Mastercard and Visa Shares Decline Due to Stablecoin BillMastercard (MA) and Visa (V) Shares Decline Due to Stablecoin Bill

Yesterday, we reported that the US Senate had passed the GENIUS stablecoin bill, which establishes a legal framework for regulating the stablecoin market. This development led to a sharp rise in the share price of cryptocurrency exchange Coinbase (COIN), while simultaneously putting pressure on Mastercard (MA) and Visa (V) shares.

According to media reports, market participants are concerned that stablecoins could pose serious competition to these companies, which earn revenue primarily from transaction fees. This serves as an example of how blockchain technology, with its low-cost features and high speed, could disrupt leaders in the traditional finance sector.

Technical Analysis of Mastercard (MA) Stock Chart

In May, MA shares formed an upward trend (shown in blue), but this was already broken by a strong downward move, accompanied by a wide bearish gap in the $575–$585 range.

Near the lower boundary of the channel, a contracting triangle pattern (shown in black) can be observed – this can be interpreted as a temporary balance between buyers and sellers. However, it didn’t last long: the widening spread of bearish candles (1 and 2) indicates growing selling pressure.

It’s possible that following a drop of over 9% from the June high, Mastercard (MA) shares might attract buyers betting on a short-term rebound. Nevertheless, in the longer term, developments related to the GENIUS bill could contribute to a continued downward trend.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Visatrading

Visa: Resistance ApproachingThe next key step for Visa should be overcoming resistance at $394.49 during magenta wave . However, if support at $339.61 fails to hold, our alternative scenario (33% probability) will be activated—suggesting the recent high already marked the end of the corrective wave alt. in magenta. In that case, a renewed decline below the $299 mark would be likely, aiming to complete the alternative turquoise wave alt.4 on a larger scale.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

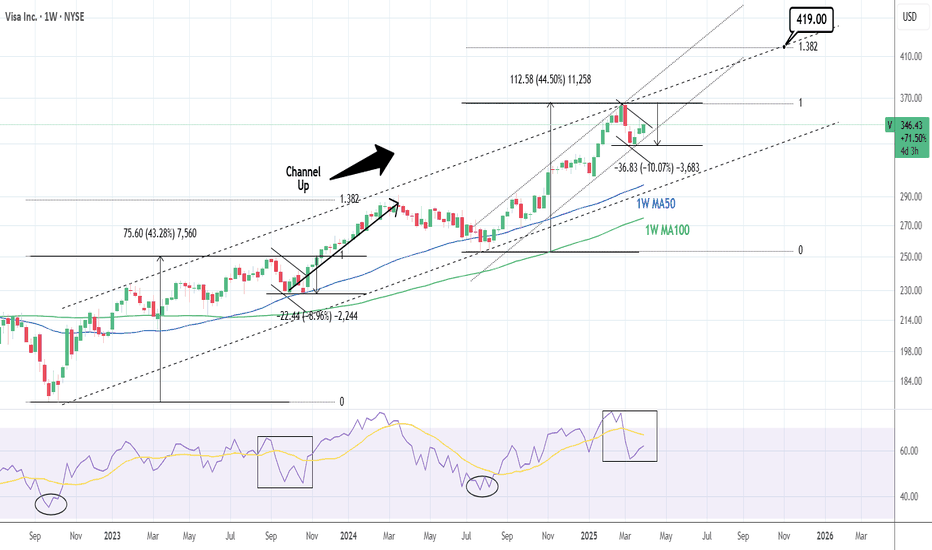

VISA: One of the steadiest 2025 stock picks.Visa remains bullish on 1W and is about to do so on its 1D technical outlook as well (RSI = 54.200, MACD = 1.140, ADX = 29.207). The 1W Channel Up is what keeps the long term trend bullish and 1D is just recovering from neutral grounds the correction of March's first 2 weeks. This is nothing new for the stock as it had the same -9% correction in September 2023 after a symmetric +43.28% bullish wave. After this correction, the index extended the rally to the 1.382 Fibonacci extension before the stronger correction.

You can see that the 1W RSI pattern now is identical to then. Consequently, we again expect a technical rebound to the 1.382 Fib extension either at or over the 2 year Channel Up (TP = 419.00) by the end of the year.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Visa: Bottom Already Established?Visa might have already reached the low of the magenta wave ; however, for now, we allow slightly more room for the downside. Nonetheless, once this interim correction has concluded, the price should proceed higher during the magenta wave and surpass the resistance at $366.34. We currently consider it 34% likely that the stock will break above this level to form a fresh high with the magenta wave alt. . But primarily, we view the regular wave as already complete.

