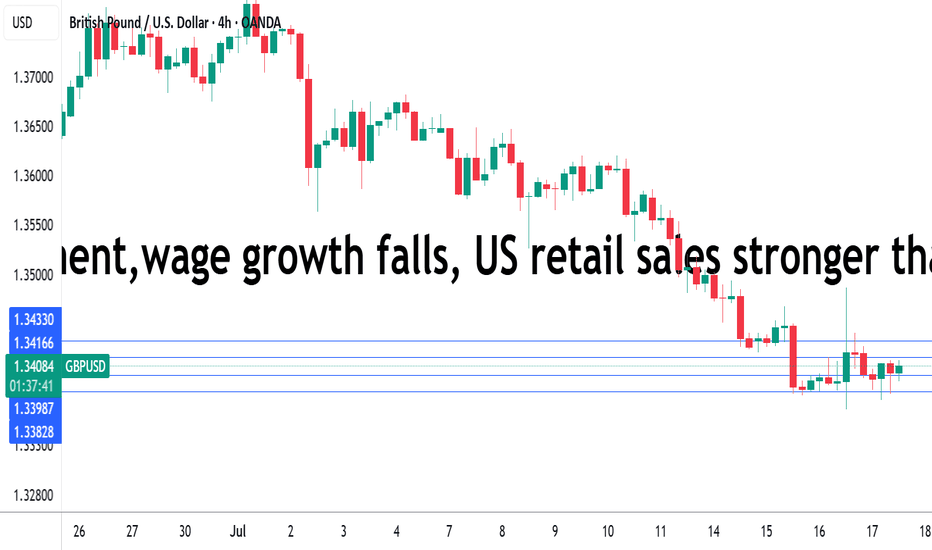

UK employment,wage growth falls, US retail sales shineThe British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day.

Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly revised from 109 thousand, easing concerns of a significant deterioration in the labor market.

Wage growth (excluding bonuses) dropped to 5.0% from a revised 5.3%, above the market estimate of 4.9%. The unemployment rate ticked up to 4.7%, up from 4.6% and above the market estimate of 4.6%. This is the highest jobless level since the three months to July 2021.

The latest job data will ease the pressure on the Bank of England to lower rates, as the sharp revision to the May payroll employees means the labor market has not deteriorated as much as had been feared. Still, the employment picture remains weak and the markets are expecting an August rate cut, even though UK inflation was hotter than expected in June.

US retail sales bounced back in June after back-to-back declines. Consumers reacted with a thumbs-down to President Trump's tariffs, which took effect in April and made imported goods more expensive.

The markets had anticipated a marginal gain of just 0.1% m/m in June but retail sales came in at an impressive 0.6%, with most sub-categories recording stronger activity in June. This follows a sharp 0.9% decline in May.

The US tariffs seem to have had a significant impact on retail sales, as consumers continue to time their purchases to minimize the effect of tariffs.

Consumers increased spending before the tariffs took effect and cut back once the tariffs were in place. With a truce in place between the US and China which has slashed tariff rates, consumers have opened their wallets and are spending more on big-ticket items such as motor vehicles, which jumped 1.2% in June.

Wagegrowth

RBA expected to pause, US nonfarm payrolls rises slightlyThe Australian dollar has started the week with slight gains. In Monday's European session, AUD/USD is trading at 0.6464, up 0.21%.

The Reserve Bank of Australia is expected to hold interest rates at 4.10% when it meets on Tuesday and a rate hike would be a huge surprise. The central bank has paused for two straight meetings and the odds of a third pause stand at 86%, according to the ASX RBA rate tracker.

The most important factor in RBA rate policy is of course inflation. In July, CPI fell to 4.9% y/y, down from 5.4% y/y and better than the consensus of 5.2% y/y. Inflation is moving in the right direction and has dropped to its lowest level since February 2022.

