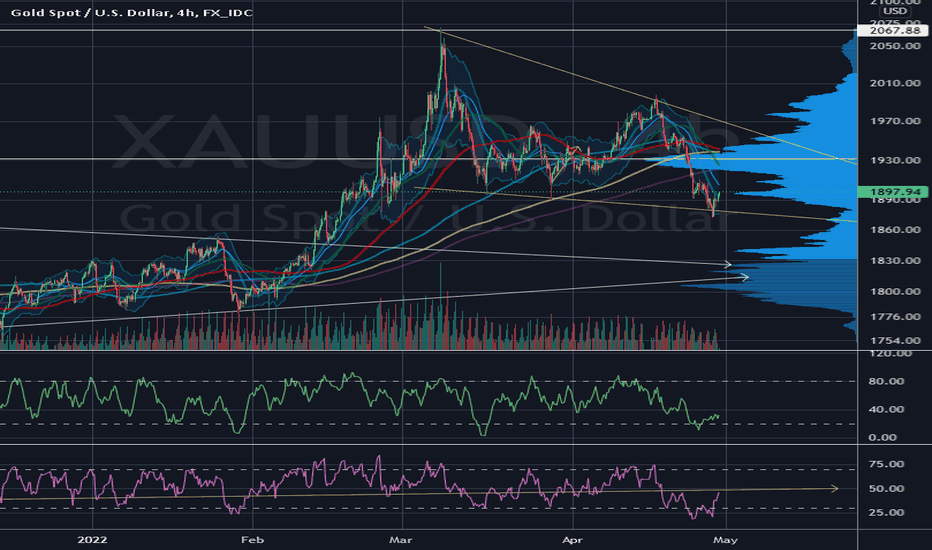

Gold Trading RangeGold may have found a floor today as both MFI and RSI indicators have bounce out oversold territory. Looking at the 4H chart, the MFI and RSI indicators have been a consistent indicator this year of telling when gold bottoms.

I have started entering into gold again but I will be trading with caution as the range is small and I am looking to liquidate my positions once we reach around 1950 range. There is a wedge pattern forming and it could be bullish but it will need momentum and volume to break out past 1950.

Forewarn, Dollar is still going strong and bonds are starting to look attractive so gold may continue to get pummeled. Gold and silver will need the dollar to come down for the two metals to start rising again.

Wallstreetsilver

Update on PMs vs Cryptos right now. Gold, Silver, BTC, ETHI designed this custom chart to monitor the relative strength of top precious metals gold and silver versus top cryptos bitcoin and ethereum, to their respective ratios.

As you can see, there is a compression triangle of sorts that has formed and looking to determine which way it will break out.

The bottom is supported also by this arc spanning a much larger time horizon.

The fundamentals favor PMs.

All this together leads me to believe we are headed UP in gold/silver relative to cryptos.

None of this is financial advice.

If you're seeking a platform to trade between cryptos and precious metals (and fiat if you like), check out Kinesis. Their gold and silver on blockhchain are real, allocated, audited, and deliverable (at a very reasonable price I might add). Really the best of the best. Check out their informational videos to learn more:

kms.kinesis.money

Silver not likely to go lower than it is right nowSilver ended last week not looking so good, and it has lead to a bad start for this week too. After breaking below $25 resistance, it has held above the next level of 24.75. It is likely to retest this zone again this week, so depending when you're reading this the title of this article may not be exactly true - but I'm really looking at where silver is likely to close at the end of the week. It's looking a bit oversold.

I like to look at the silver/usd chart, but when I want to take a deeper look at how silver is doing on a global scale, then I look at the silver/DXY. Makes sense, right? If you know what the dxy is. Anyway, that's the chart I have posted here. As you can see, silver has hit the bottom of an ascending wedge. These ascending wedges have been bullish for silver for the past decade at least. The price action could dip below this line throughout the week, but as long as it closes on Friday at or above this line, then it is considered to still be holding.

That's great news for silver apes. The only unfortunate part about this is that by this chart... it looks like we'll have to wait a while before silver breaks above $30. Like sometime in 2022. Actually that's not that bad. Probably will be here before we know it. For people stacking for decades, that's nothin

My bet on silver that wallstreetsilver movement will succesed.Charts show us on monthly and weekly candles clear bullish signs. Daily is a bit trading range from bigger picture. Anyway on 4H graph i marked the Fibonacci levels and daily plus 4H fibs. extensions, match on the same price. That price is a 27. In such conditions on the market i will place another limit order at price 26.550. My trade is based on probability that Silver will sooner reach price of 30 before we fall to 25. Although I personally believe that silver will this year break that 30 lever mark, mainly due to rising inflation and that movement Wall Street Silver. I highly recommended Wall Street Silver youtube Channel or Arcadia Economics for more information about silver market,miners.

Silver Support LevelSilver is now testing another important support level, seems to be holding.

It is also far from the MAs a short term up move is expected, the long term is unknown, but given the current economic situation there is a chance for higher moves later in the year.

A lot of paper shorts in the market, will they give in?