VISA: 2 year Channel Up seeks the next bullish wave.Visa is on a neutral 1D technical outlook (RSI = 53.426, MACD = 2.190, ADX = 43.132) and just above neutrality levels on 1W (RSI = 56.042) as despite being supported by the 1W MA50, it has been rejected twice on the R1 level. That would have been concerning on any other occasion but this time it's not as we consider this similar to the November 2022 R1 pullback, which after being contained by the 1W MA50, it reversed to the 1.382 Fibonacci extension. The 1W RSI trading above its MA for 2 months now, is also similar to October-November 2022. Consequently, we turn bullish again, aiming for the 1.382 Fib (TP = 305.00).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Visa Soars! All Profit Targets Hit in 15-Minute Long TradeTechnical Analysis: Visa – 15-Minute Timeframe (Long Trade)

Visa presented a strong bullish opportunity with an entry at 275.92. The trade has been highly successful, with all profit targets hit, showcasing the strength of the uptrend.

Key Levels

Entry: 275.92 – The long position was initiated after confirming a strong bullish signal.

Stop-Loss (SL): 274.59 – Positioned below support to manage risk and protect against potential downside.

Take Profit 1 (TP1): 277.57 – Successfully hit, confirming the initial bullish momentum.

Take Profit 2 (TP2): 280.24 – Further upside pressure pushed the price to this level.

Take Profit 3 (TP3): 282.91 – The bullish trend carried the price to this target.

Take Profit 4 (TP4): 284.56 – The final target, marking a complete and highly profitable trade.

Trend Analysis

The price remained well above the Risological Dotted trendline, confirming a strong uptrend throughout the trade. The steady buying pressure helped achieve all targets, indicating robust bullish momentum.

The long trade on Visa has concluded successfully, hitting all targets, with the final target at 284.56. This trade exemplifies the power of identifying strong trends and riding the momentum to maximize profits.

Visa Stock Slips 4.15% Amid DOJ Antitrust Suit Visa Inc. (NYSE: NYSE:V ), the world's largest payment processing company, has come under pressure as reports surface that the U.S. Department of Justice (DOJ) is preparing to file an antitrust lawsuit against the company. The allegations center around monopolistic practices in the U.S. debit card market, accusing Visa of using its dominant position to hinder competitors. In the wake of this news, Visa's shares fell 3.7% early Tuesday, marking a significant drop for the payment processor. Let’s dive into the key fundamental and technical aspects driving Visa's recent performance and future outlook.

Antitrust Concerns Cloud the Horizon

The DOJ's anticipated lawsuit is based on accusations that Visa (NYSE: NYSE:V ) has been using anti-competitive tactics such as exclusive agreements and penalties for customers using other payment processors. These tactics, according to the DOJ, have allowed Visa to maintain its dominant position in the U.S. debit card market, preventing competitors from gaining market share. This isn't the first time Visa has come under regulatory scrutiny; the DOJ previously blocked a $5.3 billion merger between Visa and fintech company Plaid in 2021, citing antitrust concerns.

Visa (NYSE: NYSE:V ) has also faced heightened scrutiny alongside its rival, Mastercard (MA), as both companies are often accused of operating as a duopoly in the payments industry. Recent reports suggest that Visa's volume-based discounts for merchants are a point of contention, with regulators arguing that these discounts create barriers for new entrants to compete effectively, keeping prices artificially high.

Despite these challenges, some analysts believe that the long-term financial impact on Visa's revenue may be limited. KBW brokerage estimates that Visa's U.S. debit business accounts for around 10% of the company’s total revenue. While the lawsuit could drag on for years, analysts are not expecting a significant blow to Visa’s earnings, although there may be volatility in the stock price during the legal proceedings.

Technical Analysis: A Slippery Slope for Visa's Stock

Visa's stock has been in a rising trend pattern for the better part of 2024, experiencing regular highs and lows as it steadily ascended. However, with the DOJ lawsuit looming, Visa’s stock experienced a sharp decline of over 4% during Tuesday’s trading, dipping to $278.04. This drop represents a crucial turning point as the stock nears a key support zone.

From a technical standpoint, Visa’s current price action shows the stock regressing towards the $255 pivot level, which previously acted as resistance in December 2023. This support level is critical, as breaking below it could lead to further declines. However, if the stock holds above this level, we could see a rebound in the coming weeks, especially if the market shifts focus away from the lawsuit and back to Visa's strong fundamentals.

