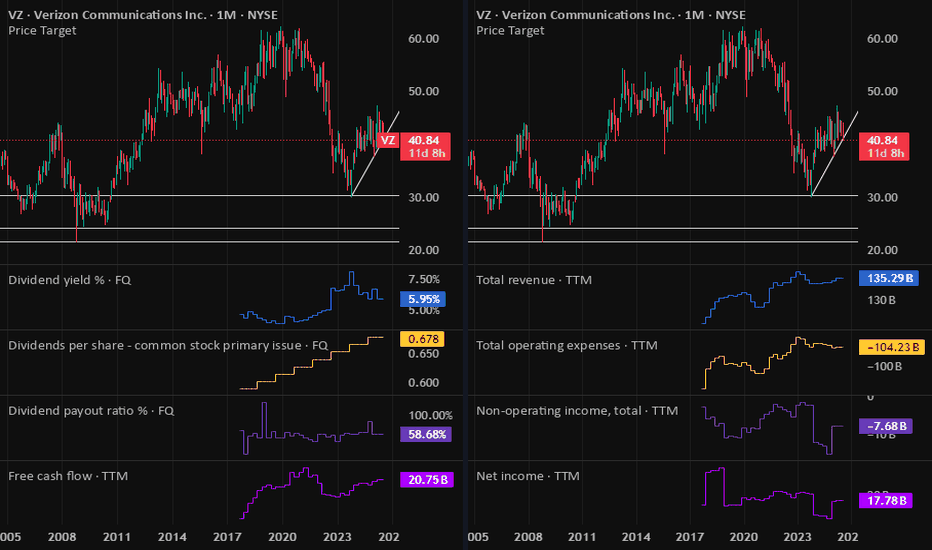

VZ: Verizon stock update after earningsVerizon jumped on positive results, which aligned with my bullish view on it.

Tomorrow will have its competitors T-Mobile & AT&T earnings result, this will update us on the industry as well. Most probably that I will go long on it in the next 24Hr.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Verizon

VZ: Verizon Earnings tomorrowwith 6% dividend yield and stock price at support level on the lower channel band, this draw attention to the earnings report tomorrow pre-market hours. Focused on future outlook as well.

If all good, I will buy VZ.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

VZ - DO YOU SEE IT? Verizon its saying helllo!

A peaka-boo breakout on the daily chart is being observed.

This stock has coiled in a tight multi week range for a long time and is ready to explode higher if this breakout holds.

Typically a boring name that doesn't do much but when it starts to trend it can really go!

I'm looking at continuation long & upside calls.

This could head to $55 OVER THE NEXT FEW MONTHS.

VZ Weekly Trade Plan – 2025-06-08🧾 VZ Weekly Trade Plan – 2025-06-08

Bias: Moderately Bearish

Timeframe: 1 week

Catalysts: Dividend optimism vs. MACD weakness

Trade Type: Short-term directional put

🧠 Model Summary Table

Model Direction Entry Strike Option Type Target Stop Confidence

Grok Moderately Bullish $0.35 (ask) $44.00 Call $0.70 (100%) $0.175 65%

Claude Moderately Bearish $0.52 (ask) $44.00 Put $0.75–0.78 $0.31 72%

Llama Slightly Bearish $0.29 (ask) $43.50 Put $0.435 (50%) Collapse >$44.50 68%

Gemini Moderately Bearish ~$0.28 (ask) $43.50 Put $0.45–0.50 $0.18 60%

DeepSeek Moderately Bullish $0.35 (ask) $44.00 Call $0.70 (100%) $0.18 65%

✅ Consensus Bias: Slight Bearish Lean (3 of 5 models bearish)

⚠️ Key Disagreements: Directional outlook (calls vs. puts); strike selection; volatility interpretation

🔍 Technical & Sentiment Summary

Trend: VZ is above key EMAs on multiple timeframes

Momentum: RSI neutral (~54); MACD mixed/bearish on intraday; bulls see recovery

Volatility: VIX ~16.8 (low), supporting slow-paced price action

Max Pain: $43.50 (anchor magnet); current price ~ $43.80

Sentiment: Positive dividend news supports bulls; short-term MACD and resistance (44.12) support bears

✅ Final Trade Recommendation

Parameter Value

Instrument VZ (Verizon)

Strategy PUT (SHORT)

Strike 43.50

Entry Price $0.29 (ask)

Profit Target $0.45 (≈55% gain)

Stop-Loss $0.18 (≈38% loss)

Expiration 2025-06-13 (Weekly, 5 DTE)

Size 1 contract

Confidence 67%

Entry Timing Market open

🎯 Rationale: Max pain magnet + weak MACD on multiple intraday timeframes provide opportunity for a quick pullback toward support.

