ETHBTC Daily Trend Change|Higher Low|Local Resistance to Break! Hello Traders!

Today’s chart update will be on Etherium, which has successfully broken out of its bear trend on the daily. It respected the .618 Fibonacci level on the 240 time frame as expected (see Chart Linked below), now currently approaching a critical resistance level that needs to break.

Will bulls have enough momentum to break through resistance?

Points to consider,

- Daily bear trend broken

- Price supported by .618 and .50 Fibonacci

- Local resistance yet to be broken

- Stochastics in upper region

- RSI approaching apex

- EMA’s supporting price

- Volume trading just below average

- VPVR declining in transactions from current point

On the daily, Etherium has put in new higher low, the overall structure of the trend has now changed with critical levels yet to be tested. Price was initially supported by the .618 Fibonacci level, signalling that buyers are strong in that area with considerable bull volume coming in. Local resistance however is yet to be broken, this is a key level that needs to be broken to keep the bull momentum intact.

The stochastics is currently trading in the upper region, can stay up here for an extended period of time, however there is lots of stored momentum to the downside. RSI is respecting its current support and resistance, coming close to its apex, a break will be imminent.

The EMA’s are currently supporting price, it needs to hold price as support in order for the new trend to mature. Volume itself is quite healthy, although just below average, Etherium needs volume to maintain into order to break local resistance.

The VPVR is quite interesting; it has clear low volume of transactions from local resistance to structural resistance. This signals that bulls will have little resistance poised by the VPVR when trading in that cluster.

Overall, In My Opinion, Etherium needs to maintain above the EMA’s as it comes into local resistance. We need a steady increase in volume to successfully break resistance and to at least test structural resistance…

What are your thoughts?

Please leave a like and comment,

And remember,

“Stocks are bought not in fear but in hope. They are typically sold out of fear.” – Justin Mamis

Vpvr

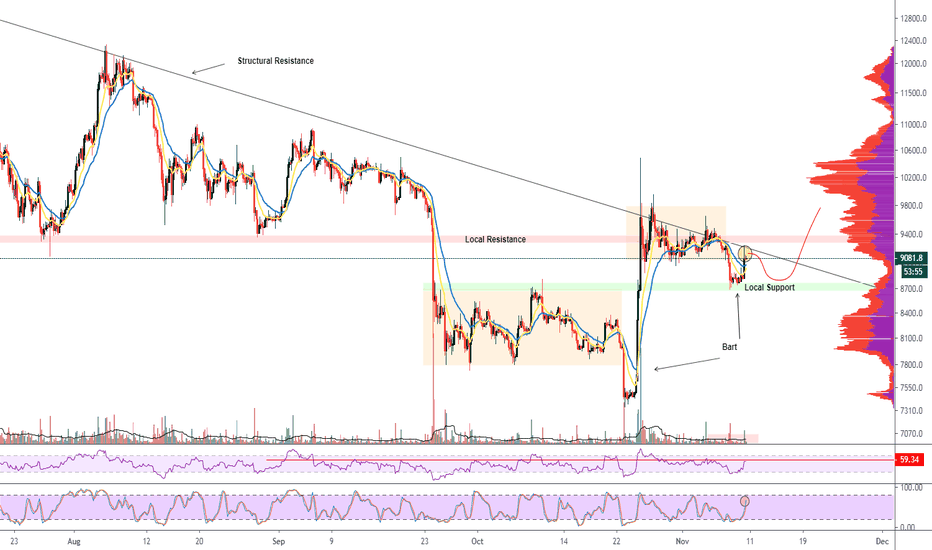

BTC Bart Fractal|Strong Resistance|Need Volume Follow Through!!Hello Traders,

Today’s update will be on Bitcoins recent developments, where a possible fractal is playing out with a confirmed Bart pattern. BTC is now trading at a very strong resistant point which can only be broken with strong bull volume.

Will bulls have enough in the tank to break resistance or is a retracement back to support more probable?

Points to consider,

- Trend confirmed Bart pattern

- Local Support Respected

- Local Resistance is in Confluence with Structural Resistance

- RSI Neutral

- Stochastics Projected upwards

- EMA yet to turn bullish

- Volume needs follow through

The recent trend in Bitcoin’s price has been following a fractal with a confirmed Bart from local support. BTC consolidated before an impulse move down, where bulls instantaneously showed up to move price right back in to resistance. The current level that is being tested needs to break for strong bullish momentum.

Local support was respected by Bitcoin, confirming the S/R flip. This signalled that buyers were strong, putting in a healthy retest of previous resistance. Local Resistance however is in confluence with the macro structural resistance. This is a very strong area that Bitcoin needs to break for continued bullish momentum. For this to come to fruition, we need strong follow through with bull volume, otherwise price will retrace back to local support.

RSI is currently testing resistance in neutral territory; it is not in overbought nor oversold at current given time. The Stochastics is projected upwards, we still have momentum stored to the upside if Bitcoin is capable of breaking the strong resistance.

