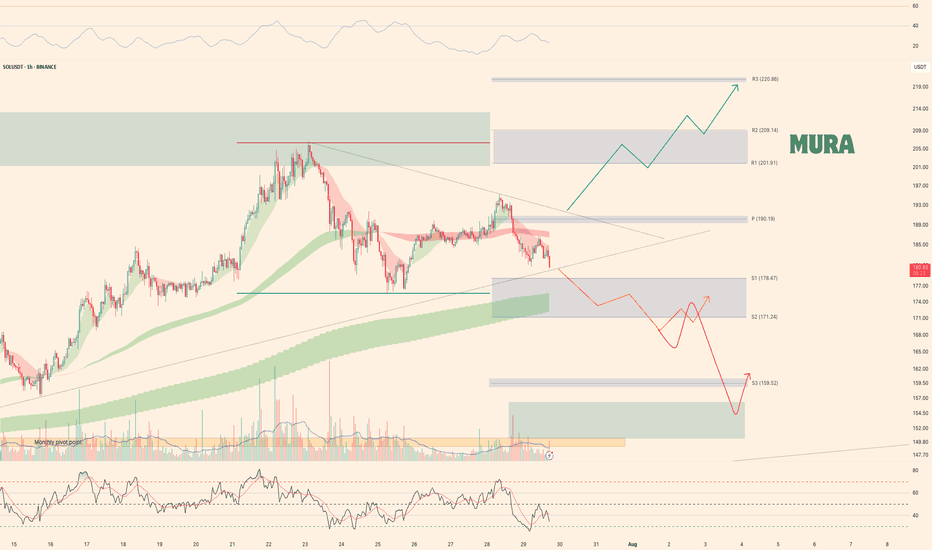

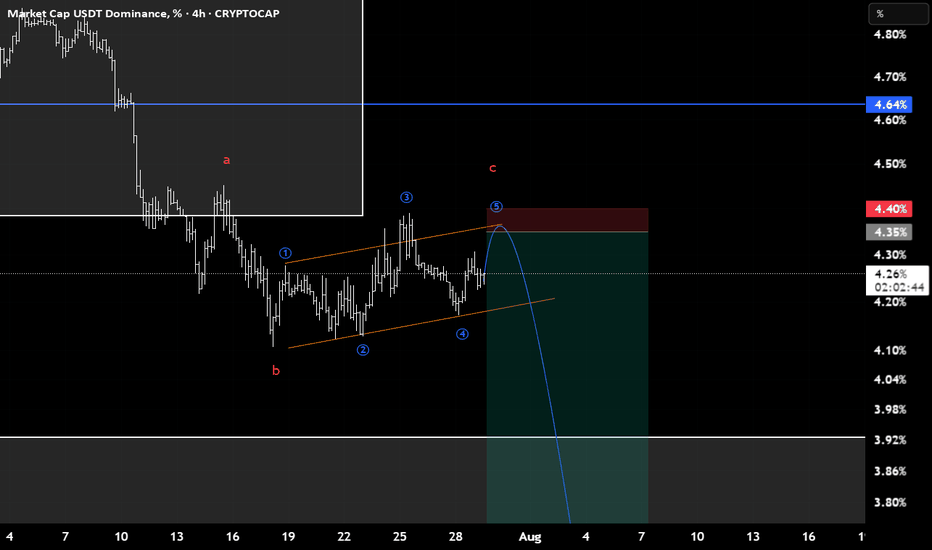

Weekly trading plan for SolanaLast week BINANCE:SOLUSDT played out perfectly according to our orange scenario. Currently, we're in a correction phase, trading below the key weekly reversal level at $190

Key Observations:

Bullish divergence forming on the hourly chart

But 4-hour chart shows further downside potential

Critical Levels:

Break above weekly pivot + trendline → Targets $220

Failure to reclaim above hourly MAs → Opens path to $160

Trade carefully - this could go either way

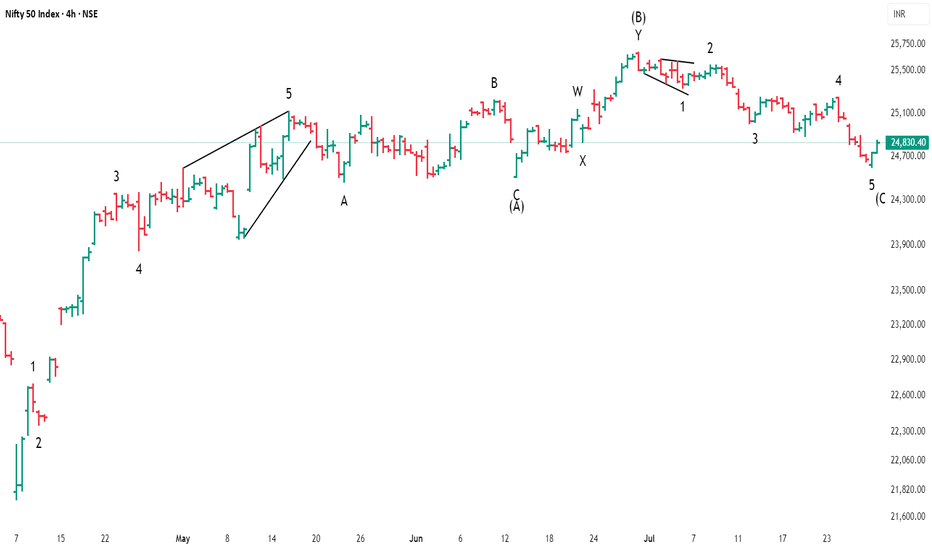

Wave Analysis

SQD/USDT Analysis — False Breakout

This token attempted to break out of a global sideways range, but failed to hold above the key level. A large amount of position closing was observed at that moment.

We are considering a short from the $0.205–$0.227 zone, provided it is retested with a clear reaction.

This publication is not financial advice.

BTC/USDT Analysis — Potential Sideways Range

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin experienced a local reversal. At this point, two zones previously marked by us have been worked out:

Buy zone — $118,300–$117,300

Sell zone — $119,500–$119,000

We now expect continued rotation within the $117,400–$119,800 range, with potential expansion in both directions. The overall context remains positive, so a full breakout to the upside could occur in the near future.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

This publication is not financial advice.

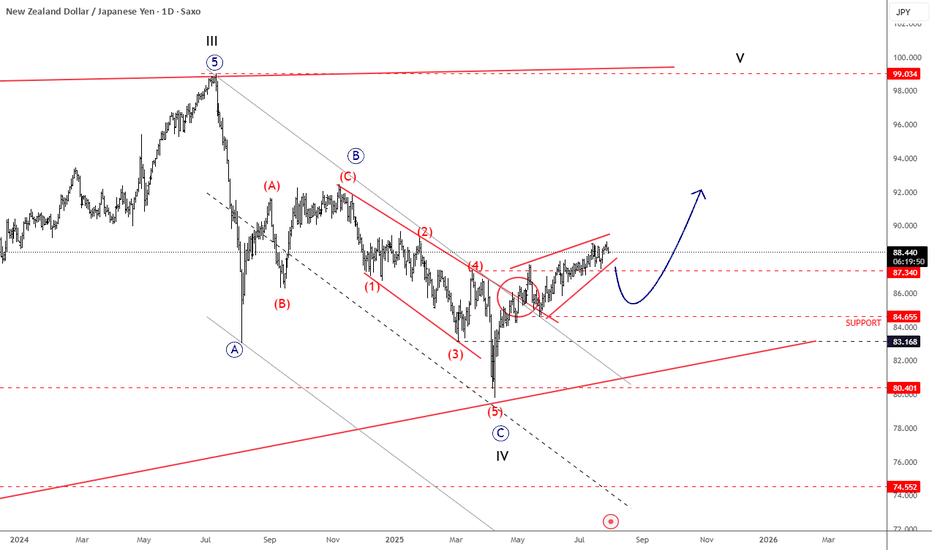

NZDJPY Is Back To Bullish ModeNZDJPY Is Back To Bullish Mode from technical and Elliott wave perspective, as we see it breaking back above trendline after a corrective decline.