⚠️ Key Risks

Dividend strength may act as a floor near $43.50–$43.60

Break above $44.00 invalidates bearish trade thesis

Gamma risk: late-week price stalling can crush premium

Low volatility could slow down option movement → be time-sensitive

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: VZ

🔀 Direction: PUT (SHORT)

💵 Entry Price: 0.29

🎯 Profit Target: 0.45

🛑 Stop Loss: 0.18

📅 Expiry: 2025-06-13

📏 Size: 1

📈 Confidence: 67%

⏰ Entry Timing: open

🕒 Signal Time: 2025-06-08 23:35:04 EDT

VZ - Verizon Communications Inc. (45 minutes chart, NYSE) - LongVZ - Verizon Communications Inc. (45 minutes chart, NYSE) - Long Position; Short-term research idea.

Risk assessment: High {volatility risk}

Risk/Reward ratio ~ 2.08

Current Market Price (CMP) ~ 44.17

Entry limit ~ 44 to 43.60 (Avg. - 43.8) on May 07, 2025

1. Target limit ~ 44.35 (+1.26%; +0.55 points)

2. Target limit ~ 44.80 (+2.28%; +1 point)

3. Target limit ~ 45.15 (+3.08%; +1.35 points)

Stop order limit ~ 43.15 (-1.48%; -0.65 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observations

= important updates

(parentheses) = information

~ tilde/approximation = variable value

-hyphen = fixed value

$VZ Trade Analysis DarkPoolsLet's analyze the provided chart of Verizon Communications Inc. (VZ) on the daily timeframe and break it down systematically to understand its current trend, key levels, and potential trade setups.

1. Trend Analysis:

Moving Averages:

The stock is trading above the 8 EMA (yellow line) and 21 EMA (blue line), indicating a bullish trend.

The price recently moved above the 200 EMA (dotted purple line), further confirming momentum.

Price Action:

The stock had a strong breakout from a previous consolidation range.

A series of higher highs and higher lows suggests the uptrend is continuing.

The last few daily candles show strong bullish momentum with large-bodied candles.

2. Key Support and Resistance Levels:

Dark Pool Levels (White Dashed Lines):

BB SW: 39.50 (A significant area where large institutional orders were executed.)

BA SW: 41.25 (A more recent Dark Pool level, which is now acting as a support level.)

Pivot Levels & Resistance Areas:

R1: 40.99 (Already broken, now acting as support.)

R2: 42.58 (Next potential resistance.)

R3: 44.28 (A major target if momentum continues.)

R5: 42.84 (Another high-level resistance.)

Support Levels:

S1: 39.09

S2: 38.79

S3: 38.48

S4: 37.58 (Major support and invalidation level.)

3. Trade Plan & Strategy

A. Bullish Trade Idea (Momentum Play)

📈 Entry: If the price holds above 41.25 (Dark Pool Level) and re-tests successfully.

🎯 Profit Targets:

42.58 (R2 Pivot Level) – Short-Term Target

44.28 (R3 Pivot Level) – Extended Target

44.84 (R5 Level) – Full Bullish Breakout Target

🛑 Stop Loss:

Below 40.49 (21 EMA & previous resistance now support)

Aggressive Stop: Below 41.25 (invalidates momentum)

Conservative Stop: Below 39.50 (breaks key Dark Pool level)

B. Bearish Reversal Play (If Price Fails at Resistance)

📉 Entry: If the price rejects 42.58 and shows weakness.

🎯 Profit Targets:

41.25 (Dark Pool Level) – First Target

40.49 (21 EMA) – Extended Target

39.50 (BB SW Dark Pool Level) – Full Target

🛑 Stop Loss:

Above 42.84 (R5 Pivot Level)

4. Conclusion & Prediction

Primary Expectation: Bullish continuation if price holds above 41.25 with targets at 42.58 and 44.28.