The EMA’s are yet to turn completely bullish, the yellow EMA needs to cross the blue EMA to confirm bull momentum. Volume is very important right now for Bitcoin, we need an increase in bull volume, currently it is looking very weak.

Overall, In My Opinion, local support has been tested and respected, but we do have very strong resistance levels that need to break. Volume is very key right now, like I mentioned, it does look quite weak but it is too early to tell. A retest of local support again is quite probable at current given time before an impulse break of major resistance levels.

What are your thoughts on the recent developments of Bitcoin?

Please leave a like and comment,

And Remember,

“Opportunities come infrequently. When it rains gold put out a bucket not a thimble.” – Warren Buffet

LTC/BTC Trend Change | Key Resistance | New local higher lowHello traders,

Today’s chart update will be on Litecoin which has changed its market structure breaking a key resistance line. Currently testing an important local resistance level that needs to break, will bulls have enough momentum to push price higher?

Points to consider:

- Trend Structure Broken

- Local resistance being tested

- Local support in confluence with double bottom

- Stochastics in upper region

- RSI in upper region

- EMA’s turned bullish

- Noticeable increase in volume

- VPVR decreasing in volume of transactions

Litecoin bulls have successfully broken its lower high trend projection, a key resistance line. The overall market structure in now looking to put in a new local higher low. Local resistance is now being tested; this area is important and needs to be broken to further confirm the trend change. Local support is found in the green zone, it is in confluence with a potential double bottom, signalling that buyers are very strong as price has now been pushed up twice.

The stochastics is trading in the upper region, it can stay up there for an extended period of time, however we do have a lot of stored momentum do the downside. The RSI is also trading in the upper region, very over-extended at current given time, a correction in price will return it back to neutral territory. Furthermore, the EMA’s have turned bullish after initial break of the trend line, it needs to hold price as support to further confirm the trend change.

VPVR is quite interesting, it has a visible decrease in volume of transactions from local resistance. This suggests that bulls will have little resistance posed by the VPVR when and if local resistance is broken. volume has increased drastically; it needs to sustain with follow through to avoid the chances of a false break from current local resistance.

Overall, IMO, Litecoin has broken a key resistance line, breaking key market structure. It is now testing an important resistant zone. It is more probable for price to retrace back to the .50 and or .618 Fibonacci Line before making another impulse move up. This will allow indicators such as the RSI return to neutral territory and will also allow the trend to put in a new higher low.

What are your thoughts on Litecoin’s trend change?

Please leave a like and comment,

And remember,

There is a huge difference between a good trade and good trading.” – Steve Burns

BTC Falling Wedge Pattern| CME GAP Filled|Buyers Looking Strong!Hello Traders!

Update on Bitcoin's recent developments in this falling wedge pattern, The CME future gap finally filled, with a large wick (check linked chart), this was not displayed on the spot charts which is weird, but I am under the assumption that it has filled...

Price is holding up in a tight range near resistance, will we see a continuation in the bull trend from here?

Points to consider,

- Trend structurally still putting in lower highs

- Price respecting structural support

- Major resistance line currently being tested

- Stochastics is flattening out

- RSI below resistance

- EMA’s looking bullish

- Volume is declining

- VPVR decreasing in volume of transactions

Bitcoins falling wedge pattern now has multiple touch points and a fake out, which confirms the significance of the current area it’s trading in. Price is respecting structural support within the pattern, this is a very key level, and price action suggests that buyers are strong at current given time. Major resistance level is currently being tested, price is holding up at this critical level with a clear cluster of candles, again signalling that buyers are strong.

The stochastics is currently flattening out which signals that a move is imminent, there is momentum stored both ways for a bearish and or bullish break. RSI is currently trading below resistance, needs to enter green zone for a bull break, it can stay in that zone for an extended period of time as price history suggests.

The EMA’s are looking quite bullish, it needs to hold price as support, this will further give the bulls momentum to push price through Bitcoins current resistance line. Volume is visibly declining, signalling volatility is imminent, and an influx in bull or bear volume will confirm the next impulsive move.

VPVR has decreased in volume of transactions rapidly from current levels up; this suggests that a bull break will have little resistance posed by the VPVR as not much volume has been traded in the upper regions.

Overall, IMO, Price has held up and above the structural resistance which is very bullish, indicates that buyers are strong in this area. Volume is declining at a key resistance point; a break will need an influx of volume, which is imminent. A bull break will allow this pattern to come to fruition and will change the overall market structure, allowing it to put in a higher low.

What are your thoughts on Bitcoin Price Action?

Please leave a like and comment

And remember,

“The obvious rarely happens, the unexpected constantly occurs.” – Jesse Livermore

BTCUSD: Descending Triangle On 4hr Chart To Look Out For?VPVR (Visible Range) shows median traded price at $9180 level with the support level of the descending triangle at $9020. Note this is also the 200 Day MA level, therefore this is not a short call. The measured move of -8.5% calculates the price target of $8250, which is another VPVR level of median price from the recent volume history from the breakdown of the Weekly descending triangle .