The stock's Relative Strength Index (RSI) also provides insight into its near-term trajectory. Currently hovering at 46, the RSI suggests that Visa (NYSE: NYSE:V ) is approaching oversold territory. While not yet indicating a reversal, this level is crucial to watch, as a dip below 40 could signal further downside momentum. Conversely, an RSI rebound could spark a short-term rally, particularly if Visa’s fundamentals stabilize.

What Lies Ahead for Visa?

While Visa (NYSE: NYSE:V ) has encountered regulatory hurdles in the past, the payments giant continues to be a powerhouse in the global payments industry. Its ability to navigate legal challenges, coupled with its dominant market position, ensures that Visa (NYSE: NYSE:V ) remains a significant player in the long term. Additionally, Visa’s aggressive stock buyback program and global expansion into digital payments and fintech partnerships should cushion the blow from the ongoing antitrust investigation.

However, the uncertainty surrounding the DOJ lawsuit may weigh on the stock in the short to medium term, as investors brace for potential headlines and prolonged legal battles. Visa's earnings are not expected to take a substantial hit from its U.S. debit operations, but the negative sentiment from the lawsuit could cause the stock to fluctuate in the months ahead.

Conclusion

Visa’s stock is at a critical juncture, facing headwinds. The DOJ’s antitrust lawsuit has sparked concern among investors, but the long-term fundamentals of the company remain intact. From a technical perspective, all eyes will be on the $255 support zone, with the potential for a short-term rebound if Visa can hold above this level. Nonetheless, the legal proceedings are likely to introduce volatility, making Visa (NYSE: NYSE:V ) a stock to watch closely in the coming weeks.

Wave of the day: Visa

5 good reasons for NYSE:V stock

1. Bounce from the value zone

2. Rising MACD histogram

3. Buying Volume coming in

4. Pocket Pivot on the last day

5. Analysts have set a mean price target forecast of 160.17. This target is 20.33% above the current price.

What's your take on Visa?Comment below

Legal Disclaimer: The information presented in this analysis is solely for informational and educational purposes only and does not serve as financial advice.

Visa ~ The 12 Month Blue Chip Trade Visa - NEO:VISA

Earnings:

Rep: $2.41 EPS ✅ Higher Than Expected

Exp: $2.34 EPS

Revenue

Rep: $8.6B ✅ Marginally Higher Than Expected

Exp: $8.56B

6 - 12 Month Trade

A potential 29% relatively safe return for the 2024 year in this dividend paying, well performing blue-chip stock. c$2.00 per annum dividend per share .

Monthly Chart (left)

✅ Long Term Monthly Trend Intact

✅ Above 10 month moving average

Daily Chart (right)

✅Cup and Handle Breakout

✅Above 200 day aligning with diagonal support

🎯 Target 1 at $330 is where the long term and short term fib extension levels indicated overhead resistance will like be. Taking 80% of the position off the table here would be wise. The Cup and Handle tare may be reached at a much later date after a correction.

🟢ENTRY ZONE: $254

$264 would be ideal but I may enter earlier

❌STOP

The stop should be placed just under the horizontal support line at roughly $249. IF the 200 day or diagonal support is lost exit the trade. Same goes for the 10 month moving average on the long term chart.

Take a tighter stop is its a larger position.

PUKA

VISA: See the excellent levels this strategy offers.Visa has been trading inside a Channel Up pattern but lately with the 1D technicals neutral (RSI = 50.905, MACD = 0.560, ADX = 28.391). This is despite staying on high levels, finding support on the 1D MA50.

As long as this and the Inside HL trendline hold, we are bullish, aiming at the Inside HH (TP = 251.00). If the price crosses below however, it is very likely to see a 1D MA200 test. Don't buy though before the 1D RSI enters the 0.236 - 0.0 Fibonacci Zone, which has been the strongest buy signal when the last two HL levels of the Channel Up formed. As previously, we will again aim at the Inside HH (TP = 252.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Visa has formed a large level double topVisa has formed a large level double top

This figure shows the weekly candle chart of Visa's stock from the end of 2019 to the present. The graph overlays the bottom to top golden section at the beginning of 2020. As shown in the figure, the combination of last week's high point and 2021 high point of Visa's stock has formed a large level double top shape, both of which are suppressed by the 2.618 position of the gold split at the bottom of the figure! This week, the stock of Visa has fallen back to the bottom of the chart, which is 2.382 on the Golden Divide. In the future, this position will serve as the watershed for judging its strength!

Visa to break higher?Visa - 30d expiry

The primary trend remains bullish.

This is curremtly an actively traded stock.

Trading volume is increasing.

235.57 has been pivotal.

A break of the recent high at 235.57 should result in a further move higher.

