XAUUSD – Bullish Breakout Confirmed Ahead of GDP🟡 XAUUSD – Bullish Breakout Confirmed Ahead of GDP

(Week 13 – 4H TPO Profile | March 26 Close)

- ✅ **Failed Auction Long** triggered Monday off Previous Week VAL (3014)

- ✅ **IBX Long** now confirmed — T closed above IB High (3033), U above PW-POC (3034)

- ✅ **U-period printed a bullish engulfing candle**, signaling conviction through resistance

- ✅ **Also closed above AMR High (3032)** — confirming expansion conditions

- 📈 **Developing Value Area rising** (3014–3028), POC steady at 3016

- 🧠 Structure is leading → market accepting higher prices

- ⚠️ **GDP release in ~3.5 hrs** — V-period will absorb or extend post-news

- 🎯 Watching for continuation toward **3044–3050** (historical median cluster)

- ❌ Reversal only on sharp rejection and close back below 3032

Conviction + Structure = Signal. The market’s spoken — now we manage it.

Volume

Tesla (TSLA) – Daily Chart AnalysisTechnical Landscape

Immediate Resistance:

Gap / Low Volume Zone: $288.14 – $338.79

0.236 Fibonacci retracement at ~$338.79

Major Resistance Above:

50% Retracement: ~$356.15

0.618 Fibonacci: ~$418.66

Key Support Levels:

$246.45 (recent structural low)

$220.48

$196.51

$180.80

Momentum Indicators

RSI

Currently rising and reclaiming the 50.00 level, a significant threshold.

Momentum profile closely mirrors the November 2024 recovery (highlighted with circle).

Prior surges from similar RSI+ structures led to multi-week uptrends.

Trend

Bullish crossover confirmed with expanding green histogram.

Momentum is accelerating out of a deeply oversold condition—similar to the late 2024 rally initiation.

Signal line separation is clear, suggesting short-term strength remains intact.

On Balance Volume

Just printed its first strong upturn in over two months.

The curve has transitioned from flat to rising, forming a mirror image of the reversal seen in November 2024.

While early, the formation suggests underlying accumulation and rotation back into strength.

Scenarios Based on Current Structure

Scenario 1: Bullish Continuation Through Gap Zone

Trigger: Break and hold above ~$288.14 (gap entry) with increasing volume and confirmation from RSI+ and WaveTrend.

Structure: Price accelerates into low-volume gap region, seeking fill up to ~$338.79.

Target 1: $338.79 (0.236 Fib)

Target 2: $356.15 (50% retracement)

Target 3: $418.66 (0.618 retracement)

Momentum Bias: All three indicators currently favor bullish continuation.

Scenario 2: Short-Term Rejection at Gap Resistance

Trigger: Price rejects within $288–$300 and fails to sustain above the low-volume node.

Price Response: Retests structural support near $246.45 or deeper at $220.48.

Setup: Look for RSI+ to lose the 50 level and WaveTrend to flatten or recross down.

Bias: Short-term corrective move, but still within a broader base-building structure.

Scenario 3: Breakdown Back Into Range

Trigger: A sharp reversal with high-volume rejection from the current rally leg, especially without full gap fill.

Confirmation: Indicators roll over—WaveTrend flips negative, Volume Buoyancy breaks down.

Target: $220.48 initially, then $196.51 and potentially $180.80 if broader market weakens.

Implication: Reclassifies price action as a failed relief rally, resuming prior downtrend.

Summary

Tesla is in the early stages of a potential trend reversal. The alignment of RSI+, WaveTrend 3D, and Volume Buoyancy with prior bottoming conditions suggests further upside is likely if the stock clears the low-volume region starting at ~$288. That said, this is a structurally thin area, and rejection within the gap could send price back to major support zones.

Volume will be key in validating breakout attempts. Should momentum fade and structural levels fail, the broader downtrend may reassert itself.

Robinhood (HOOD) – Daily Chart AnalysisAs of March 25, 2025, Robinhood (NASDAQ: HOOD) is approaching a high-volume resistance level near $48.15–$48.48. Price has been rallying off a March low and is now testing key areas of confluence that could either trigger a breakout continuation or prompt a corrective move.

Technical Overview

Price Structure

Current Resistance Zone: $48.15–$48.48, aligning with the Volume Profile High.

