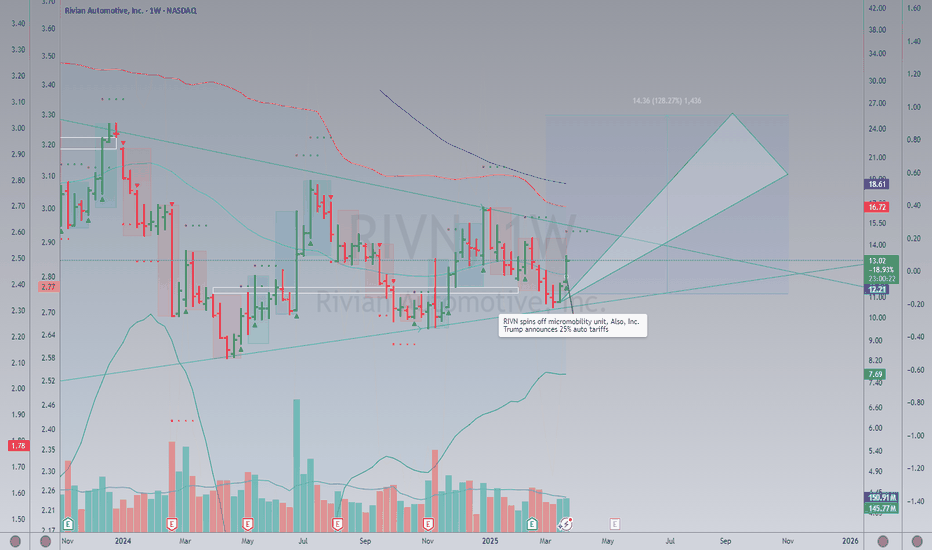

Rivian Kicking Off Potential UptrendHey, all. I'll get down to it. Obviously NASDAQ:RIVN has been an incredibly tough stock to own. Fake out after fake out. It has been brutal - unless you have been nimble enough to buy the dips and sell the rips.

I would like to posit, however, that NASDAQ:RIVN is going to start marching back higher here over time. In the signal system I have been taught via the T@M strategy, Rivian is putting in a range expansion to the upside on the weekly time frame. If you take the range of the past monthly consolidation period, attach it to the "mode" (or central zone of the consolidation range), it gives you a target of $25 over the next few months. Now, whether this is another fake out just to reverse on us... again... remains to be seen of course. It is early in the idea. But potentially offers a decent risk/reward position here.

I just do not see Rivian really going away at all and, if they can keep refining their business, they could see some success going forward. Anyway, hope you enjoy this idea! As always, position carefully as the market is risky business.

Including the Daily Chart below for your reference as well.

Value

Pinex-Capital Trade IdeaThe chart shows a bullish daily structure with a higher volume range and positive momentum. The first long idea is based on a pullback to the value area high or the 0.5 Fibonacci zone around 0.6498. Should the market test this area and show buyers there, this would be an opportunity for a long entry with a target in the area of the recent high at 0.6538. The stop can be placed slightly below the 0.618 level at 0.6484.

A second long opportunity arises on a breakout above the recent high at 0.6538. If the price breaks above this zone with volume and stabilizes there, a procyclical long can be entered with a target towards 0.6560+ (next psychological level). The stop should be placed just below the breakout level.

Pinex-Capital Trade IdeaThe second chart shows a bullish daily structure with a higher volume range and positive momentum. The first long idea is based on a pullback to the value area high or the 0.5 Fibonacci zone around 0.6498. Should the market test this area and show buyers there, this would be an opportunity for a long entry with a target in the area of the recent high at 0.6538. The stop can be placed slightly below the 0.618 level at 0.6484.

A second long opportunity arises on a breakout above the recent high at 0.6538. If the price breaks above this zone with volume and stabilizes there, a procyclical long can be entered with a target towards 0.6560+ (next psychological level). The stop should be placed just below the breakout level.

