Wave Analysis

SUIUSD Setting Up for a Potential 1-2, 1-2 Pattern — Wave 3 BlasSUIUSD appears to be forming a classic 1-2, 1-2 Elliott Wave setup — a bullish structure that often precedes an explosive third wave rally.

In this pattern, we first see a motive Wave 1 followed by a corrective Wave 2, then another smaller-degree Wave 1 and 2 within the larger Wave 3. This kind of nested structure shows strong underlying bullish momentum building up in layers.

Once the second minor Wave 2 completes, SUI could launch into a powerful third wave of Wave 3, typically the strongest and most extended move in the sequence. That’s the breakout phase where price accelerates rapidly, often leaving late buyers behind.

Watch for confirmation

GBPAUD Reverses from Key Zone – Long Setup in Play!Today I want to share with you a Long position on GBPAUD ( OANDA:GBPAUD ).

GBPAUD started to rise well from the Important Support line , Support zone(2.032 AUD-1.987 AUD) , and Potential Reversal Zone(PRZ) and managed to close the 4-hour candle above 2.053 AUD (important) .

In terms of Elliott wave theory , GBPAUD seems to have completed the main wave 4 . The main wave 4 structure was a Double Three Correction(WXY) .

Also, along the way, we can see a Bullish Marubozu candle , which could indicate a continuation of the uptrend .

I expect GBPAUD to break the Resistance lines soon and attack the Resistance zone(2.078 AUD-2.066 AUD) .

First Target: 2.065 AUD

Second Target: 2.076 AUD

Note: Stop Loss(SL): 2.040 =Worst SL

Please respect each other's ideas and express them politely if you agree or disagree.

British Pound/ Australian Dollar Analyze (GBPAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Corn Futures (ZCU2025) – Heavy Structure, Heavy Pressure📉 Corn Futures (ZCU2025) – Heavy Structure, Heavy Pressure

WaverVanir DSS shows continued downside probability in Corn as price compresses below the 0.786–1.272 fib zone and forms a supply rejection cluster near 4.10–4.27.

🧠 Macro Snapshot:

🌽 USDA WASDE (Aug 12) may revise yield upward amid favorable Midwest weather → bearish catalyst

🇧🇷 Brazil exports peaking + weak BRL = added global pressure

💵 Strong USD + elevated carry costs reduce long-side incentive

🏦 Fed tone remains hawkish → commodity bearish bias holding

🔍 Technical Breakdown:

✅ Confirmed BOS → CHoCH → Lower High confirms bearish control

📐 Fibonacci clusters align at:

🔻 TP1: 3750–3640 (1.236–200% ext)

🔻 TP2: 3480–3400 (2.27–2.41 ext + strong low confluence)

🛑 Invalidation above 4110–4140 (structural break + 1.272 retrace buffer)

🎯 Trade Setup (Short Bias)

Criteria Details

Entry Zone 3890–3880 (confirmed rejection candle)

TP1 3640 (volume/imbalance cluster)

TP2 3480 (fib confluence)

TP3 3270 (final extension)

Stop-Loss Close above 4110

Risk/Reward Targeting 3.2R at TP2

⚠️ What to Watch

📆 WASDE Aug 12

💬 CFTC Net Positioning (Fri)

🌡️ Weather swings (Corn Belt)

🧮 ZCU25 calendar spreads (ZCU25-ZCZ25)

🚀 The rocket is reserved for when fundamentals flip (e.g., yield shock, China buying). Until then, structure says one thing:

Smart money is hunting liquidity below 3640.

#ZCU2025 #CornFutures #FibStrategy #WaverVanir #VolanXProtocol #SmartMoneyConcepts #DSS #CommodityTrading #MacroAnalysis #ProbabilisticSignals #HawkishFed #SupplyChainPressure

USDCHF Signals Wave 3 With Double Bottom!OANDA:USDCHF has not only formed a Double Bottom Pattern but also may be generating a potential Elliot Impulse Wave!