Support Structure: Ascending trendline stretching from August 2024 lows; recent price behavior has respected this line cleanly.

Fibonacci Levels

0.5 retracement at $56.49

0.618 extension above $60

These are potential upside targets if current resistance is cleared on volume.

Momentum and Trend Indicators

RSI

The RSI indicator has turned upward and exited its prior downtrend channel.

The last three times this indicator rebounded from its lower band (circled on chart), price followed with a sustained bullish leg.

Currently printing near 54.68, suggesting renewed momentum without being overbought.

Trend

Recently flipped bullish: the green histogram has turned positive, and the wave has crossed above its signal line.

Previous flips from similar structure (highlighted by white dots and wave crossovers) have marked strong trend beginnings.

The clean separation between the wave and signal line is a confirmation of strength.

Volume

The most important tell: the recent reversal mirrors August and September 2024 setups nearly identically.

The March 10, 2025, bottom was accompanied by a smooth upward curve and bullish divergence.

The projected yellow path (shown on the chart) suggests volume support is building under price, signaling sustainable upside.

Scenario-Based Outlook

Scenario 1: Bullish Breakout

Price breaks above $48.48 with volume.

Indicators confirm momentum across all three custom tools.

Target: $56.49 (0.5 Fib), then $60.00–$62.00 (0.618 Fib + psychological level).

Scenario 2: Rejection & Pullback

Price stalls at Volume Profile High.

Pullback into trendline or full retracement toward Buy Zone ($37–$36).

Watch for renewed confluence from RSI+, WaveTrend 3D, and Volume Buoyancy for long re-entry.

Summary

Robinhood is at a critical juncture. Momentum across the RSI+, WaveTrend 3D, and Volume Buoyancy is aligned to support continuation—but the price must clear the Volume Profile High to confirm. If rejected, the trendline and deeper demand zone provide defined levels to reassess. Indicators suggest the recent bottom was a structural low with strength building beneath the surface.

This setup offers a favorable risk-reward profile in both breakout and pullback scenarios, provided the indicators continue to support momentum and volume follows through.

What will happen first? BTC to 67k or to 100K?Hey traders! Long time no see.

Looks like Trump and his team won’t be responsible for keeping the market healthy anymore—or maybe they just don’t care right now...

So let’s check some technicals and try to figure out what to expect next.

Not gonna lie, the picture isn’t looking too bright 🥹

Even though we’re moving up a bit, this price action feels more like a bearish flag—meaning we could be setting up for further downside (nervous laugh). Plus, that golden cross on the weekly chart isn’t giving bullish vibes, and volume is confirming our fears.

So… if this plays out, does that mean no bull season for now?

What do you think, guys? Any promising news out there?

GOLD TOP IS NEARGold appears to be distributing on all timeframes excepting daily , this added to the extensive media coverage recently makes me think that a significant all time top is near , gold still maintains support on all timeframes but that is probably the only thing holding it from a big crash.

KAVAUSD – Midpoint Retest with a Shot at a Daily Higher LowCOINBASE:KAVAUSD / COINBASE:KAVAUSDC

Watching KAVA here on the daily, and it’s at a key decision point that could define the next leg. We’ve got two sets of Fibonacci retracements drawn: the first from the March 2024 high to the August 2024 low, and the second from the August low to the December high. Right now, price is retesting the 50% level of the larger March–August move—aka the midpoint of the macro range—and it's still holding above the 50% retracement of the more recent August–December leg. We’re also sitting right on the 38.2% Fib of that second move, which tends to act as a key area for potential higher lows.

The idea here is simple: I’m playing for a daily higher low. We had a strong move off the December lows, followed by a healthy consolidation, and this is where bulls need to step in. Structure-wise, this is the ideal area for bulls to attempt a defense if the trend is going to continue. EMAs are curling up, and price is still holding above the 12 and 26 EMAs for now, which gives me confidence in a potential bounce.

If the Trade Goes as Planned (Bullish Case)

If buyers step in here and confirm a higher low—ideally somewhere between $0.48 and $0.50—we’d expect a continuation toward the recent high at $0.56. If that level breaks, then $0.64 becomes the next area of interest based on prior price structure and confluence with the upper Fib retracement levels. From there, we could even make a push toward the $0.74 area, where the last major rejection happened in late 2024.

