Inside a Candle: How to Read Hidden Order Flow Without a DOM

Difficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is for traders who want to understand the “story” behind a candle’s shape — and learn to spot aggressive buying/selling, absorption, and traps without needing footprint or order book tools.

🔵 INTRODUCTION

Most traders see candles as static shapes — green or red, big or small. But each candle is a battlefield of orders . Even without access to a DOM or volume footprint, you can still extract valuable information from just the candle's body, wick, and context .

🔵 ORIGINS: WHERE CANDLESTICKS COME FROM

Candlestick charts trace back to 18th-century Japan, where rice traders needed a way to visualize price movements over time. A legendary trader named Munehisa Homma , who traded rice futures in Osaka, is credited with developing the earliest form of candlestick analysis.

Homma discovered that price wasn’t just driven by supply and demand — but also by trader psychology . He created visual representations of market sentiment by tracking:

The opening and closing price of rice

The highest and lowest price reached during the session

This system became known as the “Sakata rules,” and it laid the foundation for many patterns still used today — such as Doji, Engulfing, and Marubozu.

Western traders only began using candlesticks widely in the 1990s, when analyst Steve Nison introduced them to the broader financial world through his book Japanese Candlestick Charting Techniques.

Today, candlesticks remain one of the most powerful and intuitive ways to visualize order flow, momentum, and market psychology — even without a Depth of Market (DOM) or depth of book.

In this article, you’ll learn how to read hidden order flow by analyzing:

Wick length and positioning

Body-to-range ratios

Candle clustering and sequences

🔵 HOW A CANDLE FORMS

Before you can read a candle, you need to understand how it comes to life . A single candle represents the full auction process during its time window.

Here’s how it builds, step by step:

Candle opens — this is the open price .

As price moves up during the session → the high] updates.

As price moves down → the low] updates.

The final traded price when the time closes → this becomes the close price .

The wick = price areas that were tested but rejected

The body = where the majority of aggressive trades occurred

If buyers push price up quickly but sellers slam it down before the close — the candle will have a long upper wick and close near the open, revealing seller absorption.

Understanding this flow helps you recognize traps, fakeouts, and reversals in real time.

🔵 CANDLE BODY: WHO'S IN CONTROL

The body of the candle reflects the result of the battle between buyers and sellers. A wide body with minimal wicks means dominance and commitment.

Big body, small wick → clear conviction

In an uptrend: buyer aggression

In a downtrend: panic or aggressive selling

Small body, long wicks → indecision, absorption, or trap

Often appears near tops/bottoms

Indicates both sides were active but neither won clearly

www.tradingview.com

🔵 WICKS: THE SHADOWS OF REJECTION

Wicks are not just “leftovers” — they show where price was rejected after being tested.

Long upper wick = seller presence or absorption at highs

Long lower wick = buyer defense or trap spring

Double wick = liquidity sweep / false breakout

Use wick direction to spot:

Failed breakouts

Smart money traps

Exhaustion candles

🔵 HIDDEN ORDER FLOW PATTERNS

1️⃣ Absorption Candle

A large wick with little movement afterward — shows that big orders absorbed market pressure.

2️⃣ Trap Candle

A candle that sweeps above/below a key high/low and closes opposite — classic smart money fakeout.

3️⃣ Imbalance Candle

Large-bodied candle that closes near the high/low with no wick on the other end — implies one-sided aggression (and often leaves an imbalance).

🔵 CLUSTERING & SEQUENCES MATTER

Never read a candle alone. The sequence of candles tells the full story:

3+ rejection wicks near resistance? Liquidity building before breakout or trap

Bearish engulfing after long upper wick = smart money selling into retail buying

Tight-range dojis + volume spike = compression before expansion

Context + volume + structure = hidden flow decoded.

🔵 PUTTING IT TOGETHER: A REAL EXAMPLE

Price breaks above previous high

Candle closes with long upper wick and smaller body

Next candle opens, dumps fast, leaving imbalance behind

Buyers trapped — move likely to continue down

This is how you read order flow from candle anatomy .

🔵 TIPS FOR MASTERY

Use a lower timeframe (1M–5M) to see microstructure

Watch how wicks behave near S/R or OBs

Confirm with volume spikes or delta-style indicators

Use replay mode to slow down the story and study cause/effect

🔵 CONCLUSION

Every candle is a message. You don’t need expensive tools to read order flow — just your eyes, context, and curiosity.

Learn to see candles not as symbols, but as evidence of behavior . Absorption, imbalance, and traps are all visible if you look closely.

Volumeanalysis

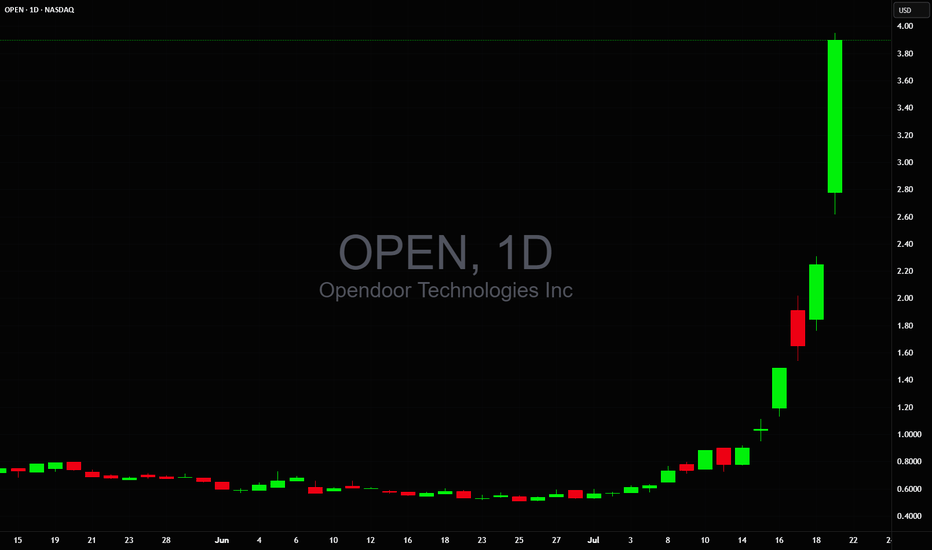

+330% this morning $1.25 to $5.38 on massive 270 million volume🚀 +330% this morning 💥 $1.25 to $5.38 on massive 270 million shares traded volume so far

NASDAQ:SNGX money maker of the day!

