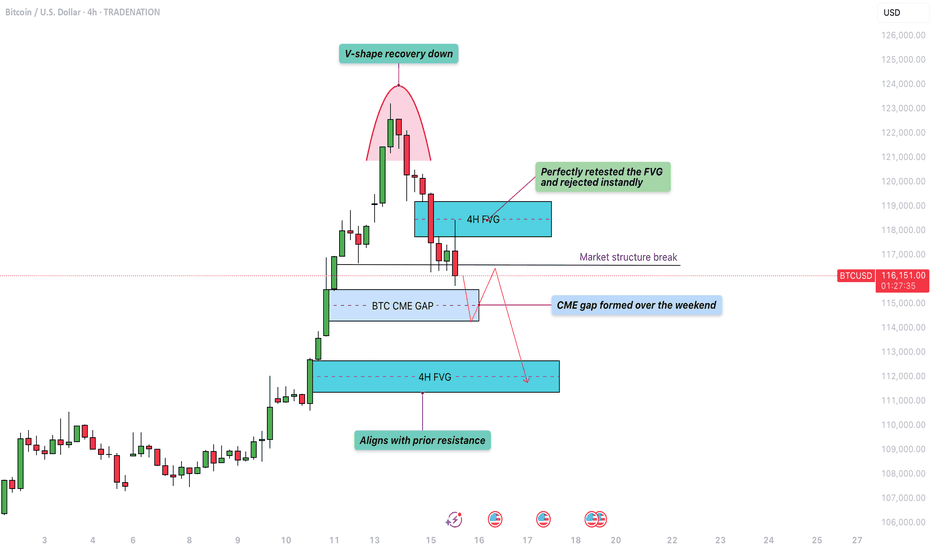

Bitcoin - V-shape recovery down towards the 4h FVG at $111.000?The move began with a strong rally that peaked near the $123,000 level. After hitting that high, Bitcoin quickly reversed and sold off aggressively, forming a classic V-shaped pattern. This type of formation typically indicates a strong shift in momentum, where bullish control is quickly overtaken by sellers, leading to swift downward movement.

4H bearish FVG

Shortly after the initial drop, Bitcoin made a retest of the bearish 4H FVG (Fair Value Gap) around the $119,000 to $120,500 zone. This fair value gap was created during the sharp move down and represented an area of inefficiency in price. The chart shows that price moved back into this zone and was “perfectly retested,” getting rejected almost immediately. This rejection confirmed that sellers are respecting this imbalance, turning it into a short-term resistance level.

Market structure

As the price failed to reclaim the fair value gap and continued lower, it broke the market structure at around $117,000. This break suggests that the previous higher low was taken out, signaling a bearish shift in the intermediate trend. The market structure break often acts as confirmation that buyers are losing control and lower prices are likely.

CME gap

Adding to the downside pressure is the CME gap, labeled as the "BTC CME GAP" on the chart. This gap spans from roughly $114,000 to $116,300 and was formed over the weekend when the CME (Chicago Mercantile Exchange) was closed. Historically, Bitcoin has shown a tendency to "fill" these gaps by revisiting the price levels within them. The current price action has already started to dip into this region, which could suggest further downside to complete the gap fill.

Bullish 4H FVG with support

Finally, the chart hints at the potential drop to the lowest 4H FVG and previous resistance, located just above $111,000. This fair value gap aligns closely with a prior resistance level from earlier in the month, making it a logical magnet for price if selling pressure persists. It represents a confluence zone where buyers may look to step in again, especially if the CME gap is filled and the market is searching for support.

Conclusion

In summary, Bitcoin is showing bearish technical signs following a V-shape top and a strong rejection from the 4H FVG at $120,000. The break of market structure and ongoing fill of the CME gap suggest that further downside toward the $111,000 level is a strong possibility. Traders should watch closely for price reaction in that lower fair value gap zone, as it could serve as a critical area for a potential bounce.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like and leave a comment, I’d love to hear your thoughts!

Vshape

"Cuban" Missile Crisis 2022The Ukraine crisis and threats with nuclear war, I see as we are getting closer to the bottom.

There are many similarities with Cuban missile crisis in October 1962, month when market bottomed out.

