SPY 200 Point Close (8%)|200 Weekly MA|RSI approaching oversoldEvening Traders!

Today’s analysis will be on SPY, a 200 point close on the weekly time frame, saving SPY from having one of the worst weeks in history as it respects the longer term trend line.

Technical points to consider,

- Price above key technical 200 Week MA

- Long term trend line respected

- Structural resistance as probable lower high region

- Stochastics projected down

- RSI approaching oversold

- Noticeable bear volume nodes

SPY is currently sitting above the 200 Week Moving Average, a level that must hold as a weekly candle close will increase the probability of taking out lows. Price respected the longer term trend line with a precise wick leading to a 200 point close.

Structural resistance is a key level to break, if bull volume does not follow through with the bounce, SPY is likely to put in a lower high.

The Stochastics is currently projected down with stored momentum, it can stay trading in the lower regions for an extended period of time.

RSI is approaching oversold conditions; historically SPY has a relief rally, which can be plausible on the open. There are noticeable bear volume nodes indicating extreme sell pressure putting more emphasis on an oversold bounce.

Overall, in my opinion, fundamentally and speculatively this bounce could be due to big balance sheets ramping up the markets to avoid one of the worst weeks in history. It could also be due to large short covering to avoid holding

over the weekend.

Technically, if price does not break and close above structural resistance within the next couple weeks and months, this will increase the likelihood of lower highs, thus testing lower levels.

What are your thoughts?

Please leave a like and comment,

And remember,

“You become fearful the moment you identify with fear. But once you begin seeing it as an impersonal changing phenomenon, you become free.”

― Yvan Byeajee,

Vpvr

Bitcoins Historic Dump | Key 200 Weekly MA| Bear Sentiment Evening Traders!

History made on Bitcoin with the most epic dump to date, over 60%, what now?

Bitcoin has a key level to hold for a bullish scenario, the 200 Weekly Moving Average, a candle body close below this will send it to sub $3000.

Points to consider,

- Strong bear sentiment (traditional markets included)

- Holding above 200 weekly Moving Average

- Structural support respected

- RSI broke key support

- Stochastics projected downwards

- Volume climax president

BTC has experienced one of its most volatile movements as the bearish sentiment rails over all markets.

Technically it is above the 200 Weekly Moving Average but a close is needed for confirmation, this increases the probability of a temporary bottom in palace.

Structural support was respected with a wick, putting evidence on a volume climax as shown by the volume node.

The RSI has broken its important trend line, approaching oversold conditions on a larger timeframe is important to note.

Stochastics is projected downwards with lots of stored momentum where it can trade for an extended period of time.

Overall, in my opinion, there really is not much plausible with TA as the market sentiment is extremely bearish with the Pandemic. Key technical levels where all negated in a single candle in search for liquidity.

For the temporary bottom to be in, BTC needs to remain above the 200 Weekly Moving Average, a close below will test lower levels.

What are your thoughts?

Please leave a like and comment,

And remember,

“The market can stay irrational longer than you can stay solvent.- John Keynes

#Bitcoin 6 month Inverse Head and Shoulders Completed? After looking at the charts once they have cooled down, we can see that the completion of an inverse H & S pattern seems to have landed perfectly in place with the right shoulder... After 26 billion dollars left the crypto market over night and now sits at 224 bill, this looks like the perfect time to "buy the dip" . The Fear and Greed Index is at 19 and patterns like the inverse head and shoulders and the cup and handle have been completed. These are months in the making, not to mention that pesky CME gap was filled today. I'm longing this market now.

However, there is caution. If we do break the fib line at 7300, we are heading down to 66 based on VPVR .. So manage your risk vs reward here. The Stock Market has continued its down fall correction. Banks are beginning to default around the world, not to mention that Oil fell by 30% and the USD is now value at 94 cents. Again, I'm longing, however, this is not advice. :-)

What are your thoughts?

- NCCM

CME Bear Flag|Open Gap|Volume Climax| Oversold Bounce Evening Traders,

Today’s TA will be based on an oversold bounce play being imminent due to the immense selling over the weekend that has left the CME Futures with a 10% Gap.