A strong bounce here also sets up a potential inverse head and shoulders structure on the daily if we revisit that neckline around $0.56 again with momentum. In short, a higher low here gives the bulls the setup they need to retake trend control.

If the Trade Fails (Bearish Case)

If price fails to hold the $0.48–$0.50 region and breaks below the August–December 50% Fib level, then we’re likely heading back to the $0.44 zone. That’s where the 200-day SMA is sitting, and it’s also a major pivot from previous support. A loss of that zone opens the door to a full retrace toward $0.39 or even $0.37—last seen during the November-December basing structure.

In that case, the trend would flip neutral at best and would require a fresh base-building phase before bulls could even think about regaining momentum.

TL;DR

Thesis: Playing for a daily higher low above key Fib levels and EMAs.

Bullish Target: Reclaim $0.56 → push toward $0.64–$0.74 if momentum follows through.

Bearish Invalidator: Break below $0.48 = likely revisit of $0.44 or lower.

Not financial advice. Just sharing my thinking as I try to stack confluence and play the levels. Let’s see if this bounce gets legs.

IP – Coiled Triangle with a $10 STORY to Tell?COINBASE:IPUSD / COINBASE:IPUSDC

We’ve got a clean symmetrical triangle forming post-initial listing volatility, and price is nearing the apex. Volume’s dropping off, just like you'd expect in the final stages of compression—classic pre-breakout behavior.

What caught my eye here is how this triangle lines up with a Fibonacci extension target up near $10. Yeah, sounds bold, but zoom out on a log chart and it actually looks pretty reasonable. The measured move from the initial impulse, paired with the triangle breakout structure, gives a clear path to that 1.618 extension level. Throw in the fact that the volume profile starts thinning out above $6, and there’s potential for a swift move if it catches a bid.

Triangle Compression and Breakout Setup

We’re in the late innings of this triangle consolidation. Lower highs, higher lows, volume fading—textbook stuff. If price can get through the $6 zone with conviction, the structure says we could see an aggressive breakout. If not, we’re probably looking at one more fakeout or shakeout before direction resolves.

Fibonacci Extension and Log Chart Math

Using Fib extensions on a log scale paints a pretty compelling picture. $10 sits right at the 161.8% extension off the initial run, and log charts smooth out the scale enough to show how that level isn’t just hopium—it’s structured speculation. The triangle adds context: this isn’t about chasing highs, it’s about waiting for the breakout confirmation from a pattern that’s been compressing for weeks.

Volume Profile and Context

VPVR shows strong acceptance around $5 and fading resistance above. If bulls can flip that region into support, the path to higher prices opens up fast. A breakout from this triangle above $6.25 or so, ideally on volume, could be the signal that this thing is ready to move.

Curious if anyone else is watching this chart. We’ve got a clear triangle, confluence with Fib levels, and log-scale structure supporting a much higher target. Could be a breakout worth watching—or just another consolidation that needs more time to cook.

Not financial advice. Just tracking setups, patterns, and potential. Let’s see if the STORY plays out.

USD/CAD - Day Trading Analysis With Volume ProfileOn USD/CAD , it's nice to see a strong sell-off from the price of 1.43820. It's also encouraging to observe a strong volume area where a lot of contracts are accumulated.

I believe that sellers from this area will defend their short positions. When the price returns to this area, strong sellers will push the market down again.

Strong rejection of higher prices and Volume cluster are the main reasons for my decision to go short on this trade.

Happy trading,

Dale

USD/JPY - Strong rejection of lower pricesOn USD/JPY , it's nice to see a strong buying reaction at the price of 148.890.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

Strong rejection of lower prices and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

ANTM Elliott Wave CountQ4 2024 is set to be very shiny for ANTM. Gold sales for Q4 only equals to 15 tons, meanwhile the first 9 months of 2024 amounts to only 28 tons. Additionally, nickel sales also jumped in the fourth quarter.

Chart-wise, ANTM just finished its fourth wave yesterday, quite a steep drop. Volume during was really good from the first until the third wave, and it dried up on this current fourth wave.

The target for ANTM is about 1750-1765.