2 Buy Alerts sent out, also posted it in my premarket watchlist while it was still up only +30%!

Forget about NASDAQ:MSFT NASDAQ:META NASDAQ:AMZN NASDAQ:NVDA NASDAQ:AAPL AMEX:SPY NASDAQ:QQQ they will never be able to create such gains in a single day or should I say minutes

This isn't options trading either, it's a stock that went up that much this morning

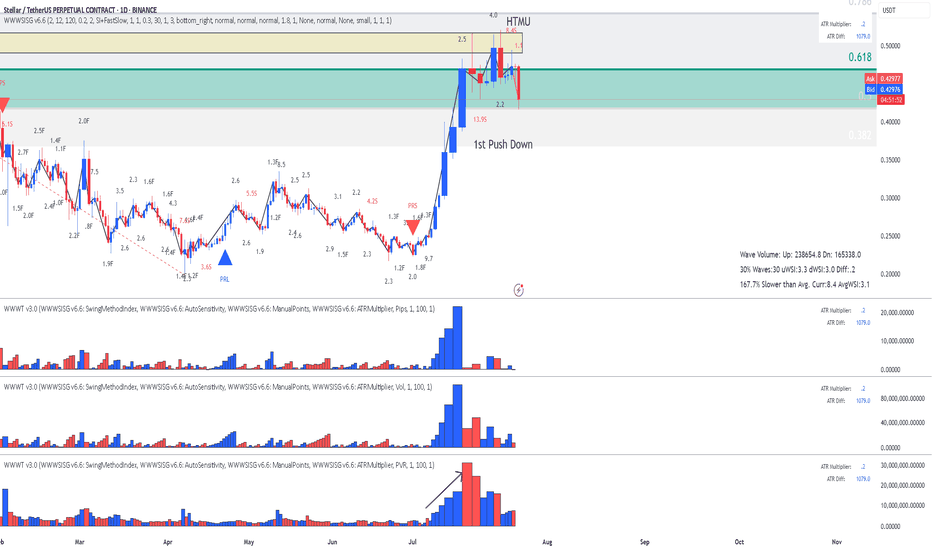

BitCoin - Is it heading for the Fib?This is a classic Entry Short for Weis Wave with Speed Index owners called " Exit from Range with a Plutus Signal" and in this case it was a PS. It looks that it's heading for the Fib, I will wait for some pullback on 1HR to confirm with Speed Index and the waves, as well as getting a better RR.

I

EURJPY Bullish Setup : EURJPY Forecast + Demand Zone🧠 Introduction: What's Happening on the Chart?

Today’s analysis on EURJPY is built on the MMC trading framework, which emphasizes the identification of institutional supply and demand zones, reaction points, QFL patterns, and volume bursts to map out high-probability trading paths.

We are currently observing a market in a corrective phase following a significant bearish drop. However, the presence of a major demand zone, along with a positive bullish pattern, suggests potential upside reversal or at least a short-term retracement.

🔍 Technical Breakdown – Zone by Zone

🔻 1. The Drop from 2x Supply Zone

EURJPY experienced a significant decline from the 173.60–174.00 area, which acted as a 2x confirmed supply zone.

Sellers took control with strong bearish candles that broke through previous minor support levels.

This drop was impulsive, showing momentum-driven selling, often linked with institutional activity.

🟩 2. Demand Reaction at Major Zone

Price entered a key demand zone marked in green (170.80–171.00), where historically buyers have stepped in.

A "Volume Burst" is visible here—large volume candles with long wicks to the downside, which typically indicate accumulation.

A positive pattern (possibly engulfing or a pin bar structure) has formed, signaling a potential bullish reversal or relief rally.

🧱 3. QFL Structure (Quantum Flat Line)

The chart highlights a QFL base, where the price consolidates after an initial drop, then continues lower before a sharp bounce.

QFL is often used to identify trap zones where retail traders are shaken out, and smart money enters.

The recent bounce from the QFL base suggests smart money might be accumulating for a reversal move.

📐 Key Levels and Zones

Type Zone/Level Role

🔵 Volume Burst Area ~170.80–171.00 Aggressive buyer entry; accumulation zone

🟢 Major Demand 170.80–171.20 Key structural low supporting bullish bias

🟠 SR Flip Zone 171.80–172.00 Crucial breakout/retest level

🔴 Minor Resistance 172.60–173.00 Short-term pullback zone

🟥 2x Supply 173.60–174.00 Strong reversal point; ideal target

🔁 Scenarios to Watch

📈 Scenario 1: Bullish Breakout and Rally (Blue Box 1)

If price breaks above 172.00, we expect:

A potential retest (bullish confirmation).

Continuation toward minor resistance at 173.00, and possibly the 2x supply zone at 174.00.

This aligns with the positive pattern formed at the base and the idea of a market rotation from bearish to bullish structure.

📉 Scenario 2: Rejection and Retest of Lows (Blue Box 2)

If the price fails to sustain above 172.00, sellers may step in:

Price could revisit the major demand zone again or even break down to 170.50.

This would invalidate the bullish setup in the short term and imply a larger continuation of the bearish trend.

🧠 Strategic Insights (MMC-Based Thinking)

The MMC approach teaches us to mirror the market’s emotion and behavior.

In this case, we see signs of:

Panic selling → smart money accumulation.

Institutional traps (QFL drop) → bullish absorption.

Traders applying MMC would anticipate reactive setups at the SR Flip Zone to determine next directional bias.

