Volume

BTCUSDT: key pointsI think the price is going to go from here to $82000 and then to $85000. There's liquidity at the $85,000 level, so I expect it to take the liquidity there and try the $82,500s again. But if it doesn't return from $85,000 and breaks directly, it may work as in option 2. this isn't investment advice.

US is going to lose this to ChinaWhilst Trump is playing his full on MAPA (Make America Poor Again) game, there is one candidate who will benefit from the new world order.

US won't be a reliable partner for anyone as long as Trump is talking and pulling the strings, whilst China is in a very good place to simply re-route exports to other nations and avoid the US craziness.

I reckon that this chart will break to the upside, although to trade it we should wait for the breakout confirmation. Once that happens, we can go long in there and let the US cripple on their own with nice tariff phantasies.

S&P 500 to tank to 5,100 pointsPEPPERSTONE:US500

The S&P 500 broke below critical support after Trump announce massive tariffs on everyone, worst than expected. Volume is increasing to the downside, and it looks like the next wave down has already started.

Wave C is supposed to be equal or larger than wave A, and reach the next critical support, which will lead us to 5,100 points in the next couple of weeks.

I heard that net tariffs on China are 54%, does than means that iPhones are going to rise in price 54%?

Maybe it will be reconsidered later, and the market will bounce in the future, but not likely in the short term.

Good luck to you

$540 incoming put trade expiring 4/4 or 4/11

AMEX:SPY

I start these Anchored VWAPs where the volume was the lowest before a major upside or downside.

When I entered this trade $540 expiring 4/4 was at $.5 on 3/27 on Thursday around 9.55am currently $2.06 closing week, however I want to highlight that the $540-$530 would be the major leg down and we might see the $570-$580 levels for first week of June imo.

Note: I am heavily comparing price actions for nowadays with 2022 first half drawdown.

TSMC (TSM) - Chart AnalysisAs of April 3, 2025, TSM has broken down through key support zones following a sharp -5.19% move on elevated volume (47.57M), closing at $157.50. This move marks the deepest downside follow-through since the broader topping pattern began in Q1 2025 and puts TSM at a critical confluence of Fibonacci levels and prior support.

Key Technical Landscape

Current Price: $157.50

Recent Breakdown: Below $163.17 and $157.38 (mid-range support)

I

mmediate Support:

$153.95 (prior structure)

$141.52 – $135.33 (First Buy Zone) aligned with the 0.618 Fibonacci retracement

Secondary Support:

$127.24 – $118.03 (Second Buy Zone) and trendline intersection

Anchored VWAP from Oct 22 lies just above the second buy zone

Long-Term Support: $109.05, $98.92, $90.02, $85.33 (1.618 extension)

Levels & Momentum

Price has decisively broken below the EMA cloud, indicating loss of short- and medium-term trend structure.

EMA ribbon has turned downward, confirming momentum shift.

Fibonacci Levels:

0.618 retracement aligns directly with the $141.52–$135.33 zone — a high-probability area for a bullish response. 0.786 zone and 1.0 retracement converge with anchored VWAP and diagonal trendline support around $127–$118, forming a broader accumulation range.

Trendline Structure:

Major uptrend from late 2023 remains intact — current pullback has not violated the primary ascending channel.Breakdown below the anchored VWAP and 1.0 level would shift the long-term outlook bearish.

Scenario Outlooks

Scenario 1: Short-Term Relief Rally

Trigger: Support holds at/near $153.95 or $150 psychological level.

Move: Bounce toward $163.17–$167.54 resistance range.

Risk: Rejection from EMA Cloud or trendline underside could cap the move.

Scenario 2: Deeper Pullback into First Buy Zone

Trigger: Continued breakdown through $153.95.

Target Zone: $141.52–$135.33 (0.618 Fib + local structure)

Setup: This is the first major accumulation zone for buyers; watch for higher volume reaction and bullish candle structure.

Reclaim Path: If support is confirmed, path back toward $163.17 and possibly $175.14 is viable.

Scenario 3: Full Retest of Long-Term Support (Second Buy Zone)

Trigger: Breakdown through $135.33

Target: $127.24–$118.03 (anchored VWAP + long-term trendline confluence)

Implication: Deep retracement into prior consolidation zone from mid-2023; high conviction

long-term level

Failure Below: Would expose $109.05 and potentially as low as $85.33 (1.618 Fib extension), shifting broader structure to bearish.

Summary

TSM has entered a key retracement phase after a sustained trend and breakout failure. The breakdown below $157.38 shifts short-term structure bearish, but two strong buy zones exist below — first at the 0.618 retracement ($141–$135), and second at the intersection of historical demand and anchored VWAP ($127–$118).