Risk Consideration: A break below 41.25 and 39.50 would signal potential weakness.

Final Thought: Institutional buying (Dark Pool activity) at 39.50 and 41.25 suggests strong accumulation. If volume sustains, this move could push VZ towards 44+ in the coming weeks.

VZ Verizon Communications Options Ahead of EarningsIf you didn’t exit VZ before the selloff:

Now analyzing the options chain and the chart patterns of VZ Verizon Communications prior to the earnings report this week,

I would consider purchasing the 38.50usd strike price Puts with

an expiration date of 2025-1-31,

for a premium of approximately $0.68.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

VZ Verizon Communications Options Ahead of EarningsAnalyzing the options chain and the chart patterns of VZ Verizon Communications prior to the earnings report this week,

I would consider purchasing the 44usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $1.23.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

VZ - Strong Bounce WeeklyPrice has bounced off a nice Weekly support and is looking for more

I have plotted a bars pattern in green showing how I think price will rise to the upper trend line also in green.

The support level was previously a resistance point but has flipped, which can be seen in the green circles.

Bullish on this Weekly timeframe.

AST SpaceMobile Shares Surge 55% on Partnership With Verizon AST SpaceMobile ( NASDAQ:ASTS ) shares have surged more than 50% on Wednesday, reaching their highest level since November 2022. The satellite communication company announced a new direct-to-cellular tie-up with Verizon Communications, which allows it to target 100% coverage of the continental United States from space on premium 850 MHz cellular spectrum. Verizon is committing $100 million to the partnership. Earlier this month, AST SpaceMobile ( NASDAQ:ASTS ) and AT&T announced a deal to deliver space-based broadband network direct to cell phones.

The latest partnership deal "will enhance cellular connectivity in the United States, essentially eliminating dead zones and empowering remote areas of the country with space-based connectivity," said Abel Avellan, founder, chairman, and CEO of AST SpaceMobile ( NASDAQ:ASTS ). AST SpaceMobile ( NASDAQ:ASTS ) has also received financial backing from AT&T, Alphabet-owned Google (GOOGL.O), and Vodafone Group (VOD.L).

Verizon is getting another satellite partner as it ups its efforts to blanket the US with coverage. On Wednesday, AST SpaceMobile ( NASDAQ:ASTS ) announced that it has reached a "strategic partnership" with Verizon that includes a $100 million commitment from the carrier. The deal will enable it to "target 100% coverage of the continental United States on premium 850MHz spectrum" with the partnership "essentially eliminating dead zones and empowering remote areas of the country with space-based connectivity."

Space-based connectivity has become an increasing focus area for wireless companies as they look to fill in gaps in their coverage that traditional, land-based cell towers can't cover. In addition to AST SpaceMobile's work with AT&T, Verizon was previously discussing satellite connectivity with Amazon's Project Kuiper and T-Mobile has announced a similar deal with SpaceX's Starlink.

Both AT&T and T-Mobile have similarly talked about how users won't need to upgrade their devices to be able to connect to the satellites, though no carrier has specified if they will need to pay more for the feature or be on special plans to use the space-based connectivity.

AST SpaceMobile ( NASDAQ:ASTS ) has already demonstrated test calls from space using a Galaxy S22 and AT&T's network and plans to deliver its first five commercial satellites to the launch pad in July or August of this year, with plans to begin its initial operations at some point in 2025.

Technical Outlook

AST SpaceMobile ( NASDAQ:ASTS ) stock is up 55.6% as of the time of writing. AST SpaceMobile ( NASDAQ:ASTS ) stock has a Relative Strength Index (RSI) of 83.77 which is largely overbought. Traders ought to be cautious of a trend reversal in the short term. The daily price chart depicts a long "Bullish Harami" candle stick pattern.

Verizon ($VZ) Earns $100M Contract With The State of MichiganT-Mobile and Verizon Communications ( NYSE:VZ ) are in talks to buy parts of United States Cellular for over $2 billion, according to the Wall Street Journal. Shares of the regional wireless carrier jumped 8.6% to $39.08. T-Mobile is close on a deal to buy a chunk of U.S. Cellular for more than $2 billion, taking over some operations and wireless spectrum licenses. Verizon's talks with the regional carrier are expected to take longer and might not result in an agreement.