NZDJPY is nicely recovering over the last few weeks after a strong rebound from 80.40 support, a key level going back to March 2023. Notice that it’s recovering after a three-wave ABC corrective decline that belongs to a higher degree wave IV correction. Current recovery looks to be in five waves, as a leading diagonal; so its a motive wave structure that already pushed above the 87.34 resistance, which is a strong bullish signal, suggesting more upside ahead. Of course, short-term pullbacks are always possible and welcome, and in that case, the 86 – 84 area could act as a nice support. But overall, we think that sooner or later the pair will target the 90 or even 92 levels, which are still possible this year. Wave V is eyeing even 100 area.

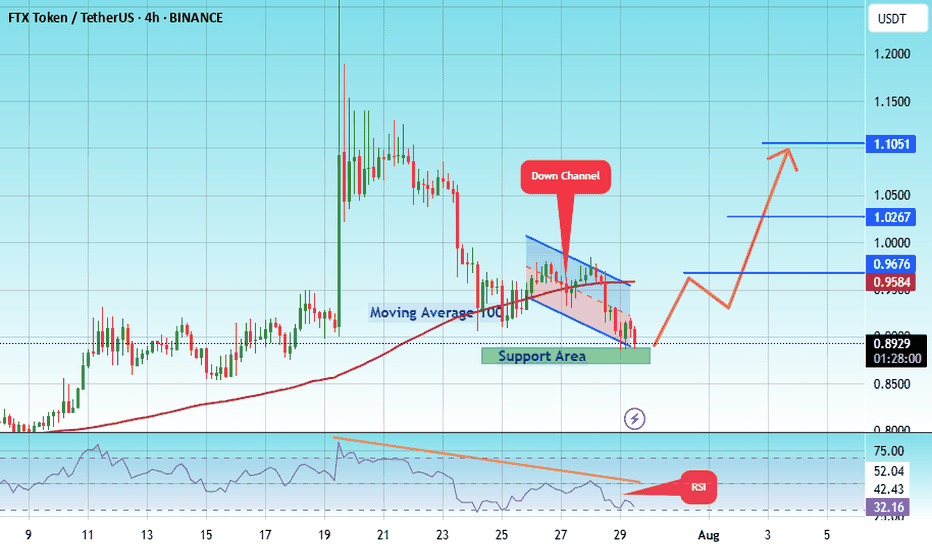

#FTX/USDT Breakout soon#FTX

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.8800.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.8760, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.8932

First target: 0.9584

Second target: 1.0267

Third target: 1.105

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

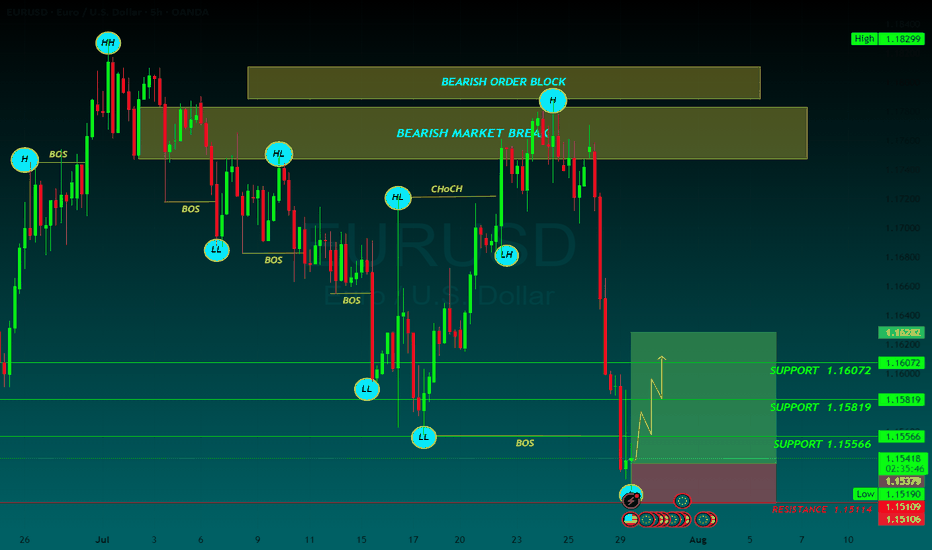

EURUSD BUYEUR/USD retreats below 1.1550 ahead of US data

EUR/USD finds it difficult to stage a rebound following Monday's sharp decline and trades in negative territory below 1.1550 on Tuesday. The US Dollar (USD) preserves its strength ahead of consumer sentiment and employment-related data releases, weighing on the pair.

