Wave Analysis

Descending Channel in Play STRK’s Next Move Could Be ExplosiveSTRKUSDT continues its decline within a well-defined descending channel, with the most recent bounce coming directly off the bottom boundary of the channel. This rebound aligns with a confirmed bullish divergence on the RSI, suggesting the current move may mark a key inflection point.

As price climbs, attention now shifts to the upper boundary of the channel, which serves as a key structural resistance. A break above this upper trendline would signify a reversal from the prevailing downtrend, validating the first higher high in the micro to mid-term, with upside potential toward $0.2422 and $0.7856, as shown on the chart.

However, failure to clear the upper boundary could trigger a sharp rejection and initiate another round of sell-off, potentially dragging price into a deeper landing zone below the demand level.

Option Chain AnalysisTable of Contents

Introduction to Option Chain

What Is an Option Chain?

Key Components of an Option Chain

Call vs. Put Options in the Chain

How to Read an Option Chain

Open Interest (OI) Analysis

Implied Volatility (IV) Analysis

Strike Price Selection

Support and Resistance Levels from Option Chain

Option Chain for Intraday & Swing Trading

1. Introduction to Option Chain

In the world of options trading, success is not just about buying calls or puts randomly—it’s about understanding market data. One of the most important tools for analyzing this data is the Option Chain. Whether you're a beginner or an advanced trader, mastering option chain analysis can help you identify market sentiment, key levels, and trading opportunities.

2. What Is an Option Chain?

An Option Chain, also known as an Options Matrix, is a tabular representation of all available option contracts (both Call and Put) for a particular underlying asset—like Nifty, Bank Nifty, Reliance, TCS, etc.—for a specific expiry date.

It shows:

Strike prices

Premiums (Prices)

Open interest (OI)

Volume

Implied volatility (IV)

Bid/ask prices

Think of it like a menu card for options, showing all the possible trades you can take, and key stats about each.

3. Key Components of an Option Chain

✅ Strike Price:

The price at which you can buy (Call) or sell (Put) the underlying asset.

✅ Premium (LTP):

The last traded price (LTP) of the option.

✅ Open Interest (OI):

The number of open contracts for a strike price. Indicates trader interest.

✅ Change in OI:

The change in open positions compared to the previous day.

✅ Volume:

The number of contracts traded in the current session.

✅ Implied Volatility (IV):

Market's expected volatility of the underlying asset.

4. Call vs. Put Options in the Chain

In every option chain, you’ll see two sections:

Call Options (Left side) Put Options (Right side)

Bullish expectation Bearish expectation

Buy if expecting upside Buy if expecting downside

Sell if expecting sideways/down Sell if expecting sideways/up

Usually, the middle column contains strike prices, with Call data on the left and Put data on the right.

5. How to Read an Option Chain

Let’s take an example:

Assume Nifty is trading at 22,200. You look at the Nifty option chain.

You’ll see multiple rows of strike prices (e.g., 22,000, 22,100, 22,200…) and for each, data like LTP, OI, IV.

Look for:

ATM (At-the-money): Closest strike to the current price (22,200).

ITM (In-the-money): For calls, strikes < spot; for puts, strikes > spot.

OTM (Out-of-the-money): For calls, strikes > spot; for puts, strikes < spot.

Example:

22,200 is ATM.

22,100 Call is ITM.

22,300 Call is OTM.

6. Open Interest (OI) Analysis

OI is one of the most powerful indicators in option chain analysis. It shows where traders are placing their bets.

✔️ What to Look For:

High OI = Strong interest at that strike.

Increase in OI = New positions being added.

Decrease in OI = Positions being closed.

✔️ Interpretations:

High OI in Call → Resistance level.

High OI in Put → Support level.

Let’s say:

22,500 Call has 30 lakh OI → Strong resistance.

22,000 Put has 35 lakh OI → Strong support.

This gives you the trading range of Nifty: 22,000 to 22,500.

7. Implied Volatility (IV) Analysis

IV represents the market's future expectations of volatility. Higher IV means higher premiums.

✔️ Why IV Matters:

When IV is high, options are expensive.

When IV is low, options are cheaper.

✔️ Practical Use:

Sell options when IV is very high (premium is inflated).

Buy options when IV is low (premium is cheap).

8. Strike Price Selection

Choosing the right strike is key for successful trading.

✔️ For Buying Options:

Buy slightly ITM for better delta and time value.

ATM works for short-term, fast movements.

✔️ For Selling Options:

Sell OTM options with high OI and low IV.

✔️ Tip:

Always check the OI and IV before choosing a strike. Avoid illiquid strikes (with low OI or volume).

9. Support and Resistance Levels from Option Chain

You can spot support and resistance based on OI data.

✔️ Support:

Strike where Put OI is highest.

E.g., 22,000 Put with highest OI = Support zone.

✔️ Resistance:

Strike where Call OI is highest.

E.g., 22,500 Call with highest OI = Resistance zone.

This helps you create a trading range.

10. Option Chain for Intraday & Swing Trading

✅ Intraday Trading:

Watch change in OI during live market.

Spike in Call OI → Possible resistance forming.

