VET/USDT – Golden Pocket Retest After Breakout!🧠 Overview: Is VeChain About to Flip Bullish?

The 2D VET/USDT chart (KuCoin) is presenting a high-potential setup. After months of downward pressure, VET has finally broken above a long-standing descending trendline, which has been intact since early 2025.

Now, price is retesting a major support zone—which also happens to be the Golden Pocket of the Fibonacci retracement (0.5–0.618). This area is crucial for confirming whether this is a real trend reversal or just another fakeout.

---

🧩 Technical Structure & Key Levels

📍 Descending Trendline (Broken)

A clear breakout from the downtrend that started in February 2025.

First signal of a potential trend reversal.

📍 Critical Support Zone – Golden Pocket

Range: 0.02258 – 0.02390 USDT

Aligns with Fibonacci 0.5–0.618 retracement from recent swing low to high.

Acts as a historically strong horizontal support — now being retested after the breakout.

📍 Fibonacci Resistance Levels (Upside Targets)

Level Price (USDT)

Resistance 1 0.02840

Resistance 2 0.03235

Resistance 3 0.03745

Resistance 4 0.04265

Resistance 5 0.05185

Extended High 0.07786 – 0.08006

📍 Major Support (Last Line of Defense)

0.01772 USDT, the lowest level seen since late 2023.

---

✅ Bullish Scenario – Valid Retest & Reversal

If the Golden Pocket zone holds, we could see:

Continuation of bullish momentum

Gradual move toward:

🎯 0.02840 as the first resistance

🎯 0.03235 – 0.03745 as mid-term targets

🎯 0.04265 – 0.05185 if momentum strengthens

Potential formation of an Inverse Head & Shoulders pattern, signaling a strong reversal base

---

❌ Bearish Scenario – Failed Retest

If price fails to hold the 0.02258–0.02390 support zone:

We may see a move back down toward 0.01772 USDT

This would invalidate the bullish breakout (false breakout scenario)

The longer-term downtrend could resume

> ⚠️ Beware of a potential bull trap around 0.025–0.026 — price rejection here could signal a failed breakout.

---

🧠 Current Price Action Pattern

✅ Descending Trendline Breakout → early bullish signal

🔁 Golden Pocket Retest → now in progress, critical for direction confirmation

📈 Reversal Potential → watching for Inverse Head & Shoulders formation

---

💡 Conclusion

VET/USDT is at a make-or-break level. The breakout above the descending trendline is promising, but the current retest of the Golden Pocket zone is the real test for bulls. If this level holds, we could be witnessing the early stages of a trend reversal with multiple upside targets in play.

#VETUSDT #VeChain #CryptoBreakout #FibonacciLevels #GoldenPocket #AltcoinAnalysis #InverseHeadAndShoulders #TrendReversal #CryptoTechnicalAnalysis #SupportResistance #CryptoSignals

Vetusdtlong

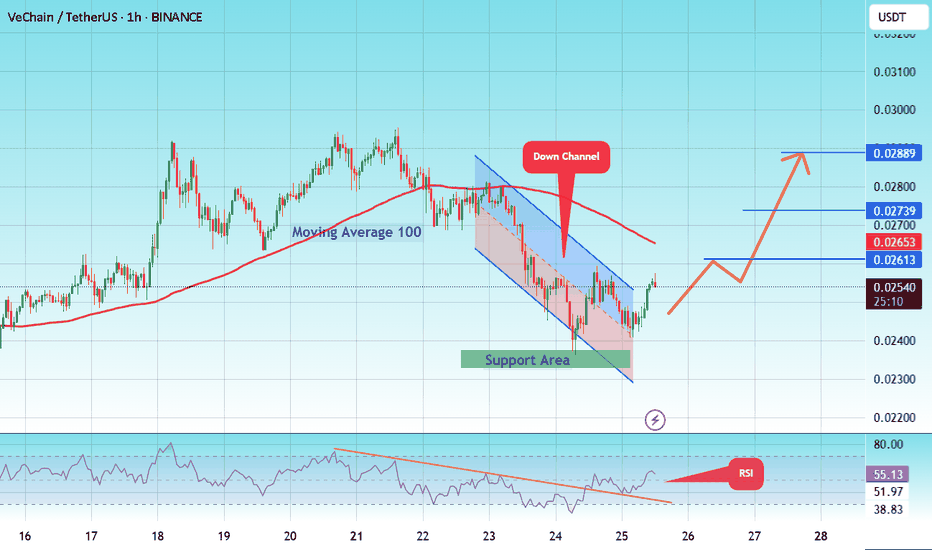

#VET/USDT – Falling Wedge Breakout?#VET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.02310, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.02360.