In another significant development, Verizon ( NYSE:VZ ) Public Sector has been awarded a $100 million contract by the State of Michigan. This agreement allows state agencies and affiliated entities access to Verizon's award-winning network and a suite of communications solutions designed to help serve the state's more than 10 million residents. The contract also allows eligible Michigan cities, townships, villages, counties, school districts, universities, colleges, and nonprofit hospitals to take advantage of available Verizon services through MiDeal, the State of Michigan’s extended purchasing program.

The new contract, effective through August 11, 2028, is renewable for up to five additional option years and includes access to devices and services including Fixed Wireless Access (FWA), 5G Ultra Wideband (UW) connectivity, special plan pricing, and Verizon Frontline, the advanced network and technology built for first responders. Verizon Communications Inc., one of the world's leading providers of technology and communications services, generated revenues of $134.0 billion in 2023.

Verizon ($VZ) Spike 2.5% in Premarket Trading on Earnings ReportOn Monday, Verizon Communications ( NYSE:VZ ) released its first-quarter earnings report. The report indicated a 4% decline in earnings from the previous year, although the earnings still surpassed Wall Street's expectations. Verizon's stock price reacted positively due to the wireless service revenue exceeding expectations.

The adjusted earnings per share for the quarter ending on March 31 were $1.15, while revenue for Verizon ( NYSE:VZ ) was $33 billion, reflecting a 0.2% increase from the previous year's revenue of $32.9 billion. The estimated earnings per share and revenue were $1.12 and $33.2 billion, respectively.

Verizon's wireless service revenue rose by 3.3% to $19.5 billion, exceeding the estimated $18.67 billion. The company was able to achieve this despite Q1 being a typically weak season by raising prices for wireless services.

Verizon ( NYSE:VZ ) lost 68,000 postpaid phone customers in the quarter, a metric closely watched by investors. However, this number was lower than the predicted loss of 92,000 subscribers, resulting in a positive market response. In Q1, Verizon ( NYSE:VZ ) lost 158,000 postpaid consumer subscribers but added 90,000 business postpaid subscribers. In comparison, the company had lost 127,000 postpaid phone subscribers in the previous year.

Verizon ( NYSE:VZ ) is presently focusing on generating growth in free cash flow and earnings before interest, taxes, depreciation, and amortization.

Verizon's stock rose by 2.6% to 41.55m on the stock market, indicating a move back above the 50-day line. The company had gained over 7% in 2024 before the earnings report, after experiencing a 4% decline in the previous year.

Verizon Communications ( NYSE:VZ ) stated on Monday that it had lost fewer wireless subscribers in Q1 than anticipated, owing to its flexible plans and streaming bundles offering discounted pricing for services such as Netflix and Warner Bros Discovery's Max. Verizon's shares rose by 2.5% in pre-market trading.

Verizon's consumer business saw its best Q1 performance since 2018, with 158,000 wireless retail postpaid phone net losses compared with 263,000 losses a year ago. CEO Hans Vestberg stated, "We are on track to meet our financial guidance and to deliver positive consumer postpaid phone net adds for the year."

Verizon's plans are usually more expensive than those of its rivals, AT&T (T.N) and T-Mobile (TMUS.O), which are set to report earnings later in the week.

Tech-Media Stocks: Macro Fib SchematicsThese Tech Media/Entertainment companies are among the biggest and most influential. Their Fib Schematics are somewhat similar but a few are unique. Twitter is newer than the rest so it takes up less room. We may see Twitter keep this support and continue onto its new schematics.

As for every single chart, we can see the monthly candles respecting these s/r lines. One must not need me to tell them which way we are suppose to go, rather they must look deep inside the chart and understand weather it is on support, on resistance, or pushing away from one of them. We can see this in ever single one.

Unfortunately, this is a 2 month chart but it still definitely works! 100 percent will still work no matter the timeframe. Its just that the structure gets more defined the lower the timeframe.

Front runs, rejections, and clear supports can be spotted here.

For me, AT&T looks like a buy because of multiple frontuns above. T-Mobile looks like a buy to resistance and then short sell. The others are too complex to put into mere words.