Spike in Put OI → Possible support forming.

✅ Swing Trading:

Analyze overall OI trend.

Look at monthly expiry data.

Identify positional buildup or unwinding.

Risk Management in Options TradingTrading options can be exciting and rewarding—but it's also full of risks. Without proper risk management, even the best strategies can lead to heavy losses. In this comprehensive guide, we'll dive deep into how to manage risk in options trading, covering everything from the basics to advanced techniques.

1. Understanding Risk in Options Trading

Before we dive into managing risk, it’s crucial to understand where risk comes from in options trading. Options are complex instruments that behave differently than stocks. The key sources of risk include:

A. Price Movement (Delta Risk)

When the price of the underlying stock moves up or down, the value of the option changes. This is known as Delta risk. A call option gains value when the stock goes up, and a put gains value when it goes down.

B. Time Decay (Theta Risk)

Options lose value over time. Even if the stock price doesn’t move, the option could still lose value as the expiration date approaches. This is known as Theta decay or time decay.

C. Volatility (Vega Risk)

Volatility reflects how much a stock moves. High volatility increases an option's premium. But if implied volatility falls, the value of your option might drop—even if your price prediction is correct.

D. Interest Rates and Dividends (Rho and Dividend Risk)

Although less impactful, interest rates and dividend changes can also influence option prices. These are more important for longer-dated options.

2. Why Is Risk Management Critical in Options?

Options give traders leverage—a small investment can control a large position. While this magnifies profits, it also increases losses. Many beginners fall into the trap of chasing big gains, only to blow up their accounts when trades go wrong.

Good risk management doesn’t eliminate risk—it helps you survive bad trades and stay in the game long enough for your edge to work.

3. Core Principles of Options Risk Management

Here are the foundational principles every options trader should follow:

A. Never Risk More Than You Can Afford to Lose

It sounds obvious, but many traders ignore this. Only use disposable capital, not money meant for rent, bills, or emergencies.

B. Position Sizing

This is one of the most powerful tools in risk management. Don’t bet your entire capital on a single trade. A common rule is to risk 1-2% of your capital on any trade. That way, even a string of losing trades won’t wipe you out.

C. Diversify Your Trades

Avoid putting all your trades on the same stock or sector. Diversification can reduce risk from unexpected news events or market shocks.

D. Know Your Maximum Loss

Before entering any trade, calculate your maximum potential loss. With long calls and puts, your loss is limited to the premium paid. But with short options or complex strategies like spreads, losses can be higher or even unlimited.

4. Practical Risk Management Techniques

A. Use Stop-Loss Orders (Where Applicable)

While options don’t always behave like stocks, you can still set a mental or physical stop-loss based on:

Percentage loss (e.g., exit if the option loses 50%)

Underlying price level (e.g., exit if stock breaks below a key level)

Time decay (e.g., exit 5 days before expiration to avoid Theta crush)

❗ Note: Stop-losses can be tricky with options because of wide bid-ask spreads. It’s important to use limit orders or mental stops to avoid slippage.

B. Avoid Naked Options (Especially Selling)

Selling naked calls or puts can expose you to unlimited risk. Unless you have a large account and full understanding, stick to defined-risk strategies like:

Spreads (credit/debit)

Iron condors

Butterflies

Covered calls

Protective puts

C. Hedge Your Positions

Hedging is like buying insurance. You can reduce risk by combining options in a way that limits losses.

Example:

If you sell a naked put, you can turn it into a bull put spread by buying a lower strike put. This limits your downside if the stock crashes.

D. Use Probability and Greeks

Understanding the "Greeks" can help you analyze risk exposure:

Greek What it Measures Risk Managed

Delta Price sensitivity Directional risk

Theta Time decay Time-related loss

Vega Volatility impact Volatility exposure

Gamma Delta’s change rate Acceleration of price impact

Rho Interest rate impact (minor risk)

Knowing your Greeks allows you to adjust trades when risks become too high.

5. Options Strategies for Risk Management

Some strategies are naturally more “risky,” while others are designed to limit downside. Let’s look at popular risk-managed strategies:

A. Covered Call

You own 100 shares of a stock and sell a call option. This gives you income (premium) and limits upside risk.

Risk: Stock falls

Reward: Premium + upside to strike price

B. Protective Put

You buy a put while holding the stock. It protects you from downside losses, like insurance.

Risk: Cost of put (premium)

Reward: Unlimited upside; limited downside

C. Vertical Spreads (Credit and Debit)

These involve buying and selling options at different strikes.

Bull Call Spread: Buy call + sell higher call

Bear Put Spread: Buy put + sell lower put

Both strategies have limited risk and reward, making them ideal for risk-conscious traders.

D. Iron Condor

You sell a call spread and a put spread on the same stock. Profitable when the stock stays in a defined range.

Risk: Limited to width of spread minus premium

Reward: Net credit received

This is a great strategy for sideways markets and offers good risk/reward if managed well.

6. Managing Risk Over Time

A. Adjusting Trades

If a trade moves against you, you don’t always have to take the loss. You can:

Roll the option to a later expiration

Adjust strikes to collect more credit or redefine risk

Convert to a spread or different strategy

However, be careful not to over-manage trades, which can lead to complex and risky positions.