Bulls are giving the April & June Lows of .8038 - .8088, another go for a second time today after surpassing the first attempted High created July 17th to break above the level.

So far Price today has broken above July 17th Highs and if Bulls are able to hold this level, this would Confirm:

1) A Breakout of the Double Bottom

2) Wave 3 continuing the Impulse Wave in the Elliot Wave Theory!

The Higher Low @ .79106 created on July 25th, broke the downtrend structure as a 78.6% retracement of the Lower Low @ .78719 created July 1st which was a new 14 Year Low, finishing Wave 2 and initiating Wave 3 of the Impulse Wave.

The Extension of Wave 3 typically will end at the 1.236% or 1.618% level which gives us 2 potential Price Targets to start:

Price Target 1) .81479 - 1.236%

Price Target 2) .82213 - 1.618%

Once Wave 3 has ended, we will look for opportunities at the Wave 4 - Wave 5 juncture!

Potential 33% gain in ELVELV has a potential for a reversal for potentially 33% gain.

Using the Data Distribution with Extreme Clusters custom indicator, we can see that the stock is overextended on both the 5D chart (longer term) and 1D (shorter term) chart.

The last weekly bar ended up on a very high volume. Looking at the trends, one thing that is often noticeable, is that moves end and begin on large volume. Since it is down 40% off its highs, coupled with large volume, there is a possibility that the stock will reverse.

Zero-Lag USI on 1D chart is showing a buy signal as the background changed to green, while Zero-Lag USI on 5D chart is showing a black background, which means that there is a possibility that momentum of the stock may change.

Niagen Breaks Out: Eyes on $15–17 as Momentum TargetsNiagen Bioscience ( NASDAQ:NAGE ) is in vertical price discovery mode, pushing into new highs with strong trend momentum, but with RSI at 78.66 and a flattening MACD histogram, it’s nearing a classic short-term exhaustion zone

Technical Breakdown

1. Price Action – Parabolic Advance

Price is climbing in a near-vertical channel from the $5–6 range in March to now $12.95 — a 2x+ move in just a few months. No clear resistance above = price discovery, but these steep climbs often invite sharp mean reversion when momentum fades. No signs of topping yet, but late buyers risk being exit liquidity if volume dries up.

2. RSI – Deep Overbought

RSI is at 78.66, right near the extreme threshold (>80) where pullbacks are common. Note the last RSI spike above 80 in April led to a sharp correction. If RSI rolls while price makes new highs, that’s bearish divergence risk — an early signal of topping.

3. MACD – Still Positive, But Slowing

MACD lines are bullishly stacked, but the histogram is flattening — a signal that momentum is stalling. A bearish MACD crossover here would confirm that this rally leg is losing energy.

4. Volume – Watch Closely

Volume data is light on this chart, but recent candles don’t show a volume climax — suggesting this may not be euphoric yet, but it’s close. One high-volume reversal candle near the top could flip sentiment fast.

Fibonacci Extension Setup

We'll anchor the extension to the March 2025 low and the recent pre-breakout high, using the most relevant and aggressive up-leg:

Swing low: ~$5.00 (March 2025)

Swing high: ~$11.50 (May 2025)

Pullback low: ~$9.00 (early May dip before this new breakout)

Extension Targets

1.0x $11.50 Already cleared (prior high)

1.272 $13.25–13.50 Short-term upside target, within reach

1.618 $15.00–15.25 Primary extension / high-conviction zone

2.0 $17.00 Stretch target in euphoric continuation

These levels line up well with psychological round numbers and the measured strength of the rally.

What Would Validate These Targets?

RSI stays above 65–70 (healthy overbought, not divergent)

MACD avoids bearish crossover and histogram turns back up

Breakout continuation above $13.25 with volume

What Would Invalidate?