Current price action favors caution on the long side until either a reclaim of $163 or a clean, high-volume reaction within one of the two buy zones. This remains a structurally intact long-term uptrend unless $118 is violated with momentum.

Bitcoin Analysis: Trump Tariffs AnnouncementAs of April 2nd, 2025, Bitcoin finds itself at a pivotal technical crossroads, with price action consolidating within a well-defined range as markets prepare for Trump's upcoming tariff policy speech. The cryptocurrency has experienced significant volatility in recent weeks, with a sharp decline from the $98,000 level followed by a consolidation phase.

Technical Structure and Price Action

The daily chart reveals Bitcoin trading in a rectangular consolidation pattern between approximately $79,800 and $88,800. This range-bound price action follows a substantial corrective move from recent highs, with the market now seeking direction. Current price hovers around $84,890, sitting below the mid-point of this established range.

The blue box on the chart highlights this recent consolidation zone, where price has been oscillating for several trading sessions. This pattern typically represents a pause in the market as buyers and sellers reach temporary equilibrium before the next directional move.

Volume Analysis Provides Crucial Insights

Looking at the Relative Volume Indicator (RVOL) at the bottom of the chart, we can observe several noteworthy volume patterns:

-Several green bars exceeding the 2.0x threshold indicate periods of significantly above-average volume during the decline and subsequent consolidation

-More recent trading sessions show predominantly yellow and red bars, suggesting a return to average and below-average volume as the market consolidates

-The most recent green volume spike coincides with a bullish candle, potentially indicating renewed buying interest

This volume profile suggests that while the initial selloff occurred on strong volume (confirming the downtrend's validity), the recent consolidation is happening on decreasing volume – often a precursor to a significant move.

Critical Levels to Watch

With Trump's tariff announcement looming, traders should monitor these key levels:

Support: $79,800 (lower range boundary)

Intermediate resistance: $88,800 (higher range high)

Intermediate support: $82,000 (recent swing low)

What Could Happen Next?

The cryptocurrency market's reaction will likely hinge on the tone and specifics of Trump's tariff policies:

Bullish Scenario

If Trump's tariff policies are perceived as positive for risk assets or specifically favorable for cryptocurrency:

A break above $90,000 could trigger a relief rally toward previous highs

The declining volume during consolidation could represent a coiling effect before an explosive move higher

Target zones would be $95,000 and potentially a retest of the $98,000 area

Bearish Scenario

If the announcement creates market uncertainty or suggests policies that might negatively impact risk assets:

A breakdown below $79,800 would confirm continuation of the larger downtrend

Volume would likely expand on a breakdown, providing confirmation

The next major support zones would become $75,000 and $70,000

Conclusion

Bitcoin stands at a technical inflection point, with the upcoming tariff announcement serving as a potential catalyst for its next major move. The consolidation pattern, coupled with the volume profile shown in the RVOL indicator, suggests traders should prepare for increased volatility.

Given the mixed signals – bearish price structure but consolidation with occasional above-average volume spikes – a measured approach is prudent. Traders would be wise to wait for a definitive break of either range boundary with confirming volume before establishing significant positions.

The next 24-48 hours could determine whether Bitcoin resumes its longer-term uptrend or continues the correction that began from the $98,000 level.

JPMorgan at a Crossroads Bullish Surge or Bearish Retreat ? Hello, fellow traders!

Today, I’m diving into a detailed technical analysis of JPMorgan Chase & Co. (JPM) on the 2-hour chart, as shown in the screenshot. My goal is to break down the key elements of this chart in a professional yet accessible way, so whether you’re a seasoned trader or just starting out, you can follow along and understand the potential opportunities and risks in this setup. Let’s get started!

Price Action Overview

At the time of this analysis, JPM is trading at 243.62, down -1.64 (-0.67%) on the 2-hour timeframe. The chart spans from late March to early May, giving us a good look at the recent price behavior. The price has been in a strong uptrend, as evidenced by the higher highs and higher lows, but we’re now seeing signs of a potential pullback or consolidation.

The chart shows a breakout above a key resistance zone around the 234.50 level (highlighted in red on the Volume Profile), followed by a retest of this level as support. This is a classic bullish pattern: a breakout, a retest, and then a continuation higher. However, the recent price action suggests some hesitation, with a small bearish candle forming at the current price of 243.62. Let’s dig deeper into the tools and indicators to understand what’s happening.

Volume Profile Analysis

The Volume Profile on the right side of the chart is a powerful tool for identifying key price levels where significant trading activity has occurred. Here’s what it’s telling us:

Value Area High (VAH): 266.25

Point of Control (POC): 243.01

Value Area Low (VAL): 236.57

Profile Low: 224.25

The Point of Control (POC) at 243.01 is the price level with the highest traded volume in this range, acting as a magnet for price. Since the current price (243.62) is just above the POC, this level is likely providing some support. However, the fact that we’re so close to the POC suggests that the market is at a decision point—either we’ll see a bounce from this high-volume node, or a break below could lead to a deeper pullback toward the Value Area Low (VAL) at 236.57.