Nonetheless, a 4hr close below $9020 would be bearish with a Daily close below the 200 Day MA required to confirm bearish bias.

The descending triangle pattern will enter the breakout zone after 75% completion on November 5th 20:00 GMT.

TRXBTC Daily Trend Change | Increase in Bull Volume Hello Traders

Two more months in the year, how time flies…

Today’s chart update will be on TRXBTC, we have a potential daily trend change which is backed up with strong bull volume…

Points to consider,

- Trend is putting in new higher lows

- Resistance at .236 Fibonacci retracement

- Support held by EMA’s (EMA’s Bull Cross)

- Stochastics trading in upper region

- RSI testing its local resistance

- Visible increase in bull volume

TRX has been on the move as of late, changing its overall daily trend with consecutive higher lows as it comes into local resistance. This resistance, the .236 Fibonacci Retracement, is in confluence with structural resistance, a key area that needs to be broken for a continuation.

Support is being held by the EMA’s which does look quite strong after a confirmed bull cross. This cross initially signalled the daily trend change.

The stochastics is currently trading in the upper regions; a healthy retracement in the trend can come to fruition as the stochastics does have a lot of momentum stored to the downside.

The RSI confirmed the bullish divergence, and is now trading in the upper region at local resistance. If this resistance breaks, is can trade in the orange highlighted box for an extended period of time, as history suggests.

Volume has been a great indicator; we have had an increase in bull volume, showing that buyers are strong in this trend change. We need to see this continue for local upper resistances to be tested.

Overall, IMO, TRX has had an impressive trend change with follow through; a healthy correction is not farfetched. This will cool of the stochastics and RSI indicators before another leg up, this will also allow the trend to put in another higher low…

What are your thoughts?

Please leave a like and comment

,

And remember

“You’re going to learn a million things, then you need to forget them all and focus on one.” - SunriseTrader

XRPBTC Bearish Divergence| Low Volume | Rising Wedge Hello Traders!

Today’s chart update will be on XRPBTC, we have another potential rising wedge formation looking to break to the downside with a strong bearish divergence. We need volume to back up the bears when and if we break out…

Points to consider,

- Trend broke out of rising wedge pattern

- Double top formation / Local resistance

- Local support at .618 Fibonacci/ confluence with Fibonacci Extension

- Stochastics showing downside momentum

- RSI respecting downtrend

- EMA’s giving price resistance

- Volume has decreased

XRP broke out of a larger rising wedge formation decisively after putting in a double top (local resistance), it wicked down to the .618 Fibonacci Level and is now forming yet another potential rising wedge.

Bulls need to break the double top resistance to keep the overall bull trend intact – it does look quite unlikely at current given time. Local support is found at the .618 Fibonacci level which is in confluence with a Fibonacci Extension level, making this support quite strong.

The stochastics is currently showing downwards projection, bears have a lot of stored momentum to the downside if and when this current rising wedge breaks. The RSI is converging from price, putting in lower highs whilst the price attempts to put in higher lows, proving the current bearish divergence being at play.

EMA’s are giving price strong resistance as of now, pushing price to lower levels, we need to see a bull cross if bulls are willing to push price back to upper levels near the double top.

Volume however is very dry, we did have a spike in bear volume which was due to the rising wedge break. Similarly, we need to keep an eye on volume for this current small rising wedge as this will confirm a breakout, avoiding a potential fake out.

Overall, IMO, local lows are more probable to be tested, especially the .782 Fibonacci level as this is in confluence with the 1.272 Fibonacci Extension and the overall support of the market structure…

What are your thoughts?

Please leave a like and comment,

And remember,

In trading, everything works sometimes and nothing works always.”

BTCUSD Symmetrical Triangle| Low Volume| Breakout Imminent!Hello Traders!,

Quick Update on BTC, Trade Setup!

We have a symmetrical triangle forming clearly on the shorter time frame, price is coming to its apex, a break is imminent.

Points to consider,

- Trend coming into apex

- Support and resistance converging

- RSI is neutral, on support

- VPVR increasing cluster of transactions

- Volume has dried up

- Futures gap below at .50 Fibonacci

BTC has been consolidating over the past couple days and has formed a symmetrical triangle which is very close to its apex point. The symmetrical triangles support and resistance lines are converging in confluence with extremely low volume, this is a very key indicator for breakout trades.

Overall a break in either direction, backed with volume is probable. An important area to keep an eye on is the .50 Fibonacci level, if price breaks bearish and tests this level, then the CME Futures Gap will be filled (Check previous chart update for further explanation ).

It is also probable for BTC to have another impulse pump before a major correction towards the lower Fibonacci levels…

What are your thoughts on the consolidation phase?

Please leave a like and comment!

CRLBF Key Resistance | Trend Reversal? Hello Traders!

Today’s chart update will be on CRLBF – CRESCO LABS INC, potential trend reversal if local resistance is broken. Price is building up near resistance, is a break imminent?

