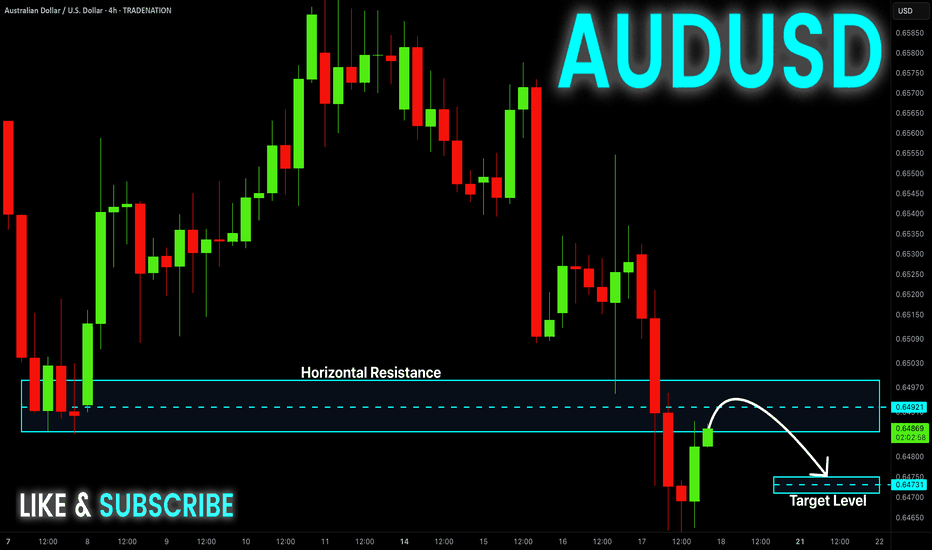

AUD-USD Local Short! Sell!

Hello,Traders!

AUD-JPY is making a bullish

Rebound and the pair is

Making a retest of the key

Horizontal resistance of 0.6497

From where we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Wave Analysis

Cocoa Bull Run over?There’s something brewing in the charts here, and it’s not a hot cup of cocoa. We had a clear rejection at the 0.382 Fibonacci and potentially the start of a C leg in a corrective pattern.

This is lower high after the bull flag breakout pattern. If we lose support here we could break the neckline and confirm the head and shoulders pattern, which is very bearish.

There’s a lot of moving parts to consider here. If you follow my trades you will know I already anticipated this as I am long a stock that behaves in an inverse manner to cocoa.

Not financial advice, do what’s best for you

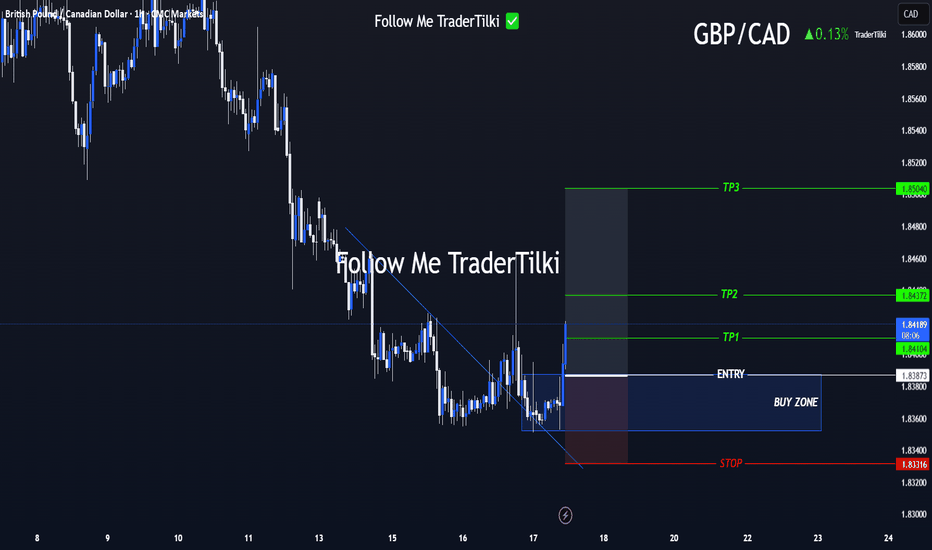

GBP/CAD Clarity in Motion! Levels Are Locked In Hey everyone 👋

📌 BUY LIMIT ORDER / GBP/CAD Key Levels

🟢 Entry: 1,83873

🎯 Target 1: 1,84104

🎯 Target 2: 1,84372

🎯 Target 3: 1,85040

🔴 Stop: 1,83316

📈 Risk/Reward Ratio: 2.18

I double-checked the levels and put together a clean, focused analysis just for you. Every single like seriously boosts my motivation to keep sharing 📈 Your support means the world to me!