A Little Bearish on Verizon StockWe received two signals for Verizon stock based on the closing price on February 2, 2024 indicating the stock will likely drop over the next 6-20 days. My SAG Gauge Conservative algorithm bearish signal has occurred 211 times. A bearish signal has successfully seen the stock drop below the signal closing price over the next 10 trading days 95.7% of the time. The typical delay, or time the stock does not immediately move downward has generally only been 1 day. This means the stock could move up on Monday, but likely begin its decline as late as Tuesday of this upcoming week.

The other bearish signal is my Up and Down MACD, which signals before a typical MACD cross would occur. Instead of signalling at the cross, I added additional parameters that trigger shortly after weakness is confirmed and well ahead of the cross most people will trade on. For VZ stock, it is accurate in determining reversals 94.50% of the time. This one is interesting in that delays that have occurred result in less than a 1% move. This means the signal price on Friday (closing price) of 42.13 would most likely not see the stock move above 42.60 before it moves below 42.13. In this instance I am looking for a drop well below 42.13.

Simultaneous signals of both algorithms at the same time has occurred 60 times. 58, or 96% of the time the stock has dropped. Simultaneous signals are something I prefer to see as it is more bolstering than solo signals. The last time these two signals occurred together and failed was March 22, 2000. The stock failed to trade downward over the next 27 days. Day 28 finally went into the red, but was a failure in my 10 and 25 day studies.

I am looking for a possible move up on Monday/Tuesday at the latest before we start to move down. A success will occur if the stock goes below 42.13. Historically, simultaneous signals send the stock down to at least 42.09 (which is a very weak success). The 10 day target is a 1.3% - 4% drop over the next 6-9 days. The 25 day target is 2.4% - 6% over by days 13-22. It is unclear where the stock will go after this movement occurs.

Verizon's 2024 Surge: Navigating the Shake-Up

Verizon Communications ( NYSE:VZ ) recently unveiled its fourth-quarter earnings report, showcasing a resilient performance despite a 9% dip in adjusted earnings to $1.08 per share. However, the company met Wall Street estimates, sparking a positive market response as VZ stock rose. The standout achievement was the robust growth in wireless subscriber additions, exceeding expectations amid a notable shake-up in the consumer business landscape.

Earnings Overview:

For the quarter ending December 31, Verizon ( NYSE:VZ ) reported a 0.3% decline in revenue to $35.1 billion compared to a year earlier, where earnings stood at $1.19 per share on revenue of $35.3 billion. Analysts had anticipated earnings of $1.08 per share on revenue of $34.6 billion, reinforcing Verizon's ability to meet and even exceed market expectations.

Key Performance Indicators:

Verizon's wireless service revenue witnessed a commendable 3.2% increase to $19.4 billion, surpassing estimates of $19.37 billion. A significant highlight was the addition of 449,000 postpaid phone customers, a substantial leap from the 217,000 gained in the previous year. Additionally, Verizon secured 375,000 5G broadband customers during Q4, signaling the company's commitment to advancing in the rapidly evolving 5G landscape.

2024 Guidance and Strategic Focus:

Looking ahead, Verizon ( NYSE:VZ ) has outlined a strategic vision for 2024, forecasting wireless service revenue growth in the range of 2% to 3.5%. The company also anticipates adjusted EBITDA growth within 1% to 3%, and an adjusted EPS of $4.50 to $4.70, aligning with market expectations. Amidst management changes, Verizon is laser-focused on generating growth in service revenue, free cash flow, and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Challenges and Market Dynamics:

Verizon ( NYSE:VZ ) acknowledges challenges in regaining its marketing claim to operate the highest quality wireless network. The brand has encountered headwinds amidst management shifts, necessitating a concerted effort to restore its market dominance.

Market Reaction and Technical Analysis:

Leading into the earnings report, Verizon's stock had gained 5% in 2024, rebounding from a 4% retreat the previous year. Technical analysis indicates a strong upward trajectory, with the stock breaching resistance at $34.98. The current testing of resistance at $41.05 is a pivotal moment, potentially sparking a negative reaction. However, an upward breakthrough at this level would signal further positive momentum.