Delta Airlines - Long Term FlyerHey, all. Pretty intense idea here, but I am a buyer of NYSE:DAL at these levels. Obviously, the chart looks awful from a recent performance perspective. However, if you take a long term view, we could actually be rebalancing after an initial range expansion to the upside. Just like NASDAQ:RIVN , airlines are/have been a pretty brutal investment. I guess I have a thing for pain. Ha.

I am certainly a believer that airlines are undervalued here and can reverse back to the upside. Of course, it goes against the current narrative that the economy is showing signs of weakness. But I am just willing to take the risk on this one. I believe the consumer and culture shift in the US to have more experiences in life will continue to hold.

Are we going to come in for a hard landing, or take off to cruising altitude? We'll see what kind of lift the market will give us. Right now the turbulence is pretty intense.

ETHEREUM is stacking up to fly! BINANCE:ETHUSDT ETHEREUM got a lot going for it right now. It's the backbone of a huge chunk of the crypto world, especially with all the DeFi and NFT stuff happening. Plus, there's always talk about big upgrades that could make it even better.

Right now, Ethereum's trading around $2,500, but some experts expect that it could climb way higher, maybe even past $8,000, if everything goes right.

That aside, I personally think $5,000 is achievable and to happen soon. It clearly broke out of the months long downtrend channel and with momentum. There's a lot of hate for ETH just for being expensive. But, let's be real, is not the 2nd biggest player in the market for nothing.

Let me know what you think? Open to counter ideas!

BINANCE:ETHUSDT

Nvidia could be worth $220 by this time next yearThe amount of money this company is making is insane and it doesn't look like its going to slow down any time soon. There is strong demand for Nvidia products universally there is no limit to how far this thing will go. Over the past 5 years it has outperformed Bitcoin, need I say more?

I am abit late to be buying into the rally but I will keep accumulating should the market provide me with ample opportunities. I think this is a fantastic growth stock for a diversified portfolio and I think Nvidia is one of the top dogs of todays economic eco system.

Despite the fact it looks expensive the stock is actually still under valued. The range of the intrinsic value is between $110 - $240. I do not recommend going all in FOMO but this thing is going up, I have done some research and it is a fantastic company to work for everyone says they love working there and they pay their employees well.

They continue to innovate and pave the way forward for semi conductor tech. I love my Nvidia chip in my laptop I can only imagine what the more expensive chips are capable of. Nvidia and Broadcom make up about 15% of my portfolio. Thank you for reading my article and please comment if you want to talk about stocks. Have a great day.

Simple Coca Cola daily chart analysisCoca Cola, my favorite defensive stock seems to be at a price decision in time. I have found a single trend line that looks reasonable. There seems to be a lot of congestion in price over the last few days this leads me to believe a breakout is coming soon. 25% of my portfolio is Coca Cola, it pays great dividends and I love the history of the company. It is a solid choice for these economically uncertain times, I think they do soda better than anyone else I been drinking Coca Cola as long as I can remember its still my favorite.

I believe its possible to see a retracement down to cheaper prices but I also don't believe in waiting for such occurrences to happen so I have already been accumulating for the last few weeks. The range of the intrinsic value of Coca Cola is between $50 - $180. My prediction for the price is that it will go up over the next 12 months. Thank you for reading my article and best wishes, cheers.

6/5 Gold Analysis and Trading SignalsGood morning, everyone!

Gold surged above 3380 yesterday but faced strong resistance, pulling back before testing the critical 3400 level. Despite multiple attempts, price failed to break through, highlighting a clear lack of bullish momentum near historical highs.

From a technical perspective, a potential M-top (double top) pattern is forming on the 30-minute chart. If confirmed, we can expect a deeper retracement, with an initial target around 3330, and possibly 3300 in case of further downside. Under this structure, today’s primary trading bias should favor short positions.

That said, if gold breaks above 3400 with strength, the 3416–3438 target zone becomes viable. However, any such breakout is likely to be followed by a pullback. In that scenario, we’ll closely monitor the 3392–3368 support range before executing follow-up trades.

📉 Technical Notes:

Price remains near a historical resistance zone, and buyers are showing hesitancy at these levels;

While yesterday’s Beige Book report provided short-term bullish sentiment, we need to observe whether the Asian and European sessions digest and extend that move.