Points to consider,

- CME bear flag confirmed

- Local support at .618 Fibonacci

- Huge open Gap (Technical Gap at $7690 open)

- RSI and stochastics overextended

- Volume node climax evident

The CME Futures gaps aren’t to be taken lightly as historically it has proven to be significant with consecutive fills. The bear flag has been confirmed with a Gap open due to spot market trading over the weekend.

Local support is found at the .618 Fibonacci, a break below this support will increase the probability of filling an open technical gap situated at around $7690.00 – fulfilling the gap prophecy once again.

The RSI and stochastics are over extended; sellers have been in full control with no convincing bounce cooling off oscillators.

Volume climax is evident; this is the first sign of potential seller exhaustion after heavy selling.

Overall in my opinion, Gaps historically tend to fill sooner rather than later. Oscillators have been over extended due to immense selling – increasing the probability of an oversold bounce.

We have entered bear territory as of now.

What are your thoughts?

Please leave a like and comment,

And remember,

“Once you find the system that works for your style/personality and confidence is gained, wash, rinse, repeat over and over again.” – Sunrisetrader

LINKBTC Bearish Divergence| Structural Support| .618 Fibonacci Evening Traders!

Today’s technical analysis will focus on LINK’s blue sky breakout that currently has a probable bearish divergence at play.

Points to consider,

- True blue sky breakout

- Structural support (S/R flip) confirmed

- .618 Fibonacci in confluence

- RSI diverging from price

- Volume nodes below average

LINKBTC has been in price discovery mode where there is no established resistance; this can be reflected by the VPVR.

The structural support has been tested confirming the S/R Flip. This level is also in confluence with the .618 Fibonacci – only if current local top is in.

RSI is diverging from price, putting in a lower high whilst the price puts in a higher low; this is a sign of topping out. The stochastics in currently projected downwards with lots of stored momentum.

The current volume nodes are below average after initial impulses, signalling a potential climax in buying.

Overall, in my opinion, LINKBTC may have put in a potential local top; a retrace to the .382 Fibonacci is the next logical target. If this level fails to hold, then a second retest of structural support comes in at play.

What are your thoughts?

Please leave a like and comment,

And remember,

“The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.” – Jesse Livermore

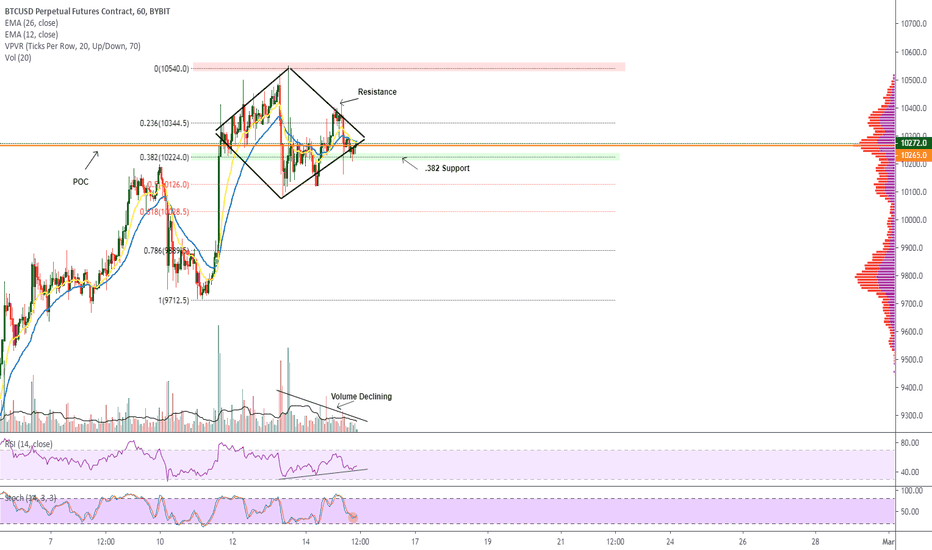

BTC Trade Setup|Ascending Triangle|Resistance|Low Volume Evening Traders!