Conclusion:

Verizon's ( NYSE:VZ ) 2024 outlook reflects a company resilient in the face of challenges, focusing on key growth metrics and strategically positioning itself in the 5G landscape. As the brand navigates through management changes and competitive dynamics, investors are keenly observing Verizon's ability to sustain its positive momentum and capitalize on the evolving telecommunications industry.

Navigating the 5G Horizon: Verizon's Stock and Future Prospects

Verizon Communications (NYSE: NYSE:VZ ) has been a stalwart in the telecommunications industry, consistently attracting income-oriented investors due to its reliable dividends. However, recent performance indicates a struggle to keep pace with broader market indices. We'll explore the various factors influencing Verizon's stock, from management changes to the delayed impact of 5G technology on revenue growth.

Management Reshuffle and Strategic Shifts:

Verizon has undergone significant management changes, including the recent appointment of Leslie Berland as Chief Marketing Officer. With experience from Peloton Interactive, Berland brings a fresh perspective to Verizon's consumer group. The company's focus on simplified pricing, segmented go-to-market strategies, and C-Band spectrum upgrades, as highlighted by Oppenheimer analyst Tim Horan, could be pivotal in driving better churn and higher average revenue per user.

5G Network Expansion and Challenges:

Despite owning midband and high-frequency millimeter wave radio spectrum, Verizon has faced challenges in capitalizing on the 5G revolution. The rollout of 5G services has been slower than expected, impacting the consumer wireless business's revenue. However, Verizon's push into fixed broadband services, with a goal of reaching 30 million homes by the end of 2023, offers a potential avenue for growth in a sector dominated by cable TV companies.

Market Dynamics and Competition:

Verizon's position in the wireless industry faces headwinds as industry growth slows, intensified by competition with AT&T and T-Mobile US. The cable TV companies' increasing influence in wireless services poses an additional challenge. The company's struggle to reclaim its marketing claim as the provider of the highest quality wireless network adds complexity to its market dynamics.

5G's Role in Revenue Growth:

While Verizon has made strides in adding fixed broadband subscribers, revenue from 5G business services using private networks has fallen short of expectations. However, partnerships with industry giants like Amazon Web Services and IBM indicate a commitment to exploring new revenue streams through 5G applications for industrial devices.

Dividends, Buybacks, and Market Share:

Despite a 7.7% dividend yield, Verizon's stock has underperformed, and a planned stock buyback has been delayed due to spectrum purchases for 5G services. The acquisition of Tracfone aims to strengthen Verizon's position in the prepaid wireless services market, providing a potential boost during economic downturns.

Technical Analysis and Future Outlook:

From a technical standpoint, Verizon's stock has shown positive signals, breaking the falling trend and indicating a potential rise to $39.43 or more. The company's use of artificial intelligence to enhance customer service and lower operating expenses aligns with its commitment to technological innovation.

Verizon Business Expands Private 5G at Port of VirginiaKey Takeaways:

1. The agreement between Norfolk International Terminal (NIT) and Verizon Business follows the successful deployment of a private 5G network at the neighboring Virginia International Terminal, another Port of Virginia property

2. The new network includes Verizon Push to Talk Plus, which is now available for use with the Verizon Private 5G Network offering.

3. The expansion of Private 5G at Port of Virginia terminals highlights Verizon’s Private 5G Network scalability and applicability in data-rich industrial environments.

Verizon Business and the Norfolk International Terminal (NIT) announced an agreement to build a Verizon Private 5G Network at their Virginia facility, following the successful deployment of Verizon Private 5G at the neighboring Virginia International Terminal (VIT). Both NIT and VIT are terminals within the Port of Virginia, highlighting the scalability of private 5G networks to meet unique connectivity demands throughout a complex, data-rich environment.

The Private 5G Network will cover 270 acres of the NIT campus with dedicated Ultra Wideband spectrum, replacing spotty outdoor WiFi and enabling secure, instant voice, text and data communication within the campus through Verizon Push to Talk Plus (PTT). PTT is a mobile app ideal for industrial and commercial worksite collaboration across phones, smartphones and tablets, all through the Verizon private Network.

Price Momentum

VZ is trading in the middle of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some upward momentum. This is a positive sign for the stock's future value.

VERIZON: Strong rally testing the 1D MA200.Verizon is bullish on its 1D technical outlook (RSI = ) as it is on a continuous rise since the bottom a month ago. Using the 1D MA50 as Support, it even crossed over LH trendline of January and crossed over the 1D MA200 for the first time since April 22nd 2022.