🗞 Fundamental Outlook:

The key event today is the U.S. Initial Jobless Claims report, which may trigger volatility;

Gold remains supported by risk-aversion flows, but traders should be mindful of potential corrections at elevated levels.

💡 Risk Management Tip:

In such conditions, it is highly recommended to scale into positions with reduced lot size, and use tight risk controls to guard against unexpected reversals.

📌 Trading Recommendations for Today:

Sell near 3423–3436, targeting short-term pullbacks

Buy near 3312–3298, if deeper correction materializes

Pivot levels for tactical trades:

3416 / 3403 / 3392 / 3386 / 3367 / 3352 / 3343 / 3328

Strategy Summary:

Favor short setups on rallies unless 3400 is decisively broken. If support at 3362-3358 fails, expect the bearish trend to gain further momentum.

ETHUSD: Buying opportunityWarning, this is highly speculative!

Ethereum faced a gruesome decline since the peak of around 4000 back in december, reaching a bottom of ~$1400

Then, in may, we had a huge rally, boasting a nearly 100% bounce from bottom to top.

Now, this fact alone has many people holding off on buying short term, as they feel a drop could be just around the corner, however, i think for this exact reason, aswell as an inbound risk-on environment, it will continue the rally, and much faster and for much longer than anticipated, creating that FOMO wave people seem so desperate to try and catch.

The whole reason you end up with the feeling of FOMO, is because your past decisions seem stupid in hindsight, and recent price action makes it seem obvious.

Well let me tell you, its NOT obvious, and that is precisely why it runs and creates that FOMO wave.

Price targets are irrelevant, focus on recognizing when greed runs amok, and take profits accordingly.

EOY Would be an obvious point at which selling heavy might be smart, but then again, its never obvious... Goodluck!

Novo Nordisk: Massive buying opportunityNovo has been struggling big time, december and march hit especially hard.

American institutions have held large positions in Novo, and this was felt when they had to sell off due to risk management with the looming tariffs.

However, the sheer devaluation & importance of their export, is going to create a massive wave following a risk-on environment, which i firmly believe is coming.

One of the few large EU based firms worth investing heavy in.

Helen of Troy | HELE | Long at $27.95Helen of Troy NASDAQ:HELE , owner of brands such as OXO, Hydro Flask, Osprey, Vicks, Olive & June, etc, has witnessed an immense decline in share price since its peak in 2021 when it hit just over $265. Now, trading in the $20s... Growth has been a problem for this company (now and future projections) and a major turnaround is needed. However, NASDAQ:HELE is implementing several growth strategies for 2025-2030 under its Elevate for Growth plan and Project Pegasus, so they are very aware of the need to re-inspire investor confidence. They also announced last month the appointment of an interim CEO and CFO. With a 22M float and 12% short interest, this could get interesting.

Excluding the current growth issue, the fundamentals of NASDAQ:HELE are quite strong:

P/E Ratio: 5x (undervalued)

Book Value: ~$70.00 a share (undervalued)

Debt-to-Equity: 0.6x (healthy)

Quick Ratio: Over 1 (healthy)

From a technical analysis perspective, it may have just formed a double-bottom near $24-$25, but a quick drop between $10-$20 is absolutely possible if bad economic news emerges.

At $27.95, NASDAQ:HELE is in a personal buy zone with a caution regarding the US economy and this company's ability to turn things around moving forward.

Targets:

$40.00 (+43.1%)

$52.00 (+86.0%)

Revenue growth nine consecutive quarters Ouster’s global partner network spans over 50 countries, supporting approximately 600 customers with applications in autonomous vehicles, robotics, drones, mapping, defense, and smart cities. Ouster has been getting lots of attention lately 230k 20 call 1/16/26 I'm wondering if someone knows there's an announcement coming this year that will get them ABOVE $20. Great growth stock huge partners here are some notable ones.