💡 Trade Ideas (For Educational Purposes Only)

Strategy Entry SL TP1 TP2

Aggressive Long 171.30–171.50 170.70 172.50 173.50

Breakout Retest Long 172.10 (after breakout) 171.50 173.00 174.00

Sell on Rejection 172.00 (bearish confirmation) 172.60 171.00 170.40

📌 Conclusion & Final Thoughts

EURJPY is showing a potential bullish reversal setup from a well-defined demand zone, supported by volume bursts and positive price action patterns. However, the SR Zone at 172.00 remains the key pivot—how the price reacts here will determine whether we see a deeper pullback or a continuation to test upper resistance levels.

Stay flexible and responsive. Let the market give confirmation before execution. As always, follow proper risk management and trade the reaction, not the prediction.

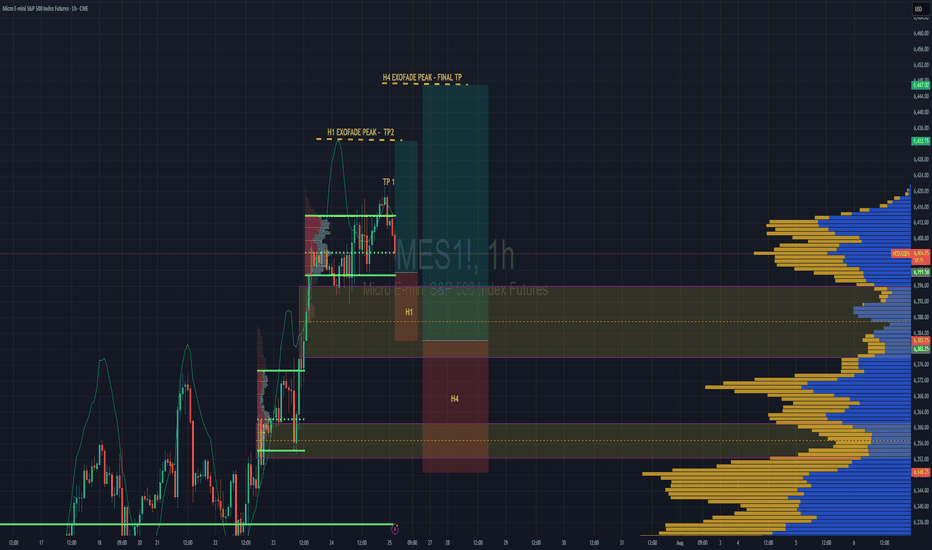

S&P 500 Intraday & Swing Entries H1 entry is close to getting activated for intraday.

If you want a swing trade then wait for H4 entry (you might be waiting a while obviously)

Reason for entries - We have broken out of Balance since July 25th and currently in a trend phase until we establish a new value area, or return to the one we broke out from.

So since Trend and Momentum is UP, then we should find Low Volume Areas to enter in the direction of the trend for a classic pullback entry trade.

Gold - Short Setup Off Major Trendline Rejection📉 Gold - Short Setup Off Major Trendline Rejection

Gold has broken down through the rising trendline and is now retesting it — the moment of truth! 🧐

🔻 Short Entry: 3,336

🎯 Target: 3,236 (Fib 1.0 + HVN gap fill)

🛑 Stop: 3,346 (Above trendline retest)

⚖️ Risk/Reward: ~1:10

📊 Bonus: High volume node above adds resistance. Bearish volume profile structure confirms the breakdown bias.

Watching for volume to pick up on the move down. Let's see if GC bleeds into August. 🩸📆

EURJPY POSSIBLE EXPECTED MOVEIn this analysis we're focusing on 1H time frame. Today I'm looking for a potential buy move from my marked key levels. This is a higher time frame analysis. Let's analyze more deeply into smaller timeframe and potential outcomes. Confirmation is very important.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is my analysis.

#EURJPY 1H Technical Analysis Expected Move.

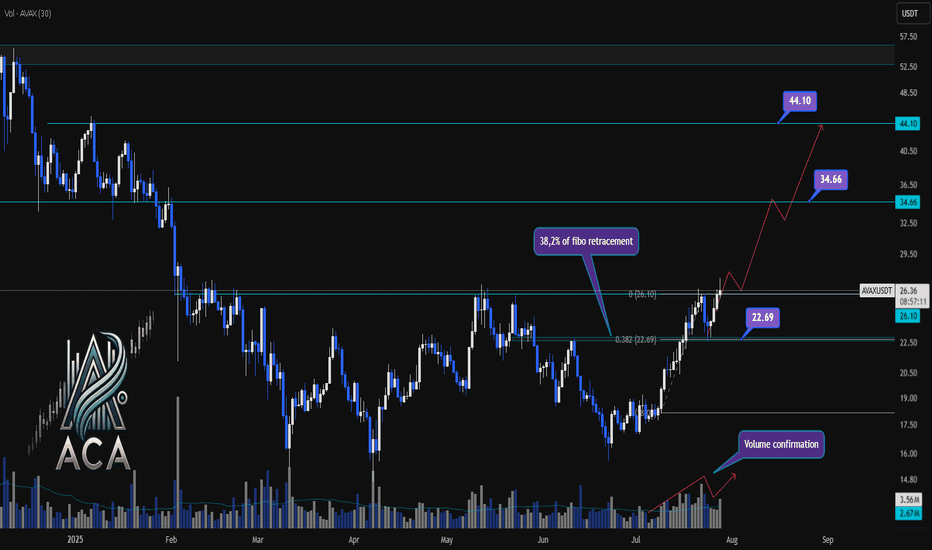

AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?

🔍 Let’s break down the AVAX/USDT setup, examining its technical structure and mapping out key opportunities as it gears up for a decisive move.

⏳ Daily Overview

AVAXUSDT has been exhibiting a bullish structure, recently reacting to the 0.382 Fibonacci retracement level (around 22.69USDT) where price paused for a correction. This correction was technically healthy, as it occurred with declining volume, while upward impulses were marked by notable volume surges—signaling strong bullish participation and confirming accumulation phases.