Points to consider,

- Trend bearish, attempting a higher low

- Support provided by the EMA’s

- Local resistance being tested

- Stochastics projected upwards

- RSI respecting support line

- Bear volume decreasing

- VPVR spikes in volume, confluence with Fibonacci Retracement and Extension levels.

CRLBF right now is attempting to break local resistance, a key level in the trend, when if broken will confirm a trend reversal as this will put in a local higher low.

Support is currently being provided by the EMA’s, there has been a bull cross, price is holding near resistance (build up), this signals strong buy pressure which increases the probability of a breakout.

If a breakout was to come to fruition, the technical target will be at structural resistance; this area is of heavy confluence as it is a key technical level. We have the Fibonacci retracement, .50 level; in confluence with the Fibonacci extension level 1.414. A test up to and retracement from structural resistance will put in a healthy higher low for the overall trend.

The stochastics is currently projecting upwards; momentum is stored for a breakout. However a rejection from current area will have the stochastics in favour of the bears due to more downside room.

The RSI is respecting its trend line, needs to hold for a breakout to come to fruition, it is currently trading in neutral territory, we are not in extreme overbought/sold regions as of yet.

Bear volume is visible decreasing, we can see strong bull volume in current level, this signals that buying pressure is greater than selling pressure; bulls have a greater probability of breaking out from here.

The VPVR is quite interesting, its cluster of transactions increases near structural resistance. This level is a very good technical target for CRLBF, due to confluences from the Fibonacci Retracement Level .50 and the Fibonacci Extension level 1.414.

In other words the more technical confluences within an area, the more significant that area will be once tested.

Overall, IMO, CRLBF is probable to reach its technical target due to strong bull volume near resistance. This will allow the stock to put in a higher low, changing the overall market structure…

What are your thoughts?

Please leave a like and comment,

And remember,

“Trade What’s Happening…Not What You Think Is Gonna Happen.” – Doug Gregory

What's next for BitcoinBitcoin looks good on the 4h. We could see a touch on the 21EMA, but we should be ready for a high within the next day or two. If this jump is anything like the last, this wave should take us around $10,000 at the least. We'll see what happens. Watch out for false breaks and plan stop loss appropriately!

Disclaimer: This is NOT trading advice! These are merely my opinions that I have posted for educational purposes only. I hope you all kill it, but I am not responsible for any financial losses. Thanks for reading!

BTC $950 CME Futures Gap| Correction Imminent| BTC Local TopHello Traders!

What goes up… Must come down!

Today’s update will be on Bitcoin in comparison with the CME futures Chart, a massive $950.00 Gap that with a high degree of probability, will get filled. Is this the local top for Bitcoin?, we have a handful of indicators that point towards that…

Points to consider,

- Trend highly overextended

- Local Support at .50 Fibonacci (.382 on the CME futures chart)

- Structural resistance being rested

- Stochastics in upper region

- RSI in overbought territory

- EMA’s yet to meet price

- Volume influx is very high

Bitcoins impulse move continues to be overextended in a parabolic manner, with indicators way overextended; we need a healthy correction at some point. Price was initially met with high selling pressure at local top, signalling a volume climax.

Local support is found at the .50 Fibonacci level, a retracement to the level will close the CME futures gap (.382 Fib Retracement), where price is likely to hold support at this area due to market structure, previous resistance turned into support.

Major structural resistance is currently being tested, it is in confluence with downs sloping resistance, the consecutive lower highs. This is a very critical area in the trend, if broken, will change the overall market structure for Bitcoin.

The stochastics are currently in the upper regions for both charts, this signals that there is a lot of stored momentum to the downside if price was to correct. We don’t really have a clear direction from the Stochastics as it can stay over extended for a long period of time. The RSI is quite interesting however, it is in highly overbought territory, last time we tested these areas, Bitcoin experienced a huge correction over 20%...

EMA’s however are yet to meet price, we need it to hold support at the .50 Fibonacci level if price where to retrace from local highs, the will validate support and in confluence close the open gap on the CME futures chart (.328 Fibonacci level).

The VPVR on the CME futures chart indicates that there is very little volume of transactions between structural resistance and the .382 Fibonacci level (close of gap). This signals that the VPVR will pose very little resistance if price was to start a healthy pull back.

The volume is way above average, signalling buying climax that ran into strong selling pressure, hence the massive wick as bullish pressure got exhausted… In other words, sellers are very strong in upper regions, putting more emphasis on a correction.

Overall, IMO, BTC is likely to be topping out, we may see a final impulse move up, but that will just make the trend even more unsustainable. A correction back to the $8,800 mark (.50 and .382 Fibonacci levels), is highly probable, as this will fill the CME futures gap. This will also be very healthy for the price and will cool of the overextended indicators.

What are your thoughts on BTC and the futures gap?

Please leave a like and comment,

And remember,

“The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.” – Jesse Livermore

ETHBTC Oversold Bounce? Key Support Area| Volume Climax Hello Traders!