To start accelerated run for BTC from that 20k accumulative range , funding rate should be way more high in negative(more shorts opened then longs), so V shape down to 16k-GOLDEN POCKET, is the way I see to become bullish again.

Dump to 16-17k range and third touch of bullish divergence on RSI

FRACTAL ANALYSIS. V SHAPE RECOVERY. 20% CHANCE. SEE DESCRIPTION.So, i have something to share with you. This is just my vision. JUST MY FANTASY. Let's speak about it now.

***WARNING*** YOU WILL BECOME A MOON BOY/GIRL, SO REMEMBER THAT IT IS ONLY 20% CHANCE.

I used fractal analysis (took a fractal from covid dump and V shape recovery that happened in 2020), to predict what can possibly happen. During Covid dump It was absolutely the same - unpredicted conditions on the markets and bad macro economic factors in general. During 2022 dip in Crypto people has been expecting the CRASH OF FINANCIAL SYSTEM, but in general we received 9.5% CPI rates and this is it. Same was with Covid dump. People has been expecting apocalypses, but economy recovered in 6 months and a lot of people who bought crypto during these dip became a millionaires just in one year (imagine ETH for $80).

According to this theory, i think, that even stock2flow model can be still correct. Just timeframes have been changed.

So lets speak about the cycle. I think, if we will see this option playing out, than overall bullish trend of 2021 was just a pre-bullrun. Real bullrun in this case should happen in 2023 when BTC will hit $300K+ price target. THE FOMO WILL BE ABSOLUTELY UNBEARABLE. And this will be the end of this cycle and we will see another bear market (apx. since september 2023 till september 2024) with an absolute bottom for 1BTC at $70k-80k.

And just enjoy how this fractal perfectly matches everything. So according to this model - we will see $60K+ for 1 BTC at the end of this year. And $300K+ for 1 BTC in the next 12 months. Crazy? yes. Possible? Yes. Will it happen? I would say yes with a 20% chance 😁

NDX Nasdaq 100 V-Shaped Recovery ?Federal Reserve policymakers will raise interest rates in March but keep options open in the face of inflation outlook and the pandemic still ongoing.

Until March theories suggest that we can still see a V-Shaped Recovery in the stock market.

Looking forward to read your opinion about it.

$TOMOUSDT$TOMOUSDT looking very bullish with V shape recovery once break some resistance line in btc pair and break 4$ decisively then $TOMO very likely to do a $Sol here

K-Shaped Recoverymany people still thinks we're in a V-Shape recovery , but it's a K-Shaped recovery in progress right now.

which is one of last thing you want to see in a major economy.

dumb money goes into many worthless tech companies and spike their market caps at unbeliavable levels. (just like before 2000 dotcom bust)

on the otherside industrial sectors are not showing any robust recovery signs.

from this perspective this market is totally unstable now and crash is inevitable.

When We Mistake the Map for the TerritoryNow that we know the virus is not going to get even remotely close to what the models were projecting (for now). I think it’s relevant to compare this V-shaped price recovery to the December 18 market plunge.

Dec. 03 peak to Dec. 24th trough = we plunged 17.10% (in 3 weeks)

From that bottom to Jan. 18 peak = we rebounded 14.74% (25 days)

-->We recuperated about 86.5% of that percentage loss

Feb. 19 peak to March 23rd trough = we plunged 35.72%

From that bottom to our April 20th peak = we rebounded 31.5% (also 25 days!)

-->We recaptured about 88% of that percentage loss

*Now why did I choose these specific dates?? Answer: Because both April 20 (2020) and Jan. 18 (2018) are the peaks we made before we deviated from that “V-shaped recovery channel”

Conclusion:

In both V-shaped recoveries, we recapture roughly 87% of that % loss in “coincidently” 25 days as well. And then deviated out of the V-shaped channel, tested the nearest support for confirmation, and tipped off a new bull market. It probably boils down to some sort of market psychology that repeats in these types of circumstances...

Now unlike the conventional belief right now, why is it all of sudden relevant and perhaps helpful to compare this crash to December 2018’s?

1)it’s the most recent liquidity crisis we’ve had

2)it was an overreaction to the potentiality of something

-fear that we’re due for a recession because this bull run is much longer than its predecessors

-this cycle has lasted for 10 years whereas the average is 4.5 years. This does not constitute a recession!

