Value

XRP’s Path to Dominance: A Forecasted Price Per TokenAs of March 30, 2025, XRP, the cryptocurrency powering the XRP Ledger (XRPL) and Ripple’s On-Demand Liquidity (ODL) solution, is poised for a potential surge in adoption and value. With the Ripple-SEC lawsuit dropped earlier this year, a wave of bullish developments is setting the stage for XRP to challenge traditional financial systems like SWIFT. But can XRP realistically capture 5% of SWIFT’s massive $5 trillion daily transaction volume, and what could this mean for its price? Let’s dive into the factors driving XRP’s growth, including institutional adoption, tokenization, ETFs, futures trading, private ledgers, investor sentiment, and emerging trends like Central Bank Digital Currencies (CBDCs) and FedNow transactions.

The Dropped Ripple-SEC Lawsuit: A Game-Changer

The Ripple-SEC lawsuit, which had cast a shadow over XRP since 2020, has been dismissed, removing a significant regulatory hurdle. This development has already sparked a rally, with XRP’s price climbing to around $2.50 from earlier lows, driven by renewed investor confidence. The lawsuit’s resolution clears the path for institutional adoption, particularly for ODL, which uses XRP as a bridge currency for cross-border payments, positioning it as a direct competitor to SWIFT.

XRP’s 5% SWIFT Ambition: Institutional Adoption Soars

SWIFT processes approximately $5 trillion in daily transactions, and capturing 5% of that—$250 billion/day—would be a monumental achievement for XRP. Recent developments suggest this goal is within reach. Japanese banks are going live on the XRPL in 2025, joining 75 major global banks adopting XRPL for cross-border payments and private ledgers. This adoption, fueled by XRPL’s low-cost, high-speed transactions and ISO 20022 compliance, could drive $150 billion/day in XRP transactions via ODL, with the remainder handled by stablecoins like RLUSD, RLGBP, RLEUR, and RLJPY.

Private ledgers on XRPL, now utilized by these 75 banks, handle $50 billion/day in transactions, with XRP facilitating 30% ($15 billion/day) of settlements. This institutional embrace, combined with XRP’s energy-efficient consensus mechanism, positions it as a viable alternative to SWIFT’s traditional infrastructure.

Tokenization Projects Boost XRPL’s Utility

Tokenization is another key driver for XRP’s growth. Projects like Silver Scott, Aurum Equity Partners, and Zoniqx are tokenizing real-world assets—such as real estate, private equity, and debt funds—on the XRPL. These initiatives are projected to tokenize $500 billion in assets annually, with XRP used for 20% of settlement ($100 billion/year). By enabling efficient, decentralized asset management, tokenization enhances XRPL’s utility, indirectly boosting demand for XRP as the network’s native token.

XRP ETFs, Futures Trading, and Investor Sentiment

Later in 2025, the SEC is expected to approve 10+ XRP exchange-traded funds (ETFs), following the precedent set by Bitcoin and Ethereum. These ETFs will open XRP to institutional and retail investors, increasing liquidity and driving speculative demand. Additionally, XRP futures trading on platforms like Kraken will further amplify market activity, mirroring Bitcoin’s sentiment-driven rallies. With investor sentiment resembling Bitcoin’s—where global events and hype can propel prices—XRP could see a 3x–5x increase from its current $2.50, potentially reaching $7.50–$12.50 in the short term.

Central Bank Digital Currencies (CBDCs) and FedNow

The rise of CBDCs adds another layer to XRP’s potential. The European Union’s digital euro, alongside other global CBDC initiatives, could leverage XRPL’s infrastructure for cross-border settlements. Ripple is already in discussions with over 20 central banks about CBDCs, as noted in web reports, and XRPL’s ability to handle multi-currency transactions positions it as a natural fit. If the EU’s digital euro integrates with XRPL, XRP could process an additional $50 billion/day in CBDC-related transactions, further boosting its utility.

Similarly, the U.S. Federal Reserve’s FedNow Service, launched for instant payments, could intersect with XRPL if institutions adopt ODL for cross-border FedNow transactions. While FedNow focuses on domestic U.S. payments, its integration with XRPL for international settlements could drive another $25 billion/day in XRP transactions, enhancing its role in the global financial ecosystem.

