Wave Analysis

Gold (XAUUSD) – H1 Wave 5 in Progress | Bearish Setup Building📉 Gold (XAUUSD) – H1 Wave 5 in Progress | Bearish Setup Building

🕐 Timeframe: H1

🔍 Strategy: Elliott Wave + Support/Resistance + AO Divergence

The market has likely initiated Wave 5 on the H1 timeframe following a clean 5-wave structure. We’re now watching for the internal corrective Wave 4 of Wave 5 to complete.

📌 Key Zone to Watch:

Fibonacci Level 2.618 lines up with a previous support-turned-resistance zone — a high-probability reversal area.

Awesome Oscillator (AO) shows convergence, signaling weakening bullish momentum.

🔧 Execution Plan:

Waiting for M15 break of structure to confirm the end of the corrective sub-wave.

Will look to enter sell on confirmation of bearish continuation.

🎯 Target Zone:

The shaded green area below marks a strong support zone — potential TP area for Wave 5 completion.

CHFJPY LONGReason for entry

1. Regular flat structure

2. Ending structure in play

3. Gap 183.065 taken

4. Liquidity at the top (equal highs)

5. MACD divergence

Strategy: Engulfing candle should take out 184.058 to enter

Take Profit : 186.023

Stop loss: 183.211

Entry: 184.058/183.587 (GAP)

Once 185.208 is taken out, place trade at BE or Take profit

Potential BEARSAfter a prolonged and a complex correction, it looks out to be a FLAT CORRECTION with wave B producing a flat correction as well in a lower degree hence making it all complex. But at the moment we have a perfect channel AB=CD correction which prompts a continuation to the south. Fingers crossed 🤞 as the market rejects a resistance of the channel.

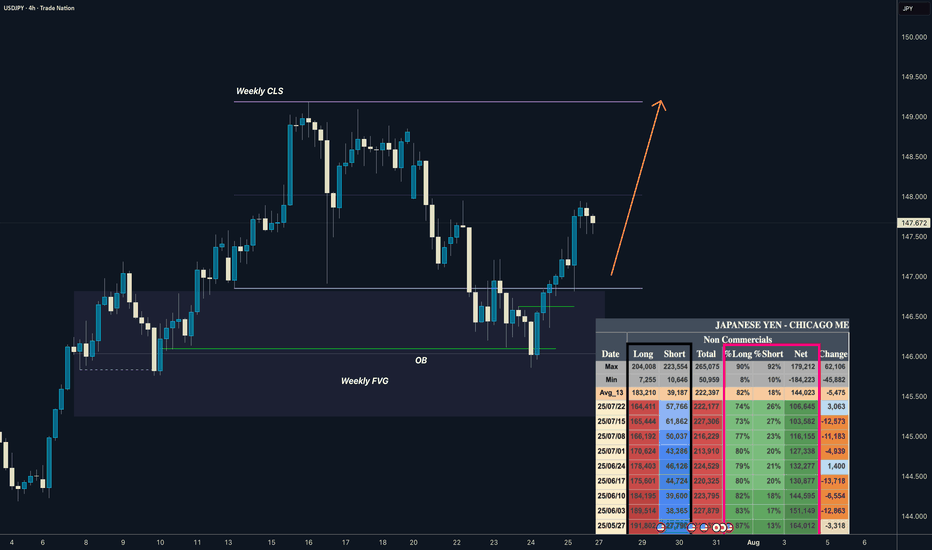

USDJPY I Weekly CLS I Model 1 / 2 I COT Bullish ASFYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

COT Data

we can see reduced longs exposure and increasing shorts on JPY contract which is clear signs of bullishness confirmed by decreasing Net positions.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Comment any Coin I ll give you my quick view

XAUUSD Thursday Chart Market Structure & Context

Timeframe: 15-Minute (M15)

Overall Trend: Bearish after a confirmed Break of Structure (BOS) to the downside

Current Price Action: In a retracement phase toward a premium supply zone

Bias: Expecting a liquidity sweep upward, followed by a strong sell-off

🧱 Key Structure Zones

NYL.H & NYL.L: High and Low of the previous New York session

ASIA.H & ASIA.L: High and Low of the Asia session

NYPM.H & NYPM.L: High and Low of the New York PM session

🔍 Critical Levels & POIs

Breaker Block (Dark Gray Box)

Formed after price swept buy-side liquidity and then broke structure upward

Expected to act as a support zone for a temporary buy or a reaction point

BSL POI (Buy-Side Liquidity - Point of Interest)

A manipulated breakout area targeted by smart money

Expected to entice FOMO buyers before a sharp reversal downward

Sell-Side Liquidity (SSL)

Located below the current breaker block

This is the final liquidity target for a continuation sell move

📈 Expected Price Behavior

Price is currently retracing upward

Projected Scenario:

Price moves up to tap into the BSL POI zone (around 3,303–3,305)

Price rejects the POI, forming a potential distribution range

Breakdown from the range initiates a sell-off

Targeting final support / liquidity sweep around 3,268.04

🎯 Trade Setup & Plan

Bias: Sell after a liquidity sweep above key highs

Entry Trigger: Upon clear rejection from the BSL POI zone

Stop Loss: Above BSL POI (~3,307–3,309)