🔺 Bullish Scenario:

The next area to watch is the resistance at 26.10USDT, which has acted as a major barrier in recent trading sessions. A decisive daily close above this level—preferably supported by a clear uptick in volume—would confirm breakout momentum and set the stage for further advances.

Upon confirmation, the chart points to medium- and long-term targets at 34.66USDT and eventually 44.10USDT. These levels are derived from key Fibonacci extensions and historic price reactions, offering logical take-profit zones for trend-following strategies.

📊 Key Highlights:

- 0.382 Fibonacci level (22.69USDT) acted as a reaction zone and healthy correction point.

- Volume profile validates trend: increased buying volume during upswings, decreased volume on dips.

- 26.10USDT is the next crucial resistance for confirmation.

- Breakout (with volume) opens path to 34.66USDT and 44.10USDT targets.

- Failure to clear 26.10USDT could result in consolidation or another retest lower.

🚨 Conclusion:

All eyes are on the 26.10USDT resistance. Wait for a clear daily close and volume confirmation before considering entries. A breakout above this level could propel AVAXUSDT towards higher Fibonacci targets, while a rejection may prompt another retest of prior supports or consolidation.

Stay sharp and plan your trades with discipline!

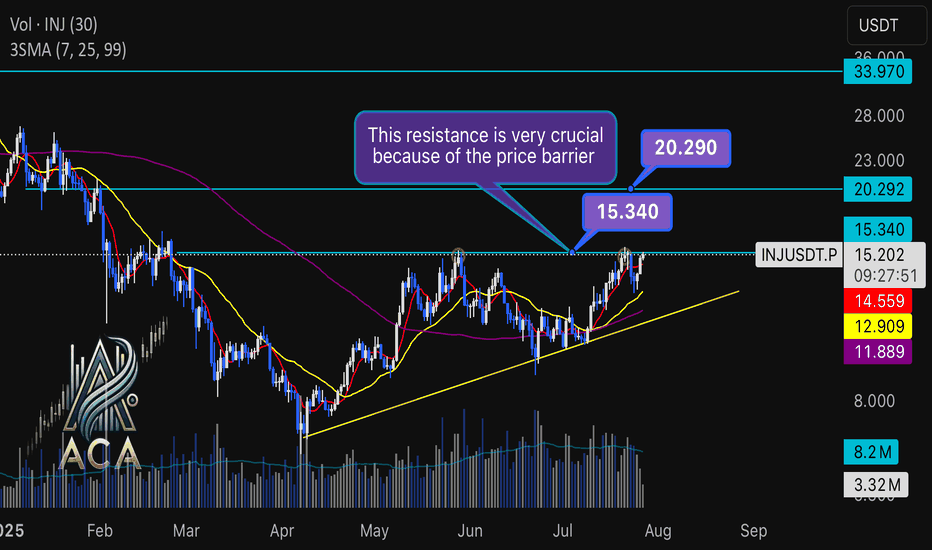

INJUSDT Daily Chart Analysis | Uptrend Brewing at Crucial LevelINJUSDT Daily Chart Analysis | Uptrend Brewing at Crucial Resistance

🔍 Let’s break down the INJ/USDT setup, examining its technical structure and mapping out key opportunities as it gears up for a decisive move.

⏳ Daily Overview

The INJUSDT pair is forming a solid bullish structure, supported by a clear ascending triangle pattern on the daily timeframe. Notably, the 3SMA (7, 25, 99) are crossing to the upside, signaling the early stage of a potential upward trend. This momentum is reinforced by the ascending triangle’s rising trendline, showing steady accumulation and higher lows.

🔺 Bullish Scenario:

Price is consolidating just below the critical resistance at $15.340—a key zone highlighted by multiple rejections in recent months. A confirmed breakout above this level, especially if backed by a surge in volume, would not only trigger a triangle breakout but also complete the weekly candle formation as a bullish hammer, strengthening the bullish case.

If this breakout sustains, short-term targets line up at $20.290, with the long-term roadmap pointing toward $33.970.

📊 Key Highlights:

- 3SMA (7, 25, 99) MA cross signals the beginning of an upward trend.

- Daily ascending triangle points to persistent bullish pressure.

- $15.340 remains a crucial resistance; price has tested and failed here twice before.

- Breakout confirmation (with volume) could ignite a rapid move to $20.290.

- Failure to break may result in another retest of the triangle’s trendline support.

🚨 Conclusion:

All eyes are on the $15.340 resistance. Wait for clear daily close and volume confirmation before entering. A successful breakout aligns with a bullish weekly hammer and could trigger the next phase higher. Beware of fakeouts, as rejection at resistance could send INJUSDT to retest lower trendline zones.

Stay sharp and plan your entries wisely!

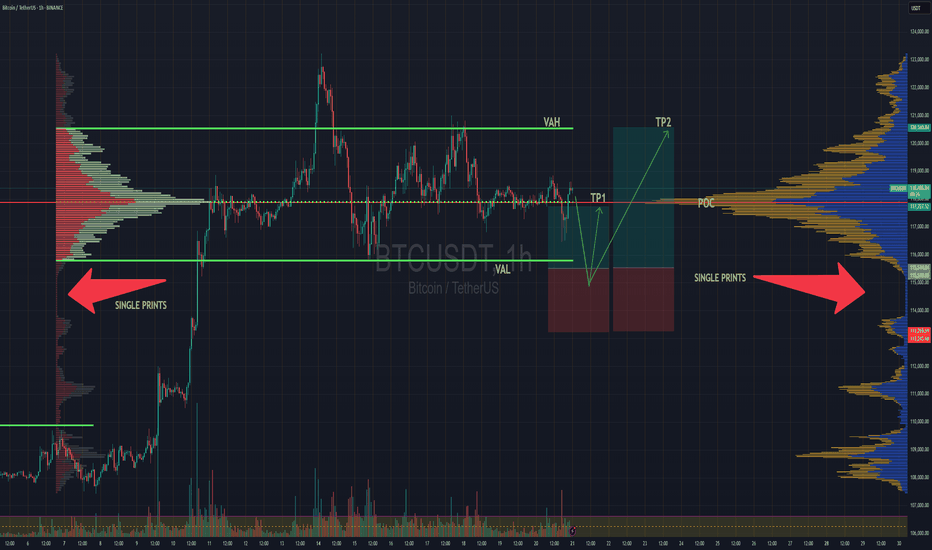

BTC Balanced Volume Profile BTC is now trading in a textbook D-Shape Volume Profile. In english - Buyers & Sellers are happy to transact here and will stay inside the value area & consolidating sideways until further notice.