Today’s TA will focus on a probable trade setup – two key levels to watch are the structural resistance and the ascending support.

Points to consider,

- Consecutive higher lower

- Structural resistance to break

- Ascending support respected

- RSI diverging

- Stochastics in an equilibrium

- Volume declining

BTCUSD has been trading with consecutive higher lows indicating more buy pressure present then sell pressure, in other words, bulls are willing to buy at these levels.

The structural resistance is a very key level to break; it has now been tested three times.

BTCUSD has been respecting the ascending support (Testing 50 MA currently), a break of this line will negate the trade, and a retest of structural support is then more likely.

The RSI is diverging from price, putting emphasis on a probable bullish divergence if another lower low is set.

Stochastics is in a probable equilibrium, closing on its apex, a break in momentum is probable in either direction.

The volume profile is clearly declining, signalling a move is imminent; this validates the theory of trading in a probable pattern.

Overall, in my opinion, a trade setup for a continuation may be at play if structural resistance is broken.

What are your thoughts?

Please leave a like and comment,

And remember,

“Sheer will and determination is no substitute for something that actually works.” – Jason Klatt

XTZBTC Key Support| Local Resistance| Lower High?Evening Traders

Today’s Technical Analysis will be on XZTBTC that has been in a strong bull trend, a correction and a retest of the .382 Fibonacci is likely before a continuation.

Points to consider,

- Bull trend intact – consecutive higher lows

- Key support (.382 Fibonacci)

- Local resistance to break

- RSI correcting to support

- Stochastics projected down

- Above average volume

- VPVR decreasing in volume

XTZBTC has been putting in consecutive higher lows keeping the bull trend intact, it has tested the .392 Fibonacci as the new potential higher low.

The .382 Fibonacci is a key support being in confluence with the structural horizontal.

Local resistance is a key level to break for the market structure, this will allow XZT to leave current trade range.

The RSI is correcting to neutral territory from overbought conditions, healthy to see in an uptrend. Stochastics on the other hand, is to correcting with stored momentum to the downside.

Volume nodes are clearly above average, this needs to sustain for a continued bull trend.

The VPVR shows low volume of transaction below key support, a break to this support can propel XTZ to test lower regions.

Overall, in my opinion, XTZBTC is putting in a probable lower high in this will defined trend. A break of ley support will increase the likely hood of a higher low – first signs of a trend reversal.

What are your thoughts?

Please leave a like and comment,

And remember,

“What seems too high and risky to the majority generally goes higher and what seems low and cheap generally goes lower.” – William O’Neil

BTCUSD VPVR Part 2: Volume Point of Control Now Turned SupportThe bullish case is here:

VPVR Point of Control, since $3K in September 2017: $8,188

Price has closed for two consecutive weeks above this PoC

Hash Ribbons buy signal - December 2019

1 & 2 Year MA bull-cross - January 2019

Price above MA Ribbons - January 2019

MACD bull-coss on Weekly - January 2019

The is continued analysis from the below, looking at the alternative VPVR perspective on Bitstamp:

BLX Volume Profile Accumulation Zone $5,910 - $8,630 (January 22nd 2020)

Related Bullish TA

Network Hash Gives 10th Buy Signal In 9 Years

February 6th-11th 2020 - The Next Swing Low

Extrapolating 2014 Correction - Could $6,500 Be The Low?

Two & Four Year MA's Claim It's Time To Accumulate

BTCUSD: Worst Case Bear Flag Extrapolation & BTFD ScenarioBear flag on 4hr time-frame, vs bullish support on longer-term time-frames. This extrapolation would be a breakdown of the bear flag targeting around $7.4K and again testing the previous maro bull flag resistance turned support trend-line, before continuing the bullish rally to $11.5K. The 4hr RSI remains oversold while struggling to leave these conditions, indicating room to fall lower. Long-term time-frames say DYOR and BTFD.