Hope your all enjoying your weekend,

Today’s update will be on ETHBTC, key levels to watch after this initial dump, will a bounce come to fruition or a continuation?

Points to consider,

- Trend broke out of falling wedge pattern on the macro timeframe

- Support at .50 Fibonacci

- Local resistance in confluence with local top

- Stochastics in lower regions

- RSI currently oversold

- EMA’s yet to meet price

- Volume climax Bars

After initial break from its falling wedge pattern, ETH topped out at local resistance before a massive dump to the .618 Fibonacci retracement level. It is currently holding support at the .50 Fibonacci level, the wicks down to the .618 level signals that buyers a strong, this area is also in confluence with local support.

Resistance is where price has locally topped out; ETH needs to break this key level for a bullish continuation in the overall trend.

The stochastics is currently in lower regions, no bottoming signal yet, it can stay in these regions for an extended period of time, a bounce however will have a lot of stored momentum to the upside.

The RSI is currently way oversold, needs to cool off from these areas, if price holds support and moves up then the RSI will have a chance to recover so with other indicators…

EMA’s are yet to meet price, it has been holding as resistance thus will add more selling pressure to the price when it meets at local support. A cross of the EMA’s at local support will be extremely bullish…

Volume has climaxed, signally a temporary bottom for ETH, unless price breaks through the .618 Fibonacci within the next couple days.

Overall, IMO, local support is strong here, last time ETH wicked down; it had a rally into local resistance. Bulls need to defend this key level, otherwise yearly lows are on the cards if support was to be broken.

What are your thoughts?

Please leave a like and comment,

And remember,

“Only The Game , Can Teach You The Game” – Jesse Livermore

MCOBTC Rising Wedge | Bearish Divergence | Correction?Hello Traders,

Today’s chart update will be on MCOBTC, where we have had a potential Adam and EVE bottom from yearly lows. Price is now testing key support that needs to hold, however we are seeing bearish signs such as the bearish divergence..

Points to consider,

- Trend is considered bullish with lower highs

- Major Resistance broke, now support

- Local resistance at 5632 Satts

- Stochastics projected downwards

- RSI diverging from price

- EMA’s holding support

- Volume below average

MCO is at a critical point in its trend where we do see multiple bearish signs in the chart. The trend is bullish however is testing key support in a falling wedge formation, a correction into the zone is more likely to be at play.

Major Structural resistance has been broken from yearly lows; MCO needs to hold current area to confirm an S/R flip. Local resistance however is at 5362 Satts, the VPVR between the two segments show a decrease in the volume of transactions. This signals that bulls are more likely to test local resistance due to low levels of transaction…

The stochastics is projecting more probable downside potential; bears have stored momentum if a correction does play out. RSI is currently diverging from price; this puts more emphasis on the bearish divergence as price puts in consecutive higher highs whilst the RSI puts in lower highs.

The EMA’s is currently holding support which is in confluence with structural support, making the zone more significant for the bulls. Volume is well below average, we needs to see an influx of volume if price where to break and or bounce from current area…

Overall, IMO, MCO is more probable to have a correction as we do see multiple bearish signs, we have a rising wedge formation in confluence with a bearish divergence. Volume is also extremely low; we need to see an influx of bull volume if price were to have a chance of respecting key support.

What are your thoughts on MCO? Will we have a correction here?

Please leave a like and comment

And remember,

“Time is your friend; Impulse if your enemy “- John Bogle

BTCUSD: TD Sequential 9 Next Week To Decide Direction?Part 9: Next week looks set for a bullish TD Sequential 9 on the Weekly chart that hasn't been seen since July 2018. Back then this led to a 40% increase in the price of Bitcoin followed by 4 months of consolidation. This scenario is labeled "A". Extrapolation C is the inverse of the "bearish" TD 9 in April 2019 that led to a continuation of the bull trend. Hence, C is labeled as the "bullish" TD 9 but would be the most bearish scenario. Scenario B is the extrapolation of the 2018 wedge breakdown, as documented in Part 1 of the Bitcoin repeating history series.

The two year vpvr "average price" is referenced as a key level to break (and close) above at $8376.

If Bitcoin Repeats History?

Part 1: Descending Triangle Looking Similar To 2018

Part 2: Measuring The Move of the Descending Triangle Breakdown

Part 3: A repeat of 2014? Worst Case Scenario A $2,500 Low

Part 4: If Bitcoin Repeats History? Extrapolating 2012 Breakdown

Part 5: If 2017 Descending Triangle Repeats? Best Case Scenario

Part 6: If Bitcoin Repeats History? Monthly TD Sequential Red 1

Part 7: Another Bearish Indicator: 200 EMA & MA Bearcross

Part 8: Bitcoin's Full Moon Reversal 6 Month Pattern

BNB Falling Wedge Breakout|Technical Target|Bullish DivergenceHello Traders!