From a technical point of view, the EUR/USD pair is poised to extend its slump. It keeps falling below a mildly bearish 20 Simple Moving Average (SMA), which provides dynamic resistance at around 1.1690. The 100 SMA, in the meantime, maintains its bullish slope, albeit partially losing its upward strength at around 1.1340. Finally, technical indicators keep heading south well below their midlines, and at multi-week lows, in line with a bearish extension ahead.

The near-term picture shows EUR/USD is oversold and may bounce or consolidate before the next directional move. In the 4-hour chart, technical indicators turned flat at extreme levels, yet it keeps developing below all its moving averages, which skews the risk to the downside. A firmly bearish 20 SMA is crossing below the 100 SMA and aims to extend its slide below a directionless 200 SMA, usually a sign of prevalent selling interest.

SUPPORT 1.15566

SUPPORT 1.15819

SUPPORT 1.15566

RESISTANCE 1.15114

GBP/CAD Possible Buy Trade With Great Pips!The price is standing at a strong area of support that is a historical area of support and pushed the price multiple. I think it can be a great area to enter a buy trade but I have 2 conditions to enter this trade:

1- great bullish price action above an area of support.

2- if we have a daily closure below this area of support this trade will be canceled.

I will commit to these conditions and see what will happen.

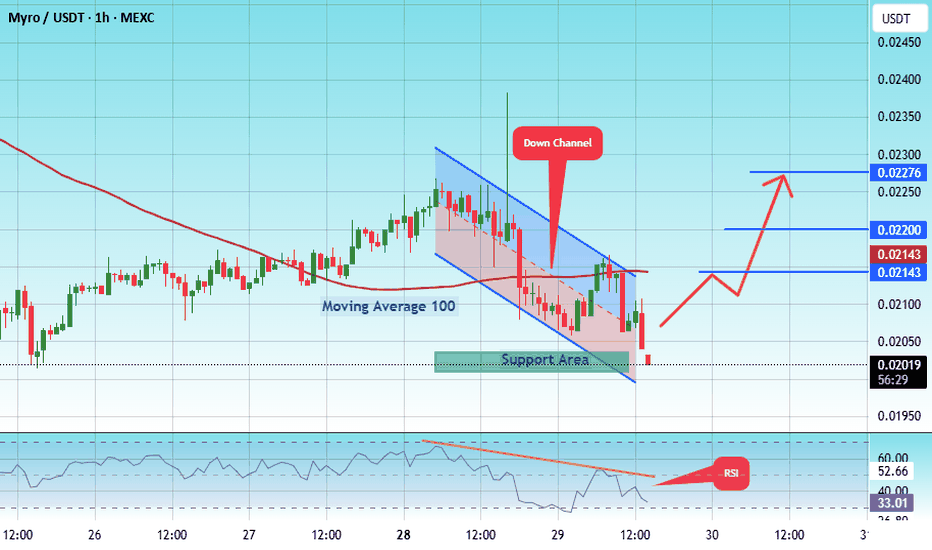

#MYRO/USDT myro road map ( 1 H )#MYRO

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.02040.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area in green at 0.02020, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.02040