Take Profit: 3,268.04, yielding a Risk-to-Reward Ratio ~4.67

⏰ Killzone Timing (SMC Timing Model)

NY AM Killzone (14:00–19:00 GMT+7)

→ Ideal for entries; likely where liquidity manipulation occurs

NY Lunch & PM

→ Potential for distribution phase completion and sell-off

📌 Additional Notes

Price action reveals a clean FVG (Fair Value Gap) and a completed BSL sweep

Final downside target aims for the NYPM Low, identified as a weak low

Rejection from the breaker block is crucial; confirmation via BOS/CHoCH on lower TF is preferred

Liquidity Grab Complete? Why USDCHF Could Be Heading South📉 USDCHF remains firmly in a downtrend on both the weekly (1W) and daily (1D) timeframes. The recent bullish retracement is now confronting a critical resistance zone 🔒 — defined by a descending trendline and a daily order block between 0.8150–0.8200.

🧱 Price action at this level shows clear signs of rejection, aligning with a bear flag formation, which could pave the way for continued downside toward the 0.7800–0.7600 region.

📊 Fundamentally, the Swiss Franc (CHF) continues to gain strength, supported by Switzerland’s stable economic outlook and ongoing safe-haven demand. Meanwhile, the US Dollar faces headwinds from dovish Fed expectations and rising political uncertainty in the US 🇺🇸.

🔮 From a Wyckoff/ICT perspective, this upward move appears to be a liquidity grab into a premium zone, with smart money likely distributing positions before initiating a new markdown phase. A sell bias is favored below 0.8200, with downside targets set at 0.8000 and beyond.

📅 Keep a close eye on this week’s US NFP and Swiss CPI releases — both could inject fresh volatility into the pair.

USDJPY Targets Completion of 7 Swing RallyThe USDJPY pair exhibits an incomplete bullish sequence originating from the April 22, 2025 low, signaling potential for further upside. We can project the extreme target area for this rally can be projected using using the 100% to 161.8% Fibonacci extension from the April 22 low. This places the target range between 150.88 and 156.33. The ongoing rally from the May 27, 2025 low is unfolding as a double three Elliott Wave structure. This structure has two zigzag corrective structure driving the upward momentum.

From the May 27 low, wave W concluded at 148.03. A corrective pullback in wave X then followed, which bottomed at 142.67. Currently, wave Y is in progress, with internal subdivision as a zigzag pattern. From the wave X low, wave ((a)) peaked at 149.18, followed by a corrective wave ((b)) that unfolded as a zigzag. Within this structure, wave (a) ended at 147.81 and wave (b) reached 149.08. Wave (c) completed at 145.87, finalizing wave ((b)) in the higher degree. The pair has since resumed its ascent in wave ((c)), developing as a five-wave impulse.

From wave ((b)), wave (i) concluded at 148.71, with a minor pullback in wave (ii) at 147.79. In the near term, as long as the pivot low at 145.87 holds, dips are expected to attract buyers in a 3, 7, or 11-swing corrective pattern, supporting further upside toward the Fibonacci extension targets.

#Nifty directions and levels for July 31st:Good morning, friends! 🌞

Here are the market directions and levels for July 31st:

In the past two sessions, the global market (based on Dow Jones) has shown a moderately bearish sentiment,

while the local market continues to reflect a bearish tone.

Today, Gift Nifty indicates a gap-down opening of around 160 points (as per the chart).

What can we expect today?

In the previous session, both Nifty and Bank Nifty went through consolidation.

Structurally, we are still in a bearish tone, and with Gift Nifty indicating a gap-down start,

if the market breaks the immediate support levels with a solid candle, we can expect further correction.

On the other hand, if it finds support there, then the range-bound movement is likely to continue.

Which means, if the initial market takes a pullback, we can expect consolidation within the previous day’s range.

#Banknifty directions and levels for July 31st:

What can we expect today?

In the previous session, both Nifty and Bank Nifty went through consolidation.

Structurally, we are still in a bearish tone, and with Gift Nifty indicating a gap-down start,

if the market breaks the immediate support levels with a solid candle, we can expect further correction.

On the other hand, if it finds support there, then the range-bound movement is likely to continue.

Which means, if the initial market takes a pullback, we can expect consolidation within the previous day’s range.

$NVDA: Cycle-Wired Levels🏛️ Research Notes

The fact that the angle of linear connection between 3rd degree points (fractal hierarchy) acted multiple amout of times as support and eventually resistance from which tariff drop happened establishing bottom and expanding from there.

That means if we were to justify the texture of ongoing wave from that bottom, we would geometrically quantify the area of that triangle to project considering historic data to remain objective approach (and NOT what levels we subjectively want to see whether we are bullish or bearish). There is mean reversion rule also going on which will be structurally addressed.

No matter where your actual target is at, there are always structural boundaries that price must break through first in order to get there. And because markets tend to move in proportion to their own scale — often aligning with exponents of the golden ratio, we treat phi as a constant within this probabilistic space.