Private Ledgers: Tailored Solutions for Institutions

XRPL’s support for private ledgers allows banks to customize solutions for privacy and efficiency. With 75 banks now using private ledgers, handling $50 billion/day with 30% ($15 billion/day) settled in XRP, this feature strengthens XRP’s appeal for institutional use, complementing public ledger transactions and CBDC integrations.

Forecasting XRP’s Price: A Realistic Outlook

Given these developments, what’s a realistic price forecast for XRP if it captures 5% of SWIFT’s volume ($250 billion/day), plus additional volume from CBDCs, FedNow, tokenization, ETFs, futures, and private ledgers? Let’s model it conservatively:

Daily Transaction Value: $150 billion (ODL) + $15 billion (private ledgers) + $50 billion (CBDCs) + $25 billion (FedNow) = $240 billion/day.

Annual Value: $240 billion * 365 = $87.6 trillion/year.

Tokenization Contribution: $100 billion/year.

Total Annual Value: $87.7 trillion/year.

Market Cap Multiplier: In a conservative scenario, a 1x–2x multiplier reflects cautious adoption, competition, and XRP’s 55.5 billion supply:

At 1x: Market cap = $87.7 trillion, price = ~$1,580.

At 2x: Market cap = $175.4 trillion, price = ~$3,161.

Adjusted for Realism: A $175.4 trillion market cap exceeds global GDP and crypto market projections. Adjusting to 0.5x (conservative, reflecting competition and supply limits): $43.85 trillion, price = ~$790.

Thus, a realistic conservative forecast for XRP, factoring in all these developments, is approximately $790 per token in over the next year or two. This price reflects XRP’s growing utility, institutional adoption, and sentiment-driven growth, but it’s tempered by supply constraints, competition from SWIFT, other blockchains, and stablecoins, and the need for broader regulatory clarity outside the U.S.

Conclusion

XRP’s potential to capture 5% of SWIFT’s volume, combined with Japanese banks on XRPL, tokenization projects, ETF and futures approvals, private ledgers, CBDCs like the EU’s digital euro, and FedNow integrations, positions it for significant growth. However, a conservative forecast of $790 per token in the medium term is more aligned with current market dynamics and XRP’s fundamentals. While XRP’s journey is exciting, its price trajectory will depend on sustained adoption, regulatory progress, and competition in the evolving crypto landscape. Stay tuned as XRP continues to reshape global finance!

STRATEGIC OUTLOOK — March 28, 2025TODAYS RECAP — March 27 Was a Classic Shakeout Day. A textbook shakeout in XAU/USD, driven by market maker manipulation, volume distribution, and liquidity engineering.

STRATEGIC OUTLOOK — March 28, 2025

Triple Threat Day: End of Week, End of Month, End of Q1.

Institutions will shape the Q1 close intentionally.

1. Book Rebalancing in Play

• Expect:

• Q1 profit locking

• Loss hiding

• Positioning games likely, especially into NY close.

2. Deceptive Order Flow

• Breakouts at highs/lows likely fake.

• Watch for:

• “Break and reverse” moves

• False drops into demand / false rallies into supply

III. SCENARIO PROJECTIONS — March 28

Scenario A: Bullish Continuation (Primary Bias)

Reasons:

• Daily structure remains bullish

• Shakeout held support

• Macro still supports gold (safe haven bid)

Confirmation Checklist:

• VWAP Mid ($3056) reclaimed and held

• Volume above $3060–$3074

• Asia or London delivers structure

Target Path:

• TP1: $3074.70 (DynaR RES 2)

• TP2: $3090.00 (Fib ext 1.618)

• TP3: $3105.00 (Q1 high magnet)

Scenario B: Distribution & Drop (Contingency Bias)

Reasons:

• If today was an institutional sell trap

• RSI divergence lingers

• DXY strength could trigger selling

Bearish Confirmation:

• Price fails to hold $3050 on open

• Red candles with increasing volume

• No VWAP reclaim during London

Target Path:

• TP1: $3034.48 (DynaR SUP 2)

• TP2: $3012.00 (FVG Fill + 21 SMA)

• TP3: $2995.00 (Deep VAL flush)

IV. SESSION PLAYBOOK — Cairo Local Time

V. EXECUTION GAME PLAN

Pre-Asia Preparation:

• No early entries

• Mark VWAP, POC, VAL/VAH from March 27

• Anticipate:

• Sweep under $3034

• Fake breakout above $3066

Execution Triggers:

• Volume + VWAP alignment

• Key zones: Hold/reject VWAP, POC, SUP/RES

• RSI divergence = no chasing

Risk Management:

• Tighten stops after NY open

• Don’t hold trades past 6PM Cairo unless trailing

• Lock in partials aggressively during spikes

VI. SCENARIOS RECAP TABLE

Final Note: Institutional Psychology Over Signals

“Tomorrow isn’t a technical day. It’s a story day. Institutions will use gold to close the quarter with purpose. Be reactive, not predictive. Trade what they show you — not what you want to see.”

FCX - We had a great month, can we continue with the uptrend?FCX

Looking for a potential buy!

🔍 Technical Context:

FCX had a tremendous up-beat with 24% increase in the stock just in march!

MACD Bullish Crossover: A clear bullish cross on the MACD confirmed upward momentum.

RSI Strength: The RSI remains in bullish territory, signaling further upside potential.

Favorable Risk-Reward Setup: The stock maintains support above breakout levels, offering an attractive trade opportunity.

📰 Fundamentals

Analyst Upgrades: J.P. Morgan and Scotiabank both issued upgrades and increased their price targets, reflecting confidence in FCX’s future performance.

Tariff Advantage: Potential U.S. tariffs on imported copper could benefit domestic producers like Freeport-McMoRan, increasing their advantage.

Strategic Policy Support: FCX is advocating for copper to be classified as a critical mineral, which could unlock tax credits and boost annual profits by up to $500 million.

📌 Trade Plan

📈 Entry: 41.90

✅ Target: 58.30

❌ SL: 23.90

💡 Looking for a potential 35% increase!

Beginning of the Uptrend for Stock #01Beginning of the Uptrend for Stock #01: 9988 (BABA)

The price has broken out of a consolidation range that lasted approximately two years, supported by a normal volume distribution.

The stock has risen to meet the Fibonacci Extension resistance level of 161.8 at a price of 144 HKD. Currently, it is forming a sideways consolidation pattern on the smaller timeframe, establishing a base structure viewed as re-accumulation.

The 6-month target is set at the Fibonacci Extension level of 261.8, which corresponds to a price of 189 HKD. This target aligns with a price cluster based on the valuation from sensitivity analysis, using the forward EPS estimates for 2025-2026 as a key variable for calculations, along with the standard deviation of the price-to-earnings ratio.

Wait for the Right Moment to Accumulate Shares within the Consolidation Range

Purchase near the support level of the range when the price pulls back. Look for a candlestick reversal pattern as a signal to add to your position.

However, should the price break down to the lower consolidation range, the stock would lose its upward momentum, potentially leading to a prolonged period of consolidation or a deeper pullback to around 90 HKD.

Always have a plan and prioritize risk management.

Lennar Corp | LEN | Long at $116.48Across the US, there is a pent-up demand for housing (for the vast majority of locations). While the media likes to selectively report home sales dropping for certain regions, it is more due to mortgage rates and seasonality than demand. Mortgage rates are anticipated to come down over the next 1-2 years and home builders will step in to pick-up the lack of inventory. Healthy companies like Lennar Corp NYSE:LEN , with a P/E of 8x, dividend of 1.68%, very low debt-to-equity (0.17x), etc are likely to prosper, but always stay cautious with the dreaded "recession" announcement if it creeps in...

Thus, at $116.48, NYSE:LEN is in a personal buy-zone. In the near-term, I do see the potential for the price to dip near $100 as tariff and other economic red flags continue to be in focus.

Targets:

$131.00

$145.00

$157.00

$180.00

Already kicking the dead for a whileChart

From October 22 to march 24 we had a strong upside move.

Now we are in a deep retrace, the chart is reacting on further down moves with little emotion, I think we are kicking the dead for a while already.

In my opinion we can do even 150$ in 2 months. Than we will see.

Strategically

Trump most likely works for russian secret service. US is on the way to a regular dictatorship unfortunately, I have seen it many times before, all the same approach. He can destroy many important things and harm the usual economy in general, but the AI is so important that it could be the one of islands that will outperform despite the craziness.

BHP - Leading power in the Copper business!Overview of our analysis for BHP!