Entry price: 0.02545

First target: 0.02613

Second target: 0.02739

Third target: 0.02889

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

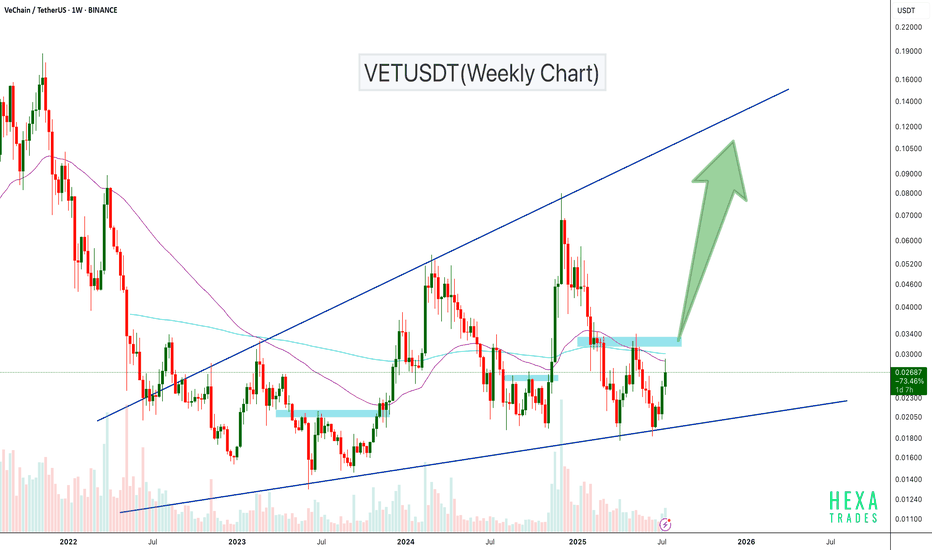

VETUSDT Ascending Broadening WedgeVETUSDT is trading inside a long-term ascending broadening wedge on the weekly chart, with price currently bouncing off major trendline support. After holding this support zone, VET is showing strength and approaching a critical resistance area around $0.033–$0.035.

A breakout above this zone could trigger a strong bullish rally, with potential upside targets in the $0.06–$0.10 range, and even higher toward the wedge top.

Cheers

Hexa

BINANCE:VETUSD NYSE:VET

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02086.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02160

First target: 0.02226

Second target: 0.02274

Third target: 0.02344

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02456.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02480

First target: 0.02530

Second target: 0.02565

Third target: 0.02612

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.02750, which acts as strong support from which the price can rebound.

Entry price: 0.02936

First target: 0.03070

Second target: 0.03200

Third target: 0.03391

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.02600.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02750

First target: 0.02838

Second target: 0.02908

Third target: 0.03000

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.02460.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02620

First target: 0.02700

Second target: 0.02765

Third target: 0.02853

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.02666

Entry price 0.02950

First target 0.03080

Second target 0.03200

Third target 0.03300

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.02630

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2700

First target 0.02810

Second target 0.02920

Third target 0.03064

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.03165

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.03342

First target 0.03500

Second target 0.03712

Third target 0.03979

#VET/USDT lONG Ready to go higher#VET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.04570

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.04670

First target 0.04860

Second target 0.05180

Third target 0.05546

#VET/USDT #VET

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.04111

Entry price 0.04407

First target 0.04640

Second target 0.04860

Third target 0.05090

VETUSDT - Only Veterans Trade Please!VETUSDT - SO there are four possible scenarios of VET as there are tight squeeze of the yellow boxes. For TL;DR - Wait for the green box in action for clear path, For daredevils, Orange marked the scalps end to the path of the channel marked, The red marked (horizontal line) is fib pockets and would play a good role here. The cyan line marked shows if tight buyers and sellers in action, expect strong attraction to 0.4534. and eventually bleed, Green shows normal fall till the red line to retest if following channels, and my most loved green box is what i wait because DOM is stacked for the orders to filled. The blue box is a point if green line gets bonked aim for the targets on it.

#VET/USDT Ready to go up#VET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.04900

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.05160

First target 0.05317

Second target 0.05633

Third target 0.06000