-However, this bad logic no longer mattered once the fear becomes a contagion

3)The unraveling effect. This begins when people are provoked(by media) to look for these assurances and “oddly enough” they find these assurances

As the wise Nassim Taleb says when describing cultural products, "It is hard for us to accept that people do not fall in love with works of art only for their own sake, but also in order to feel that they belong to a community. By imitating, we get closer to others-that is, other imitators. It fights solitude."

Just think about it for a minute. If you were really to boil down and I mean really...The Covid crash, Dec. 2018 crash, Feb. 2018 “Peak”, Dot Com tech bubble, 01’ panic were all triggered by nothing more than a cultural product. How do contagions come about? We as humans scorn the abstract, we hate uncertainty. What we have is an aptitude for reduction. We find patterns where there are not (at first). Where can these patterns be found? What does the current language around me sound like? Most people just accept this as truth but all it is, is majority opinion that becomes so widely accepted that it becomes reality.

This according to the book Black Swan is called “platonicity” which is our tendency to mistake the map for the territory. We focus on the pure and well-defined forms, the overgeneralizations, the things that make sense. And where things get dangerous is when, “...these ideas and crisp constructs inhabit our minds, we privilege them over the less tractable structures

Platonicity is what makes us think that we understand more than we actually do. Now obviously this does not happen everywhere. Only in specific applications are these models, and constructions, these intellectual maps of reality wrong. “These models are like potentially helpful medicines that carry random but very severe side effects...The platonic fold is the explosive boundary where the platonic mindset enters in contact with messy reality where the gap between what you know and what you think you know becomes dangerously wide. It is here that the Black Swan is produced.” (Nassim Taleb)

SPX at ATH! Which strategies to use now?Hello traders and investors! Let’s do a complete Multi Time Frame Analysis (MTFA) on SPX today! We are going to look at the charts, then we will discuss about strategies.

It did a new ATH today (close), which is impressive! The U.S. market is very strong, and it seems the bears can’t stand a chance. There’s no sign of a pullback ahead , and it seems SPX just fulfilled a chart pattern named V shape recovery .

Now we are near a natural resistance zone (red line), and SPX still must do a proper breakout from the black line (pre covid-19 ATH). But SPX is trading above the 21 ema, so, if it will do a pullback in the future, it has the 21 ema and the purple line as important supports levels.

Now, let’s see the daily chart:

The only thing that bugs me here is the decreasing volume. Another important thing to keep in mind is the purple trendline , which has been guiding the price for a while.

If SPX loses its trendline, the red line at 3280 is a target for a pullback. But again, it would be just a pullback, not a reversal. When we see a pullback, we buy near its supports. Very simple.

But until now, there’s nothing indicating there’s a pullback ahead. Let’s see the weekly chart for a complete analysis:

Since we are near a natural resistance, it is never a good idea to buy. Also, is not interesting to short, as the Risk/Reward ratio is not good. Now is the time to manage positions. The weekly chart suggests that a pullback to the purple line around 3232 would be acceptable.

Now, strategies:

If you are long, just book your profits if SPX loses the purple trendline in the daily chart. Another good idea is to book your profits if SPX closes under the previous candlestick low, this is a trailing stop.

Or you could just wait for a bearish pivot in the hourly chart. All these strategies are very good to manage your positions in the most intelligent way possible.

Then you may just buy SPX again after the pullback, when it gets close to a support. This will eventually happen and is better be prepared!

Also, if you liked these techniques, support this idea! And I invite you to follow me for more analyses. Every day, after the market closes, I’ll be here to share a few ideas with you.

Recent public trades (links below):

XP: +30%

AAPL: +10%

LB: +45%

UKOIL: +62%

Congratulations to all of you, my dear subs, who believed in my trading methodology, and challenged the world by being a bull! We deserve to celebrate!

BECOME A MEMBER!

Remember to follow me , I’m a trader who uses the classic technical analysis (barely any indicator, just the candles and the volume). Like this idea if it helped.

Thank you very much.