B. Avoid Trading Around Events

Earnings announcements, Fed meetings, and budget declarations can cause huge volatility spikes. Option premiums are often inflated before such events. If you trade them, keep position size small and use defined-risk trades only.

Options Trading Strategies: From Simple to AdvancedPart 1: The Basics of Options

Before diving into strategies, let’s review the two core types of options:

1. Call Option (CE)

Gives the buyer the right (but not the obligation) to buy an underlying asset at a predetermined price (strike price) within a specific time period.

Bullish in nature.

2. Put Option (PE)

Gives the buyer the right (but not the obligation) to sell an underlying asset at a predetermined price within a specific time period.

Bearish in nature.

Each option has a premium (price you pay to buy the option), and that’s the maximum loss a buyer can face. Sellers (or writers), on the other hand, receive the premium but take on higher risk.

Part 2: Simple Options Strategies

These are basic strategies suitable for new traders.

1. Buying a Call Option (Long Call)

When to Use: If you expect the stock/index to rise significantly.

Risk: Limited to the premium paid.

Reward: Unlimited potential profit.

Example:

Stock XYZ is trading at ₹100. You buy a 105 Call Option at ₹2 premium.

If stock moves to ₹115:

Intrinsic Value = ₹10

Profit = ₹10 - ₹2 = ₹8 per share

Why It’s Good: Cheap entry, high upside.

2. Buying a Put Option (Long Put)

When to Use: If you expect the stock/index to fall.

Risk: Limited to the premium paid.

Reward: High if stock crashes.

Example:

You buy a 95 PE when stock is at ₹100, and premium is ₹3.

If stock falls to ₹85:

Intrinsic Value = ₹10

Profit = ₹10 - ₹3 = ₹7 per share

Why It’s Good: Good for bearish bets or portfolio hedging.

3. Covered Call

When to Use: You own the stock and expect neutral to moderately bullish movement.

Risk: Limited upside potential.

Reward: Premium + stock movement (if not called away).

Example:

You own 100 shares of XYZ @ ₹100.

You sell 110 CE for ₹5.

If stock rises to ₹110, you sell at that level and keep ₹5 premium.

If it stays below ₹110, you keep the shares + premium.

Why It’s Good: Generates income from stocks you hold.

4. Protective Put

When to Use: You own a stock and want downside protection.

Risk: Limited downside.

Reward: Unlimited upside.

Example:

Own 100 shares of XYZ @ ₹100.

Buy a 95 PE at ₹3.

If stock drops to ₹85, your put becomes worth ₹10, offsetting losses.

Why It’s Good: Acts like insurance on your holdings.

Part 3: Intermediate Strategies

Once you’re comfortable with buying/selling calls and puts, it’s time to explore neutral and range-bound strategies.

5. Bull Call Spread

When to Use: You expect a moderate rise in the stock/index.

Risk: Limited.

Reward: Limited.

Structure:

Buy 100 CE at ₹5

Sell 110 CE at ₹2

Net Cost: ₹3

Max Profit: ₹10 - ₹3 = ₹7

Max Loss: ₹3

Why It’s Good: Lower cost than buying a call outright.

Part 4: Risk Management Tips

Never deploy a strategy you don’t understand.

Use stop-loss and position sizing to avoid blowing up capital.

Be aware of Greeks (Delta, Theta, Vega) — they drive profits/losses.

Avoid naked options selling unless you have enough margin and experience.

Always review IV (Implied Volatility) before placing straddles or condors.

Understand expiry effects — options lose value faster as expiry nears.

Part 5: Real-Life Example

Let’s say Nifty is trading at 22,000. You expect no major movement till expiry. You execute an Iron Condor:

Sell 22100 CE at ₹100

Buy 22300 CE at ₹40

Sell 21900 PE at ₹90

Buy 21700 PE at ₹30

Net Credit = ₹100 - ₹40 + ₹90 - ₹30 = ₹120

Max Loss = Spread width (200) - Net Credit = ₹80

If Nifty stays between 21900 and 22100 — all options expire worthless and you earn full ₹120.

Conclusion

Options trading is like a chess game — it's not only about direction, but also timing, volatility, and strategy structure. Simple strategies like buying calls and puts are perfect for starters, but intermediate and advanced strategies allow you to profit in any kind of market — bullish, bearish, or neutral.

The key lies in choosing the right strategy for the right market condition, managing risks, and being patient.

Whether you're hedging your portfolio, generating income, or speculating on big market moves, options provide the tools — but it’s your responsibility to use them wisely.

If you’d like charts, payoff diagrams, or examples using live data (like Bank Nifty or stocks), let me know and I can include those too!

Basics of Options: Calls and PutsWhat are Options?

An option is a financial contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset (like a stock or index) at a specific price, on or before a specific date.

Think of it like booking a movie ticket. You reserve the right to watch a movie at a particular time and seat. But if you don’t go, it’s your choice. You lose the ticket price (premium), but you're not forced to go. Options work similarly.