Huge thanks to everyone who likes and backs this work 💙 Our goals are crystal clear, our strategy is solid. Let’s keep moving forward with confidence and smart execution!

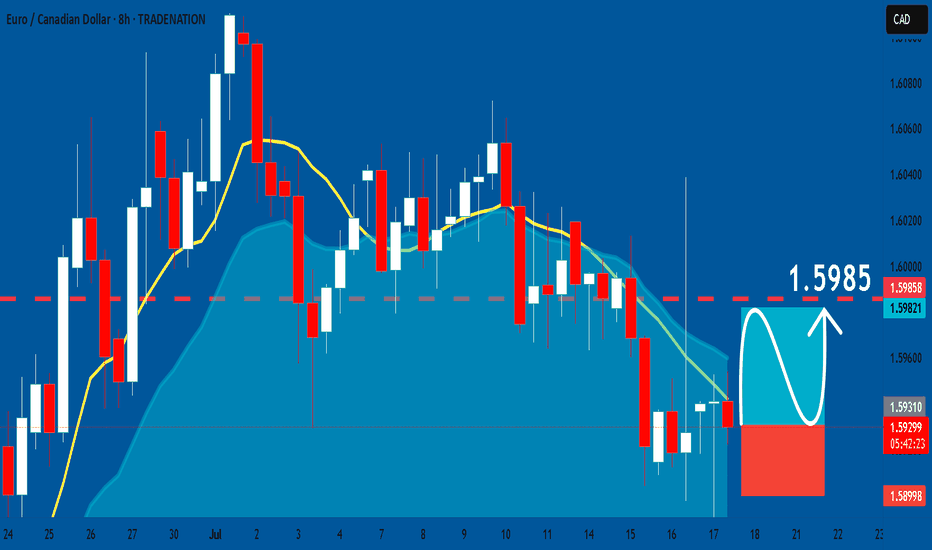

EURCAD: Long Signal with Entry/SL/TP

EURCAD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURCAD

Entry - 1.5929

Stop - 1.5899

Take - 1.5985

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

#PEOPLE/USDT Breakout in Action ! #PEOPLE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.01980.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area in green at 0.02000, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.02056