Sharp rejection from $13.25 or $14 with divergence

RSI dropping below 65 while price stalls

Bearish MACD crossover + red candle volume spike

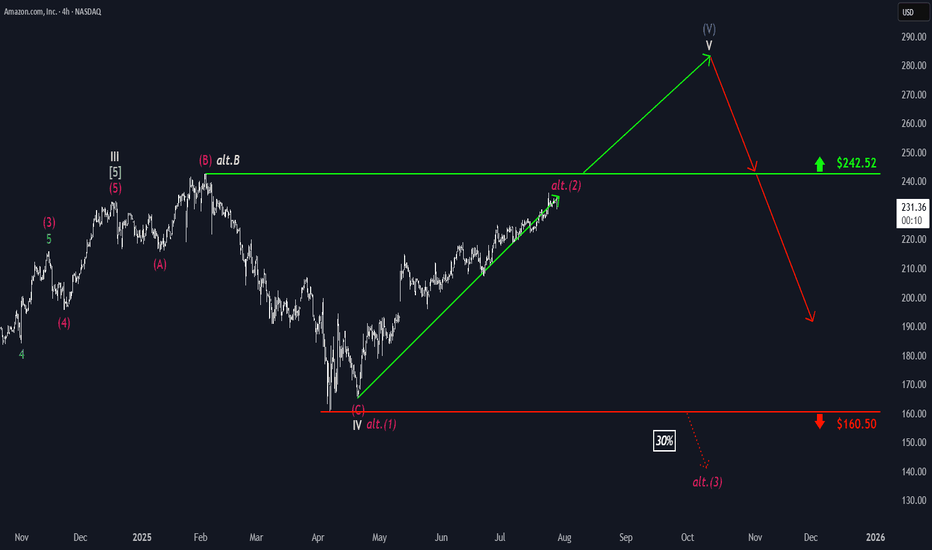

Amazon: Extending the Rally...Amazon maintaines its strong upward momentum. As this trend continues, the large blue wave (V) is expected to complete well above the resistance level at $242.52. However, an alternative scenario with a 30% probability remains on the table: in this case, the magenta corrective wave alt.(2) would peak below the $242.52 resistance, and a significant pullback below support at $160.50 would be anticipated afterward. In this scenario, the high of beige wave alt.B would have been set at $242.52, after which the stock would enter the broader downward movement of wave alt.C .

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

H4 Analysis. It's sell or buy let's see?

Gold is currently trading near 3323 after a recent sharp drop from the 3431 high. The price is respecting the downtrend line and has tested the 0.236 Fibonacci retracement at 3281 as support.

📉 Bearish Outlook:

If the price fails to break above 3314–3325, we could see a continuation toward the 3282 and possibly 3281 support zone.

📈 Bullish Scenario:

A break and close above 3355 (Fib 0.618) could push the market toward the 3431 resistance zone (Sell Area).

Key Levels to Watch:

Resistance: 3355 / 3431

Support: 3314 / 3308 / 3282

PENGU Bearish DivergenceBINANCE:PENGUUSDT

Support Levels: 0.027229 (recent low, first target for a drop).

0.007599 (deeper support, longer-term target).

Resistance: 0.046859 (recent high, potential stop loss level).

Trade Setup:

Target 1: 0.027229 (short-term, ~25% drop).

Target 2: 0.022597 (mid-term, ~50% drop if bearish trend strengthens).

Target 3: 0.016001 (long-term, ~25% drop).

Stop Loss: 0.007599 (above recent high, ~25% above current price).

RSI Analysis: The RSI shows a bullish divergence (price making lower lows while RSI makes higher lows), suggesting potential upward momentum. Current RSI is around 70.30, nearing overbought territory (>70), so caution is advised.

GOLD - One n Single Area, what's next??#GOLD... market just reached at his ultimate area as we discussed in our last week analysis and in Friday analysis as well.

The area is 3309-10

Keep close and don't be lazy here.

NOTE: we will go for cut n reverse below 3309 in confirmation.