Options are of two basic types:

Call Option

Put Option

Let’s break both down in detail.

1. What is a Call Option?

A Call Option gives the buyer the right (but not the obligation) to buy the underlying asset at a pre-decided price (called the strike price) on or before a certain date (called the expiry date).

When do traders buy a Call Option?

When they believe the price of the underlying stock or index will go up in the future.

Example of Call Option (Simple Case)

Let’s say you are bullish on Reliance Industries stock, which is currently trading at ₹2,500.

You buy a Call Option with:

Strike Price: ₹2,550

Premium Paid: ₹30 per share

Lot Size: 250 shares

Expiry: Monthly expiry (say end of the month)

You believe Reliance will go up beyond ₹2,550 soon. If it goes to ₹2,600 before expiry:

Your profit per share = ₹2,600 (market price) - ₹2,550 (strike price) = ₹50

Net Profit = ₹50 - ₹30 (premium) = ₹20 per share

Total Profit = ₹20 x 250 = ₹5,000

But if Reliance stays below ₹2,550, say at ₹2,500 on expiry, you won’t exercise the option. You lose only the premium (₹30 x 250 = ₹7,500).

Key Terminologies in Call Options

In the Money (ITM): When the stock price is above the strike price.

At the Money (ATM): When the stock price is equal to the strike price.

Out of the Money (OTM): When the stock price is below the strike price.

2. What is a Put Option?

A Put Option gives the buyer the right (but not the obligation) to sell the underlying asset at a pre-decided price (strike price) on or before the expiry.

When do traders buy a Put Option?

When they believe the price of the underlying stock or index will fall in the future.

Example of Put Option (Simple Case)

Assume HDFC Bank is trading at ₹1,600. You are bearish and expect it to fall.

You buy a Put Option with:

Strike Price: ₹1,580

Premium: ₹20 per share

Lot Size: 500 shares

Expiry: Monthly

If HDFC Bank falls to ₹1,520:

You can sell at ₹1,580 even though market price is ₹1,520

Gross profit per share = ₹60

Net profit = ₹60 - ₹20 = ₹40 per share

Total profit = ₹40 x 500 = ₹20,000

If HDFC stays above ₹1,580, your put expires worthless. You lose only the premium (₹10,000).

Key Terminologies in Put Options

In the Money (ITM): Stock price below strike price.

At the Money (ATM): Stock price = strike price.

Out of the Money (OTM): Stock price above strike price.

Who are the Two Parties in an Option Contract?

1. Option Buyer (Holder)

Pays the premium

Has rights, but not obligations

Can exercise the option if profitable

Loss is limited to the premium paid

2. Option Seller (Writer)

Receives the premium

Has obligation to fulfill the contract if the buyer exercises

Risk is unlimited for call writers and limited for put writers (if stock price becomes zero)

Profit is limited to the premium received

Difference between Call and Put Options (Summary Table)

Feature Call Option Put Option

Buyer’s Expectation Bullish (price will go up) Bearish (price will go down)

Right Buy at strike price Sell at strike price

Profit Potential Unlimited Limited (until price reaches zero)

Risk (for buyer) Limited to premium Limited to premium

Seller’s Role Sells call & hopes price won’t rise Sells put & hopes price won’t fall

Premium and What Influences It?

The premium is the price you pay to buy an option. This is influenced by:

Intrinsic Value: Difference between market price and strike price

Time Value: More days to expiry = higher premium

Volatility: Higher the volatility = higher the premium

Interest Rates and Dividends

What is Strike Price and Expiry?

Strike Price: The price at which you can buy (call) or sell (put) the underlying stock

Expiry: The last date till which the option is valid. In India:

Weekly expiry for Nifty, Bank Nifty, and FINNIFTY

Monthly expiry for stocks

SUI/USDT Update – Bearish Structure Confirmed📉 SUI/USDT Update – Bearish Structure Confirmed

Yesterday, we shared a bearish outlook for SUI from the $4.2 region, anticipating a potential rejection from that key supply zone. Since then, price has respected the resistance and shown early signs of weakness.

Here’s what we’re seeing now:

🔹 Elliott Wave Perspective

Price seems to be completing a Wave C of a larger Zigzag structure.

This upward move is forming an Ending Diagonal (ED)—a terminal pattern usually marking exhaustion.

The diagonal is weakening near the top of a multi-month resistance, adding confluence to the bearish setup.

A break below the lower channel could trigger a deeper correction toward:

$3.35 (first support)

$3.00 (major structural demand)

🔸 ICT / Smart Money Outlook

Price swept the liquidity above previous highs (~$4.2), creating a buy-side liquidity grab.

A Bearish Order Block is active around $4.05–$4.15.

📊 Analysis by @CryptoPilotAI

🔔 Follow for more smart market updates.

Signs of a Market Structure Shift are emerging as lower highs begin forming.

Watch for price to revisit the Fair Value Gap (FVG) near $3.65–$3.35, a likely target for rebalancing inefficiency.

✅ Conclusion

Unless bulls reclaim $4.15 with strength, this looks like a distribution phase with downside continuation expected.

📌 Short Bias Active – Waiting for channel break and confirmation.

