#VET/USDT Ascending Broadening Wedge #VET

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.02290.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area (in green) at 0.02278, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.02306

First target: 0.02339

Second target: 0.02378

Third target: 0.02423

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

VETUSDT

VET/USDT – Golden Pocket Retest After Breakout!🧠 Overview: Is VeChain About to Flip Bullish?

The 2D VET/USDT chart (KuCoin) is presenting a high-potential setup. After months of downward pressure, VET has finally broken above a long-standing descending trendline, which has been intact since early 2025.

Now, price is retesting a major support zone—which also happens to be the Golden Pocket of the Fibonacci retracement (0.5–0.618). This area is crucial for confirming whether this is a real trend reversal or just another fakeout.

---

🧩 Technical Structure & Key Levels

📍 Descending Trendline (Broken)

A clear breakout from the downtrend that started in February 2025.

First signal of a potential trend reversal.

📍 Critical Support Zone – Golden Pocket

Range: 0.02258 – 0.02390 USDT

Aligns with Fibonacci 0.5–0.618 retracement from recent swing low to high.

Acts as a historically strong horizontal support — now being retested after the breakout.

📍 Fibonacci Resistance Levels (Upside Targets)

Level Price (USDT)

Resistance 1 0.02840

Resistance 2 0.03235

Resistance 3 0.03745

Resistance 4 0.04265

Resistance 5 0.05185

Extended High 0.07786 – 0.08006

📍 Major Support (Last Line of Defense)

0.01772 USDT, the lowest level seen since late 2023.

---

✅ Bullish Scenario – Valid Retest & Reversal

If the Golden Pocket zone holds, we could see:

Continuation of bullish momentum

Gradual move toward:

🎯 0.02840 as the first resistance

🎯 0.03235 – 0.03745 as mid-term targets

🎯 0.04265 – 0.05185 if momentum strengthens

Potential formation of an Inverse Head & Shoulders pattern, signaling a strong reversal base

---

❌ Bearish Scenario – Failed Retest

If price fails to hold the 0.02258–0.02390 support zone:

We may see a move back down toward 0.01772 USDT

This would invalidate the bullish breakout (false breakout scenario)

The longer-term downtrend could resume

> ⚠️ Beware of a potential bull trap around 0.025–0.026 — price rejection here could signal a failed breakout.

---

🧠 Current Price Action Pattern

✅ Descending Trendline Breakout → early bullish signal

🔁 Golden Pocket Retest → now in progress, critical for direction confirmation

📈 Reversal Potential → watching for Inverse Head & Shoulders formation

---

💡 Conclusion

VET/USDT is at a make-or-break level. The breakout above the descending trendline is promising, but the current retest of the Golden Pocket zone is the real test for bulls. If this level holds, we could be witnessing the early stages of a trend reversal with multiple upside targets in play.

#VETUSDT #VeChain #CryptoBreakout #FibonacciLevels #GoldenPocket #AltcoinAnalysis #InverseHeadAndShoulders #TrendReversal #CryptoTechnicalAnalysis #SupportResistance #CryptoSignals

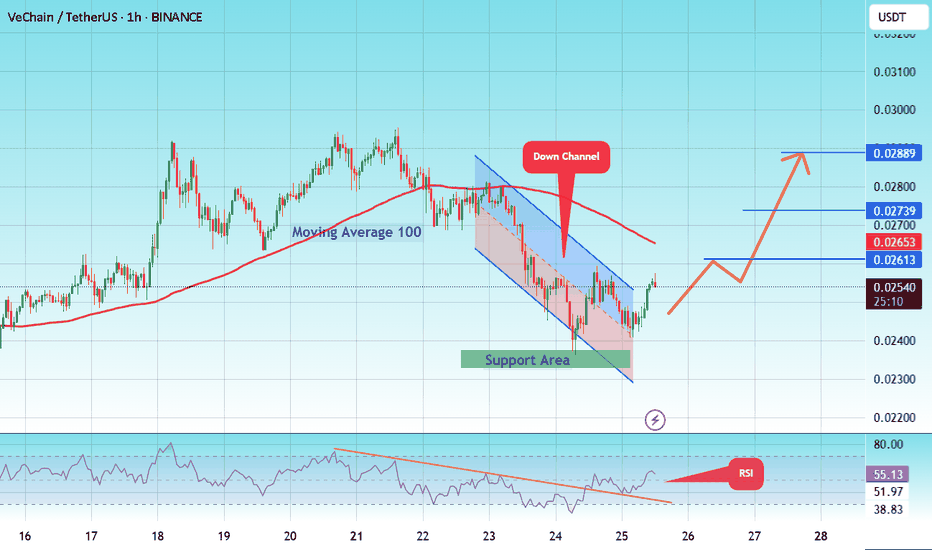

#VET/USDT – Falling Wedge Breakout?#VET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.02310, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.02360.