Good luck

Trade wisley

Please check how to trade later.Since the release of the trading strategy, I have been able to accurately predict market trends. I am also grateful to so many brothers for following me. My premium privileges are about to expire. I will put the subsequent trading content in the group. If any brothers are interested, they can find me through 🌐. As for how to deal with the future market, I have stated the extraordinary situation and will patiently wait for the rebound of gold. At the same time, I will pay attention to the impact of the Sino-US trade talks.

technical analysis- (xau-usd) (H1)This chart highlights a large symmetrical triangle formation, with an internal WXYXZ corrective structure blended with impulsive Elliott Waves (1)-(5). The price action is marked by key structural shifts: CHoCH, BOS, and EOH, signaling trend reversals and liquidity grabs.

📌 Price recently bounced off the ascending trendline, forming a potential wave (2) low, suggesting a bullish move into a wave (3) impulse.

🔼 Short-term target points to a revisit of the strong resistance zone around 3,400–3,410.

📊 Key Setup:

• Pattern: Symmetrical Triangle

• Wave Count: Corrective WXYXZ + impulsive structure in progress

• Signals: Bullish CHoCH + BOS confirmation

🎯 Trade Idea:

• ✅ Direction: BUY

• 🎯 Take Profit (TP): 3,400 – 3,410

• 🔻 Stop Loss (SL): 3,296

🔁 Sideways range compression sets up ideal conditions for short-term swing or breakout scalps.

Chapter 3: The Big Gap Fill (RGTI) Chapter 3: The Big Gap Fill

After the luminous victory of the Alienoid Bulls in Chapter 1, the quantum lattice began to warp. Unbeknownst to them, the Mech Bears had not been defeated—only waiting, recalibrating, and evolving.

Hidden in the deep recesses of the 7D stackspace, a new war protocol had been activated: Project GAP-FILL.

Forged from the remnants of collapsed timelines and corrupted trading algorithms, the Mech Bears returned with upgraded plasma scythes, vortex cannons, and distortion shields—engineered specifically to slice through fractal bullish momentum.

Their mission: rupture the vertical trajectory of the Bulls by targeting the exposed gap at $14.87 .

And they struck with precision.

The plasma walls cracked. Alienoid defenders were torn apart, pixel by pixel. Charts trembled. RSI indicators bled below the midline. Volume spikes echoed like sirens through algorithmic space.

The Bulls fought valiantly, but their entangled rally code had become predictable. Their once-pristine yellow pathways had begun to fade under the purple-fanged teeth of the Bears' synthetic sell walls.

$14.87 was now no longer just a price—it was a battlefield scar.

It pulsed in red, flickering like a dying star, as algorithms calculated:

→ Bounce? An emergency quantum surge from sector Theta-12 might catch the fall.

→ Or further dip? Toward the gravitational pull at $13.80... or even deeper, toward the haunted zone beneath $12.60.

Whispers from the quantum feed rippled across timelines:

“If the Bulls can't re-stabilize above $14.87, the mech horde will breach the next support sector.”

The volume candles crackled, RSI skidded down through 30, and the future became uncertain.

The Alienoid Bulls retreated to regroup, wounded but not broken, preparing for what many called…

The Great Reversal War. NASDAQ:RGTI

SELL CHFJPY for bullish trend reversal SELL CHFJPY for bullish trend reversal

STOP LOSS : 185.38

Trade trade is based on false breakout and divergence.....

First what is false breakout, A false breakout in Forex occurs when the price breaks through a key level (like support or resistance) but quickly reverses and returns to its original range, often trapping traders who were expecting a continuation of the breakout. It's essentially a false signal, indicating a potential trend reversal or continuation, but the price doesn't follow through....

Secondly what is divergence ,In forex trading, divergence occurs when the price of a currency pair moves in one direction, while a technical indicator (like an oscillator) moves in the opposite direction. This mismatch can signal a potential trend reversal or weakening trend. There are two main types: bullish and bearish divergence.

On this trade we are taking it because we saw regular bearish divergence

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the RSI already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....