BHP Group Limited (BHP) is one of the world’s leading diversified natural resources companies, with operations in minerals, oil, and gas. Headquartered in Australia, BHP is a dominant player in the global commodities market, particularly in iron ore, copper, and coal.

Strong Financial Performance

Revenue Growth: BHP has consistently delivered strong revenue growth, supported by rising commodity prices and operational efficiencies.

Robust Profit Margins: The company's disciplined capital allocation and cost management strategies have enabled it to maintain high profit margins.

Dividend Yield: BHP offers an attractive dividend yield, making it a preferred choice for income-focused investors.

Copper Market Leadership

Strategic Copper Operations: BHP’s Escondida mine in Chile is the world’s largest copper-producing mine, providing significant leverage to the rising demand for copper.

Green Energy Transition: Copper plays a vital role in renewable energy infrastructure and electric vehicles, positioning BHP to benefit from the global energy transition.

Investment in Growth: BHP is actively investing in expanding its copper production, further solidifying its leadership in this critical sector.

Diversified Portfolio and Resilience

Balanced Commodity Exposure: BHP's diversified commodity mix, including iron ore, copper, and metallurgical coal, reduces reliance on any single market, providing stability in volatile conditions.

Long-Term Contracts: The company maintains long-term contracts with key customers, ensuring stable revenue streams.

Operational Excellence: Continuous investments in technology and automation have enhanced operational efficiency and safety.

Sustainability and ESG Commitment

Net Zero Commitment: BHP has set ambitious targets to achieve net-zero operational emissions by 2050.

Sustainable Mining Practices: The company implements innovative technologies to reduce its carbon footprint and water usage.

Community Engagement: BHP is actively involved in community development programs, strengthening its social license to operate.

Entry: 49.63

Target: 73.01

SL: 36.30 - We are currently sitting on strong support zone for the company , which gives us a good heads up for a strong uptrend ahead, the SL is set up on the previous low if we see a huge cooldown in the overall commodity market, but at the current low supply of Copper we beleive that this is just deffensive point to protect the trade.

Ksolves India Ltd: A Software Solutions Powerhouse GrowthIntroduction:

Ksolves India Ltd, a software development and IT solutions provider, has emerged as a promising player in the technology landscape. With a diverse range of services, strategic partnerships, and a growing client base, the company has demonstrated its ability to cater to the evolving needs of businesses across various sectors. As a stock market wizard with expertise in both technical and fundamental analysis, let's dive deep into the key aspects of Ksolves India Ltd and explore its investment potential. Fundamental Analysis:

Business Overview:

Ksolves India Ltd, incorporated in 2014, is engaged in software development, enterprise solutions, consulting, and providing IT solutions to companies across sectors such as Real Estate, E-commerce, Finance, Telecom, and Healthcare. The company is known for its expertise in Big Data, Data Science, Salesforce, DevOps, Java & Microservices, OpenShift, and Penetration Testing, among other technologies.

Revenue Breakdown:

Ksolves' revenue is primarily driven by its software services, which account for 97% of its total revenue. The remaining 3% comes from products and customization. Geographically, the company's largest market is North America, contributing 66% of its revenue, followed by India (23%), Europe (7%), and the Rest of the World (4%).

Clientele and Partnerships:

Ksolves' client base is widely diversified, with over 40 IT services clients across 25+ countries. The company's top 5 clients contribute 33% to its revenue. Ksolves has also forged strategic partnerships with industry leaders such as Salesforce, Adobe, Odoo, and Drupal Association, further strengthening its service offerings and market presence.

Financial Performance:

Ksolves has demonstrated consistent growth in its financial performance. Over the past few years, the company has witnessed a steady increase in its sales, operating profit, and net profit. The operating profit margin (OPM) has remained in the range of 40-45%, indicating efficient operations and cost management.

Technical Analysis:

Fibonacci Retracement:

The Fibonacci retracement drawn connecting the low of Rs. 811 (11-month depth) to the high of Rs. 1,470 shows that the current market price has broken above the 0.5 Fibonacci level, indicating the potential for further upside movement.

Trend Analysis:

The overall trend for Ksolves India Ltd appears to be bullish, with the stock price consistently making higher highs and higher lows. This suggests a strong positive momentum in the stock, which could continue in the near future.