The Total Volume in VP Range is 62.798M shares, with an Average Volume per Bar of 174.44K. This indicates decent liquidity, but the Volume MA (21) at 165.709K is slightly below the average, suggesting that the recent price action hasn’t been accompanied by a significant spike in volume. This could mean that the current move lacks strong conviction, and we might see a consolidation phase before the next big move.

Trendlines and Key Levels

I’ve drawn two trendlines on the chart to highlight the structure of the price action:

Ascending Triangle Pattern: The chart shows an ascending triangle formation, with a flat resistance line around the 234.50 level (which was later broken) and an upward-sloping support trendline connecting the higher lows. Ascending triangles are typically bullish patterns, and the breakout above 234.50 confirmed this bias. After the breakout, the price retested the 234.50 level as support and continued higher, reaching a high of around 248.02.

Current Support Trendline: The upward-sloping trendline (drawn in white) is still intact, with the most recent low around 241.50 finding support on this line. This trendline is critical—if the price breaks below it, we could see a deeper correction toward the VAL at 236.57 or even the 234.50 support zone.

Key Price Levels to Watch

Based on the Volume Profile and price action, here are the key levels I’m watching:

Immediate Support: 243.01 (POC) and 241.50 (recent low on the trendline). A break below 241.50 could signal a short-term bearish move.

Next Support: 236.57 (VAL) and 234.50 (previous resistance turned support).

Resistance: 248.02 (recent high). A break above this level could target the Value Area High at 266.25, though that’s a longer-term target.

Deeper Support: If the price breaks below 234.50, the next significant level is 224.25 (Profile Low), which would indicate a major trend reversal.

Market Context and Timeframe

The chart covers 360 bars of data, starting from late March. This gives us a good sample size to analyze the trend. The 2-hour timeframe is ideal for swing traders or those looking to capture moves over a few days to a week. The broader trend remains bullish, but the recent price action suggests we might be entering a consolidation or pullback phase before the next leg higher.

Trading Strategy and Scenarios

Based on this analysis, here are the potential scenarios and how I’d approach trading JPM:

Bullish Scenario: If the price holds above the POC at 243.01 and the trendline support at 241.50, I’d look for a bounce toward the recent high of 248.02. A break above 248.02 could signal a continuation toward 266.25 (VAH). Entry could be on a strong bullish candle closing above 243.62, with a stop-loss below 241.50 to manage risk.

Bearish Scenario: If the price breaks below 241.50 and the POC at 243.01, I’d expect a pullback toward the VAL at 236.57 or the 234.50 support zone. A short position could be considered on a confirmed break below 241.50, with a stop-loss above 243.62 and a target at 236.57.

Consolidation Scenario: Given the lack of strong volume and the proximity to the POC, we might see the price consolidate between 241.50 and 248.02 for a while. In this case, I’d wait for a breakout or breakdown with strong volume to confirm the next move.

Risk Management

As always, risk management is key. The 2-hour timeframe can be volatile, so I recommend using a risk-reward ratio of at least 1:2. For example, if you’re going long at 243.62 with a stop-loss at 241.50 (a risk of 2.12 points), your target should be at least 248.02 (a reward of 4.40 points), giving you a 1:2 risk-reward ratio. Adjust your position size to risk no more than 1-2% of your account on this trade.

Final Thoughts

JPMorgan Chase & Co. (JPM) is showing a strong bullish trend on the 2-hour chart, with a confirmed breakout above the 234.50 resistance and a retest of this level as support. However, the recent price action near the POC at 243.01 and the lack of strong volume suggest that we might see a pullback or consolidation before the next move higher. The key levels to watch are 241.50 (trendline support), 243.01 (POC), and 248.02 (recent high).

For now, I’m leaning slightly bullish as long as the price holds above 241.50, but I’ll be ready to adjust my bias if we see a break below this level. Stay disciplined, manage your risk, and let the market show its hand before taking a position.

What are your thoughts on this setup? Let me know in the comments below, and happy trading!

This analysis is for educational purposes only and not financial advice. Always do your own research before making any trading decisions.

INTRADAY MOVEMENT EXPECTEDi can see still there is liquidity above at the poc of the weekly volume

but if the price can cross up the level it can visit the next resistance above

so if the price at london session cross down the value area i will expect visit the levels shown on the chart as support and make the rejection

so we have to follow the plan and and use the levels on the chart risk management safe the profit secure the orders after the price move stop at break even

we wish happy trade for all

IAG Airlines Group what next? $261 Reached & Breached! $172?🤔 IAG Airlines Group what next?