First target: 0.02140

Second target: 0.02200

Third target: 0.002276

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

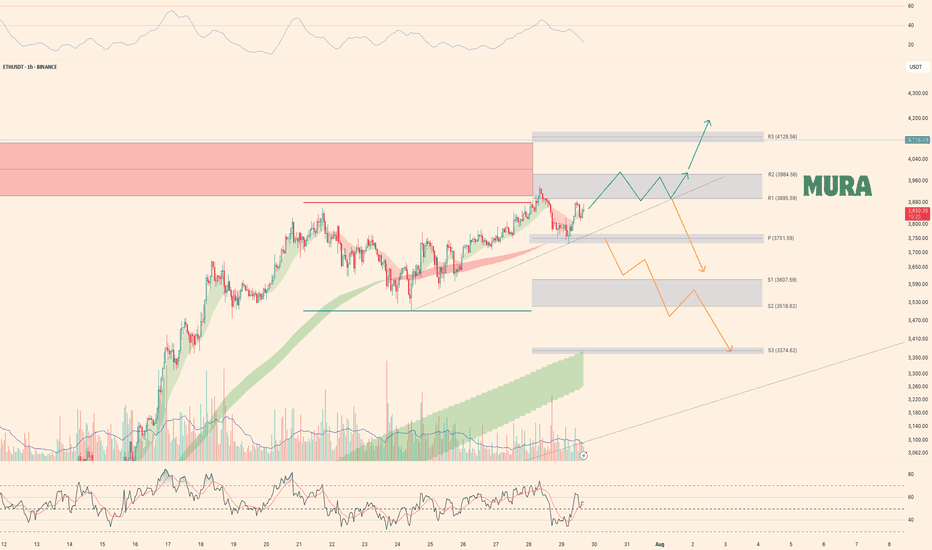

Weekly trading plan for EthereumLast week's BINANCE:ETHUSDT price action performed perfectly according to our scenarios - hitting our first target and establishing a new local high. Currently, price remains above the weekly reversal level at $3,751, maintaining potential for an advance toward Resistance #2.

Key Considerations:

While above $3,751 → Resistance #2 remains in play

Break below reversal level + trendline → Likely retest of last week's low

Such breakdown would likely breach both primary support levels

Trade Plan:

Bulls: Watch for continuation above $3,751

Bears: Require confirmed break of trendline + reversal level

As always, confirmation is key - trade the breaks, not the anticipations

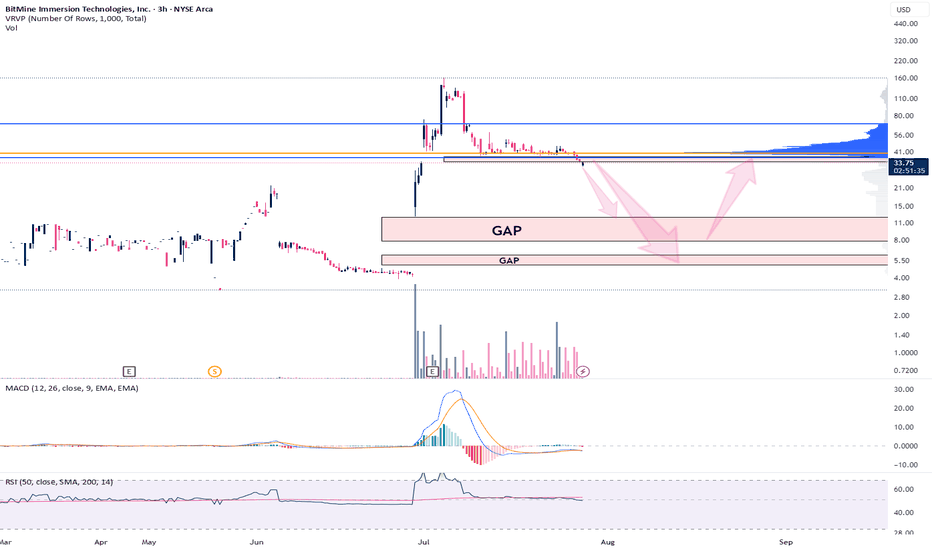

BMNR - Gaps to fill before lift offAMEX:BMNR is in competition to become the single largest ETH treasury globally with a slightly different twist - staking for a 2-5% annual return + performance.

Just like NASDAQ:SBET , AMEX:BMNR are diluting their stock to raise capital to additional purchases. This was announced a couple of weeks ago and has not yet concluded.

I expect the gaps to be filled before it really takes off.

Ideally the first gap completes at $7.92 which would be a perfect 61.8 fib retracement (EWT Target), however, if we go this low, I naturally would expect the lower gap to be taken out or at least entered.

Lower gap: $5.10 to $6.13

Higher gap: $7.92 to $12.30

If this plays out, it will be a generational buying opportunity. Like buying NASDAQ:MSTR at $11.