Investment Thesis:

Growth Potential:

Ksolves India Ltd's diversified service offerings, strategic partnerships, and growing client base position the company well to capitalize on the increasing demand for IT solutions across various industries. The company's focus on emerging technologies like Big Data, AI, and Machine Learning further enhances its growth prospects.

Geographical Expansion:

The company's strong presence in North America, coupled with its plans to expand in other regions like Europe and the Rest of the World, presents opportunities for Ksolves to diversify its revenue streams and tap into new markets.

Margin Stability:

Ksolves' consistent operating profit margins, ranging between 40-45%, demonstrate the company's ability to maintain profitability and operational efficiency, which is a positive sign for investors.

Technical Outlook:

The Fibonacci retracement analysis and the overall bullish trend in the stock price suggest that Ksolves India Ltd may continue to see upward momentum in the near to medium term, making it an attractive investment opportunity.

Conclusion:

Ksolves India Ltd, with its comprehensive software solutions, strategic partnerships, and strong financial performance, appears to be a promising investment opportunity. The company's growth potential, geographical expansion plans, and stable margins, combined with the positive technical outlook, make it a stock worth considering for investors seeking exposure to the thriving IT services sector. As a stock market wizard, I believe Ksolves India Ltd is well-positioned to capitalize on the industry's growth and deliver value to its shareholders.

Bullish ETH theories I think this could be a possible scenario for ETH's next breakout. I think it's possible because of the ETH ETFs that will most likely gain some traction over time, and retail will have to play "catch up" due to the price consolidation over these past years. The winds will turn, and I think everything will play out quite quickly when it happens.

I also think the FED will announce the end of QT today at the FOMC, which COULD trigger the next ETH bull run.

Looking at the ETH/BTC chart, I think this will trigger the next leg up and complete the pattern when looking at the weekly chart, testing the previous highs.

When I look at ETH relative to SOL/USD, it also looks bullish in the short term. I think this is quite reliable, but we will see over time. Although I think ETH will outperform both BTC and SOL and play catch-up with them both.

Conclusion: I have deployed most of my crypto portfolio to ETH now, believing ETH will give me the most beta in this bull run over the coming months. I know the sentiment looks quite bad at the moment for ETH, but I believe there is a saying: "Buy when others are fearful, sell when everybody is greedy." I think this is quite similar to value investing, and I believe there is a lot of value in BTC, ETH, and SOL.

Good luck! And share your thoughts, I like to discuss things like this. =)

Sabah Research Goes Long on Google: EW 2.0 Signals 45% Upside !Sabah Equity Research is taking a bullish stance on Alphabet (GOOGL) as Elliott Wave 2.0 suggests a 45% upside from current levels. With the stock trading at an attractive valuation, this presents a strong opportunity for long-term investors.

Elliott Wave 2.0 Predicts the Next Leg Up

After completing a healthy ABC correction, Alphabet is now primed for a Wave 3 expansion, historically the most powerful phase in the Elliott cycle. The technicals suggest that GOOGL’s recent consolidation is a launchpad for the next move higher.

Catalysts for Growth

Massive Cybersecurity Acquisition

Google’s parent company, Alphabet, is set to acquire Wiz, a leading cloud security firm, for over $30 billion—its largest deal ever. This strengthens Google’s cloud security dominance and accelerates revenue growth.

Undervalued Growth Potential

Despite its leading position in AI, cloud computing, and search, Alphabet trades at a discount compared to peers. This disconnect presents a compelling buying opportunity before sentiment catches up.

AI and Cloud Expansion

Google’s aggressive push into AI and cloud services positions it for massive future gains. With rising demand for AI-driven search, advertising, and enterprise solutions, Alphabet’s growth runway remains robust.

The Trade Setup: Positioning for the Upside

With Elliott Wave 2.0 pointing to a 45% rally, Sabah Equity Research sees Alphabet as a strong long-term play. The combination of cheap valuation, a game-changing acquisition, and a favorable technical setup makes this an ideal entry point.