Consolidation at POC is a signature of this profile, and one of the easiest and least stressful trade setups because now, your mission, should you chose to accept. Is to fade the Highs (VAH) and Lows (VAL) and avoid the middle unless you love donating money to the market.

I'll have buy limit orders waiting right below the VAL where we have the single prints. It doesn't get any easier than this.

Doesn't mean price cant rip through, but this is always the best entry with less risk, especially when the single prints have not been tested yet..

BINANCE:BTCUSD CME:MBT1!

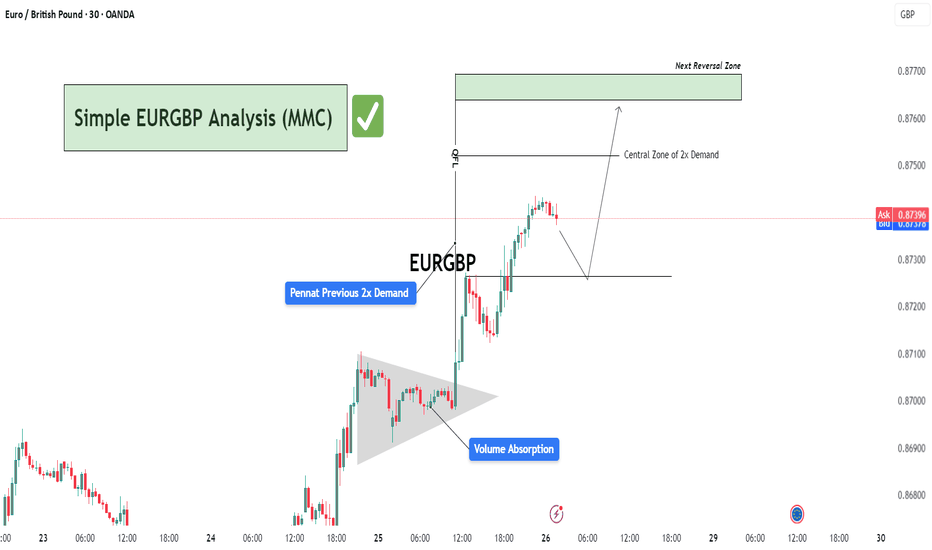

Simple EURGBP Analysis (MMC) – Bullish Continuation or Reversal?🕵️♂️ Chart Overview – 30-Min Timeframe (OANDA)

This EURGBP chart illustrates a classic bullish continuation structure following a volume absorption phase and pennant formation, leading into a vertical price expansion toward a potential reversal zone. The technical flow demonstrates smart money accumulation and re-accumulation before a sharp bullish leg.

🔷 Phase 1: Bullish Accumulation via Pennant Formation

The chart begins with a tight consolidation structure marked as a pennant, typically a continuation pattern.

This area coincides with “Previous 2x Demand”, hinting at a strong institutional buying interest.

The Volume Absorption label suggests that sell-side liquidity was efficiently absorbed—often a precursor to bullish breakouts.

📈 Phase 2: Breakout & Price Expansion

Price breaks out of the pennant aggressively, validating the absorption theory.

The post-breakout rally continues with minimal retracement, showcasing impulsive bullish momentum.

The QFL (Quasimodo Failure Level) is also marked—this serves as a structural footprint left by trapped sellers.

🟩 Next Levels to Watch: Reversal or Re-Entry Zones

As the price approaches the green "Next Reversal Zone" (0.87650–0.87700), watch for potential exhaustion or a reaction.

The Central Zone of 2x Demand (just below 0.87500) could act as a re-entry level for continuation long setups.

Anticipated short-term correction before continuation, as depicted by the projected path.

🧠 Strategic Insight & Trade Planning

Aggressive Bulls: May target breakout pullbacks near the Central Zone of Demand for intraday continuation.

Conservative Traders: Should wait for a clean reaction from the green Reversal Zone. If rejection is confirmed, short opportunities with tight stops become favorable.

Watch the price behavior around 0.87300–0.87500—this will likely dictate whether continuation or correction prevails.