Entry price: 0.02545

First target: 0.02613

Second target: 0.02739

Third target: 0.02889

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

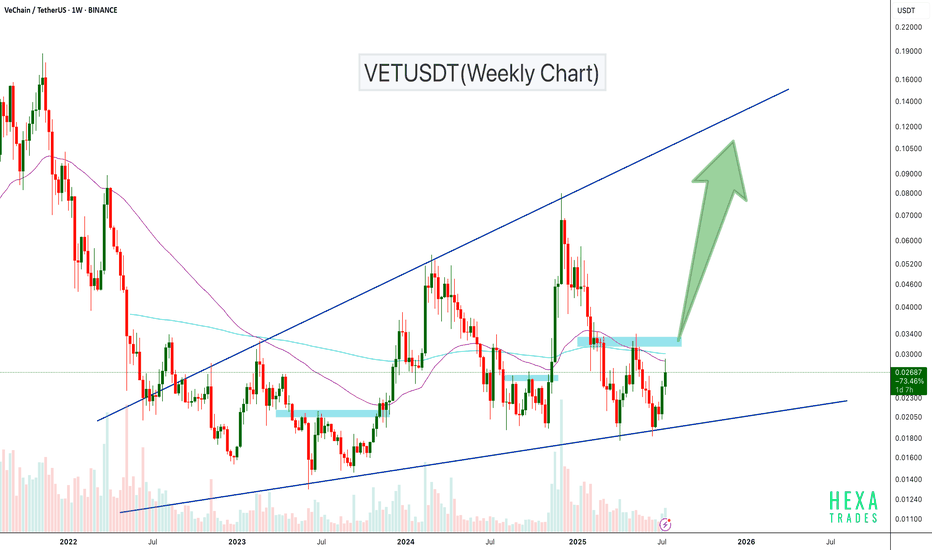

VETUSDT Ascending Broadening WedgeVETUSDT is trading inside a long-term ascending broadening wedge on the weekly chart, with price currently bouncing off major trendline support. After holding this support zone, VET is showing strength and approaching a critical resistance area around $0.033–$0.035.

A breakout above this zone could trigger a strong bullish rally, with potential upside targets in the $0.06–$0.10 range, and even higher toward the wedge top.

Cheers

Hexa

BINANCE:VETUSD NYSE:VET

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02086.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02160

First target: 0.02226

Second target: 0.02274

Third target: 0.02344

VeChain Low Prices Accumulation Opportunity Reaching Its EndVeChain. We have higher lows since June 2023 and yet, VETUSDT is still trading at bottom prices. Don't get me wrong, this is great. This only means that the pair is strong and yet there is still time to buy within a rising accumulation zone.

I am using the linear chart so we can get the full picture. After June 2022, the candles become very small. This is the consolidation period. Even when the market starts to produce higher lows and higher highs after June 2023 this is still bottom prices action. What do I mean? Just compare the size of the 2021 bull market bullish wave with the past 3 years. That is what I mean.

What will happen now is the 2025 bull market bullish wave. A wave similar in size to what we saw in 2021 but with the end result being much higher prices, very likely a new all-time high.

First the action is very slow, almost neutral as you are seeing now. The small jump from April-May, less than 80%. Then watch... Out of nowhere, Boom!, 200-300% just to start. The 200-300% bullish breakout is never the end, this would be just the start of the major 2025 bull market wave. Then it goes on and on and on... Sustained long-term growth. The end result can be 15X, 20X, 30X or more. Too early to say, but prices won't remain low for too long. This is your last chance to accumulate VeChain before a major bullish run.

Namaste.

VETUSD – VeChain’s Wave Finale: Road to $0.62VeChain (VETUSD) is showing bullish intent with momentum accelerating out of a defined trend channel. I would like to highlight the technical analysis suggesting a potential wave culmination at the $0.62 mark—a sharp leap from its current price of $0.0247. Backed by strong volume and RSI movement, the setup hints at investor optimism and possible breakout continuation.

- Wave Projection: Interpret the technical channel and present a wave count culminating in the $0.62 target.

- Price Action: Emphasize the recent surge (+13.18%) as a catalyst for bullish sentiment.

- Volume & RSI: Use indicators shown in the chart to validate potential continuation.

- Risk Disclosure: Note that speculative wave targets should be assessed with broader market confirmation.