ES - continue with the UptrendOn ES , it's nice to see a strong buying reaction at the price of 5722.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

(FVG) - Fair Value GAP and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

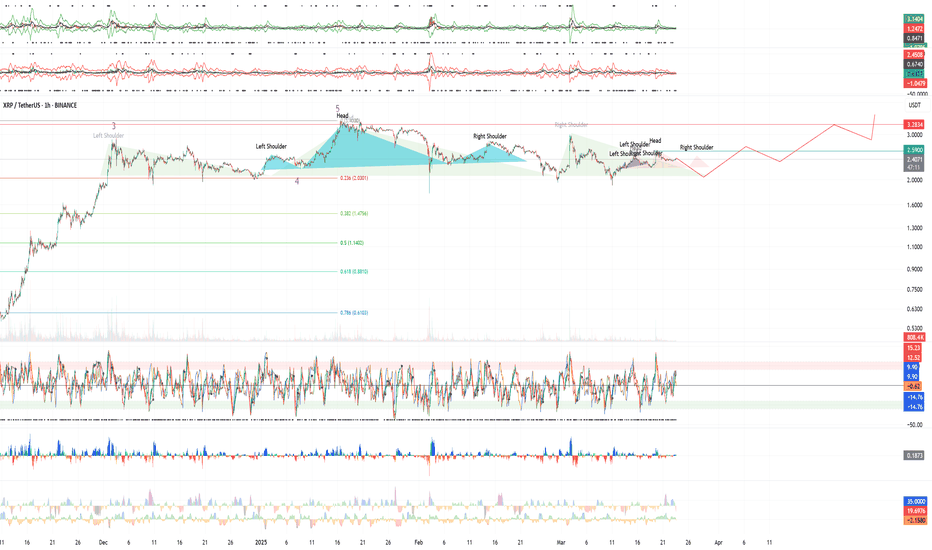

XRPUSDT Consolidating at ATHi see the consolidation as very young and it may need both : time and volume to gather serious weight in order to register new all time highs . I see a rare fractalized repetition of H&S patters on the lower timeframes which is up to end a toping pattern in the following days thus granting short term opportunities for shorting with significant R/R ratios

Insmed (INSM) - Breakout Opportunity 📌 Insmed ( NASDAQ:INSM ) – Breakout Opportunity

Insmed is a clinical-stage biopharmaceutical company focused on serious and rare lung diseases. The stock more than doubled in May 2024 following positive Phase 3 results for its drug Brensocatib. The FDA has granted Priority Review, with a PDUFA date set for August 12, 2025 — and commercial launch expected in H2 2025.

Technical Overview:

Since the massive gap up in May 2024, INSM has been trading inside a well-defined horizontal channel between:

🔻 Support: $61.65

🔺 Resistance: $84.82

Currently, price is near the upper third of the range (~$79.92), showing signs of renewed momentum with rising volume and RSI trending higher.

Plan

----

📍 Entry: Daily close above $85 with strong volume ( >2.5M )

Targets

🎯 Target 1: $94 (+11%)

🎯 Target 2: $106 (+25%)

🛑 Stop: $82 (-4.7%)

Risk ratio:

🟠 Target 1: > 2:1

🟢 Target 2: > 5:1

---

📊 Key Indicators to Watch:

✅ RSI > 60 with upward slope

✅ MACD bullish crossover

✅ Break above 20-day EMA with volume

✅ Volume expansion on green candles

⚠️ This content is for informational and educational purposes only and does not constitute investment advice ⚠️

Altcoins Targeting the $300B Mid-RangeHey everyone! Let’s dive into the current state of the altcoin market with this 12H chart of the Crypto Total Market Cap Excluding Top 10 ( CRYPTOCAP:OTHERS ). Here’s what I’m seeing:

🔹 Altcoins Halting the Free Fall: The altcoin market has finally stopped its free fall. We’re seeing a bullish divergence forming on higher timeframes, and while Bitcoin dominance continues its upward trend, it’s likely at or very close to a local top. Of course, a black swan event could change everything, but from a technical perspective, I don’t see this as the start of a bear market—just a correction and another phase of accumulation.

🔹 OBV Signaling Accumulation: Interestingly, the On-Balance Volume (OBV) for CRYPTOCAP:OTHERS has been indicating accumulation despite the decline over the past two months. Even more telling, the OBV on the 12H timeframe has just hit a new higher high, which is a strong bullish signal.