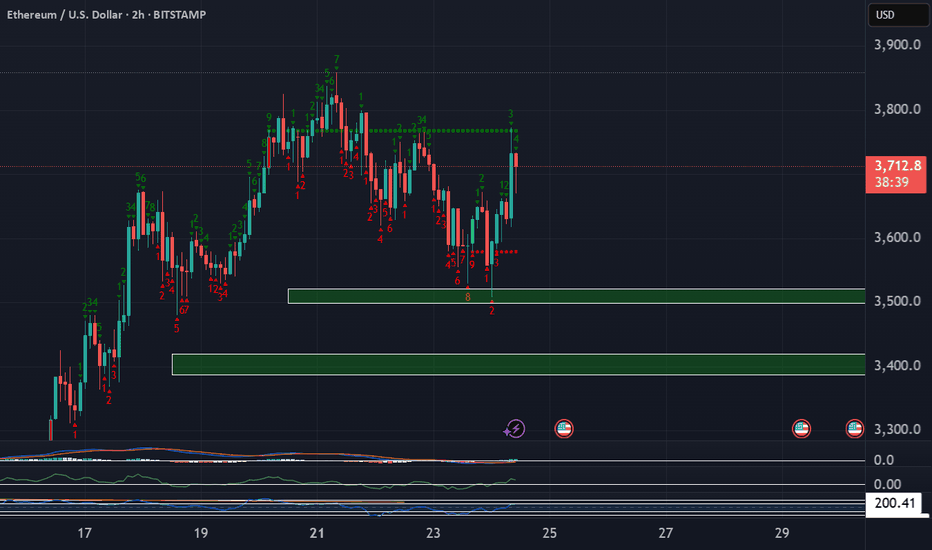

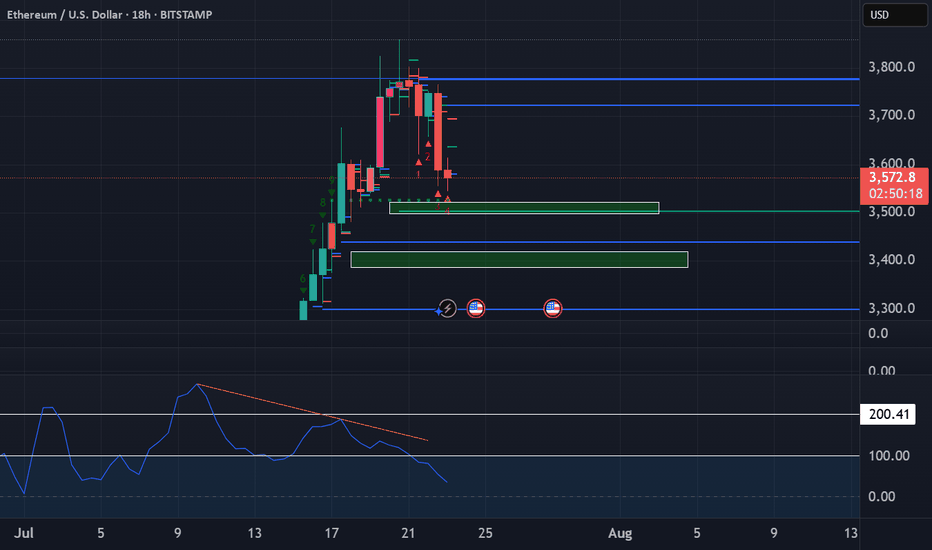

Ethereum Long These zones are significant because they represent areas where large institutions and professional traders are likely to be active, potentially causing strong price movements when those orders are triggered. We want to enter trades that have minimal drawdown to maximize our buying power.

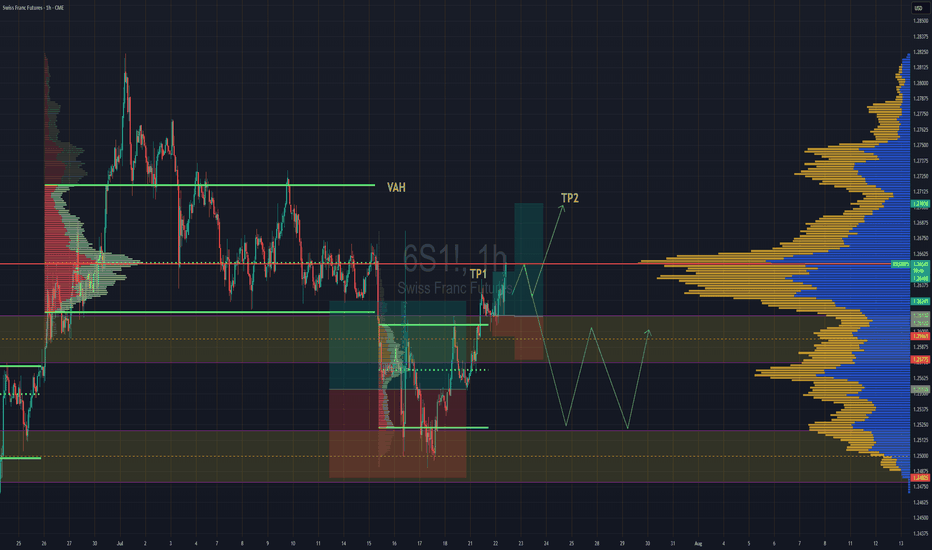

Swiss Gaining Momentum Against The DollarSwiss futures gaining strength against the dollar. We have broken back into previous rotation that was somewhat balanced, but still leaning towards a "b" style volume profile . If we are able to get above the POC, then we''ll go straight for TP2 close to Value are high.

If the POC is really strong and we reject hard from the POC then we might lose the value area and fall back down to previous value area to continue consolidation there until further notice.

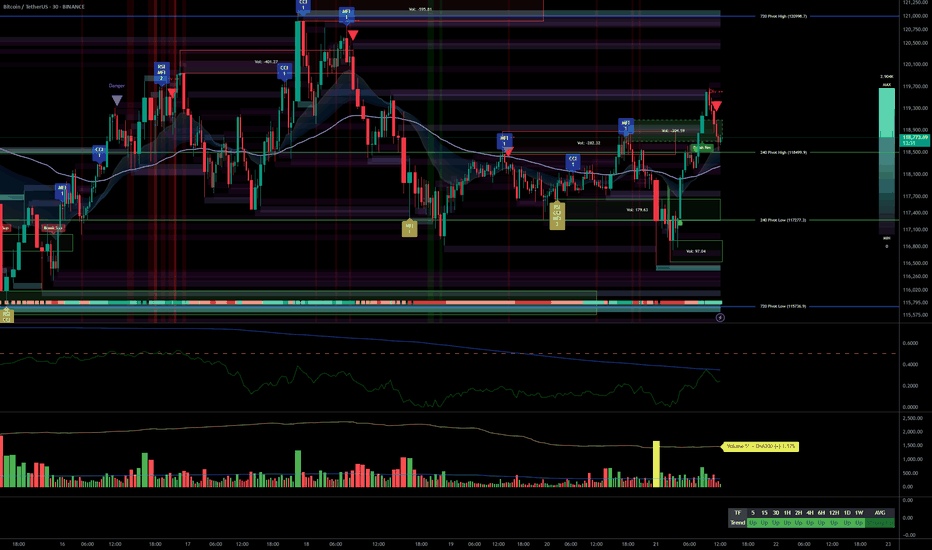

Bullish Multi-Timeframe Alignment, Macro Risks & Key Levels__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong bullish trend across all timeframes.