NextGenTraders81 NAS short swingI have my sell limit set at 23,500 as there is alot of sell limits set there, also at 23,550 hence the SL is above that zone.

I am pretty sure the position will be set on BE before it tries to return to these highs, how long it will take to hit TP, who knows.. a correction within the channel is due after numerous ATHs.

If you will follow, take partials on the way !

Good luck :)

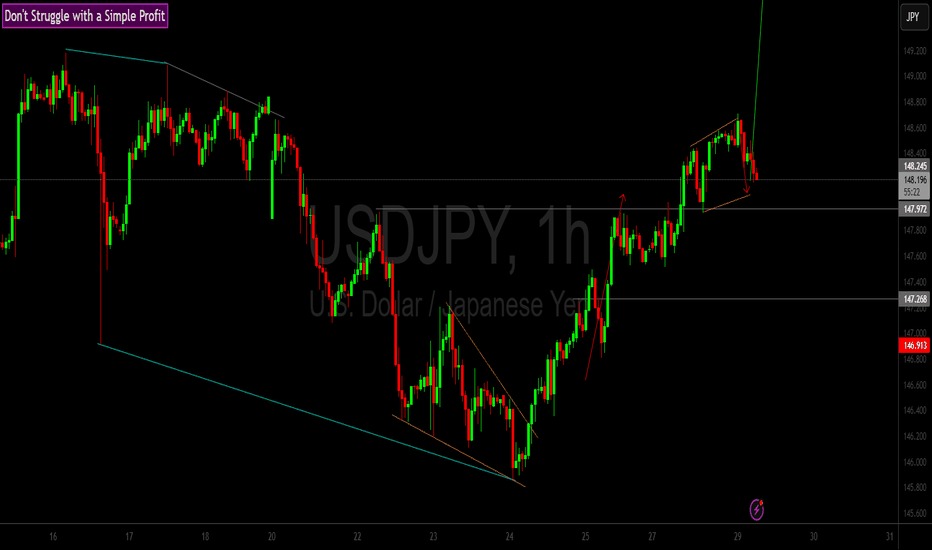

Has the Bleeding STOPPED?Yesterday witnessed a great deal of unidirectional push on major USD crosses. The EURUSD was not an exception. With the DXY strengthening for the most yesterday, the ripple effect on all USD crosses was bound to happen.

We were looking at the market for the most yesterday, trying to find a potential reversal point. While it seemed unclear, we were still able to narrow our probability into a rather slim perspective and spectrum.

Looking at the market right now, i will say that our reverssal should begin to show up any time soon.

I can already see reversals on some other USD crosses.

Price on the EURUSD is currently at a critical zone. Even though not an anticipated zone, price can see some reversal in that zone.

We still wait to see clear sign and confirmation of the reversal on the EURUSD, but for now, we still keep fingers crossed

Petronet Long Setup: Wave C Ends at 1.382 of A–Breakout + RetestThis is a trend continuation setup on Petronet, based on Elliott Wave correction structure, Fibonacci confluence, and price action confirmation.

The stock recently completed a clean A-B-C corrective pattern, with Wave C terminating around the 1.382 extension of Wave A — a common Fibonacci exhaustion zone, often signaling the end of corrections.

Key factors supporting the long bias:

🌀 Wave C = 1.382 of Wave A, indicating potential completion of the correction.

🔍 A Break of Structure (BOS) was observed, confirming the shift in trend.

📈 Importantly, the BOS was marked by a strong bullish candle, adding conviction to the move.

🔁 Entry was planned on the retest of the broken resistance, which is now acting as support.

📊 Structure suggests we may now be entering a new impulse wave upward.

Risk Management Plan:

🛑 Stop-loss just below the Wave C low / support zone.

🎯 Targeting a minimum 1:2 Risk-to-Reward, aligned with the next impulse projection.

This trade favors confirmation over anticipation — by waiting for BOS + bullish candle + retest, the entry is more structurally reliable.

