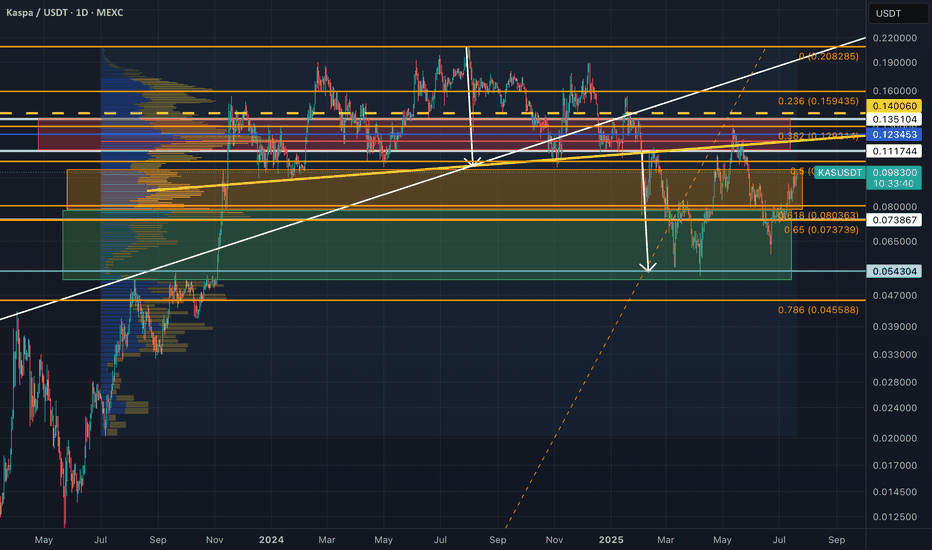

Last chance to reaccumulate Kaspa while it is below 10 cents?Second chance to accumulate CSE:KAS at below 10 cents after its correction down to 5 cents from its 20 cents ATH is coming to an end?

Previously, technicals looked great for CSE:KAS (and other ALTs too) with a breakout from a cup-&-handle pattern in July/Aug2024, but market says otherwise with gloomy economic report. >> For the small portion of capital assigned to trading crypto: I got stopped out from my (manually adjusted) trailing stoploss, with an approx. 6.8%avg loss from my BTC and ETH DCA spot injections into CSE:KAS from 10 cents all the way to 20 cents ATH.

For my long-term investment hold, I had bought from 2 cents all the way to almost ATH (at ~15 cents) and still holding and adding to it now as long as KAS is below. 10 cents. Had started accumulating aggressively again within the green zone, and probably gonna stop soon once KAS leaves the orange zone.

Last cycle, my main Altcoin investment focus was in ADA (POS and UTXO based chain based on academic research and peer-reviewed design), eventually selling most of other ALTs into ADA. This cycle, my personal investment focus is in Kaspa — and probably holding 15%(?) through the bear market correction after blow-off-top into the next cycle together with BTC and some ETH as well. Fingers crossed with regards to price; although the technology, decentralization ethos, and general fundamentals behind it is IMO extremely sound, and has a high probability (though not certain) to eventually establish itself to become one of the (if not THE) top L1s into the future.

———————————————

My reply re. the past YTD price performance of CSE:KAS , which I feel might be worth sharing here.

"For Kaspa, on the YTD timeframe, it has corrected ~50% down, after a ~10x rise from about 2 cents (when I first got in, in 2023) all the way to 20 cents. It is still an early tech about 3 years old and still not widely know; hence as an investment, it is definitely risky and high volatility is to be expected (not listed in high liquidity Tier1 exchanges yet), just like BTC in 2017 where I first bought at ~3kUSD, and a lot more significantly at 5k, and all the way to its ATH at 20kUSD, and stupidly held when it dropped all the way to 3kUSD, and kept on buying with a long-term view.

I view Kaspa in the same light as BTC (different from other cryptos), the only two that I will probably still hold a small but significant portion of, after the blow off top of this cycle due to its fundamentals that I am personally drawn towards -- e.g. POW but 6000x faster than BTC in bps, and ultimately will be 60000x faster once the DAGKnight protocol is implemented in 2026 (trilemma solved); protocol are based on peer-reviewed published research; fair-launched with no-VCs pre-allocation nor pre-mine; no central controlling figure; no DAG/Chain bloating due to implementation of pruning and where 0% TX-archival nodes are needed to maintain the security of mining, and are only necessary for explorers and institutions that intends to track TXs; (soon to come in Q4) Two Layer 2 implementations that will eventually be "Based-Zkrollups" (something that Ethereum planned to implement but was not feasible due to speed and cost issues, even after its POS-fork) -- where L2 TXs are instantly settled onto L1 without security compromising batching of TXs and delayed settlement that Eth-L2s currently does, and more.