ℹ️ $261 Reached & Breached!

Will the $261 be regained and start to offer some support or is $172 NEXT?❓️❔️❓️

🌍 To be completely transparent I have no horse in this race at the moment BUT I really would like a serious flush to try and accumulate a long-term POSITION.

🟢SeekingPips🟢 is not interested at current price at all unless we start to see some SERIOUS VOLUME START TO COME IN TO PLAY

ETH is leaving exchanges , is a "supply shock" approaching ?Hello Traders 🐺

Today I’ve got some good news for ETH, and I also spotted a bullish pattern forming. Plus, I’ll talk about the short-term price targets, so stick with me until the very end—and don’t forget to like for more support! 👍🔥

Alright, let’s get into it:

According to Glassnode and Santiment, only 14% of the total ETH supply is left on centralized exchanges. That’s the lowest level in nearly 10 years — but what does it mean?

Usually, this type of data hints at major volatility incoming. And guess what? The big players are the ones playing this game. Let me explain:

They keep the price artificially low, slowly exhausting retail traders and shaking them out. Meanwhile, they accumulate quietly. Once their bags are full, they remove the sell pressure, and suddenly…

🚨 Supply shock.

People start panic buying, and with so little ETH available on exchanges, the price skyrockets.

Also, ETH transaction fees have dropped to their lowest levels since mid-2020, which I see as another bullish sign for Ethereum. Now let’s look at the chart:

We have a clear falling wedge pattern on the daily timeframe, along with a potential double bottom forming.

If the price breaks above the neckline of this “W” formation—which also aligns with a strong daily resistance—I expect a strong reversal for ETH. 📈🚀

Make sure to act accordingly, and as always:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

USD/CAD rejection of lower pricesOn USD/CAD , it's nice to see a strong buying reaction at the price of 1.42520.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

Rejection of lower prices and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

EUR/USD continue with the UptrendOn EUR/USD , it's nice to see a strong buying reaction at the price of 1.07740.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

(FVG) - Fair Value GAP and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

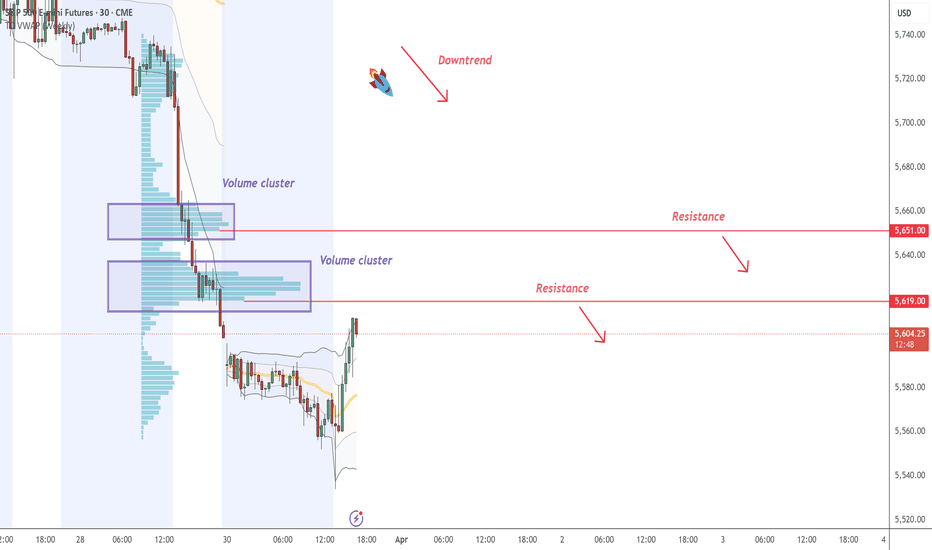

ES - Day Trading Analysis With Volume ProfileOn ES , it's nice to see a strong sell-off from the price of 5619 and 5651. It's also encouraging to observe a strong volume area where a lot of contracts are accumulated.

I believe that sellers from this area will defend their short positions. When the price returns to this area, strong sellers will push the market down again.

Downtrend and Volume cluster are the main reasons for my decision to go short on this trade.

Happy trading,

Dale

XRPUSDT.P — Is This the Beginning of the Next Pump?

BINANCE:XRPUSDT.P is bouncing back with style — and this long setup is giving off real “king of the charts” vibes. Look at that clean risk-to-reward!

Entry: 2.0905 USDT

Stop-loss: 2.0574 USDT

Take-Profit: 2.2238 USDT

R:R Ratio: 3.28

Why this setup matters:

Confirmed bounce off intraday support

Momentum shift with bullish engulfing candle

Targeting a clean resistance level for optimal exit

Tight stop, juicy upside — exactly what scalpers and day traders crave. Add to watchlist and get ready to trail that stop if momentum holds.