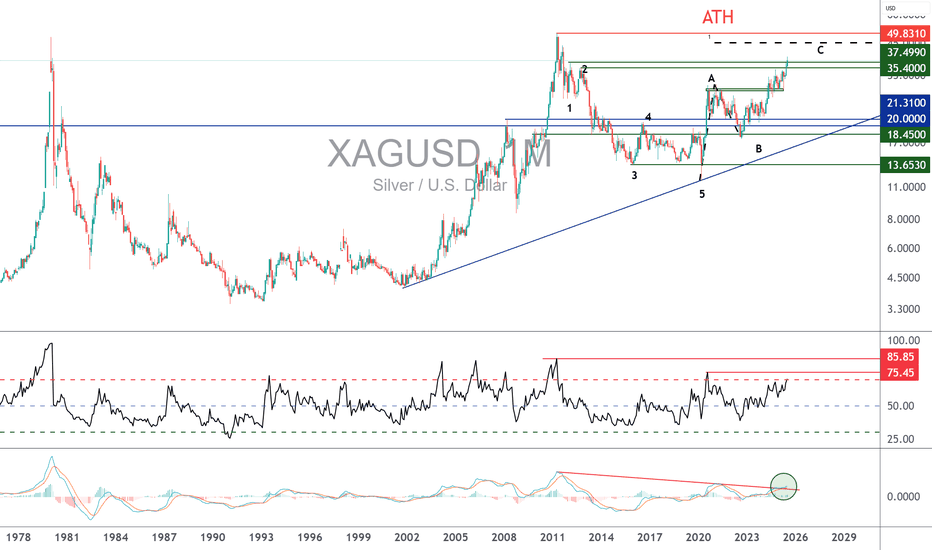

CAN SILVER RETURN TO ITS HISTORIC HIGH OF $50?In the world of precious metals, gold has already broken its all-time high in recent months, supported by solid fundamentals. Another precious metal is now catching up: silver. Unlike platinum and palladium, silver today combines all the necessary ingredients to revisit its historic peak. Its bullish potential stems from a unique blend of market volume, correlation with gold, supportive fundamentals, and favorable technical conditions. Silver isn’t just "gold’s little brother": it is currently the only precious metal with both the technical and structural setup to aim once again for the mythical $50 mark, last reached in 2011.

1) After GOLD, silver is the most liquid precious metal and has the highest positive correlation

The first key factor is liquidity. On the precious metals market, gold remains the clear leader, with hundreds of billions of dollars traded daily. Silver comes second, far ahead of platinum and palladium, with around $5 billion in daily volume. This level of activity is crucial—adequate liquidity allows speculative and institutional flows to fully express themselves. Conversely, the low volumes of platinum and palladium limit their upside, as their markets are too narrow to support the kind of momentum seen in gold or silver.

The second strength of silver lies in its natural correlation with gold. Historically, the two metals move in sync. This behavioral alignment is reflected in a correlation coefficient close to 1. Platinum and palladium, by contrast, respond to industrial demand, particularly from the auto sector and emissions technology. Silver, however, blends industrial uses (jewelry, electronics, solar panels, etc.) with a monetary and financial role similar to gold. This dual nature makes silver a hybrid asset, with both ETF-driven financial demand and jewelry-like industrial demand.

2) Technically, the SILVER/GOLD ratio remains in a short-term uptrend from a long-term support

Technical analysis reinforces this fundamental outlook. While gold appears to be losing steam after hitting $3,500, silver still shows a medium-term bullish setup—even though short-term corrections are always possible. The gold/silver ratio, historically useful to detect when silver outperforms gold, also suggests that silver is poised for further gains. Silver’s long-term trend remains bullish as long as the $34–$35 support zone holds. The $50 mark is the natural technical target of this trend.

The following chart shows the gold/silver ratio and indicates that silver is likely to outperform gold through year-end:

And here is the monthly candlestick chart of spot silver:

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

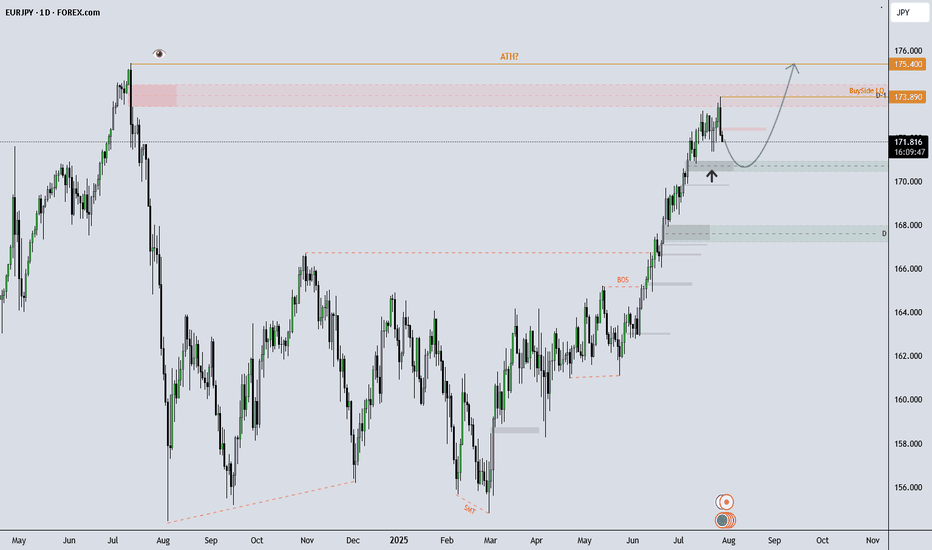

EURJPY Eyes New Highs After Pullback?What I see!

EURJPY Technical Outlook –

EURJPY remains in a strong uptrend and recently tapped into buy-side liquidity at 173.89, which now marks the All-Time High (ATH). After a brief rejection from that level, price is currently showing signs of a healthy pullback.

I’m observing the 170.00–171.00 zone, which aligns with previous demand. If price continues to respect this area, the overall bullish structure remains intact, with potential for a move back toward (and possibly beyond) the ATH.

A sustained break below 170.00 could indicate room for a deeper pullback, potentially toward the 168.00s, which would be a key area to monitor.

This analysis is shared for educational and discussion purposes only.

