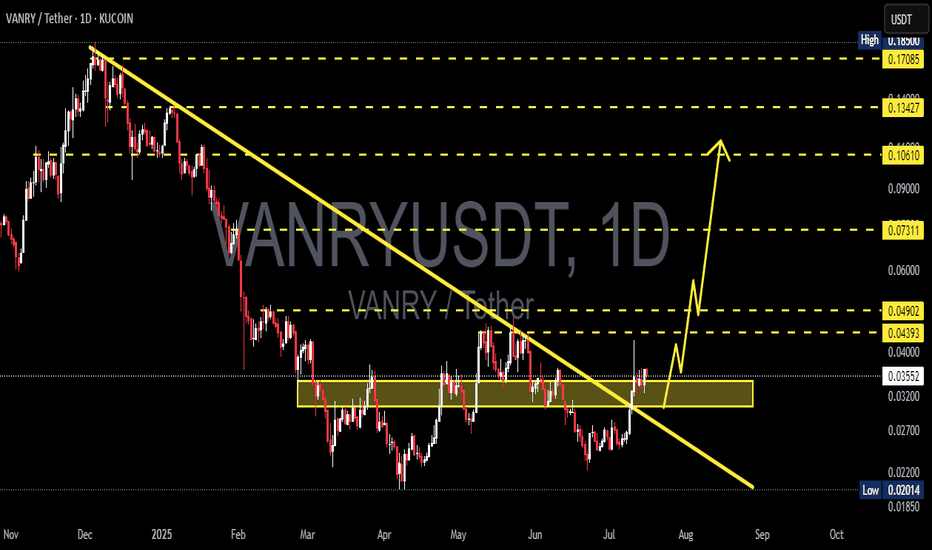

VANRY/USDT: Major Breakout from Downtrend – Is This the Start?

After months of downward pressure, VANRY/USDT has finally shown a strong technical breakout, potentially marking a shift in momentum and the beginning of a bullish phase.

📊 Technical Pattern & Market Structure

🔻 1. Descending Trendline Breakout

Price has successfully broken above a long-term descending trendline that has capped the market since November 2024. This breakout is a key signal of a potential trend reversal, suggesting the sellers are losing control.

🟨 2. Accumulation Zone Breakout

For over 3 months, the price consolidated within a clear accumulation zone between 0.02600 – 0.03300 USDT. The breakout from this zone indicates that accumulation may be complete, and price is now entering a markup phase.

🔁 3. Retest Confirmation

After the breakout, VANRY has successfully retested the previous resistance as new support (0.03300 – 0.03500), confirming the breakout as valid. This is often considered a textbook bullish setup.

✅ Bullish Scenario

As long as the price holds above the breakout zone, the bullish outlook remains intact. Key resistance levels to watch:

Target Price Level Notes

🎯 Target 1 0.04393 USDT Minor resistance

🎯 Target 2 0.04902 USDT Key psychological level

🎯 Target 3 0.07311 USDT Mid-term bullish target

🎯 Target 4 0.10610 – 0.13427 USDT Long-term rally potential

🚀 Final Target 0.17085 USDT Previous swing high

> As long as price sustains above 0.035, these targets remain highly achievable in the coming weeks.

❌ Bearish Scenario

In case of a failed breakout or rejection from key resistances, the bearish case still exists:

🔻 Drop below 0.03200 could signal a failed breakout

📉 Downside targets: 0.02700 → 0.02200 → 0.02014 (strong historical support)

⚠️ Daily close below 0.03100 confirms a potential fakeout

🎯 Trading Strategy & Risk Management

Ideal Entry Zone:

→ Retest range of 0.03300 – 0.03550

Stop Loss:

→ Below 0.03100 (invalidates bullish thesis)

Take Profit Levels:

→ Scale out profits at 0.043 / 0.049 / 0.073 / 0.106 etc.

> Using a trailing stop or scaling out strategy can maximize profits as the trend develops.

🔍 Technical Summary

This is a classic Breakout + Retest setup. The combination of trendline breakout, horizontal resistance flip, and retest creates a high-probability bullish pattern.

From a Wyckoff perspective, this could be the transition from accumulation to markup phase, especially if volume increases.

📢 DISCLAIMER:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

#VANRY #VANRYUSDT #CryptoBreakout #AltcoinSetup #BullishRetest #DescendingTrendlineBreakout #CryptoTechnicalAnalysis #WyckoffAccumulation #BreakoutStrategy

Vanry

#VANRY/USDT#VANRY

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.0374

Entry price 0.0381

First target 0.0397

Second target 0.0412

Third target 0.0427

VANRYUSDT Approaching a Breakout from Falling Wedge VANRYUSDT is currently forming a falling wedge pattern, a bullish technical setup that traders are closely watching. This pattern often signals a potential breakout, and with strong volume backing the movement, the chances of a significant price surge are increasing. As the price consolidates within the wedge, buyers are gradually stepping in, indicating growing investor confidence in this project.