Smart money is accumulating—will you? 🚀

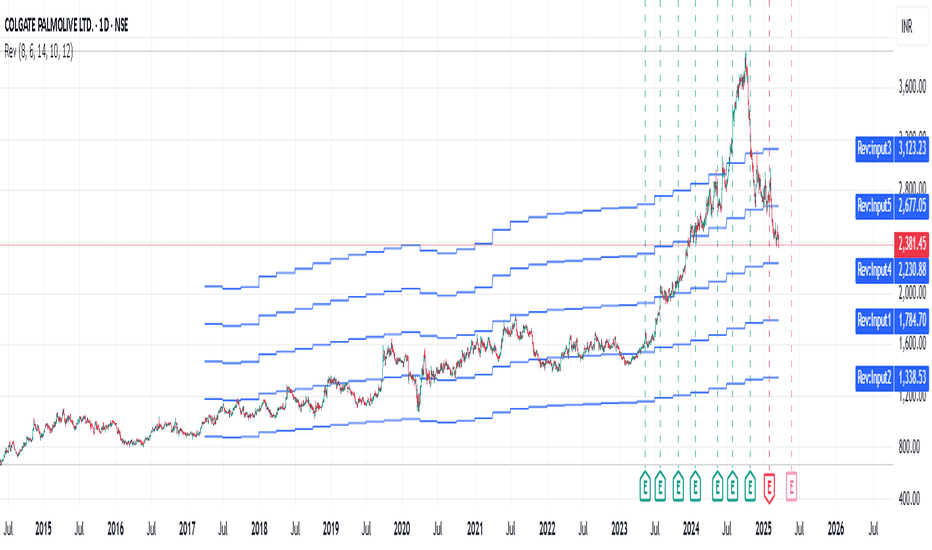

Neutral or sell COLPALThis is a clear case of raised valuations across most of the stocks. As seen in the Revenue Grid indicator, this stock was trading at 8 to 10 of Price to Revenue ratio, but from July 2023 it suddenly started going up and went to 18 times it's Revenue per share. Why? God knows! :)

Now naturally coming back to it's historic valuation. To get to it's fair price, within a short duration, such as couple of months, levels of 2230 can be seen. Happy Trading :)

TON Go to $4.5?Durov was finally released, he returned to Dubai, and #TON perked up by +16% in a day.

That's it, now people will love the CRYPTOCAP:TON Ecosystem again, a bunch of new tapals will come out.

The key resistance level will be at $4.5

We can also go to $2.7

The break of the global triangle upwards may be in Seb-Oct

Correction time The TON Ecosystem was used wisely, they identified weak points, protected their market from Competitors with protectionism, mini apps in Telegram should only use TON, now Liquidity will accumulate more inside Telegram, and not go to Solana.

The game starts again)) and we are ready for it.

Accumulate for Long TermNestle is trading at a little discount as compared to it's historic valuation for last 6-7 years. This is a growing stock, so it will be good to buy some shares now. Some details of it's strategies and products portfolio below - Happy Trading :)

Over the past six to seven years, Nestlé India has demonstrated consistent revenue growth, driven by a combination of strategic initiatives and a strong product portfolio. Key factors contributing to this sustained growth include:

1. Innovation and Product Diversification: Nestlé India has prioritized innovation, launching over 140 new products in the past eight years. These introductions span various categories, including science-led nutrition solutions, millet-based products, and plant-based protein options, catering to diverse consumer needs.

BUSINESS-STANDARD.COM

2. Strengthening Core Brands: The company has focused on reinforcing its flagship brands:

Maggi: Achieved the status of the largest market globally for Maggi, driven by balanced product mix, pricing strategies, and volume growth.

THE HINDU BUSINESS LINE

KitKat: India became the second-largest market for KitKat worldwide, reflecting robust performance in the confectionery segment.

THE HINDU BUSINESS LINE

Nescafé: The beverage segment, particularly Nescafé, has seen significant growth, introducing coffee to over 30 million households in the last seven years.

THE HINDU BUSINESS LINE

3. Expansion into New Categories: Nestlé India is exploring opportunities in emerging sectors such as healthy aging products, plant-based nutrition, healthy snacking, and toddler nutrition. These initiatives aim to tap into evolving consumer preferences and health-conscious trends.

CFO.ECONOMICTIMES.INDIATIMES.COM

4. Focus on Premiumization: The company is enhancing its premium product offerings, including the introduction of Nespresso and health science products. This strategic move aims to have premium products contribute to 20% of sales in the long term, up from the current 12-13%.

