it appears that we ahve some risk-off flows at the moment which can last a few more sessions.

The elliott wave A-B-C rally on SP500, NASDAQ100 and even DAX is not looking good for the bulls.

Grega

This chart pattern suggests yields are going higherUS10Y remains in an established uptrend on the daily chart, and Friday's bullish engulfing candle suggests a swing low has formed and more gains are to follow.

But having looked back at price action since the April low, we note that prices are yet to break the low of a bullish engulfing candle if it has formed after a pullback or period of consolidation. Granted, there are one or two of those engulfing candles that do not fit the exact description (as an open or close is out be a few ticks, meaning it has not truly engulfed). But we've relaxed the rules to note bullish candles that show clear range expansion over the prior candle.

And if that pattern persists, it looks like the 10-year yield (and likely yields across the curve) are at least going to make an attempt to retest or break their cycle highs.

Gold ready for Sell-off in 1957/73 zone for targets 1925/12/021. Gold has reached Daily supply zone 1957-73

2. 1960 is also the lower end of long term Weekly supply zone.

3. Gold is also near the top of the descending channel from May 2023 high 1981.82

4. Fall in DXY and drops in US yields did not lead to growth in Gold today.

Sell in the 1957-1973 supply zone for :

Short term targets - 1925/1912/1902

Medium term target - 1855

Please boost the idea, comment if you like any part of it.

For deeper fundamental insight, pls read the details of previous idea (the last one).

Happy trading!

Tarang

20 Reasons for sell US30 years Yield 🔆MULTI-TIME FRAME TOP-DOWN ANALYSIS OVERVIEW☀️

1:✨Eagle eye: Since 1987, the market has been continuously declining, reaching its valid low in 2020 and confirming the lows in 2022. This is the first valid low in 35 years.

2:📆Monthly: The market is undergoing a change of character from bearish to bullish after 35 years. However, the high has not been confirmed yet. There is a high chance that the price will make a corrective move to confirm the highs. Over the last 8 months, the market has been in a sideways phase, forming an asymmetrical triangle pattern. It is most likely to break to the downside to complete the move and form a valid high. We can also observe significant demand in the same area.

3:📅Weekly: The overall trend is clear and upward without a valid high. The current market is in a full consolidation phase, creating three higher highs (H3) and almost three lower lows (L3) during the consolidation period, narrowing the price range. A breakout in either direction will confirm the next move, but the bias seems to be on the bearish side. Let's wait and see.

4:🕛Daily: A valid high has been formed with a proper valid low, and the third step has created a higher low (HL), indicating potential downside movements.

😇7 Dimension analysis

🟢 analysis time frame: Daily

5: 1 Price Structure: Bullish

6: 2 Pattern Candle Chart: More than 60% of sessions close to the downside, and all downward sessions show strong bearish closings. An inverted head and shoulders pattern has also formed.

7: 3 Volume:

8: 4 Momentum UNCONVENTIONAL RSI: Sideways for a long time.

9: 5 Volatility measure Bollinger Bands: We are experiencing a tight squeeze, indicating that all volatility has dried up. The squeeze breakout will play a major role in the coming days. Let's watch and wait for the breakout below the lower Bollinger Band for confirmation.

10: 6 Strength ADX: Sideways.

11: 7 Sentiment ROC:

✔️ Entry Time Frame: Daily

12: Entry TF Structure: Bullish

13: Entry Move: Corrective

14: Support Resistance Base: Monthly resistance trendline and daily resistance trendline.

15: FIB: Trigger event also activated.

☑️ Final comments: Sell at the squeeze breakout.

16: 💡Decision: Seeking a sell position.

17: 🚀Entry: 3.78

18: ✋Stop Loss: 4.07

19: 🎯Take Profit: 3.1

20: 😊Risk to Reward Ratio: 1:3

🕛 Expected Duration: 30 days

US 10-Year Notes - LONGI've been loading on these like crazy, all day long.

Yields have peaked, by any measure. Also, the inevitable - continuous - U$D buying can't help but push these higher.

The Yuan/Rubble based trade, while present, is miniscule and capital isn't exactly flowing into mainland China. No one trusts the Chinese and the Russo-Chinese alliance is about as stable as a floating dice game. Hence, the Chinese central Bank's insane gold buying spree despite which gold prices couldn't muster more than an intra-day all time high, lasting all of 5 minutes.

All U$D, all day long.

Canadian dollar edges lower ahead of Canadian GDPThe Canadian dollar is trading close to a two-month low, as the currency remains under pressure. USD/CAD is trading at 1.3646 in the European session, up 0.34%.

Canada releases GDP later today, and the markets are projecting a modest 0.4% q/q for the first quarter, after flatlining in Q4 2022. On an annualized basis, GDP is expected to jump by 2.5%, after stalling at 0% in Q4.

The GDP report takes on even more significance as it is the last tier-1 release ahead of the Bank of Canada rate meeting on June 7th. A strong GDP release would support the Bank raising rates, while soft growth would give the Bank room to continue pausing rates at 4.25%. The key to the BoC's decision could well depend on the GDP release.

The BoC has a tough decision to make at next week's meeting. The BoC would like to extend its pause of rate hikes but inflation hasn't cooperated, as it ticked upwards to 4.4% in April, up from 4.3% in March. Inflation has been coming down, but remains well above the Bank's target of 2%.