Major Supports: 115796/117277 (720/240 Pivot Low).

Key Resistances: 119000–123200 (240/D Pivot High), watch for potential extension or profit-taking.

Volume: Healthy participation, no marked anomalies.

Risk On / Risk Off Indicator: Strong sector momentum except 15min (neutral), risk appetite confirmed.

Multi-TF Behavior Synthesis: No "behavioral sell" warning, ISPD DIV neutral, no climax.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global Bias: Clearly bullish, all timeframes aligned, no notable technical divergences.

Opportunities: Buy on pullback (HTF support) or on breakout/consolidation above 123200 with increasing bullish volume.

Risk Zones: Drop below 115796 invalidates scenario; watch for “sell” behavioral signals (ISPD red/extreme volumes) or persistent sector divergence.

Macro Catalysts: Next Fed meeting (July 21st), ongoing geopolitical tensions.

Action Plan: Closely monitor supports/resistances, strict stops below 115796, dynamic adjustment to upcoming macro volatility.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Bullish breakout, leading tech/growth sector, stable volume.

12H: Bullish signal, price held above all key HTF pivots.

6H: Consolidation below key resistance 123218, no distribution, strength intact.

4H: Sideways just below resistance, controlled pause, possible push upwards.

2H: Stalling under resistance yet bullish momentum still present.

1H: Supports defended, rising volume on rebounds, no excess.

30min: Intraday momentum positive; no signs of reversal, strong indicator consensus.

15min: Testing pivots, slight momentum decline, neutral on Risk On / Risk Off Indicator.

__________________________________________________________________________________

Technical confluence: All timeframes aligned upward, strong sector momentum, controlled volumes, no behavioral excess. Watch for resolution near the 119000–123200 resistance zone (potential supply), and monitor for alert signals on behavioral/volume side. Macro: anticipate volatility around July 21 (Fed).

__________________________________________________________________________________

Macro & Decision Synthesis

__________________________________________________________________________________

News / Macro: Upcoming Fed meeting = caution period, expected volatility spike. Geopolitics: Middle East/Europe tensions, no Asian shock.

On-chain: BTC in price discovery, initial STH profit-taking, everyone in latent profit (interim top risk if overheated, reward up to $130k possible).

Actionable checklist:

Optimal entry: Pullback on 115796–117277 or strong breakout above 123200 with confirmed volume

Stop-loss: Below 115796 (major pivot); intraday swings below 117277

Imperative risk management, avoid leveraged trades ahead of macro event

__________________________________________________________________________________

Final Conclusion

__________________________________________________________________________________

Bitcoin is structurally bullish, supported by perfect multi-timeframe alignment, strong sector leadership (Risk On / Risk Off Indicator), and positive on-chain signals. However, proximity to historical resistances and looming volatility call for strict, active risk management. Targets: $123k/$130k; stops below 115796.

GBPUSD. 14.07.2025. The plan for the next few days.The nearest interesting resistance zone was already worked out in the morning and gave a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I think we'll see a correction that can be monetized. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

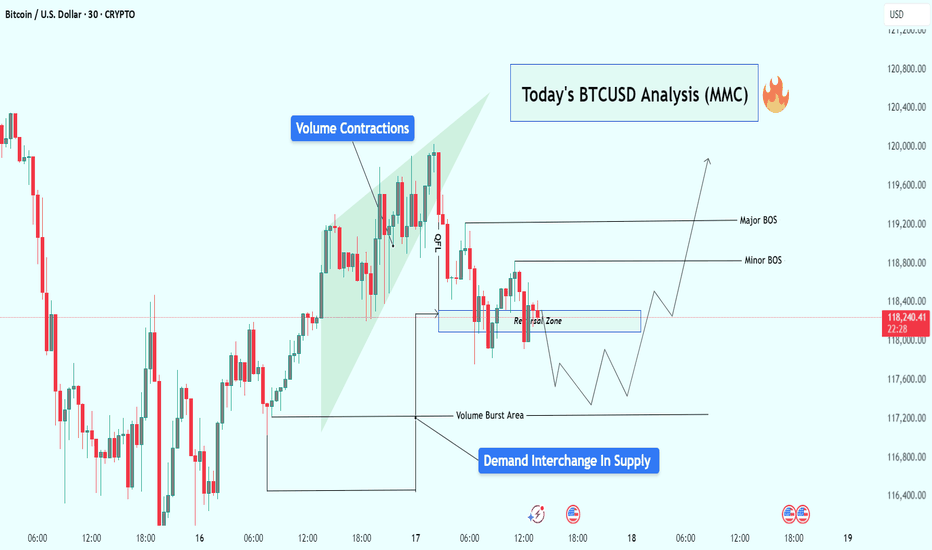

BTCUSD Analysis : Reversal Brewing from Volume Burst Demand Zone🧠 Overview:

Bitcoin is currently showing signs of a potential bullish reversal, following a classic Market Maker Cycle (MMC) pattern. The price action has been clean, respecting both volume dynamics and structural levels, setting the stage for a possible breakout above key areas of interest.

Let’s dive into the detailed breakdown:

🔍 Key Technical Elements:

1️⃣ Volume Contractions – Early Sign of Momentum Shift

At the top left of the chart, we observe a sharp upward move, followed by volume contraction within a rising wedge. This typically represents:

Absorption of orders

Reduced volatility

Market indecision

This kind of structure often precedes a reversal or aggressive breakout, depending on how price behaves near liquidity zones.