“Do you see VET following through to the projected wave target, or do you anticipate a mid-wave correction? Drop your analysis and let’s discuss.

TradeCityPro | VET Battles Key Resistance Amid Buyer Momentum👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the VET coin for you. VET is a Layer1 and RWA project with a market cap of 1.84 billion dollars, currently ranked 44 on CoinMarketCap.

⏳ 4-Hour Timeframe

On the 4-hour timeframe, as you can see, this coin experienced a downtrend and eventually reached the 0.01872 bottom. It then received support from that level and began a bullish move.

✨ Right now, a significant resistance is located at 0.02227, which I’ve marked on the chart as a supply zone. So far, it seems the price has been rejected from this area.

🔍 Price has attempted to break this zone three times already. Each time, although it managed to penetrate further, it still failed to break through and got rejected.

💥 With each rejection, the RSI oscillator has also been rejected from near the 70 level and moved downward. If, in future attempts, the RSI enters the Overbuy area, the probability of breaking 0.02227 will significantly increase.

📊 Currently, market volume favors buyers. The buying volume on green candles has increased noticeably. Meanwhile, during the rejection from the resistance zone, the selling volume was very low, which signals strong buyer control.

⚡️ If the downtrend continues and price fails to form a higher low above 0.02020, we can enter a short position upon the break of 0.02020. A break of 39.35 on the RSI would be a solid momentum confirmation for this setup.

📉 The main short position can be opened upon the break of 0.01872. This would confirm the continuation of the downtrend and could lead to a sharp downward move.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Vechain, Pick Your Own All-Time HighA mirror image from 2020-2021 would put a new all-time high for VETUSDT (Vechain) around mid-May 2026. Starts late ends late, right?

This is a great chart. Vechain hit bottom June 2023 and has been consolidating within a rising channel. A rising channel as in higher highs and higher lows. Now, this is bullish but still not a bull market but bullish consolidation.

Consolidation can happens in three different ways:

1) Purely sideways. When the action happens within a range.

2) Bearish consolidation. When consolidation produces lower highs and lower lows.

3) Bullish consolidation. As we see here, with higher highs and higher lows.

Now, this is bullish but still only part of the transition period. Bull market action is what you see on the left between March 2020 and April 2021. Notice the huge difference.

Some other projects have been producing lower lows but this isn't a bear market more like bearish consolidation. We are about to enter the bull market phase. And this phase tends to end in a bull run.

If the same pattern from 2020-2021 repeats, we can see a new all-time high in May 2026. I have four new ATH projections on this chart, pick your own.

Thank you for reading.

Namaste.

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02456.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02480

First target: 0.02530

Second target: 0.02565

Third target: 0.02612

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.02750, which acts as strong support from which the price can rebound.

Entry price: 0.02936

First target: 0.03070

Second target: 0.03200

Third target: 0.03391

TradeCityPro | VETUSDT The Best Entry Opportunity Awaits👋 Welcome to TradeCityPro Channel!

Let’s dive in and analyze one of the veteran coins in the cryptocurrency space, VET, which has a high potential for movement. Together, we’ll identify its entry triggers.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

In the weekly time frame, VET is one of the coins that’s in a relatively good position compared to other altcoins. While most altcoins have recorded new lows, VET has never lost the 0.01430 level!

After being supported at 0.01922 and closing a green weekly candle, we experienced an upward move. Currently, we’re stuck at the resistance of 0.03176, and it seems we’re pulling back to this resistance.

📉 Daily Time Frame

In the daily time frame, after an upward wave that didn’t quite reach the 0.09 resistance, a fake candle occurred, and we entered a box between 0.04197 and 0.05253. Seller presence and a rejection from the middle of the box led to losing the 0.04197 support.

After breaking this support, we experienced a sharp decline. When we reached the 0.01925 support, the bearish momentum hit its lowest point, and we saw reactions from buyers, leading to an upward move.

Currently, we’re below the key resistance at **0.03233**. After breaking this level, we can expect a sharp upward move. You can take a position in both **futures and spot**, with the safest stop loss for your buy at 0.01925

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Check if it can break through 0.03779-0.04757 at once

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(VETUSDT 1W chart)

Support zone: 0.00440-0.101741

Resistance zone: 0.03779-0.04757

If it breaks through the resistance zone upward and maintains the price, it is expected that a step-by-step uptrend will begin.

Therefore, it is important to check whether there is support around 0.03779-0.04757.

-

(1D chart)

The key is whether it can maintain the price by receiving support near the M-Signal indicator on the 1M chart and rising to around 0.03779.