In the US, the debt ceiling deal between President Biden and House Speaker McCarthy now has to be approved by both houses of Congress. Some Republicans are against the agreement, but the deal is expected to go through. The markets are optimistic, as 10-year Treasury yields dropped sharply on Tuesday in response to the agreement, which was reached on the weekend (US markets were closed on Monday). The 10-year yields are currently at 3.65%, after rising to 3.85% on Friday, their highest level since March.

1.3585 and 1.3515 are providing support

1.3685 and 1.3755 are the next resistance lines

GBP/USD drifting lower ahead of UK inflationGBP/USD is trading quietly at 1.2423, down 0.11% on the day.

UK inflation has been a thorn in the side of the Bank of England for months and is still above 10%. The UK releases the April inflation report on Wednesday and relief may finally have arrived. Headline CPI is expected to fall from 10.1% all the way to 8.3% y/y. That would be welcome news, but core CPI, which is a better gauge of inflation trends, is projected to remain unchanged at 6.2% y/y.

Bank of England Governor Bailey reiterated today in testimony before the Treasury Select Committee that inflation has turned the corner, and we'll know if he's correct on Wednesday. Even if inflation surprises to the downside, it will be miles higher than the 2% target which Bailey has pledged to reach. That means that more rate hikes are likely until both headline and core inflation show rapid declines.

Bailey received some good news from the International Monetary Fund, which revised upwards its growth forecast for 2023 from -0.3% to +0.4%. This means that the UK economy, while still struggling, will avoid a recession. The IMF projected that UK inflation would fall to around 5% by the end of the year and drop to the 2% target by the middle of 2025.

The US dollar is higher against most of the majors today, as investors remain concerned about the US debt ceiling standoff. The Democrats and Republicans continue to negotiate, with a June 1st deadline just a week away. The yield on the US 10-year Treasury notes has risen to 3.75%, its highest level since March. This has given a boost to the US dollar and yields could continue to push higher the closer we get to the deadline without a deal. The United States government has never defaulted on its debt, and a deal is likely to be hammered out before the deadline.

There is support at 1.2307 and 1.2221

1.2375 and 1.2461 are the next resistance levels

US 10Y yield convergence of resistance levels around 4.19/20We have a convergence of levels around the 4.19/4.20 zone of the chart, it is a long term double Fibonacci retracement and represents significant lows seen in 1998 and 2001.

Will be quite interested to see if the market pauses here in order to consolidate sharp gains that have been pretty relentless since August.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

When USD Hits Resistance, That's When USDMXN Will Breakdown In today's video I will look into a detail analysis of USDMXN, which is doing quite well compared to the strong USD Index. So my assumption is that when USd index will hit resistance, possibly after the 10 year US notes completed the current fifht wave up, the USDMXN can easily break through the support and will be targeting Feb 2020 pandemic low.

Crude oil is also very important for the USDMNX. Price is higher for the last two weeks as the situation between Russia and Ukraine is getting worse. OPEC also decided in its first one-on-one meeting since 2020 to cut production by up to 2 million barrels per day from November. So it appears that EU will not have easy task to limit the energy prices.

If you like this video, please leave me a comment below and press like.

Thank you

Grega

GBP/USD jumpy after BoE interventionIt has been a volatile day for the pound. GBP/USD started the day with losses but has reversed directions and posted strong gains in the North American session. GBP/USD is trading at 1.0799, up 0.61%.

The new Truss government has started off on the left foot, sending the pound to a record low in the process. The trouble began on Friday, as Chancellor Kwarteng's mini-budget promised tax cuts, despite soaring inflation which is hovering around 10%. The mini-budget was widely panned and the pound sank like a stone on Friday, falling a stunning 3.6%. The pound lost another 1.5% on Monday and dropped to a record low of 1.0359.

The scathing criticism was not only domestic. The IMF has joined the chorus of boos and attacked the government's fiscal plans, going as far as calling on the UK to "re-evaluate" its tax cuts. Moody's warned that the plan could jeopardize the UK's credit rating. With the new government's credibility seriously undermined, it's no surprise that the pound is taking it on the chin.

In a dramatic move, the Bank of England has stepped in order to avoid a possible crash in the bond market. There had been speculation that the BoE might deliver an emergency rate hike in order to prop up confidence and the ailing pound. Instead, the BoE said it would unlimited purchases of government bonds of 20 years or longer. This pushed 30-year bonds sharply lower after they had climbed to 24-year high, and the pound has moved higher.

In the US, ten-year Treasury yields pushed above 4.00% earlier today, for the first time since 2008. The markets are showing a healthy respect for Fed hawkishness, even after inflation weakened in the past two inflation reports. There is some optimism that the current rate-hike cycle is reaching its end, with Fed member Evans stating that it will be appropriate to slow the pace of tightening at some point. For now, the US dollar has momentum, driven by an aggressive Fed and weak risk appetite due to worrisome developments in the Ukraine war, including the sabotage of the Nord Stream pipelines and Russia's plan to annex parts of Ukraine.

GBP/USD is testing resistance at 1.0742, followed by resistance at 1.1052

There is support at 1.0644 and 1.0431

QE Tapering Delay Can Support Gold #ElliottwaveFed's Kaplan noted that they are watching Delta variant, and says he may need to adjust view regarding tapering. This is very important for speculators who were recently betting on the USD as this can limit the USD strenght if it proves correct.

In such situation traders may turn back to gold where price recovered back to $1800 and even erased all of the losses after the crash from a two weeks back. Rally, in fact, is in five waves which is very bullish for metal. At the same time, we are looking at the TLT as confirmation regarding lower US yeilds/higher notes, while DXY can be trading at resistance of a three wave rally up from January.

Take care,

Grega