Ethereum at a Critical Crossroad: Will $4,000 Finally Break ?Ethereum is once again approaching the psychologically significant $4,000 resistance level, a high-timeframe barrier that has rejected price on multiple occasions. As the second-largest cryptocurrency by market cap pushes higher, traders are closely watching for signs of a breakout—or another range-bound rejection.

Ethereum has entered a decisive phase, with price action now testing the upper boundary of a long-standing trading range. After multiple failed attempts to breach the $4,000 mark, ETH is consolidating just below this level, creating an environment filled with both opportunity and risk. Whether Ethereum can break through or gets rejected again will shape its mid- to long-term outlook.

Key Technical Points:

- Major Resistance at $4,000: A psychologically important level and long-time price cap on high timeframes

- Defined Trading Range: ETH has remained range-bound between $1,300 and $4,000 for an extended period

- Critical Candle Closes Needed: Breakout requires strong daily or weekly closes above $4,000 to confirm

Ethereum’s price is hovering just under the $4,000 resistance zone, which has acted as a ceiling for price action since early 2022. From a high time frame perspective, ETH has been range-bound, trading between $1,300 as the range low and $4,000 as the range high. Each visit to this upper boundary has led to a rejection and a subsequent rotation back toward mid-range or lower levels.

Now, with momentum building and bullish sentiment returning across the crypto market, Ethereum finds itself at another pivotal moment. The key technical requirement for a confirmed breakout will be a decisive daily or weekly close above the $4,000 level. Without this confirmation, any temporary push above the resistance could result in a fakeout and trap late long entries.

Volume behavior around this zone remains mixed. While there is some bullish buildup in recent sessions, there has not yet been a significant influx in volume to confirm conviction from buyers. This aligns with the historical pattern of Ethereum trading at resistance before eventually pulling back, suggesting caution is still warranted.

However, should ETH close decisively above $4,000 and turn this level into support, it would mark the first major break of this range since its inception. This would likely trigger a wave of bullish momentum, possibly sending Ethereum to new yearly highs, with $4,500–$5,000 being the next logical resistance zones based on historical price pivots and Fibonacci extensions.

What to Expect in the Coming Price Action

Ethereum’s price action is currently neutral-bullish but hinges entirely on its interaction with the $4,000 resistance. A confirmed breakout could usher in a powerful rally toward new highs, while another rejection would likely continue the long-standing range between $1,300 and $4,000. Until a decisive move occurs, traders should remain cautious and reactive rather than overly anticipatory.

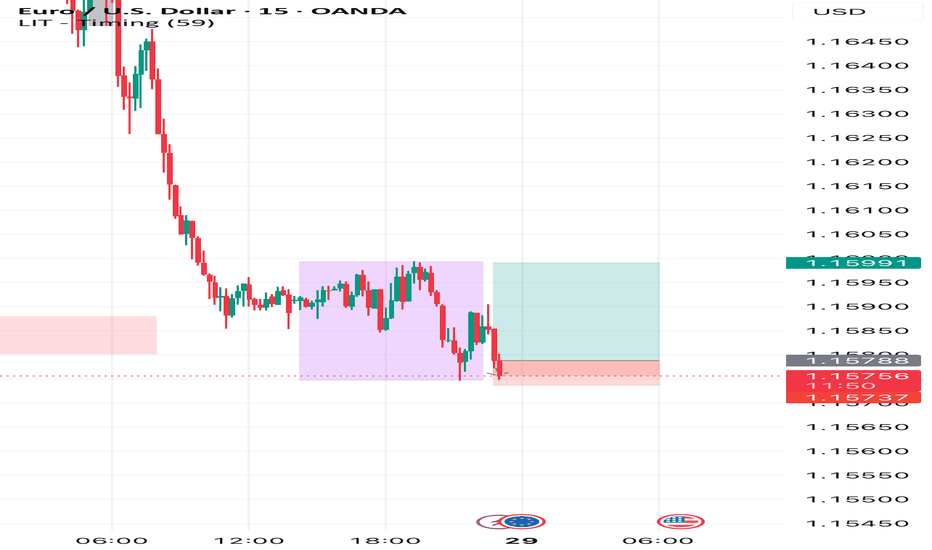

Elliott Wave Update: EURUSD Favors Weakness In To Support ZoneThe EURUSD favors upside in 3 swings from September-2022 low & should extend towards 1.1929 or higher against 1.13.2025 low. In 4-hour, it favors double correction lower from 7.01.2025 high to correct 5.12.2025 low. It favors short term pullback into 1.1512 – 1.1340 area in 7 swing pullbacks before continue rally in cycle from 1.13.2025 low. Above January-2025 low, it ended (1) at 1.0533 high, (2) at 1.0210 low, (3) at 1.1573 high, (4) at 1.1065 low & favors higher in (5). Within 4-hour, it placed 1 at 1.1830 high & correcting in 2 as double three correction before two more highs. It placed ((w)) at 1.1559 low in 3 swings zigzag correction. In ((w)), it ended (a) at 1.1659 low, (b) at 1.1714 high & (c) at 1.1559 low of 7.16.2025. Later, it unfolded expanded flat correction in ((x)) that ended at 1.1788 high of 7.24.2025. Within ((x)), it placed (a) at 1.1721 high, (b) at 1.1554 low & (c) in 5 swings at 1.1788 high.