First target: 0.02111

Second target: 0.02190

Third target: 0.02265

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

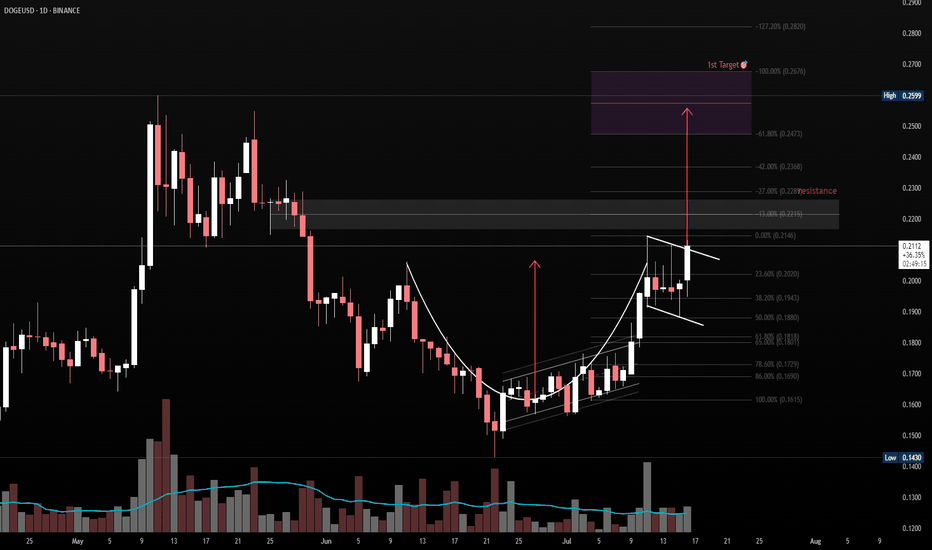

Cup & Handle Breakout Watch – DOGE/USDTPattern: Cup & Handle

Timeframe: 1D

Cup Range: $0.168 → $0.212

Handle: Forming as a descending bull flag

Breakout Level: ~$0.2125

Measured Target: ~$0.256

Confluence:

Clean rounded base (cup)

Tight flag pullback (handle)

Volume decrease during handle = healthy

Prior resistance aligns with projected target zone

Bias: Bullish (on breakout with volume confirmation)

📌 Watching for breakout above handle resistance with rising volume to confirm entry. Measured move aligns with historical supply zone.

After break out from 0.216~0.226

Target Zone: 0.24~0.26

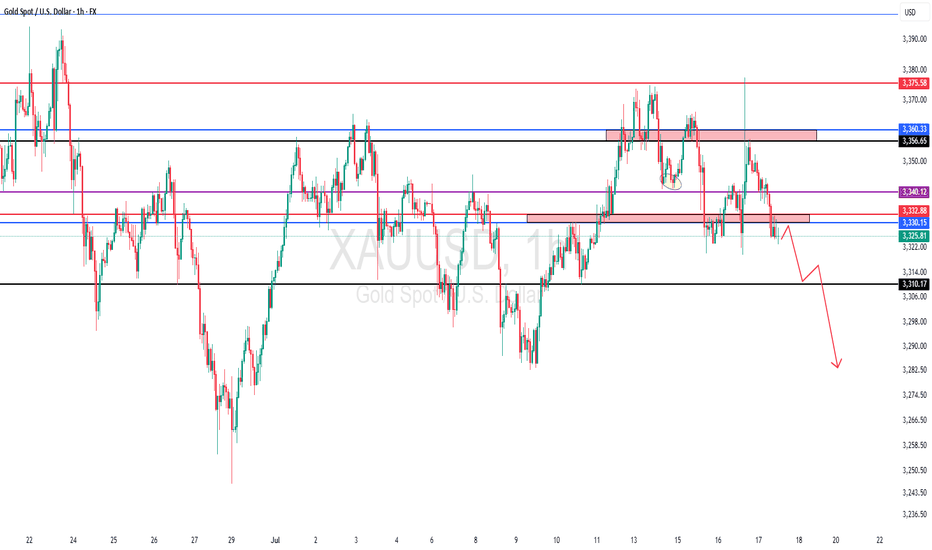

XAUUSD critical area, both sides are possiblecorrection waves are always complicated and messy often changes direction too often, goes up and down in a wide range either triangle, wedge or some sort of zigzag, internal waves usually goes as abc, wxy, wxyxz type of correction waves and it may seem like ended many times in the subwaves. so often confused with many other ideas. i believe correction continues yet criticals levles to watch 3307-3419 brake side will determen the future of gold.

my 3250 target already achieved but i expect another one, shor term targets 3250-3205 mid term targets 3119-3070-3050

daily candle body above 3420 invalidates short ideas.