* LIKE this idea and FOLLOW me, because:

- Here, you will see clean charts;

- Trades with clear risk management;

- The best of Dow Theory, Price Action and Candlestick psychology;

- Chart patterns with statistics. *

* My name is Nathan, I'm a trader and portfolio manager and I'm here to LEARN. Leave your COMMENT and FOLLOW me to keep in touch. *

S&P 500 U Shape Recovery 2020-2022The impossible "V-shaped"

The year 2020, a bad memory quickly forgotten? No, warn more and more economists, alarmed by the violence of the shock in the first half. They expect a slow recovery, provided that a second wave of the new coronavirus does not strike.

The IMF has also made it clear that, despite the expected rebound, world GDP in 2021 would come out cut by 6.5% compared to what was expected before the pandemic.

Some sectors are affected for a long time, especially in services. Perfect example: tourism and travel. No catching up possible for empty rooms, meals never served, planes nailed to the ground. Did IATA, the international air transport association, not warn that it did not expect to return to normal before ... 2023?

In industry, factories face many health restrictions. Farmers all over the world are struggling due to the lack of foreign workers.

Exit therefore, the "V" scenario that some people were still hoping for in February. Rather, it is a "U-shaped" scenario that emerges at best, with several months of recession before the economy recovers. See a "W" with alternating rebounds and relapses. Or, worse yet, an "L" with depressed activity for a very long time.

NASDAQ | Parabolic Curve | V-Shape Recovery | Blow-Off Top Todays Chart – Nasdaq 100 Index – Trading in blue-sky territory respecting the parabolic curve.

Points to consider:

- V-shape recovery

- Respecting parabolic formation

- Bullish trend- consecutive higher lows

- Fibonacci extension target approaching (4.236)

- RSI above 50

- RSI bearish divergence

- Multi confluence support (200 EMA + .618 Fibonacci retracement + structural support)

Conjuring a V-shaped recovery, NDX is looking to put in a blow-off top as the finale to what has been quite the euphoric bull run.

Despite the 30% market crash, NDX continues its higher low projection, respecting the parabolic formation as it approaches the 4.236 Fibonacci extension target.

The RSI is above 50, showing strength in the market immediate market, however, there is a technical bearish divergence indicating weakness in the forthcoming months.

Historically, NDX has retraced to the 200 EMA during bear markets which is indicative of a reversal to the 200 EMA being eventual. Furthermore, the .618 Fibonacci retracement (pulled from the 4.236 extension) is in confluence with structural support, thus a retrace to the support zone is probable.

Overall, in my opinion, Nasdaq needs to put in reversal price action (lower highs, lower lows) to validate a short trade to the technical target below.

Have you not seen enough?Why won't this V also test its high?

Weekly chart still has juice and if we beat one more key area of resistance, there is NO reason why this won't be testing its all time high...

I grabbed 07/06 335 calls before the bell today.

Fed's FOMC Repo's stop at nothing clearly...And to be honest, I think COVID is OVER - Riots validated this. I just feel very bullish on the S&P.

Cheers.

Online Retail. V-Shaped recoveryIt is rare to see a real V-shaped recovery, IBUY will most likely test previous all-time-high.

$54 to $56.5 is an important range. To see it more clearly, just zoom out, or use a weekly chart.

OBV has been indicative... as we cross above or below the 200sma, we can see OBV start a trend, either down or up, in conjunction with the 200sma. After our most recent cross above the 200sma, OBV is reaching 1-year high.

Watching closely for a new breakout, which will possibly be followed by a re-test the previous highs.

IBUY top-10 portfolio holdings with weight %:

CHWY (4.89%)

STMP (4.79%)

NFLX (4.01%)

PETS (3.83%)

PTON (3.56%)

GRUB (3.48%)

AMZN (3.35%)

CHGG (3.21%)

UBER (3.20%)

FLWS (3.11%)

When We Mistake the Map For the Territory Now that we know the virus is not going to get even remotely close to what the models were projecting (for now). I think it’s relevant to compare this V-shaped price recovery to the December 18 market plunge.

Dec. 03 peak to Dec. 24th trough = we plunged 17.10% (in 3 weeks)

From that bottom to Jan. 18 peak = we rebounded 14.74% (25 days)

-->We recuperated about 86.5% of that percentage loss

Feb. 19 peak to March 23rd trough = we plunged 35.72%

From that bottom to our April 20th peak = we rebounded 31.5% (also 25 days!)