VPVR Part 2: Volume Point of Control Now Turned Support

VPVR Part 1: Volume Profile Accumulation Zone $5,910 - $8,630

Network Hash Gives 10th Buy Signal In 9 Years

Extrapolating 2014 Correction - Could $6,500 Be The Low?

ETH- Pullback or march toward the NEXT MAJOR RESISTANCE LVLHello everyone!

BTC dominace lvl has gone down a little and, we start to see more trading volume flow into retail's favorite crypro exchange coinbase as its trading volume increased 50% recently.

Retail money is what makes the uptrend move sustainable!

VPVR looks bullish as the price pierced through VA and both long term and short-term POC with long term trend line acting a strong support below.

However, ETH is currently facing long term fib resistance (32.8) and previous support lvl .

Furthermore, many indicators indicate the overextended status ( bollinger & ichi) and oversold status hovering around 75-80 on both daily and weekly timeframe

In terms of magnitude, 8 straight weekly green candles is probably overheating.

Next major resistance lvl is around 360. Buy on the dip within the buyzone if the price pullbacks.

Please like and follow me if you find my analysis useful. Much appreciated!

BTC Cup and Handle|Hidden Bullish Divergence|$12,780 TargetHello Traders!

Today’s update will be on BTC, forming a bullish Cup and handle pattern that will only be confirmed upon a break of structural resistance.

Points to consider,

- Probable bullish pattern

- Clear structural resistance

- EMA’s barely holding BTC

- RSI putting in lower lows

- Stochastics in lower regions

- Average volume

BTC is currently trading in the handle of the probable bullish pattern yet to be confirmed. Structural resistance needs to break for confirmation with a technical target at around $12,780.

The EMA’s are currently upon the cusp of crossing bearish, still trading in the handle where a break from this range will dictate the validity of the formation.

The RSI is putting in lower lows, diverging from price, putting more emphasis on the hidden bullish divergence. Stochastics is currently trading in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside.

Volume is average, signalling no heavy sell off, a good indication for a true handle in this formation.

The typical criteria that needs to be met in a cup and handle formation is the following

1) At least a 30% Run up from local lows (BTC over 50%)

2) A sell off from high 15-30% (BTC considered early in the handle )

3) Bottom or floor of support (BTC Local Support)

Overall, in my opinion, BTC has a high degree of confirming this probable cup and handle formation after breaking structural resistance. It is a strong contender for the criteria’s that need to be met, putting a technical target at around $12,780.

What are your thoughts?

Please leave a like and comment,

And remember

. If winning trades give you a buzz, you’re conditioning your mind to drool in anticipation of its next fix. And when it doesn’t happen, it’ll upset your expectations. If thrill naturally arises (which it will), feel it as it is, but then don’t cling to it.

ETHBTC Structural Resistance| Buyer Exhaustion| Lower High Evening Traders!

Today’s update will focus on ETH’s recent developments of getting rejected from structural resistance; a retrace is probable to the .382 Fibonacci.

Points to consider,

- ETH Parabola rise

- EMA’s currently support

- Structural Resistance tested

- RSI overbought

- Stochastics topping out

- Noticeable bear volume

ETH has had an insane parabolic run straight into a technical trade location, the structural resistance which has initially rejected it. EMA’s currently holding ETH as support, must hold true to continue with a bullish bias.

The RSI is currently overbought; a cool off to neutral territory is probable. The Stochastics is currently topping out, lots of room stored to the downside.

ETH has evident bear volume, signally potential buyer exhaustion leading to a healthy pull back in the trend.

Overall, in my opinion, ETH is likely to retrace from such overbought conditions to cool of technical indicators. The Fibonacci level to pay attention to will be the .382, a healthy bull trend tends to respect this level.

What are your thoughts?

Please leave a like and comment,

And remember,

“Every trader has strengths and weakness. Some are good holders of winners, but may hold their losers a little too long. Others may cut their winners a little short, but are quick to take their losses. As long as you stick to your own style, you get the good and bad in your own approach.” Michael Marcus

Diamond Continuation Pattern| Low volume| Bullish Continuation?Hello Traders,

Today’s chart update will on BTC’s immediate projection- we have a probable diamond formation which serves as a bullish continuation pattern.