🔹 What’s Next?: Right now, CRYPTOCAP:OTHERS is attempting to break above a diagonal resistance that has been in place since January 25th. If this breakout is successful, I’d feel confident placing my buy orders. I wouldn’t wait for further downside—more likely, we’ll spend a few months in a range. Within this range, the $300B level is particularly interesting because it’s roughly the midpoint of the range, where the price will likely be drawn to at least sweep liquidity. The horizontal volume profile supports this view: the $300B level falls within a Low Volume Node (LVN) zone, indicating a volume gap. This gives the price an additional reason to push toward this level to reclaim it in the near term.

🔹 Potential Scenarios: If we break above the diagonal resistance and reach $300B but then reverse lower, I’ll close my short-term buys and wait for a return to the lower end of the range. In that case, we might be in for a longer consolidation period, potentially following a Wyckoff accumulation schematic. On the other hand, a successful breakout could set the stage for a more sustained move higher toward the Point of Control (POC) level.

Wishing everyone good luck and profitable trades! 🍀📈

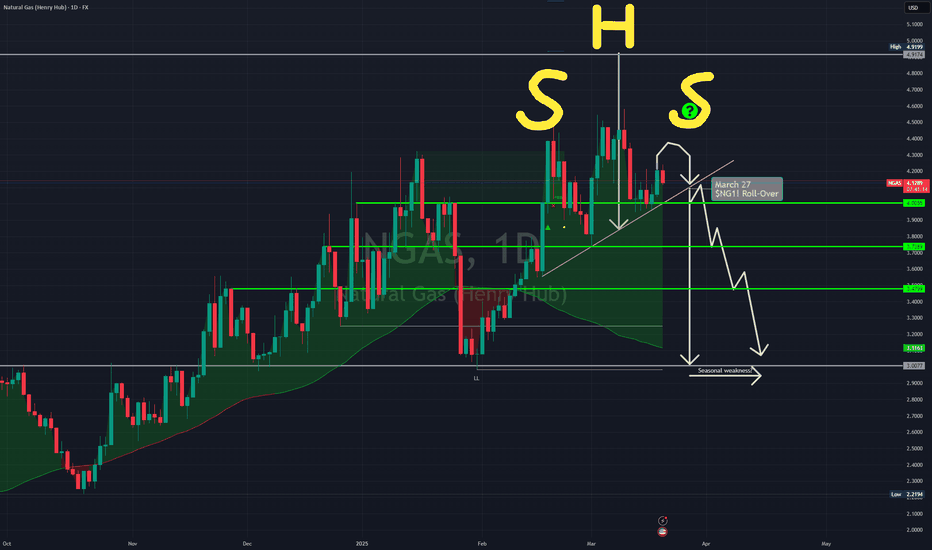

My Daily $NGAS / $NG1! Idea Because of Absent Seasonal WeaknessSeasonal weakness in FX:NGAS / NYMEX:NG1! is absent so far but it could come into play if war-related concerns are fading with Putin and Ukraine set under "friendly pressure" to end this war.

Still, the gap between ending heating period and beginning demand for cooling is big enough to see a seasonal weakness period, imo.

It's just an idea. As always, do your own research. You are solely responsible for your trades.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations

Copper Nears Possible Resistance ZoneCopper faces a potential resistance zone between 5.18 and 5.30, where seven Fibonacci extension targets align with the May 2024 peak. If this level holds, a retracement to 4.984–4.75 is possible. This area is supported by a three-point Fibonacci symmetry and the 34 EMA wave.

Bearish Scenario If FOMC News Favors BearsFOMC interest rate news is due in less than 2hours .

I Stayed out of the market waiting since last Thursday just to wait for FOMC news because the market will almost always goes into consolidation days before this news due to its significant impact. So its usually a good idea to avoid getting chopped in the sideways action unless you like donating money to the market instead of waiting for a new trend to emerge or a continuation of the on-going trend.

After todays fomc news, we will know if we will resume dumping everything, or we'll evaluate potential short term bullish scenarios. For now, my recent BTC short analysis is still intact. I already took profit on all 8 short positions i was in on various coins i shorted along side BTC. If the FOMC news favors the bears, i'll be looking to re-enter shorts in the range 86.4k to 91k.