There is no clear indication that the upward move is coming to an end.

We look to Buy a break of 236.11 (stop at 231.38)

Our profit targets will be 249.78 and 252.78

Resistance: 235.57 / 240 / 250

Support: 228 / 223.50 / 220

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Visa: Vis – à – vis 👀Visa is moving just under the resistance at $235.85 – vis-à -vis with this mark, so to speak. Soon, the share should climb above this level, though, to complete wave b in magenta. This done, it should return below $235.85 and continue the descent below the support at $208.76, dropping into the turquoise zone between $204.28 and $187.10. There, the stock should finish wave 2 in turquoise, whose low should then initiate fresh upwards movement. However, there is a 34% chance that this low could already be established in the form of wave alt.2 in turquoise. In that case, Visa would maintain the upwards momentum.

Visa, Inc. (V)Founded in Foster City, California, by Dee Hock, this American multinational specialises in global payments technology. Its primary aim is to promote digital currencies among consumers, businesses, banks, and governments. Having built its network across 200 countries and territories worldwide, it is a global leader in digital payments. The company offers three different types of cards: Debit cards, Credit cards, and Prepaid cards. It also partnered with Apple in 2014 to introduce a wallet feature to iPhones. The company has various products, such as Visa Electron, Visa Cash, Visa Contactless, mVisa, and VisaCheckout.

V Visa exposure to Russia and UkraineVisa and Mastercard restricted transactions in Russia as aggressive penalties on the country over the invasion of Ukraine.

Around $1.2 billion of Visa Inc.’s annual net revenue comes from Russia and Ukraine.

4% of Visa’s total net revenue comes from Russia and about 1% from Ukraine.

In this case, my price target for the stock is the $187 resistance, while the sell-off area could touch $174 - $183.

Visa on the Way Up? Visa - Short Term - We look to Buy at 217.06 (stop at 208.56)

We look to buy dips. Previous resistance level of 220.00 broken. 50 1day EMA is at 213.50. 20 1day EMA is at 213.00. The bias is still for higher levels and we look for any dips to be limited.

Our profit targets will be 236.42 and 246.98

Resistance: 237.00 / 250.00 / 260.00

Support: 220.00 / 210.00 / 200.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Visa Is Starting to Rise Up !Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

It looks like Visa Bearish movement has ended when a Breakout of the Descending Channel happened on the 23rd of Sep. after that the stock has started moving sideways with a small edge to the upper direction.

The breakout point has formed what seems to be a solid support level where the market was able to bounce twice from.

The 19th of Oct was a great day for the stock where the market value has jumped from 228.27 to 233.52, a 2,2% increase in 1 day and this bullish push doesn’t seem like it's going to stop yet.

Possible Scenarios for the market :

Scenario 1 :

The market seems to be having a good Bullish momentum at the time this will lead the stock value to push up and hit the resistance level located at 235.14, If the buyers were able to gather more force and breakout that resistance then we will be seeing the price zigzag until it gets to the resistance level located at 247.63.

Scenario 2 :

The Bears might attempt to drive the market back into the descending channel range but they will be met by a big support zone that’s located near the 224.00 range, where a lot of buy power is located, if the Bears were able to drive the price to that level then we will see a big battle where the price will most likely bounce back up and return to Scenario 1 movement.

Technical indicators show :

1) The market is above the 5 10 20 50 100 and 200 MA and EMA (Strong Bullish Sign)

2) The MACD line has crossed the 0 line indicating the market changing from a Bearish state to a Bullish state. With a positive crossover happening between the MACD line and the Signal line

3) The STOCH is in the overbought zone with a positive crossover between the %K and %D

Daily Support & Resistance points :

support Resistance

1) 228.28 1) 232.90

2) 225.90 2) 235.14

3) 223.66 3) 237.51

Weekly Support & Resistance points :

support Resistance

1) 222.71 1) 235.17

2) 214.44 2) 239.36

3) 210.25 3) 247.63

Fundamental point of view :

Large credit card giant Visa is moving into the cryptocurrency space with its own version of credit cards, opening up opportunities for certain large-cap growth ETFs.

With a stake in Visa, ETF investors can play VISA move towards the cryptocurrency space with the Invesco Dynamic Large Cap Growth ETF (PWB).

Indicators point to continued Q4 strength in the domestic air travel recovery, and that's good news for Visa.

The 7-day moving average of U.S. COVID-19 cases, a leading indicator for domestic restrictions and travel, continues to decline since mid-September and Transportation Security Administration screenings as a percentage of 2019 levels improved to 85% from 83% in Evercore's prior Global Air Travel Tracker issue.

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.