Today’s chart update will be on BNB/BTC which has broken bullish from its falling wedge formation that we have been looking at since September (chart is in the link below). We’ve had a bullish divergence confirmation with this break, now will BNB reach its technical target?

Points to consider,

- Trend broke major resistance

- Local support is currently being tested

- Structural resistance in confluence with target

- Stochastics showing upside momentum

- RSI respecting trend line

- Volume noticeably increased

- VPVR spiking in volume of transactions

- Potential new higher low

BNB has broken a key resistance line of the falling wedge pattern with decisiveness; this break is further sentenced with a clear bullish divergence. Price is now testing local support (S/R Flip), this level needs to hold to put in a new market structure.

Structural resistance is in confluence with the technical target of this falling wedge, BNB is highly probable to reach this target if local support holds true.

The stochastics are showing a clear change in momentum, there is a lot of room for bulls to work with in terms of stored momentum for the upside. The RSI is respecting its current trend line, converging from price (confirming bullish divergence), this further puts emphasis on the price reaching its technical target.

Volume has clearly increased upon breakout; this is very healthy as it confirms that this is not a false break. The VPVR is also showing noticeable spikes in volume of transactions, this being in confluence with increased volume further puts emphasis on the decisiveness of the break…

Overall, IMO, BNB has a high degree of probability to reach its technical target, this need to be confirmed with a respect of local support as this will establish a new market structure, putting in a higher low.

What are your thoughts on BNBBTC falling wedge breakout?

Please leave a like and comment,

And remember,

If you can’t take a small loss, sooner or later you will take the mother of all losses.” – Ed Seykota

ZRXBTC Local Top? | Bearsh Divergence | Parabolic Rise Hello Traders,

Today’s chart will be on ZRX/BTC which may be putting in a local top that is accompanied with a potential bearish divergence. ZRX has risen in a parabolic manner a correction or consolidation is highly probable.

Points to consider,

- Strong bull trend on 4 hr timeframe

- Price tested structural resistance (fake out)

- Local support between .50 and .618 Fibonacci

- Stochastics projected downwards

- RSI respecting downwards resistance

- EMA’s holding price support

- Noticeable increase in volume

- VPVR decreasing in volume of transactions

ZRX has had an impressive run from accumulation zone but now looks very over extended, a consolidation or correction phase is highly probable and we do have some early signs that suggest so.

Price has tested structural resistance; this could be the potential local top due to wicks as sellers are very strong in this area at current given time. Local support is between the .50 and .618 Fibonacci level, this is a good retracement zone if price where to correct from local top.

The stochastics is currently projected downwards, we do have stored momentum in this direction if this bearish divergence where to play out. RSI is currently respecting its downwards resistant line, clearly diverging from price which puts more emphasis on the bearish divergence…

EMA’s is clearly holding price as support, we are still is this parabolic rise until we break the EMA’s decisively as this will negate the market structure.

Volume is currently above average, we do have noticeable increase in bull volume, if price breaks structural resistance, bull volume will then need to sustain to avoid the chances of being a fake out.

The VPVR is quite interesting as it clearly shows a decrease in volume of transactions from current structural resistance and local support. This shows us that price maybe even more probable to retrace to local support due to the lack of resistance being provided by the VPVR.

Overall, IMO, ZRX needs to correct from current levels as this parabolic trend has been over extended, we do have clear signs of a bearish divergence playing out. We may consolidate to cool of indicators or we may correct to local support, putting in a higher low in the trend.

What are your thoughts?

Please leave a like and comment,

And remember,

“Trade the market in front of you, not the one you want!” – Scott Redler

BTCUSD Bear Flag | $8000 Psychological Level Hello Traders!

Another update today, which will be on Big Baddy BTC, forming a potential classic bear flag and is trading at $8000 psychological level. It is highly probable that this bear flag comes to fruition as the lower trend lend is being tested for the third time…

Points to consider,

- Trend in a bearish structure

- Lower resistance at .236 Fibonacci Level

- Stochastics in lower region

- RSI in lower regions but not extremely oversold

- EMA’s giving price resistance

- Volume below average

- VPVR showing low volume of transactions below bear flag

BTC is holding the $8000 psychological level on the lower trend line of this potential bear flag; we can say that this is one clean looking bear flag…

The trend is overall bearish as it has been putting in consecutive lower highs; no new higher lows have been established after initial bear break from upper descending triangle. Local resistance is at the .236 Fibonacci Level, which is inside bear flag, BTC has tried to break above it multiple times but has failed.

Stochastics are currently trading in the lower region; it can stay in this area for an extended period of time until we see a clear cross to project upside. The RSI is also trading in the lower region, but not overly oversold, it has cooled off from recent lows, a bounce from this current bear flag support line can further cool of the RSI.

The EMA’s providing price with resistance, however does look weak as price has been trading through it within this bear flag. Volume is below average, we need to see an influx of bear volume if this bear flag was to come to fruition.