But KAS is just a crypto project that I am personally interest in; and I am certainly not recommending anyone to buy as an investment, well unless they see something interesting in it too as I do. ;)"

Utxo

Old wallets moving, BITCOIN CORRECTIONHello Traders

As you can see in the chart above, we predicted the market correctly in the previous post. Now we expect a correction to lower levels.

On the Onchain side, I put a metric called ASOL; Average Spent Output Lifespan, which shows the average age (in days) of spent transaction outputs. The metric value has spiked today, meaning that old wallets (UTXOs) were moving their bitcoins, which creates a risk for the price.

Onchain and technicals combined, I think we can see lower levels over the weekend or might have a bearish consolidation.

Note that this is an intraday analysis and is only valid for a couple of days or even hours.

------------------------------------------------------------------------

What is your opinion? Comment below.

If you like the idea, please hit the boost button and follow me so you won't miss the updates. The information given is never financial advice. Always do your research too.

Good luck.

butterfly scenariobutterfly harmonic pattern:

AB=0.78 XA

BC=0.88 AB=$1.13

0.23 XA=$2.22

0.38 BC=$3.98

0.38 XA=$4.47

0.61 BC=$8.76

0.61 XA=$13.87

0.78 BC=$15.35

0.88 BC=$21.44

0.78 XA=$31

0.88 XA=$50.2

1.41 BC=$123

1.31 XA=$161.8

1.6 BC=$246.8

1.27 XA=$320

1.41 XA=$620

2 BC=$883

1.6 BC=$1682

2.24 XA=$1968

BTC- Buy on the dip engine activated... Trial modeWill the BTC option launch on CME finally kick off the long-awaited price surge toward the glorious BTC halving?

On the fundamental side, all the metrics list in my chart indicate that whales and long-term holders have not moved much of their BTC holdings in a while, a bullish scenario to me because it means we are less likely to see a huge selling pressure if this trend continues.

The first hurdle, daily timeframe, is cleared as most technical indicators turne bullish and some indicators suggest a slightly overbought condition, which indicates the potential short-term pullback.

No divergence detected which further validates the current trend.

However, the lack of volume on the daily timeframe is a little bit concerning though.

The ideal scenario for bulls is to end the weekly candle on the high volume above the vertical trendline.

I see a lot of confluence around 8450 on the daily timeframe and I expect bulls to defend this lvl.

Overall, I believe the successful defense by bulls at 6.5k and 7.7k has turned the tide of the battle and, bulls will continue to have the upper hand as long as BTC stays above 8k.

DGB - The sleeping giant As probably you've heard debate about scaling whole year in 2017. We already have a centralized scalability solution like "Visa" for fiat and "XRP" in cryptocurrency but they are not blockchain.

But why decentralization, security and privacy is important ? You might want to revise the definition of cryptocurrency even you're investing or not.

"A digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank. A decentralized cryptocurrencies now provide an outlet for personal wealth that is beyond restriction and confiscation"

Evolution of cryptocurrency is the future of smart economy :)

Let's say why DGB ?

1- DGB is the most decentralized because it can be mined by 5 different algorithm, always option to use either one algorithm without any forks. < Decentralized >

2- DGB block size will grow as more coins are mined - Yes, It's in the code < Scalability >

3- DGB provide Digishield to other coins which is super secure feature so far now. < Security >

In a special feature published today on the largest crypto news site CoinDesk titled “RBC Report: Crypto and Blockchain Could Unlock $10 Trillion Market”

Mitch Steves, an equities analyst with "Royal bank of Canada" RBC's Capital Markets subsidiary put it this way.

"As the application becomes successful, the protocol layer captures more value, which then creates more interest in additional decentralized application development. As scaling and protocols mature, the value of a decentralized world computer could potentially become a multi-trillion dollar industry. If there’s one positive technology item we can agree on, it’s that the blockchain has never been hacked. What happens if we build on top of this secure layer"

Easy way to find decentralized coin - Just filter out the non-mineable coin.