If it fails to rise, you should check for support near 0.02778.

If it falls below the 0.01741-0.2135 range, you should stop trading and watch the situation.

Therefore, the 0.01741-0.2135 range is an important support range from a short-term perspective.

-

The 0.03779, 0.04757, and 0.06603 points are important points as HA-High indicator points on the 1W, 1M, and 1D charts.

It is expected that a breakout trade will be possible when it breaks through the 0.03779 point, but since an important point is located before it rises much, the point to watch is whether it can maintain the price by rising above 0.04757 at once.

Therefore, when making a breakout trade, check if it rises above 0.04757, and if not, respond.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.02600.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02750

First target: 0.02838

Second target: 0.02908

Third target: 0.03000

VET ANALYSIS🚀#VET Analysis : Pattern Formation

🔮As we can see in the chart of #VET that there is a formation Inverse Head And Shoulder Pattern and it's a bullish pattern. If the candle sustain above the neckline then a bullish move could be confirmed✅

🔰Current Price: $0.02435

⚡️What to do ?

👀Keep an eye on #VET price action. We can trade according to the chart and make some profits⚡️⚡️

#VET #Cryptocurrency #TechnicalAnalysis #DYOR

Vechain, 20X, 30X Or 100X In 2025?Vechain stopped dropping in June 2023, that's the market bottom. Ever since it has been producing higher highs and higher lows. This is one of the strong pairs and the last correction already ended, last week.

The low prices in late 2024 launched a bullish wave and this bullish wave was corrected by more than 100%. This is a full flush. A full flush is always great news for bulls and buyers, because it allows for maximum growth.

The previous high is an easy and certain target which equal to about 245%. This is very easy and ultra-high probability because this level was already hit in the last wave. If VETUSDT can find buyers at a higher price, now that the correction went beyond 100% even more buyers will show up.

But 245% is only short-term and being super conservative, this pairs chart points to a new All-Time High. This is because of the chart structure, the fact that the bottom happened in 2023 and in this April 2025 we have a long-term higher low. The weaker pairs are producing new All-Time Lows now. The stronger pairs are producing higher lows. The higher low means that holders/traders/participants are not ready to part with their coins. They are simply not willing to sell and this is why the price remains strong in comparison to other pairs.

These same participants will work as the base for maximum growth in this newly developing bullish phase. The 2025 bull market, make no mistakes.

This is no usual bullish jump, no relief rally nor "initial bullish breakout" as I love to say. This is it, we are entering price dynamics similar to 2021 or better. A major bullish wave.

See here how the market performed in 2021:

Of course, it is not that the market will necessarily grow by 17,000%. I am just saying, 245% is easy, it will be a very strong bullish wave.

The top can be hit at 10X, 20X or 30X (Can be 100X for all we know)... Allow for strong variations. Regardless of the final outcome, you will be very happy with the results. It will be great.

Namaste.

TradeCityPro | VETUSDT Keep an Eye on the Charts!👋 Welcome to TradeCityPro Channel!

Let’s dive into the days when the world is buzzing with interesting events—countries are forming alliances, and news of Trump’s tariffs to negotiations is everywhere. You need to keep a sharp eye on the financial markets and your assets!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

After the bullish move from the 0.01963 support, we got rejected at 0.08271, essentially wiping out the entire move and fully retracing our steps.

We’ve now returned to the 0.01963 support, where we’re forming a solid green indecision candle, backed by noticeable buying pressure. This level has shown a strong reaction, acting as a reliable support.

This could serve as a decent buy trigger with low risk, offering a good entry point. Personally, though, I’m holding off on buying until we see stronger momentum in the chart and market, and until Bitcoin dominance experiences a deeper pullback.

📉 Daily Timeframe

In the daily timeframe, VET is among the coins that have faced a brutal sell-off! From its last peak, it’s dropped roughly 77%, and those without proper risk management have likely been wiped out.

After forming a support box between 0.04224 and 0.05298, we saw a fakeout above the box, signaling further downside. The last time we held support at 0.04224, we couldn’t reach the box’s ceiling, leading to a sharp drop. But after hitting 0.01942, the price has calmed down a bit.

For buying in spot or even futures positions, we’d need a break of the trendline and its trigger at 0.02352 to confirm entry, given the trendline’s retracement nature. If we get rejected from this trendline, a short position in a lower timeframe could make sense. Should 0.01942 break, the downtrend will likely continue. For spot entry confirmation, a surge in volume and a break above 48.68 RSI would be a strong signal.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.02460.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02620

First target: 0.02700

Second target: 0.02765

Third target: 0.02853