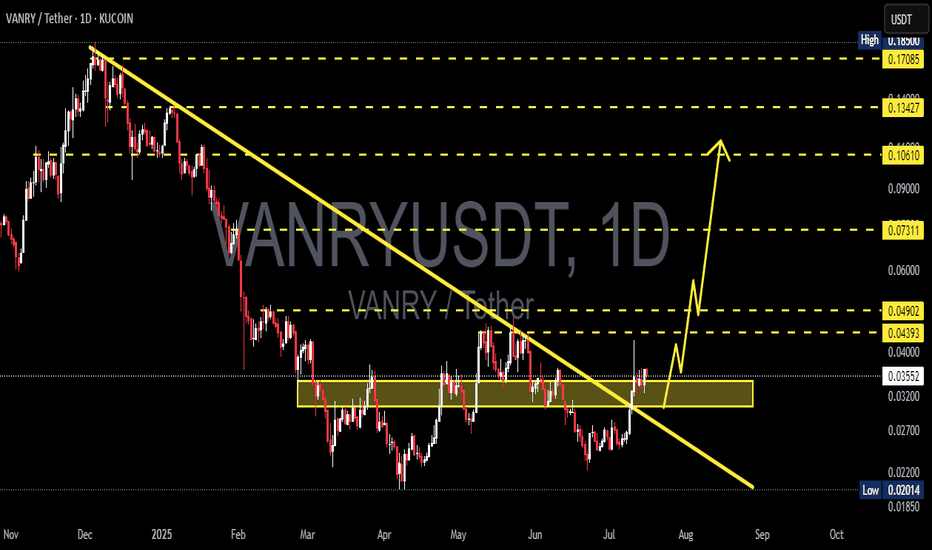

VANRY/USDT: Major Breakout from Downtrend – Is This the Start?

After months of downward pressure, VANRY/USDT has finally shown a strong technical breakout, potentially marking a shift in momentum and the beginning of a bullish phase.

📊 Technical Pattern & Market Structure

🔻 1. Descending Trendline Breakout

Price has successfully broken above a long-term descending trendline that has capped the market since November 2024. This breakout is a key signal of a potential trend reversal, suggesting the sellers are losing control.

🟨 2. Accumulation Zone Breakout

For over 3 months, the price consolidated within a clear accumulation zone between 0.02600 – 0.03300 USDT. The breakout from this zone indicates that accumulation may be complete, and price is now entering a markup phase.

🔁 3. Retest Confirmation

After the breakout, VANRY has successfully retested the previous resistance as new support (0.03300 – 0.03500), confirming the breakout as valid. This is often considered a textbook bullish setup.

✅ Bullish Scenario

As long as the price holds above the breakout zone, the bullish outlook remains intact. Key resistance levels to watch:

Target Price Level Notes

🎯 Target 1 0.04393 USDT Minor resistance

🎯 Target 2 0.04902 USDT Key psychological level

🎯 Target 3 0.07311 USDT Mid-term bullish target

🎯 Target 4 0.10610 – 0.13427 USDT Long-term rally potential

🚀 Final Target 0.17085 USDT Previous swing high

> As long as price sustains above 0.035, these targets remain highly achievable in the coming weeks.

❌ Bearish Scenario

In case of a failed breakout or rejection from key resistances, the bearish case still exists:

🔻 Drop below 0.03200 could signal a failed breakout

📉 Downside targets: 0.02700 → 0.02200 → 0.02014 (strong historical support)

⚠️ Daily close below 0.03100 confirms a potential fakeout

🎯 Trading Strategy & Risk Management

Ideal Entry Zone:

→ Retest range of 0.03300 – 0.03550

Stop Loss:

→ Below 0.03100 (invalidates bullish thesis)

Take Profit Levels:

→ Scale out profits at 0.043 / 0.049 / 0.073 / 0.106 etc.

> Using a trailing stop or scaling out strategy can maximize profits as the trend develops.

🔍 Technical Summary

This is a classic Breakout + Retest setup. The combination of trendline breakout, horizontal resistance flip, and retest creates a high-probability bullish pattern.

From a Wyckoff perspective, this could be the transition from accumulation to markup phase, especially if volume increases.

📢 DISCLAIMER:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

#VANRY #VANRYUSDT #CryptoBreakout #AltcoinSetup #BullishRetest #DescendingTrendlineBreakout #CryptoTechnicalAnalysis #WyckoffAccumulation #BreakoutStrategy

Vanrysignals

#VANRY (SPOT) entry range (0.082 - 0.097) T.(0.2149) SL (0.0802)entry range (0.082 - 0.097)

Target (0.2149)

SL .4H close below (0.0802)

*** Breakout and retest is done *****

************************************

#VANRY

#VANRYUSDT

#VANRYUSD

BINANCE:VANRYUSDT

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY ****

#bitcoin

#BTC

#BTCUSDT

VANRYUSDT is gearing up for a big jump!!VANRYUSDT is showing strong bullish potential after successfully breaking key resistance levels and completing a healthy retracement. It’s maintaining its position above the 200 EMA, indicating a solid uptrend, supported by good trading volume. We’re expecting a significant upward movement soon. now is the time to watch this pair closely! Don't miss out on the opportunity to capitalize on this potential breakout! 📈

VANRYUSDT Currently trading at $0.11

Buy level: Above $0.109

Stop loss: Below $0.102

TP1: $0.114

TP2: $0.118

TP3: $0.13

TP4: $0.14

Max Leverage 3x

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts