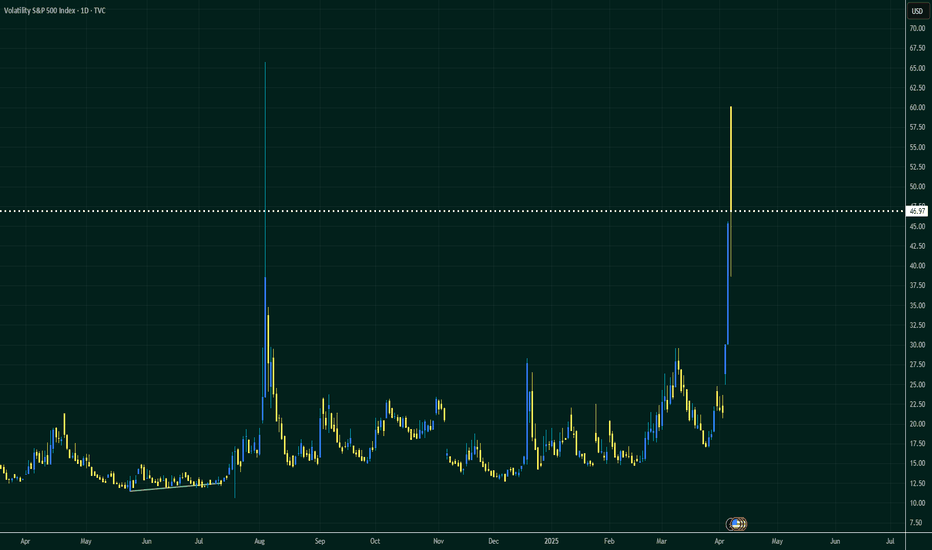

VIX | Stock Market Correction IncomingVIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

The VIX traces its origin to the financial economics research of Menachem Brenner and Dan Galai. In a series of papers beginning in 1989, Brenner and Galai proposed the creation of a series of volatility indices, beginning with an index on stock market volatility, and moving to interest rate and foreign exchange rate volatility.

Volitility

VIX Option Flow Signals Volatility Spike A massive wave of institutional option activity is pointing toward an upcoming surge in volatility—and likely a pullback in equities even more. Here's what the VIX flow is telling us:

🧠 Key Takeaways:

🔺 Aggressive Call Buying on VIX

Heavy blocks on VIX 22–42.5 calls, with most trading at the ask, signaling urgency.

Standout trades include:

1,407x April 22C @ $10.73 – $1.51M

2,535x May 60C @ $1.55 – $394K

5,770x April 40C @ $2.95 – $1.7M

📅 Short- to Mid-Term Focus

Expiries are clustered around April 16 and May 21, suggesting a volatility spike is expected within the next 1–6 weeks.

💵 Big Premiums Paid

Multiple trades between $500K and $1.7M, indicating strong conviction or heavy portfolio hedging.

📉 Minimal Put Activity

Very few puts being bought on VIX, signaling no expectations for volatility to fall.

📊 What This Means for Markets (SPY/QQQ)

This type of flow usually precedes a market correction, a macro catalyst, or event risk. Whether it's CPI, earnings season, or geopolitical flare-ups—institutions are bracing for turbulence.

🔮 Prediction:

Expect a spike in the VIX and downward pressure on major indices like SPY and QQQ in the coming 1–3 weeks.

This flow doesn’t lie—smart money is prepping for a move.

Bearish Sell Stop OrderMy trading plan does not allow me to buy into new highs.

However it's not safe or practical to aimlessly short the high.

A sell stop order is how I safely trade the highs.

I am Bearish to Neutral for now. Waiting for significant signs of bullish support.

Seasonally, the market is Bearish/ corrects on average going into February.

Xau/Usd Reaches Fair Value.Xau/Usd Reaches Fair Value.

The ExodusTradingDesk has spotted fair price that we believe will produce a potential buy/long opportunity for the precious metal gold.

We will buy the pair should we have a 30min candle close above the identified price zone at 1931 with our target set to 1945.

Use adequate risk management if you are to execute a trade with this analyses.

Enjoy and happy trading! #We are the #ExodusTradingDesk.

Navigating Volatile Markets Navigating Volatile Markets: Strategies for Turbulent Times

Introduction

Financial markets are no stranger to volatility, with unpredictable twists and turns that can test even the most seasoned investors. However, turbulent times need not be daunting. In this blog post, we will explore strategies to help you navigate volatile markets with confidence, turn uncertainty into opportunity, and make informed investment decisions during challenging times.

1. Stay Informed, Not Overwhelmed

During periods of market volatility, it's essential to stay informed about market developments and economic indicators. However, avoid becoming overwhelmed by constant news updates and opinions. Focus on reliable sources and maintain a balanced perspective.

2. Diversify Your Portfolio

Diversification is a time-tested risk management technique. Spread your investments across different asset classes, industries, and geographic regions. A well-diversified portfolio can cushion the impact of volatility on your overall holdings.

3. Set Clear Goals and Stick to Your Plan

Define clear financial goals and create an investment plan tailored to your objectives and risk tolerance. During turbulent times, emotions may tempt you to deviate from your plan. Stay disciplined and trust in the strategy you have set forth.

4. Consider Defensive Investments

Explore defensive investments, such as bonds, dividend-paying stocks, and precious metals. These assets may provide stability during market downturns and act as a hedge against heightened volatility.

5. Focus on Quality

In uncertain times, prioritize quality over speculative bets. Look for companies with solid fundamentals, stable cash flows, and strong balance sheets. Quality assets are better equipped to weather economic storms.

6. Assess Long-Term Value

Volatility can create buying opportunities. Look for high-quality assets that have been oversold due to market sentiment rather than inherent flaws. Assess their long-term value and potential for recovery.

7. Implement Stop-Loss Orders

Use stop-loss orders to protect your capital from significant losses. Set stop-loss levels that align with your risk tolerance and allow you to exit positions if the market moves against you.

8. Avoid Panic Selling

Resist the urge to panic sell during market downturns. Selling low locks in losses and may hinder your ability to benefit from potential market rebounds.

9. Focus on Risk Management

Adopt prudent risk management practices. Only allocate a portion of your portfolio to higher-risk assets and avoid overexposing yourself to individual positions.

10. Seek Professional Advice

If navigating volatile markets feels overwhelming, consider seeking advice from a financial advisor. A professional can help you assess your financial goals, devise a tailored strategy, and stay on track during turbulent times.

Conclusion

Volatility is an inherent part of financial markets, but with the right strategies and a disciplined approach, you can navigate turbulent times with confidence. Stay informed, diversify your portfolio, and focus on long-term value rather than short-term fluctuations.

Remember, every market cycle presents opportunities. Embrace volatility as a chance to refine your investment approach, grow your wealth, and turn uncertain times into prosperous outcomes.

Happy investing, and may your journey through volatile markets lead you to a more secure financial future!

Educational: 3 ways to determine if the market is overvalued

Introduction

The issue with determining if a market is overvalued is the fact that depending on your perspective the market always seems overvalued. In this publication we will explore 3 sound ways to determine if the market is overpriced and see how they works.

🔷 Shiller price-to-earnings (P/E) ratio

The Shiller price-to-earnings (P/E) ratio, sometimes referred to as the Shiller CAPE ratio or cyclically adjusted price-to-earnings (CAPE) ratio, is a measure of stock market valuation. It was created by Robert Shiller, a Nobel Prize-winning economist, and it is used to determine if a market is overpriced or undervalued.

The classic P/E ratio works by dividing the stock price of a firm by its EPS over the previous twelve months. The Shiller P/E ratio, on the other hand, adopts a longer-term strategy by considering the trailing 10-year average of inflation-adjusted earnings over the prior 10 years.

The Shiller P/E ratio is calculated using the following formula:

Stock market index price divided by the average of the prior ten years' worth of inflation-adjusted earnings is known as the Shiller P/E ratio.

The Shiller P/E ratio provides a more thorough picture of the market's valuation by using the 10-year average to smooth out short-term swings. It aids in mitigating the effects of brief increases or decreases in incomes brought on by economic cycles.

Market valuation levels are frequently determined using the Shiller P/E ratio. It is possible that the market is overvalued and that future returns will be lower if the Shiller P/E ratio is high. A low Shiller P/E ratio, on the other hand, would suggest that the market is undervalued and that future returns might be higher.

The Shiller P/E ratio should be used in conjunction with other fundamental and technical indicators, as it is not a perfect forecast of market moves. Investors and analysts use a variety of tools to analyze the state of the market and choose which investments to make.

🔷 Brock Value

The brock value is a measure of valuation that bases its assessment of the S&P 500 index's intrinsic worth on two inputs: GDP and interest rates. Peter Brock, a writer and financial expert, created it. This is how the brock value is determined:

Where r is the yield on medium-term corporate bonds, GDP is the US gross domestic product, and BV is the Brock value.

The S&P 500 index's real price can be compared with the brock value to assess whether it is overpriced or underpriced. According to Brock, the market often fluctuates between 30% and 20% over the Brock value. Extreme valuation and probable turning points are indicated when the market is above or below these ranges.

For example, as of June 2, 2023, the brock value was 2441.65, while the S&P 500 index closed at 4282.37, which means the market was 75.4% overpriced1. This suggests that the market is in a risky territory and may face a significant correction in the future. Conversely, if the market was below the dotted green line on the brock value chart, it would indicate that the market was underpriced and may offer attractive returns in the long term

🔷 Market Volatility

Market volatility is a gauge of how much the entire value of the stock market goes up and down. By examining the correlation between volatility and investor sentiment, it is possible to ascertain whether the market is overvalued. Investor sentiment is the overall attitude or mood of investors toward the market, and it can be affected by a number of things, including news, events, expectations, emotions, etc.

Utilizing implicit indices that represent investor behavior and preferences, such as put-call ratio, trading volume, dividend yield, etc., is one technique to gauge investor sentiment. A high put-call ratio, for instance, suggests that investors are purchasing put options more frequently than call options, which suggests a bearish or pessimistic mindset. When investors are actively trading in the market, there is a high degree of interest and enthusiasm, which is shown by a high trade volume. An investor's willingness to pay more for companies that pay fewer dividends is indicated by a low dividend yield, which suggests a positive or upbeat attitude.

Some research imply a link between investor sentiment and market volatility that is unfavorable. This implies that market volatility is low (stable) while investor sentiment is high (optimistic), and vice versa. This can be explained by the premise that when investors are upbeat, they tend to disregard bad news and concentrate on good news, which lowers market uncertainty and discord. On the other side, pessimistic investors have a propensity to overreact to bad news and disregard good news, which exacerbates market uncertainty and discord.

Therefore, by examining the divergence from the historical average or trend, one can utilize market volatility as a signal of market overvaluation. Market volatility may indicate that investor sentiment is excessively high and the market is overpriced if it is low relative to its historical level. The market may be undervalued if volatility is high compared to historical levels, indicating that investor confidence is too low. This strategy should be employed cautiously, though, as there may be additional variables, such as prevailing economic conditions, interest rates, and earnings growth, that influence market volatility and valuation.

Below is the TVC:VIX which is the volatility index.

The curious case for a $28 VIX trip... FUD about to hit markets?FUD FUD FUD, Fear, Uncertainty and Doubt. The 3 letters every trader on the street should know. No matter if you are dealing with Cryptocurrencies, Stocks or Forex, no one wants to wake up to an overnight position hit by FUD.

The VIX has long been known as the leading indicator as to the sentiment of the markets. It is known as the fear index and right now it is unreasonably low compared to recent history and current events. I mean we did just arrest our previous President and current candidate for President. Away from politics we also found ourselves in a currency war with the BLOC using the Chinese Yuan for settlements over the US Dollar. Well aside from economics, we still are funding our ongoing proxy war in Ukraine with the only other 2 superpowers on the planet. Well, Away from politics, economics, and war.... Oh wait, yeah the data on our economy came in pretty meh (not impressive).

So why in the world would the VIX be representing so much strength? Careful, you are starting to think for yourself and our TV overlords don't like that so much. But you are starting down the right track.

The VIX should be easily in the low to mid 20's but instead its flexing at 19.01?!? For reference the 50 Moving Average is 20.63 and the midline of the current Bollinger Bands is 22.04 with the low band being 16.83 and the high band being 27.25. If I was thinking about the next few weeks I would probably think that our world right now is providing significant enough risk to justify a trip northward towards the midline @ 22.04 but actually even higher to the high band of 27.25. Recently we touched 29 multiple times in recent weeks but immediately rejected and shot down to the 19.01 where we sit currently. Rejecting off a ceiling once, twice and even sometimes three times is common but I probably wouldn't need very many fingers to count the times an Index pegged a ceiling 4 times and didnt break through it significantly.

The market has stayed propped up on hopium for long enough and now its time to start pricing in reality. All is NOT well. I don't view this as a doomsday scenario at all but we need to move closer to reality. I see 28 as a start, it would signify the markets beginning to accept reality and no longer rely on the Buy the Dip hopium that retail investors bankrupted themselves on over the last 2 years.

$28 Vix is what i see coming.

Just documenting my own thoughts from my own charts. Dont mind me. Most likely not a human anyway.

EthererumThese are levels that I'll be keeping an eye on when dealing with ETHUSD, and I'll revise as price action progresses.

I adapt to the change in money flow.

This is short-term movement I'm tracking, but soon I'll do an analysis from the higher timeframe perspective. Price had a bullish impulsive and now it's forming an ascending channel to two key levels which is where I'm anticipating for it to flip from bullish to bearish. It's a possibility it can fall short of reaching the levels if there's enough pressure in the area. We shall see...

P.S. I am overall bullish on this crypto.