The VPVR is interesting as it shows low levels of transactions below the bear flag, price is more probable to reach technical target due to low levels of transactions (resistance) posed by the VPVR…

Overall, IMO, it is highly probable for this bear flag will come to fruition as BTC is established in a bear trend. The technical target of $6500 has historical significance; it would make a lot of sense if BTC were to retest those levels…

What are your thoughts?

Please leave a like and comment

And remember,

“What seems too high and risky to the majority generally goes higher and what seems low and cheap generally goes lower.” – William O’Neil

RENBTC Major Resistance Broken|Key Support Tested|Continuation?Hello Traders!

Today’s update will be on RENBTC , bearish divergence into daily support, which held successfully, will we see a continuation in this bull trend? Volume needs to sustain otherwise a break of daily support can come to fruition…

Points to consider

- Trend bullish on 240 timeframe

- Major daily support tested

- Structural resistance in above red zone

- EMA’s giving price resistance at current given time

- Stochastics projected upwards

- RSI bouncing of local support

- Volume needs to sustain

RENBTC has broken a very key structural resistance level which now has held support (S/R Flip) upon a bearish divergence coming to fruition, a correction was required. The trend overall is bullish after consecutive higher lows being in place, the most recent potential higher low comes to fruition due to heavy technical confluences from the .38 Fibonacci level and the daily support.

Structural resistance for REN is in the upper red region, the VPVR shows a steady decline in transactions towards that resistance. This tells as that if price sustains above current support, then bulls are more probable to reach next resistance zone (red box) due to the lack of transactional resistance being provided by the VPVR…

The EMA’s are currently giving price resistance as it recently crossed bearish , price needs to break above to eclipse local highs, this will then give the EMA’s a more bullish bias and support price in continuation of the bull trend.

Stochastics are currently projected upwards; this tells us that there is stored momentum for a continuation. The RSI is currently bouncing of support after converging from price ( bearish divergence). It needs to break the down sloping resistance when it gets closer to its apex…

Volume is very key here; we need to see a sustained increase in bull volume after this major structural resistance break to ensure that we are not in a false break. If price fails to hold above, then the whole market structure will be negated…

Overall, IMO , REN has a good chance of continuing this bull trend; my only emphasis will be on volume , which has to increase to eclipse local highs…

What are your thoughts on RENBTC?

Please leave a like and comment

And remember,

“Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win by losing money.” – Ed Seykota

BTCUSD Rising Wedge? Retest Of Local Support?Hello Traders!

Today’s chart update will be on BTC’s short term projection on the hourly time frame. We have a potential rising wedge that needs to be confirmed with a third touch on the lower trend line. A break from this formation is bearish, if it plays out; we are more probable to test lower support, where the triple bottom was established.

Points to consider

- Price respecting trend line

- Triple Bottom as lower support

- Local resistance at $8690 region

- Stochastics neutral

- RSI respecting trend line

- EMA’s giving price resistance

- Volume is below average

- VPVR, low volume of transactions between local and major structural resistance

BTC with a high degree of probability could be forming a rising wedge that breaks down to a technical target of lower support, the triple bottom region. Price is respecting trend line, we need a third touch for confirmation which will put more merit on this wedge formation.

Local resistance is a key area that needs to be broken for a bullish bias; if this level is broken we are technically more likely to reach major structural resistance as the VPVR shows very low levels of transaction between the two segments, in other words, low levels of resistance…

The Stochastics is currently neutral, no clear direction of where momentum is stored. The RSI however is respecting its trend line; a bounce from here will help put more emphasis on the formation of the rising wedge.

EMA’s both are giving price resistance at current given time, although does look weak as BTC has been trading through it. Volume on the other hand is also weak, below average; we need to see an increase in sustainable volume to confirm a break out whether it is a bullish or bearish break…

IMO, a potential breakdown to local support, the triple bottom, is more likely if this holds to be a true rising wedge. If we break local resistance, then this formation will be negated, I will then have a bullish bias, BTC will more likely retest its major structural resistance.

What are your thoughts?

Please leave a like and comment

And Remember

“The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliché, but the single most important reason that people lose money in the financial markets is that they don’t cut their losses short.” – Victor Sperandeo

ETHBTC Testing Critical Resistance Level!Hello Traders!

Today’s chart update will be on ETHBTC which is testing a very critical resistance level in its established 4hr time frame bull trend. A break of this local resistance will increase the probabilities of testing major structural resistance, presenting a potential trade set up.

Points to consider,

- Trend line being respected

- Price testing local resistance

- Support found at .50 Fibonacci

- Stochastics in upper region

- RSI testing its resistance

- EMA’s supporting price

- Volume increasing

- VPVR showing a decrease in volume of transactions

ETH is looking very bullish as it respects its trend line, confirmed by three touches; this trend line comes perfectly into local resistance. This local resistance is a very critical level as a break will continue this bullish bias; a rejection will negate market structure, putting in a potential triple top.

After initial bull impulse, support was found at the .50 Fibonacci Level, being in confluence with the trend line, this area was very strong for bulls who were able to continue the trend.