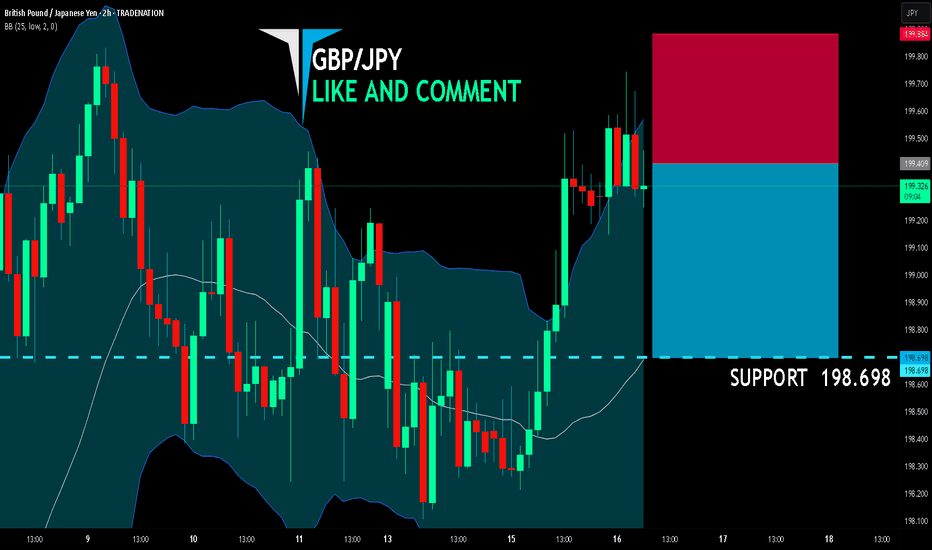

GBP/JPY BEARISH BIAS RIGHT NOW| SHORT

GBP/JPY SIGNAL

Trade Direction: short

Entry Level: 199.409

Target Level: 198.698

Stop Loss: 199.884

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

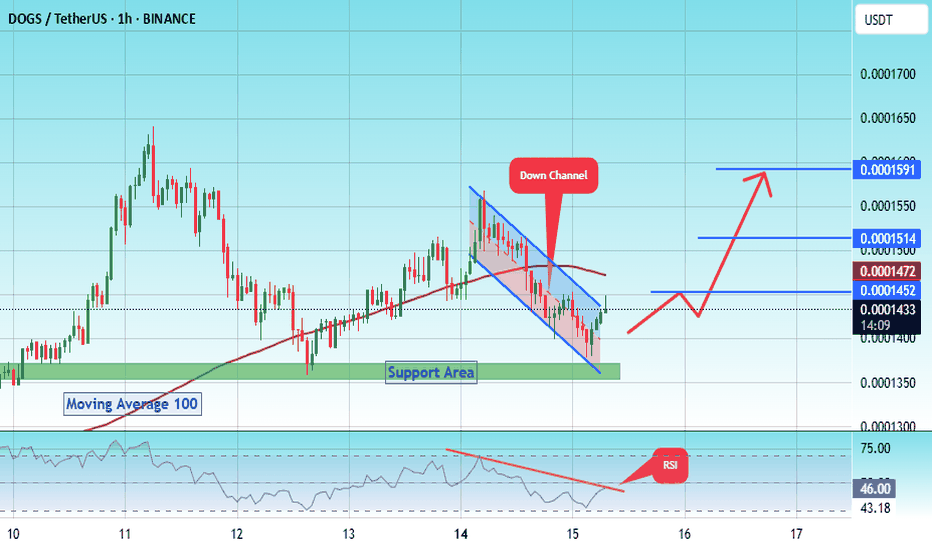

#DOGS/USDT – Launchpad or Breakdown?#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0001385.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001362, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001430

First target: 0.0001452

Second target: 0.0001514

Third target: 0.0001590

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

USDCHF long term bullish playHello,

The USDCHF is back to where it last traded in mid 2011. This reflects a significant weakening of the U.S. dollar against the Swiss franc, erasing over a decade of gains. It suggests growing investor demand for safe-haven assets like the franc — possibly driven by concerns around U.S. interest rate policy, inflation trends, or broader global uncertainty. The last time the dollar was this weak against the franc was more than 13 years ago.

While a weaker dollar is seen as good for the United States, we see a long term buy opportunity for this pair from the current level based on technical analysis. The pair is now trading at the bottom of the range.

Next week will be an important time for this pair as we wait for the inflation data. This will be key in guiding what the FED might do during the next meeting towards the end of the month.

ETHUSD Is Going Up! Buy!

Please, check our technical outlook for ETHUSD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 3,011.53.