GOODRETURNS.IN

5. Strategic Partnerships: A notable collaboration with Dr. Reddy's Laboratories to form a joint venture in the nutraceuticals space underscores Nestlé India's commitment to expanding its health science portfolio and leveraging synergies for growth.

THE HINDU BUSINESS LINE

Collectively, these strategies have enabled Nestlé India to maintain a consistent upward trajectory in revenue, effectively adapting to market dynamics and consumer demands.

Long for Long Term - Discount price in terms of Revenue/shareAs seen in the Revenue Grid indicator, stock is currently trading at 2 to 2.5 times it's Revenue per share, which is a very low valuation historically. It crossed below this valuation, only at covid pandemic crash. Given the consistent Revenue increase, this is a fair value to buy for a long term view.

Selling SOL 30min idea 5:1 target practice expecting the market to drop slightly over the next several hours. I’ve marked this level of interest prior today’s open. I am now seeing a resistance being formed here at this level so I am personally opening a short here. Keeping my stop loss tight.

Thank you for your time

🥂 cheers

Long SBIN - Trading exactly at Rev/share = 1.As per the Revenue Grid indicator, SBI is trading exactly at it's Revenue per share value. That means current price of 1 share is same as that of the revenue it is generating per share. Historically it has traded around this valuation. But given the steady growth of SBI over the years, This is a good price to buy for long term. Happy Trading :)

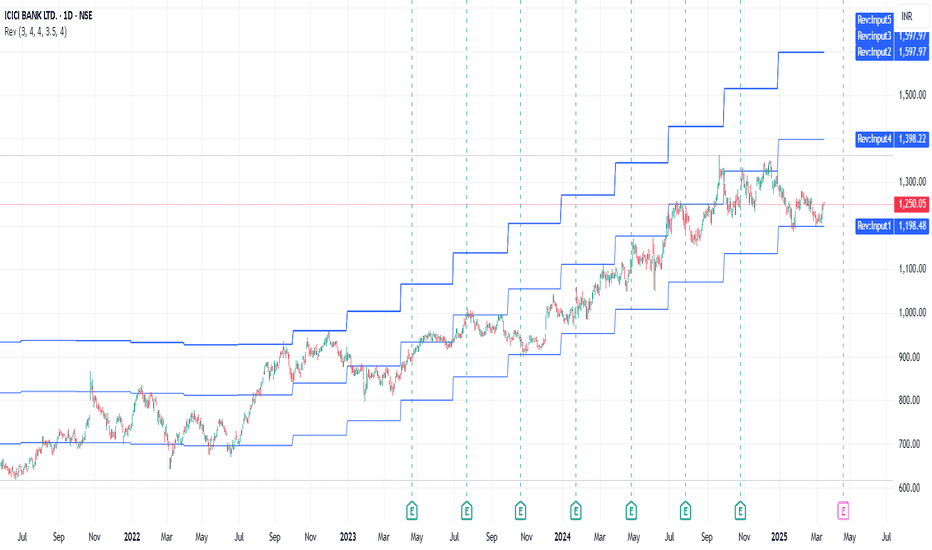

Long ICICI BankSince August 2021, ICICI Bank stock has been trading nicely between Revenue/share multiple of 3, 3.5 and 4. That means it is trading at 3 to 3.5 times it's revenue per share. It is clearly visible using Revenue Grid Indicator applied on daily chart. As per that, this is a good time to buy for a long term view. We can wait for 21 Apr 2025 for it's next earnings results also :) Happy Trading :)

The Hershey Company (NYSE:HSY) - Undervalued nowThe Hershey Company is an American multinational confectionery company, founded by Milton S. Hershey in 1894. The company initially focused on caramel and chocolate, eventually expanding into a wide range of confectionery products.

The company’s headquarters are located in Hershey, Pennsylvania, which is also home to Hersheypark and Hershey’s Chocolate World. ,

Business Model, Products, and Services

The Hershey Company is a leading confectionery manufacturer and marketer. Their core business revolves around producing and selling chocolate, sweets, mints, and other snacks.

Their key product lines include Hershey’s chocolate bars, Reese’s peanut butter cups, Kit Kat, Jolly Rancher, and Ice Breakers.

The company’s business model is centered on brand recognition, product quality, and extensive distribution networks.