Gold Bulls Charging to 3305 But What’s Waiting There?Gold has recently taken support from the lower levels and has also shown a Break of Structure (BoS) to the downside. Currently, there is Imbalance and Internal Draw on Liquidity (IDM) resting around the 3305 level. The market appears to be moving upward to mitigate that imbalance. It's important to closely monitor this zone, as once the market reaches and fills this area, there is a high probability of a potential rejection or bearish move from that level

Nightly $SPY / $SPX Scenarios for July 31, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 31, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Holds Rates — Dissent Indicates Division

The Federal Reserve maintained its benchmark rate at 4.25%–4.50%. Notably, two governors—Christopher Waller and Michelle Bowman—dissented in favor of a 25 bp rate cut, underscoring internal divisions amid growing political pressure

📈 Strong Q2 Growth, But No Rate-Cut Signal

U.S. GDP expanded at a 3.0% annualized rate in Q2, rebounding sharply from Q1's contraction. Despite this, Powell emphasized persistent inflation, particularly from tariffs, reinforcing the Fed’s cautious policy stance

🛢️ Oil Climbs as Tariff Tensions Rise

Brent crude rose to ~$73.51 and WTI to ~$70.37 on fears of supply disruptions tied to President Trump’s threats of new tariffs on Russian oil and new tariffs imposed on Brazil and South Korea

📊 Key Data Releases & Events 📊

📅 Thursday, July 31:

8:30 AM ET – Initial Jobless Claims (week ending July 26)

Initial claims rose to 222,000, up from 217,000 previously—an early gauge of labor-market trends

8:30 AM ET – Employment Cost Index (Q2)

Quarterly growth in labor costs edged lower to 0.8%, down from 0.9%—a signal of moderate wage pressures

8:30 AM ET – Personal Income (June)

Data released on household income and spending patterns—crucial for assessing consumer resilience heading into Q3

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #inflation #jobs #technicalanalysis

Technical Analysis - Gold (XAU/USD) - 4H ChartI’ve dissected the market using Elliott Wave theory and uncovered key signals that most overlook. Here's my breakdown:

## 📌 **Setup Overview*

I'm tracking a complex wave structure that hints at the final stage of a corrective pattern, setting the stage for a potential bullish rebound.

## 🎯 **Entry Strategy**

I’ve identified a prime buy zone around **3,350USD**—just above current market levels. This isn’t just a number—it's where price action and wave theory converge. High-probability setup with a tight stop. Above 3,380

## 🧭 **Projected Move**

While I’m eyeing short-term upside, the larger wave pattern suggests the potential for a deeper correction targeting the **3120.000 USD** area. I’m preparing for both scenarios to stay ahead of market sentiment.

---

Gold's Strong Moves: Will the Bears Take Over?Hello everyone, Kevinn here!

Today, gold continues to experience significant fluctuations in the new week, with XAU/USD currently hovering around 3,325 USD. Amid the strong rise of the USD, the gold market has seen a sharp adjustment. However, the medium-term trend still seems to favor the bears.

The main reason for the turbulence in gold prices is the strengthening of the U.S. dollar, following strong economic news from the U.S. that points to a clear recovery. The stronger USD has made gold more expensive for international investors. Additionally, the market is awaiting further moves from the Fed regarding interest rate policies, which is limiting the flow of capital into gold.

Looking at the technical chart, we can see that although gold has shown a slight uptick, bearish pressures are still lurking. Indicators and patterns suggest that gold may break its rising price channel, with a high likelihood of further declines. The next support level could be around 3,310 USD, and if broken, gold may continue to fall toward 3,300 USD or lower.

Based on the signals from the chart, ENTRY 1 strategy would be to sell when the price breaks the upward channel. Additionally, if the price pulls back to the upper limit zone, ENTRY 2 could present another potential selling point.

For today's strategy, I expect gold to decrease. What do you think? Share your thoughts in the comments!

WULF / 3hThe unexpected 4% decline today suggests a potential shift in the wave iv (circled) corrective structure—from the previously identified triangle pattern to a more complex (w)-(x)-(y) combination. While differing corrective variations remain possible, this alternate structure now appears to be nearing completion. It is likely to precede the anticipated advance of approximately 45% in wave v (circled) of the ongoing Minor degree wave C.

The Fibonacci extension target at 6.93 remains unchanged.

Trend Analysis >> Upon completion of Minor wave C, the countertrend advance of Intermediate wave (B)—in progress since April 9—is expected to give way to a decline in wave (C) of the same degree. This next downtrend may begin in the coming days and has the potential to extend through the end of the year.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

GBPUSD Approaching Channel Support — Rebound Ahead?GBPUSD is nearing the bottom of a well-defined bearish channel while Stoch RSI begins to curl upward.

📌 Bearish channel structure intact

📌 Possible bounce off ~$1.322 zone

⏱️ Timeframe: 1H

#gbpusd #forex #tradingstrategy #channeltrading #technicalanalysis #quanttradingpro #tradingview