Considering the today's price action, probabilities will be high to see a movement to 3,240.64.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZD/USD SELLERS WILL DOMINATE THE MARKET|SHORT

NZD/USD SIGNAL

Trade Direction: short

Entry Level: 0.607

Target Level: 0.592

Stop Loss: 0.617

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/CHF BEST PLACE TO SELL FROM|SHORT

AUD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.524

Target Level: 0.520

Stop Loss: 0.526

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Ethereum Primed for Breakout as Institutional Interest SurgesBlackRock's aggressive ETH accumulation—$276M in February, $98M just this week—signals institutional conviction as Ethereum approaches a breakout towards $3,000. With real-world asset (RWA) tokenization exploding to $21B+ (Ethereum commanding 59% market share) and stablecoin volume hitting record $717B monthly highs, ETH is positioned as the backbone of traditional finance's blockchain migration.

The convergence of institutional buying, technical breakout signals, and Ethereum's dominance in the fastest-growing crypto sectors creates a perfect storm for the next major price surge 🚀

intel.arkm.com

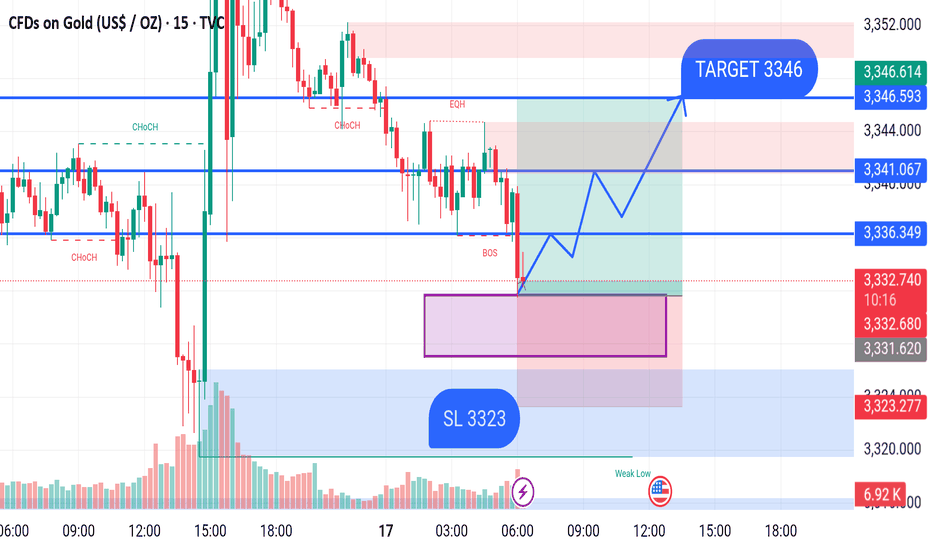

GOLD BUY M15 Gold (XAU/USD) 15-Minute Chart Analysis – July 17, 2025

Price is currently trading around the 3,333.71 level after a Break of Structure (BOS) to the downside. The market has entered a demand zone (highlighted in pink), suggesting potential bullish momentum if the zone holds.

A possible bullish scenario is illustrated on the chart:

Price is expected to retest the demand zone between 3,331 – 3,324.

From this zone, a bullish reversal is anticipated with higher highs and higher lows.

If the bullish move plays out, the first resistance level lies around 3,336 – 3,341.

The final target is set at 3,346, marked as the Take Profit (TP) level.

Key Levels:

Entry Zone (Demand Zone): 3,331 – 3,324

Stop Loss (SL): 3,323

Target (TP): 3,346

Intermediate Resistance Levels: 3,336 and 3,341

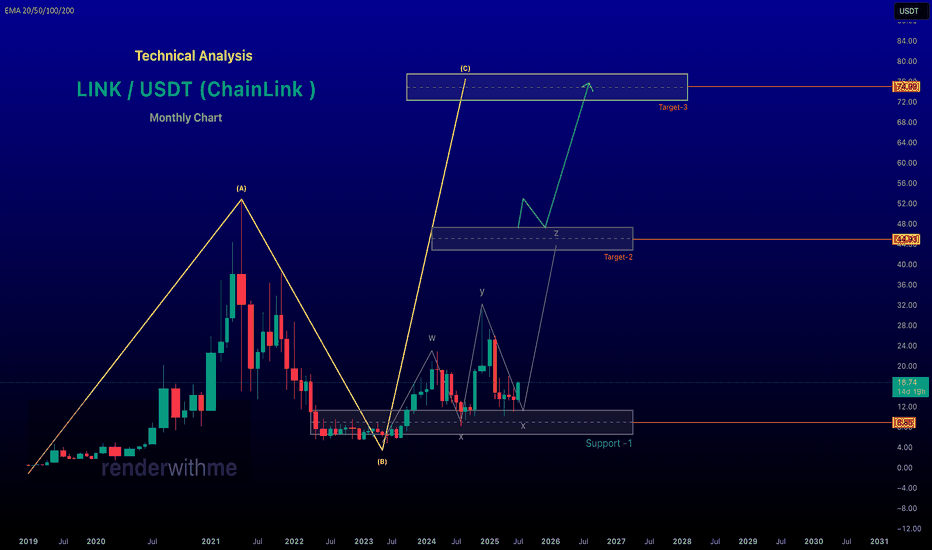

renderwithme | The unbreakable bond of Chainlink TechnicalBelow is a technical analysis of Chainlink (LINK/USD) based on the provided real-time financial data and general market insights. Please note that cryptocurrency markets are highly volatile, and this analysis is for informational purposes only, not financial advice. Always conduct your own research before making investment decisions.

# Current Price and Market Overview

Current Price: $16.70 USD at the time of posting

24-Hour Trading Volume: Not specified in the provided data, but recent sources indicate significant trading activity, with volumes around $422.74M to $672.42M.

52-Week Range: $3.25 (low) to $10.90 (high)

Previous Day Close: $16.67

chart for your reference

MSFT longThis is a After a strong pullback and a clear rejection at key support levels, the EUR/USD pair is showing signs of a potential reversal. Technical indicators suggest oversold conditions, making this an attractive entry for bullish traders.

🎯 Entry: Around 1.15873

🛑 Stop Loss: Below 1.19700

💰 Take Profit: 1.0750 – 1.14385

Always trade with proper risk management and confirm with your own analysis!good trade

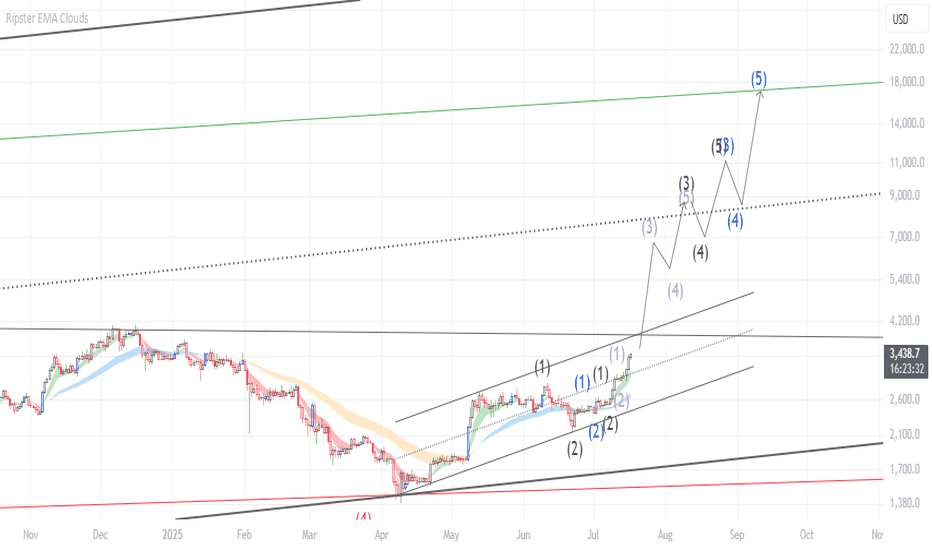

MARA Is Waking Up And Looks Promising For The Crypto MarketMARA Is Waking Up And Looks Promising For The Crypto Market, as it can send the price even higher this year from a technical and Elliott wave perspective.

Marathon Digital Holdings with ticker MARA nicely and sharply recovered away from the strong support after a completed projected higher degree abc correction in wave B/2. So, similar as Crypto market, even MARA can be forming a bullish setup with waves »i« and »ii« that can soon extend the rally within wave »iii« of a five-wave bullish cycle within higher degree wave C or 3, especially if breaks above 21 first bullish evidence level. It could be easily supportive for the Crypto market if we consider a positive correlation.