Points to consider

- Trend travelling into apex

- .382 Fibonacci as local support

- RSI respecting trend

- Stochastics in lower regions

- Volume declining

- VPVR area being tested

BTC is closing in on its apex signalling a break from this formation is imminent as local support and resistances converge. Local support is the .382 Fibonacci; BTC has been respecting this level as buy pressure is evident.

The RSI is respecting its trend line, must hold for a bullish bias as this is in confluence with the stochastics being in lower regions. It can stay trading there for an extended period of time, however lots of stored momentum to the upside.

Volume is clearly declining; increase is highly probable upon breaking out of the Diamond formation. The VPVR confirms the .382 being a strong trade location for buy pressure.

Overall, in my opinion, a break bullish is probable as the Diamond Pattern serves as a bullish continuation pattern. BTC may have one more leg up before a proper correction as this trend is getting more extended.

What are your thoughts?

Please leave a like and comment,

And remember,

“The big ones take the psychology out of the game. Have a game plan, and stick to it.” Tim Erber

BTC.D: Don't Underestimate the TD Sequential 9 & 50 Week MAAs can be seen on the Daily chart using the TI Indicator, we are currently at the 50 Week MA on a Sequential 9. While the long-term 200 Week MA is sloping downwards (has a bearish posture), the 50 Week MA is rising (has a bullish posture). It's also clear from previous TD 9's, whether buy or sell signals, have been very reliable in calling short-term tops and bottoms. The RSI is also considerably oversold.

I'm still bearish on Bitcoin dominance long-term, but remaining neutral as dominance is likely to find short-term support from current levels. It'd be reasonable to believe that dominance will retest the bear flag breakdown level, VPVR resistance as well as 21 Day MA around 66%, or even as high as the 200 Day MA at 69% that is now started to slope downwards confirming long-term bearish pressure.

TI Indicator: tonevays.com

Altcoin Dominance Eyeing Up A Breakout to 40% (January 2020)

Cyrpto Market About To Bullcross: 50 & 100 Week MA (January 2020)

Altcoin Speculation Coming Soon... (October 2019)

Altcoin Dominance Bouncing From 0.382 Fib Retracement (September 2019)

HEXO Bullish Divergence| Seller Exhaustion| Local Resistance Hello Traders!

Today’s chart update will be on HEXO CORP where we have a probable bullish divergence forming on the daily. Local resistance is a key level to break to show first signs of a possible trend change.

Points to consider,

- Clear bear trend intact

- Bullish divergence forming

- Local resistance to break

- Stochastics in upper regions

- RSI respecting trend

- Volume below average

HEXO’s current trend is bearish with consecutive lower highs in place, this current bullish divergence signals potential seller exhaustion on the daily.

Local resistance needs to break; this will further bring the bullish divergence to fruition as the trend attempts to put in a higher low. The stochastics is trading in the lower regions, can stay here for an extended period of time, however lots of stored momentum to the upside.

RSI is currently diverging from price by putting in higher lows whilst HEXO puts in consecutive lower lows, confirming a valid bullish divergence .

The current volume is well below average, it must increase when local resistance is broken to avoid the chances of a false break.

Overall, in my opinion, HEXO’s bullish divergence is the first sign of a potential trend reversal from such lows. Local resistance is the first key technical level to breach then structural resistance in order to change the current market structure.

What are your thoughts?

Please leave a like and comment,

And remember,

“Environmental distractions and boredom cause a lack of focus – All of us have limits to our attention span and these are easily taxed during quiet times in the market.” Brett Steenbarger

ADA/BTC Higher Lows | Critical Resistance | Triple BottomHello Traders!

Today’s chart update will be on ADA/BTC which has been putting in consecutive higher lows as it comes to test a critical resistance level. Will ADA have enough momentum to break this level and maintain a bullish bias?