Cathie Wood ( CBOE:ARKK ) also made large purchases of this stock via several of her ETF's. If we follow her trend of poor buying decisions from a technical perspective, then we can certainly expect a large discount on this stock. History has a tenancy of repeating itself.

Not financial advice.

ETHUSDT short positionhi traders

🔻 Short Position Setup – Overextended at Resistance

ETH/USDT is currently trading near a major resistance zone (~$4,080–$4,330), which historically marks the top of the trading range. This level has acted as strong resistance multiple times in the past, and price is now showing signs of overextension after a sharp upward move.

📊 Technical Indicators

RSI (14): Currently overbought at 77.44, with the moving average at 81.65 — levels that have previously led to pullbacks.

Volume: Elevated during the move up, but may begin to taper as momentum slows into resistance.

🧭 Trade Strategy: Short From the Top

Entry Zone: Around current levels near $4,080–$4,330

Rationale: Shorting the top of the range with overbought RSI, expecting a retracement or range rejection

🎯 Target Zones (Take-Profit Levels)

We are monitoring multiple support levels for potential profit-taking:

TP1: $3,494

TP2: $3,133

TP3: $2,827

TP4 (max target): $2,354–$2,363

⚠️ Important Note: Although we’ve identified several potential targets, we expect to close the short position earlier — depending on how the price behaves during the retracement. We'll monitor market structure, volume, and lower timeframe signals on the way down.

🛡️ Risk Management

Stop-loss: Above the previous highs (~$4,330), to limit downside risk if the breakout is sustained

Regular monitoring is essential, as macro conditions and ETH sentiment can shift rapidly.

✅ Conclusion:

We're recommending a short trade at the top of a well-defined range, with confirmation from overbought RSI and historical rejection zones. The trade includes multiple targets, but it’s likely to be managed actively and closed partially or fully before reaching the final levels.

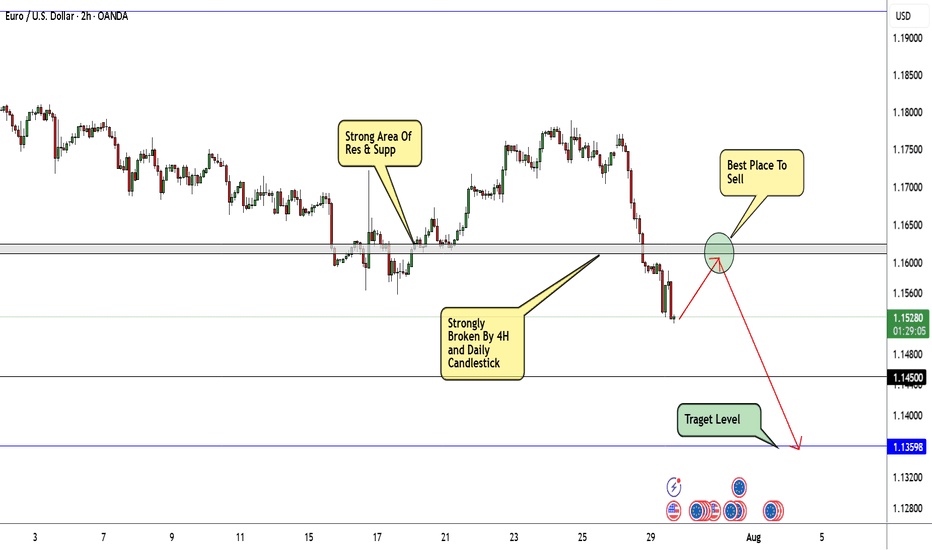

EUR/USD Will Continue Melting Be Sure To Be Part Of That!Here is my thought of EURUSD chart today. I think that this pair can go down further more specially after breaking this strong area of support and old resistance. as shown on the chart we can wait for the price to come back again and retest this area once and then this will be the best place to enter a sell trade. I am targeting around 250n pips in this trade. as I said I will wait for a retest and a good bearish price action and from there I will enter a sell trade.

FUNUSDT reversal set-uphi Traders,

We can see Bullish Signals Developing

Bullish Divergence (RSI):

A clear bullish divergence is visible between the RSI and price action. While the price made lower lows, the RSI formed higher lows (28.35 vs. previous 24 region), indicating a potential loss of bearish momentum and the emergence of buying pressure at lower levels.