-->We recaptured about 88% of that percentage loss

*Now why did I choose these specific dates?? Answer: Because both April 20 (2020) and Jan. 18 (2018) are the peaks we made before we deviated from that “V-shaped recovery channel”

Conclusion:

In both V-shaped recoveries, we recapture roughly 87% of that % loss in “coincidently” 25 days as well. And then deviated out of the V-shaped channel, tested the nearest support for confirmation, and tipped off a new bull market. It probably boils down to some sort of market psychology that repeats in these types of circumstances...

Now unlike the conventional belief right now, why is it all of sudden relevant and perhaps helpful to compare this crash to December 2018’s?

1)it’s the most recent liquidity crisis we’ve had

2)it was an overreaction to the potentiality of something

-fear that we’re due for a recession because this bull run is much longer than its predecessors

-this cycle has lasted for 10 years whereas the average is 4.5 years. This does not constitute a recession!

-However, this bad logic no longer mattered once the fear becomes a contagion

3)The unraveling effect. This begins when people are provoked(by media) to look for these assurances and “oddly enough” they find these assurances

As the wise Nassim Taleb says when describing cultural products, "It is hard for us to accept that people do not fall in love with works of art only for their own sake, but also in order to feel that they belong to a community. By imitating, we get closer to others-that is, other imitators. It fights solitude."

Just think about it for a minute. If you were really to boil down and I mean really...The Covid crash, Dec. 2018 crash, Feb. 2018 “Peak”, Dot Com tech bubble, 01’ panic were all triggered by nothing more than a cultural product. How do contagions come about? We as humans scorn the abstract, we hate uncertainty. What we have is an aptitude for reduction. We find patterns where there are not (at first). Where can these patterns be found? What does the current language around me sound like? Most people just accept this as truth but all it is, is majority opinion that becomes so widely accepted that it becomes reality.

This according the book Black Swan is called “platonicity” which is our tendency to mistake the map for the territory. We focus on the pure and well-defined forms, the overgeneralizations, the things that make sense. And where things get dangerous is when, “...these ideas and crisp constructs inhabit our minds, we privilege them over the less tractable structures

Platonicity is what makes us think that we understand more than we actually do. Now obviously this does not happen everywhere. Only in specific applications are these models, and constructions, these intellectual maps of reality wrong. “These models are like potentially helpful medicines that carry random but very severe side effects...The platonic fold is the explosive boundary where the platonic mindset enters in contact with messy reality where the gap between what you know and what you think you know becomes dangerously wide. It is here that the Black Swan is produced.” (Nassim Taleb)

GBPNZD : catch weekly up swingWe can see an attempt to break the bottom of the channel and its failure with a V-shape .

Now price is holding right above channel bottom .

Zooming into daily time frame we can see a triangle formed.

So i want to be where price is moving fast in one direction , Therefore i'll try to buy inside day before the break happens .

* If you start buying on intraday support you can catch the low of the triangle .

Best of luck :-)

SQ: V-Shape Trend Reversal Breakout FormingI watched SQ rise almost 60% from the market bottom to their peak in late February, and then consolidate down back 25%. They're a great company that's going to be the future of financial payments (watch out PYPL), and they've pioneered making credit card purchases for the common man a reality. Their peak in late 2018 was just over $100 a share, and that's almost a 45% upside from today just to make a double top! I see everyone and their grandmother using Square POS and CashApp in every social circle around me in my life. This company is going to rebound like a freight train when their new uptrend eventually settles into the share price, and I intend to be holding when that happens.

Their 50 day moving average is in the process of bouncing back over the 200 day with the price above all trailing averages and banging on the top of the Bollinger band. MACD is turning positive with a strongly rising histogram, and it seems the recent market volatility is all that was needed to start the rally again for them. RSI is above 50 and rising but not yet overbought, so there's still time to get on this freight train. ADX is showing a sharp trend reversal with DI+ rising over DI- and ADX and DI- falling below them all for a possible V-shaped reversal. Rate of change is rising and confirming the bottom of the V on the price chart. Money flow indicates that investors were already buying the dip before last week's hot rally, so they're happy, and I will be when this trend picks up full steam out of the station.