Points to consider,

- Overall trend changing

- Support respected with a triple bottom

- Resistance currently being tested

- Stochastics neutral, projected upwards

- RSI neutral, not overbought

- Bollinger bands tightening

- VPVR decreasing in volume of transactions

ADA has changed it’s mid- term trend from its overall bearish sentiment, a full trend change confirmation will only come to fruition when the critical resistance level is broken. Support has been respected; a triple bottom is evident, signalling that buyers are strong in that area. Resistance is being tested as of now, has rejected price multiple times, however this time price is consolidation near resistance, signalling a break looks imminent.

The stochastics is neutral at current time; momentum in either direction will dictate the bullish and or bearish bias. RSI is also neutral, respecting its trend line as it approaches its apex.

The Bollinger bands are tightening as ADA reverts back to the mean; this signals that a break will be imminent. The VPVR is clearly decreasing in volume of transactions; bulls have low resistance poised in the cluster above.

Overall, in my opinion, ADA/BTC will confirm its trend change by breaking current resistance convincingly. This will allow the trend to put in a new higher low. A rejection from current point will send ADA back to support, which will probably confirm a trading range.

What are your thoughts on ADA/BTC?

Please leave a like and comment,

And remember,

“If you don’t respect risk, eventually they’ll carry you out.” – Larry Hite

LTCBTC Bull Flag| Volume above average| Key Resistance Hello Traders!

Today’s update will be on LTCBTC where we have had a bull flag breakout currently testing structural resistance, a close above this will confirm a trend change.

Points to consider,

- Resistance to break

- Bull cross imminent 200 MA & 20 MA

- Stochastics projected up

- RSI respecting trend line

- Volume above average

- VPVR decreasing in transactions

LTCBTC is testing a key structural resistance, a close above will confirm a trend change putting in a higher high. Bullish cross is imminent of the 200 and 20 MA, further puts emphasis on the probable trend change.

The stochastics are projected upwards, can stay trading here for an extended period of time, however lots of stored momentum to the downside. RSI is respecting its trend line, coming close to its apex signalling a break it imminent.

The volume is above average which looks healthy, must sustain when LTC breaks structural resistance for follow through. VPVR is decreasing in volume of transactions from structural resistance and above, signalling low levels of resistance in terms of volume of transactions.

Overall, in my opinion, LTCBTC’s bullish MA cross may propel to break structural resistance. A close above will confirm trend change with a new higher high.

What are your thoughts?

Please leave a like and comment,

And remember,

“You have power over how you'll respond to uncertainty.”

― Yvan Byeajee

AIONBTC Bullish Divergence| Increasing Volume| Key Resistance Hello Traders!

Today’s chart update will be on AIONBTC where we have visibly increasing bull volume as structural resistance gets tested.

Points to consider,

- Trend still range bound

- Structural support – Accumulation

- Structural resistance yet to break

- Stochastics in upper regions

- RSI at overbought

- Volume increasing

AION’S trend is still range bound; it needs to break structural resistance promptly to allow the trend to put in a new higher high. The structural resistance is a key trade location where a close above, will further confirm a bullish bias.

Support has held AION successfully as accumulation was visible with the extreme volume coming in and staying above average. The stochastics is currently in the upper regions, can stay trading here for an extended period of time, however lots of stored momentum to the downside.

The RSI is trading in overbought territory; a correction is imminent to cool of the indicator, more probable to test its support. Volume has been clearly increasing signalling bulls are in town, this needs to sustain for follow through.

Overall, in my opinion, AION needs to break structural resistance promptly with a confirmed daily close to keep a bullish bias – volume is looking extremely bullish.

What are your thoughts?

Please leave a like and comment,

And remember,

“Reaching any goal in trading requires specific domain knowledge and technical skills. But then, after that, it's all mindset management. Yet most people ignore that —they automatically think they have that last part all figured out, and it's a mistake.”

― Yvan Byeajee

XLMUSD Key Resistance|200 MA| Trend Change ProbableHello Traders

Today’s chart update will be on XLMUSD testing a key Resistance, the 200 MA, where a break will increase the probability of a confirmed trend change.