The market sentiment around VANRYUSDT remains positive, with investors showing increased interest in its potential. A breakout from this pattern could trigger an explosive rally, with expected gains ranging between 250% to 300%. If the price successfully breaches the resistance, it could initiate a strong uptrend, attracting even more market participants and pushing VANRYUSDT toward higher levels.

With strong volume supporting the price action, traders should keep a close watch on the key resistance level. A confirmed breakout with sustained buying pressure could validate the bullish outlook. As the crypto market remains volatile, proper risk management and technical confirmation are essential before entering a position in this promising setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

VANRY: RE-BUY ZONE AT CHANNEL SUPPORT AND TP$VANRY/USDT 1D Analysis

🎯 DESCENDING CHANNEL SETUP

Current Status:

• Price: $0.0883 (-1.12%)

• Volume: 11.81M

• Inside descending channel (yellow lines)

• Gray trendlines showing potential reversal zones

KEY LEVELS:

• Major Resistance: $0.23-0.25 (upper box)

• Support: $0.065 (channel bottom)

FORECAST:

- Accumulation at re-buy zone

- Potential breakout targeting $0.25

- Channel bottom must hold for bullish scenario

Risk Management:

• Entry: $0.08-0.085

• Stop Loss: < $0.065

• Target: $0.20-0.25

• R:R = 1:3

RE-buy Zone: $0.05-0.06(IF BREAKOUT SUPPORT TRENDLINE )

#Crypto #TechnicalAnalysis #Trading

VANRY/USDT Breakout Alert: Ready for a 100%+ Rally!!🚀 Hey Traders! 👋

If this setup excites you, hit that 👍 and smash Follow for trade ideas that deliver real results! 💹🔥

VANRY: Primed for Liftoff! 🚀

VANRY is breaking out from a symmetrical triangle on the 4-hour timeframe and has successfully retested it. The chart is screaming bullish potential, and this could be the start of an explosive move!

📍 Entry Range: Current Market Price (CMP) – Add more up to $0.115

🎯 Target: 100-120% upside potential

🔒 Stop-Loss: $0.108

⚖️ Leverage: Use low leverage (Max 5x) to manage risk

💬 What’s Your Take?

Do you see the same explosive potential in VANRY? Share your analysis, strategies, or predictions in the comments below. Let’s capitalize on this opportunity together and secure those massive gains! 💰🌊

Vanar Chain (VANRY)Vanar, previously known as Virtua, is an L1 blockchain designed for real-world adoption, based on our years of experience working with games, entertainment and brands. Vanar incorporates a series of products, including gaming, the metaverse, AI and brand solutions.

Anyway, VANRY chart is straightforward. A strong upward wave was followed by a long and deep correction wave. It seems VANRY's correction has been unfolded in a descending triangle pattern. When VANRY breaks this triangle, the next upward wave has already started. Let's see what happens.

VANRY/USDT: 50% PROFIT POTENTIAL SETUP!!🚀 Hey Traders! 👋

If this analysis hits the mark for you, don’t forget to smash that 👍 and hit Follow for premium trade setups that actually deliver results! 💹🔥

VANRY Looking Strong! 📈

VANRY is forming a symmetrical triangle on the 4-hour time frame and is holding the lower trendline like a champ. A solid bounce looks imminent from here. This could be your chance to catch a big move early! 🚀

📌 Trade Setup:

Entry Range: CMP and add more up to $0.138

Targets: $0.16 / $0.178 / $0.192 / $0.214 🎯

Stop Loss: $0.132 (Keep risk in check)

Leverage: Low leverage only (Max 5x)

💬 What’s Your Take?

Are you seeing the same breakout potential? Drop your thoughts, analysis, or predictions in the comments—let’s strategize and ride this wave together for massive profits! 🌊💰

👉 Stay tuned for more winning setups! 🚀💹

VANRYUSDT Bullish Breakout or Bearish Collapse? Crucial LevelsYello, Paradisers! Is #VANRYUSDT primed for a bullish breakout or a looming downside? Here's the detailed analysis:

💎#VANRY could set up for a perfect bullish move if it successfully breaks the descending resistance trendline. Currently, the price is expected to test the support zone around $0.082 to $0.078. On the hourly chart, an *Inverse Head and Shoulders (IHNS)* pattern is forming, accompanied by a *three white soldiers* candlestick pattern—both strong bullish indicators. This suggests a high probability of a rebound from support, potentially pushing the price back up to challenge the descending resistance trendline. A successful breakout could lead to a significant move toward the key resistance at $0.113.