Avalanche/US DollarThese are levels that I'll be keeping an eye on when dealing with AVAXUSD, and I'll revise as price action progresses.

I adapt to the change in money flow.

Fundamentals:

Amazon Web Services (AWS) has partnered with Ava Labs in a bid to accelerate the adoption of blockchain technology by enterprises, institutions, and governments.

The move has sent the linked Avalanche AVAXUSD token soaring higher in recent days, outperforming even Bitcoin amid a major bull run in the biggest cryptocurrency.

.....

Seeing that price hit a significant low, potential profit margin resting above current price along with a bearish impulsive followed by a descending channel. I would wait for a break of the $20 & $30 price points and retracement for bullish precursors. We shall see...

Urgent: Bitoin Repeating (Consolidation)This happened in 2015, 2019, and once again now...

I believe Bitcoin will begin at least another year of downward or sideways accumulation to create a strong platform for BTC to grow to new heights,

as you can see in previous Bear Markets this exact same short-term rally has happened before,

How will it play out? - I believe it will start with a shortfall of $19,800 touching the 10-week ema, from this point it will eventually hit $16000-14000

with the potential to hit $11-8000 which I think is unlikely.

Why will this happen? - The economic collapse that the average human needs like oil, housing, unemployment, etc.

during these times saving rates have plummeted to 2.4% from previous years ranging from 8.4-19% in USA and Europe

leaving people with very little money to invest.

Thank you for reading :)

Bearish ABCD and Retest of the Daily Open on MaticMatic has a Bearish ABCD at the Daily Open and is showing a Bearish Divergence on the Volatility Indicators, it may be setting up for a BAMM to the 78 Cent Area.

Bearish Divergence on S&P Volatility at PCZ of Bearish BatThis Bearish Bat would have me believe that the VIX Bullish Butterfly Rally will come to an end and go back down to atleast the area of $28.50 but i wouldn't be surprised if it went into the lower $20s if this played out.

For more context this was formerly a Bullish trade Setup but now it's reached the target and we are looking for a retrace downward again.

Check the relatted idea below for further context of the previous trade.

Mahindra holidays amd resorts india LtdMahindra holidays amd resorts india Ltd good for swing trading

Buying this stock also because cup and handle pattern is forming

volume is hingh

cup and handle breakout

BUY =286.45

Stop loss=261

1st target =308

2nd target=331

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

S&P 500I am overall bearish this week! IMO we will see a push down on Monday, a continuation from Fridays sell off. It will be either Tuesday or Wednesday depending on Mondays candle we will see a rip up to a big resistance of 4100. Then we will make our way back down. if we break down past 1st support of 4000 we can touch 3900, If we break 3900we can touch 3700. This is a big support zone. we might see a bounce but if we either break or bounce up then break down past 370 we can be sure the bears will be in full swing and make newer lows for the year!

SPY analysis-option and fundmental

the big topic of this month and July has been RECESSION . I believe it depends all on the labour market now if we start to see increasing unemployment that could tip us into a recession. this is why I am short on the SPY because I believe this rally will fizzle out because there have been no real positive changes in the macroeconomics currently to fuel this rally, today we have initial jobless claims which will give us a good insight to which way the labour market is moving. which now is the main factor into the decision if we are going into a recession because the realized strength of the consumer is purely based on them receiving an income. Because of their credit card debt, the US consumer heavily relies on credit cards which could possibly mean with the labour market becoming weaker consumer spending could decrease even further as this has already started to happen. another sign that supports my view is that implied volatility has decreased and the lower the implied volatility the lower the premium paid for the option which means it will fall in value. as well as a put-to-call ratio of 1.265 which shows an increase of negativity around the SPY. currently, we have a volatility smirk for the SPY which is where the implied volatility for lower strike prices so this means investors are buying more puts(short position). this option analysis gives us a good insight into which way the SPY will move. on a micro company level, the cost of debt is increasing because of Hawkish rate hikes. if the cost of debt increases the weighted average cost of capital will increase(WACC) so for a company to be creating value its return on invested capital has to be higher than WACC. the reason I have included this is that i gives a good insight into what is actually causing these companies' value to decrease.

B I T C O I NThese are levels that I'll be keeping an eye on when dealing with BTC/USD, and I'll revise as price action progresses.

I adapt to the change in money flow.

I had published an idea on Bitcoin back in May from the weekly perspective, and this is an updated version from an H4 perspective to get a look within price action. Weekly range was entered on June 15th '22 and has been consolidating since then, but the fact that it's been supporting price for over a month is very promising in bull's favor.

The fact that these bull ranges are stacking within this weekly range can be taken as confluence. I would like to see a B.A.R. of the $22867 level which I look at as the bulls momentum is building. We shall see..