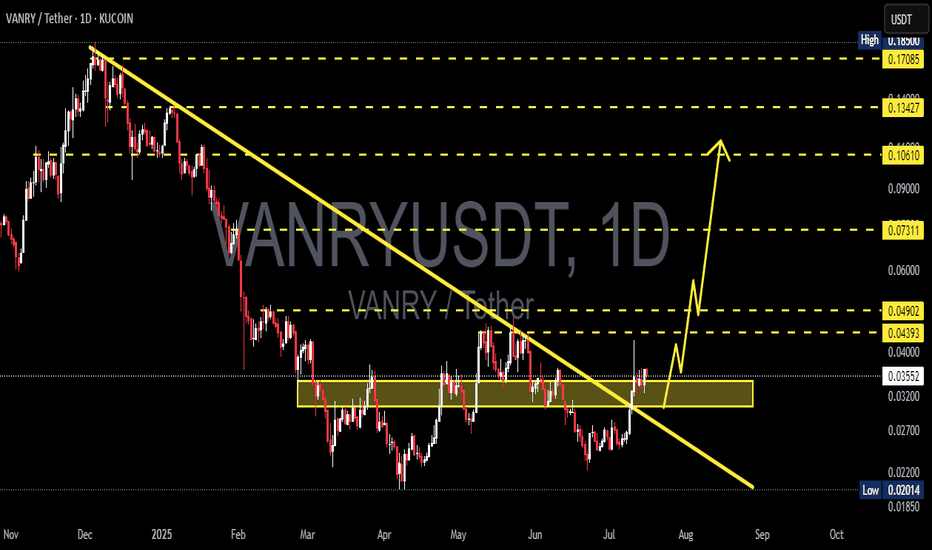

VANRY/USDT: Major Breakout from Downtrend – Is This the Start?

After months of downward pressure, VANRY/USDT has finally shown a strong technical breakout, potentially marking a shift in momentum and the beginning of a bullish phase.

📊 Technical Pattern & Market Structure

🔻 1. Descending Trendline Breakout

Price has successfully broken above a long-term descending trendline that has capped the market since November 2024. This breakout is a key signal of a potential trend reversal, suggesting the sellers are losing control.

🟨 2. Accumulation Zone Breakout

For over 3 months, the price consolidated within a clear accumulation zone between 0.02600 – 0.03300 USDT. The breakout from this zone indicates that accumulation may be complete, and price is now entering a markup phase.

🔁 3. Retest Confirmation

After the breakout, VANRY has successfully retested the previous resistance as new support (0.03300 – 0.03500), confirming the breakout as valid. This is often considered a textbook bullish setup.

✅ Bullish Scenario

As long as the price holds above the breakout zone, the bullish outlook remains intact. Key resistance levels to watch:

Target Price Level Notes

🎯 Target 1 0.04393 USDT Minor resistance

🎯 Target 2 0.04902 USDT Key psychological level

🎯 Target 3 0.07311 USDT Mid-term bullish target

🎯 Target 4 0.10610 – 0.13427 USDT Long-term rally potential

🚀 Final Target 0.17085 USDT Previous swing high

> As long as price sustains above 0.035, these targets remain highly achievable in the coming weeks.

❌ Bearish Scenario

In case of a failed breakout or rejection from key resistances, the bearish case still exists:

🔻 Drop below 0.03200 could signal a failed breakout

📉 Downside targets: 0.02700 → 0.02200 → 0.02014 (strong historical support)

⚠️ Daily close below 0.03100 confirms a potential fakeout

🎯 Trading Strategy & Risk Management

Ideal Entry Zone:

→ Retest range of 0.03300 – 0.03550

Stop Loss:

→ Below 0.03100 (invalidates bullish thesis)

Take Profit Levels:

→ Scale out profits at 0.043 / 0.049 / 0.073 / 0.106 etc.

> Using a trailing stop or scaling out strategy can maximize profits as the trend develops.

🔍 Technical Summary

This is a classic Breakout + Retest setup. The combination of trendline breakout, horizontal resistance flip, and retest creates a high-probability bullish pattern.

From a Wyckoff perspective, this could be the transition from accumulation to markup phase, especially if volume increases.

📢 DISCLAIMER:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

#VANRY #VANRYUSDT #CryptoBreakout #AltcoinSetup #BullishRetest #DescendingTrendlineBreakout #CryptoTechnicalAnalysis #WyckoffAccumulation #BreakoutStrategy

Vanryanalysis

#VANRY (SPOT) entry range (0.082 - 0.097) T.(0.2149) SL (0.0802)entry range (0.082 - 0.097)

Target (0.2149)

SL .4H close below (0.0802)

*** Breakout and retest is done *****

************************************

#VANRY

#VANRYUSDT

#VANRYUSD

BINANCE:VANRYUSDT

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY ****

#bitcoin

#BTC

#BTCUSDT

VANRYUSDT is gearing up for a big jump!!VANRYUSDT is showing strong bullish potential after successfully breaking key resistance levels and completing a healthy retracement. It’s maintaining its position above the 200 EMA, indicating a solid uptrend, supported by good trading volume. We’re expecting a significant upward movement soon. now is the time to watch this pair closely! Don't miss out on the opportunity to capitalize on this potential breakout! 📈

VANRYUSDT Currently trading at $0.11

Buy level: Above $0.109

Stop loss: Below $0.102

TP1: $0.114

TP2: $0.118

TP3: $0.13

TP4: $0.14

Max Leverage 3x

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

VANRYUSDT.1DThe chart for VANRY/USDT on a daily timeframe depicts a bearish trend over the past few months. Notably, the price has steadily declined from highs around $0.2480 in May to current levels near $0.0899. This is encapsulated within a descending channel, marked by resistance (R1) and support (S1) lines that frame the price action.

The Moving Average Convergence Divergence (MACD) indicator, as shown below the price chart, supports this bearish view. The MACD line (blue) remains below the signal line (orange)

and both are trending downwards below zero, which typically signals a strong bearish momentum.

Furthermore, the Relative Strength Index (RSI), which is at approximately 39, indicates that the asset is nearing oversold territory but is not there yet. This suggests that there might still be room for further downward movement before any significant reversal could occur.

In light of these observations, the immediate outlook for VANRY/USDT remains bearish. The price is currently testing the lower boundary of the descending channel (S1). Should it break this level, it could potentially accelerate the decline towards newer lows. Conversely, if the price rebounds from this support, an upward retest of the upper boundary of the channel (R1) at around $0.1479 could occur, although this scenario appears less likely given the prevailing downward momentum.

Investors and traders should monitor these levels closely, as a breach or bounce could offer significant trading opportunities. It is also crucial to consider broader market sentiments and news that may impact the asset's price movements.