Despite this crossing, it has closed the last candles under it, which shows the short term, to say the least, struggles on this key Resistance level. The previous pullback was on the 0.382 Fibonacci to the 0.236. Now it hit the 0.5 Fibonacci and we are expecting an analogous pullback to the 0.382 that will pave the way for the next series of green candles. We will buy that pullback and target the R1 level (TP = 37.70).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

VZ Verizon Communications Options Ahead of Earnings If you haven`t sold VZ here:

or here:

Then analyzing the options chain and the chart patterns of VZ Verizon Communications prior to the earnings report this week,

I would consider purchasing the 32usd strike price in the money Puts with

an expiration date of 2023-11-17,

for a premium of approximately $1.14.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Disney - Is Your Compass Upside Down?On trading social media, Disney has been the target of moonboys for quite a while.

For some reason, whenever a stock is in a landslide and doesn't go up, everyone gets it in their head that they're going to BUY THE CALLS and catch the next MOTHER OF ALL SHORT SQUEEZES.

And this is because you want to gamble on a single day candle, which results in you blowing your account, and then you stop using TradingView and can't have fun anymore.

Disney, fundamentally, is a company that may not have any future whatsoever in a society that returns to mankind's traditions.

For so many years, it has been pushing a warped and depraved culture at both its parks and via its broadcasting networks. It was even an entertainment industry leader in onboarding the Chinese Communist Party's Zero-COVID social credit edicts.

And this is a problem if you want to get long.

They always say "zoom out," and so let's look at yearly candles:

8 months of price action for 2023 so far indicates that we've probably just been painting the wick portion of a year that will break the 2020 COVID low.

And the first place you find support below the COVID low is at $40.

"Sure, sure. But it's Disney. It's the stock market. EVERYONE KNOWS it's going up. Bears always get #rekt LOL."

"Bear flags" and "bull flags" are astrology and don't exist. But what does exist is when an equity spends more than a year in an area it should have bounced from and simply doesn't go up, which is what we see on the monthly.

But the contrary, on the Weekly, there is a problem for bears, which is the August of '22 high at $126.

And so there is a potential that tomorrow's earnings call actually results in a raid to $80 that actually produces a bullish buying opportunity with a target of $126.

The problem is, the "JPM Collar" has the world's most significant bank long on SPX 4,200 puts that expire September 29 that have literally been under water every second of every day since they were bought at the end of Q2.

SPX/ES - An Analysis Of The 'JPM Collar'

However, I note in my recent SPX call:

SPX - The Sound of a Shattering Iceberg

And a recent Nasdaq call

Nasdaq NQ - Is It Time To Sell The Rip?

With CPI pending on Thursday morning, what happens tomorrow is really significant.

That although I suspect our index tops to get raided, the problem is, are you going to see $40+ on Disney in a time frame of less than 3 weeks?

September is likely to be something of a "chilly autumn" for equities markets with the way everything is set up, including the SOXS bear semiconductor ETF and the VIX.

If there's to be anymore rally, that rally may only come in Q4.

And thus, that would mean for Disney that a likely scenario would be a raid on the lows from earnings and even more bearish consolidation, with the $126 target being left for the beginning of Q4.

This stock is a lot like Verizon and T-Mobile. It's better left not bothered with until it starts to show you signs that a bank or a fund really wants to rip it bigly in one direction or the other.

There's lower hanging fruit and greener pastures out there to trade.

VZ Verizon Communications Options Ahead of EarningsIf you haven`t sold VZ here:

Then analyzing the options chain and chart patterns of VZ Verizon Communications prior to the earnings report this week,

I would consider purchasing the 31usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $1.08.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Will Verizon bounce from current oversold extreme?Verizon Communications Inc. - 30d expiry - We look to Buy a break of 32.01 (stop at 30.01)

We are trading at oversold extremes.

This stock has recently been in the news headlines.

In our opinion this stock is undervalued.

A higher correction is expected.

A break of bespoke resistance at 32, and the move higher is already underway.

Our profit targets will be 37.01 and 38.01

Resistance: 32.00 / 33.70 / 35.00

Support: 31.25 / 30.00 / 29.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.