2️⃣ Fakeout/Trap Above – Classic MMC Manipulation Phase

After the rising wedge formed, BTC experienced a quick fakeout (stop hunt) just above the highs, then dropped sharply. This was the manipulation leg — a clear signal that liquidity above the wedge was taken and smart money is now repositioning.

🧠 Market makers love to trap breakout traders before moving the opposite way. The drop confirms manipulation is complete.

3️⃣ Reversal Zone + Demand Interchange into Supply

Price then entered a marked reversal zone which was previously an area of demand — now interchanging into supply. This zone is critical because:

It aligns with volume burst zones

It acted as support turned resistance

Multiple rejections confirm order flow shift

This tells us smart money is now testing this area to accumulate or trap sellers.

4️⃣ Volume Burst Area – Institutional Involvement Confirmed

We can clearly identify a Volume Burst Area, where price spiked with strong momentum — this is not retail trading. This zone is now being revisited for a potential bullish re-accumulation.

Expect reaction from this area, as it likely contains unmitigated buy orders from institutions.

5️⃣ Break of Structure (BOS) Mapping:

Minor BOS: Breaks short-term lower highs, showing early intent.

Major BOS: Breaks significant structure, confirming shift in trend direction.

A successful retest of demand and then break of both BOS levels will likely lead to a strong bullish continuation.

📈 Trade Plan & Potential Price Path:

There are two potential bullish entry strategies forming:

✅ Scenario 1: Clean Breakout Plan

Price holds the current reversal zone

Breaks Minor BOS, then Major BOS

Retest of BOS confirms continuation

📍 Target: $119,600+

✅ Scenario 2: Liquidity Sweep Entry

Price dips lower into Volume Burst Area

Sweeps liquidity below and prints a bullish reaction

Enters from discount zone

Same upside targets apply

🧠 This would be a smart money entry — entering from the lowest point of pain for retail traders.

🧵 Final Thoughts:

BTC is setting up beautifully for a reversal continuation pattern within the MMC framework. We’ve seen:

📉 Initial drop (accumulation phase)

🎭 Fake breakout (manipulation phase)

📈 Upcoming expansion (breakout phase)

All signs point to a high-probability move upward, especially if price confirms with BOS + retest. Be patient, wait for price action to align with structure and volume clues.

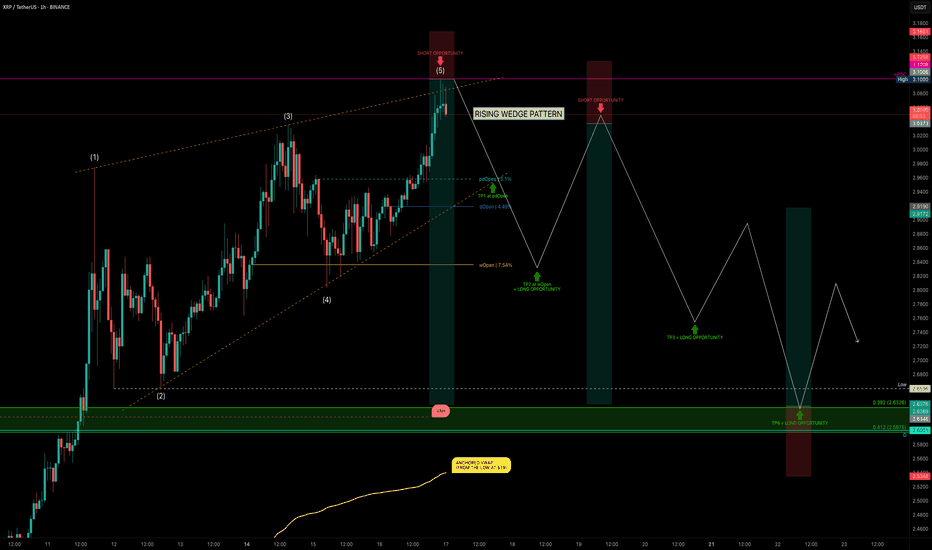

XRP Hits $3.10 — Rising Wedge or Ready to Fly?XRP has been on a strong run over the past 24 days, rallying from $1.90 → $3.10 — a +62% price increase. But after hitting key resistance, is XRP about to correct, or will it break out further? Let’s dive into the technicals.

🧩 Market Structure

Rising Wedge Pattern:

The current market structure resembles a rising wedge, with XRP likely completing wave 5.

Rejection Zone Hit:

Price tapped the nPOC at $3.10 and rejected — providing a clean short opportunity.

📉 Key Support Levels & Confluences

Taking the full 24-day bullish move:

0.382 Fib Retracement: $2.6326 — aligns with liquidity pool below the $2.6596 swing low.

226-day Trading Range VAH: ~$2.62 (red dashed line) — adds confluence.

Daily Level: $2.60 — further support.

Anchored VWAP from $1.90 Low: ~$2.54 (rising over time).

✅ Conclusion: The $2.66–$2.60 zone is a critical support area and offers a solid long opportunity.

Trade Setups

🔴 Short Setup (After Breakdown Confirmation):

Wait for a sell-off & breakdown of the wedge.

Ideal entry: retest of the lower wedge edge, ideal short entry would be between 0.618–0.786 fib retracement.

🟢 Long Setup:

Entry Zone: $2.66–$2.60

SL: below VWAP line

Target: Fib 0.618 as TP

🧠 Educational Insight: Rising Wedges Explained

A rising wedge is a bearish pattern, often signalling weakening momentum as price climbs within narrowing highs and lows.

Key points:

➡️ Volume typically declines as the wedge matures.

➡️ Breakdown below the lower wedge edge often triggers stronger sell-offs.

➡️ Retests of the broken wedge support turn into ideal short entries.

Pro tip: Combine wedge patterns with fib retracement zones and VWAP levels for higher-confidence setups.

Watch for wedge breakdown confirmation before shorting.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.