Anduril Industries: weapons/defense tech *

Komatsu: construction mining *

Vecna Robotics: warehouses

NVDIA: integration/traffic ***

Forterra, Textron, Field AI, and U.S. Army: vehicles

Google Maps, Apple Maps, Oshkosh Defense, John Deere: sensory

Amazon Robotics: Ouster’s LiDAR sensors are reportedly used in Amazon’s Proteus robots, described as part of a significant order, though not officially published. ***

Right at monthly resistance now 15$ is a strong resistance. Any pull back to $10 ish would make great buying opportunity I'm long from earlier this week July 14C / 16C Aug 17C looking to add BUT I'm also trading these the daily RSI is at 75 nearing overbought, weekly has room to run at 64 monthly is at 50 which it could reject momentarily from. Either way great company to DCA shares still under 1B market cap!

Columbus McKinnon Corp | CMCO | Long at $14.90Columbus McKinnon Corp NASDAQ:CMCO is a stock that is highly cyclical, moving in "boom and bust" cycles every 3-5 years. As indicated by its entry into my "crash" simple moving average area (currently between $11 and $13), it may be nearing the end of its bust cycle (time will tell). With a book value at $31, debt-to-equity of 0.6x (healthy), quick ratio over 1 (healthy), insiders buying over $1 million in the past 6 months, a 2% dividend yield, and earning forecast to grow after 2025, NASDAQ:CMCO may be a hidden gem for double-digit returns in the coming years. But every investment is a risk.

Thus, at $14.90, NASDAQ:CMCO is in a personal buy zone.

Targets:

$25.00 (+67.8%)

$30.00 (+101.3%)

PBF Energy turnaround happening?Fundamentals:

The stock is trading at 0.42x book value, and pays 5.58% dividend. Of course, if profitability deteriorates further, the dividend can be cut and the P/B value can fall lower, but!

PBF is doing a good job on cost cuts, in the last earnings report posted narrower loss than expected

The mexican company 'Control Empresarial de Capital' is continously buying shares of the company, and nor Carlos Slim, neither another insiders-holders selling shares.

Technicals:

The 100 day moving average is the Boogeyman for PBF Energy.

One year ago, early May 2024 the price lost it, and never got back above.

Death cross happened in 2024 July.

Got rejected by the 100MA 4 times, as seen on the picture. The 50day got under the 100, but not worked as support. In 2025 Jan-Feb it tried, but failed.

Is this time different?

A final washout is already happened to $13.45 in April.

In May 2025, the 100MA rejected the price again, but this time the 50MA held as support.

Now the price battles with the 100MA again, break above means a target of $25, as this is an unfilled gap of 2025 February, and the 200 day MA.

Short-term traders can set $25 as target.

Long-term investors can eye $32-36 with proper risk management, or continous buying-selling. Can take a year or two.

Huntsman Corporation | HUN | Long at $11.34The stock price for Huntsman Corp NYSE:HUN , a manufacturer of organic chemical products, has dropped significantly since its peak in 2022 ($41.65). This was due to lower sales volumes, weak demand in construction and transportation, higher input costs, and European operational challenges, including a $75M hit from closing a German Maleic Anhydride facility. This year (2025) is anticipated to be its worst earnings year, and the stock is priced as such. However, this stock is historically cyclical, and the company expects recovery / growth again in 2026. Moving forward, earnings are forecast to grow and the company is trading at good value compared to peers and the industry. While many headwinds may still exist with tariffs, etc., insider are grabbing shares and large options positions (very bullish). With a book value of $17, debt-to-equity at 0.8x, quick ratio under 1, etc., the company appears healthy.

From a technical analysis perspective, the stock price just barely missed my "crash" simple moving average area (currently between $9.00 and $10.50). It may reach those levels and below in 2025, for which I will add another position as long as fundamentals do not change. This moving average area often signifies "bottom" territory and historically, the stock has rebounded from this area. While my entry at $11.34 may be a little early, predicting true bottoms isn't my trading method and I hope to strengthen the position at lower trading prices.