A third straight pause from the RBA will likely raise expectations that the current rate-tightening cycle is done but I don't believe we're at that point just yet. This is Governor Lowe's final meeting and he is expected to keep the door open to further rate hikes. Incoming Governor Bullock stated last week that the RBA "may still need to raise rates again", adding that the Bank will make its rate decisions based on the data. The RBA isn't anywhere near declaring victory over inflation and has projected that inflation will not fall back within the 2%-3% inflation target until late 2025.

The week wrapped up with the US employment report for August. The Fed will be pleased as nonfarm payrolls remained below 200,00 for a third straight month, rising from a revised 157,000 to 187,000. Wage growth fell to 0.2% in August, down from 0.4% in July and below the consensus of 0.3%. The data cements a rate hold at the September 20th meeting, barring a huge surprise from the CPI report a week prior to the rate meeting.

AUD/USD is testing resistance at 0.6458. Above, there is resistance at 0.6516

There is support at 0.6395 and 0.6337

Aussie under pressure ahead of wage growth releaseThe Australian dollar started the week by dropping 50 basis points but has recovered most of these losses. In the European session, AUD/USD is trading at 0.6488, down 0.12%.

It has been a rough ride lately for the Australian dollar. The currency fell 1.17% against the US dollar last week and has plunged 3.39% in the month of August.

Australia's inflation rate remains elevated at 6%. The RBA has aggressively tightened rates, but high wage growth, courtesy of a tight labour market and high inflation, remains a key driver of inflationary pressures. Wage growth accelerated to 3.7% q/q in the first quarter, up from 3.3%, the highest level since the third quarter of 2012. The consensus for the second quarter stands at 3.7%. On a monthly basis, wage growth is expected to rise 0.9%, higher than the Q2 reading of 0.8%.

A strong wage price index reading will make the Reserve Bank of Australia's fight against inflation that much more difficult. The RBA expects inflation to fall slowly, with a forecast of 3.25% by the end of next year and falling to the 2%-3% target only in late 2025.

The RBA will release the minutes of the August meeting on Tuesday. Market expectations were split ahead of the meeting as to whether the RBA would pause for a second straight month or hold rates at 4.10%. In the end, policy makers went for a pause but added that further tightening could be required, depending on the data. Tuesday's minutes may provide some insights into the decision to pause. RBA Governor Lowe said on Friday that the central bank was leaving the door open for further tightening but only expected to make "small adjustments to calibrate policy".

China's economic slowdown could spell trouble for Australia's economy and the ailing Australian dollar. China's exports and imports are down and the country is experiencing deflation. We'll get a look at Chinese Industrial Production on Tuesday, with a consensus estimate of 4.4% for July, unchanged from June.

There is resistance at 0.6607 and 0.6700

0.6475 and 0.6382 are providing support

USD/CAD shrugs after soft nonfarm payrollsThe Canadian dollar is showing limited movement on Friday. In the North American session, USD/CAD is trading at 1.3360, up 0.06%. Canadian and US job numbers were soft today, but the Canadian dollar's reaction has been muted.

After a stellar job report in June, the July numbers were dreadful. Canada's economy shed 6,400 jobs in July, compared to a 59, 900 gain in June. Full-time employment added a negligible 1,700 jobs, following a massive 109,600 in June. The unemployment rate ticked up to 5.5%, up from 5.4%.

Perhaps the most interesting data was wage growth, which jumped 5% y/y in June, climbing from 3.9% in May. The rise is indicative of a tight labour market and will complicate the Bank of Canada's fight to bring inflation down to the 2% target.

It was deja vous all over again, as nonfarm payrolls failed to follow the ADP employment report with a massive gain. In June, a huge ADP reading fuelled speculation that nonfarm payrolls would also surge, and the same happened this week. Both times, nonfarm payrolls headed lower, a reminder that ADP is not a reliable precursor to the nonfarm payrolls report.

July nonfarm payrolls dipped to 187,000, very close to June reading of 185,000 (downwardly revised from 209,000). This marks the lowest level since December 2020. The unemployment rate ticked lower to 3.5%, down from 3.6%. Wage growth stayed steady at 4.4%, above the consensus estimate of 4.2%.