Currently, it favors downside in ((y)) of 2 & expect sideways to lower in to support zone. It favors zigzag correction lower in ((y)) to finish 2 into extreme area before resume rally. Short term, it favors downside in (a) of ((y)) since 7.24.2025 high. In (a), it placed i at 1.1700 low, ii at 1.1771 high & favors downside in iii of (a) towards 1.1576 – 1.1569 area before bounce in iv. It expects a bounce soon in iv followed by one more push lower in v to finish (a) in 5 swings. Wave (a) of ((w)) should end near 1.1578 before bounce in (b) in 3 or 7 swings connector. The bounce in (b) should fail below 1.1788 high to extend lower in (c) into 1.1512 – 1.1340 area to finish correction. It should find next support into that area to rally higher as the part of daily sequence targeting 1.1929 or higher. We like to buy in to that area for next leg higher or at least 3 swings bounce. If it breaks above 7.01.2025 high, it expects two more highs to finish cycle from January-2025 before next pullback start.

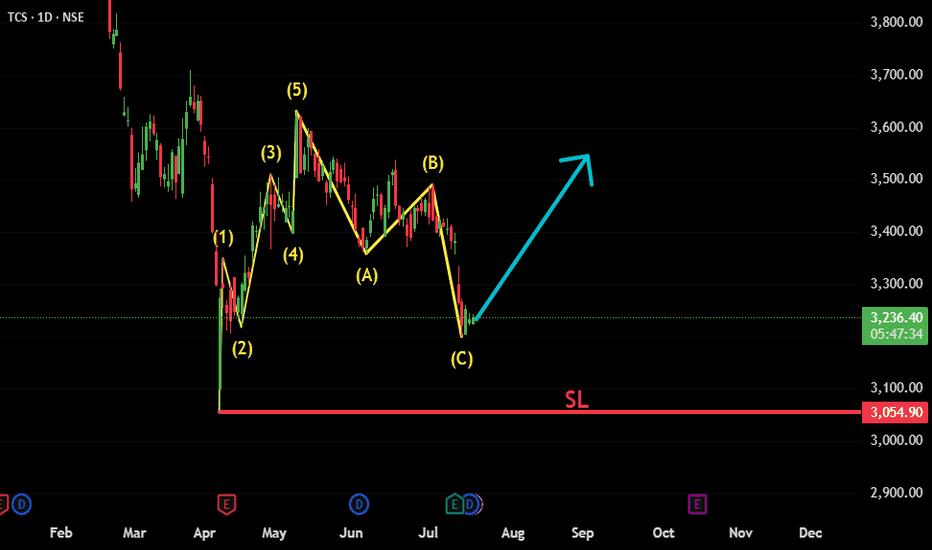

TCS: ABC Correction Complete – New Impulse Wave in FocusTCS appears to have completed a classic Elliott Wave structure, consisting of an initial 5-wave impulsive move followed by an A-B-C corrective phase. The recent price action suggests the correction has likely ended, and a new bullish impulsive move is beginning.

Fundamental trigger:

Interestingly, just a few days ago, TCS announced strong quarterly results — reporting solid profits and declaring a dividend. Despite the positive news, the stock reacted negatively and moved lower. This could have been a classic case of "good news, bad reaction" — possibly a stop-loss hunt or smart money absorbing liquidity before the next leg up.

Key technical points:

✅ Wave 1-2-3-4-5 clearly visible, forming the initial impulse.

✅ A-B-C correction appears complete with price reversing from a key support zone.

📈 Bullish structure forming; watching for confirmation with a break above recent highs.

🔍 Technicals and sentiment suggest renewed upside potential, despite short-term shakeouts.

Invalidation below recent swing low (Beginning of 1st Impulsive).

This setup offers a potential long opportunity with a favorable risk-reward

#TCS #NSE:TCS #ElliottWave #WaveAnalysis #TechnicalAnalysis #ABCCorrection #ImpulsiveWave #LongSetup #ChartAnalysis #NSEStocks #IndianStocks #Dividend #Earnings #PostEarningsMove #TrendReversal #SwingTrading #PriceAction #SmartMoney

Gold RetracementGold has been leading massively since the COVID Recession driven by all time highs of inflation and low rates across the board it also traded the best in the last 18 months and so, being almost vertical in its upward movement. And so as the old testaments of time have taught us nothing lasts, Gold didn't yet have a corrective move, and one should suspect that the 2000 levels- not so long ago used to be ATH- will be revisited some time in the 12 months period ahead.

The 3400 level is holding strong but there yet to be signs of weakness on the XAUUSD pair, 3400-3600 USD/Oz is a good as any level top sell expect pumping and dumping as high as 3800 for the FOMO buyers to be drawn in by the big whales and the Short sellers to be Margined out.

This opportunity is as good as any and the market never runs out of these opportunities so trade safely don't get greedy and live below your means.

Stay safe out there

OANDA:XAUUSD