Oversold RSI:

The RSI is recovering from oversold conditions and is currently around 34.68, showing that the asset may be primed for a short-term rebound.

🟡 Key Support Zone: Previous Resistance Flip

The current price action is retesting a previous top (~0.01172 USDT) from mid-July, which now acts as support.

This level previously acted as a breakout zone during the upward rally and is a logical area where buyers may step in again.

If this support holds, it increases the probability of a reversal or consolidation phase.

📊 Potential Reversal Targets

First Target: 0.01478 USDT (mid-range resistance)

Second Target: 0.01600 USDT

Third Target: 0.02016 USDT (strong resistance from recent top consolidation)

📉 Risk Management

A daily close below 0.01170 would invalidate the bullish setup, indicating possible continuation of the downtrend.

Volume remains moderate (13.43M), so confirmation via bullish candle and volume pickup is ideal.

✅ Conclusion:

FUN/USDT is showing early signs of a potential bullish reversal, backed by RSI divergence and a retest of prior resistance now acting as support. Traders may consider this a watchlist candidate for a bounce setup, with well-defined invalidation and targets.

ShortifyI don't post all my trade ideas ahead of time but I will share another short position that I executed before posting, this time in Spotify.

Short entered at $770, stop lost at $790.

Added to my position when we lost the monthly level of support.

The end of the 5 Wave Supercycle.

Trailing stop loss, I don't like shorting solid companies but this one got overextended.

I am short several positions, including Palantir, DuoLingo and commodities like cocoa.

Not financial advice, do what's best for you

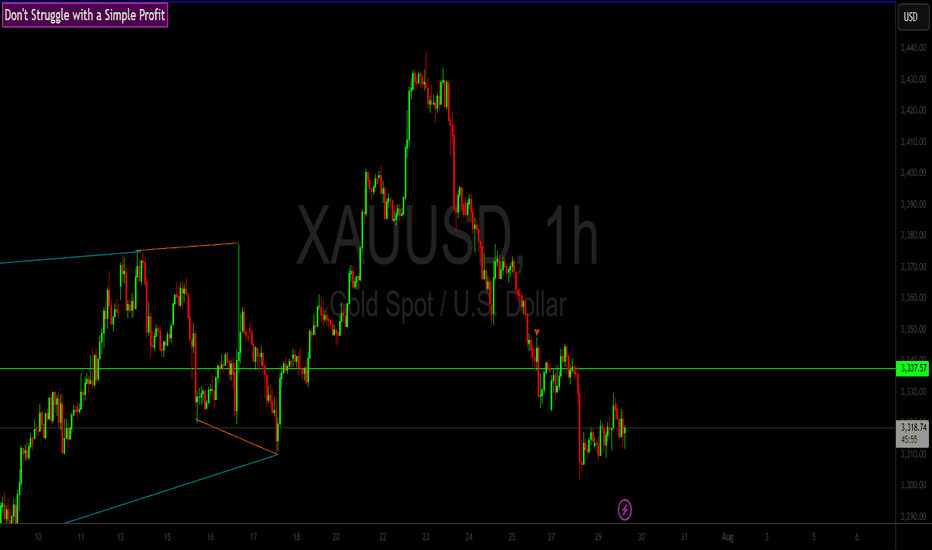

Today's Gold Price: Short at HighsToday's Gold Price: Short at Highs

As shown in the chart:

Rebound Short Strategy

Resistance: 3330-3350

Support: 3310

Technical Analysis:

1: As long as the gold price is below 3330, the market is bearish.

2: As long as the gold price is below 3350, the market is short.

3: As long as the gold price is above 3300, the long position is to buy on dips.

Specific Strategy:

Aggressive Strategy:

Sell: 3325-3330

Stop Loss: 3335

Target Price: 3310

Conservative Strategy:

Sell: 3340-3350

Stop Loss: 3355

Target Price: 3330-3310

Bottom Picking Strategy:

Buy: 3300-3310

Stop Loss: 3290

Target Price: 3350+/3400+