💎This $0.113 level is crucial; if VANRY breaks above it, we could see continued upward momentum toward the major resistance zone. However, if the price faces rejection at this key resistance, it could reverse and head downward.

💎The concerning scenario emerges if VANRY fails to rebound from the initial support zone and breaks down further. This could lead to a retest of the major support area. Historically, this zone has held strong, leading to significant rebounds.

💎For the bullish scenario to remain intact, a rebound from this level and a reclaim of the $0.062 support are necessary. If VANRY breaks below the major support with a daily close under it, it would confirm a bearish shift, potentially triggering deeper price declines.

🎖Stay disciplined and patient, Paradisers! Remember, long-term success relies on strategic trades and careful observation of key levels. Trade smart and be ready for the next big move!

MyCryptoParadise

iFeel the success🌴

VANRY looks bullish (1D)VANRY correction has started from the place where we have placed the red arrow on the chart.

This correction looks like a diametric as we are now at the end of the G wave.

We have identified two entry points for VANRY.

The targets are also marked on the chart.

Closing a daily candle below the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

VANRY Breakout Alert: Major Price Surge Ahead?VANRY is currently at a critical resistance zone Green at $0.1333 to $0.1398, which could determine its next directional move. A successful breakout above this level would signal a continuation of the bullish momentum, potentially pushing the price toward the next significant target resistance zone in Blue at $0.2399 to $0.2530. However, if the price fails to break through, a pullback is likely, with a potential retest of the trend line or $0.0993 support level. This area will be crucial in maintaining the bullish structure.

On the downside, if VANRY breaks below the support at $0.0993 and closes a daily candle under the support, the bullish scenario would be invalidated, shifting momentum to the bearish side. In this case, the price could decline further toward the support zone in Pink at $0.0769 to $0.0812, a level that has been respected in previous corrections. For now, the market’s next move depends on how it reacts to the current resistance level, making it a key areas to watch for traders.

VANRYUSDT It Will Break Out or Break Down? Key Level To Watch!Yello, Paradisers! Are you keeping an eye on #VANRYUSDT? This chart is reaching a critical level, and the next move could shape its mid-term direction. Let’s break it down.

💎#VANRY has the potential for a bullish continuation if it manages to break above the key resistance area at $0.15. If the price is rejected at this level, we could see it pulling back to retest the support zone around $0.118 to $0.11. A successful breakout above the key resistance would likely trigger a bullish movement, with a high chance of reaching the major resistance target.

💎On the flip side, if VANRY fails to rebound from the support zone and breaks below it, the price could form a false breakout. This would shift momentum downward, potentially heading to the demand area around $0.088 to $0.078.

💎Looking at past price behavior, the demand zone has been respected multiple times, providing strong support when tested. If VANRY revisits this zone, there’s a good chance we’ll see a similar reaction. However, if the price breaks below $0.078 and closes a daily candle under it, the bullish scenario would be invalidated, and we could see the price dipping further.

Remember, trading is about managing probabilities and protecting your capital for the long run. Stay sharp and trade smart!

MyCryptoParadise

iFeel the success🌴

VANRY/USDT: READY FOR AN ATH!Hey everyone!

If you’re finding value in this analysis, don’t forget to hit that 👍 and follow for more updates!

Technical Analysis:

VANRY is showing strong bullish momentum, breaking out from a falling wedge structure in the daily timeframe. With its current trajectory, VANRY looks poised to test its all-time high (ATH)—potentially offering gains of 150-200% from current levels. This could be the perfect opportunity to buy on spot and add more during dips.

Trade Details:

Entry Range: CMP and accumulate up to $0.093

Targets: 150-200% gain

Stop Loss (SL): $0.08

Leverage: Spot recommended for safety

About VANRY:

VANRY is an emerging blockchain project focused on decentralized applications (dApps) and DeFi solutions. It aims to simplify user experiences with a highly scalable and efficient platform, making it attractive to developers and investors alike. With consistent growth in its ecosystem, VANRY has become one of the most-watched projects in the altcoin market.

Conclusion: The bullish breakout combined with VANRY’s growing ecosystem makes this setup highly promising. Are you seeing the same potential? Drop your insights and analysis in the comments below, and let’s strategize for this exciting opportunity together!

#Vanry/USDT Ready to go up#Vanry

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.07342

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0920

First target 0.0980

Second target 0.1056

Third target 0.1146