What's interesting and perhaps frustrating for the Fed, is that the jobs report is sending contradictory signals about the strength of the labour market. Job growth is falling, but the unemployment rate has dropped and wage growth remains strong. With different metrics in the jobs report telling a different story, it will be difficult for the Fed to rely on this employment report as it determines its path for future rate decisions.

There is resistance at 1.3324 and 1.3394

1.3223 and 1.3182 are providing support

USD/JPY - yen slips after BoJ maintains policy settings The Japanese yen is trading at 1.36.83 in the European session, down 0.52%. USD/JPY fell 0.90% on Thursday but has recovered much of those losses today.

Bank of Japan Governor Kuroda didn't fire any final shots at his final meeting today. The BoJ maintained interest rates at -0.1%, where they have been pegged since 2016, and didn't make any changes to its to yield curve control (YCC) policy. Traditionally, BoJ governors do not make waves at their final meeting, but there was an outside chance that Kuroda might buck the trend. Kuroda has surprised the markets in the past, most notably when he widened the yield curve band in December and jolted the markets. This time, Kuroda stayed on the sidelines and the yen responded with losses as some investors were disappointed that he didn't tweak the YCC.

Kazuo Ueda takes over as BoJ Governor next month, and there is growing speculation that Ueda will change forward guidance and tweak or even abandon YCC, as distortions in the yield curve are damaging the bond markets. Ueda may not press the trigger when he chairs his first meeting in April but is expected to shift policy in the coming months.

The US releases its February employment report, highlighted by nonfarm payrolls, later today. The blowout January reading of 517,000 is widely seen as a blip, although the labour market remains surprisingly resilient, despite the bite of rising interest rates. The estimate for February stands at 205,000 and a wide miss of this figure on either side will likely shake up the US dollar. A weak reading would fuel speculation of a Fed pivot and likely weigh on the US dollar, while a strong figure would support the Fed's hawkish stance and should be bullish for the greenback.

The Fed will also be keeping a close eye on wage growth, in addition to nonfarm payrolls. Average hourly earnings are expected to rise to 4.7% y/y in February, up from 4.4% y/y in January. Higher wages drive inflation higher and an acceleration in wage growth would complicate the Fed's battle to curb inflation.

136.06 is under pressure in support. 13502 is next

136.86 and 1.37.90 are the next resistance lines

NZD/USD steady ahead of employment releaseThe New Zealand dollar has edged lower on Tuesday. In the North American session, NZD/USD is trading at 0.6462, down 0.10%.

New Zealand releases the Q4 employment report later today. Unemployment is expected to tick lower to 3.2%, following a 3.3% reading in the third quarter. This would mark the lowest unemployment rate in over four decades. Employment change is projected to have climbed 0.7% in Q4, after a 1.3% gain in Q3. What will be particularly interesting is wage growth, which has been robust and may have jumped as much as 9% y/y in the private sector. Wage growth has been contributing to high inflation, which the Reserve Bank of New Zealand is determined to bring down. Inflation was unchanged at 7.2% in the fourth quarter, more than three times the central bank's target of 2%.

The Federal Reserve concludes its 2-day meeting on Wednesday, and a 25-bp increase is priced at close to 100%. This doesn't preclude volatility in the currency markets, as a hawkish stance from the Fed, either in the rate statement or in comments from Jerome Powell, could provide a boost to the US dollar. The markets continue to talk about a rate cut late in the year due to the weakening US economy, but the markets could be in for a nasty surprise if the Fed reiterates its hawkish stance that rates will remain high until inflation is subdued. What the Fed has in mind after tomorrow's rate hike is not clear and investors will be hoping that the meeting will provide some clarity on that front.

0.6446 is a weak support line. The next support level is 0.6365

There is resistance at 0.6485 and 0.6532

Ramifications of the ending of the Gold Standard This chart shows the ramification of ending the gold standard. In short, we have been screwed. The coincidence is that they decoupled the dollar from gold when all 3 had a 1:1:1 Ratio... In other words, gold, Real Output and Wages increased by 100% since 1947-ish.. This should paint a good picture for many.