The Stochastics is currently trading in the upper region where it can stay for an extended period of time; there is no evidence of downside momentum at current given time. The RSI is currently testing it resistance, coming closer into its apex, a move will be imminent very shortly.

EMA’s are holding price support as it comes into local resistance; overall support is very strong for the bulls as the EMA’s are in confluence with the trend line. Volume itself is showing an increase, this needs to continue upon the break of local resistance to avoid the chances of a fake out.

The VPVR visibly shows a decrease in volume of transactions between the two segments of local resistance and major structural resistance. This tells us that bulls will have a greater probability of reaching technical target due to the low level of resistance from the VPVR.

Overall, IMO, a break from this critical level will be extremely bullish and will give us a trading opportunity.

A break bearish from trend line will negate market structure and a retrace back to the .50 Fibonacci will be more probable…

What are your thoughts on ETHBTC?

Please leave a like and comment,

And remember,

“Hope is bogus emotion that only costs you money.” – Jim Cramer

BATBTC Bullish Divergence|Falling Wedge| EMA Cross Bullish! Hello Traders!

Today’s chart update will be on BATBTC, very similar to XRP’s chart which I posted a couple days ago. BAT’s had a falling wedge breakout which is in confluence with a potential bullish divergence. It needs to break major structural resistance to confirm the daily trend change…

Points to consider

- Visible Bullish Divergence

- Price testing major structural resistance

- Macro trend change

- EMA’s cross bullish

- Stochastics projecting upwards

- RSI respecting up trend

- VPVR showing increasing volume of transactions

- Volume overall increasing

BAT’s chart is looking extremely bullish as its forming a well-established bullish divergence where price makes consecutive lower lows whilst the RSI makes higher lows. A very key level for BAT to break is the current resistance it’s testing; this area is very strong as it is in confluence with the 1.414 Fibonacci Extension.

BAT needs to break current resistance as it will allow it to put in a new higher low, this will confirm the daily trend change which is extremely bullish!

The EMA’s have already crossed bullish and is supporting price coming into resistance, this is a very strong indicator for the bulls as the EMA’s have been giving BAT major resistance way back in early May 2019.

Stochastics is projecting upwards momentum; technically it can stay in this area for an extended period of time. The RSI is respecting it’s upwards trend, and mentioned earlier, it is clearly diverging from price, which further supports the bullish divergence.

The VPVR is showing increasing volume of transactions after structural resistance, if price sustains above resistance despite heavy volume of transactions, then this is considered to be another extremely bullish sign.

Volume itself is showing an increase after a long steady decline, this needs to sustain to confirm that the break is an actual break and not a fake out…

Overall, IMO this is a very good trade setup if and when BAT breaks this current resistance and puts in a new higher low, confirming the trend change…

What are your thoughts?

Will BAT test upper Fibonacci Extension levels? Or will price fake out and reject from current level?

Please leave a like and comment

And remember,

“The obvious rarely happens, the unexpected constantly occurs.” – Jesse Livermore

Blue Sky Breakout | Bearish Divergence | Return to Trend line !Hello Traders,

Today’s chart worth taking a look at will be AFTERPAY which is in a strong bull market respecting its trend line and is currently in blue sky breakout mode. A return to its trend line will post a good opportunity to long this instrument!

Points to consider,

- Bullish trend on all time frames

- Major support at .618 Fibonacci Level

- Blue Sky Breakout

- Stochastics projecting downwards

- RSI respecting downwards trend

- EMA’s supporting price

- Strong volume

- VPVR showing high levels of transactions

APT’s market structure is very strong with consecutive higher highs in place, price continues to respect its well establish trend line...

A retest of this trend line is highly probable as the chart shows us that we have a potential bearish divergence forming where price makes consecutive higher highs whilst the RSI makes consecutive lower highs.

Major areas to keep an eye on will be the .618 Fibonacci Level and the green highlighted area on the trend line, Price is more probable to test the trend line before a continuation. However if price fails and breaks down, then a retracement to the .618 Fibonacci will be highly probable before a continuation up.

The RSI is diverging from price (Bearish Divergence), common when we see buyers running out of steam, last time this happened, price returned to trend line before another leg up. The Stochastics is currently projecting downwards momentum; we still have room for further downside if this bearish divergence was to play out.

EMA’s are currently supporting price, if buyers are able to hold this area then the divergence will be negated and a continuation of the breakout will be more probable. We have strong volume although slightly declining and an increase in bear volume is currently in fruition. The VPVR shows a consistent level of high transactions, this tells us that there are many buyers and sellers looking at AFT at current given time.

The probability of AFT correcting from current level is quite high if this bearish divergence comes to fruition. A good entry point will be on the trend line, however if it breaks, then the whole market structure will be negated… we then need to watch the .618 Fibonacci Level…

What are your thoughts on AFT? Will this bearish divergence come to fruition and give us an opportunity to enter on this bull trend?

Please leave a like and comment

And remember,