Targets:

$15.00 (+32.2%)

$17.25 (+49.9%)

Grounded Lithium - undervalued, strong business modelGrounded Lithium and Denison Mines are exploring and developing direct lithium extraction (DLE) from brines in Western Canada. Exploration is being directly funded via Denison Mines, who has the option to provide funding in exchange for deposit ownership. Their current deposit has an after tax NPV with 8% discount rate of $1B. Grounded Lithium currently owns 70% of the deposit and will, ultimately, own 25% of the deposit ($250M NPV). Assuming Grounded Lithium is bought out by Denison Mines at a rate of 30% of the NPV, Grounded Lithium will be valued at $75M, a 30x increase from their valuation today. This does not include any added value from additional discoveries or other reasons.

This is a long play and I do not expect Denison to make an offer until their buy-in phases have completed in 2026-2027.

100% run up into earningsChance to get hot with semis if SPX can claim above 5950

High $8 for buying until we lose the 50MA.

Break above 12 with strength/volume will be key for continuation to 20.

Price-To-Earnings ratio (12.6x) is below the US market (17.8x) *

Revenue is forecast to grow 17.78% per year *

Earnings grew by 47.8% over the past year *

Short Interest 6.94M

Short Previous Month 7.16M

Short % of Shares Out 23.30%

Short % of Float 26.13%

Short Ratio (days to cover) 17.67

they will have tariff issues, so guidance is likely to bring uncertainties

Bitcoin analysis based on market liquidity and M2 money supply This trade enters Bitcoin in the $101,500–$102,200 zone, aiming to capture a high-probability bounce from a dense liquidity pocket formed by recent long liquidations. This region has historically acted as a bull market reaccumulation zone, typically holding after 5–8% drawdowns during major trend continuations.

The trade is structured to ride a macro continuation leg toward $125,000, targeting the next major expansion phase driven by both short squeezes (clustered above $106K) and a broader surge in demand following increasing M2 money supply and institutional inflows.

The stop-loss is placed at $97,000, a deliberate distance below local support but above the deeper liquidity sweep zone at $89K–$92K. That level is unlikely to be reached unless the market undergoes a full liquidation cascade, which would likely bypass $97K altogether in a fast move. This stop protects against structural failure while avoiding premature exits in normal volatility.

The setup is designed for maximum reward with acceptable risk, offering a risk-reward ratio of over 4:1, and aligns with the thesis that Bitcoin is entering its final acceleration phase toward a new macro high.

GOLD SHORT ENTRY

AronnoFX will not accept any liability for loss or damage as a result of

reliance on the information contained within this channel including

data, quotes, charts and buy/sell signals.

If you like this idea, do not forget to support with a like and follow.

Traders, if you like this idea or have your own opinion, please feel free command me.

POLESTAR (PSNY) - LONGTERM BUYING OPPORTUNITY, RISK:REWARD 1:10Polestar (PSNY) has been in a long term downtrend since its launch on the NASDAQ, the EV sector has seen some excitement however adoption to EV vehicles has been a slow trend worldwide compared to the hype when first introduced. At current, EV sector participants are in the beginning phases of mass adoption and battery and charger technology is seeing some much needed advancement before mass adoption can take place, many barriers exist in real world infrastructure and this technology will take many years to advance. The promise of autonomous self driving will ultimately catapult these EV companies to new heights financially, however the timing is not right just yet. Once AI advances enough to power ASD, rob taxis and self driving will be a common sight around the world starting in smaller cities and eventually becoming advanced enough to power more of the vehicles worldwide. Polestar's all time low trading price is at $.60 cents and currently sits right above $1.00 per share. Any price between $.60 cents and its current price would be a good 1:10 risk reward investment with downside very limited to potential upside gains to $10 and potentially higher in the long term future. If the EV and AI fulfill its promise, the investment should pay off in the long term.

Disclaimer: With any investment advice especially those where you plan to invest your hard earned money, do your own research before taking any financial advice to understand your exposure and risk tolerance, analyze the utilization of any broker(s) or investment vehicle(s) to understand how your funds are stored or utilized within the platform and always have a plan and strategy prior to entering any market.