Points to consider,

- Short term bulls intact

- 200 MA, major resistance

- Structural support respected

- Stochastics in upper regions

- RSI respecting support

- Volume declining

XLMUSD’s chart indicates that the immediate trend is bullish with consecutive higher lows being established. Major resistance level is at the 200 MA average, where a break of it will further confirm the trend change.

Structural support has been respected putting in a clear higher low in the current trend. The stochastics are currently trading in the upper regions, can stay trading here for an extended period of time, however lots of stored momentum to the downside.

The RSI is respecting its trend line, a break of it will increase the probability of a rejection from the 200 MA. Volume is clearly declining, signalling a breakout is imminent which will come to fruition with an influx.

Overall, in my opinion, a break above the 200 MA will be a very bullish indication of a confirmed trend change as XLMUSD will put in a macro higher high. But this does need to be backed with strong bull volume.

What are your thoughts?

Please leave a like and comment,

And remember,

“A quiet mind is able to hear intuition over fear.”

― Yvan Byeajee

Bullish Divergence| Higher Low| Declining Volume Hello Traders!

Today’s chart update will be on OGI where bulls are promptly trying to change the bearish structure; key levels must break for a trend change to come to fruition.

Points to consider,

- Trend structure changing

- Local support being held

- Structural resistance to break

- Stochastics in neutral territory

- RSI diverging from price

- Volume clearly declining

OGI’s structure has slightly changed due to the bullish divergence playing out, new higher highs will confirm the overall trend change which has not happened as of yet.

Local support in being held promptly, in confluence with the .50 Fibonacci level, OGI has strong technical support confluences. Structural resistance is a key level to break; OGI must close above as this will instil a highly probable new higher high in the trend.

Stochastics is in neutral territory, momentum is stored in both directions at current given time. RSI is diverging from price with clear higher lows, signalling a local trend change.

Volume has been declining which increases the probability of an influx at current support. Bear volume visually has been drying up; OGI needs bull volume for follow through from current support.

Overall, in my opinion, local support must hold for OGI, a retest and close above structural resistance will confirmed the trend change with a new macro higher high.

What are your thoughts?

Please leave a like and comment,

And remember,

“Ultimately, consistent profitability comes down to choosing between the discomforts you feel when you follow your plan and the urge to let yourself be captures ( and ruled) by your emotions.”

― Yvan Byeajee

LINKUSD Key Resistance| Low Volume| Cup and Handle ?Today’s chart update will be on LINKUSD where key levels a prone to get tested; a bullish formation – cup and handle- is upon fruition.

Points to consider,

- Bull trend from yearly lows

- .328 Fibonacci serving as support

- Key resistance to break

- 50 MA providing current support

- RSI respecting its resistance

- Stochastics in upper regions

- Volume declining

LINKUSD’s immediate trend has been bullish with consecutive higher lows in place. The .382 Fibonacci level is currently holding as support, it must hold true with the cup and handle pattern coming to fruition.

Key resistance is yet to break, a close above will change to overall structure of the trend by putting in another higher high. The 50 MA is key, currently holding LINK support near resistance, needs to hold true when key levels are

tested.

RSI is respecting it resistance, currently trading neutral, a break of resistance will increase the bullish bias. The stochastics is trading in the upper regions with lots of stored momentum to the downside.

Volume is clearly declining, this signals an impulsive move coming, especially when key level get tested.

Overall, in my opinion, a break bullish of the current channel will increase the probability of a bull continuation. This will increase the probability of a cup and handle formation which serves as a continuation pattern.

What are your thoughts?

Please leave a like and comment,

And remember,

“In order to succeed, you first have to be willing to experience failure.”

― Yvan Byeajee

BTCUSD: Volume Profile Accumulation Zone $5,910 - $8,630

Suggested accumulation zone: $5,910 - $8,630. This is where the bulk of the volumes lies in the past 27 months.

VPVR shows point of control as $6,263 from the rally in September 2017 from mid $3ks until January 2020.

Declining volume implies a breakout in the not so distant future. Above $11,500 there is declining volume.

DYOR.