AUDUSD Hit our 5th Wave Target Zone after our Earlier Trade IdeaWe previously posted a trade idea using our Elliott Wave Indicator Suite on AUDUSD for potential Long 5th wave trade >>HERE<<

And it did just that!!

Great trade and using all of the indicators in our Elliott Wave Indicator Suite to setup a high probability 5th wave move

Find out more about our Elliott Wave Indicator Suite by watching the Video Tour >>>HERE<<<

Wave Analysis

EURUSD Potential 5th Wave Short on 5min timeframeAfter a nice bearish move on EURUSD our Elliott Wave Indicator Suite has labelled the Elliott Wave Count and our Probability pullback zones. The wave 4 found resistance in our Red zone, which represents a 75% probability that this Forex pair will go onto to hit our Automated 5th Wave target zone. Included in the indicator suite are also, our special Elliott Wave Oscillator which came close to breaking the rules and if indeed the oscillator breaks the 140% line then the trade is invalid. We also have our Special False Breakout Stochastic which helps identify strong trends in either direction. The when the wave 4 pulls back against that trend and crosses in the opposing over bought/sold zone then the probability it wants to return to strong trend is high.

Watch the video tour of our Elliott Wave Indicator Suite for TradingView >>HERE<<<

Our Elliott Wave 5th Wave Target Zone Hit on EURJPY Earlier today we made a quick education video discussing the tools in our indicator suite and how to use them to trade the high probability 5th wave moves. We used this EURJPY example as it was setting up. The orginal video can be viewed >>HERE<<

This next video is a follow to show our automated 5th wave target zone has been hit, completing a great Elliott 5th Wave trade on the 5 minute time frame for EURJPY.

Watch the video tour of our Elliott Wave Indicator Suite >>>HERE<<<

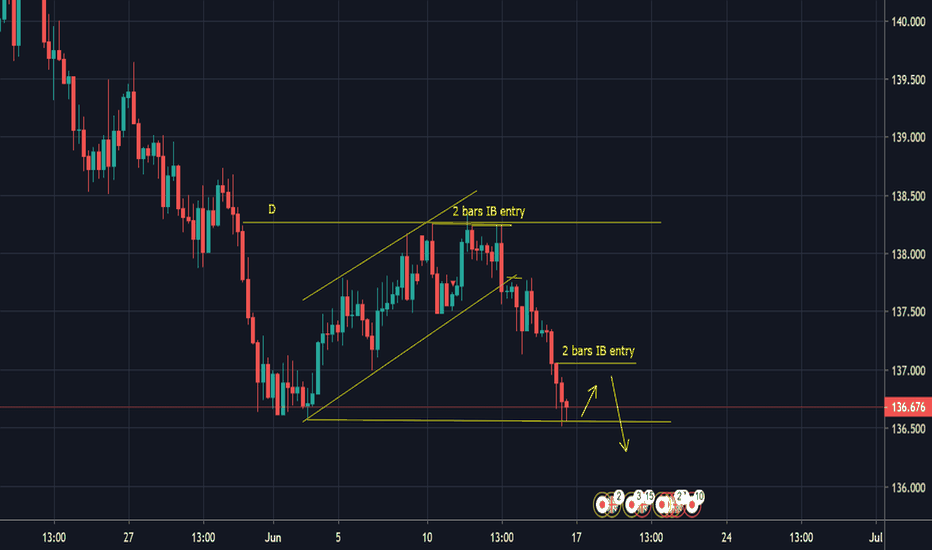

Inside Bar methodInside Bar guideline:

Impulse can be measure using 1-2 bars.

First inside bar retrace-ment prefer it to be less than 50% Fibonacci

Must have at least 2 inside bars for it to be valid.

For daily pattern with only 2 inside bars, there must be 4 hour inside bar pattern with minimum 12 inside bars

For weekly pattern with only 2 inside bars, there must be Daily inside bar pattern with minimum 12 inside bars

For monthly pattern with only 2 inside bars, there must be Weekly inside bar pattern with minimum 8-10 bars.

Tips:

Reversal are usually happens at 0.786 fib and 1.13. fib on monthly, weekly, and daily time frame.

Price likely to reverse when there is smaller time frame inside bar pattern presenting at key fib level or near

the start daily, weekly or monthly pattern.

Price likely to reverse when there is double pattern on the same time frame.

A Noob Trader - following @TheMoodCarl Analysis and having fun! It is so important to NOT go into trading without analysis and understanding. I been following @TheMoonCarl's analysis for a week and blown away my his detailed explanation. So clear and easy to understand. And more important being on target! The last time I traded I was just flying by Gut.

Inside Bar (The ultimate wave analysis?)What I meant to say is the smaller time frame structure is contain within the bigger structure.

Once you master 1 bar, you will move to 2 bar, and then you will move to higher time frame, then higher Order and Chaos contain within order within chaos within order...you get the point. Everything is being contain withing bigger structure.

PSYCHOLOGICAL LEVELS: simple & effective way to find key levels Hello Traders, here is a very precise way to find important support and resistance levels on the chart in a very simple and effective way.

HERE ARE THE FREE EDUCATIONAL IDEAS I PUBLISHED UP TO NOW

HOW TO AVOID FAKE TRENDS ( using multi-timeframe analysis )

THE PROPER WAY TO USE FIBONACCI ( majority are doing it wrong!!! )

AVOID THIS CANDLESTICK FORMATION TRAP!!! ( important!! )

HOW TO BE A SNIPER ( the line chart trick!!! )

TRENDLINES AND COUNTER-TRENDLINES ( how to use them correctly! )

Inside Bar Part 2This is a detail explaination of how I find inside pattern and how to trade it.

If you go back to last week ideas, you will find that I had my trade idea post for these pairs trading in the same direction as shown in the video.

Please like, comment and feel free to ask any questions down below.

what is Inside Bar?

-Impulse bar with smaller bars trading inside the range of the impulse bar.

Inside Bar rules:

- First inside bar pull back must be 50% or less of the impulse bar

- there must be minimum 2 inside bars, 3 or more is better

-Impulse bar measure from wick to wick,

-Inside bar measure from open to close, only the body of the inside bar need to be in the range, we don't count the wick for inside bar

Inside BarWhat is Inside Bar?

-Impulse bar with smaller bars trading inside the range of the impulse bar.

Inside Bar rules:

- First inside bar pull back must be 50% or less of the impulse bar

- there must be minimum 2 inside bars, 3 or more is better

-Impulse bar measure from wick to wick,

-Inside bar measure from open to close, only the body of the inside bar need to be in the range, we don't count the wick for inside bar.

Please give me feed back, if you want more video like this, comment below

AVOID THIS CANDLESTICK FORMATION TRAP!!! (VERY IMPORTANT)hey traders, I show in this video how to avoid getting trapped by this formation, I see many traders that are not understanding the basic way in which the market moves falling in this simple pattern and taking the wrong side of the trade.

LET ME KNOW IN THE COMMENTS BELOW IF YOU LIKE THE VIDEO

"Risk Management" (Traders) vs "Right or Wrong" (Analysts)In this video I explain you with a real time trading context, what the major difference is between a trader and an analyst. Because that's how you'll easily make the difference between the one that actually trade and manage its risks, and the one that just talks and do nothing ! Always remember that if you want to learn how to analyse a market, the follow analysts ! If you want to learn how to trade and manage the risks, follow traders... ! Because being right or wrong is nothing but bullshit in a speculative prospective !

Bests,

Phil