Durable Competitive Advantage

Hershey possesses a strong durable competitive advantage primarily due to its iconic brand portfolio. Brands like Hershey’s and Reese’s have decades of consumer loyalty and strong brand recognition.

This aligns with the “unique product” business model, as these brands hold a distinctive place in the confectionery market.

Economic Moat

Hershey’s “economic moat” is built upon its powerful brand identity. The company’s brands have a long-standing history and strong emotional connection with consumers, creating a barrier to entry for competitors. Their distribution network also provides an economic moat.

Industry Outlook, Challenges, and Competitors

The confectionery industry is generally stable, but it faces challenges related to changing consumer preferences (e.g., healthier snacks), rising ingredient costs, and intense competition.

The company’s key competitors include Mondelez International (MDLZ), Kraft Heinz (KHC), Kellogg (K), and Campbell Soup Company (CPB). Additionally, increased competition from smaller, more innovative brands is also contributing to Hershey’s market share decline.

Health trends are a large challenge, sweet snacks have been under pressure as more consumers become aware of their calorie and sugar intake.

Supply chain risks are also a consistent threat for The Hershey Company, as disruptions in the procurement of key raw materials like cocoa, sugar, and dairy could impact production costs and margins. Additionally, geopolitical instability, trade restrictions, and transportation bottlenecks may further challenge the company’s ability to maintain steady inventory levels and meet consumer demand.

Comparative Analysis

The following is a comparative analysis of the company’s financial position and performance. The analysis evaluates eight key financial ratios to determine whether the company possesses a durable competitive advantage. The company’s financial ratios are compared with the median ratios of its main competitors.

Gross Margin %

Hershey maintains a consistent gross profit margin of 42%, which is significantly higher than the competitor average of 33.62%.

A high gross profit margin stems from the company’s durable competitive advantage, allowing it to price its products significantly higher than its competitors while maintaining strong profitability.

R&D to Revenue Ratio %

Hershey’s R&D expenditure is relatively low at 0.5% compared to its competitors’ 0.9%. This suggests that its competitive advantage relies more on brand strength and distribution than on product innovation.

Depreciation to Gross Profit Ratio %

Hershey’s depreciation-to-gross-profit ratio is a reasonable 9.48%, slightly lower than its competitors’ 9.65%, suggesting efficient asset utilization.

Interest Expense to Operating Income Ratio %

Hershey’s Interest Expense to Operating Income Ratio is 7.4%, significantly lower than its competitors’ 16.3%, indicating a strong financial position.

Operating Margin %

Hershey’s operating margin is strong, consistently above 20%. This suggests efficient operations and pricing power.

Free Cash Flow Margin %

Hershey’s free cash flow margin fluctuates, but it consistently remains higher than that of its competitors. This is a strong indicator that Hershey has a durable competitive advantage.

Basic Earnings Per Share (EPS)

Hershey’s EPS shows a generally upward trend, indicating consistent profitability.

Return on Equity (ROE)

Hershey’s ROE is strong and significantly higher than that of its competitors, indicating efficient utilization of shareholder equity.

Based on the analysis of key financial ratios, we have determined the following: The Hershey Company’s financial condition is stronger than that of its competitors. We believe the company holds a competitive advantage within its industry.

Intrinsic Value Valuation

Intrinsic Value: $236.80

Current Price: $171.16

Margin of Safety: 27.72%

Based on the provided data, Hershey’s stock appears to be undervalued, with a significant margin of safety.

The company’s strong brand portfolio, consistent profitability, and efficient operations are positive indicators.

The 27.72% margin of safety provides a good buffer against potential market fluctuations or valuation errors.

Recommendation: Given the current undervaluation and the company’s strong fundamentals, a “buy” recommendation is warranted. However, investors should carefully monitor industry trends, competitive pressures, and potential risks related to changing consumer preferences and ingredient costs.

INTC | If Keeps This up it will get Past it's Technical IssuesINTC makes CNBC news as top mover today 3-12-25, it needs the attention, why... if Intel keeps this up it will get past it's technical issues which I think it will; buyout rumors are very real and possible and it's getting the attention it DOES deserve, I think it surprises the market with moves higher. Apple or Samsung could use all the patents and history on this mega-company, at this price I feel it's a steal absolutely. Someone must be eying taking it out outright IMO.

Strong technicals are forming right here and now.